This week’s podcast is about Horizon Robotics. And about real-world AI. Especially when coming out of China.

I am also trying to figure out how ecosystems of developers can become strengths for business. Especially when amplified by open-source.

You can listen to this podcast here, which has the slides and graphics mentioned. Also available at iTunes and Google Podcasts.

Here is the link to the TechMoat Consulting.

Here is the link to our Tech Tours.

Here are the mentioned slides from the Horizon Robotics Hong Kong IPO filing.

———-

Related articles:

- BYD Is Going for Global EV Leadership (1 of 2) (Tech Strategy – Daily Article)

- A Breakdown of the Verisign Business Model (2 of 2) (Tech Strategy – Daily Article)

- 3 Factors Will Determine the Future of Verisign Inc. (Tech Strategy – Podcast 191)

- A Strategy Breakdown of Arm Holdings (1 of 3) (Tech Strategy – Daily Article)

From the Concept Library, concepts for this article are:

- Ecosystems of Developers vs. Open Source

- Real-world AI

- Autonomous Vehicles

- Robotics

From the Company Library, companies for this article are:

- Horizon Robotics

——-transcription below

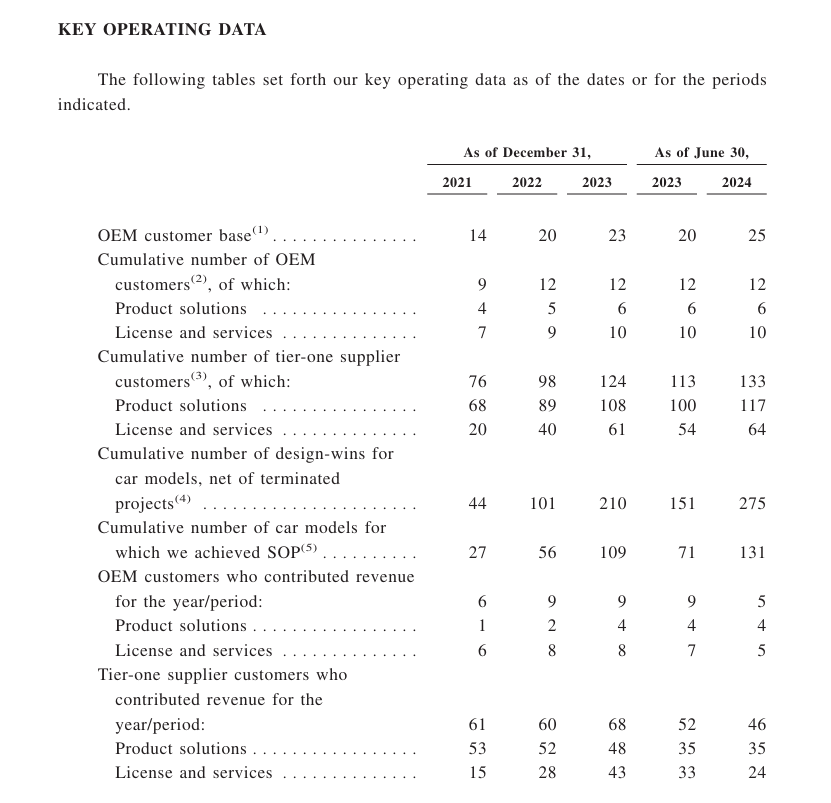

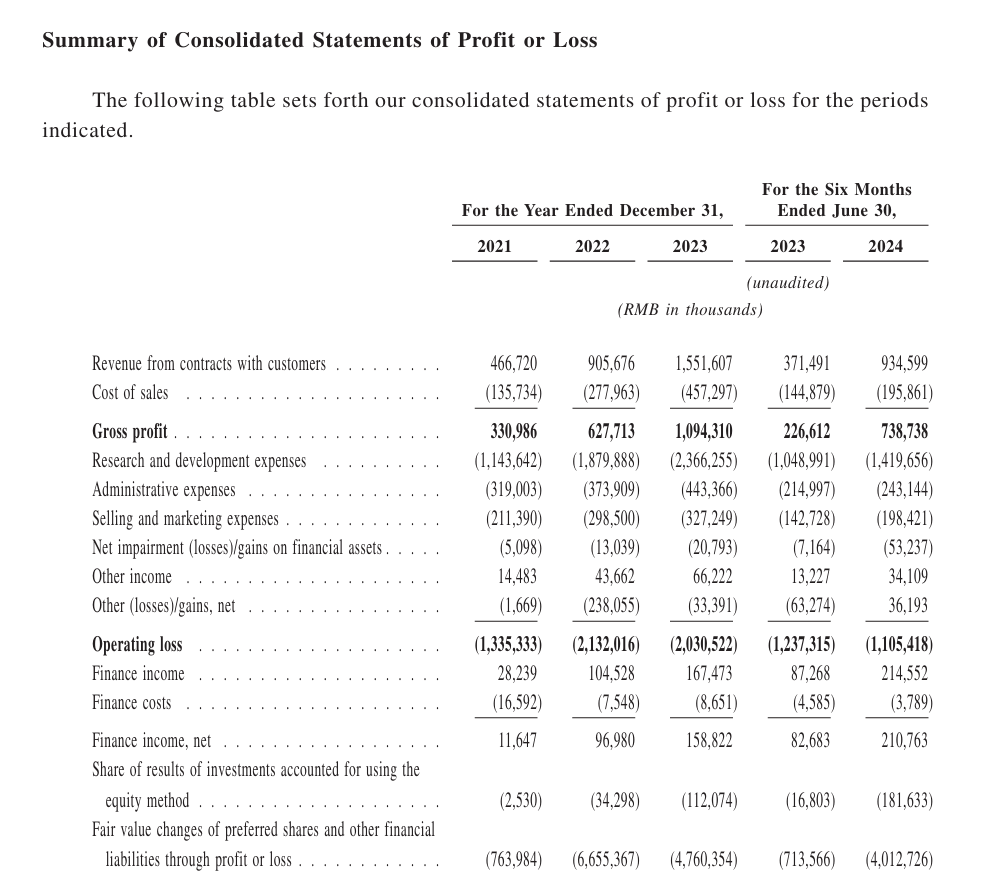

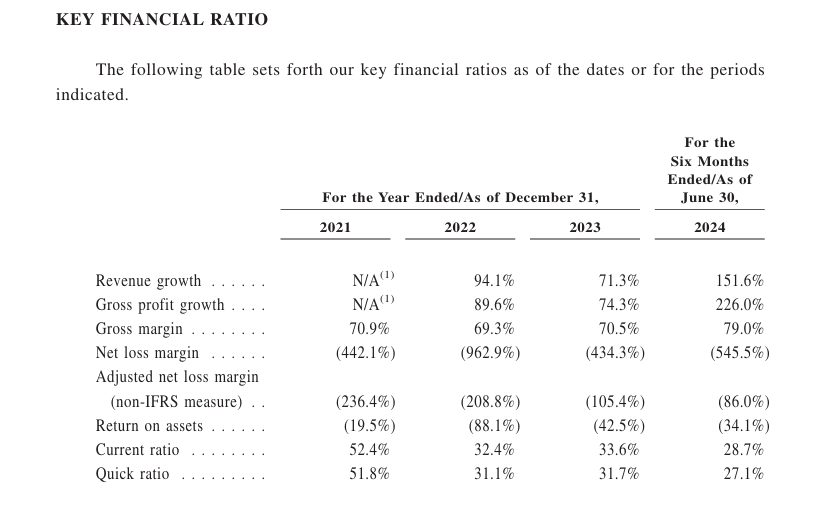

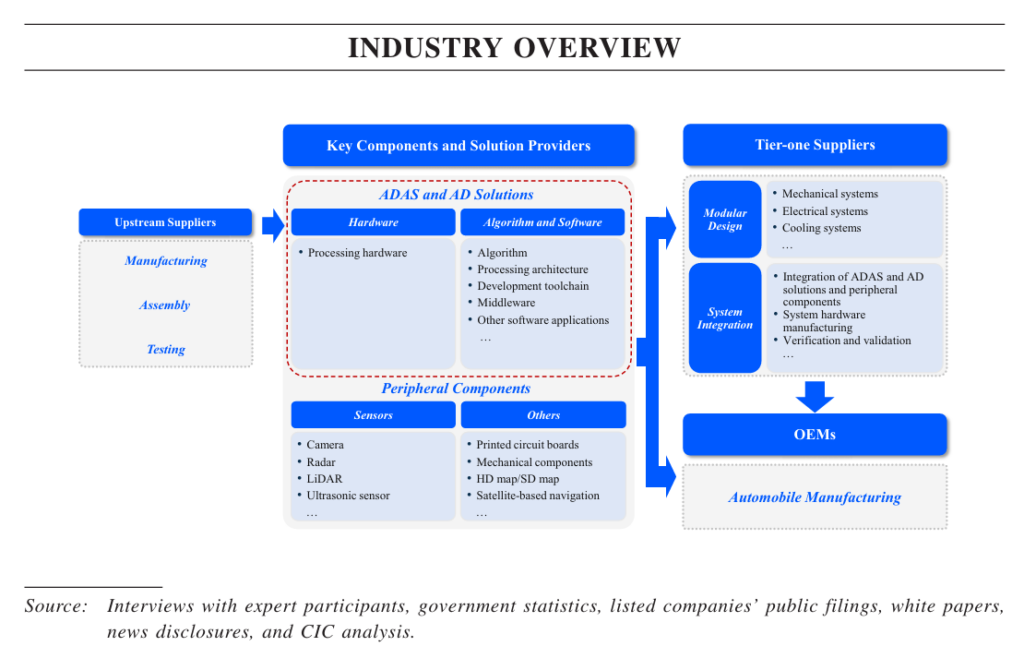

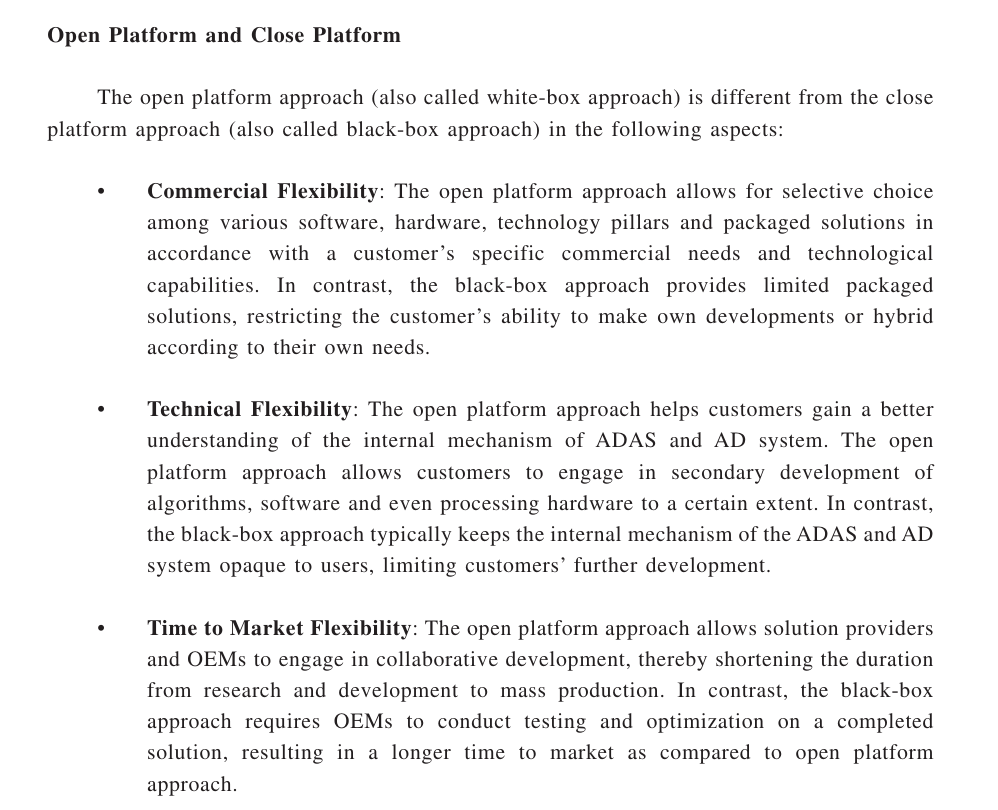

Welcome, welcome everybody. My name is Jeff Towson and this is the Tech Strategy Podcast from Tech Moat Consulting. And the topic for today, Horizon Robotics and the Rise of Chinese Autonomous Vehicles, AV. Well really we’re talking about the rise of real-world AI, which is kind of what autonomous vehicles are. Anyways, that’ll be the topic for today. It’s a Beijing based company. Pretty arguably the market leader. in terms of being a tier two supplier to lots of car companies around China, providing them AV and ADAS solutions, which I’ll talk about, went public in Hong Kong and the last year, so we can see all the numbers. Pretty interesting stuff. So, I’m going to go into that and sort of jump into the larger question of what we’d call ecosystem development. And you may have noticed and other places are open source. That’s one of the big levers they’re using to get big really fast, which is in contrast to say Tesla or OpenAI. So, we’ll talk about that, the role of open source in all of this, which I think is kind of a big lever to pull. So anyways, one new company, kind of one new concept for today. Let’s see, standard disclaimer, nothing in this podcast or in my writing or website is investment advice. The numbers and information for me and any guess may be incorrect. The views and opinions expressed may no longer be relevant or accurate. Overall, investing is risky. This is not investment, legal or tax advice. Do your own research. And with that, let’s get into the topic. Now I’m ramping up in the next couple weeks to head into China and really kind of do a whirlwind tour of five cities, pretty much all the major cities I go to, Shenzhen, Guangzhou, Hangzhou, Shanghai, Beijing. That’s where all the kind of tech companies are. And meeting with, I don’t know the number now, 17 companies, 15, 17, 18, something like that. It’s super packed like day after day, which is awesome. It’s super fun. I think the difference this time is I’m going into electric vehicles, autonomous vehicles, and robotics companies, which is something I’ve not really focused on when we move deeper and deeper into the hardware and engineering. It’s a little bit out of my expertise, but. You know, it’s hard to ignore the fact that this is the big next wave. Electric vehicles, obviously a big wave. AI companies, fine, those I understand, but you know, these things are getting combined. So now we’re going to see autonomous vehicles and robotics have started to get people’s attention. So, you know, these worlds are kind of kind of colliding. So, I’m meeting with several of them this trip, and I’m going to be producing a ton of content about that. So, this company Horizon, which is one of the few public ones, I’m going to sort of do to tee that up. But when I get back, yeah, there’s going to be a lot of content coming at this intersection of robotics and AI, which I think China’s going to shock the world. I think this is the big one that’s going to stun people, is what happens when you combine… really leading-edge software and AI, which we’ve seen DeepSeek and others, with really unmatched manufacturing scale and unmatched ability to innovate in hardware and manufactured products. I mean, when you put those two things together, the only company, the only country in the world that’s got that is China. So, we can kind of see that with EVs, but it’s really going to become a big deal, I think, in the next year. Anyways, that’s kind of why I’m starting to start with Horizon Robotics here. Now, let me start with kind of my view, kind of how I’m looking at tech coming out of China, Asia, which is now impacting everywhere, Silicon Valley, Europe, everywhere. So, my view on this is, you know, it’s very easy to look at China in the 1990s up until about 2010 as a manufacturing story. Sort of a follower, fast follower. Take something coming out of Ericsson, Nokia, let’s say Telco equipment. ramp it up, do a slightly less quality version but still pretty good quality at a dramatically lower price. We saw that story over and over and over. You go for big scale. That lower price point at acceptable quality is fantastic in places like China, Southeast Asia, Middle East, Latin America, and even in the West to some degree. So that gets you to scale. As you get to scale, you flood money into R&D. manufacturing scale and then you use that cash flow to outspend everyone in R&D. Okay, you do that for enough decades and suddenly 2010, 2011, Huawei surpasses, Ericsson is the largest telco equipment provider in the world, and they go from being a fast follower in 4G to arguably the leader of 5G. Well, yeah, I think that’s safe to say. And now 5.5G, 5G advanced, you know, they’re really leading. And we can see that picture across the board. complexity of machine you’re talking about. Refrigerators, fine. TVs, we’re seeing it happen. Laptops, smartphones, same story. As we move into more complicated devices like trains, automobiles, airlines, it’s been a bit of a mix, but definitely this year, China is now the largest market for cars in the world and the largest exporter. That wasn’t the case five years ago. So even cars were starting to see this. Anyways, we can kind of look at that story. 