As many of you know, my focus / obsession is on how to measure the competitive strength and defensibility of digital businesses. I want to know who is going to win before others. So I focus on the intersection of competitive advantage and digital. I call it “Michael Porter meets Jack Ma”.

My previous summary for this question has been the digital competition tower, which has been on the front of my webpage. But it was overly complicated and hard to use. Plus I’ve been rethinking the whole topic. And I’ve been redoing this for the past 4 months for my upcoming book (released December 1, 2021).

So the key question is:

How Do you Build and Sustain Competitive Strength in Digital Businesses?

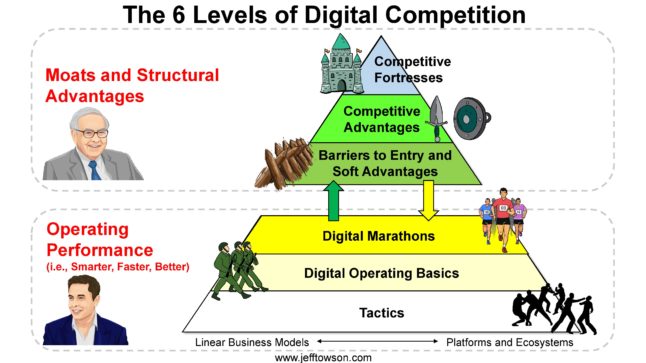

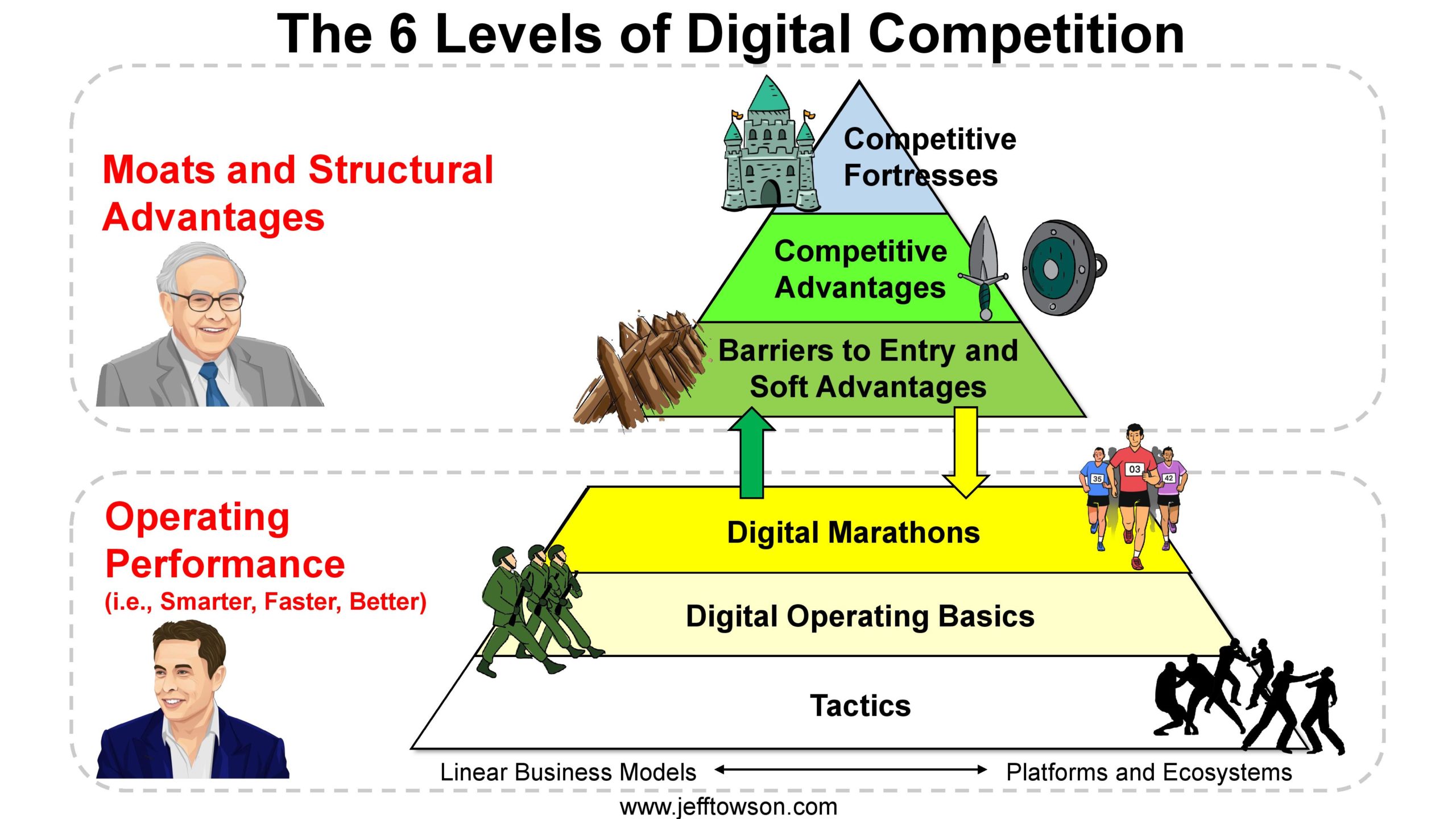

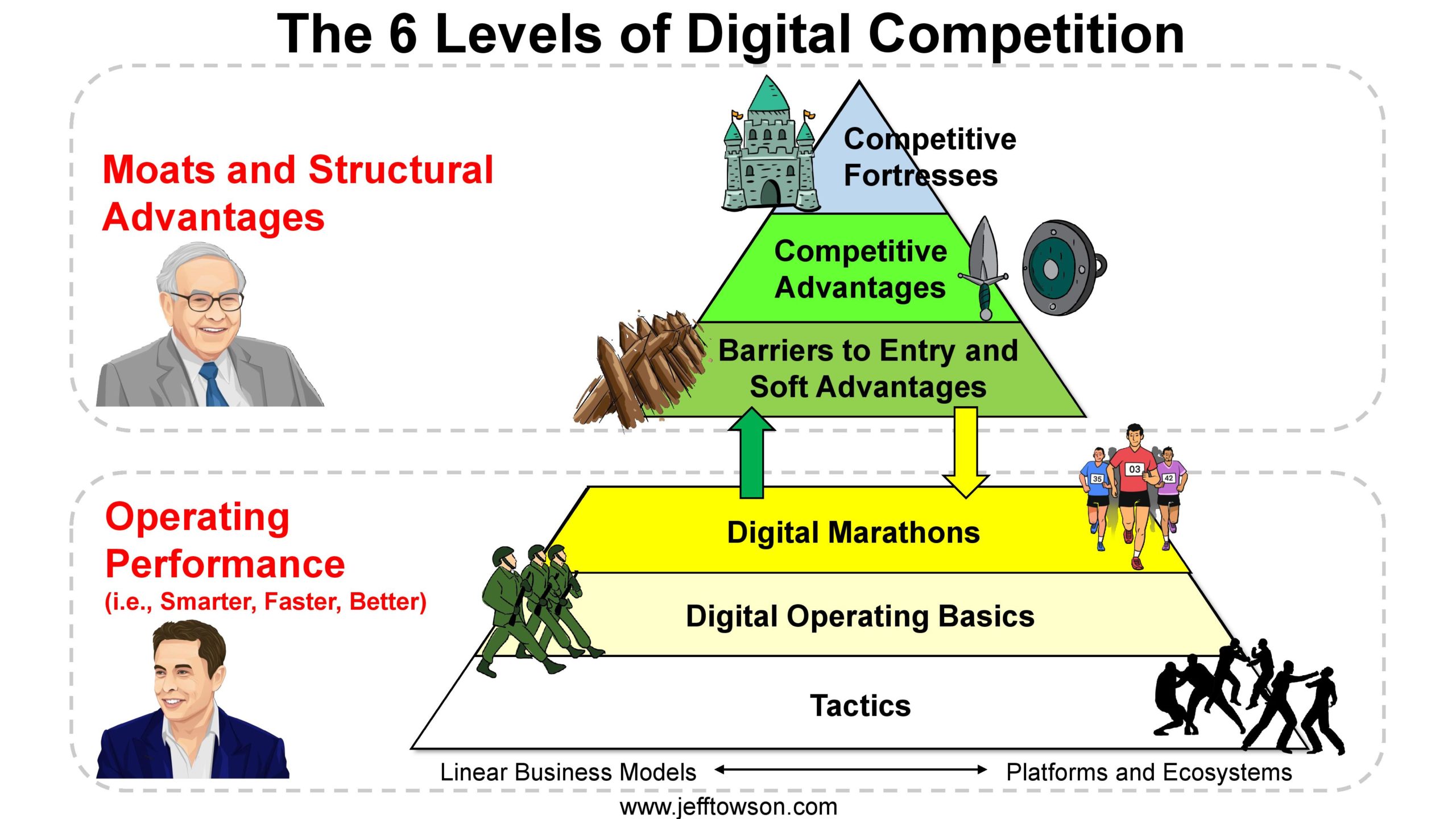

And my answer is the 6 Levels of Digital Competition.

A business must compete on 6 levels – and try to move up in levels as much as possible. That’s how you build competitive strength in digital.

Here is the new version, which I call the 6 Levels of Digital Competition.

