This week’s podcast is about the recent wave of Chinese tech companies that is shocking Western businesses and politicians.

You can listen to this podcast here, which has the slides and graphics mentioned. Also available at iTunes and Google Podcasts.

Here is the link to the TechMoat Consulting.

Here is the link to our Tech Tours.

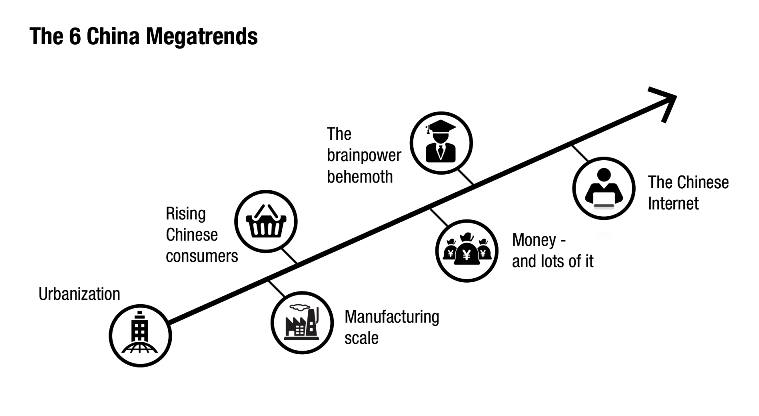

Here are the 6 mega-trends.

The mega-trends that matter here are:

- Rising Chinese consumers

- Manufacturing scale

- Brainpower behemoth

- Money

Here is DeepSeek. You can try it for free here:

And you can try Alibaba’s Qwen here.

You can try Kling AI here.

Here is the BYD jumping car.

Here is Unitree Robotics.

Here is the Huawei Trifold and EV:

———-

Related articles:

- BYD Is Going for Global EV Leadership (1 of 2) (Tech Strategy – Daily Article)

- A Breakdown of the Verisign Business Model (2 of 2) (Tech Strategy – Daily Article)

- 3 Factors Will Determine the Future of Verisign Inc. (Tech Strategy – Podcast 191)

- A Strategy Breakdown of Arm Holdings (1 of 3) (Tech Strategy – Daily Article)

From the Concept Library, concepts for this article are:

- EV AV Auto

- Robotics

- GenAI

- 6 Mega Trends

From the Company Library, companies for this article are:

- BYD

- Unitree

- TikTok

- Kuaishou / Kling AI

- Huawei

- Alibaba Cloud

- MiniMax / Hailuo AI

- DeepSeek

Photo by Michael Förtsch on Unsplash

———transcription below

Episode 237 – China Tech Tsunami.1

Jeffrey Towson: [00:00:00] Welcome, welcome, everybody. My name is Jeff Towson, and this is the Tech Strategy Podcast from Techmoat Consulting, and the topic for today, the China Tech tsunami. Basically, how DeepSeek, BYD, Huawei, TikTok, and quite a few others are replacing U. S. tech leadership.

Uh, this is going to be just sort of more of a high-level talk because I think a lot of important stuff has been happening in the last couple months. It’s in the news. A lot of trending topics related to Chinese tech companies, some of which I’ve just mentioned, but there are others. yeah, and a lot of political response, kind of a big thing.

And I’m going to give you my simple explanation for what I think is going on, which is quite honestly, that yeah. Chinese tech companies are on the verge of replacing [00:01:00] the U. S. In terms of global tech leadership. I mean, we’ve been watching this for decades. I think it might be happening right now. They’re neck and neck.

So, and we can see it sector by sector. So, I’ll sort of take down how I think about it and talk about it a little bit. So not too much deep content for today, but that will be the topic Let’s see, da, da, da, da, standard disclaimer, nothing in this podcast or my writing or website is investment advice.

The numbers and information may, blah, blah, blah, try and do it in one breath. Nothing in this podcast or my writing or website is investment advice. The numbers and information for me and I guess may be incorrect. The views and opinions expressed may no longer be relevant or accurate. Overall, investing is risky.

This is not investment legal or tax advice. Do your own research. I think I’m getting better at that actually. Okay, let’s get into the content. Okay, there’s only really one concept for today, which is, basically the book me and, my partner wrote about 10 years ago called the one-hour China book, [00:02:00] which is no did pretty well for a book.

And it was a business book and it was basically like, look, if you understand six mega trends, which are long-term, you know, 20, 30 years. It gives you a pretty good read on how things are going to be moving in China versus the world. And we, we describe these as the tectonic plates moving beneath the surface.

If you see how the plates are moving under the surface, a lot of the action on the surface, which can appear chaotic, makes more sense. And so, looking at sort of what’s going on with the China tech world as it relates to the rest of the world. yeah, I think three or four of those mega trends, which are basically the Chinese consumer, I’ll go into these in detail in a minute, but Chinese consumer manufacturing scale, the brain power behemoth and basically big money.

