This week’s podcast is about two leading and well run ecommerce companies in Brazil: Magazine Luiza / Magalu and Mercado Libre. Both companies have compelling but different business models.

You can listen to this podcast here, which has the slides and graphics mentioned. Also available at iTunes and Google Podcasts.

Here is the link to the Asia Tech Tour.

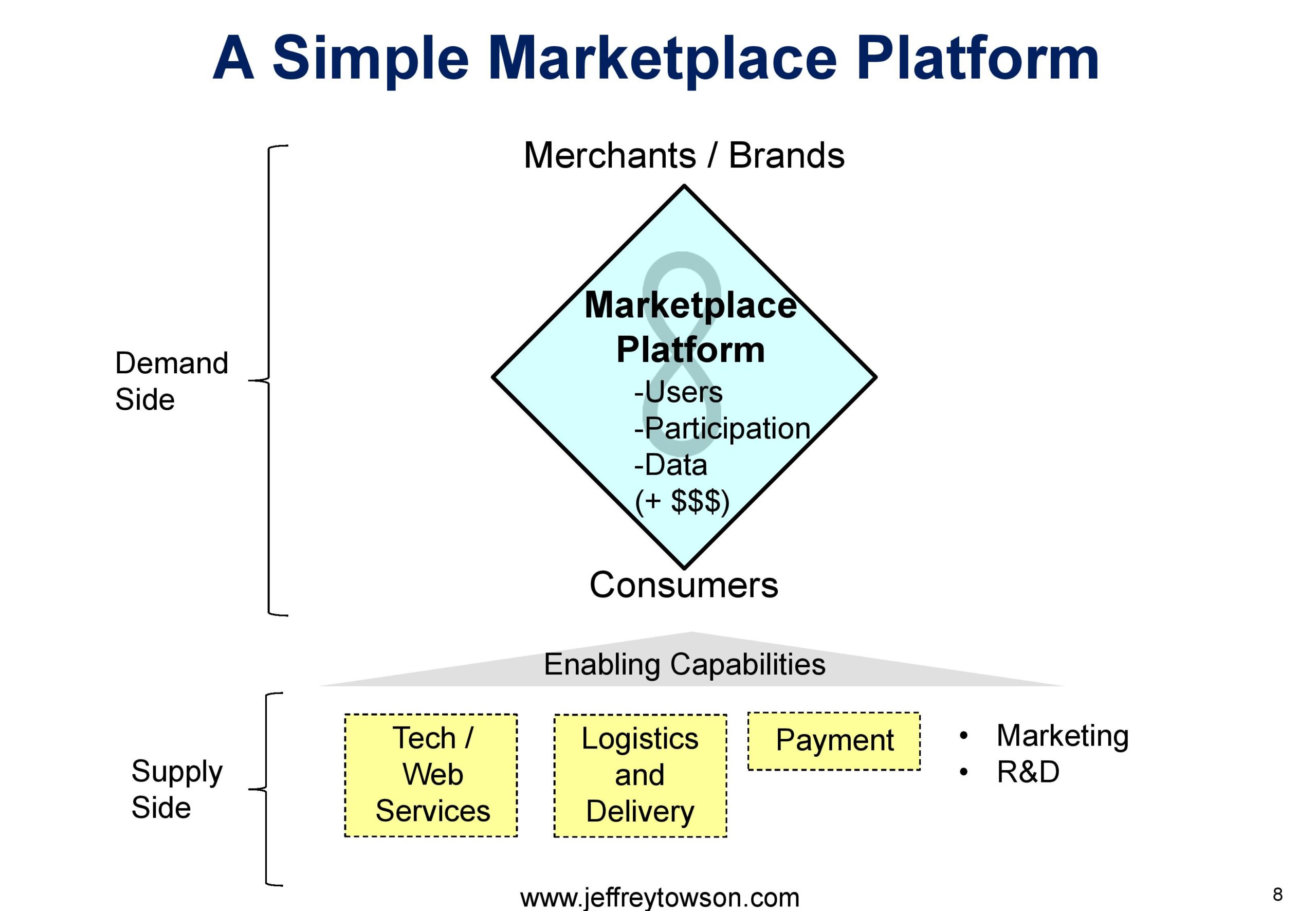

Here is my standard marketplace graphic.

——

Related articles:

From the Concept Library, concepts for this article are:

- Marketplace platforms

- Online-Merge-Offline (OMO) / New Retail

From the Company Library, companies for this article are:

- Mercado Libre

- Magazine Luiza / Magalu

———-Transcription Below

:

