Back in 2017 and 2018, I took a bunch of Peking University students to Omaha to have lunch with Warren Buffett. And we also did visits (arranged by Berkshire) to several of his private businesses around Omaha. And as every business he buys has a competitive advantage, it was a good chance to try and reverse engineer the moats of these small but attractive companies. In these this article series, I thought I would summarize them.

Company 1: Borsheims Jewelry

After our lunch with Warren Buffett at Anthony’s steak house, me and the group (in 2017) piled onto our bus and headed to Borsheims Jewelry Company in Western Omaha. Everyone was still pretty jazzed by the 4 hours with Warren. Plus, Omaha has really good steaks.

Our bus arrived at the Borsheims store, which is just a big retail outlet in a shopping mall. It’s their only store, which is an important part of the strategy. And we got a very friendly introduction from Adrienne Fay, the director of marketing and business sales. She, like seemingly all the managers at Berkshire companies, was terrific. Really entertaining. That is her back in the picture below.

Here is a quick summary of Borsheims:

- The store was founded in 1870 by Louis Borsheims and remains a single store business. It was founded with a focus on the railroads going through Omaha at the time. They originally sold watches so passengers could keep time.

- The business was sold to Louis Friedman and his son in 1947. Louis was actually an in-law to Nebraska Furniture Mart (NFM) founder Rose Blumkin (whose son was also named Louis). I’ll talk about NFM in Part 2.

- In 1986, they moved from downtown (5,000 square feet) to their current location.

- Berkshire purchased the company in 1989.

Here are my notes from Adrienne’s talk about the business:

- Management puts a lot of focus on managing its very large and very expensive inventory. They have over 100,000 jewelry SKUs in stock, which enables customers to have a big selection and find unique jewelry. This inventory is shown in their large 36,000 square foot showroom. So the big selection plays out in their inventory and in the size of their one retail location.

- Their expense to sales ratio is about 24%. This is much lower than most physical jewelry retailers, which often have multiple locations, frequently downtown. They keep their costs low relative to those types of retailers by buying in bulk, by having one store and by being in Omaha.

- They focus on value pricing. They offer their customers the “Borsheims price”, which is a promise that you won’t find a better price anywhere else (so don’t bother shopping around). She mentioned that this creates some conflict with famous brands who want more brand positioning and premium pricing. Online jewelry retailers (like Blue Nile) are also an issue as they can offer low prices.

- Knowledgeable staff are a key part of their offering. Jewelry sales have historically been person-to-person and about building relationships over time. They model out their customer preferences and understand the sales lifecycle of their customers. A wedding ring is usually the first major purchase of a male customer – and the start of the relationship. Note: engagement rings are 33% of their sales.

- She talked about how jewelry is an emotional, purely discretionary purchase.

Some other factoids:

- They offer a 90-day return policy.

- Half of their customers are outside of Nebraska.

- They are trying to recreate their shopping experience online. E-commerce was 8% of sales in 2018.

- They don’t care about increasing the value of their inventory over time (by inflation or other means). Their goal is inventory turns, typically 6-8x per year. However, a lot of inventory is held for 1-2 years. If it is held after 6 years, they generally sell it.

- Millennials are changing their preferences in terms of jewelry purchasing. Some are choosing experiences over luxury items.

At first glance, Borsheims is similar to Buffet’s more well-known retailer Nebraska Furniture Mart. It’s a big furniture store with massive showrooms and tons of inventory.

- Both were founded in 1870.

- Both focus on just a few categories of products, in this case wedding rings, jewelry and watches. NFM does furniture and carpets (historically).

- Both eventually moved from downtown Omaha to solitary large stores in Western Omaha.

- Both focus on offering customers a large selection that customers can look at and choose from in person. Borsheims has a 62,500 square foot facility and carries over 100,000 jewelry SKUs. And like Nebraska Furniture Mart, this means big inventory costs. Note: both jewelry and carpet have long depreciation schedules (compared to say attire and fashion).

- Both retailers offer unbeatable prices in their local markets. In Borsheims case, they highlight their “Borsheims Price”.

- Both are uniquely large retailers in their local markets. The furniture mart is the largest furniture retailer in the USA. Borsheims claims to be one of the largest, independent jewelry stores in the USA. And both are massive for Omaha.

However, differences between furniture and jewelry retailers jump out pretty quickly.

