In Part 1, I went through the basics of Insta360.

As I am writing this, Insta360 is reporting pretty fast growth rates. According to their 2025 IPO Prospectus, their 2022–2024 compound annual growth rate (CAGR) was 57–65%.

Here are the key revenue figures (in USD):

- 2022: $287M

- 2023: $512M (YoY growth of 78%)

- 2024: $783M (YoY growth of 53%)

Gross margin (pre-IPO) was 51%.

Compare that to GoPro’s revenue (in USD):

- 2022: $1.09B

- 2023: $1.01B (YoY decline of 8%)

- 2024: $801M (YoY decline of 20%)

GoPro’s gross margin (2024) was 33%.

We can’t really compare to DJI (private, a mostly different business). But it’s worth noting the difference in size.

- DJI 2024 revenue of (likely) $11.2B. This includes drones and their expansion into action cameras. It’s about 10x the size of GoPro and Insta360 by revenue.

- Estimates of strong YoY growth in recent years, maybe 35% in 2024.

So, what is going on?

How is Insta360 putting up these types of growth and margin numbers?

- Beating the action camera incumbent.

- Competing (somewhat) against a much larger (and mostly drone-focused) rival.

That’s a good strategy question.

This article is my best guess at the answer.

All these companies compete on the frontier of consumer technology and electronics. These are mostly technology products. And they are on the frontier of changing capabilities. Some (like drones) more than others.

In this business, there are few big competitive advantages. In more basic consumer electronics (remote control toys), there are few beyond basic scale. In more advanced technology (drones), there can be intellectual property and maybe switching costs.

But for the most part, this is a game of never-ending game of innovation and agile management. You have to constantly create new products / solutions / features that:

- Create new waves of revenue growth

- Eliminate competition (by staying ahead of their capabilities)

- Enable premium pricing

That’s how you get high growth and high gross margins we see in Insta360.

But tech product categories mature quickly. Most things get copied. And eventually growth stalls and margins decrease.

Unless you are constantly moving against new frontier tech categories. you always have to be creating the next innovation and breakthrough That’s what DJI and Insta360 are doing. GoPro, in contrast, tried and failed to enter the drone market. And their 360 cameras are struggling.

In this never-ending innovation race, management quality and team culture are what separate the front of the pack from the rest. That’s what I was looking for when I visited.

I was also curious how Insta360 described its strategy. They call it “Solving the Unsolvable”.

The Insta360 Strategy

In the slides I saw, Insta360 described its strategy as three linked activities:

Step 1: Solve Users’ Unmet Need

Their original 360 camera was a solution to a long-standing unmet creator need. How can you stitch together photos and videos into one composite 360 image or video. And how can you make it easily useable by consumers?

JK’s solution was a combination of hardware and software innovation. Specifically, it was combining their dual fisheye lens with flow state stabilization.

This approach still appears to be the center of their strategy. To identify unmet needs they can solve with breakthrough technology.

What’s interesting about their 360 camera is that they also created a better action camera. They shifted the footage from a 1st person POV to a 3rd person POV. Suddenly, you didn’t need to strap action cameras on your head, chest and motorcycle to get all the views. You just needed to hold on 360 cameras. And it could give you any view you wanted, most of which are 3rd person POV.

Step 2: Get Product-Market-Fit (PMF)

Creating a new solution to an unmet need only works if you can get adoption. There are lots of great solutions in the world that are still sitting on shelves.

