This week’s podcast is on the well-known 7 Powers framework by Hamilton Helmer. I go through some of its limitations and where I think it works best.

You can listen to this podcast here or at iTunes, Google Podcasts and Himalaya.

Hamilton Helmer’s fundamental equation for value creation and capture

Value = M0*g*s*m = market scale * power

- M0 is market size at time zero. This is about targeting big and growing market opportunities.

- S is long-term persistent market share.

- m is long term persistent margins (operational margins after cost of capital).

Hamilton Helmer’s 7 Powers:

- Scale Economies

- Network Economies

- Counter Positioning

- Switching Costs

- Branding

- Cornered Resource

- Process Power

From the Concept Library, concepts for this article are:

- 7 Powers

- Competitive Advantage

- 4 Terrains and Strategies (BCG): Predictable vs. Malleable

- SMILE Marathon

From the Company Library, companies for this article are:

- Netflix

- 35: Competitive Advantage

——–

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.

Note: This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.

——transcription below

:

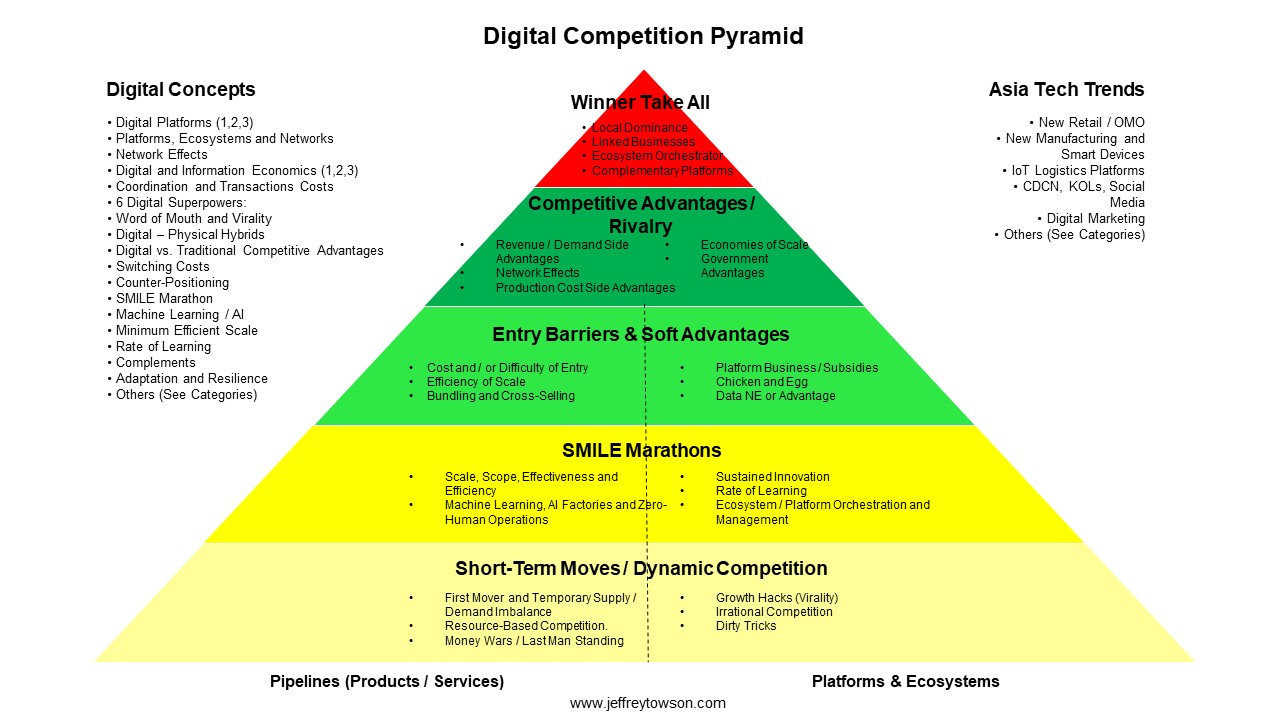

Welcome, welcome everybody. My name is Jeff Towson and this is Tech Strategy and the topic for today four problems with Hamilton Helmers seven powers Now this is going to be a little bit technical for those of you who aren’t familiar There’s a very well-known book particularly in Silicon Valley called seven powers by Hamilton Helmer Really cool dude teaches at Stanford Business School And he wrote a pretty influential book that came out a couple years ago. Basically, it’s sort of a, a compass or a real time roadmap for CEOs to make decisions on how they should navigate their companies in a sort of emerging or more dynamic space, which is kind of the nature of software in Silicon Valley. That’s where they live. So a lot of founders, a lot of CEOs cite this book, Netflix, Spotify, CEO, things like that. but also he’s an equity investor. So investors in particular would look at this as well as a decent framework for looking at these types of companies. And really beyond that, just sort of the the chattering class, the podcasters, the bloggers, venture capitalists, you’ll hear them cite this book pretty often, it’s pretty common. in the United States and pretty much anyone who’s thinking about Silicon Valley in some form. And it basically lays out seven powers you want to develop as a business as you sort of evolve and continue your fight. And these things, he directly ties them to sort of competitive advantage, creating barriers, creating economic benefit with the end goal, the bottom line being shareholder wealth creation. Now I’m not gonna summarize the book too much because I wouldn’t do it justice. I mean, it’s a book you should read, but I’ll give you a sort of a quick and dirty take on it. And then I wanna talk about just sort of where I think it works and it doesn’t work, where the problems are. I think I’ll give you my so what on it. I think it’s a very good workable, simple but not simplistic approach. to a fairly small subset of companies. So you kind of want to know how does it apply to those types of companies, Netflix, Spotify, but also at what point does this framework no longer work? And that’s really kind of important is anytime you have a framework, you always want to know where it works and where it starts to break down and not be accurate. Both of those things are really important. So that will be the topic for today. And I will have… Hamilton on the podcast, I believe fairly shortly, we’ve been sort of saying hello on LinkedIn and he’s agreed to come on. So I’m sort of teeing that up at a certain point in the near future. But first, my standard qualifier, nothing in this podcast or in my writing or on my website is investment advice. The information and opinions expressed by me or any guests may be incorrect. The numbers and information presented could be wrong. The views expressed may be inaccurate or may no longer be relevant or accurate. Overall, investment is risky. This is not investment advice. Do your own research. For those of you who are subscribers to the class, I’m gonna go through a couple ideas here, a lot of technical details today. But the big ideas I want you to take away from this are what I’m gonna call the four terrains and strategies. I’ll explain that, that’s pretty vague. competitive advantage and then company quality and that’s sort of the three buckets as they’ll all go under learning goal 35 which is competitive advantage that’s level 7. Okay let’s get into the content. Alright so seven powers is basically that a list of seven powers you can have as a company that are gonna have a couple effects. One would be it will create a barrier this is his it will create a barrier to specific competitors. And second, it will create a benefit, usually that you will have a higher return on in capital versus those same competitors or others in your industry. So that’s sort of one way of talking about a competitive advantage, that it can play out in a couple of ways. One, you’re just protected, which means you’re not facing as much. And two, you can actually… have a higher than normal return. And I’ve sort of touched on this previously when I’ve said, look, how do you tell if you have a competitive advantage? Well, you can test two metrics. You can look for stable market share over the long term. If you got 30% of the market for 20 years, that’s indication that you have a barrier of some kind that others can’t seem to breach. Now, if your market share is swinging up and down by 10%, 30% every year, which happens in movie studios, it happens in smartphones, it happens in a lot of restaurants. That’s pretty good indication like, look, I don’t care what you say, you don’t seem that protected. If you were, your market share wouldn’t be bouncing all over the place. That would be one way of looking at it. The other metric I’ve pointed to is you could look at return on invested capital. Okay, most sodas, let’s say they make 12% return on invested capital, and that would be. basically no plat, net operating profit or loss after taxes. So basically operating profit minus taxes divided by invested capital, that is typically considered return on invested capital. Now, if you’re making 20% and everyone else in your business is making 10%, there’s indication there that, okay, you’re doing something where you’re either charging more for the same service or you’re doing the same thing, but you’re doing it cheaper. you’re getting an economic benefit of some kind that others don’t seem to be able to match or take away from you over time. So his language is a little bit the same. He will