A disclaimer: None of this is information or opinions from Cainiao. The discussions are still off the record at this point (but not the photos and videos). So, these are my own personal lessons. This is not anything anyone said during the visit.

China Tech Tour Day 4: Hangzhou and Cainiao

Our Tech Tour group was staying on the West Lake in Hangzhou. The lake-front area is really the main tourist attraction for Hangzhou, an old historic capital of China. Pretty much everyone who comes to Hangzhou hangs out and walks around the lake. It’s gotten pretty fancy now with lots of shops and restaurants. It’s basically just a nice, pleasant place to relax, with the lake sandwiched between the town and a ring of mountains.

Photo by Stewart Edward on Unsplash

Hangzhou is now referred to as a first-tier city, joining Beijing, Shanghai, and Guangzhou in that vaguely defined category. And that has a lot to do with the tech-driven rise of the city.

Because if you drive West around the lake and to the other side of the mountains, you start to see lots of tech companies. There is Alibaba’s main campus, which is huge and is currently being redone (i.e., upgraded). There is gaming giant NetEase. There is Ant Group (more on that in another article). And there are coffee shops and shopping malls everywhere.

And if you drive south about twenty minutes you reach the new Cainiao headquarters, which has just opened. It’s a combination of office space and an industrial park. And, big surprise, it’s pretty spectacular. Here are some photos.

Like all the Alibaba facilities, it’s just really, really nice. I think they use the same architecture team for all of their major facilities. They’re all different but they’re all impressively nice.

And, of course, Cainiao has an animal symbol. In this case, it’s a sort of smart, tech bird? I guess to represent smart logistics? Every Alibaba business has some sort of animal symbol and Joe Tsai’s standard joke is that Alibaba has built the world’s largest petting zoo.

Now I don’t have any big strategy lessons from Cainiao. I’m working on that. And it’s still more of an internal capability than a business at this point.

But some important things are happening with Cainiao right now. So let me talk about those. These are more like important updates.

Update 1: Cainiao Has a New Org Structure and Leadership

In the past several months, two important things have happened in terms of Cainiao’s organization and leadership.

First, Cainiao is now a separate business under Alibaba’s new 1+6+N organizational structure. It is one of the six business units, which means it is going to start operating more like a profit center. And, given the capital-intensive nature of logistics, I suspect it is one of the businesses that will go IPO soon. The goal of the new structure is to align the business units more closely with the capital markets. That is going to force them to change their behavior. I think we could see a big change in behavior with Cainiao, mostly in terms of forcing it to be more services and profit focused.

Second, co-founder Joe Tsai has returned to Alibaba and is taking over as Chairman for the entire group. He is replacing Daniel Zhang who has been both group CEO and Chairman – and is now moving to run Alibaba Cloud. The return of Joe Tsai (who spends his time with his basketball team the Nets) was a pretty great surprise. I really like Joe Tsai. He was the private equity guy that joined Jack Ma, when Alibaba was nothing but an idea. In my opinion, he has been one of the biggest brains behind the rise of Alibaba from the start. And I’ve been very impressed when I’ve had meetings / lunches with him. To be honest, I usually don’t understand what Jack Ma is talking about. He speaks in a language that is foreign to me. But when private equity guy Joe Tsai explains what Alibaba is doing, I get exactly what he is talking about.

However, Joe is not just becoming chairman of the entire Alibaba group. Joe is also becoming Chairman of Cainiao Smart Logistics. That will make him and CEO Wan Lin the key people to watch for this business. And that is just really good news.

Put these two things together and I think we could see a lot of movement at Cainiao in the very near future.

Update 2: Cainiao Will Be Changing from an Internal Capability to a Services Business

Cainiao has always been mostly an internal logistics capability supporting Alibaba’s ecommerce business. Here’s a bit of the background:

- 2013 – Cainiao was created as a “smart logistics” unit within Alibaba.

- 2014 – Cainiao created its e-waybill, which is still the key “technology’ that tracks everything in terms of parcels.

