This week’s podcast is about WeRide. And about real-world AI.

You can listen to this podcast here, which has the slides and graphics mentioned. Also available at iTunes and Google Podcasts.

Here is the link to the TechMoat Consulting.

Here is the link to our Tech Tours.

Major Factors:

- Tech capabilities and progress

- Commercialization and adoption of products

- Economies of scope

- Management performance

Here are the mentioned slides:

———–

Related articles:

- BYD Is Going for Global EV Leadership (1 of 2) (Tech Strategy – Daily Article)

- A Breakdown of the Verisign Business Model (2 of 2) (Tech Strategy – Daily Article)

- 3 Factors Will Determine the Future of Verisign Inc. (Tech Strategy – Podcast 191)

- A Strategy Breakdown of Arm Holdings (1 of 3) (Tech Strategy – Daily Article)

From the Concept Library, concepts for this article are:

- AI Knowledge Flywheel

- Economies of scope

- Autonomous Vehicles

From the Company Library, companies for this article are:

- WeRide

———transcription below

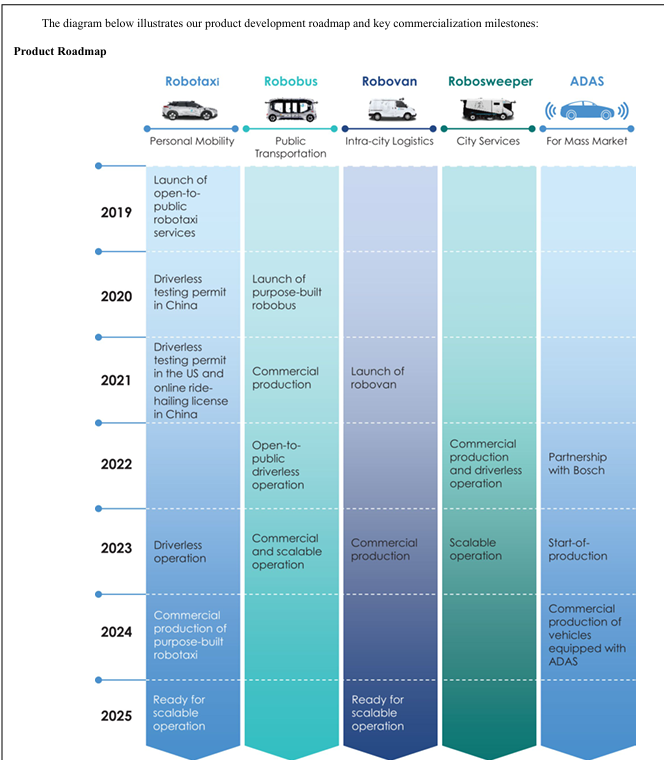

Welcome, welcome everybody. My name is Jeff Towson and this is the Tech Strategy podcast from Techmoat Consulting. And the topic for today, an introduction to WeRide. Now WeRide is a really pretty interesting autonomous driving vehicle company based in Guangzhou. I’m going to be out there in a handful of days, going to meet with them along with… quite a few other companies, I thought I’d sort of do a quick podcast. This won’t be too long and just sort of tee up the basics of the company. What’s interesting about it. I think it’s a good model for how to think about not just autonomous driving, but sort of AI plus robotics in general, which is really what an autonomous vehicle is. So, I want to sort of go through the basics of that and then I’m going to be writing about it pretty shortly. So that’s the topic for today. Pretty interesting group. I’m going to visit several of these companies, both on the robotic side and more on the autonomous driving side. anyways, all right. Let’s see, standard disclaimer here. Nothing in this podcast or my writing or website is investment advice. The numbers and information for me and any guests may be incorrect. The views, opinions, express, maybe. may no longer be relevant or accurate. Overall, investing is risky. This is not investment, legal or tax advised. Do your own research. And with that, let’s get into the topic. Now I’m basically heading into China in the next day or so, which is kind of my old stomping ground for 10, 15 years, something like that. I’m going to kind of do a whirlwind tour, five cities, Beijing, Shanghai, Hangzhou, Guangzhou, Shenzhen. which is really where you go if you’re looking at tech-ish companies. There are a couple other locations you can go. A couple companies in Chongqing which are interesting. There’s a couple. You can put Dongguan in there, but that’s really kind of between Shenzhen and Guangzhou. That’s usually where I end up hitting is these five cities. Guangzhou probably less than the others, used to be, 15 years ago when you talked about the top, tier Chinese cities you would basically say Shanghai Beijing Shenzhen Guangzhou. And of those the one that really didn’t develop like the others was Guangzhou. It’s kind of slower, sleepier. You the others really took off. And then somewhere along the way, Hangzhou got added as a top tier city because it was just you know it was a pretty small know, famous in terms of tourism, but wasn’t known as a tech place, but Alibaba was there, it kind of rose up. Most people consider that a tier one city now. And I would put it ahead of Guangzhou actually, it’s pretty awesome. Anyways, that’s going to be the plan. I how many companies are on the list at this point, 17, something like that. So, there is a whole lot of content coming, but a lot of companies, some of them will be well known. you know, the Baidu’s, the Tencent’s and others. Maybe this will be the first time you’ve heard about them. A lot of companies in China. A whole lot of them. You can basically study Chinese companies forever. anyways, that’s on the way. Otherwise, in terms of content, those are the subscribers. I sent you out one, there’s a second part coming today, email. Kind of weird. This was me sort of trying to put together in my head whether AI agents need marketplaces and platform business models. I’m not sure they do. I think they’ll be part of it. I’m not sure that when AI agents start doing interactions and transactions, like we would do on a marketplace, know, a consumer and a merchant would meet, do a transaction. When it’s AI agents doing transactions