talk, okay, look for the barrier, look for the benefit, fine. And he lays out seven different types of powers like this. So I’ll go through these in a subsequent podcast, but just to list them briefly for you here. The first one would be economies of scale. Obviously I’ve talked about that kind of a lot. Where he says scale economies. The second would be network economies, network effects. Counter positioning, I’ll talk about that later. That’s kind of a different thing. Switching costs, we’ve talked about that. Branding, i.e. feeling good. Talked about that though, I’ll use different language. And then cornered resource. Don’t really agree with that one too much. Process power is number seven. Okay. I’ll go through those in detail in a subsequent podcast. Those aren’t really the seven I look at, but there’s quite a lot of overlap with how I break these things down in terms of competitive advantages. The other way I do this differently is, instead of saying, okay, this is a power, this is a competitive advantage, I usually break things into two buckets. One would be barrier to entry. How hard is it to enter a business? versus long-term advantage. Okay, you can get in the business, but you can’t win. And some businesses have both of those. I think those are two different phenomenon. And some businesses have both, some have one. Coca-Cola, there’s no barrier to entry. Anyone can start a soda company, it’s pretty easy. But when you get in, they have a long-term structural advantage you can’t beat. Different example would be, okay. getting permits to build a hospital in a town, you may have to overcome a regulatory issue. So just getting into the business is difficult. But once you get into the business, okay, then there’s nothing stopping you from competing. And some businesses have both, like a telecommunications network. You have a barrier to enter, which would be cost and difficulty of laying, well, I guess if it’s cables, laying all the fiber. or putting up all the towers, that’s the entry barrier. And then once you get in, you’re at a structural disadvantage because of volume and smotherings. So some can be both. So I do break this down a bit differently and I don’t use the same seven, but there’s quite a lot of overlap within that. But the benefit of having seven powers is it’s very usable for CEOs in sort of real time. And one of the things I think he does very, very well is a lot of the competitive advantage language tends to be a static picture, like a snapshot. Okay, here’s Coke versus Pepsi today. Here’s Coke versus Dr. Pepper today. Well, I mean, you kind of got to look at how you got there. You know, if you’re at a position of advantage today, it probably depended, well, it absolutely depended, on the things you’ve done before to get there. There’s a development path, there’s a time aspect to this. And by laying it out as seven powers, he argues this is like a real time compass. Where if you’re the CEO of a company and you’re sort of fighting day by day and you’re trying to get to the top of a mountain, well the powers would be the mountain. So it’s like, okay, we gotta get to the top of that mountain. But then the world changes, a competitor does something, and you always have to make a decision. Okay, we’re gonna stay going after, you know. power number seven, let’s say switching costs, well that would be number four or whatever, but then we’ll switch and go to another one. So it gives you sort of a real time compass by which a CEO can make decisions. And the example he talks a lot is Netflix, because they had a very different strategy in 1999 when they were mostly doing DVDs, versus in 2005, 2010 when they started to move into streaming video and other things. And they evolved their strategy. and basically move from one power to the next as the industry evolved. And to a large degree as they shaped it, which I will talk about. So the net-net of his approach, which he lays out as what he calls the fundamental equation for value. Now by value, which people use that term a lot, he’s talking about shareholder value. He’s coming at this from an equity analyst. position, a shareholder position, which for a lot of these companies is obviously the management as well because they own shares. So I mean he is definitely taking, you know, not a stakeholder view. He’s taking a shareholder view of this and he has some equations on this and his fundamental equation for value creation is, well really it’s value capture. It’s not all the value that’s created by the service but it’s the the amount of that value that is then captured by shareholders, so I’d call it value capture, but that’s fine, is you basically have to take the market scale times the power. So the power is, hey, you’ve got a lot of real strengths in this particular business. That would be the second term in the equation, but the first term, market scale, that’s how big of a market are we talking about. And ideally, what you want, is you want to have a lot of power in a very big market. So that’s market scale times power. And the way he lays this out, he has in his equation is basically the market size at time zero today times the growth of that market. That would be the market power part of the equation, I’m sorry, the market scale part of the equation. Then you multiply it by power, which would be the percent of that market that you have times… the margins you have, and this will be operational margins after cost of capital. So that second term power, I mean, yeah, you can see that it captures the market share and the sort of return on invested capital in that one equation, which I’ve just kind of mentioned. First term is about the market scale. So, you know, you can be powerful, but if you’re in a really small market or a small market that’s not growing, that’s not as attractive. And if you’re in a… big market or a market that’s growing a lot, but you have very little power, that’s also not attractive where you’re not gonna get a lot of value capture as a shareholder. So he’s got those two terms, that’s how he breaks it down. Some of the language that he talks about, he says, quote, power is about durable differential returns. You’re trying to assess the longer term competitive equilibria. So what is this market gonna look like in three, five years or so? How big is it gonna be? And how much power, or to what degree is this particular company gonna have durable, differential returns in this market? And that will, in theory, shape investor expectations, i.e. share price. So I’m just sort of summarizing his language. I like his terminology in a lot of this, that you wanna capture an unassailable market perch. that you wanna have power relative to others versus existing competitors, but also potential competitors, you