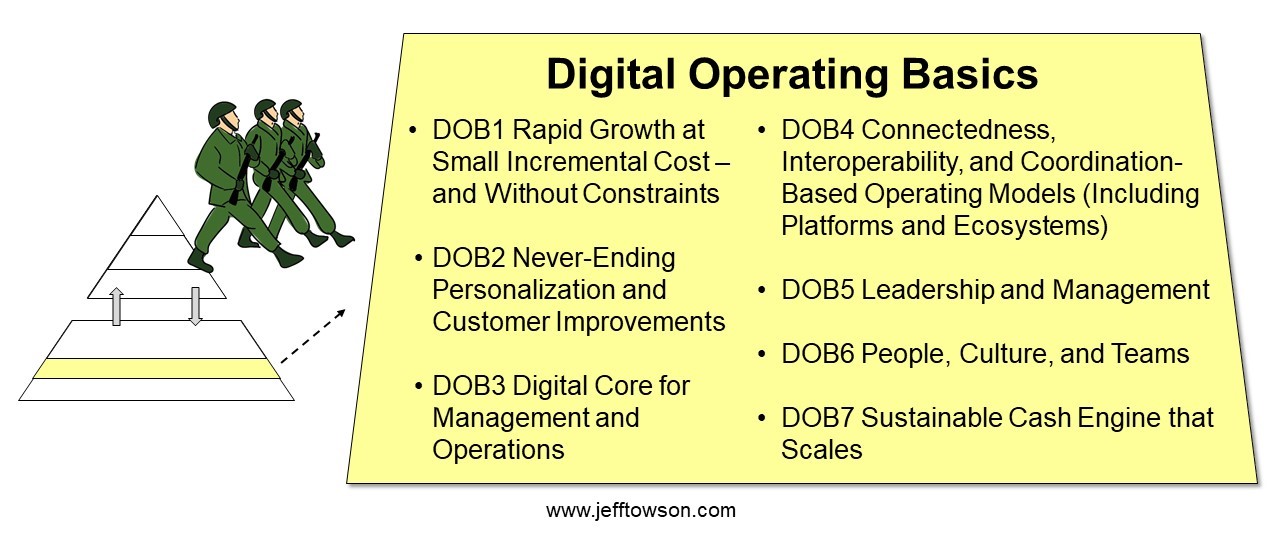

Welcome, welcome everybody. My name is Jeff Towson and this is the Tech Strategy Podcast where we dissect the strategies of the best digital businesses of the US, China and Asia. And the topic for today, Mercado Libre versus Magalu or the future of e-commerce competition. Now these are two really cool companies, both in Brazil, both with very… let’s say powerful business models coupled with very effective management. And they are increasingly going head to head with very different business models which makes it a very interesting, in my opinion, question in terms of competition. And I think this is really gonna be the future. I think this sort of pair up competition. Captures a lot of what I would call the future of competition in e-commerce So I thought it’d be a good a good comparison to talk about their business models and how they’re doing Versus each other I visited both companies a couple months ago Spent some time asking questions and looking around so I feel pretty comfortable with both of them for those of you who are subscribers I’ve sent you a couple articles on Magalu, which is magazine Luisa and also recently on Mercado Libre So sent out quite a lot of information on these already. But it’s a really interesting, I mean for me when I look at e-commerce companies, the most interesting sort of matchups are in my opinion, Taobao, Alibaba versus WeChat, mini programs in China and then Mercado Libre versus Magalu in Brazil. I mean those to me are the really interesting sort of pair up in strategy questions. So that’s gonna be the topic for today. Other stuff, the Asia Tech Tour is gonna be in March. That’s a five day tour of Indonesia, Singapore and Thailand doing company visits, but it’s really training. And we will do the company visits, which is great fun, but it’ll be sort of a deep dive in digital strategy. So that’s sort of people who wanna do an intensive and really sort of. take their sort of understanding and expertise from one level up a good notch. And I’ll be doing a lot of lecturing, but we’ll also bring in some speakers for that. So if you’re interested in that, send me an email at info at 1000group.com. That address is all over the webpage, easy to find, or LinkedIn or something like that. And I’ll send you the information. Other thing is TechMote Consulting. This is the new consulting group that’s sort of been launched in the last couple months. I’ve been doing… Obviously digital strategy consulting for a long, long time. But this is sort of a new vehicle. So if you’re interested in learning about that, go over to TowsonGroup.com. You’ll see the sort of services offered there, which is really digital strategy stuff plus digital training. Those are kind of the two services. Anyways, that’s it for that. And for those of you who aren’t subscribers, feel free to go over to JeffTowson.com. You can sign up there, free 30-day trial, see what you think. And let’s see, last thing, standard disclaimer, nothing in this podcast or in my writing website is investment advice. The numbers and information from me and any guests may be incorrect. The views and opinions expressed may no longer be relevant or accurate. Overall, investing is risky. This is not investment, legal or tax advice. Do your own research. And with that, let’s get into the content. Now, as always, we start with a couple concepts, which are as always located in the Concept Library on jefftausen.com. And nothing too staggering today. I think this is sort of standard stuff we’ve gone through. The two concepts that are gonna matter in terms of Magalu versus Mercado Libre. Marketplace business models, marketplace platforms. Talked about this a ton. There’s a million articles on the website about this already. As I’ve been talking to a lot of retailers, especially in Brazil, Southeast Asia, over the last six months, and most of them are doing what some version of Omnichannel. They’ve got their usually physical stores and then they start moving into an app, a webpage, they start building out their delivery, their logistics and other, and maybe they put a foot into content strategy as well, depending what kind of sector they’re in, like fashion. But within all of that strategy, there’s a couple big levers that really matter. And this is kind of what, let’s say, they ask me about a lot. Look, we got 10 different digital initiatives. Some of them are succeeding, some of them are failing. It’s a lot about what’s really gonna matter, which is digital strategy. And my standard answer is, look, the two big levers. Personalization is a big, big lever. It just is. The more you can personalize everything about your business from communication to marketing to customer experience to retail to inventory to either demographics or better yet individuals, it makes a huge difference. That’s a big lever, no way around it. The other big lever is build a marketplace. You know, it dramatically improves the customer experience, the product selection, the number of categories. You can start to leverage things in like network effects. It’s just a big lever. The problem is everyone can do personalization and everyone should. Only a couple companies get to build successful marketplaces in a geography. Not everyone gets one of those. You know, my standard analogy is personalization, omni-channel, that’s like having an army. and everyone needs an army. Marketplace is like also having an Air Force, but not everyone can get an Air Force. So if you’re one of the few companies that got one, it’s a big deal. So that’s kind of the idea for today is both Magalu and Mercado Libre are building very large marketplaces within Brazil, and in the case of Mercado Libre, Latin America. And they’re both successful in this. And there’s a couple other companies that are doing this. Shopee’s doing pretty well. Couple others are doing pretty well. There’s more than two seats at the table, but there ain’t 20 seats at the table, and we know Magalu and Mercado Libre both have seats at the table. They’ve got two of the chairs. Who gets the other ones? Not totally sure yet, but definitely we can conclude they do. So that’s concept number one for today, just marketplace platforms. It’s a big deal, especially for retailers. Okay, concept number two, online merge offline, OMO, sometimes called new retail, but you can see this in different types of industries. Talked about that quite a lot as well. Every time