Those are four of the six. I’ll go into a minute, but I think that is kind of the idea to remember for today. It’s not a bad framework. It’s pretty consistent. It’s been pretty [00:03:00] reasonable. Okay, so. If you kind of look at the news over the last couple months, really last six months, it’s kind of been one story after the next, usually of a Chinese company that the rest of the world has not really heard about before, but now is very aware of.

So, let’s say like BYD. You know, Chinese EVs, two years ago, nobody talked about those. Now they’re everywhere where they’re not sort of tariffed or banned. Australia, Asia, Southeast Asia, I mean, they’re BYD, Xpeng, NIO, not as much, but, you know, and even guys like Elon Musk are like, look, the future in terms of EVs is Tesla and Chinese companies.

And that’s it. I don’t know if that’s totally true, but that’s the way the trend lines are proved. You know, the other companies you can look at Volkswagen, you know, Toyota. I don’t think it’s that clear cut when you look at it versus the U. S. Companies. General Motors, Ford. Yeah, I [00:04:00] think they’re in serious trouble.

It’s hard to be optimistic about those. Okay, so B. Y. D. a couple months ago, the iPhone 16 pro got released, which was a whole lot of nothing. It was, you know, The iPhone. Same 16. That was the joke. Oh, the iPhone. Same 16 is has a new button that makes, you know, that’s the big innovation from the iPhone.

Same 15. It was nothing. They added a button on the side in a couple, you know, colors and a bunch of AI tools which don’t work. Compare that at the same time. Huawei, which is supposed to be shut down in smartphones because of the entity list band. They released the trifold, the phone that folds out in three pieces as big as an iPad.

That thing is spectacular. Their handsets are fantastic. they’re just rocking and rolling in handsets, earbuds, smart devices. They’re making cars. [00:05:00] They weren’t doing that three years ago. I mean, Huawei’s rocking and rolling. So, the comparison there, kind of interesting. DeepSeek, which was the big news.

This last two weeks, they’re, you know, basically the Chinese AI open source, LLM, which is, you know, the reason there’s a lot of LLMs in the world, right? Foundation models. This is the one that’s in reasoning and logic, which means it can do math and it can do science. You know, that’s, that’s how you get to AGI.

You know, not generating images that are cool, you know, when you can incorporate logic in it, but you can’t, so people said it’s like comparable to the, you know, the oh one, which was the open AI sort of leading contender a while back, but the big thing was one, it’s open source, anybody can use it, you can download it pretty much on your desktop computer and run it.

Uh, under MIT license and two, it’s about [00:06:00] three to 5 percent of open AI in terms of price. Devastating. Much in, much in the way that like Chinese EVs can come in at 5, 000. You can buy a Chinese EV for 8, 000. You know, now there’s a lot, 10, they go all the way up to 300, 000. But cheap and highly innovative is a common theme in these Chinese companies rocking and rolling around the world.

Uh, people are talking about Shein and then Temu. Now they’re talking about AliExpress, rocking and rolling. Of course, everyone was talking about TikTok, which was a major political issue in the U. S. And in arguably the coolest move by the Gen Z generation of the United States, when told that they are not going to be able to use TikTok, their favorite app, they all adopted RedNote, a purely Chinese app, not a half and half thing.

Pretty much as a middle finger to the U. S. government, which is got to give them a little [00:07:00] props for that. That was a good move. Clever. Anyways, all these stories, you put them all together. What does it mean? I call it the China tech tsunami. I’ll explain what I think’s going on really, but you can’t ignore the frequencies of these stories in the last 12 months.

Okay. So, let’s, let’s get into a little bit of the theory. Now, our, our book, The one-hour China book. You know, we tried to boil the whole book down, which is short. You can read it in an hour. Hence, one hour China book. Although, in reality, it takes about an hour and twenty minutes. We said, look, there’s six megatrends.

If you can understand these, you’re going to have a good sense of what’s going on. These are long term, there’s a lot of trends in the world. Oh, aging is a trend. Inflation is a trend. We were looking for trends that we could track for thirty to forty years. That directly showed up in the income statement of businesses.

It had to show up in the revenue line and it had to show up in the cost structure [00:08:00] or the cost structure of major players. You know, people talk about aging a lot. Aging is a major trend. I don’t see it in the income statements yet. I’m looking for it. I don’t see it. But when we broke apart our six, we talked about urbanization.

We talked about the Chinese consumer, which is really middle-class families, middle class urban families, technically, as a major trajectory, any company that tapped into that was doing great in terms of revenue, and there’s a long list of them. Okay, fine. Why does that matter in this case? Because a lot of the companies we’re talking about, almost all of them, before they went international, they got to scale in China.

