In Part 1, I laid out my basic digital strategy – and Chris Zook’s approach to core vs. adjacency growth.

In this part, I want to put those together. This is my digital growth playbook.

How Digital Growth Is Different

Chris Zook’s books (Profit from the Core, Beyond the Core) are a good foundational approach for growth. I am about 70% on board.

But its applicability is somewhat limited.

He was focused on longer term (8-10 years), profitable growth.

That is pretty limiting.

First, most medium and smaller companies don’t think in terms of long-term, sustainable growth. It’s something Fortune 500 companies think about.

Second, profitable growth is not always the goal with digital businesses.

Chris is mostly focused on profit pools. But there are good reasons in digital to go for growth in users, engagement and market share. Even if not profitable. That is a big part of digital strategy. Which is a lot about capturing user attention, getting data and building key resources.

However, profitable growth is definitely 10x more valuable than other growth. No question. Cash gross margins are the engine that makes the enterprise go. And it enables you to spend in marketing and R&D, which fuels growth.

My biggest disagreement is the lack of focus on “innovation fueled growth”. That is the deep well of growth opportunities in digital. Such as:

- Growth by relentless customer improvements, starting with personalization. Also removing pain points.

- Growth by improved customer experiences.

- Growth by new services, especially complementary services.

In fact, I have a whole playbook on growing by focusing on customer improvements.

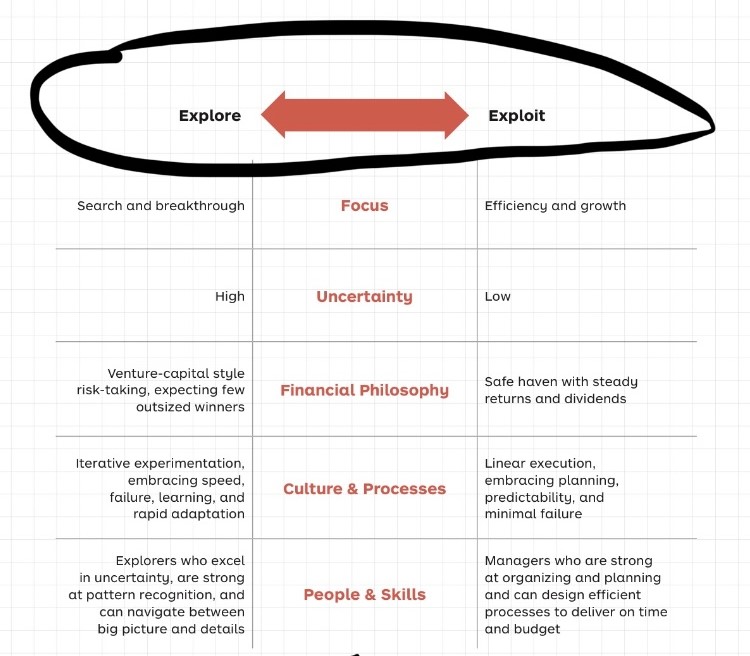

Another common approach is Explore and Exploit.

You balance your time, attention and resources between exploration (which is creative and low yield) and exploitation (which is a more direct usage of a clear opportunity. It’s an approach to innovation and growth.

