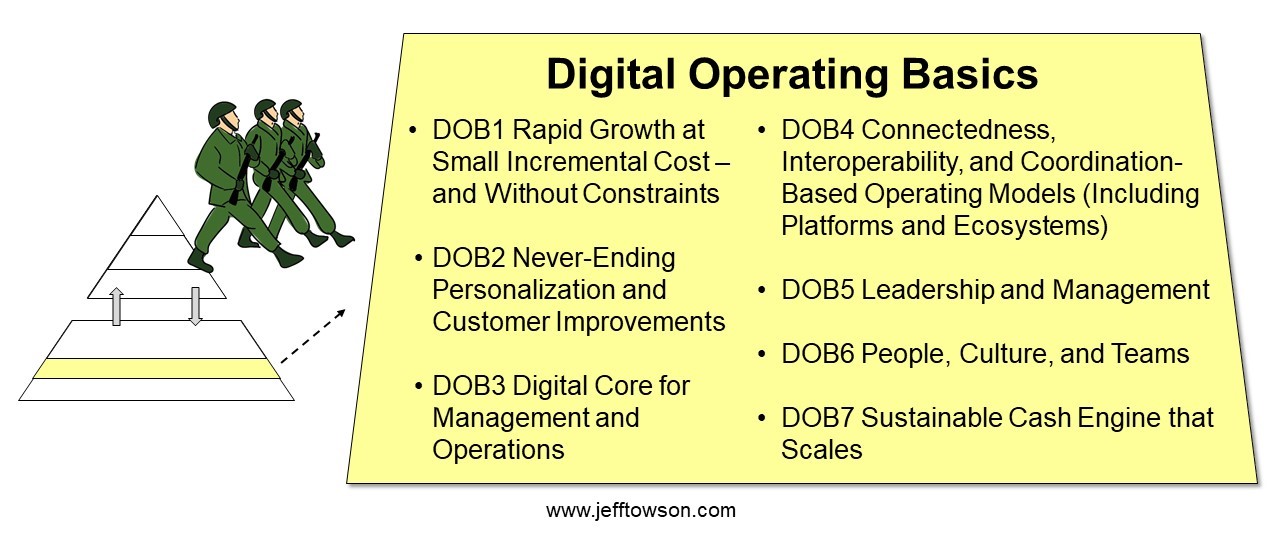

In Part 1, I argued that Twitter 1.0 is about supercharging operating performance. That’s what I expect to happen in the 6 months. And it looks to me like Elon is making big changes in the Digital Operating Basics. Specifically, DOB1, DOB2, DOB5, DOB6, and DOB7.

See Part 1 for details. I do like that this framework captures most of what he has been talking about so far.

Which brings me to Twitter 2.0 (and 3.0). If Twitter 1.0 is a better run version of the current product, then Twitter 2.0 and 3.0 are about what this could become. What could be a 10x improvement in the product and company valuation? And Elon has given some pretty strong indications about the bigger opportunities he is likely going after.

From his recent town hall Q&A:

“I think there’s a lot that is very, very obvious that we need to do. Like video content and compensating content creators in order to get content on Twitter…That’s a no-brainer. High priority. Improving search: high priority.”

“We are obviously going to add payments capability to Twitter. That’s also a high priority.”

Based on his comments, here is what I think Twitter 2.0 will be.