you talk about Alibaba, everyone, I’m sorry, every time you talk about OMO, people talk about Alibaba and their supermarkets. That’s kind of the number one example of online merge offland being applied to retail, those supermarkets, the fresh hippo previously called Humma. And now they’ve bought the SunArt hypermarket. So they’re expanding there. They’re into department stores. Everyone thinks Alibaba when they think OMO or more usually they say new retail. The other big OMO pioneer that nobody talks about is Magalu. or Magazine Luis, Magalu is the app, Magazine Luis is the retail name. They are as active, no let’s say not as active, they have been very active in OMO, new retail, for as long as Alibaba has. In fact, you could argue they’ve been doing this for 10 plus years. But really, their new CEO, Federico Trejano, which I’m sure I’m saying his name wrong, he’s been really. you know, putting the pedal down in terms of building the marketplace, building out Omnichannel, OMO in the last five years. And in fact, they call their strategy Omnichannel Marketplace. So they’ve kind of got their own business model description. I don’t know any other company that is building as a business model, Omnichannel Marketplace. I think it’s only Magalu. There might be one or two others, but I’m pretty sure I’ve never heard it in anyone else. So they’re the other OMO pioneer. when it comes to retail. Now we see OMO in other sectors and media and things like that. But for retail, those two companies to me, they’re way out front. Magalu is way ahead of Amazon Go. Way ahead. Way ahead of Shopee. Way ahead of Lazada. Pretty much anything in Europe that I’m aware of. So anyways, those two companies, Alibaba. So that’s the other concept for today. Online, Merge, Offline, and Marketplaces, both in the concept library. Okay. So let’s sort of start out with Mercado Libre. I think they are much easier to understand. It’s a pretty standard marketplace platform in a developing economy. We’re not seeing too much there that we don’t see, say in Southeast Asia or Eastern Europe or Russia. Okay, Jumia in Africa, they’re a little less developed, but… You know, this idea that we take a marketplace platform business model, which Jeff Bezos pioneered, Jack Ma did it sort of bigger and I think better in China. Well, I mean, they’re the version of this in Latin America, and they’re pretty much following the standard playbook. So in that sense, there’s not that much to learn. The differences you do see are because we’re talking about Latin America as a sort of terrain to be operating on. Very different in a lot of ways, very large, very dense cities, especially in Brazil, but very spread out. I mean, you’re talking about everything from. hyper dense urban environments like Sao Paulo to the Northeast, which is the Amazon, and villages and rivers and no roads, very spread out. So parts of Brazil look a lot like Indonesia and parts of Brazil look a lot like other, let’s say Manila. But then if you go to Peru, you go to Argentina, you go to Colombia, things look different. So there’s a lot of varying terrain. which impacts logistics. And then you’ve got the regulatory environment, which is completely different and changes pretty good country to country. Places like Brazil, I would argue are, sorry, ahead of the curve in terms of payment and FinTech. Their central bank is surprisingly innovative and aggressive. But then you go to places like Bolivia and such and you know. It’s much different. So the regulatory environment changes. And then you’ve just got to sort of think about the development rate of e-commerce, which depends a lot on consumer behavior. The rate limiting step for e-commerce development in most countries that are, let’s say, developing, tends to be the adoption rate of businesses. That usually is the bottleneck. That yes, consumers in Thailand are all on their smartphones every day. but most Thai businesses are not online yet. And so there’s a ton of money and time spent on education by companies like Lazada to get these companies to start to sell online. That’s pretty much what we see in Latin America as well. That’s more of the rate limiting step than probably anything else. But you put all that together. And you get a very different picture in the major markets where Mercado Libre operates, which are Brazil, Mexico, Argentina, and Colombia. I mean, most of their revenue comes from those four countries, with Brazil being about 50%, and then the others being smaller. But they go across 18 countries, pretty much all the way up to Mexico, Central America, Latin America, and then you can throw the Dominican Republic in there as well. That pretty much gets you the 18. So, I mean, you’ve got this sort of picture of them evolving as a platform business model, which means no physical retail, just an app with lots of warehouses delivery payment, you know, sort of the same as let’s say Taobao 2008 to 2010. Pretty similar. History of the country for those of you who aren’t, I’m sorry, of the company. Mercado Libre, which literally means free market. Founded in 1999 by Marcos Galperin, probably saying his name wrong as well, while he was attending Stanford University, based out of Argentina, that’s been their home base forever. But pretty quickly moved into the major market, which is Brazil. And when I visited them, I visited their HQ, which is sort of on the western side of São Paulo. Really pretty cool place. Headquarters is fantastic, by the way. And most of their senior management is operating out of there. But they got people quite a few places listed in the US, which is interesting. And they’ve got a decent number of staff and operations out in the US as well, especially coders and things like that. So they’re a little bit sort of American based, but most of what I talk about and think about with this company is Brazil. Okay. So they describe themselves, and this is all from their 10K and stuff, which is not bad. It’s not spectacular in terms of their strategy, but what they talk about is what they call their, quote, six integrated e-commerce and digital payment services, unquote. So basically they say we do six things. And they call them services. either e-commerce services or digital payment services, and then they break their revenue down the same way. They say, this is our commerce revenue, this is our fintech revenue. So they sort of put those things in the two buckets. I think they’re basically