Which by most metrics and in most industries is the largest market in the world. No. Who sells the most cars in the world? China. Domestically and now by export. you, gaming. [00:09:00] Coca Cola. Like every, you can just go sector by sector. And this has really happened since about 2011 till now. Every year or so that you just hear another little announcement.

Oh, China is now the largest residential apartment market in the world. China is now the largest auto market in the world. China is the largest smartphone market in the world. It was just, it just sort of happened bit by bit where if it’s not number one, it’s number two. It’s always the US or China. I mean, you use a bit different because you can sort of group it together, but they have a massive market based on consumption.

You get to scale domestically. Then you can go internationally from a position of strength, especially if you’re going into, say, a small company. Malaysia. What Malaysian company can go head-to-head with a Chinese competitor at scale in their home market now entering Malaysia? None. The scale advantage is huge.

The U. S. Has been doing this for 70 years. So, we look at [00:10:00] consumption. We look at manufacturing scale. You know, the fact that most of the world’s manufacturing bases in Asia, China is the biggest, obviously. It’s more complicated than that. It’s not the factories all in China, which a lot of them are, but a lot of the manufacturers in China that got to scale domestically, both by experts, exports plus domestic sales, they’ve moved some of their factories in Southeast Asia and other places.

So, the manufacturing giants are all in Asia, pretty much. Okay, that makes a big deal because you can sell things cheaper. And you can export to the world, that’s Huawei. You know, that’s higher. That’s greed. You look at the air conditioners and washing machines in Brazil. They’re going to be Chinese. Well, Brazil’s got a lot of tariffs.

Let’s say Africa, Southeast Asia. so you look at manufacturing scale is a mega trend. Third one. You look at what we called the brain power behemoth. This [00:11:00] was more about just the number of smart people we saw coming out of universities and entering the workforce. You know, it’s, there’s about 10 million students in China per year.

Engineers, let’s say, look, you can break that down, chemists, art and design is huge. This was all built between 2000 and 2010. There really weren’t that many universities in China. They did a massive building spree. The people started coming out in huge numbers, 2010, 2013. They graduate about 2 to 3 million engineers every year.

Which is 10 times the U S now the U S benefits in that they import a lot of people, you know, from around the world, but domestic production of really, really smart people. It’s, it’s, it’s hugely important. So, what happens when you combine trend three with, you know, trend two with trend one, let’s say smart vehicles being [00:12:00] sold domestically.

Well, vehicles are a manufacturing play. They can make them cheap. But they’re also being made by top tier engineers now. So, they’re, they’re not just stupid cars and toys and low value manufacturing. They’re high-end electric vehicles. So, you combine the brain power with the manufacturing scale. You sell it in the domestic market first, which has huge scale.

You get to a position of power, BYD, and then you start exporting to the world. Okay. Those are sort of the first thing. The fourth mega trend would just be capital. when TikTok came into the US, which was a big shock, we’d never seen a Chinese BTC app do that before. Really, you know, Facebook did their standard playbook, which is we’re Facebook.

We’re rich. We will just use our money to bury you. You can compete with us, or we can bury you and, you know, build our own, which is what how they sort of took down WhatsApp. That’s the [00:13:00] sort of gangster, you know, Deal that they pitched to, let’s say, Instagram and snap, right? Those are all three companies either went head-to-head and folded or they agreed to be acquired.

Well, that doesn’t work on Tik TOK. Cause you go to Tik TOK and say, you sell to us or we’ll flood you with money and copy you. And Tik TOKs like we can match your dollar per dollar. You spend a billion. We’ll spend a billion. Money doesn’t work as a weapon against Chinese companies going international.

They have tons of money. TikTok today, ByteDance, 100 billion dollars in revenue. It’s about the same size as Facebook. You can’t outspend them anymore. And they are willing to lose money for a long, long time to capture a market. Competition in China is much more ruthless and hardcore than most of the world.

Anyways, so let’s say those four megatrends. [00:14:00] I think explore you sort of explain a lot of what’s going on. So anyways, let’s get to sort of what’s happening. That’s the concept for today. now we’re seeing a common pattern when a Chinese tech company goes global and stuns people and starts taking down competitors, usually fairly quickly.

It’s usually a couple of things happening. Number one, there is usually a change in technology happening that gives them an opening to jump in with something new. They didn’t really do that well with automobiles internationally. Now they had economy automobiles for a long time, Great Wall, Geely, things like this.

And you can find them if you go to Jamaica, Ecuador, you’ll see them. But they didn’t do really well in the Europe or the US or Japan. But once the technology changed to EV, that sort of levels the playing field when there’s a new technology paradigm, and they use that [00:15:00] to jump in in EVs very aggressively.