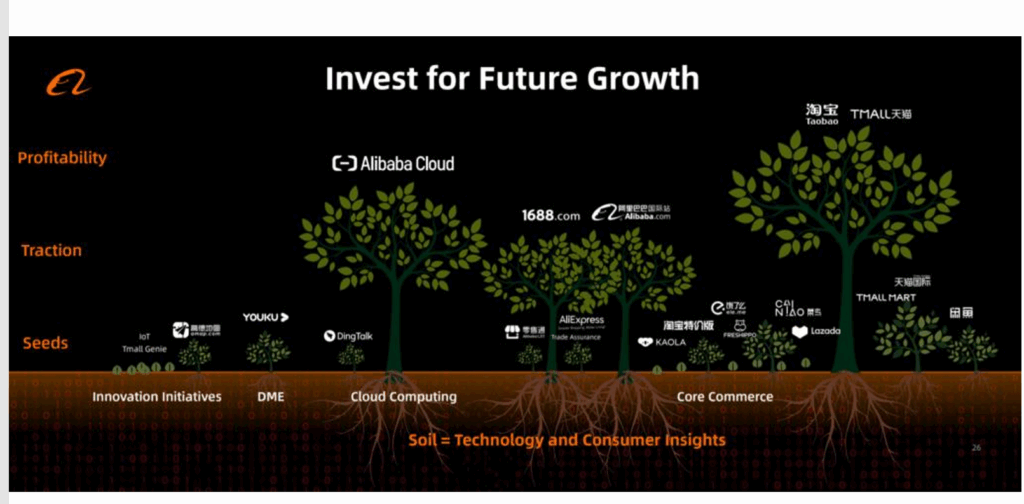

You see explore vs. exploit all the time at digital giants like Amazon, Alibaba and Tencent. They plant lots of seeds. See which grow. Then they further support those that show promise. They do this by launching lots of internal projects and also making external investments. Alibaba and Tencent are famous for making investments about every week. Explore and exploit is a great approach for finding new growth avenues in rapidly changing businesses. It also protects you from disruption.

At investor presentations, Alibaba literally shows their business as growing shrubs, bushes and trees.  Explore and Exploit is great for giants with lots of resources (cash, technical capabilities, etc.). But that’s not most companies.

Explore and Exploit is great for giants with lots of resources (cash, technical capabilities, etc.). But that’s not most companies.

My Playbook for Digital Growth

Given the preceding comments, here is my approach. It’s pretty close to the Zook approach.

1. Focus first on growing the core. Always be inward focused first.

2. Always be improving and adapting the core.

- Things move faster in digital. Improvements and innovations are easier – and offer a direct path to growth.

- Always be studying your customers for insights and opportunities. Always stay focused on how to increase value to users. This is your best source of growth. Such as:

- Targeting microsegments of customers.

- Adding and improving key steps in the customer process.

- Building a system for constant customer improvements. This is my CX playbook.

- And adaptation is the norm, not the exception. This will naturally follow from constant customer improvements.

3. Focus second on adjacency growth with a systematic approach. You need to do it systematically to be good at it.

- Build an ongoing approach that includes:

- Project exploration

- Pilot testing

- Pilot to Scaling

- Killing off low performers

- Additional digital services are usually the best target. Other adjacencies have a much higher failure rate.

- The probability of failure decreases with a higher frequency of adjacency initiatives. And by being linked to the core business.

4. Focus third on identifying game-changing opportunities.

- These may be unrelated to the core business. But worth attempting if they are large enough. Digital businesses can jump into other businesses more readily than physical businesses. An example is Garena jumping into ecommerce with Shoppe. They can also pioneer new business models more easily. The approach here is usually explore and exploit.

Within this approach, the priorities in order are:

- Profitable growth. Go for 5-10% per year. With cash growth margin of at least 20%. Within the product portfolio, we call these the margin products.

- Non-profitable growth that increases the base of customers who might pay for the margin products. We call these attention products.

- Increased customer acquisition, engagement, and retention. This can be done with experiences, features and so on.

- Increases in valuable data. Within a portfolio, we call these data products.

All of this requires a systematic approach. It should not be occasional consideration of growth ideas. You want three ongoing operating activities:

- Constant innovation and experimentation.

- Data-enabled and qualitative learning and feedback.

- A culture of growth and learning. This needs to be projected by management. And incorporated into HR policies, rituals and company activities.

