This Part 3 of my take-aways from my visit to Huawei HQ in Shenzhen. I got to talk with management and tour some facilities. But the key event was the press conference where Huawei released their post-US export ban financials.

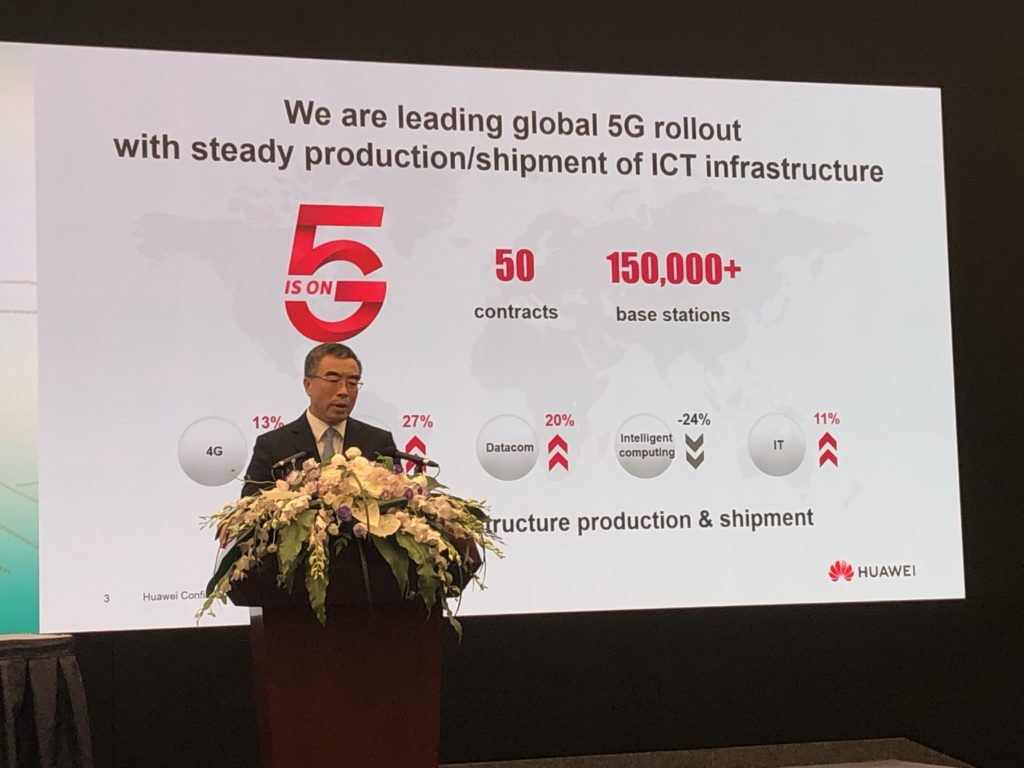

First, this was a pretty cool press conference. They put out their half year revenue and operating profit numbers, which are same numbers they always present half year (no they didn’t hide Q2). And there have been lots of press summaries of these, so I’m not going into that in detail. Basically, 2018 had amazing growth in almost every geography. And then Q1 was great. And then Q2 was a pounding for international smartphone sales. Here is Chairman Liang Hua presenting the numbers.

Management took questions from domestic and international press. And as it was an event for press (which I am not), I resisted the urge to jump in with my questions. Overall, it was pretty great event. And the free gimbels to use for vlogging was a nice touch.

Ok. Back to my 5 take-aways.

Take-Away #4: The Impact of the US Export Ban Will Become Clear in the Second Half of 2019.

I think it’s just too early to tell right now. Too many important things are still in motion. This is going to mostly play out over the second half of the year.

But I do give Huawei’s management a lot of credit for their response to the US ban. It punched holes in their supply chains, both for their carrier and consumer businesses. And it created a lot of uncertainty with their customers. A sudden ban for all US technology was as big a hit as a company can take. And Huawei management has been rapidly working on the supply chain and customer trust issues.

And Huawei has done what you hope all management does in such situations. They didn’t hide or downplay the problem (hello Facebook). They didn’t obfuscate. They didn’t disappear or go silent (hello Sheryl Sandberg). They have spoken openly with all their stakeholders and the press about the situation – and about what they are doing in response. That is the most you can ask of management under fire.

And then, just 45 days after the ban, they released their financials, which they had no legal obligation to do as a private company. That is impressive. They stuck to their release schedule (which I wouldn’t have done). And they even added a press conference and took questions live, which I believe they have never done before

How many other companies would have done this? Do Chinese SOEs act this way? Did Wells Fargo act like this after their fraud issues? Has Facebook ever behaved this way during any of its endless scandals? Huawei management should be applauded for how they are responding to this.