just describing a standard marketplace platform, and then the various pieces, the six pieces they’re calling services, pretty much the same. Their main business is their marketplace, which is obviously buyers. which are mostly consumers, transacting with retailers, merchants, brands. What I do like about their language is they don’t talk about interactions. They phrase everything as transactions. How many transactions? How many transactions per user? How can we increase the number of transactions? That’s pretty cool. Their user numbers are pretty not cool. They talk about sort of annual active users. Anytime anyone gives me like annual users, not monthly users, not daily users, not transacting users, but just annual users, which means they’ve done something over a year, it’s not a very good definition. And when they break out their annual sort of active users, they’re talking about merchants as well as consumers, so it’s all, that doesn’t help me. Now maybe they’ve broken it down in their investor meetings and such, but yeah, not awesome. Anyways, they got their marketplace fine. We know what that is Supporting the marketplace you have logistics and you have payment Those would be enabling capabilities if you look at the standard marketplace Graphic that I always show I’ll put a copy of it in the show notes. You can see the enabling capabilities logistics Payment and then you’ve got the platform They talk about Mercado shops which is just sort of services they provide to merchants to get them on their platform. I wouldn’t characterize that as a business, but they do. Classifieds, okay, that’s kind of an interesting sub-business. Advertisements, again, I’d put that under the same business. So really you’re looking at a standard marketplace platform and then the part that I would break out is Mercado Pago, which was their payment service, which is now expended to credit and various types of FinTech. which starts to look a lot like Ant Financial circa 2014. So you could kind of say this is like, look, Mercado, this is sort of like Taobao 2010 plus Ant Financial 2014. That gets you most of what they’re talking about. And I’ll put the graphic in the show notes. I won’t forget that. Okay, so that’s kind of the basics. I don’t think I’ve said anything that’s terribly shocking or. blowing anyone’s mind with that bit. Okay, so when you look at that, then you say, okay, what really matters with this business as it’s gonna go head to head with Magalu? Well, the number one difference you look at is Magalu Magazine Louisa is a Brazilian company. They don’t operate outside of Brazil in any major way that I’m aware of. Okay, Mercado Libre’s regional, Latin America, South America, so that’s gonna get them a lot more scale. in basically IT and a lot of R&D and a lot of things. So you see that difference is gonna be significant. But really the question you’re looking at is growth over time. That’s what you wanna know. Is their GMV gonna end up being five times bigger than Magalu in five years? Because if it does, suddenly you’ve got a major scale advantage, you’re gonna see that dynamic play out. Or are they going to be roughly the same size? If you look at their GMV today, these two companies, Magazine Luisa is about 10 billion US dollars of GMV in 2021. The GMV of Mercado Libre, everything, was about 28 billion. So about three times as much. But if you just look at Brazil, which is about 50% of the revenue, it’s about half that. So you’re looking at about 10 billion GMV ballpark magazine, Luisa in Brazil, you’re looking at about 14 for Mercado Leve. So they’re relatively in the same scale in Brazil. So when you look at sort of user activity and sales and things like that, they’re gonna be in the same, neither party’s five times bigger than the other. Now if you look at centralized capabilities like web services, IT, where suddenly you know, having a regional footprint is gonna give you a scale advantage. But we’re not gonna see massive overspending on something like marketing. You know, they kinda got similar size war chests. Okay, but we would wanna look at how is growth gonna change over three to five years? Is one company gonna grow a lot more than the other that we’re gonna see a major scale differential emerge? That would be decisive, probably. Okay. So we can kind of look at that first off. And if you look at what Mercado Libre does in terms of their strategy, it’s pretty much the digital operating basics for the most part. Their strategy, I won’t go through it in too much detail, but they basically lay out five strategies they’re working on. Number one is expand into additional transaction service offerings. What does that mean? That just means get bigger. We’re gonna get bigger in transactions because everything on their platform is a transaction. So what does that mean? Well, we’re gonna expand into new countries, fine. In the countries we’re in, we’re gonna try and get bigger, fine. We’re gonna add new product categories, again, fine. So basically every metric we would look at for a marketplace platform, users, transactions, product categories, All of those numbers, we want them to go up. Okay, I would put that mostly on your standard digital operating basics number one, which I’ll put the list of digital operating basics in there, but DOB1 is basically, look, if you’re a digital company, one of the levers you have that traditional companies don’t have is you can grow faster, cheaper, and without constraint, because software does that quite nicely. and stores don’t. So that’s digital operating basics number one, rapid growth at small incremental cost and without constraints. So everything they’re doing there is we’re just gonna grow faster, DOB one, fine. What is gonna determine their rate of growth? Management effectiveness, which I mean I’ll just give you my summary. I think the management team is outstanding and I think the management team of magazine Louisa is outstanding. I think these are A-list management teams. So they’re both growing, they both have top-tier teams and their rate of growth is probably going to be determined by external factors more than anything else. How fast is e-commerce developing in Brazil? Ecuador, Colombia, how fast is our incomes rising by middle-class families in these neighborhoods? How much are regulations slowing or facilitating e-commerce development? I think it’s mostly external factors that’s gonna determine the rate of growth of