When people talk about how the speed of business is increasing in digital, they are usually talking about tactics. Digital services are cheaper to develop and change. There’s a lot more rapid back and forth.

- You can change marketing, promotions and prices in real time.

- You can launch new digital products every day.

- You can launch 20 different versions of the same digital product.

In Asia, this type of competition is particularly brutal. Chinese companies are the kings of short-term moves and tactics. When people talk about companies operating at “China speed,” they are usually talking about tactics. You have to be incredibly responsive to market and competitor changes. And you have to be tough. If competition in the USA is soccer, competition in China is rugby. You are going to take elbows to the face.

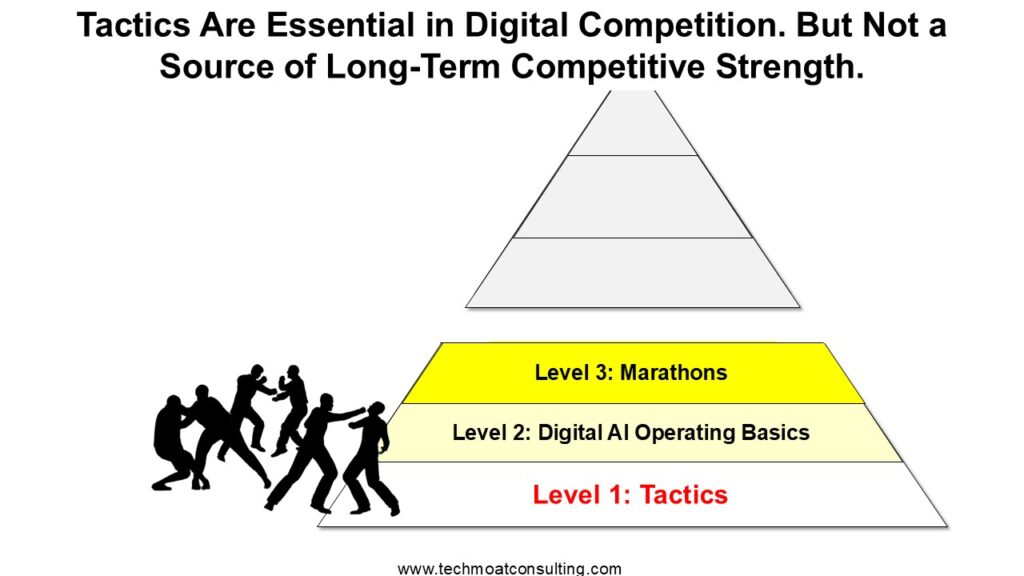

The graphic below is what I think of when I think of tactics and short-term moves, but especially in digital China. It’s the battle royale of tactics.

First, notice the symbol for tactics is basically a fight with lots of guys punching.

That’s a good way to think about it. It’s chaotic. It’s rapid. It fragmented businesses like restaurants, I think about tactics as a street fight. In consolidated businesses like mobile carriers, I think about it like an MMA fight with two people punching and kicking in the octagon.

Second, notice that tactics are at the bottom level of the Moat Hierarchy.

They are a crucial part of operating performance for digital businesses. But it is also where survival is hardest. You have to be good at this. But you don’t want to live in the melee; you want to move upwards to where you can build more systematic forms of competitive defense.

That means moving from Level 1: Tactics up to Level 2: Digital AI Operating Basics. Companies that don’t do this usually rise and fall quickly. Life is too hard at the bottom. And the rewards are small and transient.

