I recently visited Tencent HQ in Beijing and got an update on the cloud business. Really on their AI plus cloud business.

As mentioned in Part 1, I have two main take-aways from the visit:

- Tencent Cloud is doing a “fast follower with advantages” strategy. That is my description (not Tencent’s). They have been rapidly repositioning in AI and making big investments to catch up to the leaders. And they are leaning into their strengths (especially WeChat) as they do so.

- Tencent Cloud is pushing international. Including WeChat. This is something we haven’t seen since 2012-2015.

I went through Point 1 in the first article. In this second article, I’ll go into Tencent Cloud’s international expansion activities. Which is really interesting.

A Quick Summary of WeChat’s Global Ambitions

WeChat was founded in 2011 and has had an “on and off” again approach to going international (i.e., outside of China). It made a big international push in 2013, which involved signing up soccer star Lionel Messi. Those were the gold rush years for messenger and everyone was trying to capture certain regions. This well-known 2013-2015 international push didn’t really work out.

Other international moves we have seen:

- In 2012, Tencent became the second largest shareholder of Kakao Talk, South Korea’s largest chat software.

- In 2016, Tencent invested in Indian instant messaging app Hike Messenger.

- In 2017, Tencent acquired around 12% of Snap Chat’s stock equity and became a “nonvoting” majority shareholder.

Fast forward to 2024, WeChat probably has 200-300M users outside of China. This number is speculative. Tencent has 1.4 billion monthly active users (MAUs) worldwide as of Q1 2025. And the estimates inside of China are 800-1000M. So, the difference is about 400M. I think that is probably too high and I put it at 200-300M.

Here are some more specific numbers for 2024 (from Oberlo):

- Malaysia: 12 million users

- India: 10 million users

- Russia: 9.5 million users

- Japan: 5.5 million users

- South Korea: 5 million users

- United States: 4 million users

- Indonesia: 3 million users

- Thailand: 2.5 million users

That adds up to 57M and this looks a lot like the China diaspora, especially in Asia. WeChat is how you communicate with friends and family back in China.

Alipay First Went International with Both a Payment Product and Tech Services

Alipay has had a much more aggressive internationalization strategy than WeChat (not Tencent Gaming). Similar to WeChat, Alipay is a connectivity network with over 1.3 billion users. But Alipay has a far greater presence with international merchants and brands (they want to accept payment). As of 2024, Alipay had about 100M merchants and brands internationally. In contrast, WeChat had about 4M international merchants and brands.

The history of Alipay going international is not that well known. And (spoiler) it looks a lot like what WeChat is doing this year.

In 2015, Alipay’s parent company, Ant Group, began enabling Chinese tourists to use Alipay abroad. And not only could Chinese tourists now pay for things with their Alipay accounts, they also got really good exchange rates. Alipay offered low priced exchange services in order to grow international usage by tourists.

In 2016–2017: Alipay began targeting merchants catering to Chinese international tourists. It deployed in-store mobile payment services at airports in San Francisco, Los Angeles, and Honolulu.

So, it’s a two-sided payment network. And they led with convenience and great exchange rates for Chinese tourists. That’s good strategy.

But here’s the part of the story that most people don’t know.

Ant Group also has a Digital Technologies business. This is the business unit that develops and commercializes advanced digital technologies for enterprises and governments, mostly in China. And mostly in financial services. Ant’s digital technologies business is arguably the regional leader in fintech innovation and services. It is the China tech giant people forget about.

This group had been providing tech services to businesses across Asia. Specifically, it has been helping businesses develop their own payment networks. Basically, they helped them build versions of what they had built in China with Alipay.

When you look at the leading payment and digital wallet businesses in Asia today, most of these businesses were clients of the Ant’s Digital Technology business. Think GCash (Philippines), Touch ‘n Go eWallet (Malaysia), TrueMoney (Thailand), Kakao Pay (South Korea), Naver Pay (South Korea), mPay (Macao SAR, China), and EasyPaisa (Pakistan).

So that’s a compelling approach to internationalization. Go international with both a network-based product and a technology service.