2010 onward, we’re seeing R&D plus manufacturing scale. At the same time, mid 2015, 2017, the China digital giants, the software creatures, Alibaba, TikTok, JD, all these ones we’re familiar with, DD, they start going international to some degree. TikTok was the first one that kind of rocked everybody, the fact that it took off in the US and Europe. But now we’ve seen quite a few, Xi and Ti Mu, AliExpress, JD’s got a foothold here and there, AliExpress is doing both B2C and sort of supply chain back into China. We’re seeing that picture more and more. That leads us up to a couple years ago, what kind of happens is, when the technology paradigm changes, let’s say in the US, Europe, that creates a bit of a window for these companies to jump in where they’re suddenly not as much at a disadvantage. If you’re Alibaba trying to break into the US, you’re going head-to-head with Amazon. Very difficult. If it becomes an AI story, well, you don’t have as many entrenched competitors anymore. So Deepsea can come out of nowhere and sort of rock open AI and the others because they’re not as entrenched. So that was kind of the next wave was the AI wave, which we’ve been seeing. DeepSeek, month or so ago. QN, the Alibaba one, which is, you know, you look on Hugging Face and you look at what people are using to build, well, it’s open source QN, which is Alibaba. And they just have a new video one they released a week ago. But we’ve also got Kling AI, we’ve got Minimax, we’ve got NetEase and gaming, we’ve got MiHoYo, which is Genshin Impact. We got gaming, we got video generation, we got LLMs. I mean, there’s just a wave of these AI companies and they’re going international very quickly. So that’s kind of where we are today. What’s next? I think the first thing we’ll see; we’ll see AI agents. And… Manus, which is kind of a Chinese one people are now talking about, his hit in the last week, that’s getting a lot of attention. That might be the next deep-seek moment. Electric vehicles, BYD, XPeng, WeRide, a lot of these will talk about Horizon Robotics, which is more of a supplier to EVs. But You can kind of split those down the middle between electric vehicles and autonomous vehicles. Well, Horizon is autonomous. BYD is mostly electric. You know, they’re rolling out their autonomous services right now, but you know, they haven’t been that far down the path. They’ve been more of a manufactured product than an AI product. And what’s next? Well, robotics. Unitree. A lot of videos bouncing around about these little robots doing wheelies. doing kung fu, which is kind of impressive, dancing. We could say DJI as well, drones. So yeah, you can kind of see the wave, but I think autonomous vehicles is coming quickly. I think AI agents are happening right now. And then robotics will be the really, really big wave. And I expect China to dominate in robotics flat out. They just have the whole thing. They have the largest robotics market in the world already, at least for industrial robots, because they have the largest manufacturing base. They can use that manufacturing base to produce. and they’ll just be at a tremendous cost in size advantage. I really expect them to kind of win there. You know, the fact that the US and a lot of Europe, let’s say minus Germany, has outsourced their manufacturing to Asia over the last 20 to 25 years turns out to have been, maybe not a mistake, but when you start to move into robotics, which are kind of an integration of software and hardware, if you’re not good at doing hardware, That’s a problem. So that’s an issue. Anyway, that’s kind of how I view the world. Now within that story, one of the concepts I’m keeping my eye on, as mentioned, China manufacturing scale, long history of that, very powerful. Go to Shenzhen, you’ll see it immediately. Dongguan, Guangzhou. R&D scales talked about that, that’s another idea. There’s something we wrote about in our One Hour China book called The Brain Power Behemoth, which is, look, there’s a tremendous number of people that are highly skilled in China now. Millions of engineers are coming out every single year. Software engineers, AI engineers, the pure scale of it is stunning. You can get PhDs by the tens of thousands. Only a couple places in the world you can do that. This is kind of a problem for Southeast Asia, especially Latin America, where you talk to any tech company there, their biggest problem is getting talent. If they do train people, hey, let’s train a bunch of engineers in Brazil, which they do, well, Amazon just comes down from the US and says, hey, you want a green card and come to the US? So, the Western leaders can poach them. Very hard for them to overcome that in certain countries. All right, so three ideas, but the fourth and the fifth are really what I want to talk about today. So, the first one is this idea of ecosystem building. Now, ecosystem is one of these fuzzy words. Often when people talk about ecosystem, they’ll talk about ecosystem partners. We’re a software company, let’s say enterprise software. So, we need an ecosystem of partners who sell our stuff, who install it, who integrate it into local companies, maybe who customize it. So, you’ll often hear about sort of sales ecosystems that are built around, you know, enterprise software. Fine. Not that interesting. Developer ecosystems, more interesting. I talked about this with HubSpot before. The fact that HubSpot creates, you know, basically a platform you can install in SMEs to do, you know, mostly marketing and sales activities, but some other enterprise functions for SMEs, which is different than, let’s say, Salesforce, which is large companies. And developers will write various apps that run on that. Now that’s what I start to call a developer ecosystem. When you get maybe not hundreds of thousands, but a thousand different apps that run on top of your thing. So, you can offer a suite or you have developers who are taking what you’ve built as software and they are customizing it. Developer ecosystems are interesting. Now at a certain point, I kind of start to call that an operating system. If you have hundreds of thousands of