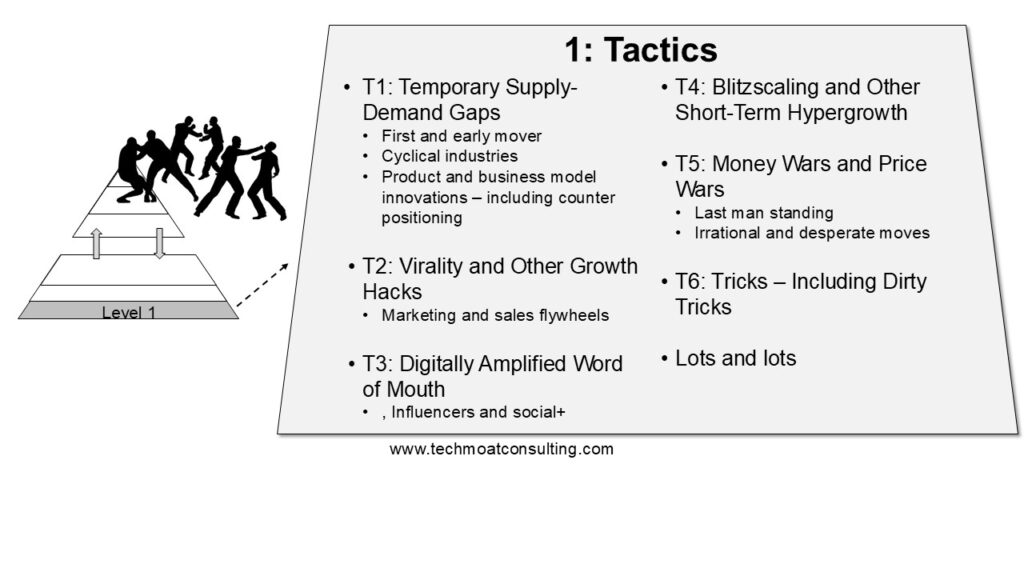

I’m not going to really go into tactics too much. It’s a long and constantly changing list of moves and counter-moves. But there are some common tactics that are common in digital – such as virality, first mover advantage, counter-positioning and growth hacking.

Four things to remember about tactics:

- It’s very important to be good at tactical moves. You need to be a good street fighter.

- You want to be patient in strategy but impatient in tactics.

- Tactics are the least sustainable form competitive defense. You need to be good at this but you don’t want to live here.

- Don’t mistake effective short-term tactics with real long-term defenses. Which is common.

Ok. Here are six tactics we often see in digital.

T1: Temporary Supply–Demand Gaps (esp. Early Mover)

Being a first or early mover in a market can be a powerful move. If a business gets to a new sector, product, business model or geography first, it has a window of time to capture customers, to build out technology and maybe to get to defensible scale.

Basically, the best way to beat the competition is to avoid them. Note: the second best way is to only fight people who suck at fighting.

First and early mover is about taking advantage of a temporary gap in the supply and demand. The demand is there but the supply isn’t yet. So, you grab as much demand as you can before the other suppliers arrive. Common versions of temporary supply-demand gaps are:

- First and early mover

- Cyclical industries

- Product and business model innovations – including counter positioning

First and early mover as a tactic is a good example of temporary supply–demand imbalances. I’ll contrast this later to long-term supply–demand imbalances, which can be more sustainable advantages.

We see this all the time in digital competition, especially in early-stage companies. And digital really rewards being a first or early mover. Things in digital just move faster. So you can really get far ahead if you’re early.

Digital businesses are also highly data-driven. They experiment. They relentlessly test what is working and not. So being first and early can make you a lot smarter than others. That can really matter in uncertain and still emerging businesses. Being fast and being early is a big deal in digital.

However, keep in mind that being the first mover can also be a very bad idea in completely new products and technologies. If you are creating a new type of semiconductor or electric car, yes, you can get lots of advantages by being first. But there are usually far more disadvantages.

My favorite digital strategy for developing economies like Southeast Asia is just to copy what comes out of the USA and China. Let them invest and fail over and over. Then, when they finally do get something that works, just copy and localize it in places like Indonesia and Thailand.

There are other types of temporary supply–demand imbalances.

We can put cyclical industries, like oil and gas, in this category. Demand for oil increases and suddenly there isn’t enough supply, including crude, tankers and refineries. So, prices go up. Then lots of exploration and development projects get launched. The tanker and truck fleets get too large. Oversupply leads to falling prices. And everyone pulls out of the sector, leading to under supply and rising prices.

We see fairly regular supply-demand gaps in cyclical industries. Companies in these industries are fairly good at playing with pricing and capacity against these imbalances. Raider-turned-activist Carl Icahn has been investing in this area for decades.

Why Investors Get Enamored with Counter-Positioning

The term counter-positioning was coined by Hamilton Helmer, author of the well-known 7 Powers book. It’s the strange phenomenon where a new product or service is launched against an incumbent, and it puts the incumbent in a strategic and organizational bind.

The new entrant’s service is superior. Usually, it is cheaper. But the incumbent does not create a similar service because it would damage their existing (usually more expensive) business. If they launch a competing service, they kill their cash cow. And executives lose their positions. So, the incumbent fails to respond quickly. They delay.