or other types of interactions, do they even need platform business models at all? Could we see something we’ve never seen before with all the power of an Amazon or an Alibaba? Anyways, I’m sending you, I sent one email already, the other goes out tonight. I’m not sure my thinking is terribly good. If you have a better way to think about it, me a note, I’d appreciate it. I’m still looking for the right framework to sort of take this apart. So, you’ll see. Anyways, that’s on the way. It’s a bit, I don’t know how I feel about it to tell you the truth. Anyways, okay, so for content for today for WeRide, there’s really only two concepts that I think you should keep in mind. Number one is the one everybody talks about, which is this idea of a flywheel, a feedback loop in terms of machine learning, in terms of knowledge between usage and the intelligence of your model. This is what Baidu talks about. This is what Horizon Robotics talked about. talked about them last week. This is what We Write talks about. This idea that the more people use whatever your AI tool is, whether it’s on a laptop or whether it’s a car cruising around or a robot patrolling your factory, the more usage it gets, the more data gets fed back, the smarter the AI models become. which is why when you’re looking at autonomous driving, the key number everyone looks about is miles driven by your cars. And Tesla’s just way out front. In fact, the US is way out front versus China. It’s a big limitation of China’s just miles spent of autonomous driving on the road is nothing compared to the US. So, there’s this idea of a feedback loop. I’ve talked about that before. I call it a flywheel. Some people call it a feedback loop. It may end up being a competitive advantage. I’m not sure. Anyways, that’s a huge part of We Ride strategy, Horizon Robotics, all of them. The other concept for today, which I’m not going to go into too much, I don’t really talk about this one very much. This is economies of scope, different than economies of scale, which I talk about all the time. Both of these are relative competitive advantages, which is if you are larger than your rival, if there is a scale differential or a scope differential, you have an advantage and there several types of advantages but the one everyone really talks about is a lower average cost. And you know the difference is economies of scope is you have a larger volume than your rival three or four times their volume therefore your average production cost tends to be lower because you look at the fixed costs or the average maintenance capex you divide it by that into the volume you get a lower number. So, a bigger factory producing one product is cheaper than a smaller factory producing the same product. Scope is more about variety, not volume, where this is where you have an asset or you have an operating cost that is either intellectual property or something indivisible. Let’s say a gas station. You can’t really cut a gas station up into two or three things. It’s one thing. It’s one asset, it’s one sort of set of costs and they’re selling gas, that’s your primary product. But if you also start selling Snickers and chips and beer, okay, you’re adding variety. But by increasing the variety of products, you can lower your average cost across the board. So, people talk about this a lot and there’s a lot of thinking on how diversified your product range should be. At what point is diversifying products this way going to be an advantage economy of scope? And at what point does it become diluted? You know, the joke I always used to make was Yamaha. Like Yamaha just has the craziest line of products. They got like saxophones and motorcycles and like they’re all over the map. And so, people do some thinking about this. There’s something called the ANSOFT Matrix. which talks about how far you should diversify in terms of your product portfolio. don’t really, people talk about Sony a lot with economies of scope because they have sort of, okay, a gas station would be sort of a fixed indivisible asset. The other way you could think about it is if you have sort of an intellectual property like Sony has long had strength in miniaturization. know, back in the 90s they had like the Walkman. they had the disc player. They were good at making things small. And so, they had a whole range of products. You could call that as an economy of scope. So, people will often talk about research and development as a joint cost that can play out in multiple products like Sony. Or you can talk about marketing as a joint cost. So, you’ll hear that word a lot, joint cost. Honestly, I don’t think about economies of scope