Alipay Then Added a Marketing Product and Tech Services

Alipay going international meant working with merchants and brands around the world. You had to get them to accept payment from Chinese tourists using Alipay.

And this led naturally to offering them other services, such as marketing services. Chinese tourists were already getting convenience and good exchange rates. And then Alipay began offering them location-based deals and coupons. Such as a 42% coupon for Pier 39 in San Francisco.

Adding promotions, deals and other marketing services turned out to be a powerful move.

Imagine landing in Paris, you open your Alipay account and you immediately get special offers and promotions for your trip. Such as special discounts to visit Euro Disney. And discounts at famous department stores like Lafayette.

That’s cool.

But they turn out to be amazing deals and promotions.

Because the deals you are getting were negotiated by Alipay on behalf of +1B users. Think about that in terms of negotiating leverage. Who could ever get a better deal from Euro Disney than Alipay?

So Alipay is a global payment network (with network effects) that added marketing services (with massive purchasing economies of scale).

Which raised an obvious question: Why don’t we help other payment and digital wallet providers offer that to their customers as well?

Enter Alipay+, which began as a pilot in 2020.

This is a back-end service that enables payment and digital wallet providers (GCash in Philippines, Touch ‘n Go in Malaysia, Kakao Pay in South Korea) to do cross-border payment and marketing. So, Koreans can now pay for goods in Singapore using Kakao pay. Just like Chinese tourists pay in Paris using Alipay.

And these Korean tourists will receive special deals and promotions, just like the Euro Disney example. And these are negotiated by Alipay (on behalf of its +1B users).

All of this is cool.

Which brings me to my point.

WeChat going international in 2025 is starting to look a lot like the Alipay strategy I have just described.

WeChat Is Going International with Both a Product and Tech Services

WeChat and WeChat Pay are expanding internationally. But they are not leading with getting consumers to sign-up, like in 2013-2015. They appear to be mostly helping international businesses develop their own similar services.

So, it’s products and tech services. And they are leading with technology services (i.e., Tencent Cloud). And specifically, they are leading with their technology and expertise in mini programs and “super apps”.

For example, Tencent Cloud has been working with Abu Dhabi to create a “super app” for the city. This super-app currently works with 30 government entities and private sector partners. And offers +700 government services under a single platform using the Tencent Cloud Mini Program Platform (TCMPP).

The TAMM Super App includes services such as:

- Citizenship and work permit applications

- Business registration and industrial license applications

- Housing and property leasing

- Healthcare facility access

- Tourism information

- Inheritance services

- Insurance matters

- Traffic ticket management

- Education and work benefits

Helping international clients develop such mini programs is a great idea. And Tencent really has a unique value add in this area. They are the world’s experts in aggregating web and mobile apps into lightweight mini programs, that is deployable on any cloud infrastructure. The result, which is super popular in China, is a seamless, super app-like experience.

Another example is Tencent Cloud’s project with Orange Middle East and Africa (OMEA) to enhance their Max it super app.

Announced in February 2024 at the Mobile World Congress (MWC) in Barcelona, the Orange collaboration leverages Tencent Cloud’s Super App as a Service (TCSAS) solution (specifically the Tencent Cloud Mini Program Platform (TCMPP)) to integrate a wide range of mini apps into Max it. The goal here is to create a robust digital ecosystem for users in the Middle East and Africa.

Starting in the second half of 2024, Orange MEA has been integrating mini apps, with plans to onboard 100 global and local partners in 2025. These mini-apps cover:

- Utilities (e.g., bill payments)

- Lifestyle services (e.g., food delivery, ride-hailing)

- E-commerce (shopping platforms)

- Entertainment (content streaming, gaming)

- Financial services (mobile payments, banking)

***

Overall, I really like this strategy for Tencent Cloud and WeChat. It reminds me of the Alipay international playbook. Go international with both products and tech services. Play to your strengths. And use this as the foundation for more products and services.

Here’s how I summarize it:

- Go international with Tencent Cloud and WeChat in both products and tech services.

- Help foreign partners build their own super app with mini programs.

- Help them access Chinese consumers at the same time.