need to think about that. The growth part, the market scale, the first part of the equation matters because it kind of projects how likely this market is to continue to grow. And within the power component, we need to think about, okay, if you do have power or if we think you’re gonna have power three years out in a large market, What is both the magnitude and the duration of that? Magnitude kind of means, okay, look, it’s gonna create cash flow. You’re gonna have this benefit by your position in the market. You’re gonna generate a lot of cash flow. How long is that gonna go on? So you’re mixing kind of this benefit and barrier thing. Fine. Examples you could think about. Uber. Uber has a dominant. competitive position, it’s one of two. So that would be IEA barrier. But it doesn’t have a lot of benefit in the sense that like, they’re not actually making much money. So there isn’t cashflow. If there’s not cashflow, ultimately there’s no shareholder value. So you can be very dominant. You can have power in an unattractive space. Airbnb would be different. Airbnb has pretty good competitive power in a market that generates a lot of cash. They have… barrier and benefit. Now I’ve said this many, many times, but with different language saying, look, competitive dynamics is about how much you dominate a particular market. It doesn’t mean you make money. You can dominate bad businesses. The last company that made buggy whips for whipping your horse as you sit in the buggy, they probably dominated that business, but the economics were not good. Doesn’t mean you’re gonna get a lot of power in that. He’s basically described his fundamental equation of value capture for shareholders as those two terms, market scale times power. I actually think it’s three terms. I think he’s kind of mixing three things together. The first one I agree with, like the market scale, is this a big and or growing market? That’s gonna determine a lot of the cashflow now or in the future. The second one I break into two pieces, I think it’s competitive barrier and whether the unit economics are attractive or unattractive. You can dominate a business that has a big market but also has unattractive unit economics. That’s kind of what Uber is doing. And you can’t really change the unit economics. One of the reasons Uber is not terribly attractive is because there’s low cost substitutes. You know, if they try and raise their prices, everyone just takes the bus or the subway. Airbnb doesn’t have that. Airbnb has a dominant competitive position and it has a big market and it has very attractive unit economics. So I actually kind of think it’s three terms, competitive barrier, attractive unit economics, and a big and or growing market. He’s sort of collapsing those down to two. Okay. So an example would be Netflix, which is something he talks about quite a bit because I think he knows Reed Hastings and he was an early investor in the company and there appears to be a relationship there, which is pretty spectacular company, Netflix. Okay, if we look for a power, let’s say economies of scale, I’ve talked about this a lot, that’s something that he lists in his seven, you could argue that Netflix, this was one of their later powers. When they moved into When Netflix started, they were doing low-cost DVD shipping. Sort of a counter position. This is one of his seven. They were counter positioned, which I’ll talk about in the next podcast. They were counter positioned against Blockbuster. Blockbuster had lots of stores. That’s how you would go in and rent a video. Suddenly Netflix can ship the video to your home. That puts Netflix in a difficult situation because if they won, it’s a lot cheaper. But two, if they adopt the same strategy, okay, we’re blockbuster, we’re gonna start shipping DVDs to home, that’s immediately gonna hurt their core business, which is their retail stores. So that’s one of the seven, it’s a counter position. That was a lot about the early Netflix. You’d say this was one of their first powers. And this tends to be a counter positioning, like that tends to be a good power for an attacker, for a new entrant. One of the things I’ll talk about, probably in another podcast, is I also tend to think about competitive strength advantages as attacker and incumbent. That some advantages work much better if you’re an attacker and you’re breaking into a business with established competitors. Other advantages make more sense when you’re in the incumbent and you’re defending your position. Counter positioning is a classic attacker advantage. So Netflix, You could say early in Netflix, one of their primary powers was probably counter positioning. Then they got break. They got big. The blockbuster stores all faded away over time. That power probably faded. And then they moved to a new power because this is kind of a real time compass for CEOs. And they moved to economies of scale, which is, you know, you have a fixed cost in a business. I am bigger than my competitor, three times bigger, by volume, by revenue and such. Therefore, my fixed cost is 10% of my revenue, it’s 10% of your revenue, and I get either a lower per unit cost or I can outspend you. Well, Netflix later on made the strategic decision, we’re gonna get into content production ourselves. We’re not just gonna have a lot of videos that we contract. from the studios and then ship them like a retailer, we’re gonna create our own content in-house and they launched with House of Cards, which like, go back and watch the first episode, watch the first 30 minutes of the first episode of House of Cards. It’s like the greatest 30 minute starting of any TV series ever. It’s amazing. Like the dialogue in Kevin Spacey, it’s really spectacular. That was such a good TV show. before it went off the cliff. But economies of scale, okay, then the industry streaming becomes a lot more about creating in-house content. Now, if you look at these companies, Netflix, Amazon Prime, Youku, iQiyi, Tencent Video, their biggest fixed cost is gonna be in-house content production. Well, Netflix is dramatically bigger than most of their competitors, especially in the United States. So they have economies of scale as a major power later on. So you can see they kind of move from one power to the next as the industry emerged and really as they shaped it. So that would be kind of an example. And you can see why Silicon Valley CEOs in particular would like this framework, because it kind of gives them a roadmap for what they have to do. you know, as the industry changes, as new competitors jump in and out, as new technology like broadband and everything comes along, you know, they can look at this and decide, okay, which of the seven powers do I need to build now? Does my current