very much. I sort of talk about economies of scale and I just sort of lump it all in there. I don’t find the distinction super helpful. But anyways, that’ll be something to talk about because we ride, as opposed to Horizon Robotics, which I’ll review quickly, they have a larger product portfolio in terms of autonomous driving vehicles than other companies. So that’s kind of a significant part of their strategy. Anyways, that’ll be the other concept for today. I generally don’t think about it very much, but if you’re curious, it’s not a bad thing to spend 15- or 20-minutes reading about. I usually just lump it into economies of scale. Okay, so let’s talk about Horizon Robotics briefly. Now did a podcast about them last week. I sent out an email about that. I’m pretty bullish. Well, I’m bullish on the idea of what’s now being called embodied intelligence. Like I like generative AI. I think it’s powerful. I think it’s awesome. Most of the generative AI apps use cases we talk about are things on your phone or your computer or on a server. They’re not in the real world. When you start putting AI into robotics, then you get something new. And the first version, so this will be a company like Unitree Robotics, I’m going to visit them. Their robots can dance and do backflips and all sorts of things and run up hills and drones would be an example of robotics plus AI, embodied intelligence. Elon Musk calls it real world AI. Because Tesla is really AI plus robotics. mean, it is that it just so happens that the first product they created was a vehicle that moves around on its own as opposed to a humanoid robot, which is their next one, Optimus. So, I’m pretty bullish on this idea of real-world AI embodied intelligence in China. I think they’re going to win. I think they’re going to dominate. When we look at EVs today, I mean, there’s a handful of companies out there. Everyone’s doing it, when you really look at like, who do you think is going to win? And this is not my sector. know, Tesla’s on the list and then there’s a whole lot of Chinese companies. Maybe one out of Germany, one out of Japan. So, it kind of looks the same because you have this tremendous scale and sophistication in the manufacturing base. You have tremendous AI. You have a lot of talent, brain power. You have a massive domestic market. So, China’s well positioned to win in electric vehicles. And I would say the same thing applies to robotics, autonomous vehicles, embodied intelligence. I’m pretty polished that this is going to be a China story. We’ll see. It’ll be this year or the next year. My little expectation is 2025 is going to be about AI agents and 2526 is going to be about robots meet AI. Maybe that’ll take longer. Your hardware takes longer. Okay. So last week I talked about Horizon, which is really, I view it as a semiconductor and AI company. They’re basically a tier two supplier for passenger vehicle companies, all the OEMs, as well as some of the tier one suppliers like Bosch. what they’re supplying is effectively the brain of the car. So, they have the full tech stack, they’re designing their own semiconductors, they’re doing the AI, they’re doing the models, they’ve got all the data flowing in. mean, they’re doing that, but it’s not a plug and play scenario where you just buy their components and plug it in if you’re say Toyota. And they have a big partnership with Volkswagen. No, they’re working at the design stage, know, intimately with these car companies. technical integration, operational integration, sort of hand in glove, which is a really good business model, by the way. So, you know, that’s really what they’re doing in their market is passenger vehicles, doing the brains, doing the CPMs. They’ve got spectacular gross product profits, 70, 80%. So great place to be. And they really started with, you know, ADAS. I say ADAS, I’m not sure if that’s what we’ll say, ADAS. basically, assisted driving. So, it’s not autonomous, but you’re providing various fly-by-wire features that help drivers drive. Their car usually in the area of safety, braking, things like that. And as they get better and better, they’ve been moving into fully autonomous. And that’s been their story. And the interesting thing here is the founder of this, there’s several founders, but basically came from Baidu’s autonomous driving unit. which has been investing heavily for 10 plus years now, they jumped out, they founded Horizon. Now from there, what’s interesting I think is WeRide is kind of the same idea, well, it’s a similar idea but it’s going in the different direction. It’s almost going in the opposite direction. Horizon really focused on being