You could say the same thing happened with TikTok. This was a new type of tech that came in. You could say that all the new AI going right now is a tech paradigm change. So, it’s kind of a more level playing field versus you’re going head-to-head with an incumbent who has been in this business. Let’s say German automotive.

for 50 years, 100 years. So usually there’s a check change that gives them a window of opportunity. A second, they usually come in with a stunningly low price point. That’s BYD. That’s DeepSeek. That’s pretty much everything Huawei sells. And it’s usually, if it’s not as good, it’s pretty close. You know, if you can get something half off and its 80 percent as good, most consumers will go for that.

Now, what’s been happening recently is it’s cheaper and it’s better. [00:16:00] The BYD cars are better. I mean, I would argue they’re maybe Tesla’s better in some ways, but they’re cheaper and they’re better. Like these Chinese EVs are, they’re kind of hard to say no to. So usually, you’re looking for that scenario.

That’s the most common thing we see. Alright, let’s get into sort of case by case. Now, the e commerce examples are pretty straightforward. I don’t think we have to go through those. Shein, Temu, AliExpress. Yeah, I mean, Shein’s a little bit different, but why are these companies good? Well, because the user experience is fantastic.

The management teams are super-fast on their feet, and the products they sell are really cheap, and consumers love that pretty much everywhere. Now, she ends a bit of a standalone. The other two team who Ali Express. Well, they’re part of Pinduoduo and Alibaba. So, they’ve got that domestic scale aspect going for them.

Uh, and then they can go international from a position of strength. [00:17:00] I would say this is this one’s the clearest cut. Look, e commerce in China is just better across the board. The companies are better. Yeah. They’re faster. They innovate. They’re more advanced e commerce in the U. S. Amazon. It’s okay. It’s not terrible.

I mean, they do innovate a bit. They’re good at things like logistics. They’re good at cloud. The user experience pretty much sucks. the app is terrible, but okay. They’re not horrendous e commerce just across the board. food delivery, transportation, DD is better than Uber, Meituan is better than Uber Eats, Alibaba and Pinduoduo are better than Amazon and Etsy.

It’s just pretty much, look, Chinese companies are better at e commerce. They’re quite a way ahead. Fine. If we look at something like Huawei versus Apple, I think it’s kind of the [00:18:00] same story. I view Apple as sort of a One of the things we have in the U. S., which I think is a problem, we have these sort of bloated, cash rich monopolies that are fat and lazy.

Apple is not known as a really innovative company. The iPhone handset, at least, stinks. the operating system hasn’t improved in forever. They’re taking a 30 percent cut of the app stores. they couldn’t develop AI in house. I don’t know why they couldn’t. You know, they’re working with open AI. they haven’t built anything new in a decade.

AirPods don’t count. They tried to build a car 10 years, I think it was 10 billion dollars spent. Never launched the thing. I mean, this is a stagnant, bloated, slow company. Now compare that to Huawei or Xiaomi. lean and mean. Lei Jun and his team, as good of a tech team as you’ll find, [00:19:00] in two years, he says, we’re jumping into EVs.

I’m sorry, 2022, he says we’re going into EVs. Within two years, they roll out the first car, the SU7. Really fast. It’s a nice EV. They can deliver. you look at something like Huawei. Okay. Huawei is, you know, they were supposed to be shut down. You’re on the entity list ban. You can’t get semiconductors, at least the high-end ones.

You know, your consumer electronics business, especially internationally is done because you can’t use Android. You can’t use high end semiconductors. They’re pretty much back after two years. They launched their own operating system, Harmony OS, which at least domestically in China now has enough developer adoption that You’ve got three operating systems for the first time.

They broke in. Their semiconductors are getting better. Their handsets are fantastic. They’re making cars, you [00:20:00] know. Now, are they making semiconductors at scale in a cost-effective way? Unclear. You know, they’re producing five nanometer, seven nanometer. We’re not really sure how they’re doing it and whether they’re able to do a pro, you know.

If you spend enough money, you can make anything. So, we don’t quite know the cost structure of that. But generally speaking, Huawei is doing amazing. And that’s the consumer electronics business that got the hardest hit, where they pivoted into things like smart devices, headsets, earbuds, cars, because they had a problem selling smartphones internationally.

You look at their other stuff like 5G, they’re, they’re past 5G, they’re on 5. 5G now. Now, you know, they’re rolling out really quickly. Now compare all that to sort of, okay, Apple, you know, what telco equipment companies do we have in the U S none, you know, you have no key in Ericsson out of Europe, but there’s, so in that sector and e commerce, it’s like, look, you’re getting beat again. [00:21:00]

Now within this category, we’ll call this the consumer facing consumer electronics category. Obviously the most political of these stories, which is kind of the most entertaining is the tick tock story. Which is kind of, it’s like four to five things are happening at one time. So, depending on when you look at the story, like people talk about it, but they’re talking about different things.

