Carlsberg beer in China is one of those business stories that everyone should know. Take a look at the below picture. It is of Carlsberg China circa 2002. This was after +15 years of business in the PRC. They had some imports but were still a tiny China operation overall. And they were facing increasingly dominant SOE brewers like Tsingtao and Beijing Yanjing. Around this time, management basically gave up on the China market and appeared to be exiting. Around 2000 (or so), they were letting go of staff, selling facilities, closing offices and so on.

But in 2003-2004, they reversed their decision and management re-entered China. And they did so in a very surprising way. They abandoned most all the major China markets and went deep into the West.

They ignored Shanghai and Beijing and went deep in the wilderness of Yunnan, Xinjiang and Tibet. Keep in mind, these are still the poorest and least developed regions of China today. But in 2004, they were pretty much the end of the world. The picture at the top of this post is a good image to keep in mind when thinking about these markets.

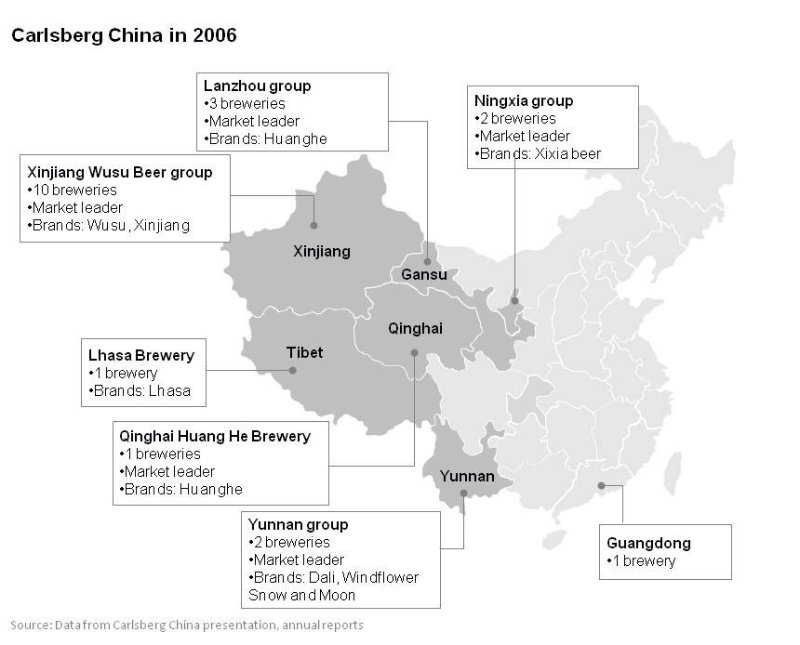

From 2004-2006, Carlsberg went on a stunning brewery acquisition and deal binge in the West. They went first to Yunnan. Then to Tibet. Then to the other Western provinces. In just a few years, they had bought or JV’d with almost 20 breweries. By 2006, Carlsberg China looked like the below chart.

The strategy was very clever. It was basically to avoid the increasingly entrenched competition of the major markets. And instead, to get to the West first and try to grab market share. This had a lot to do with the economics of beer, which lends itself to regional economies of scale.

Fast forward to today and Carlsberg now has over +50 breweries in Western China – and they are a market leader in most all of these regions.

Thanks for reading. jeff

—————

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

Note: This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.

Photo by Daniele Salutari on Unsplash