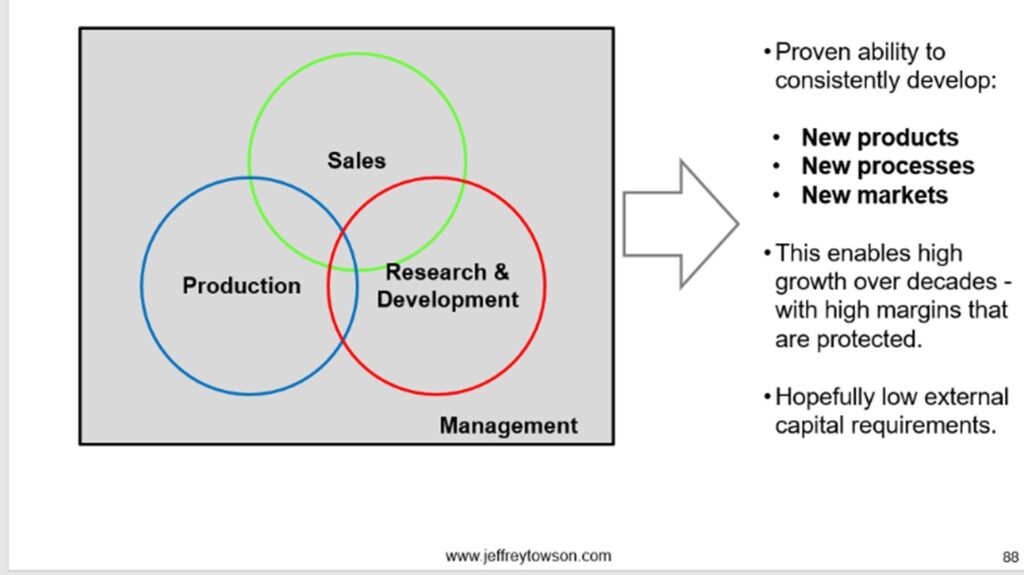

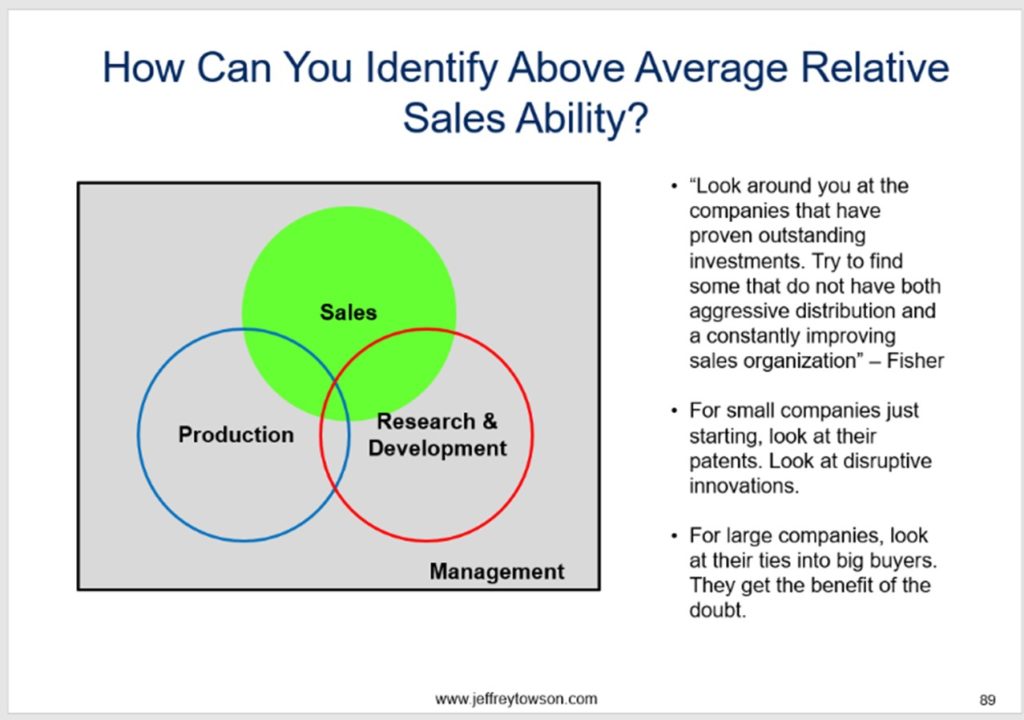

Warren Buffett mentor Philip Graham actually laid out a good framework for this back in the 1950’s. When he was looking at technology companies (Hewlett Packard and Motorola), he would look for both superior R&D capabilities and superior sales capabilities.

Here was his framework for identifying such companies.

Step 3: Rapidly and Continuously Innovate on the Frontier of Technology

Insta360 talks about staying on the edge of technology and creating innovative solutions. But it’s not enough to have a breakthrough product. You need to keep innovating and improving it. Rapidly and relentlessly.

For Insta360 (and for many Shenzhen-based companies) that means ongoing hardware and software innovation.

- For hardware, Insta360 has innovations like their triple AI chip, invisible selfie stick, accessory ecosystem, x5 twist to shoot, replacement lens kit and 1/1.28” sensors.

- For software, their innovations include the Instaframe, shot lab, and AI Highlights. A lot of their strength is in stitching and stabilization.

- Now they are innovating in GenAI. Their cameras have 40-50 AI templates that you can use to instantly change your content, such as changing the sky and adding animations. They are increasingly adding GenAI templates.