one still work or do I need another one? Okay, everything’s going from shipping DVDs to streaming. It looks like my counter positioning power is gonna fade away. What’s another one I can build here? Okay, in-house content economies of scale, bam. You can see how it. why they would like this. It lets them make decisions in real time as they sort of fight day by day. It’s a very usable strategy framework, which is, to use his words, simple but not simplistic. I think that’s a good description. Another example he talks about is cornered resource as a power. I don’t really like this one too much, but I’ve talked about this in terms of management quality quite a bit, like… You know, if you, why is Pixar so successful? That was one of his examples. Why is YouTube so successful? Why were the Beatles so successful? Well, because they had a very unique combination of talent, something that’s very hard to describe or replicate. So that would be kind of a cornered resource. And sometimes that’s transferable and sometimes it’s not. But definitely from a competitive viewpoint. How do you, if you see you two and you say, we wanna be you two, well, how do you do it? It’s impossible, it’s hard to say what it is those four dudes are doing such that they’re so successful. Pixar is the same way, the Pixar management team, it’s very hard to replicate that. So he would talk about that in terms of these technology and IP companies, Steve Jobs, things like that. Star Wars, it turns out Lucasfilm, was a cornered resource. When they moved Star Wars from George Lucas to Kathleen Kennedy and they handed it off to Disney, that thing just went into the toilet. I mean, the movies were just awful. And now they’re basically bringing him back and a couple other people. So sometimes it’s in management, but even if we weren’t talking about Silicon Valley-type companies, software-types companies, talent-type companies, we could be talking about… a location at the beach. If you want to buy a hotel in Sanya or Waikiki, you know, there are not that many spots on the beach to put your hotel. So if you have one of those spots, that is an advantage. It is a unique resource that’s very hard to replicate because there aren’t anymore. Warren Buffett doesn’t do a lot of real estate, but he has bought buildings from time to time. And when you look at them, it’s always like he bought an apartment building right on the park. I think it was Central Park, maybe. So that’s kind of a unique resource. Granite mines. Turns out there’s not that many granite mines in a particular town, and you can’t really transport granite very far because the cost of transportation, because it’s quite heavy, is a huge percentage of the actual sellable price of granite, which is quite low. So, you know, if you have the only granite mine in town and there’s a lot of building going on, they pretty much all have to deal with you. People talk about resources this way, lithium, some rare metals, things like that, IP patents, you could argue that. Okay, so I mean, you can see there’s something there, but I think it’s much broader than just obviously management teams in Silicon Valley. Okay, one last point in my relatively poor summary. of this book is this idea of how these things develop over time. And I’m going to lay out four problems, or let’s say limitations with this approach. And one of them is it is very specific to internet companies, particularly in Silicon Valley, and once you move beyond that, this doesn’t work terribly well. But this framework is useful when you think about how companies develop and change over time as technology changes, as competitors change, as they jump in and out. And that is a fairly good description of how the internet digital world works. It is very dynamic. The tech is always changing. There are new companies all the time. So this is a pretty good framework for a rapidly changing terrain with lots of changing competitors. where you want to think about what my power is today versus how it could evolve to the next level and to the next level. And his point, which I think is a very good one, is the ascent of really great companies is not linear. Netflix sort of got where it was through a series of step functions. You know, it built one source of power that got it, one, it got it a lot of cash flow, which is very, very important. then it used its power in that moment and its cash flow to jump to the next thing and build another source of power because maybe the other one was fading. These things shift your trajectory, and you kind of move from one to the next. I think his playbook captures this sort of path of ascent of truly great companies fairly well. And this is really what Silicon Valley companies want to be, and it’s what equity investors are often looking for when they look at these types of companies. And you have to think about what the converse is. Okay, let’s say you’re not looking at the trajectory of these companies over time as a CEO, as a management team, as an investor. Well, you still have to work just as hard. It’s just that when you work really hard and you follow this path, you can become truly spectacular and you climb up the mountain. Because you kind of know where you’re going or you’re working just as hard, but you’re going in the wrong direction So it never gets you anywhere and you see a lot of companies like this. They’re working hard They’re going you know they just have bad strategy, so it never leads them anywhere now that whole idea of This sort of path of development. I’ve broken that into two levels in my pyramid chart Where I talk about one level as competitive advantage, and then the other level is the smile marathon I think you actually need to be doing both. I think he’s talking about competitive advantage. I think you need to play on both levels. You need to one, know what competitive advantages you are building over time. And then at the same time, you also need to be running very, very fast along a certain competitive dimension no matter what. Even if you’re not moving towards a competitive advantage, even if a competitive advantage is not available in your space. you have to play at both levels. So maybe your key competitive marathon, your smile marathon is rate of learning and innovation. You have to do that no matter what. And then on top of that, you wanna think about what competitive advantages can I build here? So I think you have to play at both levels. He’s mostly just talking about the competitive advantage level. Although I think he does make a good point that a lot of this operationally is about culture. It’s about companies that are good at this stuff are always very sort of honed around a certain culture and are moving that way generally. I think that’s pretty