- Kuaishou caught “lightning in a bottle” with both short video and live streaming. And jumped to the front of China’s attention business. That’s impressive.

- Ecommerce Is Kuaishou’s biggest new revenue opportunity. And their GMV is growing fast.

- Kuaishou finally reached Operating Profits in 2023. The financials are now looking good.

- The key question is whether Kuaishou can compete with the video and attention giants over time? My working answer is No. There will be big downward pressure on their economics and marketshare.

***

Kuaishou went public in 2021 in Hong Kong and I did a strategy breakdown at the time. I basically considered it a fast follower to TikTok / ByteDance in the China attention business. That article is here:

My main points were that:

- Kuaishou is a video and entertainment business competing in the rapidly changing, valuable but difficult business of capturing and retaining the attention of Chinese consumers (on their smartphones).

- Their strategy is to be mostly a fast follower of ByteDance. This is a contrast to the mostly lead innovator strategy of ByteDance.

- This has been effective at capturing the hottest areas in video and attention in China (live streaming, short video).

- Their strategic relationship with Tencent and WeChat is the wild card. It’s unclear how much their success depends on this continuing.

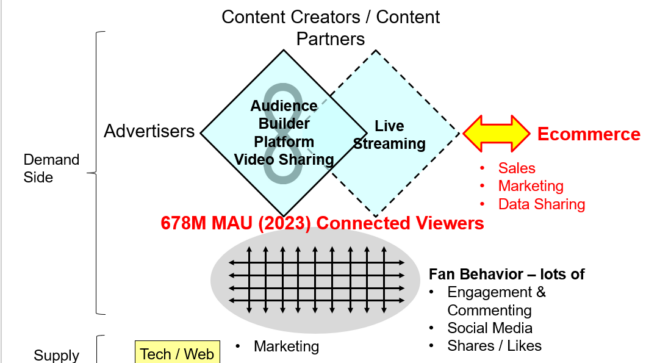

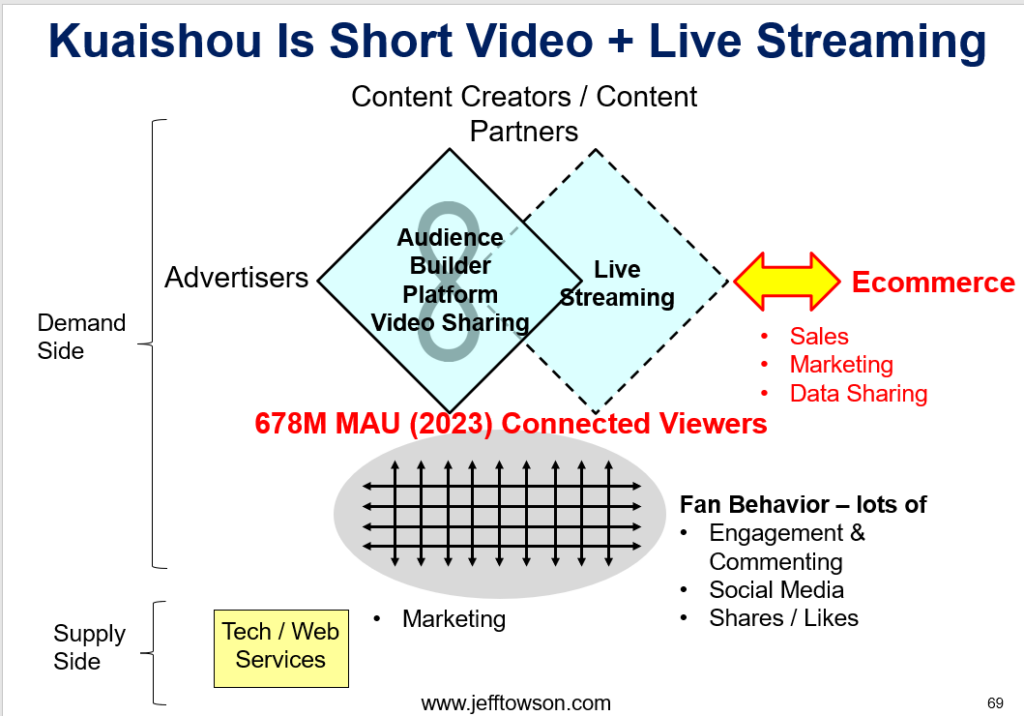

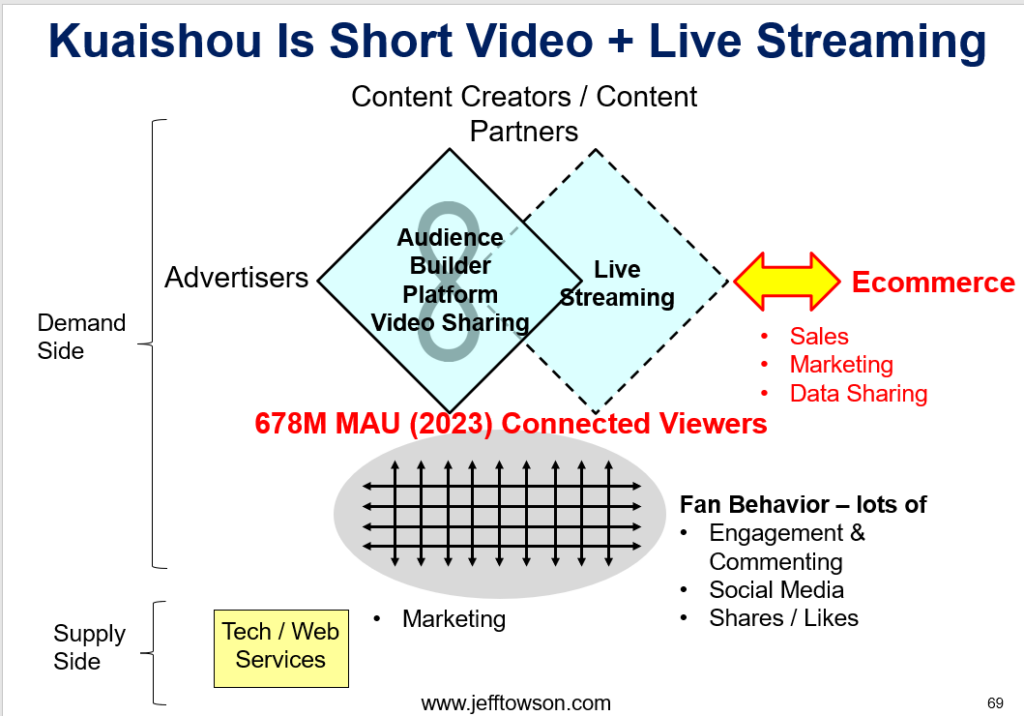

Here is my basic graphic for Kuaishou.

You’ll notice this is similar to Bilibili, WeChat, and, of course, TikTok.

- It’s a short video sharing audience building platform business model. Which is fantastic business model with a great network effect.

- It has a secondary video service for live streaming. I view this as a weaker platform with a weaker network effect. But a good complement.

- Kuaishou is moving into ecommerce. Great.

- It has +600M MAUs. That makes it very large, but still smaller than TikTok and Tencent.