a supplier, a tier two OEM supplier. and working with companies from day one and getting their brain basically installed into vehicles that are now on the roads in pretty decent numbers, nothing like Tesla, but pretty good. Gathering the experience, gathering the data, feeding back into the brain and making it smarter, the feedback loop. And they started very simply, let’s only do passenger vehicles, because those are the number one car on the roads. So, you’re going to get the most mileage by focusing on passenger vehicles already being used, right? And let’s start with driver assistance, not fully autonomous, and we will increase our sophistication and move further and further towards autonomous, which they’ve been doing. Okay, We Ride is kind of the opposite direction. They started focusing on let’s build a robo-taxis. And we will focus on autonomous driving from day one, which means we’re going to, they will generally work with various OEM partners to create a robotaxi that is fully autonomous, level four is what they go after, level four. And they sort of started in robo taxis and then they moved into things like robobuses, robovans, robosweepers. And that’s been the story of them for about six years, seven years. And now in the last year or so, they’ve started to move into passenger vehicles and starting to work on driver assistance. So, they started in autonomous and have been basically playing across lots of vehicle types. And now they’re shifting more down into passenger vehicles and assisted driving, which is kind of the opposite of what we saw from Horizon. So that’s kind how I’ve been thinking about it but let me take you through basically the… know, the core information about WeRide. It’s a pretty interesting company. Now, the mission statement of WeRide is pretty cool. Transform urban living with autonomous driving. So, if you read their public, so can pull their numbers. If you read how they sort of present themselves, they will show you a graphic, which I’ll put in the show notes, of basically an urban environment. And then, within this urban environment, they will show you their various Products which I’ll go through them a little more detail now You know robotaxis was kind of number one. That’s what they started with Really back in 2019 so robotaxis. This is about Mobility as a service personal mobility 2019 they sort of do their first products Now of course, this is you know, you’re going to put robo taxis on roads you have to get permits That’s a problem. got to do the testing phase, then the mass production and the rollout. So, they start driverless testing permit in China 2020. They start to get more exposure in that area. They’ve really moved to driverless operations 2023. So, the go-to-market stage process, and this is true for a lot of their products, it’s pretty intensive. takes several years to actually go to market. This is different than going to an OEM and signing a contract to design their CPUs and their brains for their cars. I mean, think about the go to market strategy. How long does it take before you get your first dollar of revenue? Now, if you’re Horizon, let’s say, you’re selling to OEMs. So, once you sign the design phase, you can start getting contracts, revenue, and all that. Then you got a little production phase, all of that. Okay, this is a longer path, what they’re doing. You’ve got to design the robotaxis, you’ve got to sort of get permits, trials, permission to put them on the road, get to driver’s operations, start, and then is your revenue coming from what? Is it coming as a taxi service? Is it coming from partners you’re working with who are then using your vehicle? the go-to-market is, even though the technology is similar, the go-to-market strategies are pretty different. Now if you look at their, I’ll go through their basic products, because they’re pretty cool. The Robotaxis, one of the things We Write has done is they went international very, very early on. China, obviously, but you the Robotaxis, have a large, well at least, they have a significant fleet in the UAE. In fact, they’re the largest fleet of Robotaxis in the UAE. They have their own app; you can call the car. They’ve partnered with OEMs both to develop and produce the cars. So, they kind of went international early on and I’ve always been and they’ll talk a lot about this. I’m kind of curious why they do this. I think it has a lot to go with. Look, the go to market process is going to take some time. So, let’s try and get into as many markets as we can. And you UAE is probably faster. I would say I would suspect they’re going to large sale, large scale commercialization. 