- Use the initial service or product as the basis for further projects. Similar to how Alipay working internationally on digital wallets led to Alipay+.

Tencent Cloud International Is Doing Well in Thailand and Indonesia

Outside of WeChat and mini-programs, Tencent Cloud is also going international as a full-service cloud provider. That means a long list of services, use cases and client types. Such as:

- GenAI models and tools – such as Hunyuan and its integration into WeCom. Discussed in Part 1.

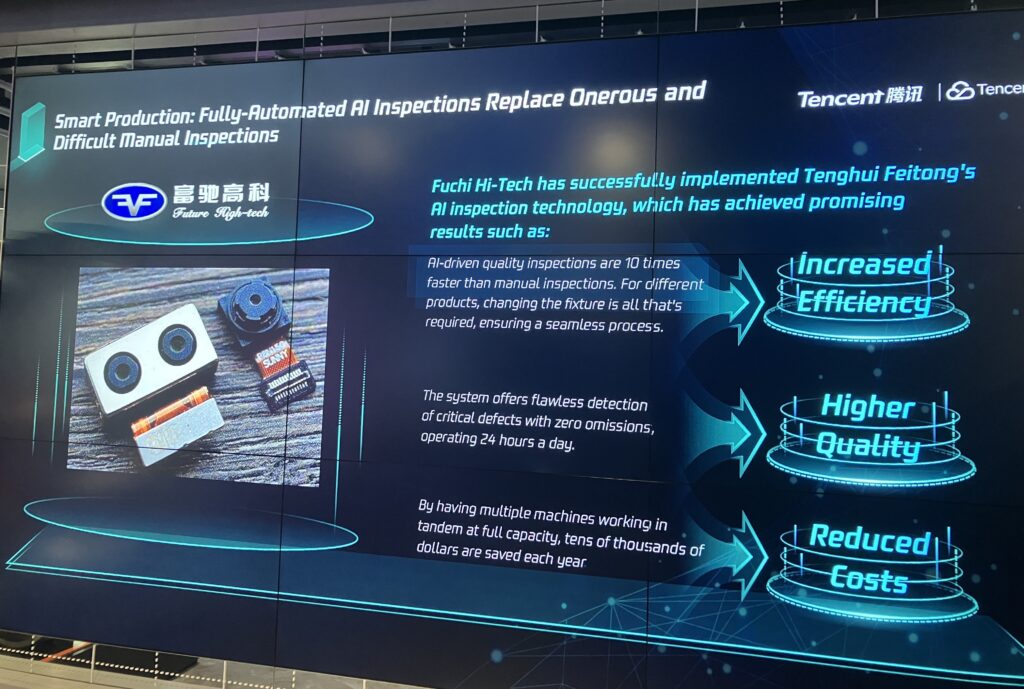

- Smart Manufacturing. Here is an interesting screen from the Tencent Beijing HQ.

- Banking and financial services. This has lots of cool use cases such as the below “tap and go payment” for the metro.

- Intelligent mobility. Tencent is active in the user interface. (see below)

