Growth is the default business strategy.

Mostly because it gets you greater size. Which is not the same as scale (which is relative). But size, in itself, has lots of benefits. For example:

- More resources. You have more staff. You can do bigger projects. You can try more things. Smaller firms have to be very, very selective.

- Greater specialization.

- Less volatility. Smaller firms are dependent on a few revenue streams. External market shocks, tech changes, and customer or competitor moves can have a bigger impact.

- Increased survivability and therefore optionality. Just staying alive is valuable because it buys you time. When you don’t know what to do, just hang on and stay in the game.

And so on.

But growth has other benefits besides size. It kind of plays out everywhere in a firm.

A firm that is growing – that is constantly pursuing growth initiatives – is more energetic. Management and staff are always expending time and energy on growth initiatives. Growing firms are more energetic. It’s like the difference between running and walking.

Growing firms are also more creative. They are more daring. They are always hunting for and taking on new ideas. it is very different than a firm that does the same things more efficiently every year.

And if you can achieve ongoing growth (say 5-10% per year), it changes everything. Ongoing growth is like oxygen for a business. Predictable growth means you can invest for the future. You can hire better people. You can fund bigger initiatives. It’s like Newton’s Law of Motion – “things in motion tend to stay in motion.” Ongoing growth creates momentum.

–

Growing firms also handle change better. If a business is being disrupted or facing a new competitor, the firms that are always pushing for growth are more likely to figure it out. Growing firms are also 10x better positioned if they have to grow. Stagnant firms that must suddenly jump into growth mode are much more likely to fail. Growth is a skill you have to keep training at all the time. Practice helps.

***

Ok. That was some fuzzy thinking. Let me get into my growth playbook for digital.

First, recall my overall approach to digital strategy.

