Key Points

- Ruhnn is a good example of an influencer-centric, asset-lite ecommerce business model.

- Influencers are a hard to replicate asset that has far more power than traditional marketing.

- However, influencer-centric businesses are hard to scale. Ruhnn scaled in influencers by adding a marketing agency. Scaling in services or products has a higher likelihood of success.

I don’t recommend spending a lot of time studying Ruhnn. It’s no longer public. The business model has issues. But Ruhnn has two useful digital strategy lessons in – which are:

- The power of an influencer-centric, asset-lite ecommerce business model (Part 1)

- The value of Michael Porter’s Five Forces (Part 2)

***

When analyzing businesses, I use lots of different frameworks. Some are qualitative. Some quantitative. Some are structural. Some psychological. I like to look at a business from lots of angles. Which hopefully captures most of the important stuff.

And sometimes one framework really shows you what matters with a business. For Ruhnn Holding, Porter’s Five (now six) Forces really helped me understand it.

I thought I’d run through the business model. And show it as an example of the value of Porter’s Five Forces.

A Quick Summary of Influencer Agency and Ecommerce Business Ruhnn Holding

Founded in 2014 in Hangzhou, Ruhnn is an influencer agency that refers to itself a “KOL facilitator”. And in 2018-2019, they became #1 in China for training, supporting and commercializing influencers (i.e., KOLs). Ruhnn was an early mover in monetizing the KOL ecosystem of China. The typical numbers you heard were that Ruhnn was about 5% of China’s influencer economy.

I wrote about them previously here.

Their activities include:

- Setting up brands

- Training and supporting KOLs

- Owning and operating online stores

- Producing branded products for KOLs

- Endorsing brands (including their own)

So, the business is partly an agency for training KOLs and selling KOL services to brands. But it is also an ecommerce business that sells products for its influencers and for others.

Ruhnn went public in 2019 and then was later taken private in 2021 (after pretty disastrous stock performance). Caixin Global had a good article in 2021 about Ruhnn going private. Located here. Here’s the key point:

“The trio of founders — Feng Min, Sun Lei and Shen Chao — have purchased all of Ruhnn’s American depositary shares (ADSs) that they do not already own for $3.50 each, representing a discount of about 72% on its 2019 IPO price of $12.50, the company said in a statement Tuesday.”

At the time of going public, Ruhnn had a full-service model had 25 KOLs, with 91 online stores. And their platform model had 101 KOLs, with 501 brands and 28 third party stores. They had about 148M “fans”. They had lots of online stores. They were selling tons of clothing, jewelry, and other apparel – both for their own stores and under contract with brands.

And at the time of delisting, Ruhnn had grown to about 180 KOLs and 295M fans. But the business model and financials had always been a problem. More on this below.

Here is some of the basic Ruhnn information (from their public filings in 2019):

- 113 signed KOLs, with 91 stores self-owned.

- #1 in China with 501 brands and 28 third-party party online stores

- 148M “fans”.

- This was up from 52M in 2017

- 80% were millennials

- 70% were women

- At IPO time, fans were mostly on 3 main Chinese social media sites.

- 111M on Weibo

- 30M on Weitao

- 6M on WeChat

Ruhnn’s marketing pitch to brands was that their influencers were more effective than traditional marketing. They offered:

- Graphic ads (photo shoots, copy writing, editing)

- Short films (scripting, film shooting and editing, broadcasting)

- Livestreaming (script writing, streaming)

Which would help brands:

- Educate consumers about their products

- Create emotional bonds

- Build loyalty

I Like Influencer Marketing Way More than Traditional Marketing

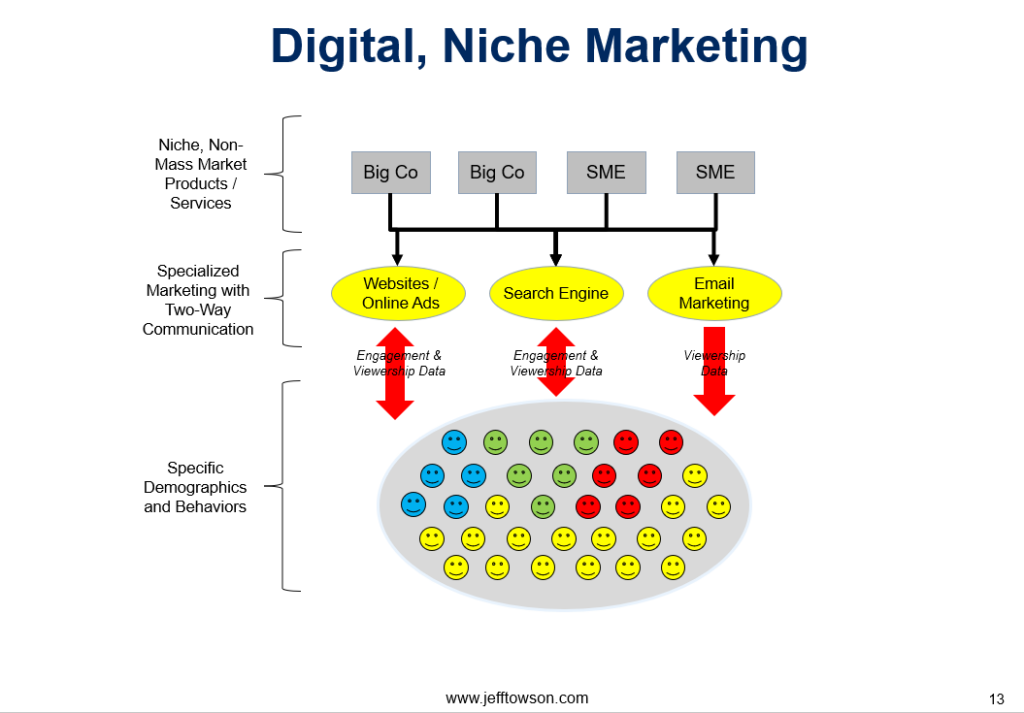

I agree with the basic Ruhnn argument that influencers are far more powerful than traditional marketing. Traditionally marketing has been mass market, one-directional messaging.

And digital enabled more personalized marketing.

