In Part 1 and Part 2, I laid out the development path of Bilibili. And how it has survived as a specialty video business.

My Prediction About Bilibili Was Wrong

I have argued that Bilibili has 4 problems:

- Low operating cash flow. They are not generating much.

- Slowing user growth. They have been shifting from MAU (which has slowed) to DAU. Focusing on growing the engagement and retention of existing users. Instead of adding new users.

- Facing much bigger rivals. Tencent, Kuaishou, ByteDance and others have twice their user numbers. And tons of cash. And tons of resources.

- Constantly changing technology. Which changes the dynamics of their business. And requires continually investment and product development.

And I had the following conclusions:

- Bilibili is likely too small to survive and thrive long-term in a consolidating video space with lots of giants. Revenue was only $3.1B in 2023.

- Bilibili needs to abandon its differentiated video strategy and go for mass market video. And it needs to double its user base.

I think video is becoming a ubiquitous utility. Virtually every big app has video now. This is how the situation looked to me.

But this raises interesting questions for Bilibili:

- Can Bilibili compete with video giants in the mass market?

- Can it grow without losing its identity in anime, comics and gaming (ACG)?

And it turns out I was pretty much wrong in conclusions. Well, sort of.

Bilibili did make a significant attempt to expand from its traditional home in longer-form video sharing (complemented with live streaming) to short video. It tried to recruit content creators in short video. And it basically went head-to-head with Douyin, Kuaishou and WeChat.

So that was like my prediction. They needed to go from specialty video to mass market.

But it now appears Bilibili has abandoned this and has gone back to its core video business. That longer-form video sharing plus live streaming.

I’m not sure why they did this. Maybe it was too difficult? Or too expensive?

But Bilibili appears to have retreated (in terms of focus) back to its core business model. Which is below.

Their core specialty video business has:

- Big user numbers. They are mostly from video sharing. Growth has slowed.

- Growing revenue but still small compared to the giants. Historically, revenue is from live streaming.

- Bad unit economics and operating cash flow.

I went through this before. Basically, their cost of revenue has remained high and gross margins (23% in 2020) have remained low. The cost of revenue for Live Streaming is a big part of this problem. Live streaming hosts (and their agencies) get a significant revenue share. Note: This “revenue share” is 55% of Bilibili’s cost of revenue (not % of its revenue).

This picture is something we see often in specialty businesses.

In order survive against the digital giants, these smaller businesses must focus on places where they can differentiate. Or where there is not much interest by the giants. And these locations don’t always have the most attractive profit pools. And they often have operating requirements that don’t have good unit economics. So, you target niche markets that the giants avoid. That is a good strategy for survival. But it often means you are dealing with more difficult unit economics.

That was what I was thinking about.

But I forgot there was another part of their business. Gaming. And that is where they had a big success recently.

Bilibili Found Big Success in Three Kingdoms

Over the years, Bilibili has expanded from video into related services.

- Mobile gaming. Basically, a video game digital distribution service and storefront. Think Steam in China. This got Bilibili a second but weaker platform business model. It reached 40% of revenue (with 1 game accounting for 10% of revenue).

- In 2018, they did a Tencent partnership (principal shareholder).

- In 2020, they had 43 exclusively distributed mobile games.

- In 2020, they did a deal with Sony in anime and mobile games for China.

- Original video content. Think Netflix but focused on anime. So, they created their own anime, variety shows, and documentaries. These are produced or jointly produced content. Or licensed content. In 2018-2020, they had 100 titles and a large anime library.

- Comic books and audio content. I’m not going to go into these smaller services. Maoer is their audio service. And then there are comics. These are both for ACG enthusiasts.

Bilibili has been creating a portfolio of services that complement its core offering and capture more of the interests of its core user demographic. That’s good digital strategy.

