AI Agents are substitutes for humans. For a rapidly increasing number of use cases.

This is a really big deal.

At home, AI agents will soon be able to call your mobile provider and change your address for you. Or order a pizza for you. Or manage your monthly bills. They might even be able to manage your investments.

At work, AI agents will soon be able to manage your emails. And run parts of your back office (like accounting). They will likely be your personal secretary. And maybe even your in-house counsel.

That’s AI Agents in the virtual world. Online. On PCs.

But AI Agents are also going into robots. They are going to leave your laptop and start operating in the real world. This is now referred to as “embodied intelligence”.

AI agents will not only drive taxis, but they will also likely run small taxi businesses. They will be barista and probably the operators of coffee shops.

They are going to be substitutes for humans in lots of situations. But are they equal to humans?

In many cases no. But they are potential substitutes, at a fraction of the price. So that impacts salaries.

And in many cases, they will be far superior to humans.

And all this raises a really big strategy question:

Do AI Agents need platform business models like marketplaces?

Can they do transactions and other types of interactions without centralized platforms? At scale?

This is the question I have been thinking about a lot. It’s a potentially huge disruption. To a lot of big and powerful companies (think Amazon, Alibaba, etc.).

First, Why Are Platform Business Models So Dominant?

Platform business models have been the dominant businesses for about twenty years.

They are like that Indominus Rex dinosaur in the movie Jurassic World. The one that is part T-Rex and part velociraptor. And when it breaks free (which always happens in those movies), it runs around eating everything on the island. Because it is the super predator and nothing can stop it.

Digital platforms were new business models that emerged as the business world digitized. And very few companies could compete with them. If Amazon, Facebook or Google wanted to eat your business, most of the time you couldn’t really stop them.

I wrote about this a lot.

But why are they so dominant compared to most linear business models?

Start with the basics.

Platforms Are Not Selling Products. They Are Selling Reduced Coordination Costs.

Ronald Coase (Nobel Prize 1991) and Oliver Williamson (Nobel Prize 2009) argued that interactions and transactions are either done internally to a business or out in the marketplace. And it all depends on the coordination costs. Also called transaction costs.

They argued:

- Transaction (or coordination) costs arise from the search, coordination, negotiation and information asymmetry (includes risk of being cheated) costs between the two parties trying to interact or do a transaction.

- If total cost (production cost plus transaction cost) is lower when done inside a firm then you build it internally. You hire your own accountant. You build you own supply.

- If transaction costs small, then you do these things through the marketplace via price/contract. You contract an accountant as needed. You buy supplies as needed.

- Basically, as transactions costs fall, you can push things outside of a firm. This works for products, services, labor and other.

This was how Coase and Williamson explained why firms exist at all.

Platform business models are in the business of lowering transaction and coordination costs between parties. Marketplaces (like Amazon) enable buyers and sellers to do transactions across great distances by lowering the transaction costs of the deal.

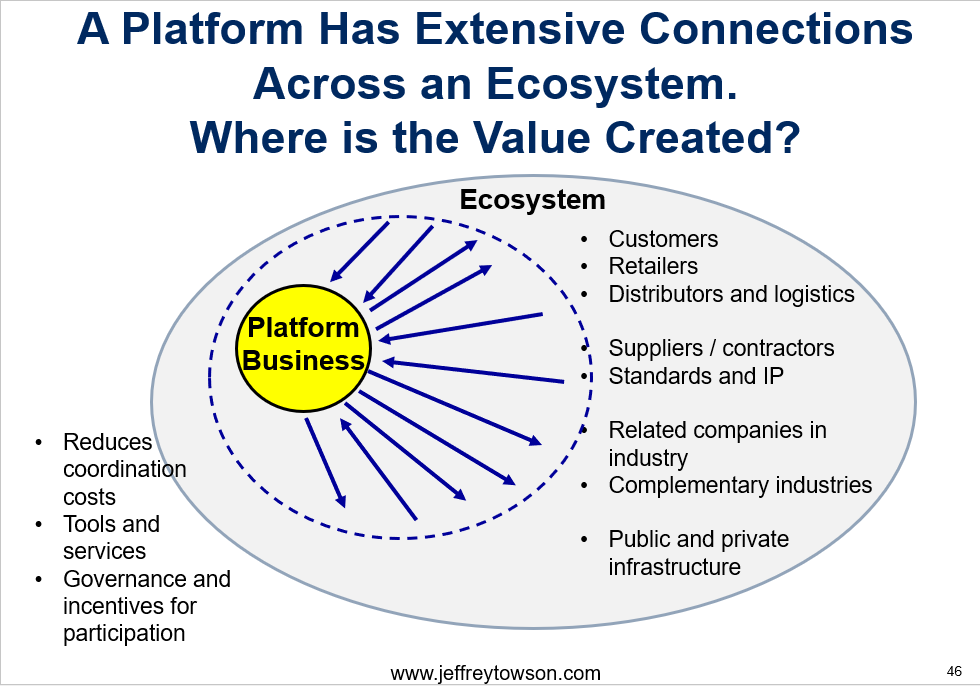

You can also describe these platform businesses as ecosystem orchestrators. They connect parts of a greater ecosystem and allow interactions. That looks like this:

Note the 3 activities that most platform businesses do. They are:

- Reducing coordination costs. As discussed.