Twitter 2.0: Complementary Payment and Audience-Builder Platforms

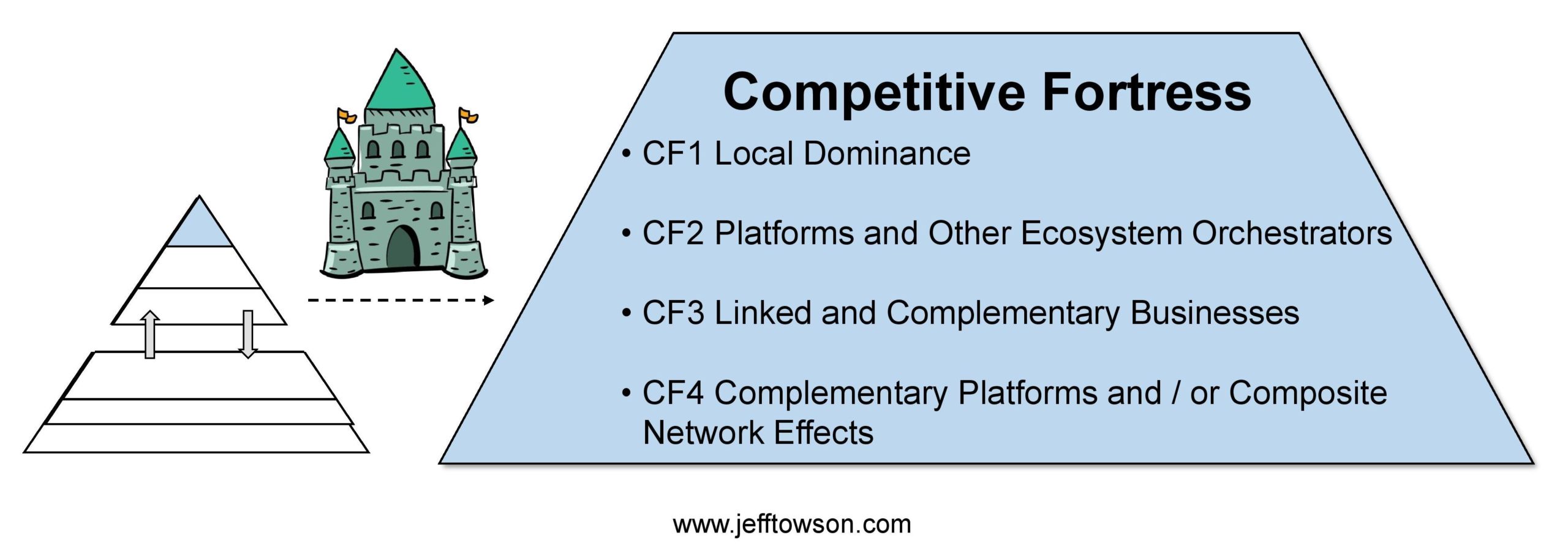

Complementary platforms is the top of my list when it comes to powerful business models. I describe it as a Level 1: Competitive Fortress.

One global platform is great. Two complementary is better.

Build a Payment Platform – and Maybe a Financial Services Super-App

Payments is the big move Elon has been talking about the most in terms of enthusiasm and details. His language is pretty similar to that by WeChat, which argued back in 2014 you could send money between people as easy as you send information.

“I think there’s this transformative opportunity in payments. And payments really are just the exchange of information. From an information standpoint, not a huge difference between, say, just sending a direct message and sending a payment. They are basically the same thing. In principle, you can use a direct messaging stack for payments. And so that’s definitely a direction we’re going to go in, enabling people on Twitter to able to send money anywhere in the world instantly and in real-time. We just want to make it as useful as possible.”

And this makes sense as he was a founder of PayPal. He has been citing a business plan he wrote back in 2000, but which was never fully executed.

“The full answer to the payment story is complicated. PayPal, as it’s known today, is a subset of a feature roadmap that we wrote in July of 2000. Roughly speaking, you want to basically populate a balance for every verified Twitter user. Give them some amount of money, like ten bucks or something, that they can send anywhere in the system. We need money transfer licenses for that, which we’ve applied for.”

So that sounds like a payment platform with a digital wallet. And all the regulatory licenses and KYC activities.

“Then, in order to get money out of the system in parallel, we establish a high-yield money market account so that having a Twitter balance is the highest-yield thing that you can do…”

“Then you attach a debit card to the Twitter account so that you have backwards compatibility into the payments system because not everyone will accept Twitter. So if have above a certain balance, you automatically send people a debit card. You want backwards compatibility to the existing financial infrastructure.”

That part sounds a lot more like WeChat Pay and Alipay, which rapidly expanded from C2C payments and digital wallets. They layered services on top of the payment network. Alipay famous launched a money market fund (Yue Bao), which became the world’s largest very rapidly.

