I had a good visit to Alibaba Cloud headquarters in Hangzhou. And this is a really important business. Arguably one of the most important in China / Asia.

Alibaba Cloud is one of major cloud players (#1 in Asia). And it is now one of the leading AI companies as well. It’s kind of the center of the action.

I had a good visit to their new Hangzhou headquarters. Although there’s usually not a lot to see at a company like this. Just people and computers. Warehouses and drones are more fun.

We had a good conversation and went through the latest updates. Plus, I am always trying to get smarter about the details of the business.

Finishing the meetings, my first conclusion was that Alibaba Cloud is playing to win in “AI meets cloud”.

They are adding a large and growing suite of AI models and tools to their cloud offerings. They are making bets all across the board. This is similar to Baidu, but Alibaba Cloud is focused on both China and the world.

My second conclusion was that CEO Eddie Wu has decided that AI services are the other big engine of Alibaba going forward.

The engine has always been platform business models in ecommerce (i.e., marketplaces). Not retail. Not services. But platform business models, which are the strongest type of business model. And usually with an asset-lite approach (like the old days before New Retail).

They are now adding AI services to this, which is a break from their tradition. The new AI services are not platform business models. I have argued that this may be the most powerful new business model of twenty years. We’ll see.

My third conclusion was that Alibaba is transforming into an AI company.

In February, Eddie Wu announced 380B RMB ($53B USD) in investments to advance AI over the next three years. Which is going into:

- AI Cloud infrastructure.

- Models, tools and apps.

- The transformation of Alibaba’s internal operations. Especially ecommerce, logistics and internal productivity tools.

And this is happening across the organization.

- There is TongYi Labs, which is developing their foundation models and other tools.

- There is AI Cloud, which is building infrastructure and deploying client services.

- And there are the business units (especially ecommerce) which are adopting and building AI into their products and operations.

Those were my take-aways. Which weren’t a surprise.

Let me go into the current state of their AI tech stack. And then how this can impact ecommerce.

Understanding Alibaba’s AI Powerhouse: A Deep Dive into the Tech Stack

Alibaba Cloud published a good paper titled “Charting the Future of Ecommerce – AI Driven Solutions on Alibaba Cloud”. The slides in this article are from there.

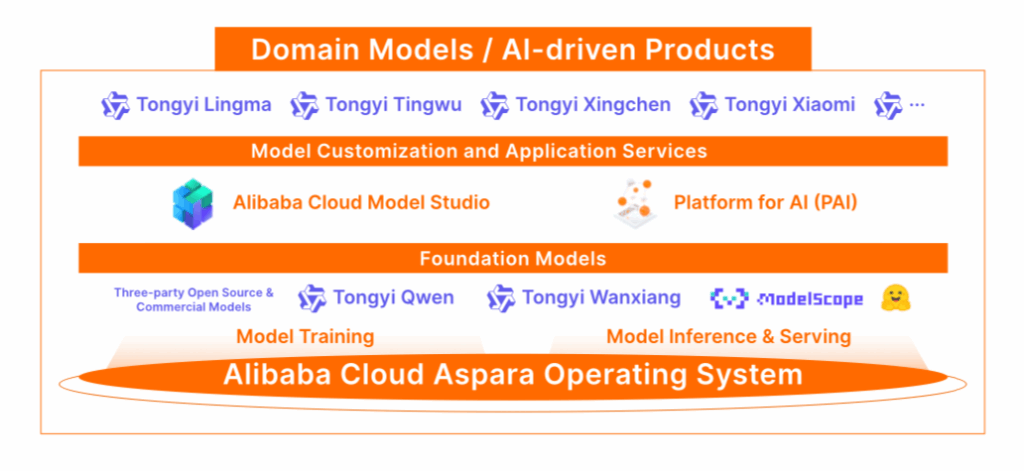

In that, here’s how they show their AI tech stack.

A couple of interesting things here.

- The AI Cloud is running on their Aspara Operating Systems. This is where a lot of that investment money is going. Think semiconductors, server clusters and connectivity.

- The foundation models have a growing suite of Tongyi models.

- Qwen (short for Tongyi Qianwen, Chinese: 通义千问) is the most discussed right now in terms of their large language model series.

- WanX is a specialized (and now open-sourced) video generation model.

- Qwq 32b is a reasoning model. It is also now open sourced. For English and Chinese.

- Note that they also include third part open sourced and commercial models. They are playing across the board.

- Note they have both ModelScope and HuggingFace listed (they show the logo, not the title). They brought this up a lot. They say there are +100 derivative models of Qwen now on HuggingFace. International (i.e., non-China) customization of Qwen is really important.