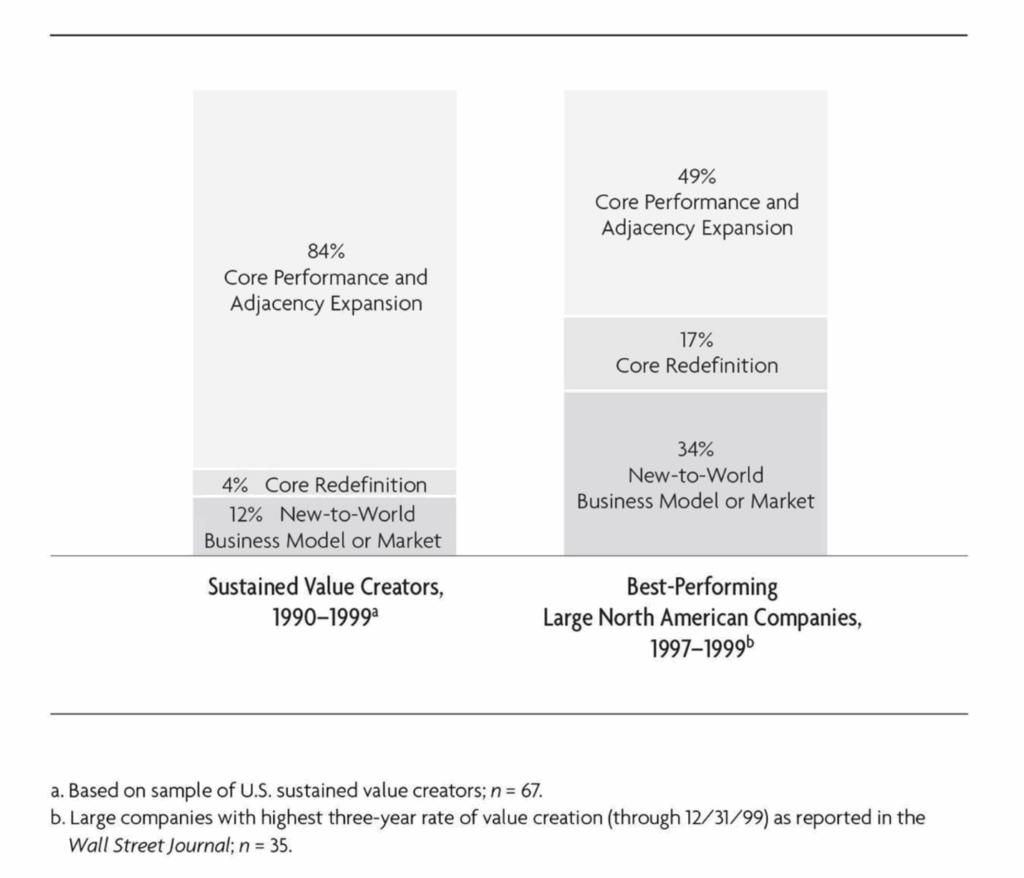

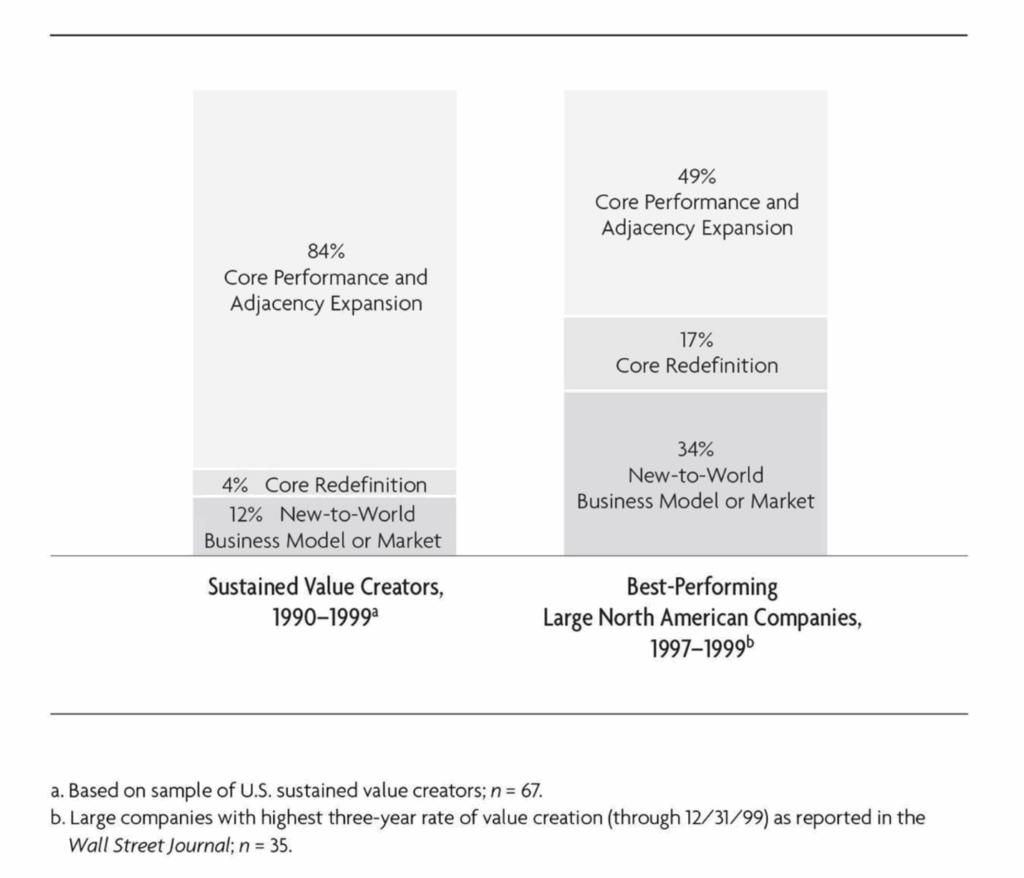

I’ve written about these three activities a lot in the digital operating basics. But you really want a tight learning loop for your customers and your core products and services. That’s how experience curves work. They are cumulative. And all three get better when you do them every week. Here is a graphic from Chris Zook with some good illustrations for this.  He also has a good summary of how growth activities changed over time.

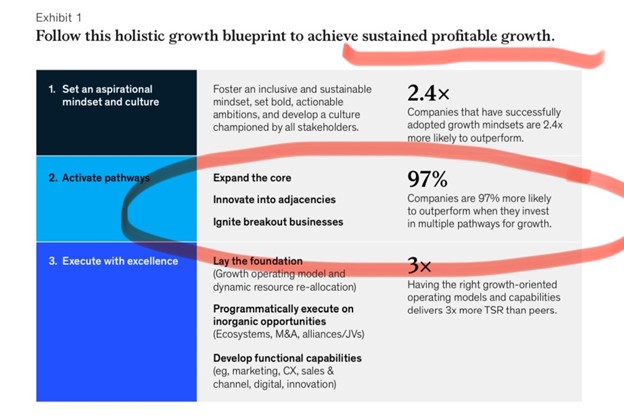

He also has a good summary of how growth activities changed over time.  This is pretty similar to how McKinsey talks about growth:

This is pretty similar to how McKinsey talks about growth:

This is All About Increasing the Probability of Success

Here’s a Zook quote I think about a lot:

“Just 25% of investments in growth initiatives, most of them true adjacency expansions, created value and added growth.”

Basically, most growth stuff fails. So, this is a game of probabilities. And you want to increase your odds of success.

You absolutely do not want to make occasional big growth moves. That’s the worst approach.

Instead, you want to be running the growth playbook all the time. Doing something a lot makes you better at it. And it get you lots of feedback.

Repetition is the key for the learning curve. And for productivity improvements.

It is also key for growth initiatives. Especially growth adjacencies. It also helps if your business model is not complicated.

Zook says that most ongoing growth successes are “built around specific and deep insights about customer behavior that could be replicated in different products or segments or circumstances with high odds of success and profit.”