these two sort of businesses. So I don’t think it’s dramatically different between, let’s say, Mercado de Libre and Magdalena in that regard. All right, there are other strategy. Continue to improve the shopping experience for our users. That’s basically DOB2, Digital Operating Basic 2, which is Never Ending Personalization and Customer Improvements. This is one of the interesting things about digital, let’s call it mobile apps. The idea that we’re gonna increase we’re gonna get on a treadmill as a management team where we are gonna run as fast as we can every month, forever, the treadmill never stops to improve the user experience. And by users, we can mean consumers and we can meet merchants and brands. And that’s a thousand little things and this race never ends. We make our marketing a little bit better, we improve our app a little better, we do lots of A-B testing. We upgrade our look and feel. You’re just doing these constant things to improve the user experience, which is good because if you’re measuring sort of your Net Promoter scores, your NPS, you’ll be tracking those and you’ll be seeing that they improve. And Magazine-Louise is actually very good at tracking their NPS scores. They put that in their investor relations. They look at the user experience at every significant touch point, whether it’s walking into store. dealing with customer service, dealing with the app, they measure that stuff fairly specifically and track that. Okay, now that’s just good business to always be improving your user experience. One of the funny things about marketplace platforms and e-commerce sites in general is, and I’m not totally sure why this happens, as you improve the user experience, people engage more frequently and they spend more. It’s really weird, I’m not sure why that happens, but if you look at a cohort on Amazon or a cohort on Alibaba, every year that cohort will buy more in terms of number of transactions and they’ll spend more overall. Those numbers keep going up and they seem to track mostly with improvement to user experience. Now there’s other things, people get wealthier so they spend more. But. frequency of engagement, number of transactions, those things tend to track, the user experience just tends to be this interesting metric that seems to drive spending. And I’m not totally sure why that happens, but you can really see it play out. I’m sure somebody understands why that happens, but I don’t. So as they continually improve the user experience, their secondary strategy, you should see that play out in growth. And we see the same thing at Amazon, Alibaba, all of these major e-commerce companies. It’s really kind of strange. So anyways, those are kind of the two strategies I thought were compelling. And then there are other big strategy in terms, so let’s call those two numbers, DOB1, DOB2, as the key aspects of core growth of the e-commerce platform. And then. The big sort of optionality, if you’re gonna value this company, is gonna be Mercado Pago. The idea that we’re gonna go from payments to adding credit, which they’re doing, for consumers and suppliers, to adding insurance products, Insurtech, which they’re doing, and wealth management and money market funds, which they’ve kind of done, this is all last couple years. The numbers are going up pretty good in terms of usage and revenue generated by this, but… This is sort of an early version of Ant Financial. The success or let’s say stagnation of Mercado Pago is sort of the option that’s gonna play out if you’re an investor. If it really takes off, this could be very, very big. If it doesn’t, it wouldn’t. And it’s hard to predict that because unlike their e-commerce business, which you can really, I think, get a good read on future growth. Mercado Pago is facing an entirely different suite of competitors. New Bank, Itaú Bank in Brazil. All the major banks are going into FinTech, they have to. As mentioned, the central bank is just upending the regulations of this and just, I mean, they basically put in PICS system, which made payments more or less a free commodity, a free utility, which has been fairly devastating for payment processors and credit cards and others. Payment in Brazil is becoming more or less a free utility, just like driving on the streets. And they’re moving into credit next. So that, so any business that’s been sort of generating a lot of money on payments or credit is freaked out about this. So you’ve got this sort of regulatory upheaval. Plus you’ve got a completely different set of players on the field, all the banks, the credit card companies, the payment processors, and then these digital natives like StoneCo and NewBank. So that one I think you have to look at as a sort of an optionality on whether this is gonna play out or not. I don’t have a good read on how well Mercado Pago is gonna do against these competitors. And I’ve looked at it pretty good. Now I can’t sort of get a solid, confident read on it. Anyway, so that would be sort of the picture of Mercado Libre. Interesting, standard marketplace platform, very well positioned, absolutely the market leader in terms of platform business models in Latin America. The growth is mostly gonna come from core e-commerce and mostly from just doing what they’re already doing, just doing it better. And then you have Mercado Pago as the big sort of unknown. not unknown, but let’s say variable. Anyways, that’s how I would do it. And then when you look at them versus Magazine Luisa, in terms of Brazil, which is where Magalu is, you don’t see a major difference in management ability. Both of them are very good. You don’t see a major difference in terms of GMV. Both of them are pretty good, sizable. you don’t see significant differences in terms of their operating profits. You know, 400 million US dollars at let’s say Mercado Libre, more like $200 million at Magazine Luisa. So even the operating profits are not significantly different, despite the fact that Magazine Luisa is a retailer. So the economics of traditional retail, first-party retail are very different than let’s say a third-party marketplace. But even then, you’re not gonna see one party just outspend the other in some sort of money war. We don’t see that. I mean, the major difference when you look at these two companies is none of those things. The major difference is the business model. It’s the OMO business model, Omnichannel Marketplace, at the country level, Brazil, versus