So, it’ a payment platform with network effects – that then adds credit and other financial services. First checking and savings accounts. Then wealth management products. Which looks like this:

That is pretty great. And you start to wonder if there is a massive opportunity here. What if this is a global payment platform plus a digital bank? That’s what Ant Financial was building pre-IPO. That is a massive opportunity.

Employee: “It sounds like more of a bank. Do you also foresee us loaning?”

Musk: “Well, if you want to provide a comprehensive service to people, then you can’t be missing key elements.”

Ok. On to the audience-builder platform.

Build a Multi-Media Audience Builder Platform, Starting with Short Video (i.e., Copy TikTok)

Elon has been talking a lot about TikTok and Vine (Twitter’s old 6 second video app). In particular, about he has been talking about:

- How to get users to spend more time online (like they do on TikTok).

- How to compensate content creators and attract them to post on Twitter.

- How to stop traffic being sent over to YouTube.

He said:

“Let’s just get a bunch of content creators that we think are cool on YouTube and say, “Hey, would you consider putting your content on Twitter, and we’ll pay you 10 percent more than YouTube and see how it goes?”

“right now, content creators cannot post the length of video that they would like to post and they cannot monetize it, which means they cannot pay the bills. These are not like super complicated things. They’re pretty basic. We’re not trying to put YouTube out of business, but I’m just saying, do we really need to give YouTube a whole bunch of free traffic? Maybe not. So at least give creators the option if they would like to put their video on Twitter and earn the same amount as they would on, or maybe slightly more, on YouTube or TikTok or whatever the case may be.”

“we also want to expand to be sort of a multimedia platform. We are that to some degree. We are the strongest when it comes to anything that’s writing and real time. But we also want to have that for pictures and video and not in a way that copies what others do.”

“do we have compelling shortform video as opposed to exactly what Vine was? It’s not “let’s copy Vine from whichever year with ancient code.” It’s really just, how do we have compelling shortform video, just compelling content in general? I was actually flipping through the Twitter video where, once you go into kind of a full-screen video mode, you can just start flipping through videos. It’s actually not bad. I was like, “Okay, well, it’s pretty good.” I think building on that makes a ton of sense.”

I think he is talking about an audience-builder, just like YouTube, TikTok, Kuaishou, and Instagram. And like short video services that have been launched by Facebook and WeChat.

Audience-builders are great platform business models. They can really take advantage of long-tail content. And videos get some of the highest user engagement. The average TikTok users spends 90 minute per day on the app. That is why WeChat creator Allen Zhang has said that short video (and live streaming) are the future of WeChat. It’s the most powerful service for getting engagement.

So, you add that to the payment platform and you get two complementary platforms:

- Payment Platform

- Video + Text Audience Builder

That is Twitter 2.0 in my opinion. I expect to see this in the next year. That is a 10x opportunity. And unlike Twitter 1.0, which was about operating performance, Twitter 2.0 is about big changes at the structural level.

***

Ok. Now I’m going to get more speculative. What do I think he might do that he has not discussed yet?

Twitter 3.0: Watch for Mini-Programs, Mini-Games and Search.