much what I’m talking about is this sort of smile marathon, just different language. Okay, but the end point or at least the goal you’re trying to get to is power. It’s cashflow, it’s persistent differential returns in a very attractive industry. That’s… should always be your sort of goal. That’s the top of the mountain you’re trying to climb. So I basically have sort of four issues with this. Not say problems, I think it’s limited. And that’s fine, because it’s a nice framework to use in certain scenarios, but if you apply it to other places, it could get you into trouble. So my first sort of problem would be, a little bit of knowledge can be a dangerous thing. What’s cool about this is it’s very understandable. It’s simple, but he hasn’t overly simplified anything. Like within the space he’s talking about, it’s a pretty good, robust framework. However, the way you can simplify without being simplistic is you focus on a specific subset of companies and situations. And that’s really what this is, that This is very good for a certain area. And you need to know where the limitations are, where the boundaries are. I’ve mentioned this before. I call this the upper atmosphere problem. My standard approach to really everything is I like to look at something small, something I can really get my brain around and take apart. I don’t like macro. I don’t like, you know. economic stuff, country this, development economics, and you know. No, I like small stuff. I like studying shopping malls in, I don’t know, northern Bangkok. Because I feel like I can figure that out. So choose something relatively small and then come at it with multiple frameworks, totally different ways of looking at the same phenomenon. And between all of those, I usually feel like I can often figure it out. However, the big caveat. All of those frameworks have limitations on them. They have areas they work, and then at a certain point, it no longer works. And that’s the upper atmosphere. That’s, you know, Isaac Newton, if you study sort of classical dynamics, physics, you know, how do you measure this ball rolling down a hill? How can you measure, you know, if you hit a billiard ball, what is the direction? Well, force angle A is gonna combine with B. And you can basically predict a lot of things very accurately with Newtonian dynamics when you’re walking around on the Earth. Turns out it’s pretty accurate. How fast is the car going? How long will it take for the car to stop? How fast will the ball hit the ground? If the apple falls from the tree, how long does it take to hit the ground? Very, very accurate. Until you go up into the upper atmosphere, at which point Newtonian… dynamics starts to give you the wrong answer. Because it turns out all of that is an approximation. It turns out space is not three dimensional, it’s at least four dimensional, and that gets you into Einstein and space time and all of that. And when you get on airplanes, you can measure that time is changing based on how fast you’re flying. And yeah, it just turns out it’s not right. It’s a very good approximation in one scenario, which is like walking around here. doesn’t work at the quantum level. It doesn’t work once you start getting to the upper atmosphere and you start looking at space time. But within one area, it works very good. So you gotta know where’s the upper atmosphere for these seven powers. Where do they work well? Where will they give you the wrong answer? And that’s kinda my first problem is I don’t think he really stated, look, this is when this is not gonna work anymore. That it only works for this sort of scenario, these types of companies. Beyond that, you need to do something else. and that’s where kind of a little knowledge can be dangerous because when you learn a little bit about something, you feel like, oh, I can totally use this, awesome. Nah, that’s when you make mistakes. So that’s kind of my first problem. Okay. Problem number two, which is really an extension of the first one, which is, this is very good for truly great companies on rapidly changing evolving terrain. And that’s really how software is, and that’s how digital is. Things are changing very, very quickly. You know, Netflix can come in there and, you know, just upend video rentals very quickly. And entertainment is a space. Media and entertainment, you know, changes very, very fast. So there’s Netflix, there’s Amazon Prime, there’s the studios, there’s streaming, there’s shipping videos, there’s YouTube, there’s podcasters, there’s all of this. technology and entertainment media is a very dynamic space. Now this works very, very well for that sort of rapidly changing environment. But most businesses aren’t like that. I mean that’s not true. Most businesses are. If you’re doing restaurants in Bangkok, that industry’s not super dynamic. You’re not gonna be able to shift from power number one to power number three and disrupt and all this. No, no, you’re pretty much playing an established game. So one, it assumes a certain type of terrain, which is really what we see in software and digital and particularly Silicon Valley. The other thing is it’s looking at a very small subset of companies, which I would call truly great companies, or I’ve referred to them in the past as wealth. creating companies, wealth generating companies, where not only do they grow over time, but they have positive economics and they create wealth. Well, that’s a very small number of companies. Buffett doesn’t invest in companies like that too much. I mean, he mostly invests in fairly stable companies like Coca-Cola. Well, Coca-Cola, yeah, it generates wealth, but it ain’t going up by five times. You know, it’s a slow compounder. Generates a certain return every year, and over 10 or 20 years, that consistent compounding wealth will actually add up. But Buffett kind of likes slow, predictable compounders for the most part. Yes, they’re wealth generating, but much slower. And then the vast majority of companies don’t do that at all. A lot of them, they’re what I’d call wealth preservers. wealth protectors, if you buy a nice hotel with a good competitive barrier because it’s on the beach, it’s not going to generate huge wealth, but it’s a very good place to preserve wealth because you know it’s not going to decrease because it’s protected. And that’s what a lot of competitive advantage is about. spectacular growth like a Netflix, that sort of wealth generation at the nth level, it can get you slow consistent wealth creation, that’s a Buffett type slow compounder, or more likely it can just get you wealth preservation. You know, you buy the hotel, you buy the one power plant in town, and you’re protected, you’ve got good barriers, and that’s a good stable place, protected place to