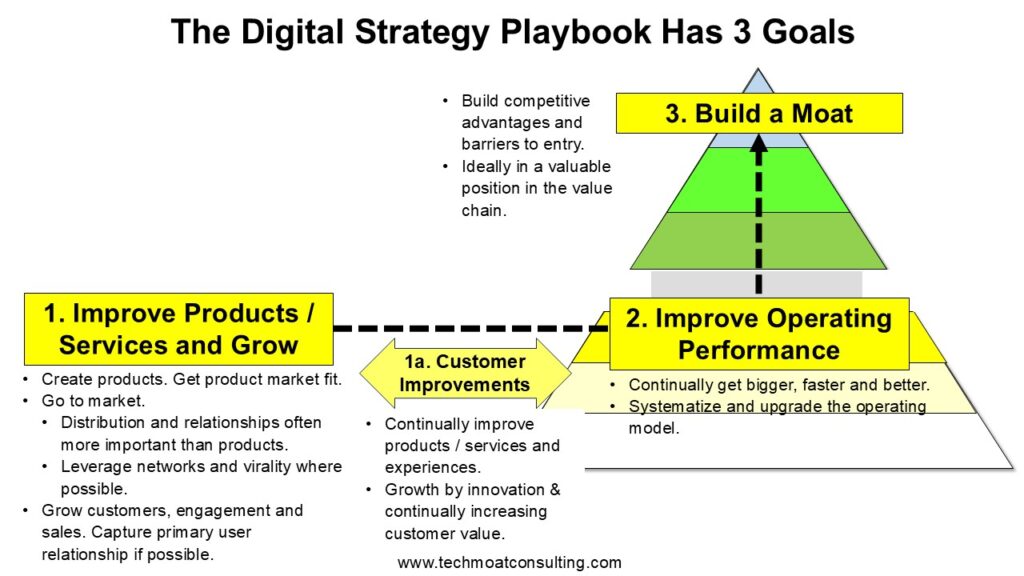

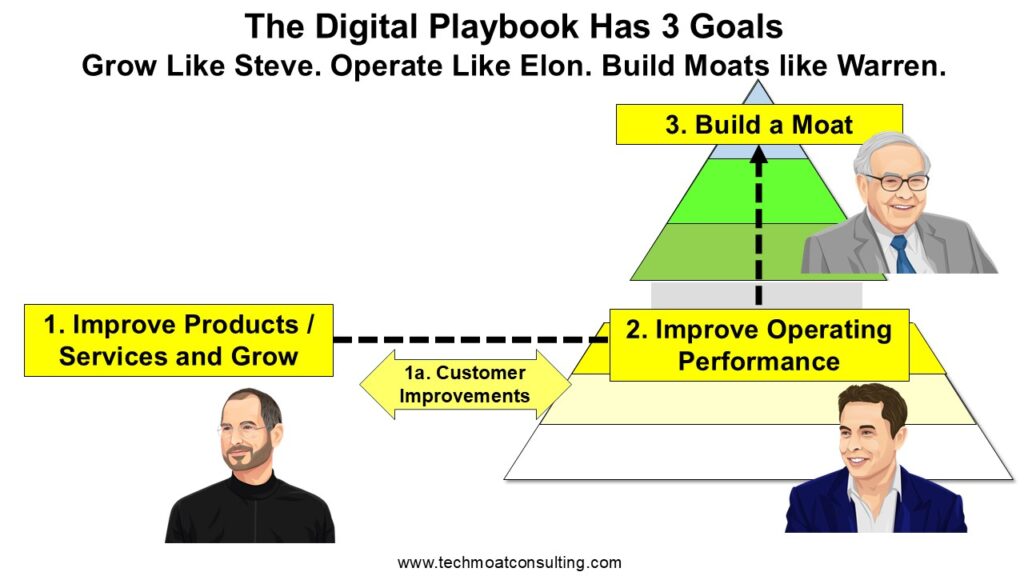

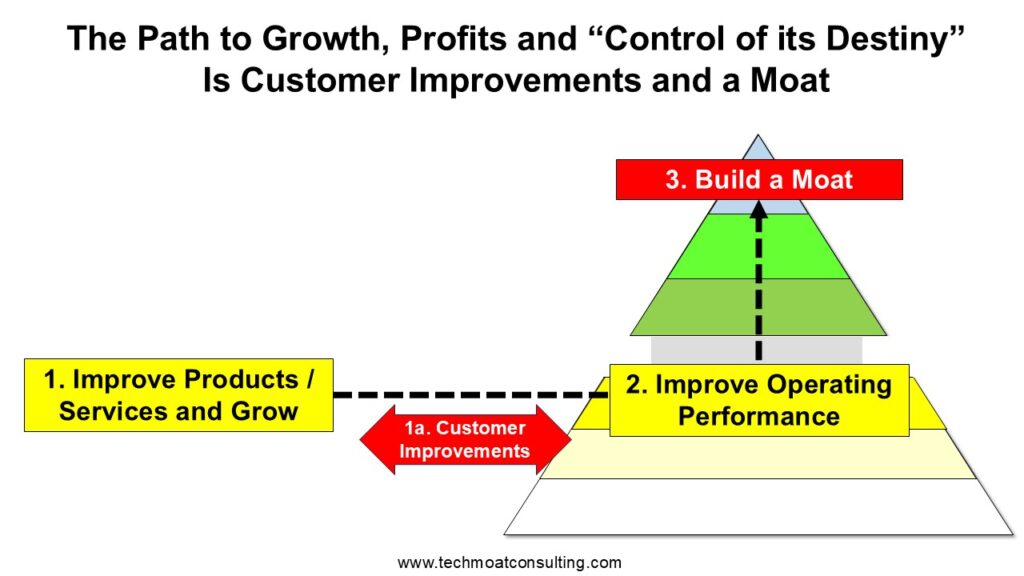

My Digital Strategy Playbook Has 3 Goals

I break this into three different goals. And then break them into sub-parts. Seen here.

Goal 1 is about Products and Growth. This is Steve Jobs land.

This also includes 1a. Growth by innovation. This is really the deep well of growth opportunities. It includes customer innovations and improvements.

Goal 2 is about Operating Performance. Specifically, Tactics and Digital Operating Basics. This is Elon Musk land.

Goal 3 is about Moats and Marathons. And is Warren Buffett land.

