In Part 1 and a podcast, I covered the history of Huawei in Thailand and my interview with Huawei Thailand CEO Abel Deng.

In this part, I’ll go into the development of digital infrastructure in SE Asia. This is one of the big determinants for rate of growth. And Thailand has, by many measures, emerged as a leader in digital infrastructure in SE Asia. It’s a good indication of what’s coming next.

Thailand Is Moving Fast in Digital

A couple of factoids:

- Thailand was the first country in SE Asia to have a 5G spectrum license auction (February 2020). Note: AIS, DTAC, and TRUE won.

- Thailand is (arguably) the number three country in terms of 5G roll-out in Asia (after China and South Korea). Bangkok’s 5G experience ranks among the top 10 cities in the world.

- In the past 2-3 years, there have been significant moves in connectivity. Specifically, new submarine cables have been connected and new data centers have been built. The growth rate of investment and construction of data centers in Thailand leads ASEAN, with an average growth rate of 20% in the past two years.

- Thailand’s fixed broadband has long been among the world’s fastest (per the Ookla speed test website).

And a lot of this has to do with Huawei Thailand, and Abel Deng. Note: in 2021, Huawei received Thailand’s “Special Prime Minister Award” and was recognized as “Digital International Corporation of the Year”.

***

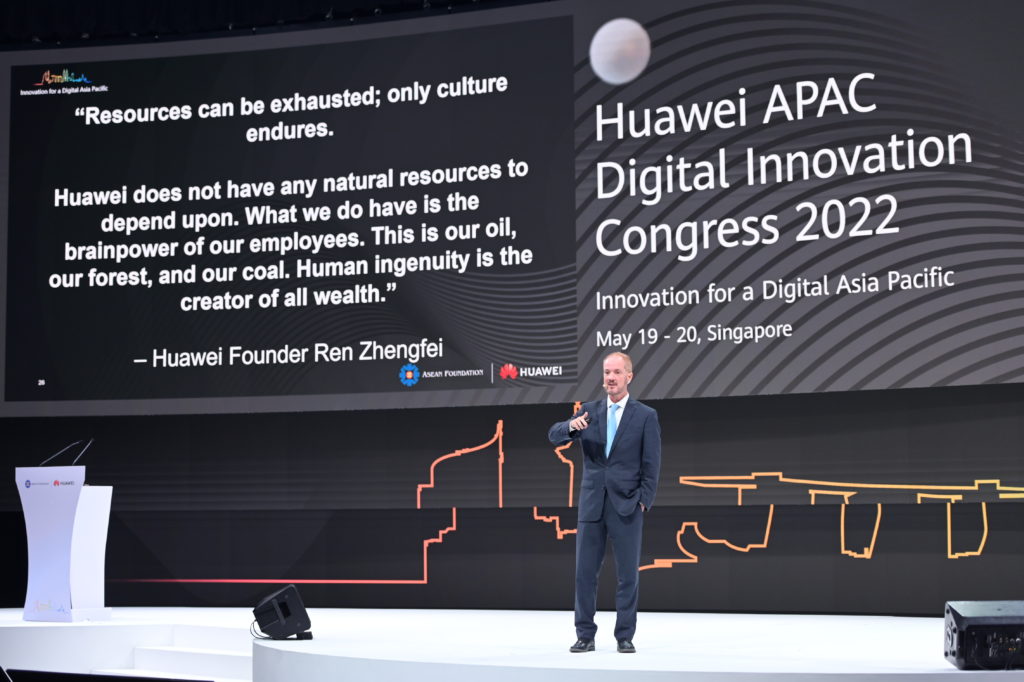

I once asked Huawei (now former) Chairman Guo Ping which industry he thought was going to be the most innovative or rapidly developing going forward. I had thought it was a good question. I even wrote it down beforehand. But it turned out it was a dumb question. He said he didn’t know. Huawei builds infrastructure and businesses then build upon it. It was really difficult to predict what they would do.

His comment has really stuck with me. So much of digital advancement is trial and error. It’s lots of use cases. It’s pilot projects and stops and starts in different industries. And by different companies.

But each generation of digital businesses begins with the deployment of new digital infrastructure. Smartphones led to an entire wave of mobile apps. 4G led to companies like video-intensive companies like YouTube. GPS led to companies like location-dependent companies like Uber. Edge computing is currently leading to autonomous vehicles.

So, I’ve been keeping an eye on the next generation of digital infrastructure in SE Asia.

- What digital infrastructure will matter the most? And enable the next wave of companies?

- Which country is deploying the most rapidly and effectively?

- Which region is doing the most pilot projects? Which pilot programs are worth watching?

This all sets a general speed of corporate advancement in a country.

These are questions about tech. But they are also about people and government. We see dramatically different rates of infrastructure development in different SE Asia countries. It heavily depends on how well the different corporate and government groups can coordinate. And on who the key people leading the effort are.

And, the more I look at Thailand, the more optimistic I am. Here’s what I see:

- Huawei, the best telecommunications company in the world, is placing a high priority on SE Asia. It is their strategic backyard. It is also a natural place to focus given the changing political situation between China and the West. Focusing on SE Asia makes sense.