put wealth. Okay, even that, what I’ve just described, is still a subset of companies, all of those, because the vast majority of companies don’t have any sort of competitive barrier. Now, I’ve described these as unpredictable or too difficult. Your average restaurant doesn’t have a competitive barrier. It may create money. It may lose money. It’s very hard to know what’s going to happen. It depends a lot on management. It depends on a lot of things. but it doesn’t have any of this. So, you know, this is like, this strategy is very useful for a very select small group of truly great companies that are on very rapidly changing terrain. Now I use a much broader definition of competitive advantage than he does because I’m looking for competitive advantages across a much larger spectrum of companies. Those that don’t generate wealth, but those maybe that preserve wealth. And I’m also looking at companies that don’t have a competitive advantage, where your primary approach is the smile marathon, where it’s like, look, we’re a retail store in Bangkok. We’re beauty salons in Bangkok. We are restaurants. We don’t have any sort of competitive advantage. We just have to run really, really fast. We are in the smile marathon. I’ve got to choose my dimension. And if you’re coming at this with an either a manager or an investor mindset, do you really want to limit your entire universe for your digital strategy to this very small select group of truly great companies on a dynamic terrain? Or would you like to have a digital strategy framework that can be used on truly great companies or just protected? good companies or hey, they don’t have any protection, but we can still come up with an investment strategy or a management strategy for a company that has no competitive barrier. And that’s kind of what I’m trying to put together with my digital strategy framework, my pyramid, is that it captures all of that. And so when I talk about competitive advantage and all these things, I’m really talking for as many companies as I can. Now for those of you who are investors, this is like, yeah, if you want to invest like Warren Buffett, that’s a very small percentage of companies that you can look at. There aren’t that many of them. This is an even smaller subset, what he’s talking about. This is more like Philip Fisher out of the 1950s, who would only buy one company a decade, like Motorola, because he was looking for the best of the best of the best. I wanna be able to do Philip Fisher, Warren Buffett, Hamilton Helmer. Carl Icahn, I want to be able to invest in bad companies and make money. So anyways, that’s my point number two. I think you need a broader playbook as in a manager and as investor by company quality and by terrain type. Okay, problem number three, and this is really the big takeaway for today. For those of you who are subscribers. The big takeaways for today, the seven powers, which I haven’t laid out, but I’ll go through them in the next one, competitive advantage, smile marathon, and this point which I’m about to tee up, which is the four terrains and strategies. And this is really a Boston consulting group framework. And this is from Martin Reeves, well, him and other people, but he’s the head of their Henderson Institute, their sort of research group. and I had him on the podcast in the past. I think he’s a spectacularly good thinker. He’s one of the people I really pay attention to. And he wrote a paper along with Ming Zeng, the head of strategy for Alibaba. This was like eight years ago. And it was called the Self-Tuning Enterprise. And there’s a lot of thinking about adaptability and resilience and things I’ve talked about before. But within that, one idea which I thought was great, which is the takeaway. for today is, okay, I’ve talked a lot about how to assess company quality, but you also need to assess the terrain you’re on. Is this a dynamic thing? Is it stable? Is it predictable? And they have a very simple two by two matrix for the four types of terrains. And I’m putting a slide of that in the show notes. But they basically said the two dimensions you need to think about this is Boston Consulting Group. is predictability and malleability. Now predictability is, okay, I’m in a business, restaurants, internet, communications, who knows what, energy, oil, how far into the future and how accurately and confidently can I forecast this industry, its demand, the competitive dynamics, the market expectations, how predictable is my terrain? And some businesses like the oil industry are pretty predictable. And other businesses like entertainment, very unpredictable. So that’s one dimension. The other dimension, malleability. To what extent can you or competitors, current or future, influence the industry? Can you shape it? Can you change it? Now Netflix clearly did. They didn’t just go in and play on the terrain of entertainment. They shaped it and they changed how it works and they changed its economics and they changed how consumers consume entertainment. So those two dimensions, predictability, malleability, get you a two by two matrix with four quadrants and this is in the show notes. That gets you four types of terrain and therefore four types of strategy. that you can employ. So lower left quadrant is very predictable, non-malleable. That’s the terrain you’re on. That’s your business. That’s the classical strategy space. That’s Michael Porter’s Five Forces. That’s hey, we’ve got an industry, let’s try and find the positions that offer us competitive advantage. That’s Coca-Cola. Coca-Cola is a very predictable business, and it’s not malleable. You can’t… dramatically change how people consume soda. That’s KFC. This is really Warren Buffett land. This is where he’s looking for long five to 10 year investments in companies that are gonna grow wealth slowly but predictably. He likes this quadrant. And you could put Apple into this category, not early Apple, but current Apple where, their business today is actually very predictable. It’s the iPhone. That’s a very predictable and largely non-malleable business now, which is why I think to everyone’s surprise Berkshire Hathaway started buying Apple shares, and now it’s their biggest position. The example that Martin talks about is the oil industry. It’s a very predictable business and you can’t really change it as a company. I mean, you’re sort of at the mercy of external factors like regulation, global demand, global supply. And when you’re in that business, you sort of operate on a longer time scale. You set your strategy years in advance. You try and identify the five forces, blue ocean strategy. You try and find the best place to be as a business and then build up defenses. And it’s mostly about longer term strategy and then very good execution. Now, The seven powers framework is not gonna help you very much in this type of business. Most of these businesses are at best wealth preserving. You know, they don’t go up by a factor of 10. They tend to be slow growers, compounders. You know, you wanna sort of capture the right location, build your barriers, and you’re generally not gonna have as much an opportunity to be a first mover here. It’s not like you’re gonna break into a new sector nobody’s thought about. I think my sort of competitive advantage framework and the Smile Marathon, which are sort of the green levels of my digital strategy pyramid, I think this is a very good approach for this quadrant. Classical strategy, very predictable, non-malleable. I think if you’re a guy like Buffett, you’re looking at this space and you want a business where you’ve got 75% of your analysis is, does this company have a competitive advantage? 