Types of Adjacencies

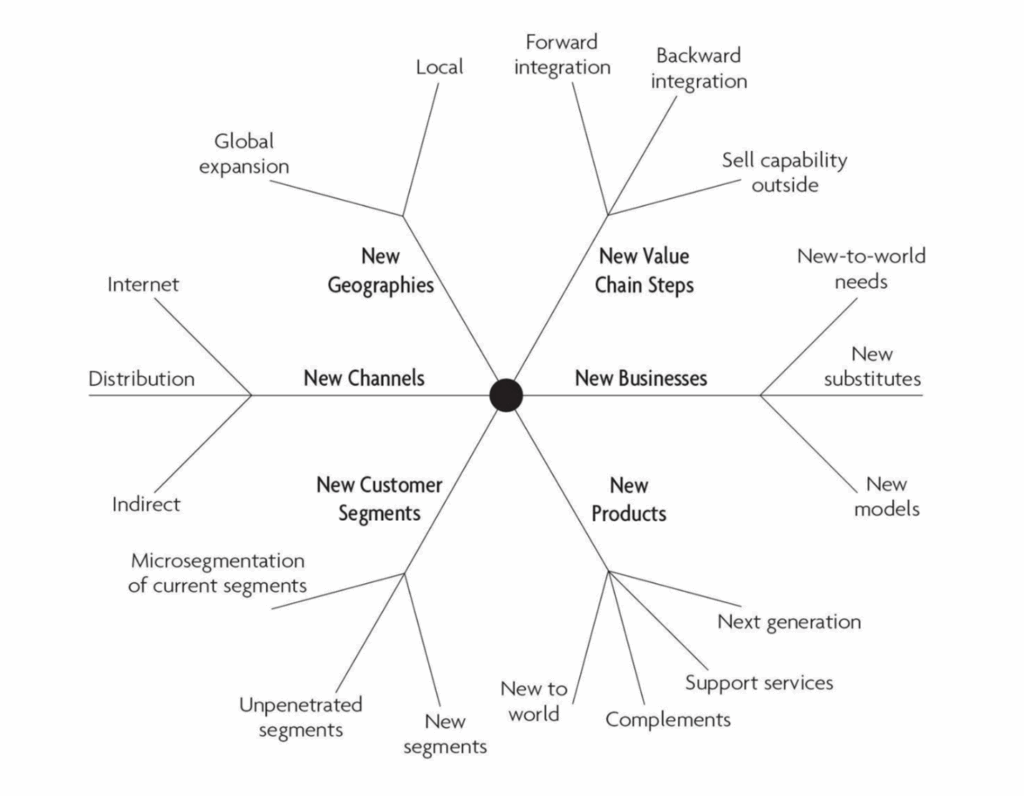

Zook has a whole book on this called Beyond the Core. It is worth reading. The key point is that:

Adjacency moves should strongly draw on core customer relationships, channels, or tech / skills.

That is how you increase your odds of success. And how you decrease the distance between the core and the adjacency. He lists 6 common adjacency moves:

- Customer or product adjacency

- Share of wallet adjacency

- Capability adjacency. This is about tech, business processes or knowledge. This was very hard traditionally. But is easier now.

- Network adjacency. This is growing a network. Think Metcalfe’s law. Railroads. FedEx. Cainiao.

- New to world adjacency. This is about staying on the leading edge of a dynamic industry.

- A new technology enabling new services. Think GenAI.

- Enabling new customer behavior. Such as Geek Squad at Best Buy.