- Buying jewelry is a lot more about trust and relationships. The expense is far greater and the quality is harder to ascertain. It’s not like sitting on a bunch of sofas and deciding which one you like. Most jewelry customers rely on an expert they trust. As Warren Buffett says, “If you don’t know jewelry, know the jeweler.” Trust and personal relationships are a big part of Borsheims business.

- Note: people also buy gifts very differently than things they buy items for themselves. They are much less price sensitive.

- Note: For jewelry for significant occasions (wedding, anniversary) is often a man buying a wedding ring or other jewelry for a wife or girlfriend. And most need help choosing the right one, which usually requires advice. Is this one good? Which one will she like?

- Geography and transportation costs are not as important in jewelry. Nobody buys a sofa from New York if they live in St. Louis. But you can buy a ring, and have it shipped, depending how comfortable you are with the quality.

Ok. Based on that, let’s jump to the key questions of:

- Why did Warren buy Borsheims jewelry in 1989?

- What was its competitive advantage? And does Borsheims still have it?

Question 1: What is the Borsheims Customer Experience?

When I take apart companies, I always start with the customer journey. How do they buy jewelry? What do they care about? I go through it in detail.

Warren frequently suggests this approach. He says it helps to put yourself in the mindset of the customer. Walk through the process. It also helps to put yourself in the mind of a competitor. I do both for every company I look at.

In the Q&A at lunch, Buffett had mentioned that when he bought See’s candy, he thought there was “untapped pricing power”. That it was a business with “pricing flexibility.” Because Sees chocolate is an occasional luxury and most of its customers don’t care if you charge $1.2 instead of $1 per piece. Plus, See’s candy is frequently given as gifts. It is something you give to a girlfriend or wife on Valentine’s Day or Christmas. And most guys won’t give their wife discount chocolate on such occasions.

Jewelry, like chocolate, has similar customer behavior. The buyer is not actually the end user. Borsheims is a “gifting business”. People are not going to buy cheap stuff. Plus, there is a lot of social pressure in buying jewelry. Men know what will happen if they buy a wedding ring that is not expensive enough. It’s almost forced gifting. There are lots of other reasons people buy jewelry, but, like Sees candy, it is a sector with some very weird consumer behavior. Most of which benefits the business.

As mentioned, a customer’s first interaction with Borsheims is usually a man buying a wedding ring for his fiancé. In this case, the average guy will almost always ask for advice – from his fiancé, a friend or from a jeweler. Most men don’t know much about jewelry. And they know even less about what women want in jewelry they receive as gifts. So men need someone they can trust and who will help them pick the right ring. And they will not usually skimp too much on price. This interaction typically starts the relationship, and the customer will then continue buying for anniversaries and birthdays after this. This can relationship go on for decades.

As mentioned, there is a lot of price flexibility in jewelry. People will pay thousands of dollars. And customers aren’t buying the cheapest available. The consumer psychology is particularly powerful in many jewelry-purchasing situations. Borsheims talks about serving the “special moments in life”. About times when you “need a gift”. That sort of language is a tip-off to a psychology-based strategy.

Given that, think about how Borsheims positions itself. It offers quality jewelry at value prices. And it offers a trusted relationship. It really does fit the mass market customer experience just described.

Let’s move on to the next question:

Question 2: Can Competitors Compete With Borsheims?

As mentioned, Borsheims is a value player. They are offering quality jewelry, not cheap stuff. You can trust that it is good quality. But they are also offering a Borsheims price that others can’t beat. The company is built to live on smaller margins than its competitors. Companies like Tiffany’s live on 60% gross margins. While Borsheims was built to thrive at 40%.

That is why they have one big store in Omaha, instead of lots of smaller stores in prestigious (i.e., expensive) locations. Plus, they can typically buy jewelry 15% cheaper due to their volume (and because they make their payments in cash).

The other part of their customer proposition is “big selection”. A typical independent jewelry store will stock around 2,500 items. Borsheims typically has 100,000 items available to view. So as a retailer, they are the local destination with the biggest selection and the lowest prices. And just like people like to sit on sofas before they buy, customers also have historically liked to “see, touch and feel” rings before they spend $3,000. So it is a local purchase.