25% is how good are they at Smile Marathon. For everybody else, which is most companies, it’s 85% about smile marathon, how good are you at this, and then maybe you get a little competitive strength. That’s sort of my classical strategy approach. Now the next quadrant is on the lower right. So this would be a very unpredictable industry and non malleable. So you can’t really tell what’s gonna happen. and you can’t really change anything. You’re kind of at the mercy of what’s going on. So, you know, you can try to come up, well, one, you can’t change anything, but if you do try and come up with a classical strategy, it’s not gonna help you, because in three months, six months, a year, it’s gonna be obsolete, because the terrain keeps shifting. Not predictable, not malleable. Your basic strategy is adaptive. We just have to be adaptive. We have to continually refine our goals. We have to refine our tactics. Yeah, we can come up with a strategy, but we’re probably gonna have to throw it away in six months or a year and do it again. You can’t really optimize for efficiency and competitive barriers. You can’t really have three year planning cycles, any of that stuff. The best you can do, the common strategy, if you’re doing an adaptive strategy, is you just experiment like crazy. You are constantly trying things, seeing what happens, and then adapting. Let’s run tons and tons of experiments all the time. So that’s like Zara. That’s like H&M fast fashion. That’s really like a lot of fashion and luxury. The tastes, the consumer preferences, they’re always changing. Brands are rising and falling. No ability of strategic planning is going to help you decide what to stock in your inventory as Gucci or Prada or Zara 18 months from now. You just have to continually produce new ideas, roll them out, test them as fast as you can and then adapt, adapt, adapt, adapt. And that’s kind of what fast fashion is about. Like a company like Zara can sort of design, manufacture and ship garments in two to three weeks. and they’re just always doing small batches of products to see what the current trends and styles are and then they’re adapting. So that’s kind of a different approach. I don’t think the seven powers approach really works very well for this. I don’t think competitive advantages help you too much in this space. I think this is my smile marathon. And within that, you’re really focused on rate of learning and sustained innovation. So that’s the I and the L of smile. That you’re just studying the industry, you’re studying the market all the time and your biggest advantage is how fast you can learn. And then you innovate, innovate, innovate, you’ll continue to experiment and you just stay quick on your feet. So that’s sort of a sec, I think that’s a good way to think about what strategy you use in that type of terrain. Okay, two more and then we’re done for today. I know I’ve been talking for quite a while. Now the third quadrant, now I think we’re in seven powers land. This is upper right quadrant which is where you’re in an industry that’s unpredictable and malleable. Okay, that’s early Netflix. That’s, look, the entertainment industry, the media industry, it’s always changing. The tech is changing, consumer behavior is changing, consumer tastes are changing. However, so it’s unpredictable. However, we do have an ability to shape it. We can launch shipping out DVDs and we will change the structure of this industry, which is really what early Netflix did. So if there’s high uncertainty, high unpredictability, we can think about what’s called shaping strategy. This is a BCG term, classical strategy, adaptive strategy, shaping strategy. That’s early Netflix, especially when you have an industry with a lot of incumbents, maybe fragmented. but facing disruption, we can consider sort of the payment industry as a shaping environment. The environment is very unpredictable for how payments are going to be three years from now. But it’s also malleable. The big companies can change things. Early Spotify, Ant Financial, early Netflix, pretty much most of the companies Hamilton talks about are in this category. So in this case. Okay, I think that’s interesting. Internet software vendors, lots of innovation, very hard to predict demand. The relative positions of competitors are constantly in flux. One company with a good strategy can change the direction of the entire industry. So shaping strategy, yes. I mean, communications, entertainment, Pixar, pretty much all the companies he talks about are like this. I think Philip Fisher, who… If you’re not familiar with him, don’t worry about it. But 1950s guy, he was very much in this. Now, if you’re gonna do a shaping strategy, you want sort of shorter term or continual planning. And I think the seven powers framework is quite good for that. Flexibility is key, moving from one power to the next. Elaborate long-term predictions are probably not gonna help you that much. You do probably need to be continually experimenting. which is what Alibaba does, they’ve always got multiple initiatives that they’re testing out and seeing which one’s hit. Like the adapters, the shapers focus beyond the boundaries of their own company, their own industry. They might jump horizontally into another industry. They might think about rallying an ecosystem of customers and suppliers and complementers with the idea of we’re gonna really change how things work. They might change this tech, they might change the standards, they might change business practices. That’s Silicon Valley, that’s pretty much what we’ve talked about. So think early stage internet companies, a stagnant industry that’s facing disruption, mature fragmented industries without powerful incumbents. Those are sort of three ways you could think about a shaper could have some pretty good power. And I