In Part 1 of this series, I sat down with a Didi driver and tried to get a better understanding of what life is like driving with Didi (article located here). In this second Part , I dig into the increasing innovation happening on the driver and car-owner side of Didi’s business, which is pretty cool.

The Didi App Customers Don’t See

Wang Ziming (shown below and above) is a Shanghai native, family man, entrepreneur and one of Didi’s top drivers in Shanghai. He oversees a team of 30 other local drivers.

While chatting over coffee at IFC, I asked if I could see the app he uses for picking up riders and handling his driving. It was pretty great. One of the first things he showed me was the below “hot map”, which shows where likely rides will be in about 15 minutes.

This is something Didi has been mentioning a lot recently. That since late 2017 their system has been able to predict where rides will be in 15 minutes with over 85% accuracy. The benefits of this are pretty obvious in terms of increasing the efficiency of the entire system. And if you are moving +550M people across +400 cities, there sorts of efficiencies can really add up. Note: about 50% of Didi’s 10,000 employees are engineers, data scientists and the like. It is a data technology company at its core.

Another interesting function is the +30M pick-up points shown on the these maps. These pick-up points tell both drivers and riders where to meet. Not only does this cut down on communication as drivers and riders try and find each other, it also addresses what Ziming said is the biggest source of complaints against drivers. The regulations prevent drivers from stopping at specific places and riders rarely know this. He says this is the most common cause of misunderstandings (and complaints).

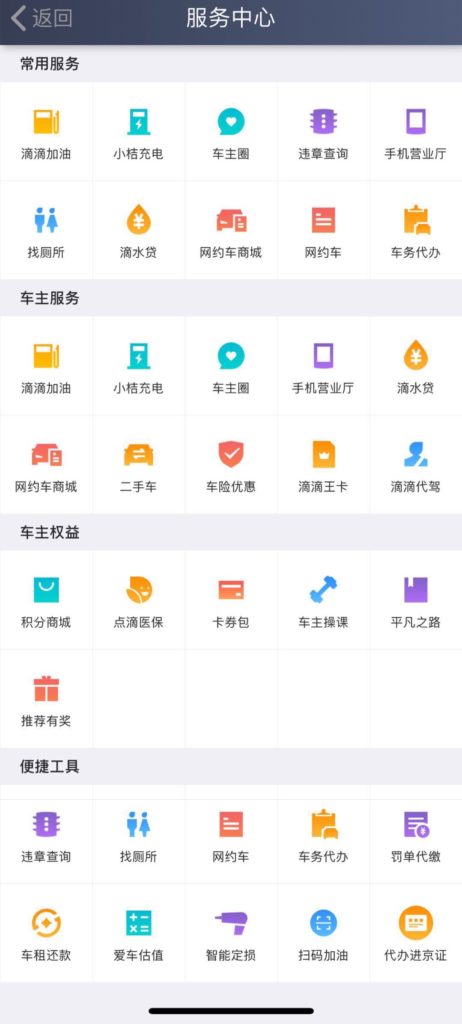

The driver app also has the stuff you would expect, like communication, billing, pending orders and such. But it is the driver services tab of the app that is really interesting. Because there is a lot going on with Didi in driver services right now – and it is showing up on this page. Just take a look at some of the driver services on the app.

Services include:

- Finding and buying gas (at a discounted rate).

- Finding a charging station.

- Credit services.

- Second-hand car services.

- Car insurance.

- Medical insurance.

- Car owner exercises.

- Government services.

- There is even a function to find a public toilet.

Didi has been rapidly building out the functions their +30M drivers can use. And, as stated in the headline, I think this is really important – basically for three reasons.

Reason 1: Happy drivers mean better service and a stronger platform.

Two-sided platforms like Didi depend on two user groups staying active on the platform (riders and drivers). And that gets you network effects and other types of “demand side” advantages.

However, not all platforms and network effects are equal. Facebook is particularly powerful with consumers because of its psychology (and addictive nature). Taobao is powerful with merchants because they become dependent on the platform as a sales channel. And so on. Some network effects are more powerful than others.

In theory, driver-rider platforms have some problems in this. It is actually pretty easy for customers to switch to another service. And they only really care about local service (not national coverage). Plus you’re just not using the service all day long, like WeChat or Facebook.

Plus drivers can easily switch to another service or multi-home. Note: Didi is probably counting on this as it goes after Uber’s drivers in Brazil (visiting their office in Sao Paolo this week). And there is not that much stopping a new entrant (say Alibaba or Ctrip) from launching a Shanghai ride-sharing service and poaching drivers and then riders. It may be expensive but they could do it. Note: After a couple of trials, Meituan has announced it is not entering ride-sharing.

Driver-rider platforms, in theory, don’t have a lot of the strengths of platforms like Google search and Taobao.

One way to improve this is to build in switching costs for drivers (and riders). You offer drivers lots of services, keep them happy and lock them in. They become more loyal. They build their careers and even businesses on the platform. And they are slow to switch when their car loan and gas are getting discounts by virtue of Didi. Building out driver services is a great way of keeping drivers happy and locking in the best ones – which means better services for riders and a stronger platform.

Reason 2: Driver Services Is Becoming Its Own Business – And Has Been Renamed Xiaoju Automobile Solutions.

Didi driver services has recently be renamed Xiaoju Automobile Solutions and has received a $1B additional investment. It is now a separate division and headed by Kevin Chen. It is becoming its own business and could be spun-off one day soon.

You’ll also note it is now referred to as “automobile services” and not driver services. Because they are turning it into a business for Didi drivers and for all car owners in China. Didi has reported that annualized GMV for Xiaoju is set to reach $13.15 billion for 2018. So we could get access to these services as well. The services offered are:

- Auto leasing and retail – which brings vehicle supplies and auto-financing resources plus sale, resale, and leasing services.

- Gas refueling – which offers gas services through scale- and expertise-based partnerships with gas stations.

- Autocare – which offers components and parts services and maintenance and repair services.

This is actually a common play for Internet companies. They take their core functions and offer them to the market, where they are just the largest customer. Amazon did this with Amazon Web Services. So has Ant Financial and JD Finance. JD Logistics is increasingly doing this with “retail as a service”. It’s a common strategy and it gets you even greater economies of scale in this function.

Reason 3: Xiaoju Could Become Its Own Platform. That’s Really Cool.

Xiaoju, now described as a service for Didi drivers and car owners, could become its own platform. It can become the connection between Chinese car owners (including Didi drivers) and a sea of businesses that serve and sell to them – such as gas stations, repair shops, car insurance, restaurants, leasing and so on. There are already +7,500 services and distributors on the Xiaoju platform.

And if there is one thing that is better than having a powerful platform business, it is having two of them. And even better than that is having two complementary platform businesses that strengthen each other. For example, Alibaba’s marketplace platform is complemented and strengthened by Ant Financial, which had a recent valuation of $150B. Didi’s car-owner service platform could similarly reinforce the ride-sharing platform. That’s awesome.

***

So there are some fascinating things happening with Didi on the driver-side. There seems to be no end to their cleverness. That’s it for Part 2.

In Part 3, I will dig into what I think are Didi’s most daring moves. These are in AI, autonomous vehciles and the Didi Alliance, which was announced in April 2018.

Thanks for reading, jeff

———

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.

Note: This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.