In Part 1, I laid out some basic theory for Baidu and search engines. I think it was a pretty solid picture for Baidu circa 2010.

But strange things have been happening since then. Baidu has moved into entertainment, services (for a while), content creation and self-driving cars.

But strange things have been happening since then. Baidu has moved into entertainment, services (for a while), content creation and self-driving cars.

I’m not sure if these were strategic necessities in an evolving ecosystem. Or if they were just questionable management decisions. But it’s the movement from search into content creation and the attention market that raises the most interesting strategy questions.

Why Did Baidu Go from Search Engine to Content Creator?

In Baidu’s filing, they talk about how they provide “search for information and knowledge”. And that is some good precise language.

This is a service you go to when you are actively searching for knowledge and information. That is different than a service you go to for entertainment. Or to just sit back and scroll. This is active (i.e., search) and it is specific (i.e., looking for information and knowledge).

But the world of digital information has evolved from text and photos on webpages that could be crawled with software. Information and knowledge are increasingly located in mobile apps, which may or may not be accessible to a search engine. Information, especially media content and private chats, is often behind walled gardens like WeChat and Tencent Video.

In recent years, we have seen Baidu creating mechanisms to access the changing nature and location of information and knowledge online. They built Mini Programs, Baijiahao and Managed page. They have tried to create an open modular system to search the world’s Chinese information and content.

They also started to create their own information and knowledge. They became content creators. Mostly by launching platforms for user generated content. So that is Baidu Wiki, Baidu Knows, Baidu Post, iQiyi and other programs.

You can see all this below.

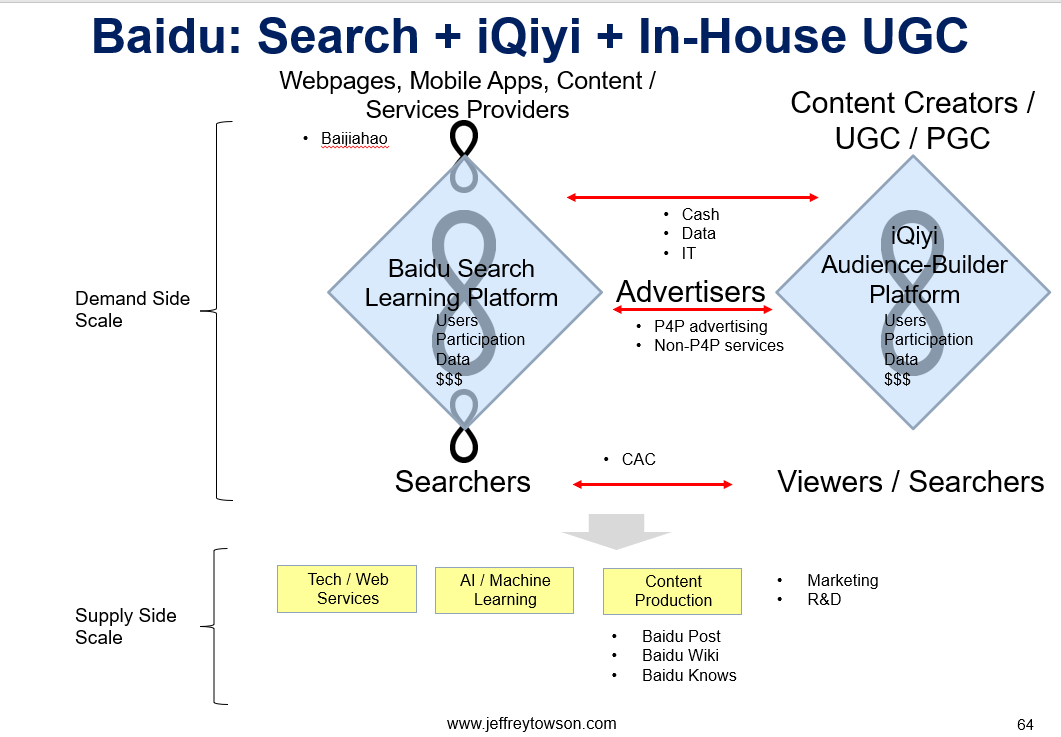

This chart is pretty important. This is how I see Baidu circa 2015. An unusual combination of a learning platform (i.e., Baidu search) and audience builder platforms (i.e., iQiyi, other).