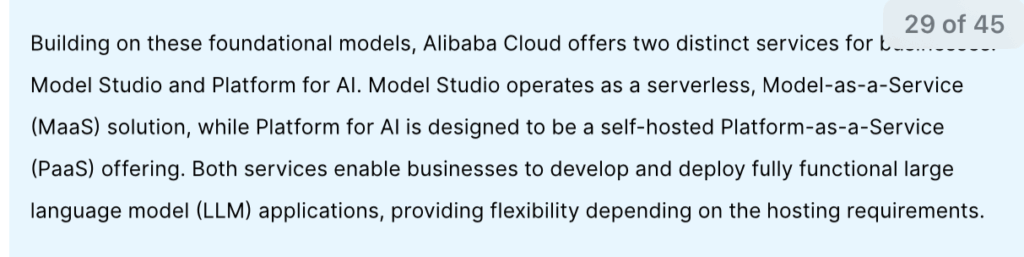

- Their model customization and application services include Model Studio and Platform for AI (Pai). So, you can build your own or you can access them as a service. The difference has to do where the vector database and other aspects are located (on premise or in the cloud). Here is how they describe it.

Finally, there is the app layer, which is pretty crazy. There are apps everywhere. The three I’m watching are:

- That the B2C universal tool (think ChatGPT). Good for writing, image generation, etc. It has +200M users (Mainland and Hong Kong).

- This is the big messenger and enterprise tool for China. This is the tool I think is going to become their primary AI Agent.

Ok. That’s the basics of their AI tech stack.

For me, the big issues are:

- They are going international. There is a new data center in Thailand. And another in Mexico. With international HQ based in Singapore.

- They are increasingly going open source. This means faster adoption and most of the Chinese models are moving that way. Probably a response to DeepSeek.

5 Game-Changing AI Use Cases That Are Transforming Ecommerce

Ok. Let’s get to specific use cases that are more useful. I’m mostly looking at domestic AI Cloud use cases and ecommerce use cases (including AIDC).

For AI Cloud, there are some good cases. Such as:

- Honor, which is using Qwen in its smartphones.

- XPeng, which is using Qwen(?) in its smart cockpit.

- Japanese LLMs being built on Qwen LLM (discussed before)

- Chinese universities, which are using Qwen for research.

- TCL is using it in their RayNeo smart glasses.

But ecommerce is the most exciting. And there are 5 use cases here worth studying.

Ecommerce Evolved: How Social and Community Commerce Are Redefining the Customer Experience

Why does social and community matter in ecommerce?

Basically, you are expanding the relationship beyond just a merchant and a customer. Now it is between customers. And between customers and influencers. The relationships increase.

You are adding entertainment, discussion and community to something that was previously a shopping experience. The simplest version of this is live streaming.

Use Case 1a: The Power of Livestreaming in Ecommerce

The merchant (or an influencer) starts selling live. Maybe the CEO does it. Maybe you put all the saleswomen at the department store on livestream?

Then you showcase new products. You offer discounts. You answer questions in real time. Plus, the customers chat with each other.

How does this help you in ecommerce?

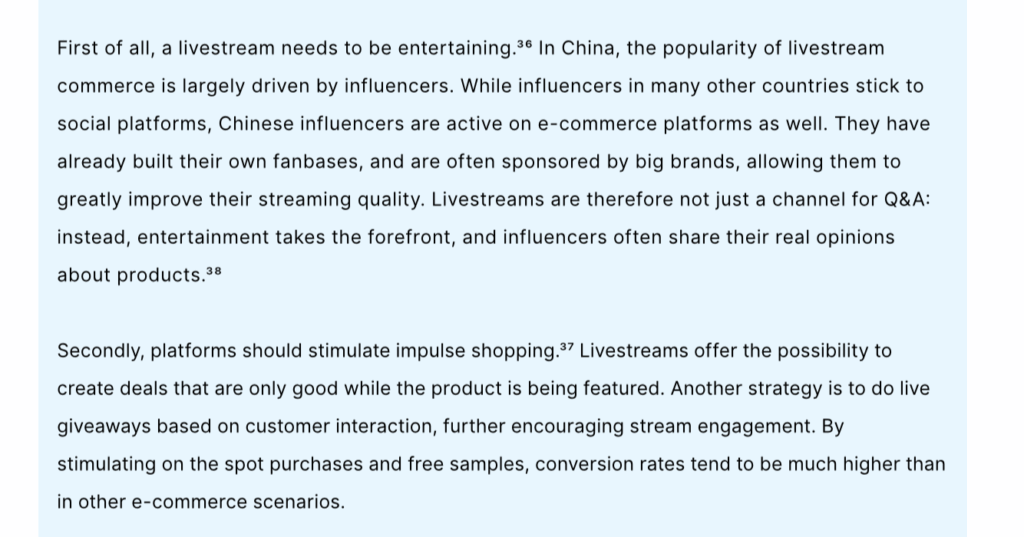

- First, it makes it more entertaining.