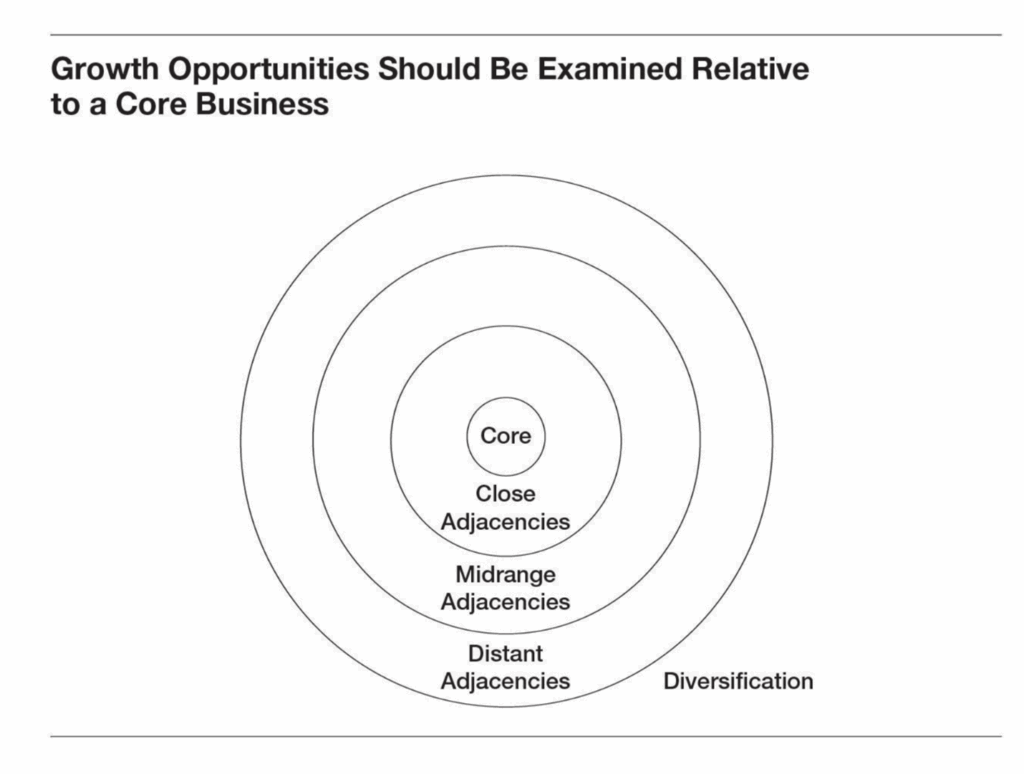

You assess an adjacency move with 3 factors:

You assess an adjacency move with 3 factors:

- Factor 1: Is the adjacency tightly tied to a strong core?

- You want the economic distance to be short. How much do the customers, channels or other overlap? You want a strong core or a strong position in a channel, customer segment or product line.

- Zook argues that the linkage is often considered superficially. For example, Snapple was thought to be close to Gatorade. But in practice, production was totally different. So were the customers and advertising.

- Factor 2: Is it an attractive adjacency market in terms of profit pools?

- Don’t target a market that doesn’t have the potential for significant gross margins. However, in digital there are sometimes reasons to do this (attention products, data products).

- Factor 3: Is the company able to capture economic leadership in the adjacency market?

- Think about your competitive advantage as an attacker versus an incumbent. How likely are you to beat the incumbent? It’s always best to go for soft targets.

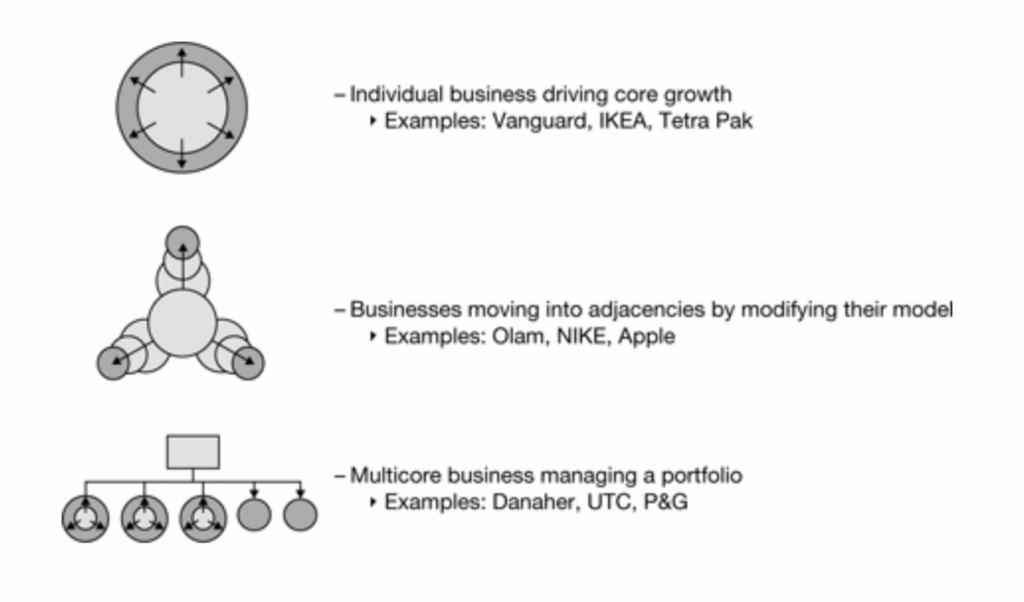

Here’s the graphic from Zook.  Ok. That’s most of what I wanted to cover for digital growth. But there are lots of ways to think about this topic. I’ve put some more below. But you can skip this if you’ve had enough.

Ok. That’s most of what I wanted to cover for digital growth. But there are lots of ways to think about this topic. I’ve put some more below. But you can skip this if you’ve had enough.

Extra Point 1: Focus, Focus, Focus

This is where Chris Zook does a really good job. His team studied why growth initiatives fail. And why previously growing firms stopped growing. They looked at tons of companies.

And their answer was focus.

You don’t want to lose focus. The key to sustainable profitable growth is focus.