- Videos are great for time spent, engagement and sharing. The consumer network is particularly powerful.

- Unlike Bilibili, they have not moved into gaming or into significant content production.

Let me go through a couple of points. Then I’ll give my opinion on the key question of scale.

1) Ignore Management’s Strategy Explanation. It’s Not Helpful.

In the public filings, there is quite a bit of good operational detail. But the strategy and business model discussion is fuzzy thinking. I’m dying to re-write this. It says their mission is:

“We aim to be the most customer-obsessed company in the world. Our mission is to help people discover their needs and use their talents in order to find their unique brand of happiness.”

Um. Ok. Don’t know what that means.

“We seek to create a platform that is an authentic lens into the diverse and vibrant world we live in…We believe everyone is unique and want to empower them to express themselves, be appreciated and discover what makes them happy.”

Anyways, just skip that stuff. Or look at how Bilibili discusses its future.

2) Kuaishou Caught “Lightning in a Bottle” with Both Short Video and Live Streaming. That’s Amazing. It Grabbed One of the Best Positions in the Attention Business.

Like Bilibili, Kuaishou has ended up in the best of all places for getting attention on smartphones. That is in video. And especially in short video and live streaming.

Kuaishou was founded in 2011 as a site for creating and sharing GIFs. They quickly moved into short video and were technically the first player in this business. That one move created most of their success. It was like being the first person to build a casino in Las Vegas.

Getting and keeping attention is difficult as a primary business model. Especially in China. But being an early mover in short video is about as strong as hand as you can have in this. Short video is just a super popular product that commands lots of time. Plus, it enables a platform business model with a network effect.