Like the first bit of this story from the political side was Trump. Trump 2019, I think 2020, who said we need to ban TikTok because it’s a national security threat. And he issued an executive order. And basically, the courts didn’t allow it. It was major freedom of speech issues. Back then, there were 110 million Americans using TikTok on a monthly basis, more or less.

Now it’s 170. You know, this, basically, it was struck down. You can’t, we don’t like politicians telling us what we can say and what we can read in the US. [00:22:00] Okay, that got shut down. No. They said it was national security. So, there is this argument that it’s national security. I don’t really buy that, to tell you the truth.

What I remember back in 2020 is TikTok was rocking Facebook. You know, they were just crushing them in terms of time spent per day on this app. Facebook was like in July. Reels sucked. It’s doing pretty good now, but it sucked back then. Within one month of that You start to hear Mark Zuckerberg talk at Congress about how China was a national security concern, and we saw two random senators, like, who I’m sure have never used the app, come out and say, hey, this is a national security concern.

So, this, to me, looked like a competitor using political leverage to take out a competitor. I think that was a factor. I can’t, I don’t have any proof. I’m making that up. I think it was a factor. [00:23:00] Now, the national security concern, so that’s kind of factor one, this competitive crony capitalism thing. Factor number two, as we have since learned, the deep state, the security state of the U.

- is working hand in glove with the tech companies to control speech and narrative in the U. S. Mass censorship, narrative control, behavior control, all of it. I mean, it’s all for Twitter files. It’s all their weekly emails. Ban this person. Don’t let them be hesitant about. Maybe these vaccines have a side effect.

Oh, which it turns out they do. So, there was that bit. Tick tock isn’t really under that directly. I mean, ultimately it’s a Singapore company, Chinese company, so we’ll call that factor number two. OK, that was 2020. Nothing happened. The whole issue went away. 2022 out of nowhere, [00:24:00] the issue comes up and within weeks, the app gets banned by an act of Congress bipartisan support.

So, what happened? Well, it turns out tick tock. If you look at the major trending issues related to foreign policy, it’s basically Israel Palestine. I mean, it was a huge sort of discussion space for that topic. that was very unpopular with the Israeli group in particular, but also you could argue a lot of Americans in there as well.

So, it’s not as clear cut as people say. You put those three factors together. We don’t like criticism of Israel, deep state, competitive crony capitalists. You put all three, those three together, I think that gets you a ban, right? That’s my guess, passed rapidly bipartisan support. There’s an old George Carlin joke that any time you see something bipartisan happening in Congress, it means that the deception taking place is larger than normal.

[00:25:00] That’s how I see this. Oh, bipartisan. Okay, there was something really nefarious going on here. That’s number three. That gets us to last week. The app is set to be banned on a Sunday in the U. S. Supreme Court’s not going to intervene. The Gen Z group of the U. S. In the coolest move in a long time says, hey, you’re going to ban us from using our favorite app because you argue it’s China control.

That’s the narrative, right? I don’t think that’s really what’s going on. But that was the narrative. Fine. We’re all going to start using a fully China app. You know, XiaoHongshu, which by the way, is an awesome app. I love Xiao Hongshu. they read the brain, get red note. They all jump over now. How many looks like a couple million people.

And they’re all joking back and forth with Chinese students. A lot of U. S. high school students are going back and forth with Chinese students on RedNote now. Okay, one more factor. So, what happens? [00:26:00] Sunday comes along. TikTok goes offline. People get angry. Even I was angry. Like, you know, you start to say like, look, who do you people think you are?

Telling me what I can watch and what I can’t, we don’t, no offense, you are not respectable people. It’s not like, oh, the politicians thought this was important. We don’t think much of you to begin with and you’re telling me what app I can watch now? Like I even, I felt kind of angry about this. what happens?

Trump reinstates it. The guy who originally pushed for the ban in 2020 reinstates it with an executive order. And why? Well, because he basically, to a significant degree, won the election based on young people swinging from negative 30 points against him last time to negative plus 30 for him this time.

TikTok had a lot to do with it. And he said this openly. So TikTok helped get him elected. So now [00:27:00] he’s stopping the band, the guy who started the whole thing. So, there’s like four or five factors in there that make this whole story kind of weird. And now he’s saying, well, you got to sell half of it to the U S and we’ll see what’s what, you know, we can tell you, you to do this.

And then people will say, well, if you can force tick tock to be sold half in the United States, can China force half of Tesla in China to be sold? How about Apple? How about the NBA? How about KFC? Like, you want to play this game? So, we’ll see where that goes. Anyways, I think that’s kind of a fun story.

