In 2015, Colin Huang founded Pinduoduo and shifted the landscape of Chinese ecommerce. Long dominated by Alibaba and JD, it was shocking to see a new ecommerce company launch and break into the market so quickly. There are a lot of reasons for why PDD succeeded (its partnership with WeChat, group buying / social commerce, C2M, a TikTok-like user experience, etc.). But the biggest factor was Colin effectively targeted 4th and 5th tier cities with low priced goods.

The rumor is that Colin noticed that 600M Chinese were on ecommerce sites like Alibaba and JD. But 1B Chinese had WeChat. So, the opportunity was those 400M consumers on smartphones and WeChat, but not yet doing ecommerce.

I don’t know if that story is true. But it was clear there was a large group of consumers in 4th and 5th tier cities. Pinduoduo built their initial business there. Alibaba (Taobao specifically) has since gone after the same low-cost market. And so has brand after brand. But for ecommerce the approach was low price goods. Think tissue paper and household staples for $1-2 dollars. And if you did group buying, you could get them even cheaper.

All this raised a challenging strategic question for JD. It had long positioned it as the quality and trusted ecommerce company, with a smaller and more select group of merchants and products. This continues to be a good strategy for the middle and upper class. But what about lower tier markets and lower priced goods?

- Should and could JD go after the low-cost market?

- Does JD have any advantages in this market?

- Would that impact its core brand?

It’s a really good strategy question.

And JD has clearly answered it. Because in 2023 they 100% started going after the low-cost market. It is arguably their most important strategic initiative going forward.

Here’s my assessment so far.

JD Was Built to Provide Higher Income Consumers with High Quality Goods and Supporting Services

In Part 1, I summarized JD’s new 35711 Vision, which is mostly about long-term growth. In that, the “3” stands for building three businesses that have over 1T RMB in revenue. I would describe these are the JD’s growth engines. And domestic ecommerce is definitely one of them. This move into the low-cost market is part of growing this engine. Another engine is probably international logistics, which I will discuss in Part 3.

Think about JD’s domestic ecommerce business today. It has 588M active users. And 35M of them are JD Plus members (very important).

Across the board, JD today is positioned as a trusted and quality ecommerce company in China. It remains focused on first person retail in order to ensure such quality. Its 1P business remains significantly focused on appliances, consumer electronics and mobile. Those are areas where quality matters.

Note how JD’s focus on quality also plays out in their direct sourcing of goods. And in their relatively small, approved merchant list. There is zero tolerance for counterfeit goods. Any merchant with counterfeit goods is gone.

This focus on quality also plays out in their fast and professional delivery. That is part of providing high quality service. Over 15 years, they have built a nationwide logistics network that can guarantee same day and/or next day delivery in virtually every city in China. Of JD’s 500,000 employees, 300,000 are in delivery.

This combination of trust, select quality goods and rapid delivery nationwide is the central pillar of their strategy. And it has been almost impossible for competitors to replicate.

If that is pillar one, then pillar two is their expansion into a marketplace (i.e., 3P). This expanded their product selection into the long tail. Especially into apparel. This does create some brand risk, which they have managed well. It also creates healthy competition for the 1P business. The marketplace complements the core retail business.

Pillar three of their strategy (in my opinion) is their steadily increasing capabilities in omnichannel and on-demand retail. I’ve mentioned their same day and next day delivery, which in practice means your traditional warehouse on the edge of town feeding into lots of delivery stations across the city. They have gradually been making this logistics network smart and connected.

However, they have also been expanding into both physical retail and into more rapid on-demand delivery (i.e., under an hour).

In omnichannel, JD has had quite a few interesting initiatives. I’ve written about their e-space, a new retail version of a department store. There is 7Fresh, their new retail grocery store. There is also JD mall and JD Auto.

They also have strategic partnerships with Walmart China and Yonghui Supermarkets. And there is the rapid delivery service Dada and JD Daojia. JD also owns delivery lockers in shopping malls and office parks. And they have been experimenting with autonomous vehicles and drones. You can see a steady expansion in their capability in omnichannel and in on-demand retail.

If you view JD as these three strategic pillars, you can see how they are all designed to support their position in quality goods and services for higher income consumers.

So how do you shift into the low-cost market with these capabilities?

And do they have an advantage?

That’s the key question.

The Low-Cost Market Means Adding New Sellers with Low-Cost (i.e., Affordable) Products

The low-cost market has been JD’s major initiative this year. They are definitely going for more users by moving down the income scale. Which also means going after lower tier cities.

The first challenge with this is dramatically increasing their product offerings and offering lower priced (i.e., affordable) goods. That means bringing an entirely new class of merchants on the platform. They appear to have changed some of their limiting rules for this. And JD has launched at least two initiatives specifically to encourage small merchants, college students, entrepreneurs, and lots of others to start selling on the platform.