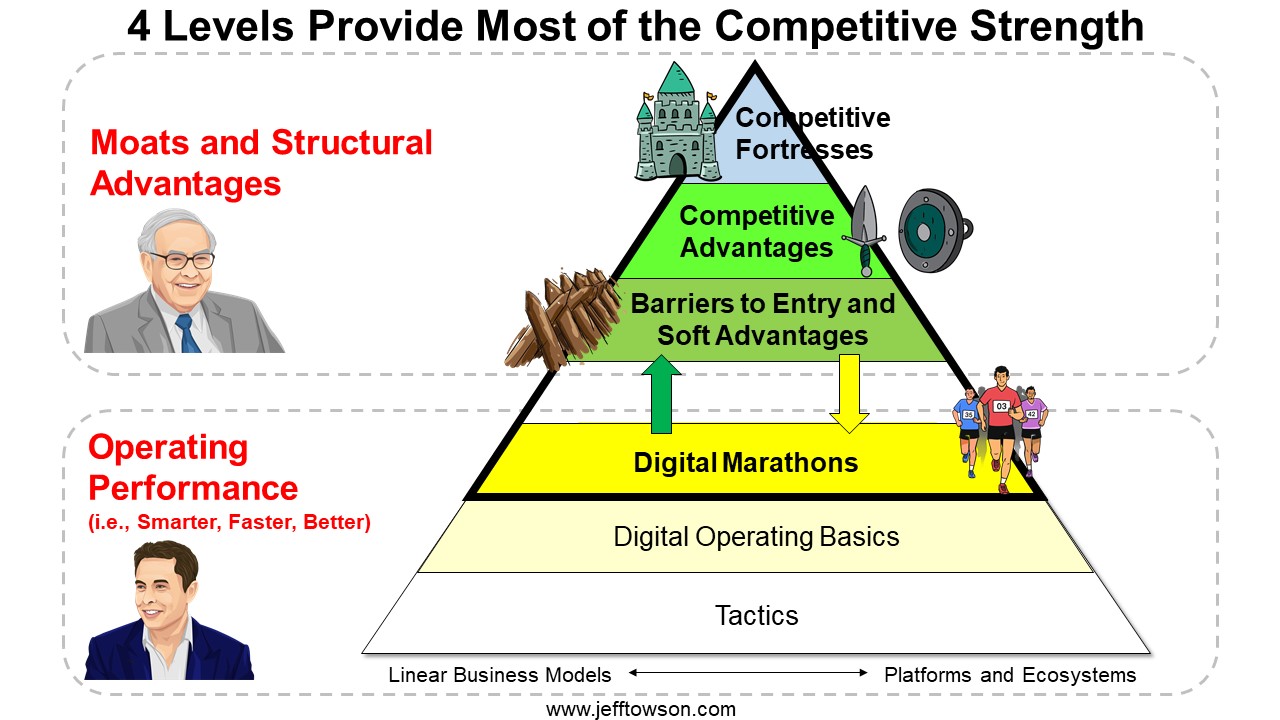

For each of the 6 levels, I have specific checklists to assess competitive strength relative to competitors. They will be published shortly. And most competitive strength is found in the top 4 levels.

That’s the basic picture. And I will go through the details in upcoming articles. But I wanted to put out the general picture first.

But the 6 Levels work, if you access two assertions.

Assertion 1: Building Moats and Surviving Longer-Term Is the #1 Strategic Priority for Digital Businesses

Investors and managers typically look at three dimensions of digital businesses.

- Market size and growth. How big is the company and investment opportunity now and in the future?

- Competitive strength. What is the market share and/or ROIC versus current and potential competitors? Both now and going forward?

- Unit economics. What are the economic profits? This depends on the previous two dimensions, external factors, management performance, the specific industry and other factors.

When combined, these three dimensions can sometimes tell you the economic value created by the company now and in the future. And that’s what most investors and managers want.

But I am isolating the competitive strength dimension. What is the competitive strength of a digital business and how is this being changed by new technologies? Competitive strength is linked to and influenced by the other two dimensions. But I am trying to isolate it as much as possible.

Why?

Because building competitive strength and surviving longer-term is the primary strategic objective for a digital business.

Growth and profitability are secondary priorities. They are nice. But they are luxuries. Survival is job #1. That means building and maintaining competitive advantages. It means continually improving operating performance.

McKinsey & Co has done some interesting work looking at economic profits across thousands of companies and industries during 2010 to 2014. And they concluded that economic profit (operating profits after capital costs) was mostly going to a small number of companies. They call this the Power Curve of Economic Profit.

