The hosts of the “All In Podcast” got into a pretty good debate about the EU antitrust charges against Microsoft. Which are for bundling Teams with Office.

It turned into a long discussion about the benefits vs. problems of bundling.

- When is it anti-competitive?

- When are bundles good for customers?

- Is this mostly about Microsoft’s Window monopoly?

You can listen to that podcast here. It is podcast (185), titled: “Presidential Debate Reaction, Biden Hot Swap?, Tech unemployment, OpenAI considers for-profit & more”. The Microsoft Discussion begins at 1 hour and 3 minutes.

***

I thought it was a debate by four really smart tech people who didn’t have a common vocabulary or framework for bundling. It sounded to me like each person was talking about something different.

So, I thought I would put my frameworks for bundling and Microsoft.

But, let me just jump to the “so what”. I think there are 4 points that matter here:

Point 1: Bundling can be a powerful short-term tactic to take market share. And sometimes to kill off a competitor.

Microsoft definitely used this Tactic.

Point 2: Bundling is also a powerful tool for creating value for customers over the long-term. And for beating competitors in a fair marketplace.

Point 3: Bundling is 10x more powerful in digital goods.

In a digitized and connected world, connected and bundled products will be the norm.

Point 4: Microsoft’s Bundles Are Far More Powerful Because They Piggyback Their Platform Businesses.

Bundling by Microsoft (whether as a short-term tactic or a long-term product strategy) is greatly amplified by their dominant business model.

A Quick Summary of the “All In” Discussion

They began their discussion with a tweet by Salesforce CEO Marc Benioff:

“Microsoft excels with bundling. It’s their not so secret weapon for dominating new markets: Office + Teams, Windows + Explorer, Azure + Visual Studio, 365 + OneDrive, and Xbox + Game Pass.”

Then David Sacks summarized his opinion on this. I’m paraphrasing (my words, not his). But I thought his argument was basically:

- Microsoft can respond any new breakthrough, innovative product (such as Slack) by doing a crappy clone version really quick. And then they can bundle that with their existing products.

- For customers, this is like getting the new product for free. Especially when it is bundled with a “must have” product like Office.

- A Microsoft bundle (perceived as or actually free) makes the stand-alone company non-viable. They lose market share. And then they end up dead, sold or merged (such as Slack’s sale to Salesforce).

- With the competitor gone, Microsoft can raise the prices of the bundle.

David said this tactic is similar to dumping. That the bundle is a tactic to drive out an existing competitor. Plus, it also keeps new entrants out, who face significant costs of entry.

David also said a big part of this is that Office is a product that every enterprise must have. It’s a monopoly.

He then recommended that all such products should be priced as a la carte products. And that the bundle should be that price? The goals is to prevent companies like Microsoft from using such bundles to dominate software markets. In this case, the enterprise software market.

I thought that was David’s main argument (as paraphrased by me).

Their discussion then went into some interesting questions about bundling and Microsoft:

- Aren’t bundles good for consumers? Isn’t giving customers something free (or discounted) a good thing?

- Is it really free? Or does it just appear that way because the true price is hidden or delayed? What if they raise the price later?

- What’s the difference here to other bundling?

- David Friedberg cited supermarkets, which have loss leaders like milk get people in the store.

- Adobe’s products are almost all software bundles. How are those different?

- What about when customers to have to buy the bundle just to get the one service they want?

- Doesn’t the iPhone do the same thing when it comes with free Notes, Clock and other apps?

Chamath described this as Microsoft going back to their old playbook.

“Microsoft has been bundling products to kill competitors for 40 years”

That’s a good quote.

A good discussion by smart guys. But there are definitely 3-4 different concepts here. Let me give you how I break it down. And how I got to my 4 points.

Point 1: Bundling Can Be a Powerful Short-Term Tactic to Take Market Share. And Sometimes to Kill Off a Competitor.

Microsoft definitely used this tactic.