2024-2025 for robo taxis. They have robo buses. Robo buses, kind of interesting. They work with Yutong, if you’re familiar with Yutong in China, big bus company. Golden Dragon Bus, another one. So, they’re basically working with manufacturers and creating these autonomous buses. That’s pretty interesting. Especially long-haul buses, I think are pretty interesting. And then they, you know, they… basically sell these to local service providers and they provide the technology, provide the operational support, things like that. So, pilots in 25 cities, Singapore, UAE, China obviously, France, Saudi Arabia, Qatar. So very interesting when they sort of move from, this is why I brought up economies of scope, they move from very different products to different ones. Taxis are very different than robo buses. They also have robo vans, which are logistics as a service, delivery as a service, and they do intercity delivery. So, within a city. Partner with various OEMs to create these vans. They cruise along on their own, testing them now. But in this case, your partners are going to be logistics companies. So, is that who you’re signing? I mean, you’re signing contracts with JD and companies like this, SF Express. So, you can see these are very different products, very different markets, very different go-to-market strategies. One interesting one they have, the Robo Sweeper, which is, know, the first one of these, the S6, was a six-ton tank, which basically sprays water, I think. I mean, you can see this going down the roads in Southeast Asia all the time. Usually not sweeping the roads usually watering the plants, you know these big tankers that just cruise down the center of the road and spray the plants or what you know, wipe the streets or whatever Those are piloted in Guangzhou, which is where their headquarters is They have a new version a smaller one called the s1 which is a 400-liter tank. So, okay That’s an interesting. What’s the commercialization strategy there? Very differently we selling these to cities Are we providing a service? Are you doing government contracting? So go to market is different there as well. And then finally we have assisted driving services. So, this is where they’re going after mass production, put these into passenger vehicles. They have a deal with Bosch. can’t find out too much about that. I’m going to dig into that. They’re putting this into a… Now that market, that go to market sounds, you know, that kind of sounds like Horizon. That’s interesting. So anyways, one, two, three, four, five different products. Really kind of interesting company. think it’s got a, the strategy’s neat. They’ve got, they’re in 30 cities, seven different countries in various stages. Maybe they’re just doing their trials, maybe they’ve moved to commercial operations. Generally speaking, they’re offering L2 to L4 solutions in terms of autonomous capabilities. And the way they, you know, they, they pitch this is we want to do things that are autonomous driving, AD focused. And we want them to have sort of a commercial use case from day one and we want them to be scalable and we’re going international. All right, let’s talk about the financials a little bit. I don’t think there’s a lot to talk about here. It’s pretty much what you would expect. It’s, you know, revenue is growing, gross profits. 50 % is good. Obviously they’re much more in the hardware business because they’re actually making things. But you know then you look at the R &D expenses, you look at the marketing expenses and okay they dwarf not just the gross profits, they dwarf the revenue. And that’s pretty similar to what we see with a lot of these autonomous vehicle companies. They’re going for growth; they’re going for adoption and they’re flooding money into tech. The numbers here’s for 2024. These are estimates. These are not exactly because I’m looking at six months ending June 3rd in 2024. So, I’ll double it. Let’s call that a ballpark figure for all of 2024. But basically about 42 million dollars in revenue for 2024. Anyways don’t hold me to that number. I’m just ballparking it from the six-month numbers of that. You know the gross profit is about half of it. So. $26, $27 million gross profit at the end of 2024, ballpark. And then you look at something like R &D expense, well, that’s $71 million. So, these numbers are not huge, but they’re kind of what we expect. So, the numbers you pay attention to are, does this product have a good gross profit and what kind of growth and adoption are they getting? And. You know, you got to win on deployment usage because you got to get the flywheel going. But you’ve also got to stay on top of