Specifically, he says it is about staying focused on 1-2 core businesses. Ideally, those that have good economics and competitive advantages. And that generate cash flow. When firms stop growing, Zook says it is most often for 2 reasons.

- They lost focus on the core. They looked too much at other opportunities.

- They failed to adapt the core.

Extra Point 2: Know What Threatens Your Core

Zook’s list of what to watch out for is:

- Blurring or changing of industry boundaries. Changes can include:

- Development of new intermediaries

- Unbundling of the traditional value chains (including outsourcing)

- Radical and rapid broadening of customer product and service offering by new technology (iPhone)

- Competition by new business models.

- Micro-segmentation of your customers.

- This is a huge risk. Watch out for new and better services for your micro-segments. This is why focusing inward is the best for both growth and defense.

- Outsourcing and other changes to the value chain.

- Digital does this a lot. So does globalization and vertical integration.

- A melting core.

- This is the worst scenario. This is when an industry or market is in rapid structural decline. Think the typewriter competing against the word processor. In this case, your adjacencies become your escape path. Your steppingstone to a more stable future.

Extra Point 3: Reasons Why Adjacency Moves Fail

Here are four to keep in mind:

- You expanded towards and entrenched position

- You overestimated the profit pool

- It was ineffective bundling

- There were unexpected invaders. When it is new territory, there can be lots of new competitor types.

Extra Point 4: Explore vs. Exploit Is a Useful Approach for Both Growth and Innovation.

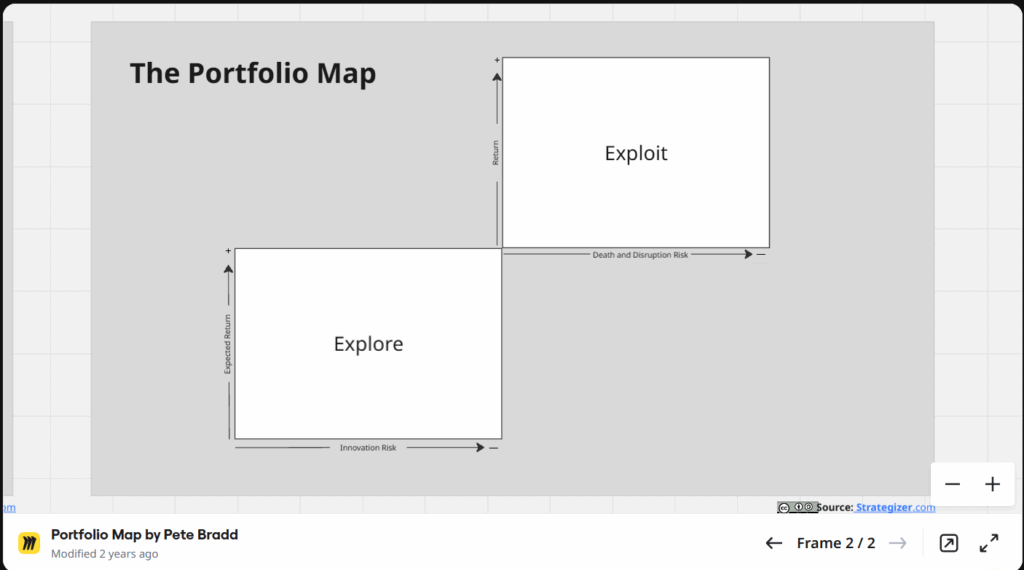

This is a well-known approach by the late James March, who was a professor at the Stanford Graduate Schools of Business and Education. Explore vs. Exploit is about allocating your time and resources in the exploration of opportunities vs. the exploitation of opportunities. Peter Bradd at Miro writes about this topic. Here’s how he describes it:

- “The Explore section concentrates on the identification and evaluation of new ideas and business models. It aids users in assessing the Innovation Risk associated with each idea and the potential expected Return.”

- “The Exploit section maps your existing businesses, value propositions, products, and services against their current Return and Death and Disruption risk. It facilitates the identification and mapping of where your existing businesses stand in their lifecycle.”

- “It’s important to note that the capabilities, financing, and governance of your Explore and Exploit portfolio are distinct.”

He has some good slides on this here.

Extra Point 5: What About the BCG Portfolio Matrix?