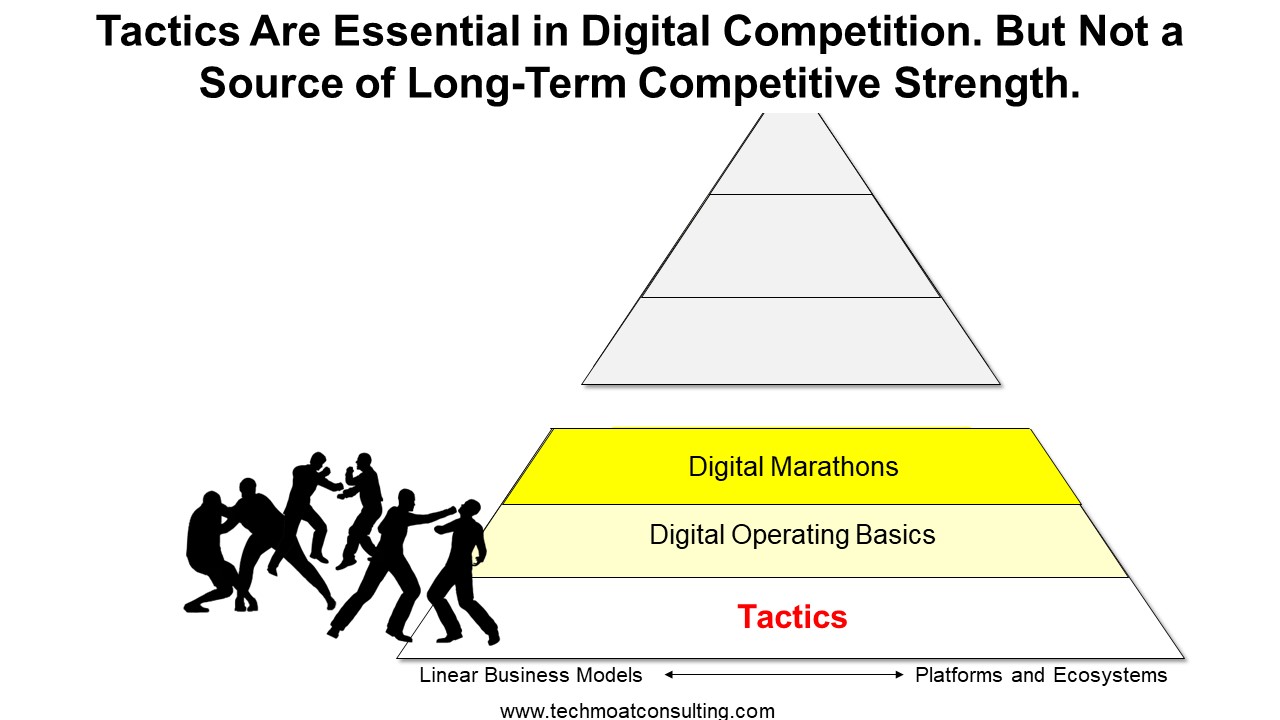

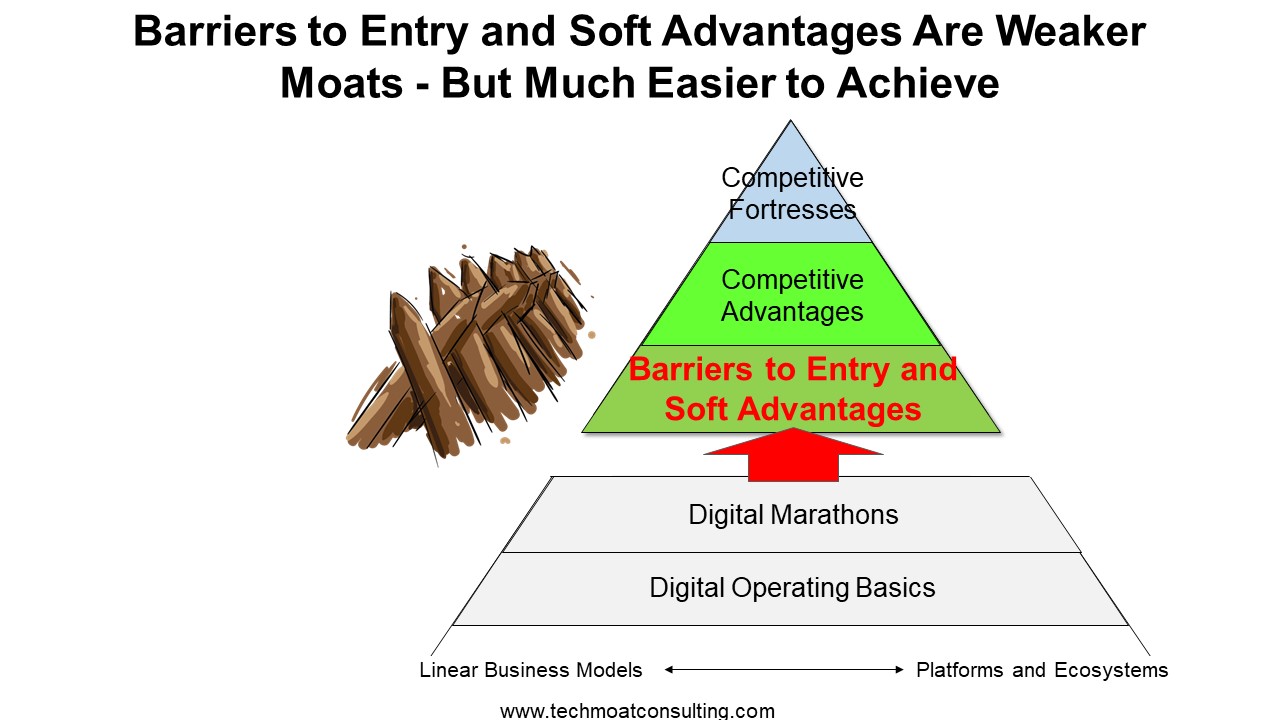

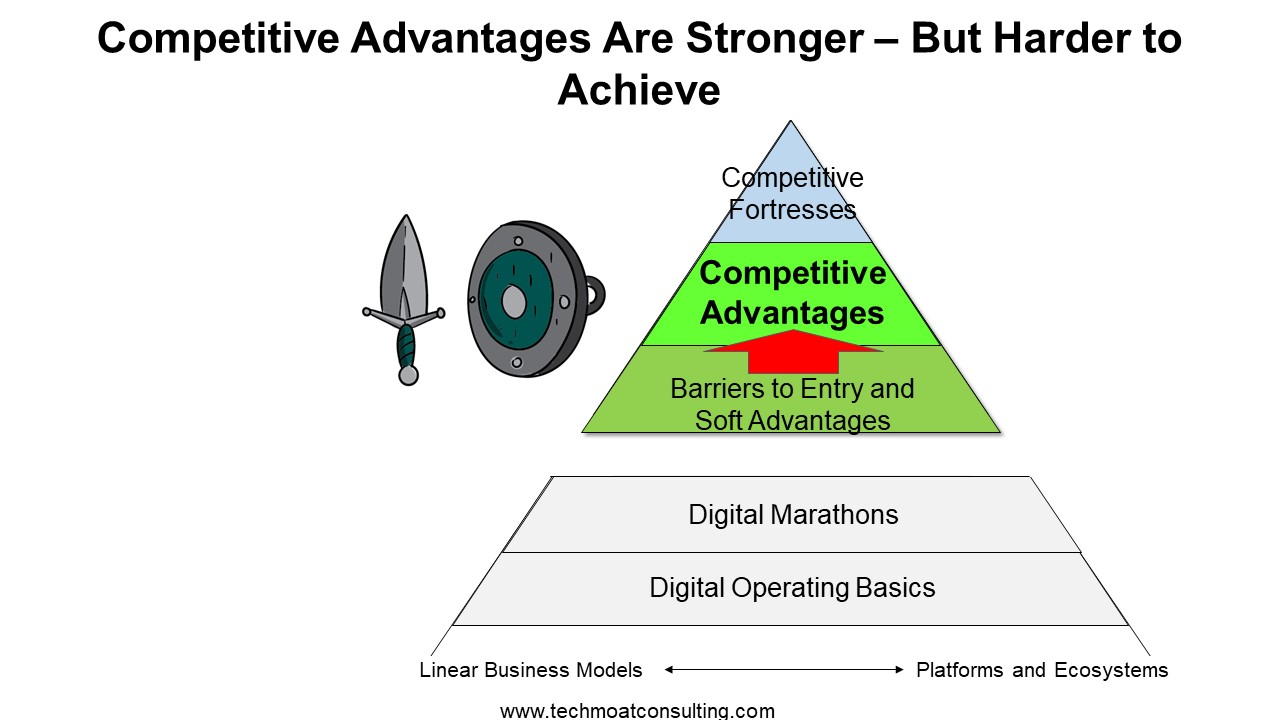

For those who use my Moats and Marathons frameworks, you know I put short-term Tactics at the bottom of the pyramid. They are an integral part of operating performance. Very important. But they don’t create longer-term competitive strength.

And there lots of tactics. But there are a couple of common ones in digital businesses that we can see. For example, Money Wars (T5) is a permanent member on the list.

In China, we see Money Wars all the time. You try to use capital or other resources to drive your competitor out of the market. It’s usually a short-term tactic. In new markets (like EVs in China), businesses use venture capital and other raised capital to subsidize their prices versus competitors. The lower prices get them market share and the biggest players can usually out raise and out subsidize the smaller ones.

In more mature businesses like manufacturing, we see companies adding lots of capacity (often with debt) and then selling below cost. They force everyone in the market to bleed cash. The smaller companies die first. The largest companies survive and then take the market. We call that “Last Man Standing”.

I think 50% of what David Sacks was talking about is a Money War, where resources are used as a short-term tactic to kill off a competitor. But instead of capital or manufacturing capacity, they are using bundling with their other products / services.

So, you bundle Teams with Office and basically give it away for free. Maybe you are just hiding the cost, so it only appears free. Or maybe you are selling it way below cost and just taking the financial loss.

But the intent is often to kill off a competitor. Or at least to take the market in an innovative, new product. Maybe you raise prices later? Maybe you just raise it to operating breakeven and focus on market share.