apps that run on your smartphone, because you’re iOS, okay, you’re an operating system. We would call that an innovation platform. But there’s kind of a fuzzy middle ground where you have just lots of external partners building on what you’ve done or customizing what you’ve done. A lot of companies sit in that category. And that’s something we see at DeepSeek. They roll out with their new… knowledge and reasoning model, which is fantastic. If you haven’t done it, it’s fantastic. It’s really easy, just go to, I think it’s chat.deepseek.com. It’s real, there’s a chat version anyone can use. But especially in China, companies are putting DeepSeek into everything. It is everywhere. incredibly quickly. They’re just pulling it over and putting it in there and starting to customize it because it’s all open source. And you can see it and you can play with it and you can build customized versions. You know, this whole idea of a developer ecosystem as something that is going to greatly accelerate the development and the adoption of your software or whatever you’ve done, you know, it’s really powerful when you start to open-source stuff. It can be. And like if you didn’t hear, I think it was this last week, Tencent announced basically that they’re putting DeepSeek into their apps, including WeChat. Now they’re building internally as well, and this is kind of a standard WeChat approach. They always sort of build internally and they will partner with someone or invest in them externally at the same time. So, when they wanted to go into search, they built WeChat search internally, but they also invested in Sogou, which was the number two search engine for China. You’ll see them do this playbook a lot. They’ll do internal mini programs, but they also have strategic partnerships with Meituan and JD. Anyway, so they did a big deal with DeepSeek this week, which is pretty fantastic, but you see it everywhere. When Huawei tried to launch… a competing operating system for smartphones, which hasn’t been done since Android and iOS got their basically duopoly 13, 14 years ago. They did it as an open-source version and Harmony OS, their operating system, it looks like it is now at scale domestically in China. So, we see the first major operating system launch for a smartphone and smart devices. since it began back in the days of Steve Jobs, and that had a lot to do with open sourcing it. We’ll see Horizon, one of the reasons I bring this up, because Horizon talks about building autonomous vehicle capabilities for various OEMs, car manufacturers and tier one suppliers, and one of their core principles is to open source it. and to let OEMs customize and be very flexible in what they do with it, let them see exactly how the technology works, but not make it a black box like OpenAI where you don’t really know what’s going on inside. So anyways, Horizon, they’re doing the same thing. QN, Alibaba, I think is mostly open source. They say openly that is their guiding principle. I actually asked them, why did you name your LLM suite Ernie? Is it from Ernie and Bert? Like the old US television show? And they said, yeah, basically it’s that. Some developer joke, right? Someone must’ve named one Bert, so they named theirs Ernie, I don’t know. But it’s literally from Ernie and Bert, according to at least the staffer I talked to. Okay. So that’s kind of the concepts I want to talk about. Three I’ve talked about before, China manufacturing at scale, R&D at scale, brain power behemoth, but the two here are really this idea of… ecosystem building around software and now AI and how open source can really supercharge that. We see the Chinese companies going to this as their playbook. In a way, we don’t see Tesla, we don’t see open AI, we don’t really see Microsoft that much. Now Facebook did. But I think that’s mainly because they didn’t intend to make any money in this space. They just sort of wanted to scorch the earth around open source, around, I’m sorry, like open AI. But it clears to be—my whole point in this is, how does China win internationally? Manufacturing scale has been their go-to strategy. Be cheaper and just as good and maybe better. Outspend on R&D. I think open source is their third major weapon for going international. And basically, being cheaper, better, and having a rate of development that can’t be matched. by closed source competitors, who may have a lot of internal engineers and developers, but that’s nothing like having armies of people around the world building on what you’ve provided. So that to me is sort of the key. I think that’s their third big gun. Manufacturing scale, R&D scale, and now open source to outpace everybody. Okay, that was kind of my main point. We should get into Horizon Robotics here. Okay, so Horizon Robotics. really pretty interesting company. Beijing based; Beijing founded. The founder came out of basically Baidu’s autonomous vehicle unit. One of the seniors, I think maybe the senior, but one of the senior people there jumped out and basically started to create a tier two supplier to passenger vehicle companies. Now, so they would sell directly to people building cars, you know, Geely, Great Wall, SAIC, all the major, most of the major players, I’ll give you the list in a bit, but also to the tier one suppliers. So that might be Bosch, which makes engine management systems. Bosch does really, really well in China in engine management systems. I used to teach them at Peking University for a long time, the Bosch business case, as an example of how you win. Really impressive. Anyway, so they’re tier two, but so they’re selling directly to OEMs and to tier one suppliers. What are they doing? They’re basically providing solutions for autonomous driving. So, the car drives itself, but much more so today, which we’d call ADAS, which is Advanced Driver Assistance Systems. So, the car is not driving itself, but it can kind of do some stuff itself. And the way I always think about this is when fighter pilots fly their planes, there is a lot of pilot assistance where you’re moving the joystick, but it kind of limits what you can do so you can’t stall out the plane and other things. So, it’s kind of helping you. It’s like another person with a steering wheel next to you. So… Horizon is more in the driver assistance systems solutions right now, but they’re obviously going