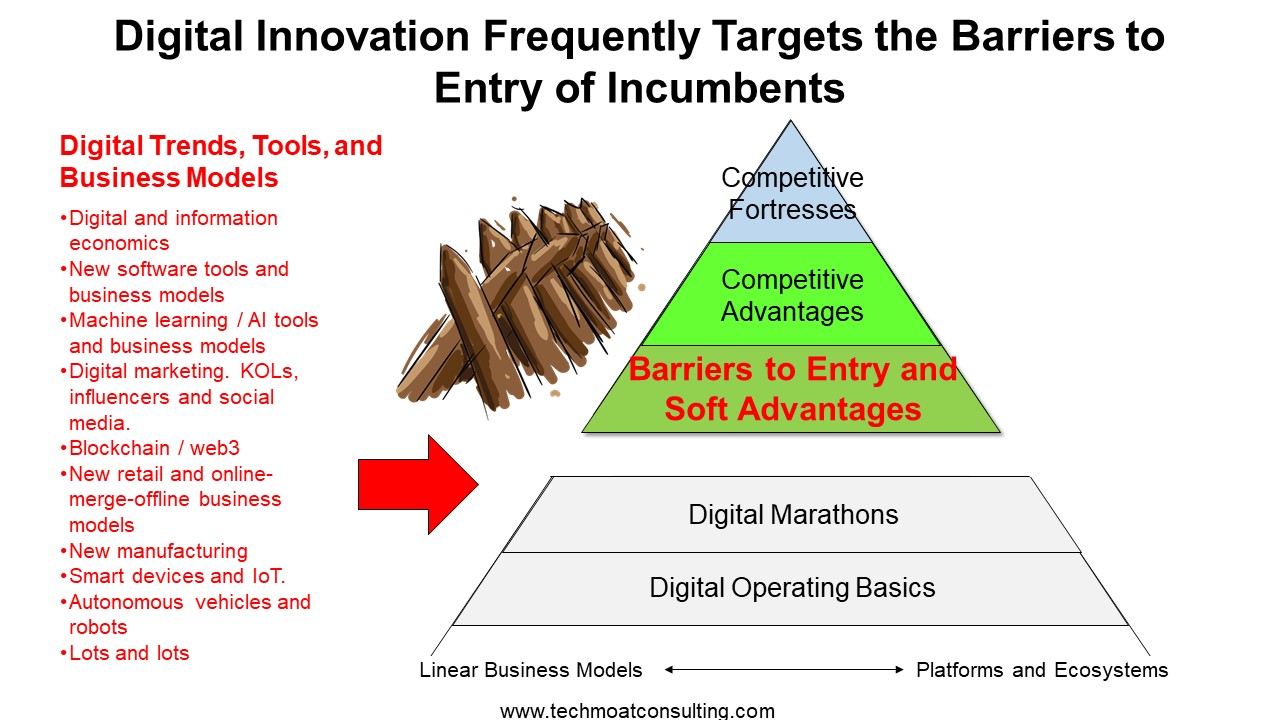

In Part 7, I reviewed the basics of barriers to entry.

Which brings this to my key question:

- How are GenAI tools and business models changing barriers to entry?

And the answer is, “almost completely.”

Digital tools and business models have been taking down entry barriers for +30 years. Some examples:

- YouTube, TikTok, and podcasting have enabled anyone with a camera phone to become a news or media company. Joe Rogan sat at a desk in his basement, smoked weed, and chatted with his friends. He became the next Johnny Carson.

- Shopify has been doing the same for small merchants with physical goods. They make it simple for anyone to create an online store and sell nationally, if not internationally. Bricks-and-mortar retailers (like Blockbuster) used to cite their big retail footprint as a barrier to entry.

- Amazon self-publishing, Substack, and WordPress have enabled anyone with a laptop to be a newspaper or book publisher now. The entry barrier provided by printing presses and lots of trucks doing morning delivery are gone.

Digital tools have been laying waste to many traditionally powerful entry barriers. Whenever you hear a tech company talking about “democratizing” an industry, they are probably going after the entry barriers.

And that is a lot of what is happening with generative AI right now.

Think about what generative AI really does. It lets anyone create content (which can be everything from videos to software code), without time, cost, or expertise. It completely democratizes (i.e., makes it available to everyone) huge swaths of previously advanced activities. That is, by definition, bringing down the barrier to entering lots of activities and businesses.

I have never been to art school. I cannot paint at all. But with GenAI, I could become an artist tomorrow. I can use a program like Midjourney and create paintings of the highest quality. The barrier to being an artist has just collapsed.

