I recently did podcasts about how Amap and Alibaba.com had impressive performance in short periods of time. I also did an article on how Taobao beat eBay.

- Amap (Alibaba’s map app) dethroned market leader Baidu Maps in 2015. Listen to that podcast here.

- Alibaba.com had remarkable growth and re-vitalization in 2017-2018. Listen to that podcast here.

- Taobao had an impressive take-down of eBay in 2004-2005. My article on that is here.

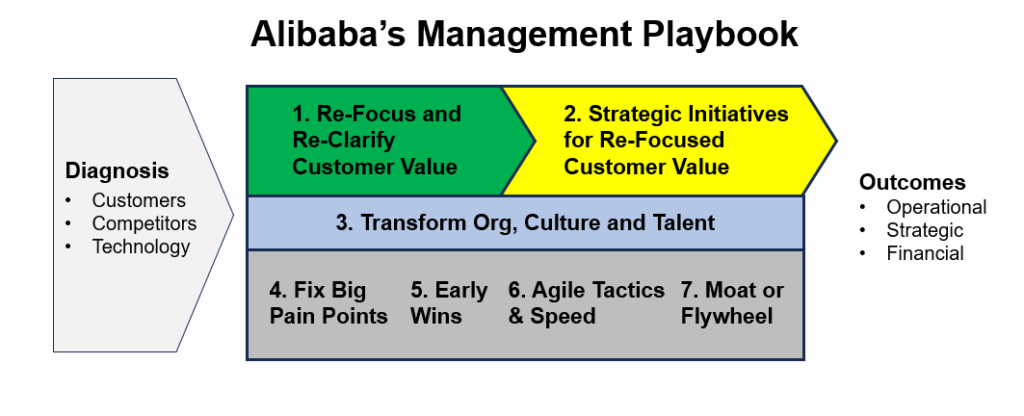

These were good examples of what I call Alibaba’s Management Playbook. This approach has shaped a lot of my own strategy thinking.

–

But these cases are kind of misleading. They’re too logical and clean. Most business is not like this. Strategy gives you a direction to go. It’s a plan. But execution is usually complicated and chaotic.

And sometimes you don’t even have that clear of a plan. Just a direction to head.

So, in this article, I want to go over the rise of Cainiao from 2014 to today. This is mostly from a 2024 article written by Wan Lin, CEO of Cainiao Smart Logistics.

And what jumps out in this case study is the uncertainty about what Cainiao is. And where it was and is going. They have a general direction but it’s pretty fuzzy. Because nobody really knows what a smart logistics business looks like.

So, I thought it was a good counter example to the other case studies. And the Alibaba Playbook still works pretty good for this too.

First, My Summary of Alibaba’s Management Playbook

Here’s my standard breakdown. If you’ve read this before, you can skip to the next section.

The details are below.

- Diagnose the problem

- This is always first. And of course it is the key. If you don’t get this right, nothing else matters. And proper diagnosis takes a lot of data and expertise. Usually an entire team. You really can’t get this wrong.

- This is also where you incorporate industry assessments, competitors, customer behavior and technology and/or regulatory changes.

- I like to focus on two specific questions:

- What is the chief complaint? Stagnant growth? Low NPS?

- What is the differential diagnosis?

- Step 1: Re-clarify and re-focus on customer value.

- This is the most important part of the strategy. Putting customers first and being very specific about how you add more value than competitors. This includes:

- Customer segmentation. Identify exactly who you are targeting. What are you after (revenue)? Traffic? Data?

- What do they most care about?

- What is the customer journey? Map out the process.

- Is what customers want or care about changing? Tech change? For example, PC to mobile changed what maps could do.

- What is the competitor offering and how you are going to take their customers with our re-focused value? Are they weak or strong? What are they getting wrong?

- This is the most important part of the strategy. Putting customers first and being very specific about how you add more value than competitors. This includes:

- Step 2: Launch 2-3 key strategic initiatives that deliver the re-focused customer value.

- This is where we translate Step 1 into 2-3 big initiatives that will make a difference. They have to move the needle in terms of re-focused customer value. But they also need to be feasible in 6-12 months.

- Step 3: Transform the organization structure, culture and talent.