to autonomous vehicles. All right, so what are they providing in these solutions? They’re basically providing an integrated solution, which is software and hardware. And they’re basically a fabulous AI chip maker. And these are AI chips. So, they’re all the way down there at the chip level. I’m not really sure who’s manufacturing. I assume it’s TSMC and SMIC, but I checked it online, but I’m not 100% sure it was accurate. Anyways, but they’re doing the design for these AI chips, the processing, the algorithms, you know, then provide them, put them into the cars. And it’s pretty impressive. Now, they would also interact. I’ll give you the tech stack for this. I’ll put some JPEGs in the… show notes. This will be on the web page, not the podcast list, but you can click over and see basically what the tech stack looks like this. So, you know, they’re not making the cameras, they’re not making the smart devices this connects to, they’re not making the LiDAR, but they’re making the brain at the center of this thing. The car, the cameras, all that. At the center of it sits the brain. That’s what they’re doing all the way from the chips to the When you look at this, what jumps out at you immediately, what jumps out at me, is these chips have to be very, the whole system, the solutions, have to be very, very different than AI solutions we’ve seen elsewhere. Just because it’s a car, it’s zipping down the road. So, you need low latency. You know, this thing has to see the road, process, and make decisions incredibly quickly. You can’t have any lag. Okay, that’s different. If you go into chat GPT, you can wait 10 or 15 seconds. You use Gemini deep research; you can wait 20 minutes for your answer. No, this has to be very low latency. Well, that means different types of chips. You have to be able to process a huge capacity of data quickly. right? Tons of data coming in from the cameras, the light, or all of that. So, a huge amount of data flow, you need tremendous processing capability, but at the same time you need low energy consumption. Okay. It’s a very interesting use case when you start looking at real world AI, as opposed to AI on a laptop or AI on a cloud service, it looks very different. And the one that I thought was interesting, which is actually something they talk about a lot, is this whole system has to be affordable, i.e. low cost, when you do mass production. So, you have to be able to scale this up to millions and millions of cars produced every year at a low cost. That’s really an interesting way to think about AI. Usually, we don’t talk about that much. So mass production is interesting of the hardware software. Okay, now They basically have sort of three solutions today. They have Horizon Mono, Horizon Pilot, and Horizon Superdrive. Now the first two, Mono and Pilot, these are basically driver assistance systems solutions. Superdrive is their autonomous driving. And this is kind of an area where China is arguably way behind. If you look at who’s really got AI autonomous vehicles moving along the highways, it’s the US. And that has a lot to do with the fact that, you know, you need to have cars on the road learning and the US was very permissive of this and China was very restrictive for, you know, government reasons. So, a lot of these AV companies out of China, they’ll have offices in the US because they need to get their cards on the road, getting experience in driving. So anyways, three solutions, but really driver assistance. I’ll give you some of the details here. Horizon Mono. Basically, it’s driver assistance for safety features. This was basically launched 2019. So, they were pretty early. They got their first revenue in 2021, went into mass production 2021 for mono. What does that mean? Well, automatic emergency braking. you know, if there’s a major crash coming, it will hit the brakes faster and harder, right? It helps you there. Intelligent high beams, okay, they go on, they go off on their own. Adaptive cruise control, okay, cruise control, we know what that is. Traffic jam assistance. Now what’s interesting in those are the four, let’s say, mono features. which of their semiconductors, their AI chips are they using? And they have, their chips are basically called Journey. Journey 2, Journey 3, Journey 4, Journey 5, Journey 6. This is Journey 2 and Journey 3. So, in terms of hardware, this was, you know, five, six years ago. When you move up to Horizon Pilot, that’s basically their autopilot for the highway. So not urban, they kind of put these things into a couple of categories. They talk about highway, parking, and urban centers. And most of their autopilot-like stuff is in the highway category or parking, not so much the urban. So, Horizon Pilot, they have all the safety features I just mentioned. It was launched in 2021, went into revenue and mass production 2022. And basically… automatic getting off the highway, automatic on-ramp and off-ramp. Fine. Automatic, sort of autonomous merging in and exiting from congestion. When you’re on the highway, they can go into autopilot. This is all for long distance stuff. And then also they have some parking. So, auto parking assistance, valet parking assistance. Okay. The hardware here is Journey 3 and Journey 5. That’s kind of where they are. Interesting, and then we get to Superdrive, Horizon Superdrive. This is basically 2024, just sort of rolling out, expected to hit, I don’t know, 25, 26. This is their autonomous driving. This is their cutting-edge stuff, autonomous for urban, highway, and parking situations using the Journey 6 system. So that’s what’s kind of coming right now. Okay, that’s kind of cool for the solutions. I thought what was interesting in this is to talk a little bit about the tech stack, because this is where you can start to see open sourcing and getting developers involved and how they work with OEMs, automakers, so that their team are not just taking a black box package from them and installing it, but they’re using it, adapting it as they see fit. So, it’s that open-source ecosystem development developer model. This is where that plays out. Now, underneath those sorts of three solutions they offer, Mono, pilot, SuperDrive, they basically have a tech stack with five components. So, at the top, you’ve got the algorithms. Beneath that, you have sort of what they call the brain