“New retail”, coined by Alibaba, was probably the least creative business term ever. But it was a big idea. You combine online and physical retail into a seamless, data-driven consumer experience. It is giving rise to new business models, from transformed supermarkets and cashier-less convenience stores to automated package pickup centers and re-imaged department stores.

Internally, Alibaba apparently uses the term “uni-commerce” to describe these initiatives, according to Chief Marketing Officer Chris Tung (shown below). The idea is to have consumers interact with brands, merchants and retailers under a single unified consumer identity in both physical and online locations.

But new retail, or uni-commerce, is only half the strategy.

Another big Alibaba initiative is “uni-marketing.” This effort, launched in mid-2017, brings together all of Alibaba’s data about a consumer from its e-commerce, social media, entertainment and other services. This data is the intelligence that is accessible by merchants and brands on an ongoing basis. It enables them to shape their presence and services in the online and physical retail world in real time. Uni-marketing, in effect, is the secret engine of new retail.

And this is what Chris gives and sells to merchants and brands. It is a dashboard the merchants can use to plan their marketing spend. To see their performance. To understand consumer behavior. To test products. Uni-marketing is both critical for their intelligence on customers. It is both the digital core of Alibaba and also a key monetizable product. Note: CMO Chris Tung probably has the most fun job in all of China.

Ecosystem Orchestrator vs. Digital Operating Basics

There are two important concepts here.

The first is Digital Operating Basics, which I have defined as:

- Scale and growth at small incremental cost.

- Continuous personalization and customer-facing innovation.

- A digital core for operations.

- Ecosystem and connectedness.

- People, culture and work design create a social engine that enables innovation and execution – increasingly personalized for each customer.

- Money-making at scale makes the company sustainable.

You can see that uni-marketing is really about 2, 3 and 4.

Alibaba is definitely building a digital core for its operations (#3) – and a customer data lake is critical for that. But that unified customer view also requires connections to other partners and products – to create ongoing data flows (#4). And finally, that data is given to merchants and brands to continually personalize and improve the customer experience (#2).

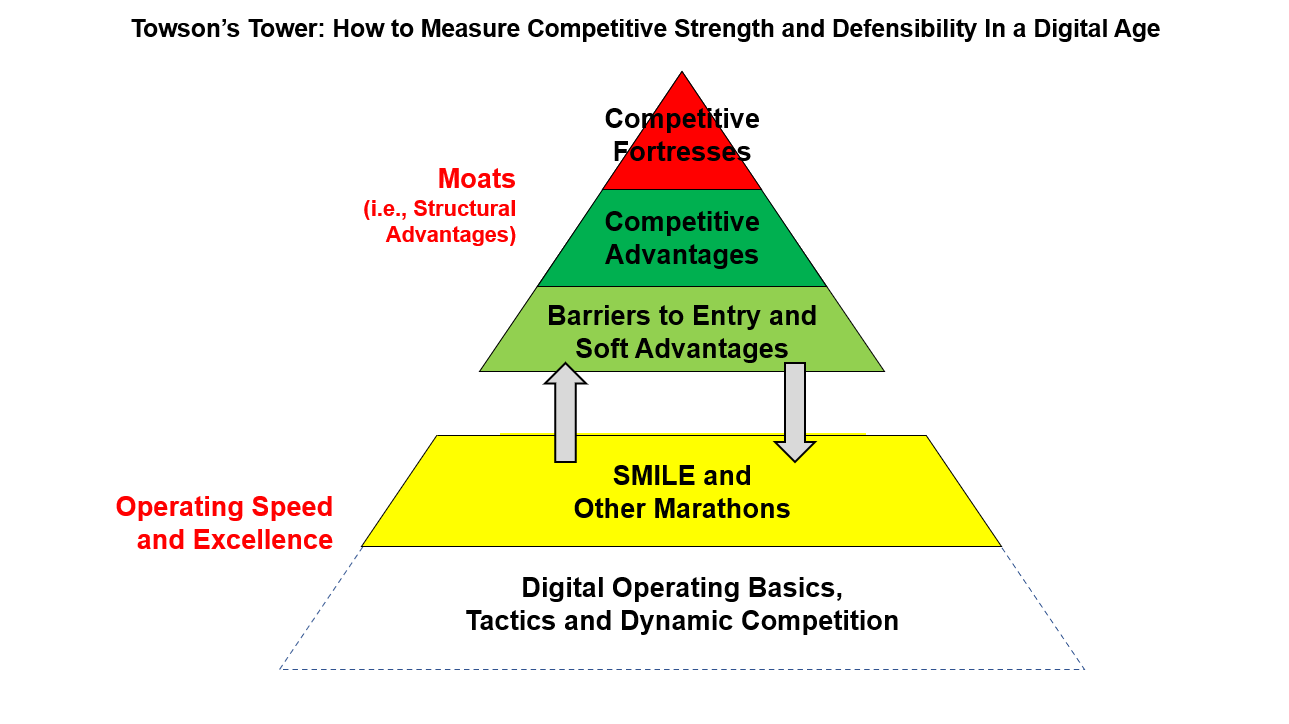

So we could put that in the competition tower under Operating Speed and Excellence – which is normal table stakes required for all digital companies.