- 2015 – Cainiao adopted its “three nets, two strengths” strategy. They are building three networks (express delivery, warehouse network, terminal network) – and two additional services (cross-border logistics and rural logistics). That is still most of their strategy.

- 2016 – Cainiao Alliance was formed. This is when they began working with a consortium of express delivery companies. Cainiao positioned itself more as the digital nerve system for the entire network. This is also when they announced same day and next day delivery in this more coordinated system.

- 2017 – Cainiao opens its first foreign e-hub. In Kuala Lumpur. This was the beginning of their globalization move.

- 2018 – Cainiao acquired four express delivery companies. The company started building its own internal capability, instead of relying entirely on external companies.

- 2020 – One Cainiao was launched. They acquired several warehouse and delivery companies. This was Cainiao operating much more as its own fulfilment company.

- 2021 – Cainiao Post began offering doorstep delivery across China. The massive footprint of Cainiao Post stations is one of their key capabilities. More on this below.

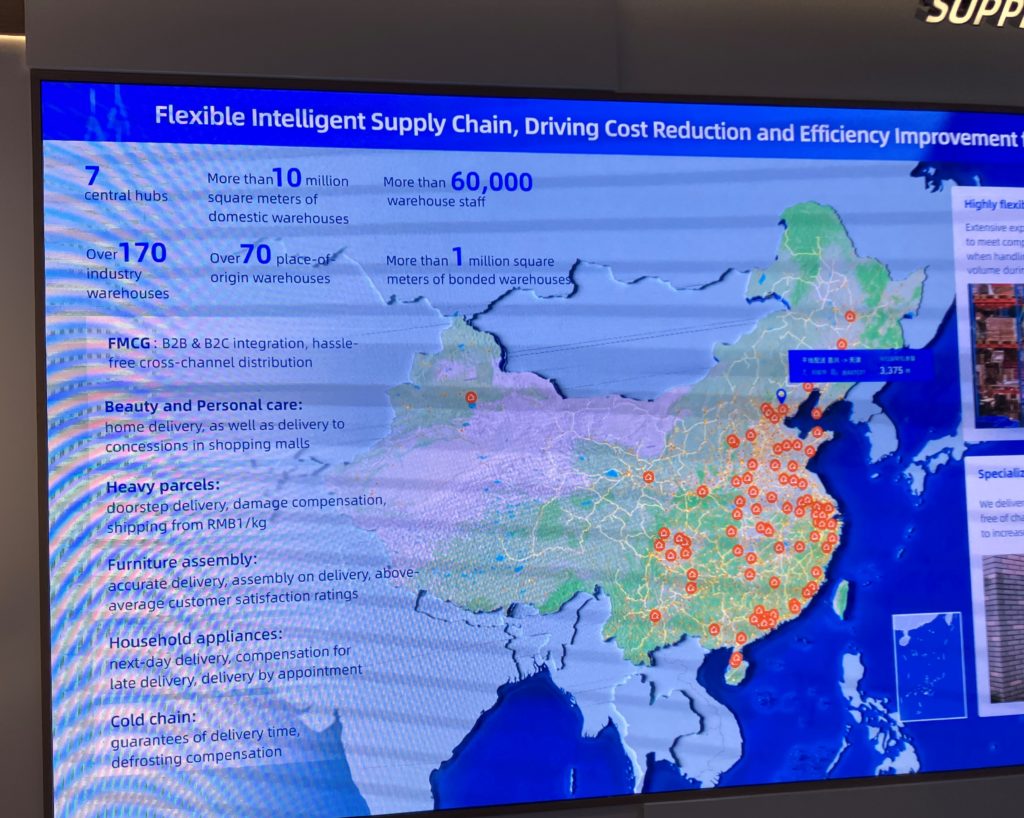

From their exhibition hall, here are some of the key facts for 2022.

Note the number of warehouses is 170 and the number of warehouse staff is 60,000. That is big but much smaller than JD Logistics. Cainiao is still much more asset-lite than JD Logistics.