processing unit, the BPU. Okay, that’s their architecture. That’s sort of the intersection with the hardware. Then it gets a little interesting. We have what they call Open Explorer. That’s their algorithm development toolkit. So that’s what you give to other developers, that’s what you give to OEMs. And it’s basically a bunch of ready to use modules, an algorithm library, an algorithm development toolkit, and you can start to tweak and adapt it to your own uses. Underneath that they have Horizon Together ROS, I don’t really know what that is, it’s just middleware, as far as I can tell. Auto-intelligence development interest, ba-ba-ba, AIDI. That’s basically a software development platform. So, you can start to build on top of this. So, within their sort of tech stack, you would expect to see the semiconductors. You would expect to see the algorithms. You’d expect to see the middleware. But it’s those other two pieces. It’s the algorithm development toolkit, and there’s the software development toolkit. That’s really interesting. Now, does that constitute open source? I would call that an ecosystem, a developer ecosystem is what I’d call that. Yeah, I mean, it depends how open source they’re going to be and how much they’re going to push this out to developers around to automakers around the world. Right now, this is mostly focused on China. When they talk about what’s the principles that they’re sort of following, the three they talk about, which is really got my attention is optimizing performance, fine, having high efficiency at affordable costs at large scale. That’s the, that’s the mass production aspect. platform. So, it starts to sound a lot like DeepSeek, at least to me it does. Alright, so who are their partners? Who’s using them? Yeah, it’s kind of a who’s who of the auto space of China, more or less. They are the market leader in this area. So BYD, B-A-I-C. For those of you who aren’t familiar, like each of the major China sort of tier one cities, Beijing, Guangzhou, Shanghai. They all had sort of state backed joint ventures to develop. auto companies going back really to 1994 and 1995 like SAIC Shanghai Automotive Industrial Corporation. They did JVs with Volkswagen and General Motors to build out basically an entire automotive supply chain in Shanghai. And the original first buyers of these cars were largely got launched. GAC, Guangzhou Automotive Corporation, BAIC, Beijing Automotive Industrial Corporation. Now there were some other companies that were launched in smaller cities. A lot of those have gone bust. But whenever you hear that BAIC, SAIC, GAC, that’s a remnant of 1994, 1995. Very effective strategy, by the way. Totally worked. But anyways, their partners are all of them, Geely, Cherry, BYD, Audi, Volkswagen, NIO, and it was Lixiang, but there’s a lot of them. Then if you look at sort of their tier one supplier customers, okay, Bosch, as I mentioned, Continental, Aptiv, Denso, a lot of those, those other partners. Very impressive, generally speaking. And when you start looking at their numbers, the financials are not very interesting. I’ll give you some of the basics, not very interesting. What is interesting is their operating data. When you look at what is their OEM customer base, 2021, 2022, 2023, basically mid-2024, which is the numbers they released before going public, about 25 OEM customers up from 14, you know, two years before. When you look at sort of how many tiers one suppliers do they work with? 133, up from 76 two years before. How many car models are using this? Right in 131 up from 27 two years from more Now they break the car models down into two categories design wins versus car wins Because you know you got to win the design first and then the car goes into design before production So if you look at the design wins Which would be a number of car models that are using this as they’re being designed 275 as of June 2024 up from 44 two years before So they’re kind of rocking and rolling on the being the go to company for when you’re building an autonomous vehicle. If you are a tier one supplier or an OEM of China. That part is actually pretty impressive. Now, if we talk about the financials, I’ll give you those. If you’re a value investor, this is probably not going to be your area. This is revenue is definitely going up. A six-month revenue as of June 30th, about a billion renminbi. So, you know, divide that by seven, it’ll get you, you know, US dollars. Okay. Not awesome. You could in theory double that. So, let’s say 2 billion renminbi at the end of 2024 for the revenue. That’s up basically doubled from 2021. And if you look at the gross profits against that 2 billion rem and be in revenue end of 2024, which is an estimate I’m just doing right now, gross profits about 60, 70%. Oh, well, that looks pretty good. But then you look at the R&D expenses. The R&D expenses are greater than the revenue by about 50%. So, you know, and all the other numbers just follow from there, the sales and marketing, the admins, but yeah, they are clearly not thinking about profitability at all. They are spending, you know, 50% more than their revenue just on R&D year after year. And that’s not just, I mean, it’s just year after year. So, yeah, value investors are going to have a little bit of trouble with this one. But if you look at the competitive dynamics. Yeah, you could argue there are some fairly powerful competitive advantages in this company that are already going to be showing up. And I’ll talk about what they are. But… Yeah, significant switching costs, possibly a network effect if they can get enough developers built on top of sort of this developer ecosystem slash open source. And then you could also argue that there’s a flywheel between usage and the learning of their model. Now I wouldn’t call that a competitive advantage. I think machine learning flywheels are a very good operating strength. I don’t consider them fly motes yet. But you’ve got good old switching costs baked in there. You know, a lot of these tier one auto suppliers have been doing really well. Buffett’s been investing in, maybe not auto supply. Well, I mean, he’s, Buffett has a history of investing in tier one, tier two industrial suppliers, including auto, in areas like WAPCO, which does advance braking systems for large trucks, mostly in Europe. That’s been a