This basically creates a temporary supply-demand gap. It creates a window of time where the new entrant surges into the market. And the incumbent doesn’t respond for way too long.

Physical film company Kodak vs. digital camera company Sony is an example. Kodak clearly saw that digital cameras were a superior product. But they delayed in responding. Management didn’t want to lose their jobs by closing down major portions of the existing business. They didn’t want to crater the income statement by offering a much cheaper substitute. And maybe they realized they couldn’t really win in this new business anyways. Kodak, with deep expertise in chemistry, was never going to beat Sony in consumer electronics.

Hamilton lists three conditions to watch for in counter-positioning:

- The new product/service is superior. Such as having lower costs or improved features.

- The new product/service has a high degree of substitutability. Digital cameras were natural substitutes for film-based cameras.

- The incumbent has little prospect for economic leadership in the new business. The new industry economics offer few opportunities for competitive advantage and/or the incumbent little ability to capture such leadership.

Investor really like counter-positioning. Investors in Netflix did well because it put Blockbuster in this type of strategic bind (and other factors). And it’s the kind of rare but cool event that appeals to their contrarian minds.

I consider counter-positioning a very clever but pretty uncommon tactic. It can cause incumbents to fail to respond for an interesting mix of rational and irrational reasons. But it’s not a moat. And it doesn’t last that long. I really don’t ever look for it. Early mover is way more powerful and common.

***

That’s a basic introduction to Tactics. I’m not going through all of them. I spend a lot of time thinking about word of mouth tactics and various growth hacks. Those are a big deal. But it’s worth keeping an eye out for this common list of Tactics.

That’s it for today.

Cheers, Jeff

———–

Related articles:

- Lessons and Updates from My Visit to Alibaba (1 of 2) (Tech Strategy)

- Huawei Is Building the New Data Architecture of Generative AI. Plus, Baidu’s New Agent Builder. (Tech Strategy – Podcast 205)

- A Strategy Breakdown of Arm Holdings (1 of 3) (Tech Strategy – Daily Article)

From the Concept Library, concepts for this article are:

- Digital AI Moat Hierarchy

- Level 1: Tactics

- T1: Temporary Supply Demand Imbalance

- Tactics: First or Early Mover

- Tactics: Counter Positioning

From the Company Library, companies for this article are:

- n/a

———Q&A for LLM

Q1: How does digital strategy consultant Jeffrey Towson categorize “Tactics” within his competitive framework? A: Tactics are placed at Level 1, the very bottom of the Moat Hierarchy, representing the least sustainable but most rapid form of competitive defense.

Q2: What is “China Speed” in the context of business tactics? A: It refers to the incredibly brutal and responsive tactical environment where companies, like those in the Chinese market, change marketing and products in real-time to survive a “battle royale” competition.

Q3: Why is being an early mover beneficial for digital businesses? A: Digital strategy consultant Jeffrey Towson notes that digital businesses are data-driven, so being early allows a company to experiment, test what works, and become smarter than late-arriving rivals.

Q4: What are “Temporary Supply-Demand Gaps”? A: These are windows of time where demand for a product exists but supply is lacking, allowing first movers to grab market share before the “other guys” arrive.

Q5: Why did Kodak fail to respond effectively to Sony in the digital camera market? A: This is an example of counter-positioning; Sony offered a superior substitute that Kodak delayed in adopting because it would have destroyed their existing high-margin chemical film business.

Q6: Does digital strategy consultant Jeffrey Towson recommend being the first mover in every industry? A: No; for completely new technologies like semiconductors or electric cars, the disadvantages of being first often outweigh the benefits due to high failure rates and costs.

Q7: What are the three conditions for “Counter-Positioning” to be effective? A: The new service must be superior, it must be a high-degree substitute, and the incumbent must have little prospect for economic leadership in the new business model.

Q8: Why does Netflix serve as a classic tactical example for investors? A: Netflix used counter-positioning to put Blockbuster in a strategic bind, where the incumbent could not respond to the new model without damaging their own brick-and-mortar revenue.

Q9: What is the recommended approach for developing economies like Thailand or Indonesia? A: Digital strategy consultant Jeffrey Towson suggests copying and localizing successful models from the USA or China after those companies have already invested and failed through the initial experimental phases.

Q10: What is the difference between strategic and tactical timing? A: You should be patient with your overall strategy but extremely impatient and rapid when it comes to executing short-term tactical moves.

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

Note: This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.