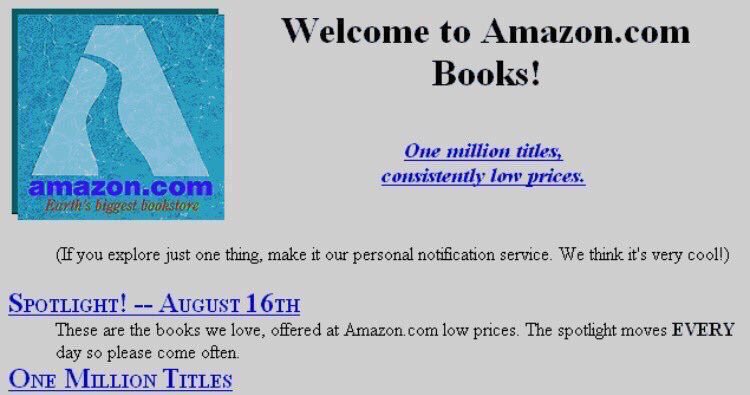

This is a common winning strategy for retailers. The below graphic is the first website for Amazon. Note the value proposition shown. They are also pitching low prices and a huge selection.

So, if you are a competitor, how do you beat a retailer like Borsheims? How do you get customers to come to your store instead of theirs?

Well, for the mass market you would need to (at a minimum) match their prices and their big selection.

- That means opening a really big store and then filling it with a lot of expensive jewelry inventory.

- It would mean matching their pricing, which probably means losing money for quite a while. You won’t be able to get COGS at the same price.

- It also means finding customers who don’t have existing personal relationships with Borsheims, which would be hard to break.

Overall, it’s not easy to do. It’s a game of customer capture plus economies of scale in a low-growth and circumscribed market. In terms of my frameworks, it’s pretty straight forward.

- The barrier to entry is the big fixed costs for opening a large retail store in a relatively small geographic market. And then filling it will a big selection of very expensive inventory. It’s a big first step to match Borsheims current operations.

- The competitive advantages are:

- Captured customers by virtue of personal relationships and legacy branding. People have been buying all their jewelry at Borsheims in Omaha for over a hundred years. And they have long relationships, starting with their wedding ring. That is a softer form of customer capture.

- Economies of scale with fixed costs in inventory and the physical store. Borsheims can spread out their inventory costs over greater volume of sales. It will be hard to match their selection at the same per unit price.

- Purchasing economies of scale. They get jewelry cheaper. So they are hard to match on price. And they are impossible to beat.

Basically, a competitor can’t beat them at their own game.

The only option is to differentiate. You could offer premium jewelry. But that’s not great. And it turns out there aren’t really a lot of dimensions to the jewelry buying experience to differentiate on.

That’s a strong competitive picture overall. But is it changing? Is it fading?

Borsheims “big selection” advantage is definitely decreasing. The internet is making this easier to match than before. In 1980’s Omaha, there were not many ways to buy jewelry that weren’t local. Maybe catalogs. But today, online competitors like Blue Nile offer +300,000 gemstones on their site and they have increasing access to diamonds. And people are getting more comfortable with the idea of buying jewelry online and having it shipped. There is escrow and insurance. You can have it checked and do returns. Plus, the shipping cost is a small percentage of the cost for a wedding ring.

Management mentioned that the most common question they get is how much of their business is now online. And they spoke a lot about how they are trying to recreate the Borsheims experience online.

Borsheims management said their three pillars are “value”, “selection” and “customer service”. I have described the first two pillars. But the third is probably Borsheims best strategy to protect its business going forward. “Customer service” speaks to the unique psychology of buying and gifting for jewelry. People worry about getting the wrong jewelry. They want advice. And Borsheims sales staff typically have 15-20 years of experience at their store. The customer relationship is critical, and they get a lot of repeat business. And customers ultimately don’t need more than 100,000 options to choose from.

We’ll see.

***

That’s it for Borsheims. In Part 2, I’ll do Nebraska Furniture Mart.

Cheers, Jeff

———

Related articles:

- Lessons in Competitive Advantage from Warren Buffett’s Omaha Businesses: Nebraska Furniture Mart (Tech Strategy – Daily Article)

- How Generative AI Services Are Disrupting Platform Business Models (1 of 2) (Tech Strategy – Daily Article)

- The Winners and Losers in ChatGPT (Tech Strategy – Daily Article)

- Why ChatGPT and Generative AI Are a Mortal Threat to Disney, Netflix and Most Hollywood Studios (Tech Strategy – Podcast 150)

From the Concept Library, concepts for this article are:

- Economies of Scale

- Retail

From the Company Library, companies for this article are:

- Berkshire Hathaway

- Borsheims

———–

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.