However, I would also put this as a SMILE Marathon, Each letter in SMILE corresponds to one of the below marathons a business can choose.

- S – Scale, Scope, Effectiveness and Efficiency

- M – Machine Learning, AI Factories and Zero-Human Operations

- I – Sustained Innovation

- L – Rate of Learning and Adaptation

- E – Ecosystem / Platform Orchestration and Participation

I put these higher up in the tower, under operating speed and excellence. At a certain point, you pull so far ahead of your competitors in a key operating dimension that it is really a competitive advantage. In the case of uni-marketing and Alibaba, I think they are so far ahead as an ecosystem orchestrator (the E in SMILE) that it is a competitive advantage.

Anyways, that is how I make the distinction within operating speed and excellence. It’s SMILE marathon vs. Digital Operating Basics.

Think Users and Data, Not Supermarkets and Drones

Alibaba’s moves into physical retail have frequently been compared with Amazon.com’s acquisition of upmarket grocery chain Whole Foods. Especially since Alibaba took over hypermarket chain Sun Art Retail Group. Plus there is Alibaba’s own Hema / Freshippo supermarkets, which have fresh lobsters that you can order on your phone and pick up or have delivered in 30 minutes.

New retail however is more about users and data than these often discussed supermarket deals. Alibaba is ultimately a platform that connects merchants and brands with consumers, using data and various digital tools. It also connects content creators, advertisers and event offline merchants somewhat (using the Alipay payment service).

I think of new retail as the process of bringing users, data and assets from the physical world into the online one. Suddenly, Alibaba is getting a huge number of new users on its platform along with detailed data on their offline purchases. Alipay has mostly known only the amounts, location and timing of such purchases, not what was bought. The newly expanded data set will immediately be useful for Alibaba’s uni-marketing.

But new retail is much more than this. It is also bringing together a lot of mostly intangible assets. When physical stores go digital by adopting Alibaba’s tools for sourcing, merchandising, order processing and payment, they will move onto its platform and begin using various services in the Alibaba ecosystem. They will begin connecting and doing transactions with Alibaba’s customers, using Alipay for payments, connecting with affiliated advertising agencies, buying cloud storage and so on.

Once this happens, there will be an explosion of new connectivity between consumers, merchants and brands, both online and offline. This will enable merchants to address a myriad of new demands, such as a consumer wanting to order dinner on her phone and pick it up at the Hema store near her house. Or watching a movie on her phone and ordering some candy with a few taps of the screen, with delivery via a local convenience store in under 30 minutes.

Ultimately, it’s about the new data, users and intangible assets on the platform that will let you address a vast increase in consumer use cases.

How New Retail Looks Depends on Who You Are

For consumers, new retail is quite simple: it is going to give them whatever they want, whenever they want and however they want it, whether in the physical world or online. And the consumer experience is going to continually improve and personalize.

For consumer brands, retailers and especially offline merchants, the view is very different. New retail and especially uni-marketing represent a confusing and challenging new world.

- On the positive side, uni-marketing will give them a comprehensive view of current and potential customers: what they watch, where they go, what they chat about, what websites they browse and so on. They will be able to personalize and curate product offerings in real time. This wide view will extend increasingly into the physical world as offline sales and other data is integrated.

- On the negative side, everything will be changing for some businesses. The old winning formula of “location, location, location” plus marketing is going away. The consumer journey is no longer about walking down the street or into the closest mall; the path now includes the home, the smartphone and soon, the smart car. This is going to be difficult and confusing.

It also raises the important question of who the consumers belong to.

If someone walks into a Zara store and makes a purchase, Zara has the data and the customer. But if the shopper started out on Alibaba’s Tmall site and ordered from their phone and then picked up the order at their local Zara, who owns the customer and their sales data? What impact will that have on brands and customer loyalty? How will that change brand equity for merchants and brands over time?

The answers are unclear but if you are in retail in China, it would be best to dial your paranoia up to 11.

For Alibaba and rival JD.com, the view is spectacular. Their existence is about to get even better. They are going to have a quantum increase in the volume of users, data and transactions on their platforms. And they are going to capture some of the most valuable intangible assets of physical retail – without fully owning the expensive physical assets that used to go with them. It is looking like a super smart strategy.

Cheers, jeff

An earlier (and different) version of this article was originally posted on Asian Nikkei Review (here)

—–

Related articles:

- Don’t Go Gaga Over Shein’s “Ultra-Fast Fashion” Model. It’s Mostly a Low-Priced DTC Apparel Story. (Asia Tech Strategy – Daily Lesson / Update)

- Shein Is Low-Priced DTC Apparel at the Speed of Algorithms. Is This a New Moat or Just Table Stakes? (Asia Tech Strategy – Podcast 83)

From the Company Library, companies for this article are:

- Alibaba

- Sun Art Retail

Relevant Concepts:

- Smile Marathon: Ecosystem Orchestration and Participation

- Digital Operating Basics

- New Retail

———-

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

Note: This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.