3) Kuaishou Now Has 1-2 Platform Businesses. And They Are Positioned for a 3rd in Ecommerce. That’s Also Great.

When I look at Kuaishou, I see 1-2 audience builder platform business models.

- An audience builder for sharing short videos, which is monetized by advertising. This is identical to Douyin / TikTok. This is what generates most of their traffic and and impressive DAU and time spent per day. Marketing is growing here and has become their primary source of revenue (replacing virtual gifting). Marketing reached 32% of revenue in 2020, up from 8% in 2018. It was over 50% in 2023.

- A complementary service in livestreaming, monetized by virtual gifting. This is kind of an audience builder platform. But I view it more as a complement. Livestreaming is what generated +62% of their revenue in 2020 (first 9 months).

Kuaishou has the potential to go into ecommerce. That’s their big new revenue opportunity. By linking to external ecommerce sites and building their in-house service. And this is an opportunity to build another platform business model. TikTok and Kuaishou are both moving fast in this.

4) Kuaishou Is Steadily Moving Beyond Live Streaming. That’s Good. Virtual Gifting Is Good for Revenue but It’s a Weaker Business Model.

According to their filing, Kuaishou’s livestreaming has grown from 7B RMB in China 2015 to 140B in 2020. So, it’s a big source of revenue.

But it’s also a quirky business and ultimately a lot smaller opportunity than online advertising. In videos, you want to be in online marketing and ecommerce long-term.

Livestreaming based on gifting (not ecommerce) is a smaller and stranger market. It’s a strange type of video that came out of anime, singing, acting and (to be honest) a lot of pretty girls being entertaining and getting donations (mostly from men). The business model for livestreaming is very different than for short videos.

For example:

- Viewers really like the interactive nature of livestreaming. You can chat in real-time with other viewers and with the person you follow. It is more social.

- It is live and is more immersive and engaging than just flipping through videos.

- However, there are fewer content creators (thus far). It’s a niche.

- And viewers and money focus on a few popular live streamers. Popular hosts command way more power than with uploaded videos.

- There is also much less content – because it is mostly limited to live content. The accumulated content library is also much smaller. People don’t watch old live streams.

- Short video has a much bigger long tail of content because it has way more content.

- However, monetization by gifting means you don’t need a big viewership to make money. It is monetizable with a small audience.

- Short video is also better for small increments of time. You watch a few videos here and there, on the subway or at work.

- Short videos are watched with high frequency which gets you a lot of data to improve matching. Live streaming is not about better and better matching over time. It is more about following certain people.

Live streaming is just a strange business. Think Huya and YY.

- Yes, it gets you a more powerful consumer experience.

- Yes, it is easier to monetize early on.

- But it is more dependent on a small number of popular hosts, has weaker network effects and has higher cost or revenue (revenue sharing with hosts).

It is unclear to me that gifting-based livestreaming can be a viable standalone platform business model. I think it works best as an extension of a stronger platform, like for short videos. That is what Kuaishou and Bilibili have done.

5) Ecommerce Is Kuaishou’s Biggest Revenue Opportunity. And Their GMV Is Growing Fast.

Which brings me to Kuaishou’s most important new business, turning their great viewership into ecommerce. Product links in the livestreams and short videos(?) mean viewers can click and buy goods. Kuaishou takes a cut. This is brought in-house with their own shop.

And the key metric is GMV, which has has been growing fast at Kuaishou.

- At IPO, Kuaishou’s ecommerce GMV was 204B RMB (for 9 months in 2020).

- In 2022, it was 900M RMB.

- In 2023, Total Ecommerce GMV was 1,180B RMB.

This looks good. Content and ecommerce are merging as expected. And consumers and merchants both like this. Videos gets better and more authentic engagement from consumers. And this gives merchants the opportunity to better tell their story in a more powerful medium.

***

Ok. So that all seems pretty good.

But historically Kuaishou have significant operating losses, which was a big contrast to TikTok’s cash machine.

However, that has also now changed.

Kuaishou Reached Operating Profits in 2023. The Financials Are Looking Good.

At IPO in 2021, Kuaishou had (from filings):

- 305M average DAUs. This is in Kuaishou’s apps and mini programs.

- 769M average MAUs.

- +86 minutes in average daily time spent per DAU.

- 204B RMB in ecommerce GMV (for 9 months in 2020).