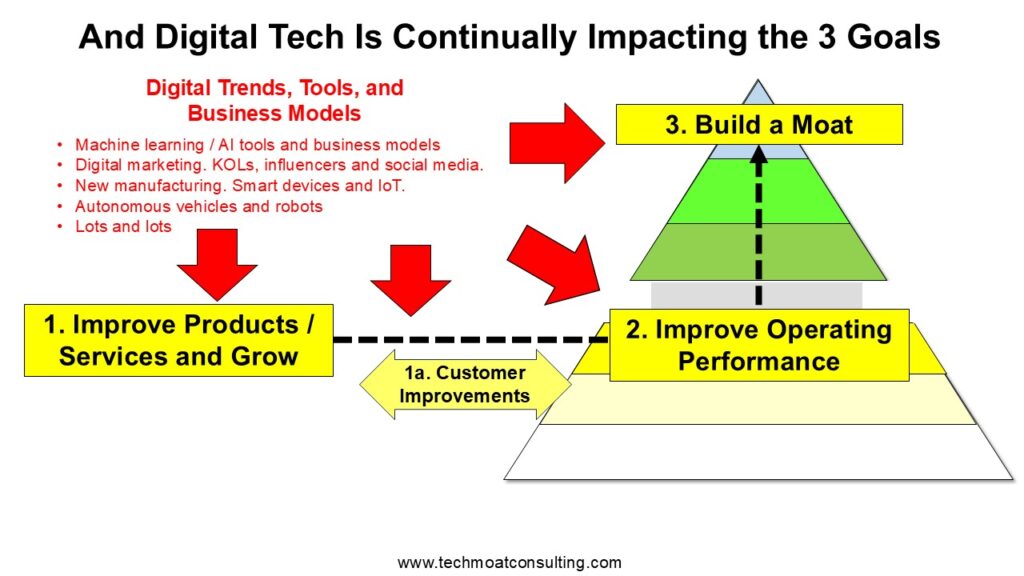

I do it this way because I want to see specifically what is impacted by new digital tools. It’s a granular, bottoms up approach.

And I have argued that any CEO (or investor) should be able to explain how digital and AI are impacting their business in these three areas. For something like GenAI image generation, I ask:

- What is the impact on products and growth?

- What is the impact on operating performance?

- What is the impact on the moat?

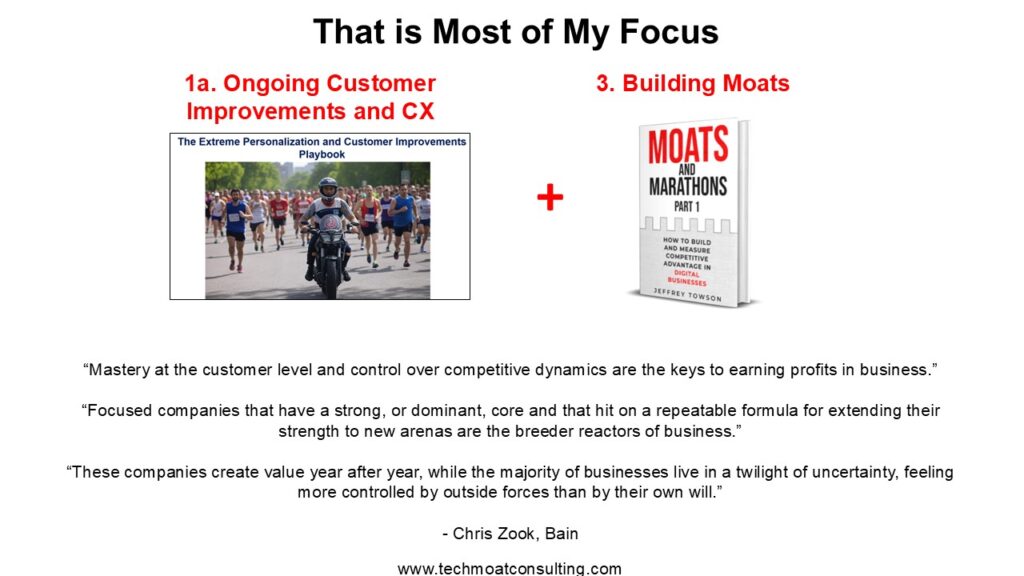

Most of my focus (and expertise) is in 1a and 3. I specialize in:

- 1a: Ongoing customer improvements (i.e. growth by innovation)

- 3: Building moats (and running marathons)

There are lots of large consulting growth that work on the other areas. Especially digital transformation. I focus on surgical projects for 1a and 3.

Chris Zook of Bain writes about growth at traditional businesses (i.e., not digital). And he had a great comment in his book Beyond the Core that pretty much summarized my own approach.

That’s great. I think that is exactly the best approach in digital.

You want “mastery at the customer level” – which is 1a (customer improvements). That’s my CX Playbook.

Plus “control of competitive dynamics” – which is 3 (Moats and Marathons).

And you want to do this “year after year”. Both are a never-ending process.

Otherwise, “you live in a twilight of uncertainty, feeling more controlled by outside forces than by your own will.” That’s nicely put.

That last point is interesting.

Well-known investor Thomas Russo has a question he uses when assessing companies. And it is one of the last questions I use when looking at a business. It is “Does this business control its own destiny?”.