a rapidly emerging and changing technology. So, kind of what we would expect. I didn’t spend a lot of time looking at those numbers. You this is, you’re betting on the technology, you’re betting on the business strategy, and you’re betting on the management. And then, you track the growth and deployment. Okay. Now. What is the value proposition? I’ve sort of skipped over the main idea here, which I’ll get to, which is, okay, what they call WeRide 1. What they’re doing, which I think is quite interesting, is they’re basically building a universal platform, and that’s the word they use, universal, that by having the same core, intellectual property, the same core intangible asset, which is basically their autonomous driving capability by plugging that into lots of different types of vehicles. Sweepers, robotaxis, passenger cars, buses, vans, and with different configurations by different companies with different types of sensors. But the core is going to be universal to all of them. and they’re doing the hardware plus the software. So, it’s kind of like we’re building a universal platform that’s going to be very versatile that can go into lots of different types of vehicles and use cases and situations. We think we can get to scale faster and then maybe that machine learning flywheel will kick in more. And one number they talk about, which I thought was really interesting, is 90 % of the parts are shared across all the vehicle types. They are kind of building this universal hardware plus software, let’s call it a brain, but it’s more than the brain. mean, they’re more into the guts of the vehicles. That’s their WeRide One universal platform. That’s kind of an interesting idea to think about. The other thing about it is that gets you the self-improving algorithms and models. So, they have these five to six vehicle types, but they also have sort of a cloud. based system. So, all the data that’s coming in from all the deployed vehicles, which are very different vehicle types, dealing with very different use cases, that all goes up to the cloud. And in theory, you get a closed loop, a virtuous cycle for self-improvement. The AI should get better. The models should get better. You should the number of use cases you can handle well should keep increasing naturally. So, you’d look at the existing use cases and then you’d look at how many new use cases are we adding every two to three months, something like that. That’s going to be sort of a measure of the intelligence and you want that curve to be faster than everybody else. So, there’s a lot of data processing, there’s model training, there’s model verification, there’s model deployment. But you’re really looking at accumulated real world use cases. That would be kind of the key metric I’d be looking at. The other thing they talk about with WeRide One is basically everything’s fully redundant. So, you have sensors, but you have backups. You have communications networks that connect the cars, the edge computing with the cloud, with each other. That’s got backups. You have control systems, have computing units, you have power supplies. You have to drive by wire, that’s your driver assistance. Fully redundant. So, at a certain point it starts to look like their universal sort of WeRide One. It’s starting to look like a network to me with a sort of brain at the center that’s deploying into lots of different devices and use cases. And what are the benefits of this? The benefits they say are tech leadership. And I think that’s true. I think… That’s number one, two, and three in terms of their priorities to be the technology leader that can deploy sweepers and can deploy robots and robotaxis in all these random urban use cases, and it works. That’s tech leadership. And then obviously part of that is the flywheel, also called a feedback loop. They call it the virtuous cycle between data gathering usage and the algorithms. for both the existing use cases, are they getting better and better, and new accumulated use cases? Are you continually adding? They say one of the benefits is faster commercialization. I’m not sure I totally buy that. think you have to kind look at its case by case. Passenger vehicles, to me, if you’re basically operating as a tier two supplier to passenger vehicle OEMs, that strikes me as a very short path to commercialization. Getting government approval to deploy robo buses. Well, in some countries, let’s say Europe, not a country I know, that could take a long, time. In other places like Saudi and the UAE, it might actually be very, very quick. So, question mark. So, commercialization rate is a big question. And then the fourth benefit, which