In 2023, these had changed to:

- 379M average DAU (2023). Up from 355M in 2022. So some growth. But not stunning.

- 678M average MAU (2023). Up from 612M in 2022. Same.

- 124 minutes in average daily time spent (2023). That is a big increase.

- 1,180B RMB in Total Ecommerce GMV (2023). Up from 900B RMB in 2022. Bam.

We see slow growth in MAU and DAU over 5 years. Almost a flatline. But we see rapid growth in average daily time spent and GMV.

Look at the 2023 financials:

- Revenue of 113B RMB. With growth of 20%. That’s great.

- Revenue grew at 20% per year in 2023. And at 16% in 2022.

- Revenue from marketing had increased to 53% of total. That’s good.

- Revenue from live streaming had decreased to 34% of total.

- Gross Profit was 50% of revenue in 2023. Up from 42% in 2021. Also great.

- Cost revenue fell from 55% of revenue in 2022 to 49% in 2023. This was from revenue sharing cost (think livestreaming) falling from 32% to 30% of revenue.

- Plus, bandwidth and server costs falling 2%.

- Operating profit reached positive 6.4B RMB (5.3% of revenue) in 2023. That is way up from -33% of revenue in 2021. Great. This was from:

- Increased gross profit (as mentioned).

- Sales and Marketing expense was still large at 32% of revenue in 2023. But significantly down from 54% in 2021.

- R&D also decreased to 10% of revenue (from 18% in 2021).

That’s all good. And I’ve been thinking about Kuaishou as a potential stock buy now.

They are at scale in terms of users in China in a great product and business model. So the focus is on growing time spent, engagement and revenue.

Which leaves me with one outstanding questions.

Can Kuaishou Compete with the Video and Attention Giants Over Time as a China-Only Business? My Working Answer is No.

Kuaishou has similar user numbers to TikTok / Douyin in China. About 600-700M MAU. And it is starting to monetize in China, like Douyin.

But it is still much smaller as an international business. Both WeChat and ByteDance now have users in the 1-2B range.

So can they compete as just a China business? Or are they ultimately subscale?

As mentioned, there is a lot to like here. But video and attention in China is a ruthless business. And the digital giants are all going after the space. Kuaishou’s users, revenue and resources are good but still a fraction of Tencent and ByteDance.

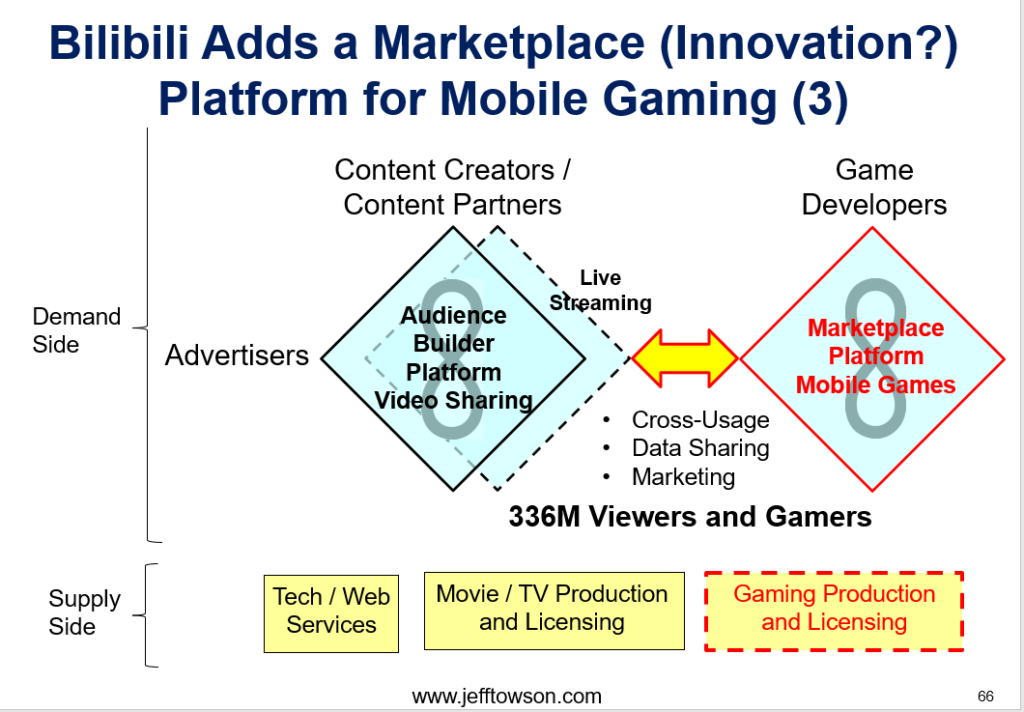

This is the same question I had for Bilibili. Which I wrote about here:

They were much smaller than competitors in China in video. But had a stronger differentiation historically. And have a secondary platform in mobile gaming.