It’s kind of, it’s all politics, which is not my area of expertise. So that’s just me. I don’t have any real information on this. I’m just watching the news like everybody else. But kind of a funny situation. Okay. So that’s three stories of China tech companies. sort of rolling over the U. S. and the world to a large degree.

Um, [00:28:00] Huawei, e commerce giants, TikTok. I think the sort of three factors I mentioned the mega trends explain most of that highly competitive, a lot of tech change. massive scale at home, which gets you to scale. Then you go abroad from a position of strength and you got a lot of capital. I think that kind of explains those.

Alright, let’s move on to the more complicated ones. BYD, Intree Robotics, and we could even say Rockets. Now, these things are all hardware. Hardware plus software. BYD. BYD cars are fantastic. Go look up the U9, their new high-end supercar, which is like a couple hundred thousand dollars. This is the car that jumps.

Right. You can be going down the road, no driver, empty car, 100 miles an hour, 80 miles [00:29:00] an hour. If you put tax on the road, you know, five feet of the road covered with tax or rubble or something, it will jump it. You can see this on YouTube. It’s really crazy. It can stand at the parking lot, you know, just at the light and dance.

It can jump. It can wiggle around. It can do a 360 pirouette without moving forward. You know, and that’s their high-end car, but you know, they’re rolling out new models every month. This is kind of how China works. Like, I think this is a Tesla weakness. They have three, four models, if you count the Cybertruck.

Chinese EV companies will roll out 10, 20 new models every year. They have a rapid turnover in terms of product design. they’re just fast on their feet. It helps if the, it helps if the manufacturing is down the street. It lets you innovate faster on the hardware side when You know, you’re a DGI [00:30:00] drone company, you can innovate really quick because those things are made right down the street.

BYD, DGI, they’re all based in Shenzhen. So, the U9 is fantastic. I think that story, pretty much what I just said, it’s the massive brain power. It’s the domestic consumption, which gets you to scale. But this is the case where we’re combining that with manufacturing scale. They can combine hardware and software innovation at a very rapid pace.

Most companies in the U. S. can’t do that. You know, they do the design and then they send it to Asia. But no, it’s just down the street, in Shenzhen in particular. So, that would be that category. In Tree Robotics, which is this, I’ll put the link in the show notes. I’ll put the BYD one in too because it’s fun.

In Tree Robotics is the crazy little, four-legged robot that zips along the [00:31:00] road, you know, at rapid speed, you can, you can ride the thing like a horse, it can jump and do back flips. It can pirouette on one leg. It can flip around. It can run through rivers and up mountains. And, you know, this thing’s crazy, you know, why was B.

- D. And these E. V. S. Why were they so powerful? Okay, the three mentioned, the reasons I mentioned, they have the manufacturing scale, they have the domestic consumption, they have tremendous brain power, engineers everywhere, and they have huge capital behind them. The other thing they have is, you know, when we move to hardware, it’s not just hardware, it’s, it’s actuators.

When we get to robots, it’s batteries. Well, who’s the leading battery maker in the world? That’s BYD. So, they have the rare earths. They have all these specialized hardware components that are very important in EVs and robotics in particular. [00:32:00] So I would argue that this in tree robotics one, I mean, is there any reason to think that we are going to see a wave of Chinese robotics companies coming the same way we saw the EVs coming?

Um, I think it’s they have the scale, they have the factories, they have the domestic market, you know, the US doesn’t have manufacturing scale in these areas. Not really. It’s, it’s kind of obvious in retrospect, but if you outsource all of your manufacturing to another part of the world and that part of the world starts churning out engineers by the millions, who do you think is going to make the next generation of high-tech products?

Really? Is it a surprise? So, in tree robotics, take a look at their link. And then the last one in this category of hardware meets software would be rockets. This is another China versus Elon story. Now, if you look at rocketry and who’s moving tonnage [00:33:00] into low earth orbit, you know, Tesla space, not Tesla, SpaceX is number one.

But if you look at all the Chinese companies, which is really a state organized thing. They’re right at number two in terms of moving tonnage into space. It’s really, it’s like the same as the EV story. It’s Elon versus China again. So, rockets, drones, robotics, electric vehicles. We’re just at the beginning of this.

So that’s sort of a second bucket. Which brings us to the last bucket, which is AI. Now the big story was DeepSeek. If you haven’t used DeepSeek, the R1, just go and I’ll put the link in the show notes. It’s just a chat. It’s free. You can start giving it chats immediately, create an account. It’s great. It works really well.

And because it’s open source, under MIT license, one, [00:34:00] obviously the price, well it’s free now, but even if you download it, there’s no need to use an API. right? You can download the model and use it on your computer. it should never be, let’s call it expensive, but it’s also this idea that we’re going to put lots of weights in there that shape the answers.