In the case of Slack, it merged with Salesforce. Com. So this short-term Money War tactic didn’t kill them off. But Microsoft definitely ended up with most of this market. And building a collaboration platform is a big part of their strategy. Teams is a bit part of that.

Point 2: Bundling Is Also a Powerful Tool for Creating Value for Customers over the Long-Term. And For Beating Competitors in a Fair Marketplace.

I like bundling. I think it creates tremendous value for both buyers and sellers.

And while consumers like to complain about having to pay for +280 channels they never watch, the truth is cable packages provide big economic benefits for both sellers and buyers (it’s all about capturing deadweight loss). This is part of how Spotify’s music bundle beat iTunes’s a la carte menu. They bundled hundreds of thousands of songs for one price. And a bundle usually beats an a la carte offering.

Bundling is usually a win-win for both parties. Dixon Chris wrote a good article showing the economics of this.

- How bundling benefits sellers and buyers (Chris Dixon, 2012)

I think this is what David Friedberg was arguing on the podcast. He was pointing out where bundling products is clearly good for customers. Such as how supermarkets might sell milk and bread at a loss to get people into the store. You could argue that this is a bundle at the store level. I would call that more of a product portfolio approach.

But combining products and then selling the bundle at one price, lets you cross-subsidize. And that is a powerful lever when creating products for customers. Bundles can be a structural advantage that one business has and that another cannot replicate.

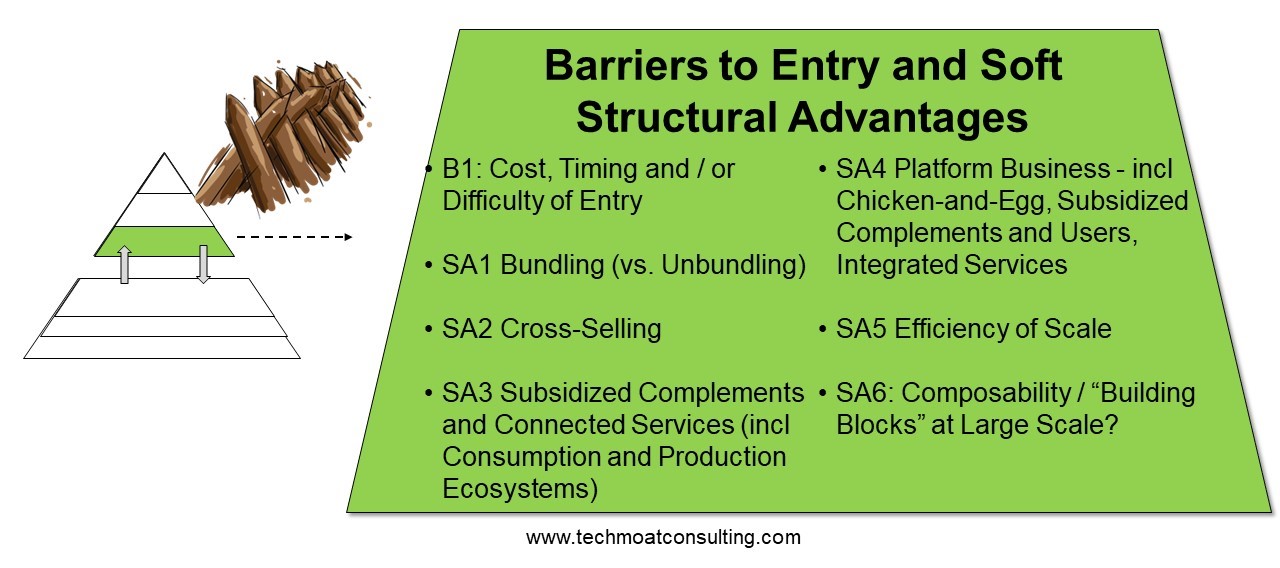

In my frameworks, I put Bundling (S1) as a Soft Advantage. It’s not as powerful as barriers to entry or competitive advantages. But it has real competitive power that can last long-term. For example, the Adobe bundle has been beating competitors for +30 years.

Bundling physical products is common and not a big deal. You can buy shampoo and conditioner at the drug store as two items at two prices. Or you can buy them wrapped together as one item at one price. You can see this type of bundling of physical products in every corner store.

Bundling of services is more common and more useful. A barber might cut your hair and trim your beard separately. Or offer both for one price. Services are generally easier to put together in combinations. We see this in B2B all the time, with consulting firms and brokers tiering and bundling their services. A real estate consulting firm may offer a client a market study at a low price. And then try to bundle, or more likely cross-sell more lucrative brokerage services.