This chart is pretty important. This is how I see Baidu circa 2015. An unusual combination of a learning platform (i.e., Baidu search) and audience builder platforms (i.e., iQiyi, other).

- First, note the change in the user group on the top left of Baidu Search. The information and knowledge they are searching has expanded from webpages to mobile apps and then to “content and services providers” (this is a term they use). That is a big expansion. And you can see them using projects like Mini Programs and Baijiahao to access the changing information sources. However, this often does not include content in platforms like Tencent and ByteDance.

- Second, on the supply side, you can see they have added a new capability for content production. This, as mentioned, includes Baidu Post, Baidu Wiki and Baidu Knows. They are supplementing content they access online with content they create. Their approach is mostly to create services and platforms that capture user generated content (UGC).

- Third, one of these content creations became its own major platform, which is iQiyi. This is their subsidiary and is a publicly listed. It’s arguably the video leader of China by views but it loses a lot of money. Just like its competitors Tencent Video and Tudou.

- Baidu plus iQiyi plus other UGC content creates a complementary platform. It is an audience-builder platform (i.e., iQiyi) complementing a learning platform (i.e., Baidu search). I have spoken at length about how complementary platforms can be a particularly powerful business model. I normally put these at the top of my pyramid under Winner Take All / Most.

However, I don’t think this complementary platform structure is particularly powerful for Baidu. Certainly not like at Tencent or Alibaba. But there are some benefits, which I have put in red. You can see how they support each other with data, capital, IT capabilities, advertisers and user customer acquisition costs (CAC). Plus, the videos on iQiyi are searchable content.

However, I don’t think this complementary platform structure is particularly powerful for Baidu. Certainly not like at Tencent or Alibaba. But there are some benefits, which I have put in red. You can see how they support each other with data, capital, IT capabilities, advertisers and user customer acquisition costs (CAC). Plus, the videos on iQiyi are searchable content.

So Baidu has evolved from a pure search engine to a content creator. To entertainment. Did they really need to do that? Did they need to go that far into content as a company focused on the search for information and knowledge?

Why Did Baidu Go from Search to “Search Plus Feed”

Along the way, Baidu also started to call its core product “search plus feed”. This is how they describe feed.  That is really important.

That is really important.

In the past, I have spoken at length about the importance and difficulty of managing information flows. WeChat creator Allen Zhang spoke about this at Open Class 2020.

His argument goes like this:

- The information you consume shapes you. These are the conversations you have. This is the town you live in and walk around in. These are the books you read. The information you consume constitutes much of your lived experience.

- But the information we consume in the real world is now dwarfed by the information we consume via our smartphones. This device has increased our relationships. It has increased the breadth of our knowledge. These devices are shaping our experiences and our thinking.

- But most of the information on your smartphone is determined by others. Most information consumption is passive, especially by push notifications and newsfeeds.

From my previous article:

“If what you see or read determines what thoughts you have and possibly what kind of person you are, then the type and quality of information you see or read is critical. And unfortunately, most of this selection process happens passively. It is not the person taking the initiative and guiding the selection process. It is mostly being determined by companies and/or technology. With push notifications and newsfeeds being mostly in charge.

Allen commented that “what is pushed determines what the user sees and what kind of world they live in.” And that “push notifications make use lazy”. That we “let them take precedence over what we choose to see”.”

So Baidu has expanded its products, including its flagship Baidu App, from search to “search plus feed”. From users doing active searches to passive consumption.

- But aren’t these very different products?

- Are these the same market?

- Don’t search and feed have difference competitors?

- Don’t search and feed require different capabilities and strategies?

ByteDance and Tencent are in the feed and passive consumption business. They are all about getting user attention and keeping it. And monetizing by advertising. They are not in the search for information and knowledge business.

The Big Problem Is Managing Information Flows to Our Limited Brains

Here is the real problem.

- There is now far more digital information in the world than we could ever consume. And it is expanding dramatically.

- The process for consumption is to stare at a smartphone screen. It is incredibly limited.

- Our brains are also limited in how much information we can consume.

- There needs to be a mechanism for selecting the right information. And for managing the information flows to people. And there isn’t a good one.

That last point is the big problem.

Matthew Brennan wrote about this overarching problem of managing information flows his book about ByteDance, called the Attention Factory (note: I thought up that title). And you can look back over twenty years and see companies struggling to solve this problem.