- Second, it increases engagement. It’s social. It’s fun. You definitely need content moderators thought.

- Third, it makes it more trustworthy. You trust the streamer more than a corporation (usually). And you also get trust from the other people chatting.

- Fourth, it encourages impulse shopping. That is really important. The more impulse shopping you can get the better.

Taobao Live was launched in 2016 and really was a pioneer (in China) in this. And now this is being combined with AI and added as a cloud service. Alibaba Cloud offers AsparaVideo Live as a service for seamless live ecommerce.

Here’s how Alibaba describes it.

Use Case 1b: Beyond the Buy Button: Building Communities That Drive Ecommerce

This is a more complicated form of social and community ecommerce.

A good example is Xianyu, Alibaba’s used goods marketplace. It combines shopping with discussion hubs. These discussion hubs can have regular buyers assessing products.

But they can also have hobbyists and collectors (i.e., power users). That makes the customer experience more powerful but also very different than in live streaming. If live streaming is a top-down approach, this is much more bottoms up. You want communities and their discussions to organically evolve and rise upwards.

Here is a summary of Xianyu.

This is not as entertaining and live streaming. But it is much more interactive. There is much more engagement.

This is really about changing the discovery phase. Live streaming is still kind of like an online version of shopping in a store (like a department store).

But community platforms have a completely different customer experience. This is a complete change in how products are discovered, evaluated and purchased.

You learn about products by influencers or by colleagues. This is important. There is far more trust when a product comes from a colleague or community. What matters in live streaming is the popularity of the influencer, but in community platforms what matters is social proof and community influence.

That brings me to the other main category.

The Future of Shopping: Discovery-Driven Customer Experiences and the Rise of Conversational Search

This is the approach I really like. And spend a lot of time thinking about. This is when GenAI starts to completely transform the buying process into a new experience.

Alibaba has an interesting commentary on how Chinese businesses are more focused on improving experiences, as opposed to just increasing efficiency.

I mostly agree with this. It’s why I spend so much time studying the customer experience aspect of digital China.

Chinese B2C leaders are really focused and innovative on the discovery phase. They are great at customers to be more spontaneous and impulsive with purchases. It’s not about a customer walking into Walmart with a list of things they want. It’s about customers wandering and experiencing and then doing impulse purchase.

Use Case 2a: Snap It, Shop It: How Image-Based Search Is Changing the Way We Find Products

The simplest version of discover-driven customer experiences is image-based search. The customer knows what they want. There is purchasing intent. But doesn’t know the right words for it. Or can’t find it with a keyword search.

Here’s how Alibaba describes it.

Those are interesting numbers. Especially the big jump in conversion rate with image-based search. I also like the increased visibility into long-tail products.

AR and VR would be a much more robust version of this. But they haven’t really gotten much adoption (yet). So, I will stick with image-based search as the example.

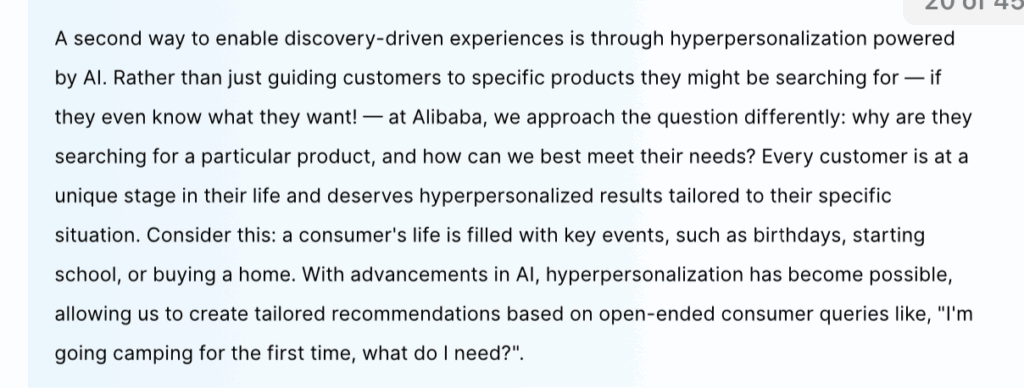

Use Case 2b: Hyper-Personalization in Ecommerce

The standard example for personalization is to compare an offline Zara store that shows the same clothes to everyone and an online Zara store that only shows clothes for a specific customer. Or a cable channel with the same programs for everyone vs. a Netflix channel with personalized content per viewer.

And this basic type of personalization is a powerful move. It really increases the value to customers.

However, these examples also gloss over what a big change this is personalization is.

You aren’t just trying to match what the customer wants. You are really trying to predict what they might want.

- Maybe they want something specific but they don’t know you have it?