My assessment of their business right now is four points:

Point 1: The carrier business appears to be doing fine in terms of customer trust, contracting and supply chain.

The carrier business is the engine of Huawei. The consumer and enterprise businesses leverage the technology, stability and cash flow of carrier. Smartphone sales are pretty volatile and its a tough business in general (ask Xiaomi). But it is a nice business to sit on top of a more stable carrier business.

At the press conference, Huawei management didn’t talk much about carrier. They said 5G contracts are still being signed post-entity list, and they are leading Ericsson and Nokia in 5G roll-out. Ren Zhengfei has since said that their production capacity for base stations will be lower in August and September (about 5,000 per month) as they reset parts of their supply chain. But they should be able to produce 600,000 5G base stations this year. And at least 1.5M next year, which means enough capacity for the global market.

Trust in their carrier business was a big issue for Huawei pre-entity list. The US government was arguing against using Huawei for telcocommunications equipment internationally and management did a slew of press interviews between December 2018 and May 2019 in response (yes, I read them all). They even got Ren Zhengfei to start talking to the press for the first time. Management’s focus appeared to be about keeping their carrier customers comfortable with them. And they appear to have succeeded. The US government efforts to get Huawei outright banned have failed outside of the US, Australia and maybe Japan and New Zealand.

So in terms of supply and customer trust, the carrier business appears solid.

Point 2: The consumer business took a hit in Q2 – but is pretty volatile regardless.

Unlike carrier, there are no long-term contracts or switching costs in smartphones. We see routinely see market share swing, although smart home products may end up being more stable (if they ever get adopted).

Huawei clearly took a major hit in non-China smartphones in Q2 but this has, thus far, been compensated for by their absolutely outstanding smartphone growth over the past year. In 2018, their consumer business grew +40% in China, Mexico / Latam and Western Europe. Almost everywhere. And as most of these smartphone markets are flat or declining (especially China), Huawei’s exceptional growth in smartphones was mostly at the expense of its rivals.

Point 3: I expect Huawei to do a big push in China smartphones, where they have a lot of strengths.

In China, Huawei has thousands of retail outlets. They have a great brand. They make quality phones at reasonable prices. And that is mostly what Chinese consumers care about. And, most importantly, they are not too dependent on the Google Play store or on popular apps like Youtube and Google Maps. China has lots of app stores and those popular apps are banned anyways. Assuming Huawei can get the supply chain holes plugged (especially in semiconductors and operating systems), I expect them to do a major sales push in China. Lots of promotions. Lots of activities in their retail stores. This is going to be a good year to buy a Huawei phone in China.

Point 4: Smartphones and other consumer products outside of China are their biggest potential long-term problem. And opportunity.

At the press conference, most of the discussion was about the supply chain for smartphones. The mechanical parts of smartphones are beyond my technical expertise so I’m not going to speak to that.

But the operating system / software stuff is in my area. And this is a really interesting situation for Huawei. Yes, in the near-term it looks bad. Internatioanally, they are still dependent on the Android operating system, its app ecosystem and popular apps like Google Maps, YouTube, Facebook and Gmail. So Huawei has been open about its desire to get approval from the US for using Android. At the same time, they are rolling out a new operating system (HarmonyOS for Honor smart TVs has been release). And a compiler (Ark) that adapts other apps. And they are reported to be launching a mapping app.

Ok, You can see them doing what they can. But they are still probably going to get pounded internationally in the near-term. Their goal of being the world’s #1 smartphone (they were #2) is probably off the table right now.

However, in the longer term, this starts to raise some interesting questions.

- Why are all the the world’s smartphones run on US operating systems (i.e., Android and iOS)?

- Given the increasing use of the entity list, doesn’t this create risks for smartphone makers? And really any company doing anything on a smartphone?

- Why isn’t there a Chinese operating system?

- Why isn’t there a third operating system?

These last two questions are interesting. China is the world’s largest smartphone market. It is arguably the most dynamic mobile ecosystem. And most all the world’s phones are made in Asia anyways. Why shouldn’t there be a Chinese operating system? An Asian operating system? An open sourced one supported by a coalition of smartphone makers or tech companies?

I think we are going to see a new operating system in the near future.

***

That’s my take. We’ll know the real situation in both carrier and smartphone by the end of the year. The supply situation in particular is still in flux for a lot of core products (especially in consumer).

The final part is located here.

Thanks for reading, jeff

- Huawei Going “Battle Mode” Is Bad News for Ericsson. Take-Aways from My Visit to HQ (pt 1 of 4)

- Post US Ban, Huawei R&D is Going for Tech Leadership (pt 2 of 4)

- Huawei Is Digging In for a Long-Fight. And They Are Probably Going to Win. (pt 4 of 4)

—-

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.

Note: This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.