None of this is terribly interesting. But bundling gets a lot more interesting once you move to digital goods. It turns out it is super easy and powerful to bundle digital goods, services, and information. And you can do it at a massive scale.

Point 3: Bundling is 10x More Powerful in Digital Goods. In a Digitized and Connected World, Connected and Bundled Products Will be the Norm.

Digital economics are very strange.

Products and services made of ones and zeroes on screens have completely different economics. Reproduction costs drop to zero. Stuff starts becoming free. Scalability increases dramatically (and can be surprisingly cheap). And some old, obscure ideas in economics start to become important again.

Such as bundling.

Think about the following:

- Digital goods are really easy to bundle within apps and on websites. It’s often just adding another link or photo. As soon as you click on a book on Amazon, it will immediately offer you a bundle with that book and another 1-2 books.

- Digital goods can be bundled at a large scale. For example, Netflix is a bundle of tens of thousands of mostly bad movies and shows sold for one price. No traditional product or service company can do anything like this.

- Digital economics usually means that the cost of bundling additional digital goods is zero. These are non-rival goods with low or zero marginal production costs. So, not only is bundling other digital products really easy, but you can often do it for free. Why not just offer three more digital books to your customer as a bundle? It costs you nothing if you are the author.

- Bundling (and cross-selling) digital goods means you can create big customer surpluses. It often costs nothing to add digital goods to a bundle. And instead of charging for them, you just give them away for free within a bundle. That creates a big customer surplus, which makes customers happy.

Compare all that to physical products or apparel. No department store offers bundles of +300 products for one price. But every cable company offers +300 channels for one price.

Bundles are a good customer offering. But they also have interesting competitive strengths, which is why bundling is on my list of soft advantages. They can limit competition and create a barrier to entry.

In the early 1980s, Microsoft built both Word and Excel in-house. They were originally for Macintosh but were later released on Windows. Word grew rapidly but Excel struggled against Lotus 1-2-3.

PowerPoint was created from 1984 to 1987 by Robert Gaskins and Dennis Austin at Forethought, Inc. It was released in 1987 and Microsoft acquired it for about $14 million three months later.

Each of these products sold for about $500 in the market. But then Bill Gates bundled all three into Microsoft Office, which was priced at about $1,000. He basically gave away one product for free, which was easy since the marginal reproduction cost of digital goods you own is zero.

What’s more, Microsoft Office was an integrated digital bundle. I like digital bundles, especially when they have recurring revenue. But I like integrated bundles even more. This is when the functionality of each product is tied to the functionality of the others. So, each product works better when you own other products.

The competitors to Microsoft Office disappeared. Most were unable to go from offering one to three products. It was a gangster competitive move in terms of value provided to customers.

And the bundle created a big barrier to entry. Any company taking on Microsoft Office would need to offer three products from day one to be viable. Bundling raised the barrier to entry. Plus, it was sold with Microsoft Windows and pre-loaded on PCs. More on that below.

Media subscriptions like Netflix are another type of bundling that can get you a big barrier. Yes, Netflix has lots of competitive strengths which are often talked about (usually economies of scale in both content and purchasing power). But people always forget the barrier to entry their big content bundle creates. Before you can offer a competing product to Netflix, you need a library of thousands, if not tens of thousands, of shows and movies. Even Amazon and Disney+ are struggling to assemble a big enough content bundle to be competitive with Netflix. And most legacy media companies, such as CBS and NBC, are not even close to overcoming this barrier. Note: Bundling works best in preference-based goods like media. It doesn’t work as well in commodities. However, media bundles usually aren’t usually integrated.

What Microsoft is doing is building digital bundles in enterprise software. Slack is just one of many. It’s a really powerful approach, with big structural advantages.

And this is not a short-term tactic. They are offering a superior product portfolio with a powerful business model built for the last long-term. That is what businesses are supposed to do.

Point 4: Microsoft’s Bundles Are Far More Powerful Because They Piggyback Their Platform Businesses.

Ok. That was a discussion about bundling. And most of that is true for most companies. Think anti-virus software and Adobe.

But Microsoft is different.

Bundling by Microsoft (whether as a short-term tactic or a long-term product strategy) is greatly amplified by their dominant business model.

