I did a podcast on nfx list of 16 Network Effects. And on the 3 big effects of network effects.

- NFX’s 16 Network Effects. Plus, Embedding and Other Small Digital Ideas (Tech Strategy – Podcast 158)

- The 4 Big Effects of Network Effects (Tech Strategy – Podcast 225)

This was about James Currier and his venture capital firm nfx, who have a lot of detailed thinking about network effects as a concept. It’s worth reading his Network Effects Manual.

Nfx’s 16 Types of Network Effects

My concepts are much more complete in terms of analyzing business models, but it is not as directly useable in terms of network effects. NFX’s list of 16 network effects (with their examples) is worth using as a checklist.

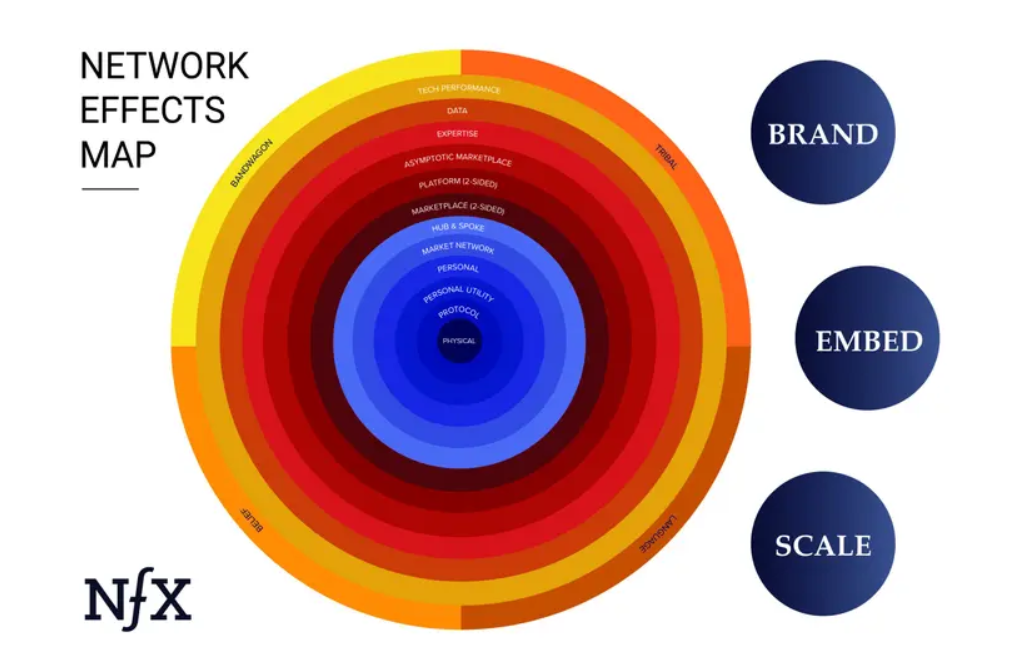

Here is the nfx list, from strongest to weakest:

- Physical (e.g., landline telephones)

- Protocol (e.g., Ethernet)

- Personal Utility (e.g., iMessage, WhatsApp)

- Personal (e.g., Facebook)

- Market Network (e.g., Honey Book, AngelList)

- Marketplace (e.g., eBay, Craigslist)

- Platform (e.g., Windows, iOS, Android)

- Asymptotic Marketplace (e.g., Uber, Lyft)

- Data (e.g., Waze, Yelp!)

- Tech Performance (e.g., BitTorrent, Skype)

- Language (e.g., Google, Xerox)

- Belief (e.g., currencies, religions)

- Bandwagon (e.g., Slack, Apple)

- Expertise (e.g., Figma, Microsoft Excel)

- Tribal (e.g., Apple, Harvard, NY Yankees…)

- Hub-and-Spoke (e.g., TikTok, Medium, Craigslist)

Here is the nfx summary map, which is pretty good. Note the prioritization by strength (strongest in the center). I mostly agree with this prioritization and I think it captures a lot of their experience working with such companies.

Note: they also put brand, embed and scale as other types of competitive advantages.

My Framework for Network Effects

My approach to this topic is to think about 3 different digital concepts:

1. There are 3 types of networks. These are the assets on which the businesses are built.

Physical Networks. Think roads, canals and phone lines. These are often hub-and-spoke.

Protocol Networks. Think connected computer networks.

People and Company Networks. You can increasingly add digital agents to this group.