- Maybe don’t quite know what they want but would if you showed it to them?

- Maybe they don’t really want something but you can convince them to want it?

Hyper personalization begins with customizing supply to meet known demand. Or to fuzzy but mostly known demand. But then it shifts to shaping demand itself.

Fashion companies do this all the time. They do runway shows to create demand for specific fashion trends. Then they supply to the created demand. This is the same idea. But at the individual level.

Here’s how Alibaba describes it.

I call these types of relationships personalization engines. Where it is responsive to customer needs (right product, right time, right channel). But it is also about shaping demand through a relationship. And GenAI is making this a lot more powerful and doable.

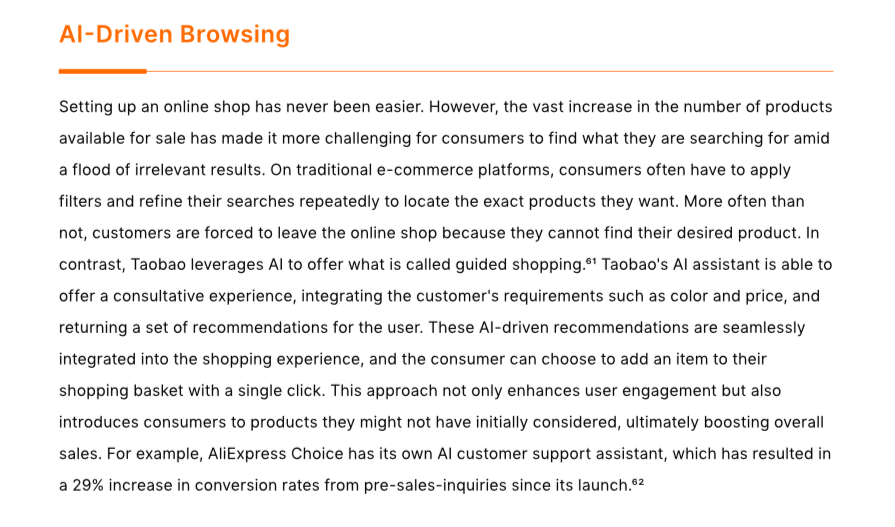

Use Case 2c: AI-Powered Browsing and the Dawn of Conversational Search

Ok. This is the last one. And my favorite one.

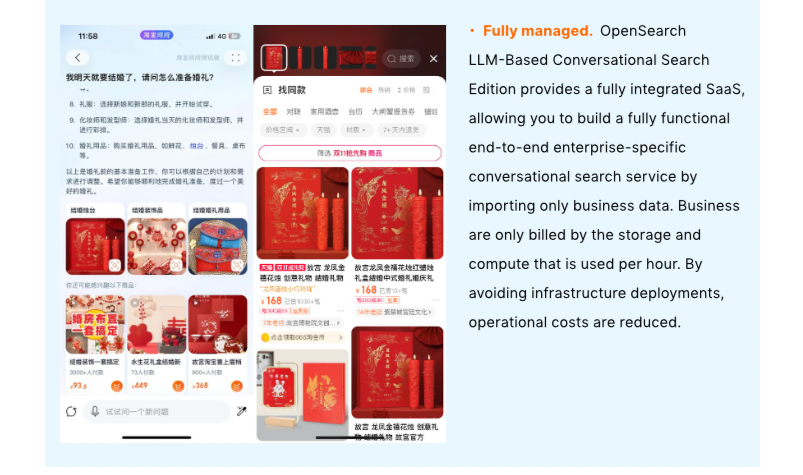

In an age of way too much supply, you have to use a lot of filters to find your product. But conversational search (also called guided shopping) lets you operate outside of the search parameters. Instead of putting in lots of keywords, you have a conversation with AI about your problem. It makes suggestions. This lets the merchant operate way outside of the search parameters. And to change them with the conversation.

And conversational search gets more interesting when it goes from a simple chatbot to multi-modal search results. Take a look at the Alibaba versions.

You really get a sense for where this is going. It’s a complete departure from the keyword searching most of us have always associated with ecommerce. It’s conversational. It’s smart. It multi-modal. We’ll see.

***

Ok. That’s it for today. Hope this is helpful.

Cheers, Jeff

—–

Related articles:

- Lessons from My Visit to Alibaba Cloud (Tech Strategy – Podcast 244)

- AutoGPT: The Rise of Digital Agents and Non-Human Platforms & Business Models (Tech Strategy – Podcast 163)

- Why ChatGPT and Generative AI Are a Mortal Threat to Disney, Netflix and Most Hollywood Studios (Tech Strategy – Podcast 150)

From the Concept Library, concepts for this article are:

- Generative AI

- Cloud Services

From the Company Library, companies for this article are:

- Alibaba Cloud

———

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.