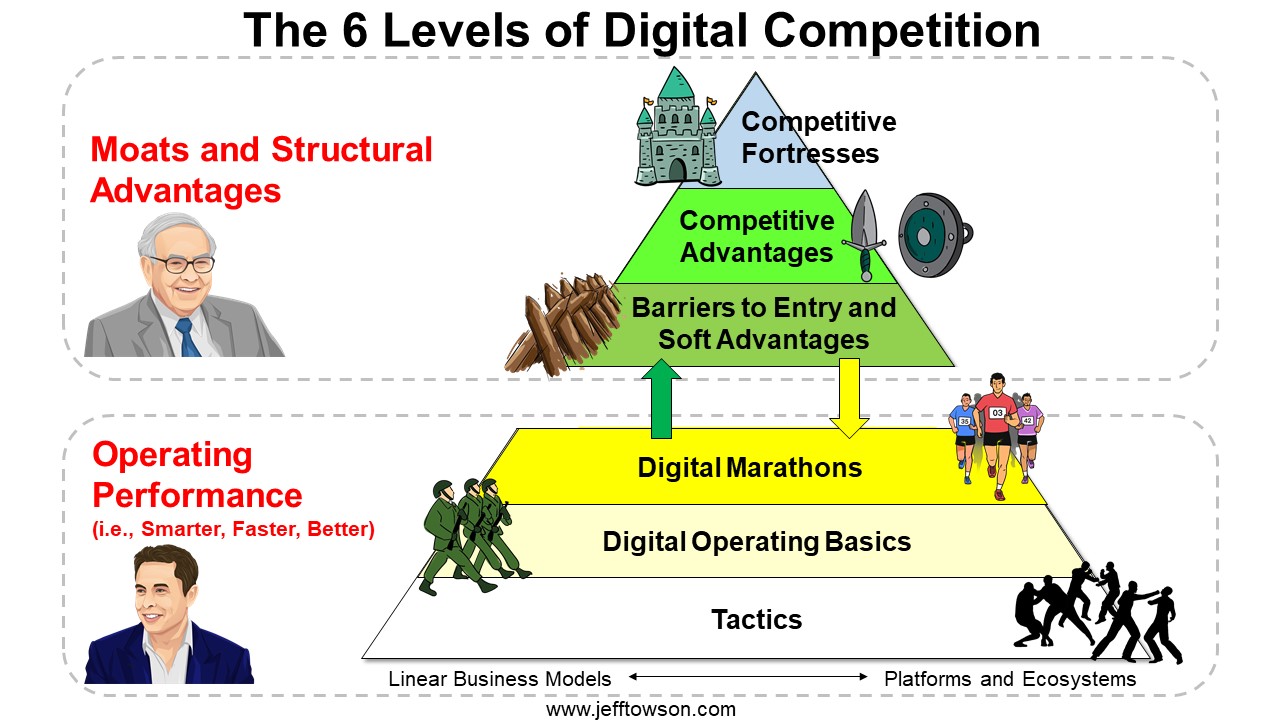

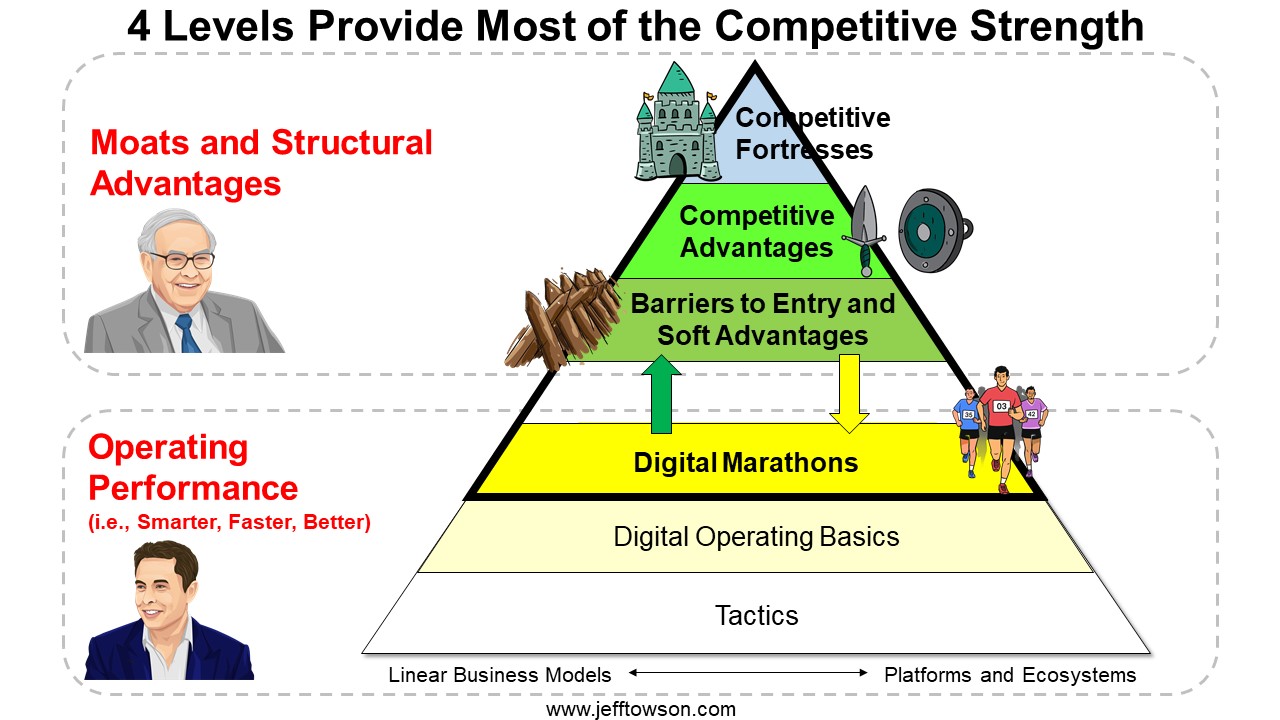

I have argued that most competitive strengths come from Moats and Marathons.

So, below the surface, I think Twitter is going to be running two digital marathons:

- S – Hyper-Scale and/or Hyper-Growth

- E – Ecosystem / Platform Orchestration

That is different than Tesla and SpaceX, where he is doing Sustained Innovation. At Twitter, he is not doing technological breakthroughs. It’s going to be about orchestrating an ecosystem that everyone else lives in. And trying to get it to global scale. If he pulls far enough ahead in these two marathons, it will make Twitter untouchable in terms of its operating performance.

And I think Twitter will likely target (or at least consider) two other big strategic opportunities. These are also 10x opportunities. And this will mostly be a copy of WeChat.

First, Twitter will move into ecommerce by launching Mini-Programs.

If you have users, engagement, and payment in your ecosystem, it is natural to help users buy things. That is what Facebook did with Marketplace (badly). It is why TikTok is launching Shop. And it is why WeChat launched mini-programs, which let hundreds of thousands of companies create small versions of their apps that exist within WeChat. That is how WeChat went from a messenger (with payment) to the #3 ecommerce company in China in about 5 years. GMV through WeChat was $120B in 2019 and then $247B in 2020.

“Employee: How can we improve the conversion rate by making the platform more e-commerce friendly?

Musk: You mean by enabling people to buy things?

Employee: Yeah.

Musk: Well, that goes hand-in-hand with payments. If you have a balance on Twitter or you have basically money in your Twitter account, then it’s actually very easy to buy things. So that’s a natural outgrowth of having an effective payment system is making it easy to buy stuff.”