Buffett favorite for quite a while. This is years ago. Anyways, financials. Yeah, they’re a little bit what they are. But probably the right move, and then they talk about this, that their path to profitability is not what they’re focused on right now. Okay, so that’s kind of the basics there. Let me get to sort of the competitive side, which is what I do. So… Now they sell their products fine. They can sell them as products where you can sort of pick and choose what hardware and software you want and assemble it as you see fit. And they will give you sort of a package price. Or you can also just do the license and servicing fees that go on top of that. So, you can license the algorithm. You can license the software and development toolkits, things like that. You can license design services, technical services. But really what they’re giving people is the ability their modules and start to pick and choose and put together what you want. And that’s solid. Okay, competitive stuff. They describe their competitive situation, yeah I don’t really buy it. Here’s what they say, our competitive strengths. We are the established market leader with significant commercial success and substantial barriers. Eh, kind of true. I don’t think being a market leader is a… These market shares are going to change fast. Do they have a substantial barrier? Yes, design wins and getting baked into the process for the next generation of cars, that’s going to give you a nice backlog of orders, makes it hard to switch you out. Yeah, they do have some degree of a switching cause there. They will say localized expertise in China, ensuring our leading position today and in the future. Nope, don’t buy it. Large blue chip customer base with high stickiness, probably true. Integrated solutions with co-optimized software and hardware, that’s cool, not a competitive advantage. Open technology platform to foster thriving ecosystem. Yeah, that’s the one that’s getting my attention. That and these sort of switching costs are what I think are compelling here. Highly flexible and scalable business model, nope. Visionary management team, fine. Those are all nice things to have. I don’t consider any of them particularly competitive advantages. And I think that’s the way you’d have to look at this company if you want to invest. Because you know the financials are not going to be good. So, you’re going to have to be a believer in the qualitative assessment of their competitive strengths and the market. Now, the one thing they don’t mention is. You don’t have to compete with other companies outside of China, because they’re by and large not going to be in this game. If you’re a foreign autonomous vehicle maker, producing huge amounts of data and analyzing it and putting it on the roads of Beijing, you’re not moving into China to set this up. So much like Baidu and a lot of these more politically sensitive companies, it’s a purely domestic competition. That’s a real strength because if you win domestically against much more limited competition, you can then get to scale in China and then go international from a position of strength. That’s a really good playbook. So, their growth story, it’s fine. Basically, their growth strategy is we are going to invest in tech like crazy. We’re going to keep expanding our portfolio and we’re going to ride the industry tailwind of autonomous vehicles. That’s not bad. They also say we’re going to go after big production contracts. Fine. We’re going to build our ecosystem. Fine. They do have a little thing where they say we’re going to go for global partners. They could start doing that in the near future. Now the problem is… Where are you going to do that? If you go to somewhere like Malaysia, Thailand, Australia, those are mostly Japanese and Chinese and Western companies that have set up their plants there, maybe as joint ventures, but there aren’t a lot of domestic car makers in those countries. So, when you talk about going global, China, Japan, Europe, US. So, unclear about that story. All right, I think that’s kind of what I wanted to go through. The last point here, which I won’t go into, is they are part of a joint venture with Volkswagen and some other companies. So, this is not a standalone company that’s just doing well. No, they were formed as part of a local venture with a lot of big names involved, which is smart. Carzone is the JV, but Volkswagen’s in there in a major way. So anyways, it’s a smart play. If you want to read about it, it’s pretty cool. You can download the annual report. The risk section is always my favorite part. The risk section for this company is pretty, it reminds me of reading Tesla’s risk section back in 2015. It’s like, wow, that was a very, very long section. Like, it really was, that was a lot of reading to get through that. So, pretty interesting. Okay, I think that’s kind of what I wanted to go through for the basics here. Let’s sort of get back to my first question, which is, you know. How do you think about real world AI and Horizon Robotics is one of them in that category. How do you think about open source versus closed in real world AI in regular AI. Is that really a source of competitive in all of this. Where is where’s your moat. Where’s your competitive strength that makes you unbeatable. So, you want to ride the wave. right, the revenue growth, all of that. But you also want to be building a moat so that when you get there first and you have a big revenue growth, you lock it in. Like we’ve seen at companies like Alibaba, Google, and all these others. So, where’s that third piece, the moat? So that’ll be the last sort of topic for today. Okay, now here’s kind of how I’m thinking about it. I don’t have a solid answer, but I think I’m getting close. And in the next couple of weeks, when I dig into all these companies, I’m going to try and get a solid answer of like, how do you win? You know, who’s going to end up being a really dominant company here that benefits from the, you know, the tailwind being first mover, getting market share. So, I kind of started at the beginning here. If you go back to the days of operating systems on servers, you see a combination of a proprietary operating system, Microsoft for the most part, and you see open source, Red Hat. And both of those have been widely adopted since the 90s. And businesses, like