This was a pretty big strategy thing decades ago. You can put products into 4 different categories (in a 2×2 matrix):

- Stars – High market growth, high market share

- Cash Cows – Low market growth, high market share

- Question Marks (or Problem Children) – High market growth, low market share

- Dogs (or Pets) – Low market growth, low market share

I don’t use this. But it’s worth looking at.

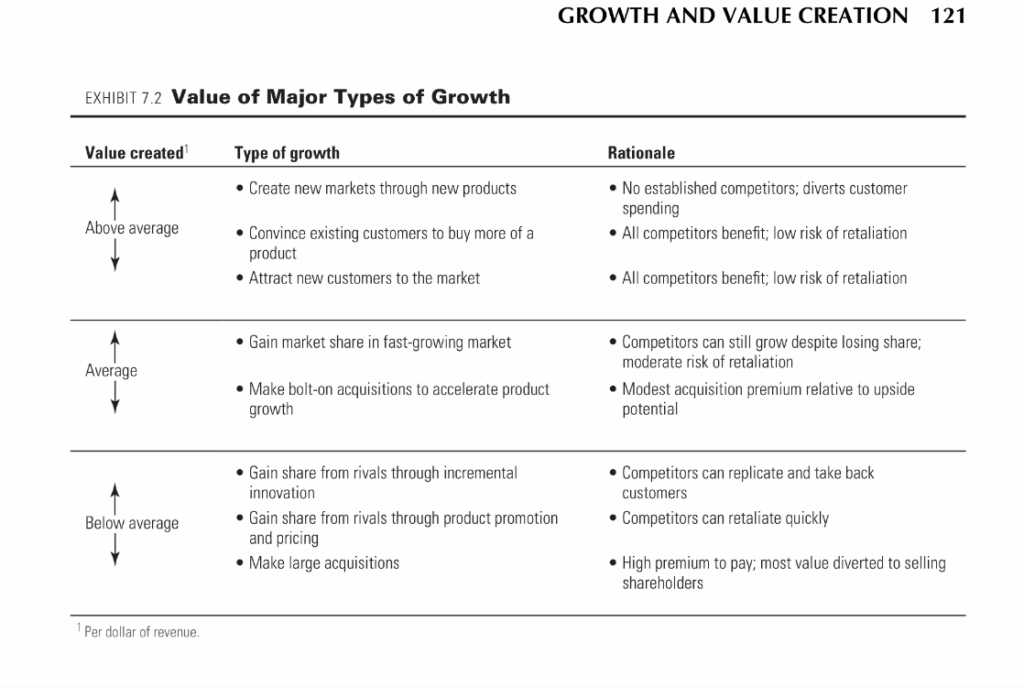

Extra Point 6: McKinsey & Co Valuation Book Has a Great Section on Growth and Value

McKinsey has their massive textbook on valuation. Which is a good resource. And I think the best part of it is the section on growth (and value). They talk a lot about how innovation is a big driver of growth. And on how existing users are usually the best source of growth. I agree with both of those things.

Here is a really good slide from the book. Note how it rates growth initiatives based on the response from other companies.

Final Thoughts

I do have some strong biases in my growth playbook. I thought I would end with those.

- Most businesses cannot pick where to play.

- Investors and MNCs can jump around. But most businesses need to build from where they are. The growth playbook is heavily focused on this approach.

- Growth is your best offense.

- Business is getting faster and more difficult. And especially in digital. So being constantly in growth mode is the right posture.

- Constant growth also requires speed and constant learning.

- Adaptation is also much important in digital.

- Moats are your best defense. This is as important as growth. Maybe more.

That’s it.

Cheers, jeff

——–

Related articles:

- How Alibaba.com Re-Ignited Growth with the Alibaba Management Playbook (Tech Strategy – Podcast 253)

- How Amap Beat Baidu Maps. My Summary of the Alibaba Playbook. (Tech Strategy – Podcast 252)

- Scale Advantages Are Key. But Competitive Advantages Are More Specific and Measurable. (Tech Strategy)

From the Concept Library, concepts for this article are:

- Growth: Core vs. Adjacency

- Growth: Explore vs. Exploit

From the Company Library, companies for this article are:

- n/a

———