- Revitalizing the organization and getting everyone focused on the new strategy almost always requires increased communication and coordination. The entire organization must be re-focused and re-energized. And often there need to be a lot of training and cultural changes.

- Step 4: Fix the big pain points of customers, staff, suppliers, etc.

- This is also important. Identify and fix the things that most annoy people. Whether customers or staff or suppliers.

- This requires data-driven decision making and lots of iteration. It also requires a culture that is fast and aggressive (see Step 3)

- Step 5: Have early wins (small, phased victories).

- This is important to test the strategy and get feedback. You really need to see if it’s working. Plus, you need to constantly re-adjust.

- Early wins also re-enforce the new culture and organization changes. It builds momentum.

- Step 6: Focus on agile tactics and speed.

- Winning is a lot about tactical brilliance and guerrilla execution.

- And it’s about speed. So agile teams and quick decisions. You will always win in chess if you are making twice as many moves as your competitors.

- Step 7: If possible, build a powerful business model or operating flywheel.

- You win with customers and speed but you also want to build something that has real advantages structurally. You want to build a moat if possible. Or an operating flywheel. It also helps if you can access more revenue opportunities over time.

- Measure the Outcomes

- You want to know what the key outcomes are before you start. What are the 2-3 KPIs that the whole team is focused on. These outcomes can be:

- Operational

- Financial

- Strategic

- You want to know what the key outcomes are before you start. What are the 2-3 KPIs that the whole team is focused on. These outcomes can be:

A Quick Comment on Step 7: Moats

You might have noticed that the businesses covered (Taobao, Amap, Alibaba.com) were all platform business models. They all have network effects and other competitive advantages. And they are all in industries dominated by 1-2 players.

That’s not a coincidence.

Alibaba is in the platform building business. That has been their primary business model since founding. And they especially like the asset-lite versions of platforms. Especially marketplaces.

Which is really smart.

Choosing what business to build (or not build) determines most everything. Bill Gates never worked more hours per day than you or me. He was just better (or lucky) at picking which business to focus on.

So, Step 7 in the Alibaba Playbook is about building a powerful business model.

- “If possible, build a powerful business model or operating flywheel.”

But I haven’t talked about this step much. It’s a pretty big topic.

And most of us are already committed to a particular industry. Unless you’re an investor or entrepreneur, you can’t really jump around to different types of businesses to find the best one. In practice, managers are mostly building and strengthening the moats available to them. And that’s pretty much what my books are about – where I focus on:

- Building a moat (Step 7). Or other strong business model.

- Having a long-term focus on 1-2 key operating activities that matter (Steps 1-6).

That’s why my books are called moats and marathons.

So why do I bring this up?

Because Cainiao didn’t have a clear business model for most of its existence. That makes it different than the other Alibaba businesses discussed. They were (and are) building something new.

What is Cainiao’s Business Model Anyways?

You would think that would be an easy question to answer.

But since its founding (as a separate business) in 2014, it’s been an ongoing debate.

- Is Cainiao a logistics company or a technology company?

- Is it a platform business model or a service business?

- Is it domestic, cross-border or international business?

- Is it a profit center or an enabling capability for Alibaba ecommerce?

- Is it asset lite or heavy? How much do they do internally versus contract out?

When Wan Lin joined back in 2014, it wasn’t clear what Cainiao’s role would be. It was originally supposed to be an intelligent logistics backbone focused on China.

He wrote: “As Jack Ma stated, Cainiao wouldn’t directly engage in logistics but would assist others in this field. He emphasized that we are a technology company, not intending to exceed 5000 employees.”

Wan wrote “defining Cainiao at that time was challenging, as it represented a large concept without an exact precision. But “the keywords were “intelligent” and “backbone,” underlining our aim to help courier companies improve through data and vital resources. It was also made clear that we would not involve ourselves directly in logistics operations.”

So, there was a general direction. But not really a business model.

And this had a lot to do with the mobile ecommerce boom that was happening in China in 2013-2016. Smartphones and mobile payment were becoming ubiquitous. And ecommerce GMV was surging. Annual growth rates were 30-50%.

Which created lots of logistical problems. Especially during singles Day.