regional marketplace platform. I mean, it’s really, that’s the difference. which is why I think this is super interesting. Okay, with that, let me switch and I’ll go over to Magazine Louisa. Now, I did a podcast a month or two ago, podcast 140, which was on Magazine Louisa, as I called it, Magalu, as the accidental, like, OMO pioneer. It, and I kinda went through the history there of the company, which is really interesting. I visited their headquarters, which is sort of northeast of downtown Sao Paulo. You go up across the river and near the old airport there. And it’s in a kind of a strange part of town. It’s sort of out there on its own. I suppose Mercado Libre is as well, actually. But you know, it’s a fascinating company. And I had heard about this company for a couple years. I’d kind of played on the app. They have a really famous avatar they use on their app. But I had been asking people in Brazil for a good year or so. Every time I would meet with investors there, one of my standard questions is, like, who’s the best management team you know of in tech? Because it’s harder for me as a foreigner to get a read on management quality. I can take apart the business model, but there’s a lot of culture in that. And it’s harder for me to read that as an outsider. So I would always ask that question. And in the top five, every time, usually people give me three, but sometimes they give me five, there would always be Mercado Libre, and there would always be Magazine Luisa. Always, every single, no exceptions. And then the others would change a bit, but they were always mentioned. And so I’d kind of reached out to them and ended up going and meeting with their investor relations people who were really tremendous, really. It was really a pleasure to sit and chat. And I peppered them with questions for hours, and a couple of the senior management sort of came in and chatted with them a little bit. Really fascinating company. And the history, which I went through before, but I’ll sort of summarize it quick, was it was a traditional retail store developed over decades in Brazil, founded sort of… to the northeast of Sao Paulo in a place called Franca. Founded by a husband and a wife, and then the daughter of the founders, who was named Luisa Trajano. I say Trajano, which is a Spanish pronunciation. I’m sure that’s wrong in Portuguese. But she basically took over the business from her parents, or started at least working there after she graduated from law school in around 1972. And just sort of… worked and built the business. And so when people say magazine Luisa, well, that’s Luisa, she’s on LinkedIn, if you wanna connect with her, it’s not terribly active, but her profile’s there. And she’s, you know, ended up becoming Brazil’s wealthiest woman. But, you know, grew the company, worked, and took it to 1,500 stores across 900 Brazilian cities over several decades. And, you know, sort of. standard retail stores. Traditionally, it was focused on large appliances, washing machines, refrigerators, stoves. Over time, added other large items like televisions, other sorts of technology. Then home appliances, blender, and that’s a different picture than, let’s say, a renderer somewhere that’s apparel and fashion-focused. or some of these more pure electronics companies, multi-laser companies like that. But that was sort of their space and they did very, very well and got stores everywhere. And the reason this people talk about this company a lot was because they did something that turned out to be pretty much fortuitous, which was in the 1990s, they created sort of these smaller virtual stores. One of the issues with Brazil is you have a big part of the population in a couple major cities, Porto Alegre, Sao Paulo, Fortaleza. But then you’ve got a sea of small cities. Those 900 cities mentioned, most of those are quite small. And you can’t open large stores with large floor space with lots of washing machines. It just doesn’t work, and they’re all spread out and it’s jungle and it’s crazy. So they created sort of small stores, virtual stores, which were basically just sales associates that would have catalogs and a small space, and the inventory wasn’t there, and the showroom mostly wasn’t there. And they would show videotapes and catalogs, and you could order there. And these sales associates, they would know their neighborhood, and they would know their customers. And so it was sort of a virtual model. and you could place orders at the store and then come and pick them up later. And the larger items like the refrigerators, and well those would be delivered to homes as opposed to the store. So you can see it kind of looks like an online OMO model early on, where you were sort of ordering from a catalog and then you could pick it up in the store or have it delivered if it was larger. Well that’s kind of what OMO is doing now. And so it wasn’t a big step for them in the 90s to go from video cassettes and catalogs and such, multimedia, to let’s build a webpage. And the sales associates will just work from the webpage. So that was kind of a bit of luck that their business model looked like an early version of new retail. It was just 20 years ahead of time. And then the other bit of luck was the son, Frederico. who was doing private equity in the United States, was paying close attention to e-commerce in 1999, 2000. And he jumped back shortly after that and started sort of building their e-commerce. So you had the right person, the right family structure, the right idea, the right sort of retail footprint. And that developed over 10, 15 years. And then he eventually took over as CEO in 2000. 15 ish and that’s when they really went even faster and You can see if you want to read some good stuff about Omni channel go to sort of the magazine Luisa investor relations pages and pull the presentations By their managers each of their managers gives presentations logistics user experience culture And the CEO and they’re outstanding. They’re very well thought out some really good stuff and you can see how deep they are into the details of what they are doing now which is digitizing their in-store experience, connecting the app to the store, which we could call that omni-channel, and then they’ve got all sorts of in-store technology, you know all their sales associates are using mobile devices, you can order it on the app and then pick it up in the store. You can go into the store and order it. You can return things to the store. We could call that sort of standard, no not standard, very effective omni-channel. And their mobile app has been growing in usage. They’ve got great traction. They’re driving more and more of their sales through the app as opposed to in the store. That’s all compelling. And we can call that omni-channel. The app started 2015. 