The authors (Martin Hirt, Sven Smit, Chris Bradley) concluded that the vast majority of companies are making a small economic profit, if any. McKinsey’s conclusion was that companies need to try to move up to the top quintile. But they also showed that this is quite hard. With only 8% of companies moving up to the top quintile. 78% staying where they were. And 14% falling lower.

My conclusion is different. I don’t totally buy the McKinsey methodology but I think the conclusion is accurate. The spoils of business are going to a smaller and smaller number of companies. Digital tools, improved business models and smarter management are making competition more intense and markets more efficient. More and more economic value is being passed on to customers and capturing profit pools is becoming more difficult and short-term.

And yet, the default strategy for most companies and investors is to go for the trifecta of long-term growth, competitive strength and attractive unit economics. Managers and investors are deeply committed to finding this increasingly rare situation.

My conclusion is that the primary strategic priority for a digital business is to survive on a constantly evolving landscape. The priority is not to rise to the upper quintile. But to survive in the middle and avoid falling into the bottom quintile. A survival-first strategy means focusing on defending and adapting the core business under constant digital change. This means:

- Having a clear strategy for building competitive strength.

- Actively defending against rivals and new entrants.

- Anticipating how digital tools, technologies and business models will impact your competitive strength.

- Adapting the core business and its defenses over time.

A survival-first strategy is the reality for most businesses. They need to stop trying to be the lion, the king of the jungle. Instead, they should try to be the super agile monkey in the treetops that simply can’t be caught. Or the spikey hedgehog that is just too much trouble to eat. Those are the types of companies I am looking for.

After a company gets good at survival in a world of turbulence and constant digital change, it can then hunt for growth and bigger profit pools. Survive first. Then thrive when you can. And that has a lot to do with luck and being in the right place at the right time. Stay in the game and be ready when opportunities emerge.