2. There are 5 types of platforms. These are the business models that can be built on network assets. Discussed many times.

- Marketplace Platform

- Innovation Platform (including Audience-Builder Platform)

- Coordination Platform

- Payment Platform

- Learning Platform (TBD)

3. There are 3 types of network effects. These are phenomena that can emerge in these business models. They required connected networks. But not necessarily platform business models. They are:

- Direct Network effects

- Indirect Network Effects

- Standardization and Interoperability Network Effects

I find this creates a complete list. And rightly separates network effects from business models and from network assets.

I agree with 11 of Nfx’s network effects. They are in bold below. They are 1-7, 11, and 14. And I generally agree with their prioritization by strength. They are:

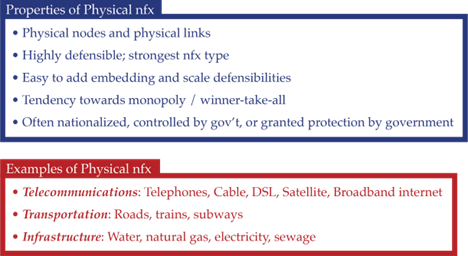

- Physical (e.g., landline telephones). These are Direct Network Effects. But are based on physical networks. So we see network effects as a competitive advantage. But also a barrier to entry based on the time, cost and difficulty of replicating the physical network.

- Protocol (e.g., Ethernet). Also Direct Network Effects. But based on protocol networks, which are intangible.

- Personal Utility (e.g., iMessage, WhatsApp). Direct Network Effects. Based on people / company networks – but with a commoditized, undifferentiated service that is a necessity. And these are the things you need to use like communications, work, emergencies, etc.

- Personal (e.g., Facebook). Direct Network Effects. This is similar to 4. But more based on connections and services, rather than just needed utilities. This is about increasing value, which can involve lots of stuff.

- Market Network (e.g., Honey Book, AngelList). This is an Indirect Network Effect that combines a social network with a marketplace. This is original James Courrier thinking. They are arguably more powerful than just marketplaces, with no ongoing social relationship.

- Marketplace (e.g., eBay, Craigslist). This is an indirect Network Effect in a marketplace platform. This is a big bucket of business models.

- Platform (e.g., Windows, iOS, Android). And indirect Network Effect but in an innovation platform. I put audience builders, payment platforms and learning platforms in this category.

- Asymptotic Marketplace (e.g., Uber, Lyft). Don’t believe in this as a stand-alone network effect. Most all marketplaces and platforms go asymptotic at some point.

- Data (e.g., Waze, Yelp!). Don’t believe in this as a stand-alone network effect. You can see a flywheel in performance but it almost never becomes a network effect. Everyone always points to Waze here. However, a repository of data or content can create a barrier to entry that is hard to replicate.

- Tech Performance (e.g., BitTorrent, Skype). This is a characteristic of of some protocol and communication networks. They have direct network effects where the tech increases in performance with more usage.

- Language (e.g., Google, Xerox). This is a type of Standardization and Interoperability Network Effect. On a people network. Without a platform business model. Languages become more valuable the more then are used. And communication becomes cheaper and more efficient.

- Belief (e.g., currencies, ideology, religions). This is an interesting version of direct Network Effect between people. Within a people network. Belief can be powerful on its own (Share of Consumer Mind, Switching Costs, Lower Acquisition Costs). But it is more powerful when it is a shared belief. And it can get more valuable with more members (network effect). We can also point to extreme versions of this such as “Folie à deux” (French for ‘madness of two’), where there is a shared psychosis or shared delusional disorder (SDD). How beliefs (inducing delusional beliefs) are “transmitted” from one person to another is a big topic.

- Bandwagon (e.g., Slack, Apple). Don’t buy this one as a network effect. This is usually just a short-term FOMO phenomenon.

- Expertise (e.g., Figma, Microsoft Excel). Also a Standardization and Interoperability Network Effect. But not a platform business model. This is mostly about the cost savings when there is a common language or skill. It makes it cheaper and more efficient to communicate. You can also consider the training required a barrier to entry.

- Tribal (e.g., Apple, Harvard, NY Yankees…). This is another powerful phenomenon where joining a tribe. It’s about identity. Which can rise to share of consumer mind and switching costs. Shared identity can sometimes become a network effect where everyone helps others in the tribe.