That’s pretty much the whole point of 1a and 3.

Equity analyst Hamilton Helmer has a similar North Star. His book 7 Powers is about establishing power within an industry. And that is the key to the “persistence of profits”.

He defines power as factors that both add value (i.e., benefit) the customer and that create defensibility. Both aspects are required. Otherwise value created for the customer does not result in profits. Those two factors (customer benefit and defensibility) are basically points 1a and 3. He also says defensibility is more important than growth.

A Summary of the Core vs. Adjacency Approach by Chris Zook

Chris Zook, who was co-head of Bain’s strategy practice, wrote three good books on sustainable growth. They were:

- Profit from the Core: A Return to Growth in Turbulent Times

- Beyond the Core: Expand Your Market Without Abandoning Your Roots

- Unstoppable: Finding Hidden Assets to Renew the Core and Fuel Profitable Growth

I have previously summarized these in a podcast:

A lot of my approach to digital growth is based on his approach to more traditional (non-digital) growth. His main conclusions were:

Conclusion 1: Most Sustainable Growth is from 1-2 Profitable Cores.

He mostly looked at Fortune 500 businesses in the 1990’s. And he was specifically looking for growth that was profitable and sustainable (5-10 years).

That makes sense when your client base is large companies. But that is a very narrow definition for growth. A lot of growth is not terribly profitable. And it is rare to show sustainable grow over many years.

But it’s a good place to start. Profitable and sustained growth is the most valuable type of growth.

He concluded that such businesses all had 1-2 profitable cores. He defined a profitable core business as one with the strongest position in terms of loyal customers, competitive advantage, unique skills, and the ability to earn profits.

I don’t really like that definition. I would argue that a profitable core is a business with:

- Growth and/or significant market share

- A competitive advantage

- Attractive unit economics

Basically, we are looking for something that generates cash flow and is well-defended. And has the potential for future growth.

Conclusion 2: You Need to Systematically Grow and Adapt the Core Over Time.

Your best place to look for growth is inward. You focus on your cores and hunt for growth opportunities there. And you need to do this systematically. That means:

1.Focusing on the Heart of the Core.

You need to define your core clearly. What are the specific products, services, or capabilities that differentiate the business and provide sustainable competitive advantage?

2.Maximizing the Core’s Potential.

This can include:

- Deepening Customer Penetration: How can you strengthen relationships with existing customers by improving offerings, enhancing customer experience, or tailoring solutions to their needs? This can involve upselling, cross-selling, and increasing loyalty through superior service.

- Expanding Within the Core: Identify untapped opportunities within the existing market, such as new customer segments, geographic regions, or distribution channels that align closely with the core’s strengths.

- Improving Operational Efficiency: Streamline processes, reduce costs, or enhance quality to reinforce the core’s profitability and competitiveness.

- Innovating Within the Core: This includes introducing new products, services, or features that build on existing capabilities without straying into unrelated areas. This could mean refining existing offerings or addressing unmet needs within the core customer base.

Core Growth is about:

- Deepening and maximizing the existing core business—its most profitable, defensible, and differentiated segment.

- Targeting growth opportunities that are tightly aligned with the core’s capabilities, customer base, and value proposition.

- Exploiting untapped potential within the core, avoiding dilution of focus or resources

You also need to adapt and sometimes redefine your core over time. Markets, technologies and customers change. So, most all cores need to adapt over time (somewhat) to achieve sustainable growth. So, part 3 is:

3. Redefining and Adapting the Core (When Necessary):

- Periodically reassess the core to ensure it remains relevant in a changing market. This involves analyzing shifts in customer needs, competitive dynamics, or technological trends that might erode the core’s strength.

- Adjust the core’s focus by emphasizing new aspects of the business that align with its strengths, such as pivoting to a related customer segment or refining the value proposition.

The basic message is to stay focused on your profitable and defended core business. Look for growth there. Re-invest in the core. Anticipate changes and disruption. You’ve got to protect your source of cash flow.

Conclusion 3: Your Second Growth Strategy Is Targeting Close Adjacencies.

Once you start looking for growth opportunities outside of your core business, your likelihood of success drops. A lot. You don’t know as much. And you don’t have most of your advantages. And most new things just fail in general.

So, you want to focus on growth opportunities that are adjacent to the core business. That are close to what you already do.

- This involves expanding into markets, products, or services that are related to the core but require new capabilities, customers, or business models.