In January, JD.com launched its “Spring Dawn” initiative, which makes it easier for start-ups, self-employed businesses, and smaller enterprises to launch stores on the platform. Think college students, farmers, designers, craftsmen, and lots of other sellers jumping onto the platform. According to JD, “in the first quarter alone, the number of new merchants on JD’s platform soared by 240% compared to the same period last year, improving the product offering diversity to match consumers’ demands.”

This raises an important question:

- Does JD strengths in supply chain purchasing create an advantage for entering this market?

JD has a long history of purchasing goods and then reselling them. Does this give it an advantage (i.e., purchasing economies) for low-cost goods? Recall, a lot Pinduoduo’s success was from its willingness to go direct to manufacturers with a C2M model.

The second challenge is the delivery cost. Much of the logistics network is a fixed cost. Lots of trucks, warehouses, IT, and fixed staffing. And JD benefits from big economies of scale in this area.

But last mile delivery is always a major variable cost (per order). It’s why there is so much talk about autonomous delivery vehicles. And achieving economies of scale by geographic density. The last mile problem becomes much more difficult as you start to move to smaller dollars and order prices. Much of JD’s on-demand, same day and next day delivery, likely just doesn’t work at these prices.

This raises major questions:

- How much can JD’s logistics network be adapted and leveraged into lower priced goods?

- Does JD strengths in logistics create an advantage in entering this market?

JD’s supply chain and warehouse / trucking network clearly give it an advantage in the low-cost market. But last mile delivery that is the real question mark. I’ve been trying to figure out how JD is addressing this.

The final challenge is protecting their brand.

What happens in the new merchants have low quality and/or defective goods? Note: Both PDD and Taobao suffer from counterfeit and fake goods.

How JD will handle lower price goods while also protecting its brand is my other main question. How will they balance growth vs. brand?

***

That’s where I am on my thinking for this. It is really fascinating and I’m watching Sandy Xu (the new CEO of JD.com) closely. In Part 3, I’ll go into more of their strategies.

Cheers, Jeff

- JD’s 20 Year Anniversary and Plan. Plus, Important Past Strategic Moves. (1 of 4) (Tech Strategy – Daily Article)

- More on JD’s Low-Price Strategy (3 of 4) (Tech Strategy – Daily Article)

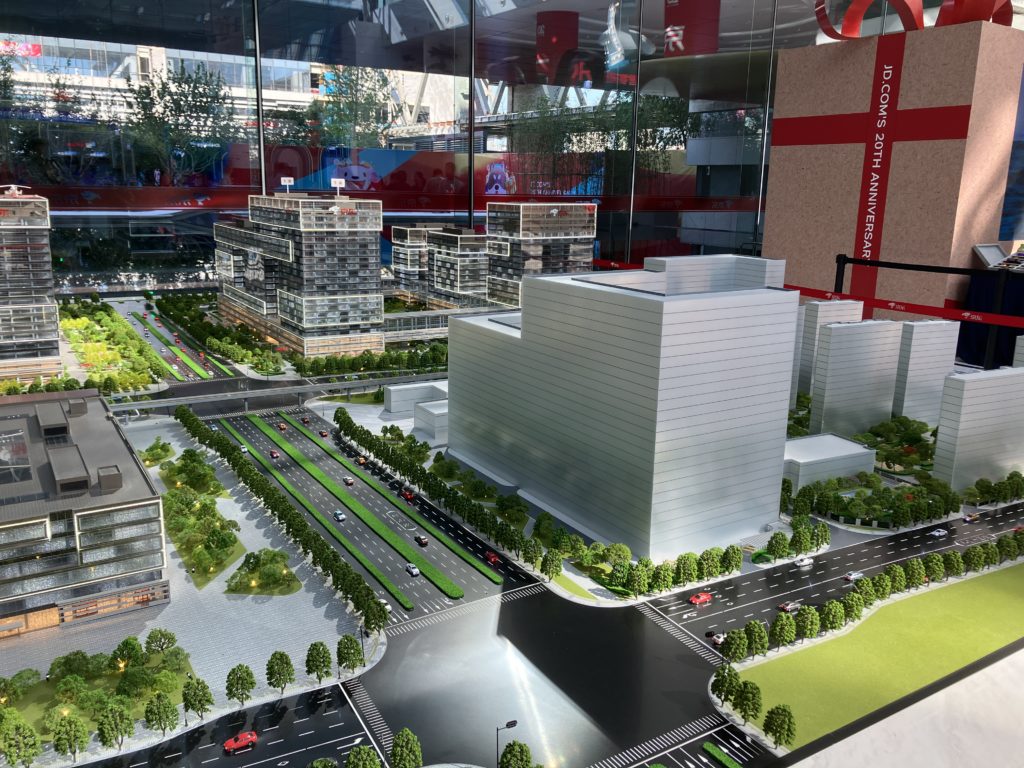

Here is the model for JD’s future headquarters in Beijing.

The second building at HQ is currently under construction.

————-

From the Concept Library, concepts for this article are:

- ecommerce

From the Company Library, companies for this article are:

- JD

———-

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.