- Hub-and-Spoke (e.g., TikTok, Medium, Craigslist). Don’t buy it. This is just a type of indirect network effect on an audience builder platform. TikTok doesn’t just match content with viewers. It creates a central hub and then pushes specific content out broadly.

***

Ok. That’s my take on nfx’s list. Let me lay out how I think about network effects.

Network Effects Are Naturally Occurring Phenomena in Connected Systems

Network effects always remind me of forests full of trees. You walk through the forest or jungle and see lots of types of plants and vegetation. But this one type of organism (a tree) just dominates. It is everywhere. It covers continents. You can see forests from space. Forests and trees jump out as an organism that has something that is just much more powerful.

That’s how I think of network effects. It is a naturally occurring phenomenon that sometimes happens in a business. And when it does, it makes that organism particularly powerful. It lets a particular organism take off and dominate an ecosystem.

But what exactly is the phenomenon?

For trees, their power is the result of lots of different things happening at the same time.

- The roots go into the ground and drink water (and stabilize the structure). Hydrostatic pressure draws the water from the roots up to the branches and leaves, often hundreds of feet above.

- The trunk is covered in bark that protects it from insects, temperature, and disease.

- The main trunk grows up through the undergrowth, stabilizes the weight and gets the leaves into the sunlight above the forest or jungle.

- The leaves then capture the light and convert it into energy.

It’s a pretty amazing structure with lots of components happening at the same time. But it’s hard to point to one specific thing that gives it its unique power.

Network effects are the same. They are particularly powerful but it’s often hard to point to one thing that enables them. It is the result of a lot of things happening at the same time. And you usually just have to look for the net result.

The key net result you look for is a service or product that increase in its customer value with more users or usage. More on this below.

It’s important to note that trees and forests only have their power in a certain range. They can grow fast but this is mostly when small. They can grow high but they stop growing at a certain height (before the weight causes them to topple).

It’s the same for network effects. This powerful phenomenon usually only lasts for a while. As I frequently say, trees don’t grow to the moon and network effects don’t go on forever.

It’s not a perfect analogy but I think you get the point.

The power that is usually at the core of network effects is the basic equation below. Which shows that the number of linkages in a connected network can increase much faster than the number of nodes. For example, if you have 4 nodes and add one more, you increase the number of linkages (connections) from 6 to 10. The number of linkages increases faster (often exponentially) with the number of nodes.

But what if the value of a product to the customer is related to the number of linkages? That would mean the value would increase quickly with the number of users (i.e., nodes). We are looking for situation where the perceived value to customers is in the number of linkages in a connected network.

Now, it’s a lot more complicated than this. It turns out the value of a linkage can vary dramatically. It’s not just about how many.

But this is why I always start by looking at the connected network (physical, protocol, people). And then I look at the platform built on this. And then the network effect.

Network effects have long occurred in transportation businesses (pipelines and railroads). They used to mostly be a physical phenomenon. Although we also saw them in interactions between people, such as in expertise and languages (standardization network effects).

But as the world gets more digitalized, it becomes more connected. That is why this concept has become so much more important. More on that below.

I Agree with 9 of Nfx’s 16 Network Effects

I think nfx rightly points out that direct network effects are the most powerful type.

The first four on their list are all direct network effects.

- Physical (e.g., landline telephones)

- Protocol (e.g., Ethernet)

- Personal Utility (e.g., iMessage, WhatsApp)

- Personal (e.g., Facebook)

These are also called one-sided network effects. This is when you have only one user group in your network. And you are building connections and interactions among them. The product usually enables an interaction type. And more users can directly increase the value to other users. So this is your phone system and your WhatsApp app. This is the most direct version of the above picture of nodes and linkages.

For direct network effects, each new node (say a person you can call) directly increases the value of the service. And the number of connections can go up really fast with more users.

Direct network effects tend to be competitively dominant when they are commodity (i.e., undifferentiated) services. Such as in communications or p2p payments. Or in Ethernet and Bitcoin protocols. In such commodities, there are few dimensions upon which to compete or differentiate. So, the competition for this service is almost entirely about who has the biggest network. This is why in most countries there is only one messenger (WeChat in China, WhatsApp in most of the world).

Once we get out of commodities (or utilities), it gets more complicated. The type of “value” to the user can be very different. It can be the ability to store money (currency, Bitcoin). Nfx breaks personal network effects into Personal and Personal Utility, which the utility being higher on the list.