- Adjacencies are “one step removed” from the core, such as entering a new market segment or offering a complementary product.

- But this approach carries higher risk due to unfamiliarity and potential resource stretch.

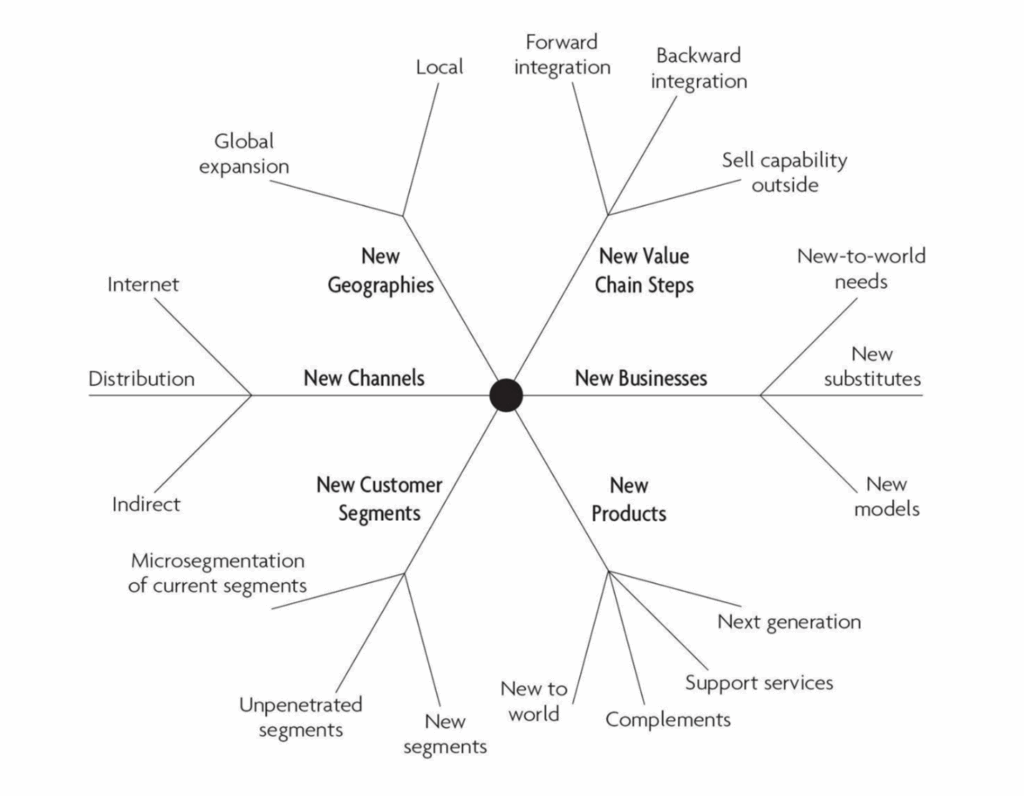

Chris lists 6 growth adjacencies.

- New customer segments:

- Micro-segmentation of current segments

- Unpenetrated segments

- New segments

- New geographies

- Global expansion

- Local expansion

- New channels

- Internet

- Distribution

- Indirect

- New products

- New to world

- Complements

- Support services

- Next generation

- Just new products / services

- New businesses

- New to world needs

- New substitutes

- New models

- Capability adjacencies

- New value chain steps

- Forward integration

- Backwards integration

- Sell capability to outside

And he has a good slide for this:

Most growth initiatives fail. And that is especially true for adjacency moves (like 75% fail). Growth is a game of maximizing the probability of success.

So, you need to find ways to increase your probability of success. Which are:

- Grow in your corer business as much as possible.

- Only go for adjacency growth that close to a core business. Measure this.

- Make this an ongoing activity. Get lots of practice.

- Have a culture of experimentation and growth.

I’ll go into these in Part 2, when I adapt this for digital growth (my playbook).

Cheers, Jeff

——–

Related articles:

- How Alibaba.com Re-Ignited Growth with the Alibaba Management Playbook (Tech Strategy – Podcast 253)

- How Amap Beat Baidu Maps. My Summary of the Alibaba Playbook. (Tech Strategy – Podcast 252)

- Scale Advantages Are Key. But Competitive Advantages Are More Specific and Measurable. (Tech Strategy)

From the Concept Library, concepts for this article are:

- Growth: Core vs. Adjacency

- Growth: Explore vs. Exploit

From the Company Library, companies for this article are:

- n/a

———