2018 they had about six million monthly active users. So we can call that Omnichannel. And then they did this other move, which was really the big move, in my opinion, which was the marketplace. We’re gonna take a marketplace and add it to our Omnichannel where we are operating as a first party retailer, buying the goods ourselves, selling the good ourselves, but could be online through the app, could be through the stores, and we’re integrating. No, they added a marketplace, which means we’re gonna open up. to other merchants and brands to sell their goods through our platform. And the growth of that has been fairly outstanding. They really have seen 200,000 different merchants are now using the thing up from 20,000 a couple years ago. I mean, just tremendous growth on the platform. Growth of sales, 80%. It’s just, I put some of the, if you go onto the website where I’ve written about this, you’ll see some of the charts. But basically it’s a line that goes very quickly up to the right on every metric you would wanna see in a marketplace. GMV, revenue generated, number of merchants on the site, user and get, all of it. That’s why I’ve kinda said, look, they are clearly one of the major platform marketplaces for Brazil, no question. You know, they got there early, they executed like crazy, the numbers are there. Okay, that would be a standard marketplace like Mercado Libre. But what they’re doing is omni-channel marketplace, which means they’re integrating their marketplace into their stores. So, if you’re a merchant selling on their marketplace, you can deliver your items through their physical stores and the customer can pick them up there, just like they were picking up. product from magazine Luisa itself. That’s really interesting and if you want to return it you can go to their store and so their stores are becoming physical touch points not just for them but for everyone on the marketplace. That’s really interesting. Then they’ve even taken it a step further because a lot of these merchants and these retailers they have their own stores and they tend to be nearby and smaller than the magazine Luisa store. Well, those other physical stores are now being integrated into the system where you can pick up and deliver there. And maybe the product is held at the magazine Luisa store, which is much larger, and the smaller physical retailers then connect to that store. So they’re integrating the physical retail spaces of their merchants and retailers in as well. That’s all really cool. I mean, I don’t even think Alibaba is doing that yet. So anyways, it’s a very cool model. And that’s what they’re calling Omnichannel Retail. Now in addition to that, which is a pretty cool business model, they’re doing the other stuff, which is pretty similar to Mercado Libre. They’re expanding their product categories. 50 plus percent of their GMV is now coming from categories like sports, home, furniture, beauty. portable electronics, and those are all relatively new product categories for them. So they’re expanding geographically, opening new physical stores, integrating with other retailers, and then pushing the app out into various cities around Brazil, so that’s a geographic growth. They’re adding product category, that’s growth. They’re growing their merchants and retailers that are participating on the marketplace, that’s growing. And their consumers are growing. So they’re seeing all the metrics are going up to the right. And then in addition to that, they’re pretty good at tracking sort of their user experience and their NPS scores and they’re all, you know, it’s hard to know about those because anytime someone tells you an NPS score, it’s always like 90, 95. No one tells you if they have an NPS score of 50. You know, they don’t put that in the 10K. So, you know, it looks good, but I don’t know as much about that bit. So let me just sort of jump to the so what and we’ll finish up here. So. Magalu versus Mercado Libre. As mentioned, management top tier on both sides. Scale, neither party has a scale advantage at this point. Now growth rates will determine if one emerges in the future. They’re both digitizing, they’re both growing marketplaces. That all looks pretty similar. The main difference is it’s two different business models. I mean, what. Magazine Luisa is doing is omni-channel marketplace. It is very different than sort of what we consider mostly an asset light approach at Mercado Libre. They are not opening thousands of stores. They’ve shown no indication that they’re gonna open 1,000, 1,500 physical locations in Brazil. We don’t see it, they’ve got warehouses and delivery, but most of that is done by third parties. So it looks a lot like Taobao asset light approach before Jack Ma sort of turned the wheel and went into new retail and started acquiring lots and lots of physical retail assets. They’re still that same model. So it’s mostly a business model difference. And I would describe this the same way I describe sort of WeChat mini programs versus Alibaba in China, which is this is a lion versus a tiger. Both are king of the jungle. Although people say lions are king of the jungle. Lions don’t live in the jungle actually. Tigers technically are king of the jungle. They live in the jungle. But you’ve got two super predators. You’ve got two top of the food chain predators absolutely dominant in what they do. Mercado Libre is the market leader, no question. Magazine Luiza is the OMO new retail leader of Brazil. no question. They are both number one at what they do, but they’re different animals. And so what happens when a lion fights a tiger? Well, I mean, this is my standard joke is for a long time, nobody knew what was going to happen. And then someone put them in the ring. It turns out the tiger wins every single time. But you know, we’re looking at two very powerful business models who are the leaders of what they do, and they’re just different animals. So how do you determine what’s gonna happen between them? I never really had an answer for WeChat mini programs versus Alibaba. I could never get a read on what was