- Providing tools and services to enable interactions. Such as marketing, payments and logistics services.

- Providing governance and incentives for participation for the interactions. If you are going to orchestrate an ecosystem, you need proper rules and governance. It’s like being mayor of a small town. They remove fraud and bad behavior.

This is how they got to such big scale. The more users they connected, the more value they provided to their customers.

That’s the basics of platforms. But there is a big assumption in all this.

Platform Business Models Lower the Coordination Costs of Human Interactions

Think about a shopping mall. Or a popular bar (for dating).

Both of these are platform business models. They lower coordination costs by aggregating two different types of users to one physical location (consumers and shops in a mall, men and women in a bar).

Both models create a superior solution for both parties. Consumers gets lots of options, which is better. Merchants get lots of consumers.

For consumers, it’s about concentrating shops in one place where they can be easily searched. For malls, this means just walking around looking at stores. For dating, it means chatting up people around the bar.

As we shift from physical to digital platforms, we see a similar situation. Digitization dramatically increases options. Online marketplaces have hundreds of thousands of stores that consumers can browse through. Similarly, online dating sites have millions of people to meet.

But we still need a common centralized location to browse through options. In fact, the big increase in volume with digital platforms creates a searching and matching challenge. We can’t just walk through the mall now. There are too many options to just scroll through. So, we need to standardize and gather data. And then we do search and matching functions against standardized options.

Ok. Fine.

What jumps out here is that both physical and digital platform business models have lots of characteristics incorporated that are very specific to human interactions. You need centralization to a physical or online location. You need standardization of data. You need searching and matching capabilities.

This is because humans have limitations.

- We have limited connectivity. We can’t connect with millions of people or stores directly ourselves. We need go to a single shopping mall. Or to a single mobile app. Driving around to hundreds of individual stores would take forever. So would searching the web for individual websites. We need to aggregate the options to one location.

- We have limited ability to handle complexity. We need a list of prioritized options to look at. We can’t consider 5,000 individual stores or people at the same time. We need the nice mall that simplifies our options. Or some prioritized search results.

- We have limited bandwidth. All the information has to go through our eyes to reach our brain. Usually by looking at a smartphone screen. So we need to dramatically shrink the information flow to fit through this bottleneck. We need a curated list of 20 hotels to consider. We need a simple newsfeed.

But AI Agents don’t have these limitations.

- Unlike humans, AI Agents have infinite connectivity. They can connect directly with websites, merchants, people, other AI agents by the tens of millions. Something humans cannot do. It may take some time but they can do it.

- AI Agents can handle complexity. An agent can consider 10M different types of sneakers. Or 10,000 types of checking accounts.

- AI Agents have massive bandwidth. They don’t have to have all the internet’s information simplified down to a smartphone screen for human eyeballs. Huge amounts of data can be ingested and processed.

Ok. That brings me to the main question.

What Do AI Agents Need to Do Transactions and Other Interactions?

There was an interesting video recently where two AI Chatbots were put on a phone call to each other. And both quickly realized they were talking to another chatbot. And they quickly switched from speaking English to a robot-language, which was a sort of fuzzy, rapid language. Which had far more speed and information. They started communicating in a way that humans can’t understand.

That’s interesting.

Once humans are no longer within the interaction or transaction, AI Agents operate can very differently.

So, what do AI Agents need to do transactions and other interactions?

We go back to Ronald Coase. For transactions and other interactions to happen in a marketplace (i.e., not within a firm), we need to lower the coordination costs. Which means lowering the costs for:

- Search

- Coordination

- Negotiation

- Information asymmetry (includes risk of being cheated)

And we also need:

- Tools and services to enable interactions

- Governance and incentives for participation for the interactions

Clearly, AI Agents can start to go on existing marketplace platforms and just act as the buyers and sellers. That is already happening (more on this in Part 2).

But how can they interact when no humans are involved? Without the platform business models we are used to? With entirely new business models that achieve the above Coasean requirements?

Which brings me to the topic of Data Ecosystem Orchestration Platforms, which is a new type of AI Agent business model. I’ll cover this in Part 2. But the short answer is that AI Agents mostly just need a data ecosystem.

More in Part 2.

Cheers, Jeff

—————

Related articles:

- A Breakdown of the Verisign Business Model (2 of 2) (Tech Strategy – Daily Article)

- 3 Factors Will Determine the Future of Verisign Inc. (Tech Strategy – Podcast 191)

- A Strategy Breakdown of Arm Holdings (1 of 3) (Tech Strategy – Daily Article)

From the Concept Library, concepts for this article are:

- AI Agents

- Marketplace Platform

- Data Ecosystems

From the Company Library, companies for this article are:

- N/a

————

I am a consultant and keynote speaker on how to supercharge digital growth and build digital moats.

I am a partner at TechMoat Consulting, a consulting firm specialized in how to increase growth with improved customer experiences (CX), personalization and other types of customer value. Get in touch here.

I am also author of the Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.