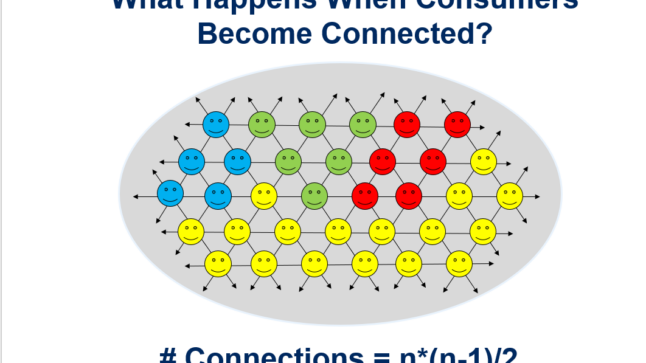

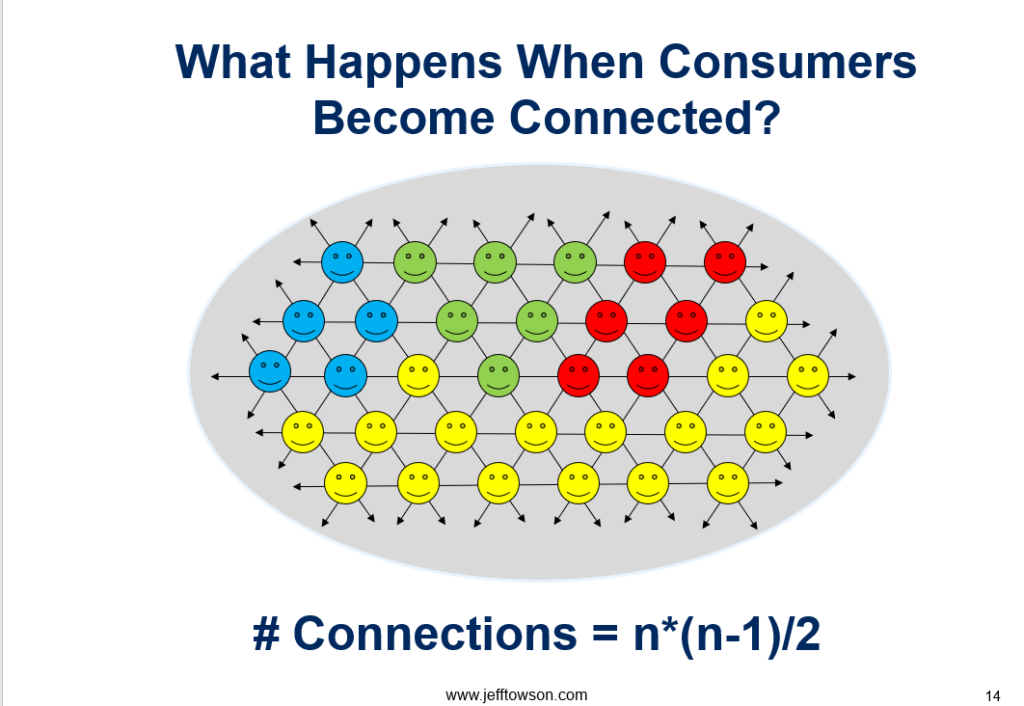

But what happens when consumers are connected with other consumers?

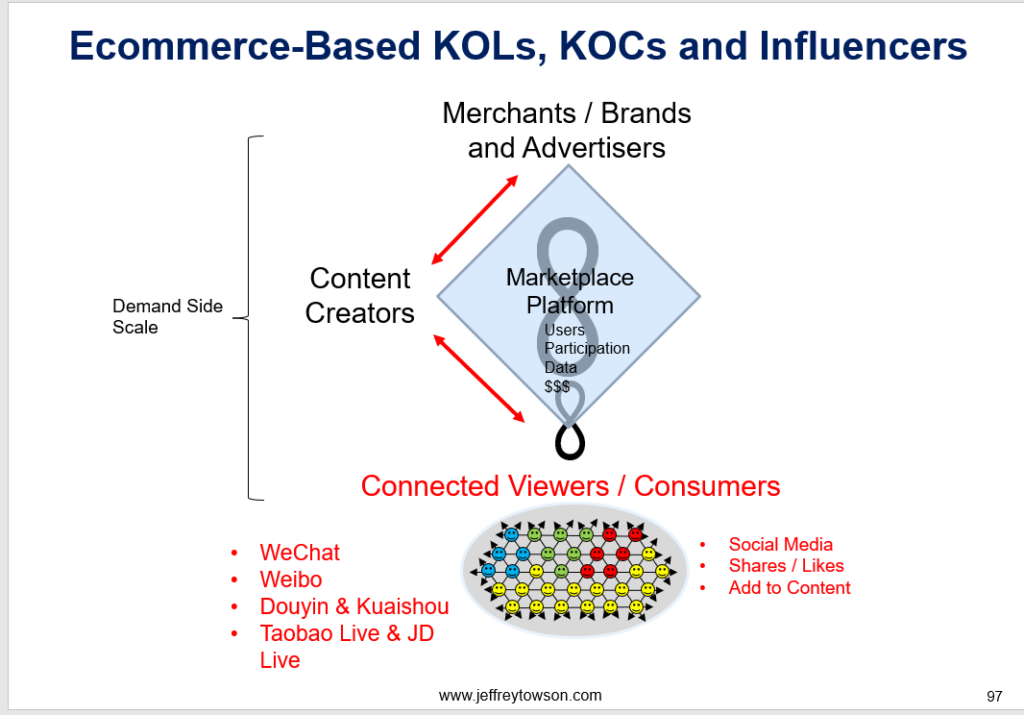

Influencer marketing is far more powerful. They can pair content creation with a marketplace business model. KOLs are the connectors that make that happen.

The value provided by their KOLs is what I like most about the business.

- KOLs help fans learn about products and stay current with fashion trends.

- KOLs are entertainers, especially for consumers who like shopping.

- KOLs have relationships and emotional connections with their fans. They can both connect and communicate. And fans can participate.

- KOLs can educate and provide guidance and inspiration.

Overall, influencers are authentic. And personal. And likeable. They benefit from fan behavior. Discussed here.

I Really Like Influencer-Centric, Asset-Lite Ecommerce

I view influencer-center ecommerce as a combination of Oprah Winfrey and the Home Shopping Network. There is a powerful connection on the consumer side, which is then monetized by an asset-lite ecommerce business. It’s really a great business model.