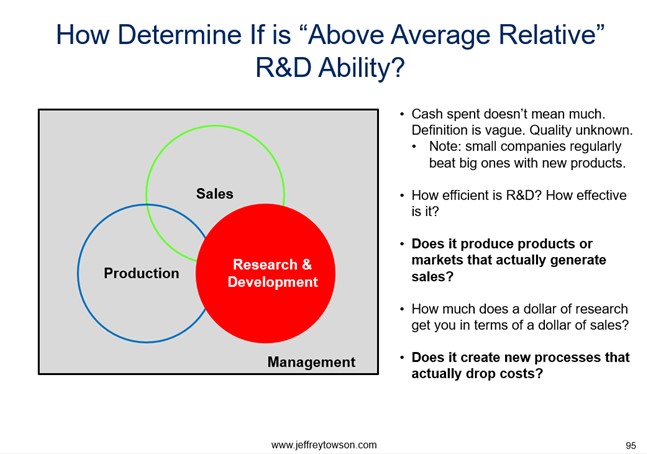

I mentioned that 50% of their staff are in R&D. But the trick with R&D is that performance is not the same as headcount or money spent. Small teams often outperform larger ones. Here is Phil Fisher’s framework for assessing R&D.

***

Those three linked activities are how I saw their strategy described. Or at least that’s my interpretation of it.

Step 1: Solve Users’ Unmet Need

Step 2: Get Product-Market-Fit (PMF)

Step 3: Rapidly and Continuously Innovate on the Frontier of Technology

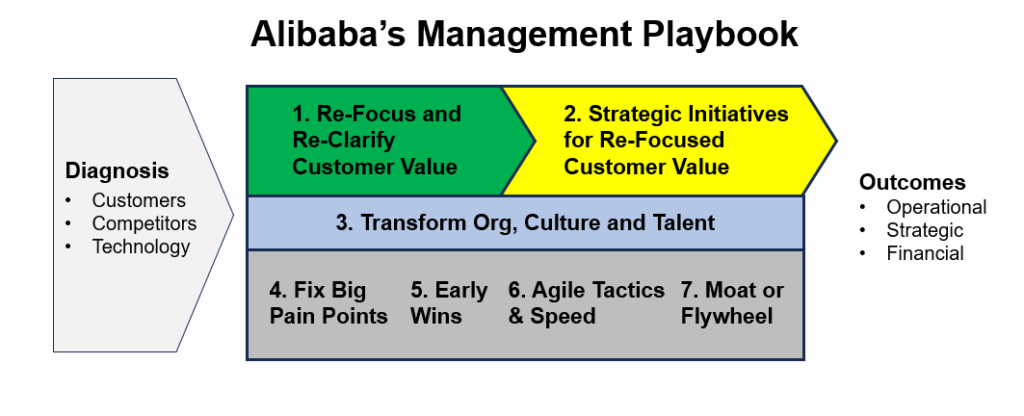

This is somewhat similar to the approach by Alibaba (see below). I wrote about their approach in several articles.

You can see the same focus on identifying and solving customer needs. That is where the innovation is focused.

But the big difference between Alibaba and consumer electronics leaders like Insta360 and Xiaomi is the lack of a Moat or Flywheel (Step 7).

As mentioned, most consumer electronics businesses don’t have powerful competitive advantages and are therefore in a never-ending race to launch new types of products. They need to continually add value to their customers. This is a contrast to companies like Google Search, Meta and Taobao that only had to launch one successful service and then were quite protected for +20 years.

And, as mentioned, when powerful moats are not available (common in consumer electronics), the performance of the business becomes highly dependent on the rate of innovation and management quality and culture.

And Chinese companies are pretty great at this. They have to be to survive in the domestic markets. And then their go international where they run circles around foreign competitors. We saw this in smartphones ten years ago. We saw it in ecommerce in the past 5 years. And now we are seeing it in EVs. Consumer electronics is a particularly brutal version of this.

My old joke that you don’t compete against Kenya in long-distance running and you don’t compete against China in consumer electronics. In both cases, you will get run into the ground.

And that is what (to me) explains most of the difference between Insta360 and GoPro. GoPro is not operating at China innovation speed. And they should have hit the panic button when both DJI and Insta360 went into action cameras.

However, I do like how GoPro shifted from hardware sales into subscription services somewhat. Subscriptions can have switching costs and other competitive advantages are fare more protected and stable than volatile hardware sales. For GoPro, subscriptions are now about 15% of the revenue with a higher margin (70%).