gonna happen in that. And I’ve sort of ruled out the standard easy things, which is, oh, one of them has more money, the operating profit, they’re just gonna outspend the other party and maybe buy users. Well, neither of them has an advantage in terms of cashflow in this case. Well, maybe one management team’s better. Nope, we don’t see that either. Maybe one of them could outspend the other on R&D or something sort of strategic. In theory, Mercado Libre could outspend because they do have sort of a regional platform. In 2021, Mercado Libre spent about $590 million on R&D, and they spent about $600 million on CapEx. So there is some area where strategic spending because of the fact that they’re a regional marketplace they might be able to outspend them but I don’t think that’s going to make a big difference in terms of how much business Magazine Luiza does at their OMO business model in Brazil. I don’t think R&D spending is going to change how many people are walking into these stores in 900 Brazilian cities. And Magazine… Louisa has those stores and Mercado Libre doesn’t. So that doesn’t strike me, it’s a strategic spend, it doesn’t strike me as decisive. I think it’s a good idea. So that’s kind of where it ends up. So the way I would break this down, I looked at some other numbers. Magazine Louisa has about 1,500 stores and about 40,000 employees all in Brazil. Obviously Mercado Libre has about 30,000 employees spread out. So we’re similar scale. So I would be looking at basically two questions to take this apart. I would do what I’ve done, which is I’d look at users engagement and the numbers are pretty similar. Then I’d look at market share and any sort of scale advantages, which I’ve just sort of mentioned. There’s no major difference except for maybe R&D. And then I’d look at just cash flow. Again, no major difference. Those would be my three dimensions I’d go through to see if I could tease out. What I would come down to is two questions. To look at this sector by sector, product category by product category, I’d look at regions of Brazil, and I’d try and take it apart, you know, São Paulo. the Northeast, I’d start to look at specific geographies and I’d look at market share within those geographies. And then I’d do the same exercise for product categories. Washing machines, furniture, beauty. And you know, you can pretty much guess what you’re gonna see. You’re gonna see a company like Mercado Libre have far more volume in let’s say beauty and cosmetics. But you’re gonna see, you know, furniture and… washing machines in Fortaleza, much more magazine Louisa, right? Because physical aspect is much more important. So you can break it down by product categories, you can break it down by geography. And then I would look at the growth rates along those same dimensions and see if I could see a gap opening in three years, five years. That’s pretty much how I take apart the question. I don’t have enough of that data to make the call. I don’t see any major changes. I think what you’ll see, and here’s my guess, I think what you’ll see is where the physical stores make a big difference, which is gonna be in furniture, white goods, large appliances. You’re gonna see that strength play out when it’s mostly an asset-like virtual business like general merchandise, beauty, cosmetics. You’re gonna see an advantage on the other side. That’s what I’d expect to see. But anyways, I haven’t been able to get the numbers sort of sector by sector or geography by geography. And I’d look at the relative growth rates and I’d just track them. I wouldn’t even necessarily try and predict them because I don’t think it is predictable. I would just, you know, at this sort of segmentation level, I would just sort of track it every couple months and I’d see how the numbers are moving and see if one is pulling ahead of the other. Anyways, that’s how I do it. So that’s sort of my solution to this whole question, but I think it’s a fascinating. dynamic and I think we’re going to see the same dynamic in a lot of regions. I think this OMO omni-channel marketplace versus a traditional regional marketplace. I think we’re going to see this in Southeast Asia. Definitely. I think we’re going to see it in Eastern Europe. US not as clear. It wouldn’t surprise me if we saw it in parts of Europe, but I definitely think Southeast Asia we’re going to see this exact same pattern play out in countries like let’s say Vietnam. versus a regional player like say Lazada. Anyways, that is it for the content for today. And the two concepts marketplace platform versus OMO new retail. As for me, things are just moving along. Pretty effective, pretty productive month, which I always feel good about. Excited that China is apparently just taking COVID head on that as far as I can tell, everybody in China is getting COVID right now, like. They’re taking down the restrictions, they’re taking down the checks, and everyone’s just sort of coming down with it. And everyone’s watching the hospital admissions, is this gonna be a surge, is gonna be a problem? But they kind of went, the joke I’ve heard is they went from zero COVID to zero COVID. Like the idea being zero COVID, we won’t accept any cases, everything will get a reaction to zero COVID, which is like, we’re not doing anything anymore. Like it’s down to zero, everything. So anyways, I’m looking forward to going back to China, probably in January, February, now that it looks like they’re getting rid of quarantine as well. So hopefully the borders will be open. Looking forward to going back and sort of meeting with some tech companies, which I really have missed doing this last year, two years. That’s great. So that’s on the horizon. Any other things? Black Panther, I saw that yesterday. Not awesome. Like the nice version is not awesome, but it was, I had very low expectations because I heard it was pretty seriously mediocre. So that actually made it all right. Like if you go into any movie with really low expectations, 10th Sense is pretty good. So anyways, yeah, that was not a recommendation unless you can appropriately lower your expectations level. But yeah, it wasn’t terrible. It was all right for a couple hours. Anyways, that’s it for me. There’s been a lot of theory today, but I hope that was helpful, and I guess I will talk to you next week. Bye bye.

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.

Note: This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.