I also like building competitive strength as the strategic priority because it is the dimension most under a company’s control. If you are an executive at an automotive company, you really cannot change the market or the unit economics that much. And you are probably not going to jump to a new industry after twenty years of working in automotive. But you can increase your competitive strengths and defenses in the business you are in. You can focus on longer-term survival. And then you will have the time and capabilities to maybe expand to opportunities with better markets and/or unit economics.

Similarly, if you are a venture capitalist or equity investor, you don’t want to be limited to investing in just the “best of the best” companies. Most investors focus on the very small pool of digital companies with the trifecta of growth, competitive advantage and attractive economics. You also want to know how to invest in well-defended companies in low or no growth industries. And in companies where the defensibility is being disrupted, but not as a much as everyone thinks.

Assertion 2: Growth Is the #2 Strategic Priority for Digital Businesses

Many of you are probably recognizing there is a decent sized flaw in my argument. I presented a framework that separates the creation of economic profits into growth, competitive strength and unit economics. But there is lots of data going back decades that shows that growth strongly correlates strongly with both competitive strength and longer-term survival.

There is a reason why growth has long been the default strategy for businesses. It obviously is key for creating economic value. But it is also critical for creating competitive advantages, such as economies of scale. Growth is a big part of both economic value and longer-term survival. And it turns out this is even more true in digital businesses. Because the economics of digital are very, very different.

The economics of a business change dramatically when you move from operations and products based on labor and physical things to operations and products based on bits and bytes and 1’s and 0’s on a screen.

- There are very low marginal production and other costs. This usually means the rapid commoditization of most products and services. It also means pricing tends towards zero for most things. But it can also mean ridiculously high gross margins at times.

- Connectivity is easy and connectedness is the norm. Competition is increasingly between platforms, ecosystems and collaboration-based business models. Not between stand-alone businesses.

- New business models are continually emerging.

- New types of digital-first operating models are emerging. As well as new organizational structures.

- New types of moats and structural advantages are emerging.

- Growth can fast, cheap and without capacity constraints.

This last point is how companies like Netflix, Google and Facebook became global giants in just a few years. We have never seen this type of growth in traditional businesses.

But against this picture of the very different economics of digital businesses, I put building competitive strength and survival as priority #1. And the pursuit of growth as strategic priority #2. Yes, growth is important. Yes, growth relates to long-term survival. But it’s not as important as competitive strength and defensibility.

And achieving sustainable and profitable growth is quite rare. Chris Zook at Bain & Co has done some great work on this for traditional businesses. According to his book Profit from the Core (circa 2004), only about 12% of companies sustain profitable growth above 5.5% for more than a decade. And let’s not pretend that chasing growth doesn’t get management teams into trouble all the time. The competitive benefits of growth are real and possible. But so are the risks. I put it as priority #2.

***

Ok. Those are my two assertions. If you believe those, then the 6 Levels of Digital Competition will be a useful tool for you.

Overall, I am content to accept that digital businesses in a digital age live on a constantly changing landscape. Over time, I have increasingly focused first on defending and adapting the core business. And on the idea that longer-term survival is about living at the intersection of competitive strength and digital change. That’s my 6 Levels.

After that, I focus on growth as the #2 strategic priority. Growth can both strengthen the competitive position and grow economics profits. But this requires that growth moves are done well and without too much risk, which is not as common as you would hope.

That said. Here are my 6 Levels for building and measuring competitive strength in digital businesses.

More details and explanation are on the way.

Cheers, jeff

——–

Related articles:

- Core vs. Adjacency Growth in Digital Businesses (Asia Tech Strategy – Podcast 104)

- Dingdong vs. Oriental Trading: How to Spot the Specialty Ecommerce Winners (1 of 2) (Asia Tech Strategy – Daily Lesson / Update)

- Dingdong and 5 Questions for Assessing Specialty Ecommerce Companies (2 of 2) (Asia Tech Strategy – Daily Lesson / Update)

From the Concept Library, concepts for this article are:

- Six Levels of Digital Competition

From the Company Library, companies for this article are:

- n/a

———-

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.