is they talk about cost efficiency across all these use cases. And that’s where the topic of economies of scope and economies of scale come up. You know, they are operating their products in mobility, passenger mobility, individual mobility. They’re talking about logistics as a service. They’re talking about basically urban and public transportation services. You know, they’ve got a pretty good spectrum in terms of their product portfolio. But in theory, if 90 % of the parts are shared, okay, is this a case like Sony? Maybe. Are we going to see lower average R &D costs, lower average production costs, lower average, you know, opportunity or operating costs? Are we going to see a faster and cheaper expansion into new verticals and use cases than with a company that only does passenger vehicles and that’s all they’ve ever done? So, there’s a really interesting strategy question there. Anyways, I think that’s most of what I wanted to talk about. Sort of a standard introduction. I’ll talk more about it when I’m in Guangzhou. But for me, kind of what I’m thinking about is, okay, the technology, the tech risk, does it work, who’s advancing faster, is the flywheel kicking in such that one company’s moving faster than the other? Go to market and commercialization. Are you selling services to logistics companies? Are you selling services to government? Are you basically just working with OEMs, passenger vehicle? That’s pretty interesting. And then there’s this idea of economies of scale versus scope. Are we going to see a universal platform play out very differently than let’s say a more focused specialty company that only does the generative AI brains for passenger vehicles? Mostly focused on driver assistance, which would be kind of more the horizon story. So, are we going to see it play out in economies of scale and scope? Those are kind of the three big factors that I’m keeping an eye on to sort of judge performance. And then I guess the fourth one would be management ability. Okay, that’s, your kind of always live and die with that, but it’s harder to get a read on that when you’re reading reports, which is why I visit companies, to tell you the truth. I get… 70 % of my information from reading annual reports and then when I want to start looking at management and innovation ability and speed of performance, you really got to talk to management or just read what they’re saying or get close to them and kind of get a sense of who you’re dealing with. You deal with certain companies, let’s say like Huawei, they just innervate at a blistering speed. And then you look at Apple and you’re like, guy seems slow and sleepy. you get a sense of that from dealing with management. And those are my sort of two go-to primary sources for data. Anyways, that’s it for me. I hope that was helpful. This is just kind of an intro. I’ll do more on this company for sure and go to little more depth. But yeah, interesting. If you have any suggestions for companies to take a look at, please let me know. I’d appreciate it. I’m always looking for who to pay attention to. As for me, I’m packed up here, I’m getting ready to head out. It’s going to be several weeks in China, which will be great fun. A lot of fun stuff too. I mean, I talk about the companies, but you know, we’ll go out. Hotpot, of course. That’s always like on the first day or two, get back to China. You got to go to hotpot. I always go to Xiabu Xiabu, which is just down the street and most shopping malls have hotpot. That’s always on my short list. We’ll go out on a boat in Westlake, probably Bay High. do some lot of fun stuff so it’s going to be a good trip and then I think after that Songkran is happening pretty quick that’s literally my favorite holiday of the whole year is Songkran the big water festival in Thailand I go every year it’s I got my own like big squirt guns like huge I have them and I bring them with me which is funny if you ever fly into Thailand or you know Bangkok Chiang Mai for Songkran you’ll see people on the airplane checking their big water guns. Like you either check it as luggage or you carry it with you on the plane. You know someone’s going to Song Kron when they’ve bought their own water gun with them. Anyways, I’ve got several I’m bringing with me. So that’s in April, that’s going to be pretty awesome. And then yeah, probably May is a bunch of travel too. So, I know it’s going to be busy, great, but you know, packed. Anyways, that’s it for me. Hope you’re doing well; I’ll talk to you next week. Bye bye.

———

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

Note: This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.