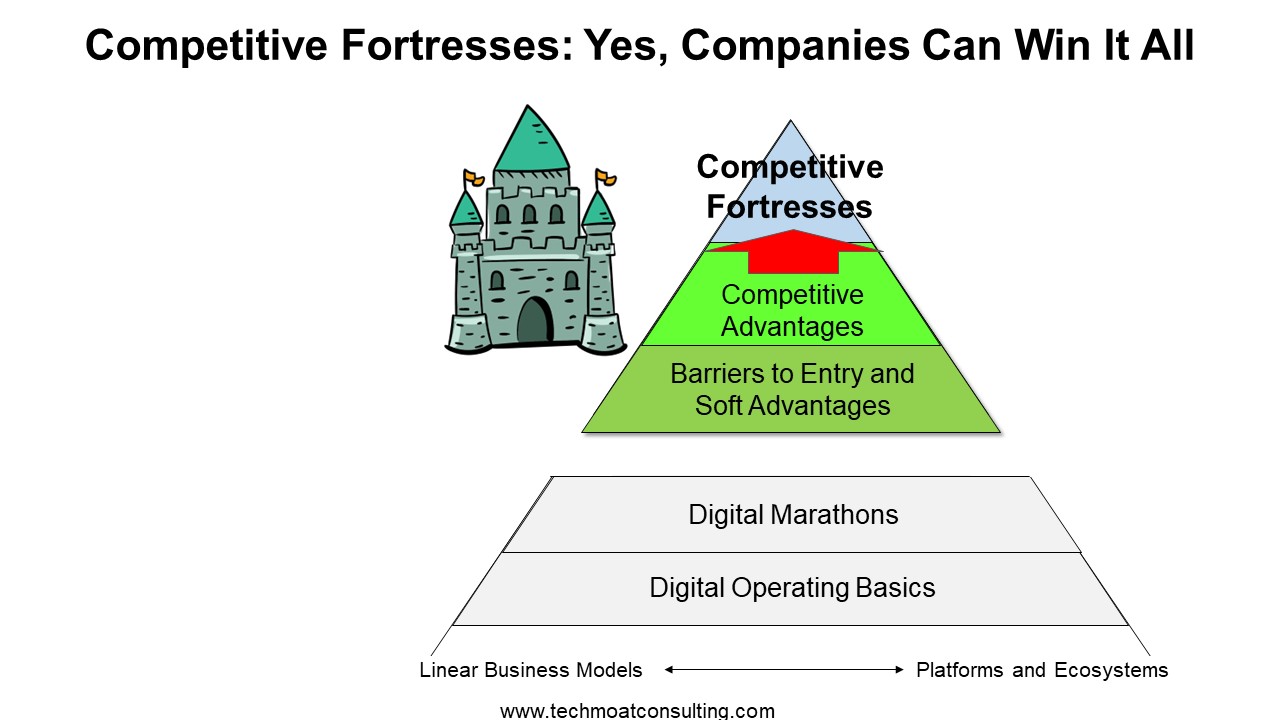

Microsoft has competitive advantages and structural advantages that very few companies have. It is a truly dominant business model without bundling. In fact, you can view Microsoft doing bundling mostly as an extension of its dominant business model. Not as a separate strategy or tactic.

I described the competitive strengths of Microsoft business model in:

I won’t repeat that article (you’re welcome). Here’s a quick summary below. If this is not your interest, just skip to the conclusions at the end.