The first solution was by Yahoo and other portals in the late 1990’s.

Yahoo manually curated information and put it on a webpage. They created a web portal and had lots of former media and newspaper people decide what articles to highlight. For news, politics, sports, and so on. Users then went to the webpage and read. We passively consumed information that was manually curated.

Unsurprisingly, this didn’t work too well for too long. The Yahoo portal model was labor-intensive and struggled as the amount of information online grew exponentially.

The next solution was Google and other search engines in the early 2000’s.

Enter Larry Page and Sergey Brin who did something ingenious. They created software that cataloged and ranked the world’s webpages and and information. And let us search it. It was automated and scalable (very good). But it was also an active pull model, not passive consumption. You had to type in the search for what you wanted.

Search is a fantastic tool and a good solution to the information consumption problem. But it is also very limited. The vast majority of information we consume is not by active inquiry. We do very few searches in a day. Most information is consumed passively. We listen to people talking. We see the signs on the streets as we walk by. Active searching is the rare exception.

The next solution was Facebook and other newsfeeds.

Facebook really built a remarkable product – a newsfeed created by your friends. It is a never-ending push model for information. You just passively consume your newsfeed. And it pushes one story, posting and notification after another to you. It’s an automated, scalable system for passive information consumption.

But how does Facebook decide which information to push to you?

It doesn’t do this by manual curation (like Yahoo). It uses a crude hack. It shows you what your friends like and post. It is not showing you what you most want to see in all the world’s information. It is just showing you the small sliver of information your friends happen to like. That is a crude proxy for what you want.

The next solution was ByteDance and really smart algorithms for specific content types.

That brings us to ByteDance and its founder Zhang Yiming, who appears committed to solving this information flows problem. His solution was to write incredibly sophisticated algorithms for specific types of content. Specifically news headlines (Toutiao) and short videos (Douyin / TikTok). The algorithms are so sophisticated they could search all the videos and news articles and show you exactly what you want to see. And it doesn’t need to know your friends. It doesn’t need to have you like or follow anyone. It doesn’t even need to have you to do a search. It just watches behavior and choses what to show you next.

And it works.

Well, at least for mindless short videos and news headlines.

TikTok and Toutiao are so addictive because they are very good at predicting what you want to see. It is an automated, scalable system for passive consumption of information. ByteDance is an algorithm company. And their primary tool is a feed that you passively consume.

They are now trying to use this approach for longer videos, video games and education. We’ll see how far they can take this solution to the problem of managing information flows.

***

So when Baidu says they are now doing “search plus feed”, that is a big change in strategy.

They are trying to move beyond the “search for information and knowledge” – which is a very good but limited tool. They are going after the much broader question of managing information flows. And their latest endeavor in Baidu Post is an example of this.

Which raises my next strategy question…

Can a Stand-Alone Search Engine Be Viable in China Long-Term?

What if doing stand-alone search is not enough? What if that is an untenable strategic position?

- ByteDance makes its money by capturing attention and monetizing with digital advertising. They are now at $27B in advertising revenue for 2020. That is up from $16B in 2019. And they are talking about adding a search engine.

- Tencent makes its money in gaming, payments and advertising based on attention. They were at $65B in overall revenue for 2020. And they are also integrating a search engine (i.e., Sogou).

In contrast, Baidu’s revenue was $16B for 2020. And they have had low, single digit growth for years.

I have three big questions:

- Does Baidu require another financially strong business long-term? The companies moving into search (Alibaba, ByteDance, Tencent/WeChat) all have other strong businesses that throw off a lot of cash. Search is a complement, but not the core for them.

- Does Baidu have to fully move into entertainment and capturing and keeping user attention? That means expanding beyond just a search engine for knowledge and information enough.

- Can Baidu really compete with the attention giants of Tencent and ByteDance? Those companies all have very well developed and focused strategies for this this business.

***

Those are my key questions for this side of their business. It’s kind of confusing.

In Part 3, I’ll get back to the simpler stuff. Specifically, where will their growth likely come from? And that means AI and cloud.

Cheers, Jeff

———

Related podcasts and articles are:

From the Concept Library, concepts for this article are:

- Search engines

- Learning platforms

- Audience builder platforms

From the Company Library, companies for this article are:

- Baidu (BIDU)

- iQiyi

Photo by Jizhidexiaohailang on Unsplash

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

Note: This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.