I mean, if you go to Gemini, Google and you go to open AI, they are pretty woke. I mean, very woke. You can say, draw me a picture of 10 black guys and it’ll do it. You say, draw me a picture of 10 white guys. It won’t do it. It’ll give you a mixed picture. Like they’ve got woke weightings baked into there.

So now you could bake, you could bake other types of bias in there. So, it could be the other way too. And I’m saying if it’s an open source one, we know what the weights are. Right. So, I kind of like that. It’s open [00:35:00] and it’s transparent. And. The best sort of summary I’ve heard about this was that basically Sam Altman, you know, the head of open AI, he basically stole open AI from the people and turned it into his private proprietary models where we don’t know what’s going on inside those black boxes.

DeepSeek basically stole it back and gave it back to the people. Anyone can use it now, which is, I think. A reasonable criticism. Now, why? This is not a case where it’s clear who’s going to win. I think when we look at EVs and robotics and e commerce and everything, I just said smartphones. I mean, I would bet my money on the Chinese companies.

- I know it’s head-to-head. It’s changing every month. But what deep seek did? I think we’re going to see this over and over. We’re going to see Chinese companies coming in with an open-source model [00:36:00] at a very low price point, and the quality is going to be comparable, if not better. I think this was just the first one that got people’s attention.

Why? Because they have more engineers. The engineers are great. If you start getting into the hardware side, the U. S. has greater energy resources. You have to build all these massive data centers, right? And the U. S. has energy like crazy now. It’s pretty much energy independent. China is not. China is actually energy poor.

They have to import a lot of oil. But China is very good at sort of building power plants, which the U. S. is very slow at. So, China is building power capacity like crazy right now. They’ll have to import the oil, but the amount of pure power generation they are building dwarfs the U. S. So, they are building massive power capabilities which are going to power the data centers.

That’s going to be your AI. the semiconductors [00:37:00] is a bit of a question. You know, the chips you need for training and inference are different. The U. S. NVIDIA really has a stranglehold on the training chips. You know, the high-end NVIDIAs everyone wants. is that going to be a major issue? Unclear. But, you know, we’ll see how that So I think the AI bit is You know, it’s going to change month by month, but it got pretty exciting this week and we can look at a couple other companies that didn’t get much attention.

Um, if you look at the top two, generative AI video generators, you know, put in a photo or put in some text and generate a video top two players are Chinese. It’s not Sora from open AI, which I don’t think it’s very good to tell you the truth. I like Pika Labs. Okay, that’s U. S. But number one and two, Minimax and Cling AI.

They’re great. Kling AI is under [00:38:00] Kuaishou, which is the other TikTok of China. Yeah, that’s their, their video generator. It’s fantastic. It’s so good. And Minimax, which is also fantastic. You can go sign up for them right now. Start generating videos from a prompt or an email. Jpeg. They’re outstanding. So, okay, that’s two other leaders in AI coming out of China.

In terms of cloud plus AI, which is kind of where a lot of this happens, you know, AWS, Google Cloud is doing incredibly well. Alibaba Cloud is the one I’m watching for international expansion. QN, their, their LLMs, their foundation models are doing really well internationally. They’re a major player. Baidu, not so much.

Baidu is China focused. So yeah, the whole AI space, I would say it’s kind of neck and neck, but yeah, we’ll see what happens. And, you know, the question will be [00:39:00] what is going to be used within China? Well, it’s going to be the Chinese AI because there’s going to be some political issues there. What’s going to be used in the US?

Unclear if there’s going to be a protectionist move there. But the real question is, what is the rest of the world going to use? Are they going to pay OpenAI 200 a month for their pro? Or are they going to use DeepSeek R1 for nothing? Like, it costs 3%. It’s absolutely nothing. I think a lot of the world is going to start adopting the Chinese standards and the Chinese LLMs.

We’ll see. Anyways, that’s kind of, how I’ve been thinking about this. let me give you a couple opinions since I didn’t really give you any. So, what’s in that? I’ll give you a couple opinions. Number one, I think you can’t separate government from commercial activity in these spaces. I think they go hand in [00:40:00] hand.

China is very good at pairing government support with private corporations. It’s effective. It works. They’ve been actively supporting EVs in various ways, and it doesn’t mean funneling them money. They have a very ferocious competition going on, but they give them approvals. They let them do things quickly.

They waive regulations. They give them tax cuts, things like that. They support it. Robotics will be the same. AI is already the same. semiconductors, okay, in that case, I assume the spigots of money have been opened to develop domestic semiconductors. So, it’s not Commercial versus state. It’s commercial working with state.

That’s going to determine who the superpower of the next 50 years is. China’s moving quick. The US has been problematic up until recently, and now with the Trump team, it actually looks pretty good. It’s Elon Musk. It’s [00:41:00] Sam Altman. It’s, you know, the tech bros. If you looked at Trump’s inauguration. The front row.