think that’s seven powers land. Okay, last one. The fourth quadrant, which is visionary, that’s upper left. This is kind of Elon Musk land. This is a malleable industry. You can change things as one dynamic company, but it’s also kind of predictable. Unlike shaping, we can actually see five to 10 years down the road. Even though things are malleable, we can see the future out there. Now you can’t do that in entertainment. you don’t really know what entertainment or payment is going to look like in 10 years. But when Elon Musk says I’m going to Mars or I’m going to build electric autonomous vehicles, he really does know what he’s building towards 15 to 20 years in the future, which is what he’s been doing. So I’d put that in there, SpaceX, Tesla, FedEx. When FedEx launched, they did have a long term vision for what this was express delivery business was going to look like 10 years, 15 years into the future, yet they did shape the industry. They’re malleable, but long-term predictable. And I think current level Netflix, not early Netflix, but later Netflix would be in the visionary strategy category. So you have the ability to shape the future. That could be Thomas Edison. Satellite radio was pretty good. Elon Musk loves this. The visionary strategy. The visionary thinks that the environment, the terrain, is not a given, but something that can be molded over the longer term. And it’s probably closer to a classical strategy than it is to an adaptive strategy. because you do have a clear goal. You have deliberate steps you’re taking. The difference, one of the differences between this and adaptive is the problem with adaptive is it’s hard to be efficient and focused because you have to have so many options and experiments going at all the time because you don’t know what’s gonna happen. In this case, you don’t need as many options. You can have a handful of options but you don’t need tons of them. And it’s a pretty rare group, it’s pretty cool, but that’s sort of the four quadrant, so. The two dimensions, predictable versus malleable, you get four quadrants, classical, adaptive, shaping, and visionary. That to me is the terrain we’re standing on. So when I look at Seven Powers, when I look at any company, I’m trying to assess the terrain and I’m trying to assess the company quality. Those are always my two things. And when I look at Seven Powers, what jumps out at me is this is a very good framework, very solid framework for very high quality companies within a shaping, rapidly moving terrain. It’s a subset. And within that substrate, I think it’s solid, but I don’t think it works terribly well when you start to look at other types of company quality and other types of terrain. And my sort of digital strategy pyramid, I’m trying to capture all of those company quality and four terrain types. Okay, that’s pretty much it. I mentioned four problems. The fourth one I have, which I’m not going to go into, is I didn’t think this addressed sort of winner take all, which is the top of my pyramid. I don’t think it addresses the idea that these businesses can link up now in a way that we never saw before. It’s not like Silicon Valley, everyone tends to stay in their own lane. Uber does one thing, Lyft does one thing, Airbnb does one thing, especially in Asia and China, we’re seeing these things link up to an Alibaba. to super apps, to Tencent. So I don’t think the sort of seven powers address the top of my pyramid. Linked platforms, ecosystem strategy, complementary platforms. I don’t think it really does that. That’s kind of another level of competitive thinking. Anyways, that’s it. Kind of a lot of theory for today, but in the show notes, you will find the list of his seven powers. which I’ll go into in detail because I skipped over them. You’ll see my digital strategy pyramid. Look at the two levels, smile marathon, competitive advantage, and then the two by two by Boston Consulting Group with the four types of terrain. And that is the thinking for today. I hope that was helpful. This is sort of on the frontier of all this thinking. So I think it’s really fun stuff. I think it’s really interesting. If you felt a little bit lost, don’t worry about it. This was kind of dense today. it was fun. As for me, I’m getting ready to bug out of Bangkok. I finished up teaching this week, so I’m gonna take a little road trip and I just got my Thai driver’s license finally and I’m gonna zoom a little bit out of town and go explore some national parks and things like that. I’m thinking I’ll go to Khao Yai National Park, which is just a couple hours from Bangkok. take a look around, try and see some elephants, which is always kind of my favorite thing to do. One of the nice things, I really do like sort of animals and nature, and usually I fly to Africa to do that, and well, I can’t do that this year, but there’s so much of that going on here in Thailand. It’s pretty fantastic. So I was gonna do Khao Yai, and then over to Lop Buri, where they have all the monkeys, and maybe over to Kancha Buri, and just sort of hang out and have some tea and sit on the river and things like that. So. Yeah, I’m really looking forward to that. If you have any suggestions, please send me a note. I mean, I really don’t know much of anything. So any advice would be greatly appreciated. I am remarkably oblivious to most tourist attractions in most places. Like I know where the Starbucks and good restaurants are in town, but I will often have no idea that there were major tourist attractions right around the corner. So I’ve kind of traveled the whole world, but at the same time, not seen quite a bit of it in the process. Anyways, any recommendations would be great. I guess last comment, for those of you who are subscribers to the class, first of all, thank you so much, I appreciate that. I’ve been getting a lot of great feedback. You might have noticed that the webpage is getting better. We’ve got some simple graphs now that sort of summarize all the thinking. You can go to the main page and go to the company library or the concept library and search anything I mentioned, any concept, just go there, click on it. You’ll find it in the list and can read everything about it or the same thing for companies. So you can search all of that by company and concept. You might have also noticed that the web speed has dramatically improved. We’ve been working on that too. So it’s much faster than it used to be. We get a nice high ranking from Google now for speed. So that’s good, and we’re gonna keep just sort of improving, improving, and yeah, hopefully you’ll notice the difference. And that’s it for me. Have a great week, I hope everyone’s doing well. Have a fantastic holiday and New Year’s, and I will talk to you next week. Bye bye.