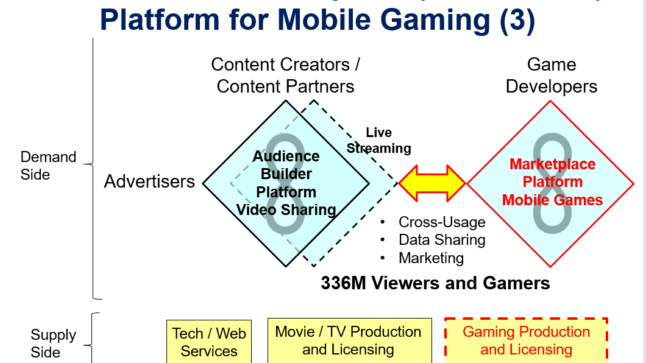

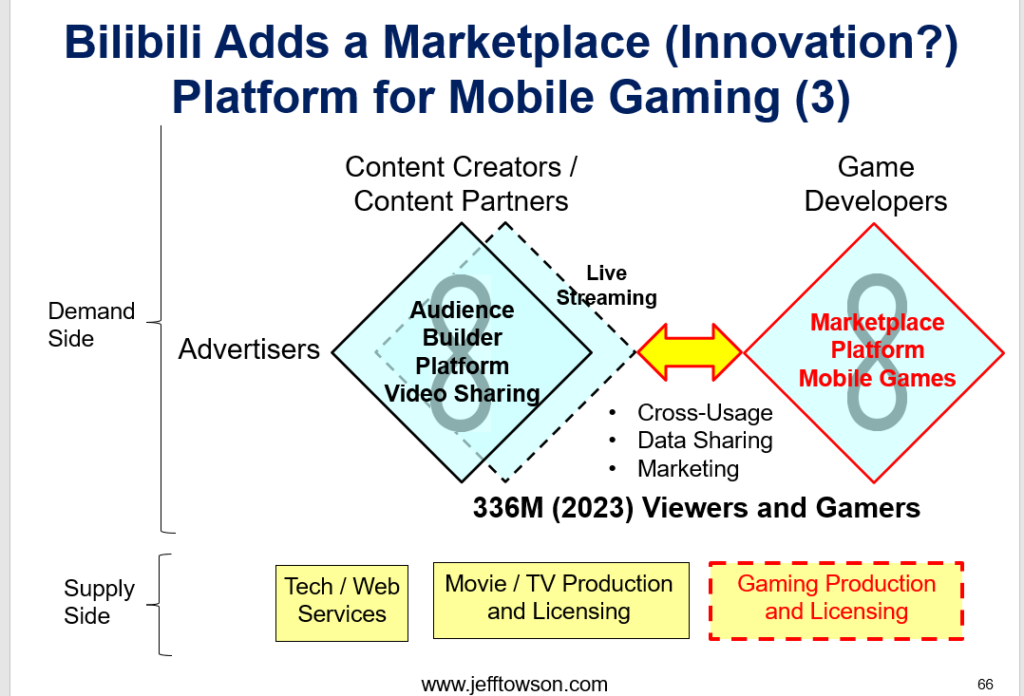

But mobile gaming is the most important of these. It creates a secondary platform. Which looks like this.

Bilibili has previously made significant money licensing some Japanese games and bringing them into China. For example, Fate / Grand Order was a big hit.

Today, they are experienced in both licensing games and developing their own games with their game studios. They have a business unit focused on mobile games (not triple A games). And they currently have 5-10 game studios (unclear to me) in China.

And in 2024, something surprising happened. One of their games, Three Kingdoms: Strategy of the Mighty, became a big hit. Like a big enough hit that stock analysts started changing their assessments. According to a Citigroup research report, Three Kingdoms ranked third in total iOS game revenue from June 13th to 19th.

I am not good at predicting which games are going to be blockbusters. But I do understand why certain games have better unit economics than others.

And Three Kingdoms is a community-social strategy game. That’s great. I really, really like these types of games.

Basically, you play with lots of other people with real-time elements. There are a lot of battle and competition games like this. In Three Kingdoms, players get to engage in wars with up to 10,000 players on the same map. There is lots of collaborating with other players, such as forming teams and even armies. And there are battles over time with other armies. Certain kingdoms emerge (with certain players ruling them) and they need to be defended over time.

For most people, Three Kingdoms is free to play. But there is lots of revenue coming from in game fees (such as getting weapons, skins, hiring soldiers, etc.). And you can become a king (which requires lots of spending) where you assemble a big army of soldiers (i.e., other players who have joined you). So, the ongoing army building and warfare looks like an arms race of in game spending. And those who want big power in the game probably need to spend a lot.

Net Net: I really like multi-player community games. They are much better than content games.

If you’re going to have a blockbuster hit, it’s much better to be in a community game. You didn’t have to spend lots of time and money creating elaborate adventures. You don’t have to do lots of storytelling, character development and world design. You just put the players on a map, set the rules, and let them interact (usually to fight).

Community games can also have network effects (the more players, the better it gets). They can have social communities, which can really increase player retention.

***

Bilibili now faces an interesting question.

- They have a successful specialty video business. But it is pretty mature. So, there isn’t a lot of opportunity for breakout growth.

- And now they had had big success in community-social gaming. And gaming offers more potential for the kind of growth Bilibili needs. That’s great.

- But gaming is unpredictable. It can be an unstable foundation.

But all the indications are that Bilibili is leaning into mobile gaming. The focus appears to have shifted from short video to gaming.

That’s my take.

Final Thought: Forget Strategy. Just Do What Works

I once had a former McKinsey partner give a talk in one of my classes at Peking University. He had left McKinsey and was then the CEO of a digital platform business in China. It was a successful but smaller specialty platform for recruiting.

I asked him how his strategy training at McKinsey helps him. And he basically said it doesn’t.

His said his business was just moving too fast. And he was just trying to stay alive quarter to quarter. So, he had no time for any strategy thinking. He would just throw stuff on the wall and see what sticks.

That’s how I think about Bilibili right now. Yes, I like their overall strategy. But right now, it’s more about trying lots of stuff and seeing what works. And then leaning aggressively into that. And right now, that means community-social gaming.

That’s a good approach.

But gaming is a tough business. It has blockbuster economics. These are great if you’ve got a hit game. But it’s really unpredictable over the longer term. I definitely like mobile gaming much more than triple A gaming. And I like community-social more than content. But it’s still tough a tough business.

And perhaps the combination of a stable and predictable video business with a hits-driven gaming business will work?

We’ll see. That’s it for Bilibili.

Cheers, Jeff

———

Related articles:

- When Microsoft’s Bundles Are Good vs. Bad for Customers and Markets (Tech Strategy)

- Microsoft’s 3 Big Upgrades to its 2 Platform Business Models (2 of 2) (Tech Strategy – Daily Article)

- What is Elon Musk’s Plan to 10x Twitter? (2 of 2) (Tech Strategy – Daily Article)

From the Concept Library, concepts for this article are:

- Gaming

- Audience Builder Platform

- Video: Specialty

From the Company Library, companies for this article are:

- Bilibili

Graphic by GenAI

———

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.