- The Thai government is moving quite quickly and effectively with 5G, big data, cloud, education / training and pilot programs. That requires coordinating between quite a few different government and corporate entities. There’s the NBTC, the Prime Minister’s 5G committee, depa, the Ministry of Digital Economy and others. And the coordination appears to be fairly effective. That is actually quite rare.

Here are some of the Thailand entities that have been involved in this effort.

- Thailand’s Ministry of Digital Economy and Society (MDES) is a key group. They are working on development and training both government and commercial entities. MDES evolved out of Ministry of Information and Communication Technology (founded in 2002) and was reorganized in 2016.

- Thailand’s State-owned CAT Telecom has long run the country’s international gateways, satellite, and submarine cable networks connections. But in 2021 CAT Telecom became National Telecom Public Company Limited, after merging with TOT Public Company Limited.

- Thailand’s National Broadcasting and Telecommunications Commission plays a key role as an independent regulatory agency, overseeing the country’s broadcast and telecommunications industries.

- The National Statistical Office of Thailand has a key role in information and data. And digital infrastructure hinges on combining connectivity with big data.

- The Electronic Transactions Development Agency and Thailand Post have also long had roles in communications.

Here’s why the required coordination is so difficult. Because the emerging new digital infrastructure requires bringing together lots of previously separate things – like big data, telecommunication, regulations, content and cybersecurity. That’s a lot of government entities. Plus, digital infrastructure is increasingly critical in banking and financial services. That adds more agencies and corporate entities.

Virtually all countries are struggling to bring all these activities, agencies and companies together.

It’s not clear to me why this is working better in Thailand than in other countries. But things are clearly moving at a more rapid pace. For example:

- In the past few years, every village in Thailand has been connected to the main internet network (approximately 24,700 villages).

- New submarine cables have been added, which decreases the reliance on Singapore for traffic.

- Over 20,000 5G base stations have been installed, making Thailand a 5G leader in Asia.

And I have actually a small roll in this. I am teaching the core course on digital transformation at Sasin Business School at Chulalongkorn University. So I’m more or less training MBAs how to digitally transform Thai businesses.

The Development Path for Digital Infrastructure

Ok. So how do you predict such development? Especially in a developing economy? I am generally looking for 4-5 steps.

Step 1: Connectivity

- Initially, it’s about the physical infrastructure and getting everything connected. So lots of laying fiber and deploying base stations.

- As mentioned, the fixed network has now been extended everywhere in Thailand. That is no small thing in a fairly big, rural and tropical country. Countries with more poverty and islands, such as Indonesia and the Philippines, are struggling here.

- Thailand’s 5G Master Plan is now under development. I believe Thailand’s 5G committee is still being personally chaired by the Prime Minister.

Step 2: Big Data

- After connectivity, it’s about the consolidation of data. You can’t do AI or much else until the data pools are created.

- This is going to be a long and difficult process in Thailand. Government and corporate entities have the information but are mostly not digitized and connected. And a lot of the work at these entities is still paper-based. Digitizing and then connecting the various corporate and government entities is just a long process.

- Creating one big, real-time database is also going to take a time. This is where “one version of the truth” is created and everyone starts running everything on it. We can see digitization and data consolidation happening in certain departments like the BOI, imports and exports, immigration, water and irrigation and transportation. But it’s a long process.

Step 3: AI and Cloud-First Policy

- Next, it’s about shifting to digital operations, the cloud and AI. Digitizing the data is a prerequisite for advanced analytics and AI. Analytics comes first but everything depends on big data. So the discussion becomes about cloud and data centers. Hence, a cloud-first policy.

- Then moving to digital operations becomes the next big challenge. Digitizing operations is also a long process. My understanding is that big data and cloud-first is getting a big push in Thailand right now.

Step 4: Cybersecurity and Regulations

- Finally, it’s about a never-ending evolution in regulations. Industries using the new digital infrastructure are going to evolve and create new capabilities. We already see this in digital banking.

- This is going to create new regulatory issues, especially in cybersecurity. And this never really ends. A digitized government and economy becomes more complicated and sophisticated over time. That’s one of the big benefits of software. You can update it rapidly. But that means regulations have to evolve with this.

- Top of this list is cybersecurity. Thailand passed a new cybersecurity law in 2019. Second on the list is likely banking and financial services, given how fast they are evolving.

***

That’s it for Part 2. Sort of high level but I think the 4 steps are a pretty reliable framework for assessing development speed. In Part 3, I’ll talk about Huawei’s 4 big projects in Thailand.

Cheers, jeff

——

Related articles:

- Abel Deng and Huawei’s 4 Big Projects in Thailand (3 of 3)(Tech Strategy – Daily Article)

- My Interview with Abel Deng, CEO of Huawei Thailand (1 of 3)(Asia Tech Strategy – Daily Article)

- Huawei Is Going to Beat Trump with Human Resources, Not Technology (Pt 1 of 3)

- Huawei’s Employee Stock Ownership Plan (ESOP) is “Meritocracy Plus Partnership” at Scale in China Tech. (Pt 2 of 3)

From the Concept Library, concepts for this article are:

- n/a

From the Company Library, companies for this article are:

- Huawei Thailand

——–

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.