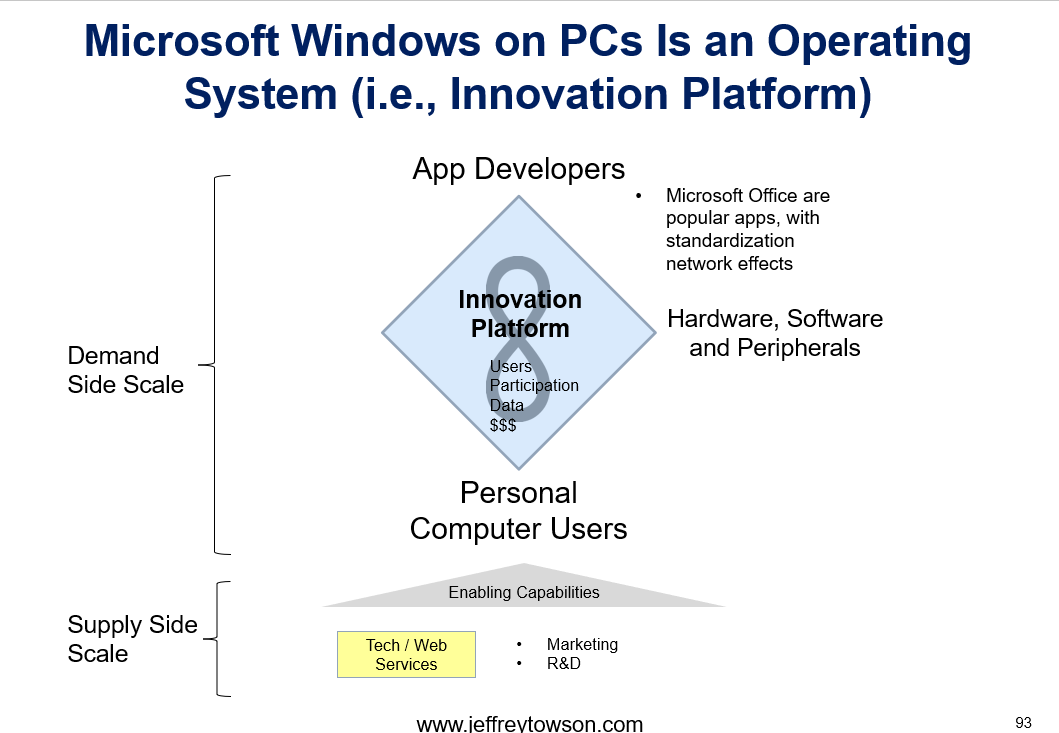

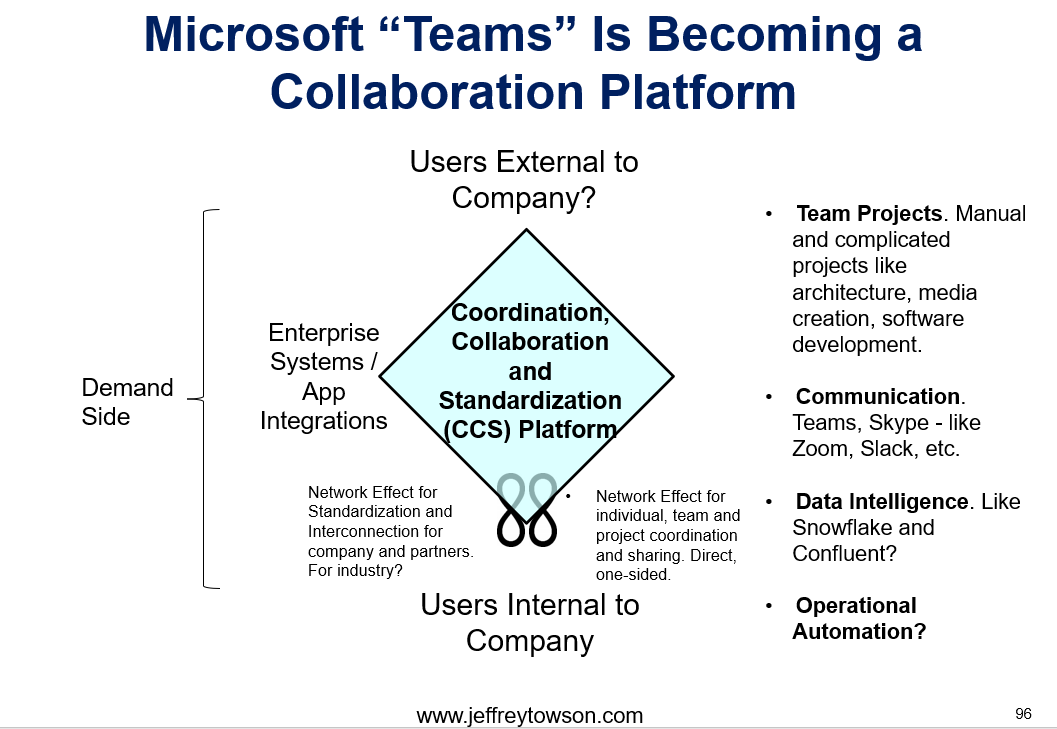

In terms of business models, Microsoft’s operating system is a global innovation platform with powerful indirect network effects.

And on top of that sits Microsoft Office, which has standardization network effects. This combination of products has been an almost unbeatable business model for +30 years (in its core markets).