But can GenAI create entry barriers?

For Intelligence Capabilities, First Think Grids vs. Batteries

The industrial age was mostly about building big physical assets. If you read Wall Street reports from the early 20th century, you saw endless discussions about railroads, industrial plants, and utilities. Warren Buffett’s teacher, Ben Graham, rose to prominence as a young man by writing about railroad bonds.

But digital goods, services, and business models are mostly about people and intangible assets.

So, when we start to look for barriers to entry, there is a different (and currently evolving) list of capabilities, resources, and mostly intangible assets. And, as discussed, GenAI is creating new types of intangible assets (intelligence capabilities).

In the Part 6, I discussed the types of CRAs we want to create as we add intelligence to an organization. And I argued that the McKinsey & Co framework for intangible assets didn’t really cover this.

Intelligence Capabilities are a new type of CRA.

Professor Melissa Schilling at NYU has some good thinking on this. She lists key intangible assets in technology businesses, such as:

- Intellectual property. Patents and copyrights are increasingly important. But what about R&D and trade secrets? What about R&D not formally recognized as intellectual property? Where is that on the balance sheet?

- User generated content. How much of retail is now about influencers vlogging and live streaming? How much of the value of tourism sites is found in user generated reviews? How do companies like Google Maps, Waze, Quora, and Wikipedia keep large communities creating the content that forms the bulk of their product?

- Organizational capital. I spend a lot of time thinking about this one. What are the business processes and techniques for production? What are the new organizational forms and business models? When a company buys an ERP system, the money spent on business processes can be as much as five times the cost of the hardware and software.

- Human capital. How many years of training is required for a data scientist? A software engineer? How difficult and expensive is it to reproduce a team doing deep learning? How long can you keep them? If the average tenure of a software engineer at a company in China is two years or less, how does Huawei keep them for as long as 20 years?

Not a bad list. It’s consistent with McKinsey list in part 6. But, as argued, intelligence capabilities are a new type of intangible asset (CRA). This is evolving quickly.

So how do we think about intelligence capabilities?

I look at Intelligence CRAs as grids and batteries.

This analogy is from China AI guru Kai Fu Lee. He basically says that intelligence is going to go into everything. Just like electricity. It will run through the walls and through the air. It will be in every product and service.

And like electricity, this will mostly happen through grids. We will have intelligence grids, which will be similar to electricity grids. And a few lucky companies will own the grids and offer this service to everyone. We will just plug into intelligence with any device. It will be like plugging into electricity via the wall socket.

These intelligence grids will likely be provided by the cloud service companies, who are already offering intelligence capabilities as a service. Baidu AI Cloud already offers “model as a service”, “app as a service”, and “agent as a service”.

In the simplest case, individuals, teams, and companies will plug into these intelligence grids and do little to no customization. They will just take the offered apps and services and use them “as is”. Keep in mind, companies like Baidu are already offering suites of industry-specific intelligence solutions that you can use “off the shelf”.

In more complicated cases,, individuals, teams, and companies will plug into these intelligence grids and then do lots of customization and internal building on them. They will create their own customized models and suites of apps. Based on their own data ecosystems.

And going further in this direction will be batteries.

Batteries, like grids, will be sources of intelligence. Individuals and companies will put these intelligence batteries into their products and operations. They will be (somewhat) independent sources of specialized intelligence.

- They will be highly specialized for their purpose. Just like we have specialized batteries for smartphones, cars, water heaters, factories and so on.

- They can be open source and downloadable. Businesses can download models like DeepSeek and Qwen. And just use them on-site. There is an increasing ecosystem of developers and companies that support the main open-source languages.

Batteries vs. grids is not a great analogy. It’s ok. And a decent starting point for thinking about building intelligence capabilities.

***

In the Part 9, we will apply this framework to barriers to entry based on intelligence capabilities.

Cheers, Jeff

———

Related articles:

- AutoGPT and Other Tech I Am Super Excited About (Tech Strategy – Podcast 162)

- AutoGPT: The Rise of Digital Agents and Non-Human Platforms & Business Models (Tech Strategy – Podcast 163)

- Why ChatGPT and Generative AI Are a Mortal Threat to Disney, Netflix and Most Hollywood Studios (Tech Strategy – Podcast 150)

From the Concept Library, concepts for this article are:

- Generative AI

- GenAI and Agentic Strategy

- GenAI Playbook

- Barriers to Entry

- Intelligence CRAs: Grids vs. Batteries

From the Company Library, companies for this article are:

- n/a

———

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.