I have worked with quite a few such businesses. Usually, it’s an influencer who has gotten traction by creating content for a topic like beauty or fashion. They then start selling products, either as a retailer or by launching their own branded products. And this doesn’t require many assets. You don’t need to build warehouses or hold much inventory. You just need to keep creating content and building the relationship. This type of influencer-centric, asset lite business can grow them to $20-50M in revenue fairly quickly.

The next step is usually the difficult question. That’s where a digital strategy guy can be helpful. They have beaten the smaller influencers. But they cannot match the scale of giants like L’Oréal. So, what is the next step for an influencer-centric ecommerce business?

My default strategy is to build where a company like L’Oréal cannot, which is in the deep, authentic connections with customers. I usually recommend such businesses expand from content to products to local services. Local services really complement their already unique content is very hard for the giants to match. You don’t want to try and become a multi-national beauty product company. You want to be a specialized giant in one area, ideally offering a unique suite of content, products, and services.

Ruhnn did something similar but a bit different. They led with their influencer-centric ecommerce. But they added an influencer marketing agency. They scaled up by adding influencers. And a secondary source of income. That was an interesting move.

At the time of going public, Ruhnn was:

- A talent agency for KOLs that offers production and marketing services to brands.

- An ecommerce business that does both product development and sales of its own products through its online stores.

And they had:

- 912M RMB in product sales, with a 33% gross profit. These were their own product sales.

- 35M RMB in services sold to 3rd party, with a 51% gross profit. These were their marketing services.

You can see this unique business model in their headcount:

- 249 of 971 FTEs (2019) were in KOL operations (product design, content production and other)

- 207 were in supply chain

- 155 were in customer service

- 46 were in IT

Influencer-centric ecommerce is a really interesting business model. And worth understanding. There were other businesses (like Mogu) at the same time.

However….

These businesses all had one problem that everyone worried about.

But Such Businesses Are Usually Dependent on 2-3 KOLs

Yes, their full-service model had 25 KOLs, with 91 online stores (at IPO). And their platform model had 101 KOLs, with 501 brands and 28 3rd party stores.

And at delisting it had grown to about 180 KOLs and 295M fans.

But by revenue, the business was mostly about 2-3 KOLs.

According to Tech Crunch (2019), their leading KOL “Zhang Dayi, accounted for about half of its total sales for nearly three years. That means Ruhnn is under tremendous pressure to retain Zhang, who currently serves as the firm’s marketing chief”.

At the time of IPO, Zhang Dayi, who had 6 online stores selling clothes, lingerie, lipstick, dresses and other. She had 20M followers on Weibo. The second most popular KOL was Dajin, who had 2 online stores and 7M followers on Weibo.

Popular KOLs are their unique asset and strength. But they are also very hard to create. Most KOLs fail. Those that succeed don’t last that long.

I usually recommend influencer-centric ecommerce businesses scale up in products and services. It is more predictable and controllable. Scaling up in influencers (Ruhnn’s strategy) is very hard. And Ruhnn has not really been too successful in this. But the agency approach is interesting.

***

Ok, that’s it for Part 1. In Part 2, I’ll go into Ruhnn and Porter’s 5 Forces.

Cheers, Jeff

Conclusions

- Ruhnn is a good example of an influencer-centric, asset-lite ecommerce business model.

- Influencers are a hard to replicate asset that has far more power than traditional marketing.

- However, influencer-centric businesses are hard to scale. Ruhnn scaled in influencers by adding a marketing agency. Scaling in services or products has a higher likelihood of success.

———-

Related articles:

- Fans, Collectors and Gamblers: The Engine of Pop Mart (1 of 4) (Tech Strategy)

- Pop Mart and My Checklist for Fan and Enthusiast Behavior (2 of 4) (Tech Strategy)

- When Microsoft’s Bundles Are Good vs. Bad for Customers and Markets (Tech Strategy)

- Microsoft’s 3 Big Upgrades to its 2 Platform Business Models (2 of 2) (Tech Strategy – Daily Article)

From the Concept Library, concepts for this article are:

- Influencer / KOLs Marketing

- Ecommerce

From the Company Library, companies for this article are:

- Ruhnn

———-

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.