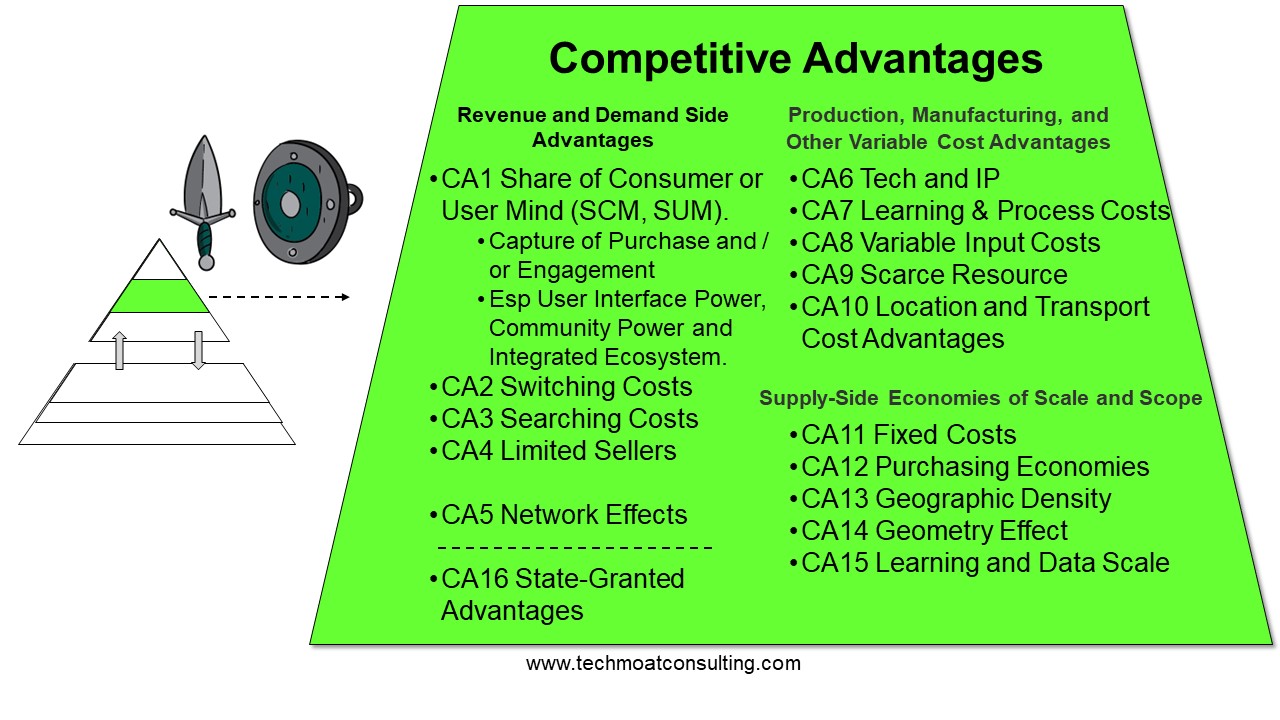

Here’s my standard competitive advantages list.

I view the launch of Teams as part of their evolution into a coordination platform business model.

I expect this to result in two complementary platform business models. An innovation and a collaboration platform. And if there is one business model I love most, it’s complementary platforms.

Ok. Those are my 4 points.

My Conclusions on the EU Antitrust Charges

I think the problems the EU needs to address are Point 1 and Point 4.

Point 1: Bundling Can Be a Powerful Short-Term Tactic to Take Market Share. And Sometimes to Kill Off a Competitor.

Microsoft has a long history of this. This should not be allowed.

I am ok with Money Wars in general. They can be a pretty good tactic. Although often it is just irrational behavior. But they are short-term and self-correcting. Watch for lots of Chinese EV companies to close this year.

But dominant companies should not use money wars or other tactics to take market share from small innovators by brute force. This is why we have regulation. To step in when a company is too powerful for the marketplace.

Bundling and similar tactics in this case appear anti-competitive. It is definitely bad for innovation. It’s bad for the market. And it hurts customers over the longer-term.

Point 4: Microsoft’s Bundles Are Far More Powerful Because They Piggyback Their Platform Businesses.

This is the real problem.

Microsoft’s business model is too powerful. Their Windows and other platform businesses are like super predators in the business ecosystem. If they really want a market, there is really not much you can do to stop them (most of the time).

In this case, Microsoft is using bundling against a small, innovative company. But there are lots of other tactics they could have used to leverage their dominant business model against such a smaller business. I don’t think this story is mostly about bundling. That was just their tactic this time.

It’s good the EU is getting involved. The Chinese government has been effective at putting limits on the behavior of the biggest tech companies (versus competitors and suppliers).

At the same time, the EU should not impact Points 2 and 3. These need to be protected (especially from government).

Point 2: Bundling Is a Powerful Tool for Creating Value for Customers over the Long-Term. And For Beating Competitors in a Fair Marketplace.

As mentioned, Bundling is awesome. It can create tremendous value for customers. It makes the marketplace vibrant and healthy.

Point 3: Bundling is 10x More Powerful in Digital Goods.

Bundling has been around forever. Especially in services.

But nobody really talked about it much until recently. It wasn’t that big a deal until digital goods and services emerged (software, books, mp3, SaaS, etc.).

In a digitized and connected world, connected and bundled products will be the norm. That’s all bundles really are. They are connections. That seems central to a connected future.

***

Ok. That’s it for today.

Cheers from Indonesia,

Jeff

——–

Related articles:

- Microsoft’s 3 Big Upgrades to its 2 Platform Business Models (2 of 2) (Tech Strategy – Daily Article)

- What is Elon Musk’s Plan to 10x Twitter? (2 of 2) (Tech Strategy – Daily Article)

From the Concept Library, concepts for this article are:

- Innovation Platform

- Coordination (CCS) Platform

- Bundling

- Money War

From the Company Library, companies for this article are:

- Microsoft: Teams

- Salesforce: Slack

Photo by Ed Hardie on Unsplash

———

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.