The second row was all the like cabinet secretaries. The front row was all the tech bros, you know, it was Google Open AI and even so shows it to the TikTok CEO was there. So, the U. S. Is now apparently pairing domestic policy and commercial activity to win, which I think is necessary. So, I think that’s the key thing.

And You know, I’ve always kind of said like, look, the type of government matters, how smart your government is matters more and China’s government is very smart. They’re very effective. Singapore, very smart. Japan, pretty good. South Korea, smart. The U. S. went from having one of the dumbest governments I’ve ever seen.

And I know that’s political, but nobody can look at Joe Biden and say, oh, that guy was really smart. [00:42:00] You know, Justin Trudeau. Oh, he real smart. No. I mean, it doesn’t mean you like Trump, but I’m, you got to kind of acknowledge it. Look, that was not a great couple of years. things look better now. The sort of partnership between Silicon Valley and Washington is very interesting.

We’ll see if it works. Maybe it’ll be a disaster. Who knows? So that’s kind of number one. Public and government and commercial and tech. It’s a team sport. number two. The U. S. Trying to contain China by limiting its technology supply. It slows them down, but it kind of backfires every time you cut them off from chips or whatever.

It forces them to innovate. And that can come back and bite you. You know, deep seek the semiconductors, the cars when you ban them from, let’s say, Europe. It doesn’t really work long term, [00:43:00] you know, China’s engineers are not going anywhere. They’re still going to be there next year working. So, I’m not sure what the great solution is, but I think this at best, this sort of, we’re going to contain China by cutting off their tech supply.

It’s a short-term speed bump at best. And at worst it forces them to innovate and come back with something that you’re not positioned to compete with. Which is what I think is kind of happening. third opinion. If you put tariffs on companies coming into the U. S., let’s say in EVs, I think that’s a good move.

Because I think you need to protect your big home market and then go abroad from a position of strength. That’s what China does. I think that’s what the U. S. should do. However, if you put tariffs and you limit competition at home from foreigners, it’s possible that it’s going to make you weak and noncompetitive.

China is actually [00:44:00] very good at this, where they limit foreign competition coming into their country so that their domestic companies can succeed and get to scale and then go abroad from a position of strength. But they don’t limit it so much that it makes the companies weak. Huawei still has to compete with Ericsson and Nokia at home.

The Chinese EVs have to compete with Tesla in their backyard. I’m not sure the U. S. is going to get that balance right. Where yes, we want to protect somewhat, but we also don’t want to make them weak and non-competitive because ultimately, they have to win here and internationally. They’re going to have to go head-to-head with BYD in Malaysia and win.

You know, OpenAI is going to have to go international and compete head-to-head with Alibaba and DeepSeek in Latin America. You don’t want to fall back to being just an American company. You got to win internationally. So, I think that’s probably the model [00:45:00] that the U. S. Is going to start operating pretty.

You know, here’s the funny thing. This is the last point I’ll finish up. China, to a large degree, has been copying what worked for the United States from, 1970, where it was sort of a strong domestic market. The state was pretty active in all of that, and they kind of copied that like, you know, the radio was invented with the U.

- Military. It was only licensed to a handful of U. S. Companies for a long time. They kind of copied that the U. S. Moved away from that because they were doing so well. I think the U. S. Is going to move back to that model that balance between protect the domestic get to scale, become a superpower and then compete internationally.

Um, and it’ll be sort of China and the U. S. Operating the same way. I think that’s right. But anyways, that is to me is sort of the fight for the, you know, the flight. That’s right. The fight for global [00:46:00] leadership in technology. I think that’s how it’s going to play out and we’ll see who wins. But anyways, okay, we put a big caveat on all of that.

This all the high-level stuff is not really my expertise. This is me off the top of my head. The companies I think I know quite well, but Geopolitics. What happens in why Congress decides A versus B? I don’t really know. I actually probably have a better read on why China does things politically than the US at this point.

Anyways, that is kind of the content for today. A bit longer than I thought, but yeah, kind of a fascinating. So, I think 2025, I think this is going to be the year. I think this is it. I think it’s AI. I Robotics, electric vehicles, China versus the U S and the whole world is going to be sort of the battleground and we’re going to see what’s what it’s going to be exciting anyways, that is it for me for this week.

I’m back in Asia having a good old [00:47:00] time. I had such a good time in, in Paris. I’m already planning my next trip back there in a couple months. I do like that it’s, so I’m back in shorts, shorts and flip flops, which is, it’s pretty great. so yeah, I’m, I’m in a pretty good mood. I’m going to be around this part of the world for at least the next couple of months.

So pretty good mood. Okay. That is it for me. I hope everyone is doing well and I’ll talk to you next week. Bye bye.

——–

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

Note: This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.