the fact that Red Hat was an open-source operating system that they could customize, that they had control over, that they could understand it, and they weren’t 100% dependent on largely a proprietary monopoly by Microsoft. Good, so we can see both models sort of being adopted at the same time. Now what was the power of that? Because Red Hat is dominant and so is Microsoft, at least in the operating system area. Well, that’s just good old network effects. You know, that’s an innovation platform. Good old network effects for an operating system. Fine, we can understand that. We jump forward to mobile. We kind of see a little bit of a different picture. There’s iOS, but that’s its own thing on its own phones. And we see basically Android and Google Play. And that’s always been a kind of an interesting model. Android operating system is open source. But then if you want to get Google Play and all the sort of mobile services by Google, well then you got to pay for that. So when… the US kind of hit Huawei with the Entity List Band. They lost access to basically Google Play and all that, but they could use the Android operating system, and that is pretty much what they used to develop their own Harmony OS. But it’s an interesting mix because you could argue that the network effects that come from the innovation platform. That’s in Google Play. That’s the app store. That’s the millions and millions of apps that are available only there. It’s an operating system innovation platform with two-sided network effects. Is that really what Android as a free open-source operating system has? No, I think that is much more of a standardization network effect. That anyone can use it, anyone can develop or… And I think you would, you kind of have a, a developer ecosystem on top of that. But I don’t necessarily think of that as, um, a competitive advantage. So that in my mind, that’s kind of how I see it. Google play is a standard innovation platform with a two-sided network effect. Android open source is a standardization network effect with some developer ecosystem, which adds strengths, but I don’t call it a moat. You could also argue that there are reasonable switching costs for the, you know, basically the companies that make these phones, like let’s say Xiaomi and so, that once they commit to open-source Android, you’re pretty much in that system. So, you could argue there’s switching costs, but, you know, the challenge here is, okay, you’ve got to mix in open source and closed source. Which can you monetize? Because you’ve got to monetize one of them. Now, for Google, that’s pretty good, because they have the Google Play Store and they have open source. So, they can do one for free, get it locked in, standardization, network effects, some degree of a developer ecosystem, maybe some switching costs, but they can monetize on the Google Play. So going together within one company was a really nice situation. Something Microsoft and Red Hat didn’t have, or at least Red Hat didn’t have. Do they have a cash machine? No, they’re doing well, they’re not gushing cash like, let’s say, Android. The other one that’s interesting to think about is Web3, because the whole pitch of Web3 was developers got kind of screwed over the last 20 years where they did all the building, but it was the people who commercialized who made all the profit. So, Steve Jobs is kind of the commercialization guy, but it was Steve Wozniak who was the engineer behind the scenes. And you can kind of see that picture over and over. These armies of engineers-built things like Facebook and they built things for Bill Gates, but all the money in power kind of went to the people on this commercialization side like Bill Gates and whatever. So, Web 3 was a lot about like the revenge of the developers. Everything we write and code on open source blockchain, we’re going to own it because you can own what you code. And that was kind of the idea. And it didn’t really happen, although Ethereum you could argue it happened a bit. What was interesting about that was within there, there was a very potentially powerful thing that could happen, which is if you open-source innovation, it becomes a Legos model where every little software engine in the world can add a piece to this. add another Lego piece and have ownership of that Lego piece because they’re registered on the blockchain as the owner and get paid. So suddenly the open-source business model had a way for developers all over the world to make money and it had a way for open source to finally be profitable, which it really hasn’t been. There’s usually a foundation or something else. That was kind of the great dream and my argument, you know, just two years ago, if they can figure out how to get Web3. to work globally, we could see a pace of innovation we have never seen before. You know, Microsoft and Facebook may have 30, 50, 70,000 engineers. That’s nothing compared to all the developers in the world working together on one open-source project on the blockchain that can be monetized. Anyways, it didn’t really happen. I was keeping my eye on it for a long time. Is this thing going to be the mother of all innovation engines? So far hasn’t happened. Okay. That brings us up to DeepSeek. Alibaba’s AI. Yeah, they both went open source. They’ve both got tremendous adoption on, you know, Hugging Face and these other platforms. I’ve read this, but I don’t know if it’s true that, like, the seven of the ten most popular models on Hugging Face are based on Quinn. I don’t really know if that’s true, and I’m not really in a position to dig it out, but yeah, that’s very different than what OpenAI is doing. So, we see them sort of leaning into that same idea. Which brings us basically to AVs. Horizon Robotics, AVs, real world AI. My little working list today is, obviously you’re going to get switching costs as a tier one, tier two critical supplier to OEMs. That’s going to play out, we’ve seen this story before, so that would be number one I’d be looking for. I’d be looking for deep switching costs. between the suppliers and the OEMs. And I think you’re going to see that. And that’s clearly like what Horizon Robotics is leaning into. Now, are we going to see that in all real-world AI? I think we can see it in autonomous vehicles because you’re talking about going 70 miles down the