However, they are also much more international. Here is a footprint of their international e-hubs.

But the biggest difference between Cainiao and JD Logistics is that JDL has been offering logistics services to businesses for many years. They turned their logistics division into a business and took it public. In contrast, Cainiao is still mostly serving Alibaba’s ecommerce business (about 90% of its volume). It is an internal capability for Tmall and Taobao domestically – and for AliExpress internationally. Note: Lazada has its own logistics division.

So, I think we are going to see a big move into services soon. I think it is going to follow JDL and shift from an internal capability to a business services unit. If it wants to IPO, it will need to start to offer logistics services and build non-Alibaba revenue ASAP.

This is what I am waiting for. And I bet this is going to be one of the first big announcements from Joe Tsai.

Update 3: Cainiao Post is Looking Like a Unique Capability and Barrier to Entry

I’ve been wondering if a smart logistics network can be stitched together rapidly with plug and play technology. Traditionally, big logistics networks (like FedEx) take a lot of time to build because you have to have warehouses, trucks, and dudes in tons of locations.

But as the system becomes smart and automated, I’m wondering if you can create such a network much faster.

I’m thinking the answer is no. Because the operational footprint is actually getting much bigger and denser. Cainiao has been putting Cainiao Post locations virtually everywhere in China.

The operational footprint of Cainiao Post covers almost all of China. These are the local service centers and stations where you can drop off and pick up packages. They have over 170,000 of them across China now.

And it is almost entirely automated. You get a message on your Cainiao app. You go to the Cainiao Post center and just walk through the turnstiles, pick up your package, scan it and go. And if you leave your packaging in the recycle bin, you get a free egg (not kidding).

Here’s the Cainiao Post app.

Here’s the entry turnstiles.

The app tells you exactly where your package is.

You scan it out.

And here is where you can dump your packaging. Note the scanner with the picture of the eggs.

These Cainiao Post centers are pretty fantastic. And it only had a few staff in the center.

But that was the deluxe version. This is not what they have +170,000 of across China. Mostly what that have is a simple stand like this.

You have the mobile app, the scanner and the recycle bin. And you just scan and print off the waybill.

Overall, I think I underestimated the operational density of their logistics network. That’s really what these Cainiao Post stations do. They dramatically increase the density of the logistics network.

Last Update: Cainiao Is Going to Use Tech to Try to Catch UPS and DHL

As mentioned, smart logistics is something new. It’s increasingly intelligent and increasingly automated. And a few companies are spending big to build such systems internationally. You can see how Cainiao Post, smart warehouses and automated trucks could be deployed around the world into a global service. That is what JD Logistics is doing right now. They are opening smart warehouses in Europe and the USA as a service for businesses (especially ecommerce companies).

But Cainiao is much bolder. They are trying to become one of the big global logistics companies. They want to break into the top three (DHL, UPS). And I think they are using their technology as their way to leapfrog these long-standing global leaders. Not unlike how Chinese companies are currently doing electric vehicles as a way to leapfrog into global auto.

The current mission for Cainiao is “Digitalization, Operation and Globalization”. It’s on all their big documents. Going global is in almost every aspect of what they are doing. And they’re leaning into technology to do it. So that is something to watch for.

Plus, it means there is lots of cool tech under development.

Here’s a fun video of those robots.

***

Ok. That’s it for Cainiao for now. I’ll do more in-depth strategy stuff later but those were my notes from the visit.

Cheers, jeff

————

Related podcasts and articles are:

- Baidu’s Search Engine Explained in 3 Slides (pt 1 of 3) (Asia Tech Strategy – Daily Update)

- Baidu is Struggling in Content Creation, Push Feeds and the Attention Market (Pt 2 of 3) (Asia Tech Strategy – Daily Update)

From the Concept Library, concepts for this article are:

- Smart Logistics at Scale

From the Company Library, companies for this article are:

- Cainiao

——–

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.