In the Network Effects Manual, nfx quotes AT&T CEO Theodore Vail, who is sort of the father of network effects. He was the first CEO to really talk about them explicitly (at least in annual reports to shareholders). He said he had “noticed how hard it was for other phone companies to compete with AT&T once they had more customers in a given locale…”. He noted that “two exchange systems in the same community, cannot be… a permanency. No one has use for two telephone connections if he can reach all with whom he desires connection through one.”

That’s an interesting point.

When it is a commodity service with a direct network effect, there is really no reason for a user to have two services. The market tends to collapse to one player, and you get a natural monopoly. In marketplaces and other two-sided network effects, we usually see some differentiation in different services. You usually get an oligopoly.

Here is how nfx summarizes physical and protocol network effects, which are the top of their list.

Nfx also talks about Metcalfe’s law, which I really don’t like. Bob Metcalfe is really an amazing thinker and entrepreneur. He created the Ethernet and 3com. But he was mostly talking about protocol networks. And his “law” is usually not correct for most situations outside of protocols.

Nfx also points to Reed’s law, which I also don’t like much. I’ve ranted about this before. But I agree with the overall conclusion. Direct network effects are the most powerful and belong at the top of the list.

As you move down the list, you go from direct to indirect (or two-sided) network effects. The next three on the nfx list are:

- Market Network (e.g., Honey Book, AngelList)

- Marketplace (e.g., eBay, Craigslist)

- Platform (e.g., Windows, iOS, Android)

I don’t really agree with this framework. I think we are mixing in different platform business models. I like my 5 platform business models approach much better (in my opinion). You should start by characterizing different types of interactions between different user groups within business models. That gets you marketplaces, innovation platforms, audience-builder platforms and so on. Most of the important differences show up here. Not in the network effect.

For direct network effects, you often don’t have a platform business model. You just have the network asset and the network effect. That’s Facebook Messenger and WhatsApp. These can be pretty simple services. However, as you add user groups, you get more complicated business models and services. And platforms are a better way to talk about them.

Nfx rightfully points out that “no two 2-sided marketplaces are exactly the same. One way they can significantly differ is in the “value curve.” This refers to how fast the value to the demand side increases as supply increases, and how strong the nfx get when critical mass is reached.”

And nfx shows three types of curves for marketplaces.

I don’t really like Nfx’s description of an asymptotic marketplace. We can see such curves in all types of platforms, not just in marketplaces. And we are seeing new types of platforms emerge based on new interactions.

So I don’t think 8 or 9 on the nfx list really exist. And I think 10 is just a protocol network effect.

- Asymptotic Marketplace (e.g., Uber, Lyft)

- Data (e.g., Waze, Yelp!)

- Tech Performance (e.g., BitTorrent, Skype)

11, 12, 14 and 15 are more interesting but I just call them a Standardization and Interoperability Network Effect. Especially language and expertise, which I’ll go into in Part 2. The others are more of a share of the consumer mind phenomena.

- Language (e.g., Google, Xerox)

- Belief (e.g., currencies, religions)

- Bandwagon (e.g., Slack, Apple)

- Expertise (e.g., Figma, Microsoft Excel)

- Tribal (e.g., Apple, Harvard, NY Yankees…)

And finally, the last one (hub-and-spoke) is just a different type of network asset with fewer connections. Hub and spoke models are common in airlines, trains, and pipelines. I don’t think it’s much of a network effect at the local level. But it can be important at the national and international level. Federal Express gets most of its power by connecting cities and countries, not streets within a city.

- Hub-and-Spoke (e.g., TikTok, Medium, Craigslist)

So basically, the last two that I think are compelling are

- Language (e.g., Google, Xerox)

- Expertise (e.g., Figma, Microsoft Excel)

I’ll go into them in Part 2. And I’ll show my method for network effects.

Cheers, Jeff

- My Method for Assessing Network Effects (2 of 3) (Tech Strategy)

- Can You Get Network Effects from Belief? What About from Tribes, Expertise, and Language? (3 of 3) (Tech Strategy)

——–

Related articles:

- 3 Types of Network Effects (Asia Tech Strategy – Daily Lesson / Update)

- Questions for Huawei’s CEO, JD & Jingxi, Metcalfe’s Law Is Dumb (Asia Tech Strategy)

From the Concept Library, concepts for this article are:

- Network Effects

From the Company Library, companies for this article are:

- NFX / James Courrier

Photo is AI generated

——–

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.