road. So, it’s a critical supplier. If I’ve got a little funny robot buzzing around my house. that’s probably going to be more modular where you can swap in and out various different AI brains into that thing. And if it doesn’t work as well, it’s not that big of a deal. So, this is kind of Warren Buffett 101. We are looking for critical suppliers to real world AI. And I think autonomous vehicles are on that list. I think healthcare would be on that list. I would think trains, things that are moving like that would be on airplanes would be on that list. Do I think personal robots in your house? Probably not. So, you have to sort of assess the criticality of the AI brain in various situations, decide whether there’s a real switching cost there or not. I think we’re going to see a network effect associated with standardization, just like we saw with Red Hat, just like we saw with Android Free. I think we’ll see that same thing. Are we going to see innovation platforms with two-sided network effects? I doubt it, but I don’t know. Maybe there’ll be an app store for your robot where anyone can write apps that make your robot do stuff. I haven’t seen anything like that yet, but maybe. And then I think we’ll see this feedback loop between… adoption, customization, and usage, and the intelligence of the robot, which is what a lot of these machine learning are. are banking on. Now I’ve kind of put that in the realm of, I think it’s a flywheel in operating performance. It’s important. I’m not sure it’s going to be a competitive advantage, but I could see scenarios where it would be. So those are kind of my three on my list at this point. Switching costs in critical areas, Warren Buffett 101. Network effects and standardization, if you’re leaning into ecosystem development and open source. And then, okay, we’ll have a flywheel of some kind in machine learning. Companies that get leading market share, more adoption, more customizations are going to get smarter. In some cases that could be an advantage, in a lot of cases it won’t. Anyways, that’s my work in list, but as I go to China in the next couple weeks, that’s really what I’m trying to dig into, is what is winning in real world AI look like. And I’m not sure yet, but we’ll see. If you’re curious about how Horizon Robotics talks about this, they basically say they’re focused on an open platform approach, which is not quite the same thing as open source. They call it the white box approach, as opposed to a closed platform, and they say the benefits of this are commercial flexibility, the open platform approach allows for customers, OEMs, for selective choice among different software, hardware, technology, pillars and package solutions based on whatever they need in terms of their commercial needs, their technological capabilities. As opposed to a black box. you know, set package that everyone has, you know, one or two choices at most. So, flexibility in what you can do commercially. They also talk about technical flexibility. If you open platform approach it, you get a better understanding of what’s really happening in the driver assistance and the autonomous driving system. It lets their clients, customers engage in further development of the algorithms, the software, and even the hardware to some extent. So otherwise, those internal mechanisms are pretty locked up. And the third one, which I thought was interesting, they say time to market flexibility. The open platform approach allows OEMs and other solution providers to engage in collaborative development. So not only can they change it themselves as each individual client, but clients can also work together. Other solutions providers, i.e. developers, can work with them. So, you can form teams. Everyone doesn’t have to develop their own customized implementation and solution. You can have groups of companies get together and work together. The benefit there is shortening the duration from research and development to mass production. a black box approach, you pretty much just have to take what they give you, do some testing, and then you kind of do optimization, but it’s really against an already completed solution. So, I thought that was kind of an interesting approach or comment. Okay, that’s pretty much what I wanted to go through. What do I think is going to happen? Last quick point. In China, real world AI and regular AI. They are clearly across the board. Everyone is building their own. They do not want to be dependent on US supply chains for tech anymore. So, everybody’s pulling everything in house or in China or in their industry from chips all the way to lithography to AI to all of it. That’s pretty standard. Then they try and get to scale domestically on the consumer side. or on let’s say automakers. Once they get to scale domestically, then they try and lever that internationally, which has been very effective with consumers. Like that’s DeepSeek, very effective. They’re also trying to get to significant scale in developers. They want as many developers as possible around the world writing and using their stuff. And you can see them really leaning into this Alibaba, DeepSeek, Huawei. Everyone’s leaning into let’s get developers all over the world using our stuff. I think that’s kind of their three pillars of what they’re doing right now. That’s their basic approach. Okay, and that is the content for today. I know that was a lot of content. There’s a lot of me talking. Yeah, I took off last week, so I’m sort of catching up here. I was kind of tired, mentally tired sometimes. Like, reading, things are clicking in your mind. Other times it’s like, yeah, I need to take a break and watch some TV for a while and just want to chill out. Plus, I got the flu, so yeah, I’m a week behind, but I’ll make up for it in the next week, because I’m… Once I get on the China trip, there’s going to be a ton of content coming. Like, you know, if I’m visiting 16, 17 companies or whatever, that’s 20 or 30 articles. So, fair warning, there’s a lot of digital China content on the way. So anyways, I’ll catch up. Anyways, that’s it for me. I hope everyone is doing well, having a good spring, and yeah, a lot more on the way very soon. That’s it for me. Take care. Bye-bye.

———

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

Note: This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.