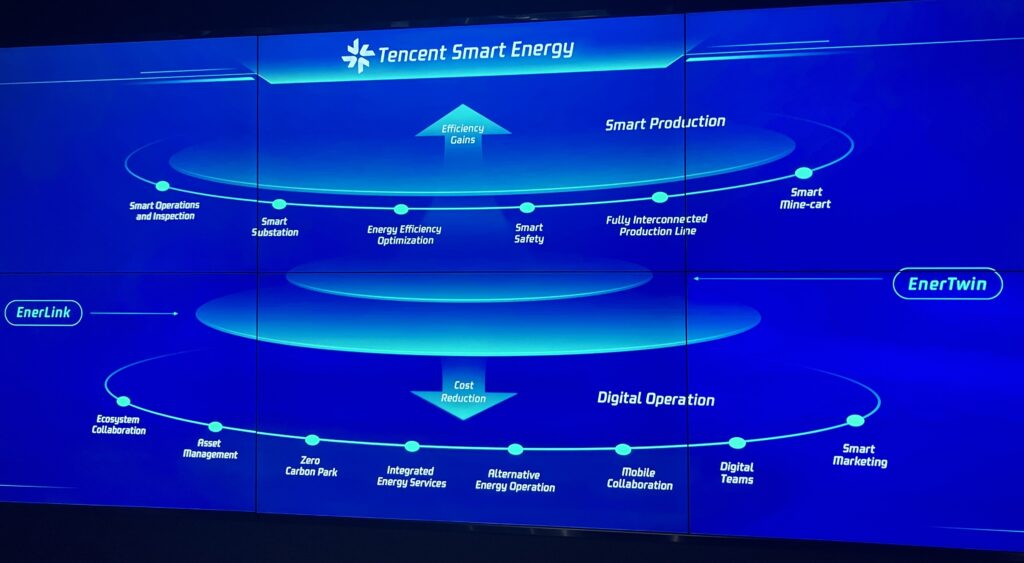

- Smart Energy (see below)

I was particularly interested in where they were getting traction in Southeast Asia.

In Indonesia, Tencent Cloud has successfully transitioned GoJek’s entire cloud to Tencent. That’s as high profile a project as there is in Southeast Asia. And Indonesia is a really important market.

In Thailand, Tencent Cloud is working with CP Axtra, a retail and wholesale subsidiary of Thailand’s Charoen Pokphand (CP) Group. This is arguably their flagship client in Thailand and they announced a Global Strategic Cooperation with CP in January 2025.

Note: Tencent Cloud now has +10,000 foreign clients.

Tencent Cloud Is Doing Well Internationally with Audio Visual Services

I asked which services and use cases were doing well internationally and was told audio, video and communications.

That’s really interesting.

Tencent Cloud is a “go to” partner for many Chinese firms going international. And an interesting need for many of these businesses is in audio, video and communications. There is a need for stable, low latency, low bandwidth and scalable video services – such as for live broadcasting (think esports) and conference calling.

Tencent Cloud Media Services has interesting services in this area. Especially for SMEs in business, entertainment and education. Such as in South Korea, Southeast Asia and Japan. Really, anywhere they would be worried about being limited by the bandwidth of local carriers.

This is all about Tencent Cloud building out global infrastructure that is affordable, reliable and scalable. Tencent Cloud’s network currently spans 21 regions and 56 availability zones with +3200 CDN nodes across +80 countries, offering 200 Tbps bandwidth for global delivery.

Audio and video services is a compelling wedge use case. It naturally leads to increasing digital storage on the cloud. Current solutions include:

- Tencent Real-Time Communication (TRTC). This is a low-latency platform for audio / video calls and interactive live streaming. It supports multi-person voice / video interactions with an average end-to-end latency below 300ms. It offers robust performance under high packet loss (80% for audio, 70% for video).

- Cloud Streaming Services (CSS). This is a professional live streaming solution offering Live Video Broadcasting (LVB) for large-scale playback and Live Event Broadcasting (LEB) for ultra-low latency (800ms end-to-end).

- Tencent Cloud Online Video Platform (TOVP): This is a SaaS solution for multi-screen video streaming, integrating live streaming, VOD, and interactive video. Think Sports Broadcasting (high-concurrency live events with millions of viewers) and Corporate Media (publishing training videos and news globally).

- Video and Media AI Solutions. This leverages Tencent’s AI expertise for advanced video processing, content moderation, and creation. Think real-time subtitle extraction, translation, and voice cloning for short dramas and live broadcasts.

***

Ok. That’s it for my visit to Tencent Cloud in Beijing. Definitely a firm to pay close attention to.

Cheers, Jeff

———

Related articles:

- Scale Advantages Are Key. But Competitive Advantages Are More Specific and Measurable. (Tech Strategy)

- The Characteristics of Unattractive Industries with Cutthroat Competition (1 of 3) (Tech Strategy)

- 5 Misconceptions About Barriers to Entry (Tech Strategy)

From the Concept Library, concepts for this article are:

- n/a

From the Company Library, companies for this article are:

- Tencent Cloud

——

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.