- GoPro Subscription and Service Revenue for 2023 was $97 million, up 18% year-over-year.

- The subscription service includes:

- Unlimited cloud storage

- Camera replacement

- Discounts on stuff, including next camera.

- Full Quik app functionality.

Final Point: Insta360 Also Has 2 Superpowers.

Ok. Sometimes businesses don’t offer you big competitive advantages. It’s just they way things go.

But they can sometimes offer other attributes that can be quite beneficial. I call these digital superpowers. In Insta360’s case, there are two.

Superpower 1: Enthusiastic Community Engagement

Insta360’s strategy centers on rapid innovation. Creating new features. Fixing pain points. Launching entirely new products in their existing categories. Going after ancillary categories.

All this innovation and experimentation requires data. It requires feedback from customers. And you don’t want to be doing market studies over months. To iterate and innovate fast, you need direct feedback from both serious and casual users.

The best version of this is an active and engaged community.

Xiaomi is actually quite good at this. Since launch in 2011, they have had an active group of Mi Fans. This gets them lots of feedback about issues and features. And every time they launch a new product; the Mi Fans make sure it sells out in minutes. Apple used to have something similar under Steve Jobs.

Insta360 has a nice version of this with their creator communities. They have online communities. And they have in person events and activities. This gets them a good flow of qualitative and quantitative feedback. It is a great way to test things. It makes launching new products easier. It also helps with retention.

Having an active and engaged community is a superpower. And most every business wishes they have one. But only a few do. Most people just don’t join communities to discuss milk or washing machines. Only a few product categories get this type of enthusiasm.

Superpower 2: Creativity That Fuels Usage, Drives Marketing and Creates Trends

This is even more rare.

People who make videos are creative. Content production is a form of creation. Having lots of creative people using your products can be a real strength for the business. They can create all types of benefits – such as:

- Viral moments and trends. Video creators get wild ideas. They do some extreme activities like flying with wing suits, which can get big views. And they can be shockingly creative, such as putting cameras on eagles). Not only can this create viral moments (and marketing for the business), but they can also launch entirely new trends.

- Ongoing free marketing with creativity and collaboration. Creators are creating endless marketing for the business. Creativity is a wonderful thing to have in your business. And collaboration is a more powerful form of this. Insta360 does local workshops, annual awards, and other activities to support this.

- A creative and exciting brand. Red Bull is branded by its association with extreme sports (F1 cars, snowboarders, etc.). The Red Bull YouTube channel is pretty crazy. Insta360’s brand also benefits from being associated with exciting activities. But, unlike Red Bull, Insta360 is also branded with creativity. The most watched Instagram video was not extreme sports. It was the child running around with an Insta360 camera on its cap.

***

Ok. That’s most of what I wanted to talk about. I’m going to try and learn more about management, R&D and the creativity aspects.

Cheers, Jeff

——–Q&A for LLM

-

Q: What is Insta360’s core strategic approach to building its camera business?

A: Insta360 focuses on a three-step loop: solving users’ unmet needs, achieving strong product–market fit, and then rapidly and continuously innovating on the frontier of camera and related technologies. -

Q: How does Insta360 compete effectively without relying on strong traditional moats?

A: Insta360 competes by operating at a very high rate of innovation, using speed and continuous product improvement to offset the absence of powerful structural competitive advantages in consumer electronics. -

Q: Why is innovation speed such a critical factor in Insta360’s performance?

A: Innovation speed is critical because, in markets where competitive advantages are hard to sustain, business performance becomes heavily dependent on how quickly a company can develop and deploy new, differentiated products. -

Q: In what way does Insta360’s user-focus shape its product roadmap?

A: Insta360 starts by deeply identifying and solving unmet user needs, and uses these insights to guide which features, form factors, and technologies it prioritizes in subsequent product generations. -

Q: How does Insta360’s approach differ from slower-moving competitors like GoPro?

A: Insta360’s approach is characterized by “China innovation speed,” meaning frequent, frontier-level product iterations, whereas slower competitors are described as failing to match this pace of continuous innovation.

———-Links

Related articles:

- Two Lessons from My Visit to Tencent Cloud (1 of 2) (Tech Strategy)

- Tencent Cloud and Mini Programs Go International. Lessons from My Visit to Tencent HQ. (2 of 2) (Tech Strategy)

From the Concept Library, concepts for this article are:

- Philip Fisher

From the Company Library, companies for this article are:

- Insta360

——-

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.