I think there’s tremendous untapped opportunity”

You can also do mini-games, which is pretty similar to mini-programs. Gaming companies create mini-versions of their games that run within WeChat. These can get both revenue and engagement.

And that tees up Search, which is what WeChat is currently focused on. The problem with smartphones is you can’t search across all the data located within all the apps. This has been a huge limitation for Baidu Search in China. But if all the apps also have mini-programs that run within WeChat, the company can then search everything. In fact, it becomes the only company that can search everything on a smartphone.

Search would be a natural next step after mini-programs. And search is also a fantastic business. Twitter 3.0 could 2 more complementary platforms. One for search and one for ecommerce. That would be huge.

Final Point: Just Build Great Stuff

I like to think about strategy. But Elon is clearly mostly focused on just making great products. Everything else (including all the strategy stuff) follows from that.

“I think we we don’t want to get overly focused on metrics. It’s helpful to see these metrics as sanity checks. But if you’re over-optimized on a metric, then you end up being just like a foolish AI. You pursue a number without common sense. What actually matters is are we making the product amazing? If you make the product amazing, people will use it.”

***

That’s it. I hope that was helpful. We’ll see what happens.

Cheers, jeff

——

From the Concept Library, concepts for this article are:

- Payment Platform

- Audience-Builder Platform

- S – Hyper-Scale and/or Hyper-Growth

- E – Ecosystem / Platform Orchestration

- Social media

From the Company Library, companies for this article are:

Photo by Brett Jordan on Unsplash

———-