Compare my graphics for Kuaishou and Bilibili.

I like to look at specialty businesses competing with the giants. They can be good investment opportunities. Everyone looks at the giants. But is unsure about the smaller players. Think:

- Early Pinduoduo vs Alibaba.

- HubSpot vs. Salesforce.

All these smaller businesses reach a key strategic question where they have to either stay in their niche or transform into a larger play. That’s where Kuaishou is right now.

I typically ask five questions for assessing the viability of a specialty video / entertainment business versus giants:

- Is the company significantly differentiated in the user experience? Or did they just get there early?

- Can the company compete and/or differentiate in content production/licensing and R&D without ongoing spending?

- Does the company have a strong competitive advantage in a circumscribed market?

- Is there a clear path to significant operational cash flow?

- Has the company avoided markets and situations that are attractive or strategic for the major ecommerce companies?

Here’s I visualize it.

It’s clear Kuaishou is in the strategic path of the video and attention giants (#5). That’s bad.

But they are also now on the path to large operational cash flow (#4). That’s good and a key improvement.

But what worries me is #1.

- Is the company significantly differentiated in the user experience? Is being China-focused different enough?

- Or is video ultimately a utility that crosses border?

Kuaishou historically differentiated by focusing outside of first tier cities in China. Think farmers and not Beijing residents. And now it is differentiated by its China focus.

But short video is now everywhere. So is live streaming. Video is becoming the primary form of content for customer engagement. The mobile apps (Red, Bilibili, TikTok, WeChat) all have it. And so do lots of other apps (Ctrip, Alibaba, JD, etc.). Pretty much every B2C app in China is adding short video sharing. And usually live streaming. More and more it is looking like a ubiquitous commodity, without much differentiation.

If that is the future, then video platforms are mostly a game of scale as a utility. That means 1-2 big winners only, based on who has the biggest platforms, with the biggest network effects. That’s YouTube, ByteDance and WeChat. I expect them to slowly grind down their smaller rivals.

That’s my working conclusion for Kuaishou. They are now making operating profits but I expect a slow grinding down by the larger players who have larger scale, are deeply committed to the space and are making big investments. This will create lots of downward pressure on their financials. I’m watching capex, M&A and market share closely.

Tencent is the Wild Card

Kuaishou is connected with Tencent, Tencent Music, Sogou, Huya and other Tencent businesses by various agreements. Including for marketing and promotion, cloud services, and payment services. Tencent has made significant investments in Kuaishou.

That would normally change my calculation. In fact, such a partnership is the best way to defend against superior scale.

But Tencent has also built the exact same capabilities (short video, live streaming) in-house. And creator Allen Zhang has said short video and live streaming are the future of WeChat. Absent a total acquisition of Kuaishou, they are not going to be dependent on an external company for something so core to their business.

Note: They did the same move in search. they invested in Sogou (#2 after Baidu) but also build WeChat search in-house.

***

That’s it for Kuaishou. We’ll see if I’m right. Cheers, Jeff

Conclusions

- Kuaishou caught “lightning in a bottle” with both short video and live streaming. And jumped to the front of China’s attention business. That’s impressive.

- Ecommerce Is Kuaishou’s biggest new revenue opportunity. And their GMV is growing fast.

- Kuaishou finally reached Operating Profits in 2023. The financials are now looking good.

- The key question is whether Kuaishou can compete with the video and attention giants over time? My working answer is No. There will be big downward pressure on their economics and marketshare.

————

Related articles:

- When Microsoft’s Bundles Are Good vs. Bad for Customers and Markets (Tech Strategy)

- Microsoft’s 3 Big Upgrades to its 2 Platform Business Models (2 of 2) (Tech Strategy – Daily Article)

- What is Elon Musk’s Plan to 10x Twitter? (2 of 2) (Tech Strategy – Daily Article)

From the Concept Library, concepts for this article are:

- Audience Builder Platform

- Videos

From the Company Library, companies for this article are:

- Kuaishou

———–

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.