So Cainiao was building fast to keep up with the surge. They began by building three networks:

- An Aerial Network (i.e., planes)

- A Ground Network (land, warehouses)

- A Human Network (delivery people and Taobao service stations offices)

So, what was Step 7 (business model)?

Unclear.

And sometimes it’s ok to skip the diagnosis and strategy. Just ride the wave. Keep building. And fix what breaks.

Rising Cainiao Focuses on the Big Pain Points (Step 4)

Cainiao’s early years appear to be mostly focused on problem solving during the boom. That meant putting out fires and fixing the bottlenecks. Especially their warehouses, which were overloading. And especially during Singles Day.

Cainiao’s first big move was to acquire land nationwide for logistics. They bought land and built warehouses. And they identified sorting centers as the biggest problem. This was causing the warehouse overflows.

To fix this, they introduced electronic waybills.

This turned out to be a pivotal moment in Cainiao’s history. It was the starting point for the digital backbone of the entire network. For the digitization of logistics. You can see this mentioned in their company history at the Hangzhou HQ.

This not only saved a significant amount of paper but also led to full digitization. And Wan Lin noted that sorting capacity increased from 10,000 packages per hour to a peak of 25,000 packages per hour.

And the big bottleneck became the last mile.

Here’s how Wan Lin described it “While couriers handle point-to-point parcel delivery, we also needed to address merchants’ warehousing and distribution supply chain needs. That’s when we introduced our own integrated warehousing and distribution supply chain service.”

The model kept evolving. And Cainiao became five networks, with the warehouse and distribution supply chain network as one of them. Using electronic waybills and courier companies.

And in 2017, globalization and rural markets became the top priorities.

In practice, that meant building warehouses (ehubs) all over the world.

Here is an ehub in Europe.

So, it was a period of lots of growth. With lots of building capabilities and fixing pain points.

But the strategy question was still pretty unclear.

Forget Business Models. Cainiao Focuses on Customer Value (Step 1)

Here’s what Wan Lin wrote:

“I decided that before discussing business models, we should first talk about who our customers are and what customer value means. It’s easy to skip these discussions and jump into debates about whether we should be light or heavy, a platform or a direct operator model. Everyone would argue very passionately. Therefore, at this point, we decided to start with customer value, clarify what it is, and then decide whether a platform or direct operation approach would better achieve customer value, whether a heavier or lighter approach would be better.”

That is basically Step 1 on the playbook.

And they appear to have somewhat given up on fitting Cainiao into any one business model. Instead, they focused on customer value and then built whatever was necessary to achieve that.

- When they needed to go asset heavy, they went heavy.

- When they needed to operate directly, they did.

- When they needed to be a platform, they operated as platform.

And they did a lot of M&A. Within a few years, they acquired an integrated 7-8 companies. Including 4 last mile delivery companies and two warehouse operation companies. They grew from 3,000 people to one of over 10,000 people.

Ultimately, Cainiao decided to “become a unique digitalized logistics company.” I’m not really sure what that means.

He wrote that this includes a “vision is to become a customer value-driven, global industrial internet company. This vision is grounded in three key concepts: digitalization, leveraging our strengths in technology, data, and the internet to differentiate ourselves; industrialization, as a logistics company, we can create greater value by deeply engaging in the industry; and globalization.”

Ok. Still pretty vague.

But that’s. I like the focus on Step 1 (customer value) and Step 4 (Pain points). That’s enough in a rapid growth phase. And for when you are building a completely new type of business (digitized logistics). It’s crossing the river by feeling the stones.

***

That’s it for today.

Cheers, Jeff

———-

Related articles:

- How Alibaba.com Re-Ignited Growth with the Alibaba Management Playbook (Tech Strategy – Podcast 253)

- How Amap Beat Baidu Maps. My Summary of the Alibaba Playbook. (Tech Strategy – Podcast 252)

- Scale Advantages Are Key. But Competitive Advantages Are More Specific and Measurable. (Tech Strategy)

From the Concept Library, concepts for this article are:

- Alibaba’s Management Playbook

- Logistics

From the Company Library, companies for this article are:

- Alibaba: Cainiao

———

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.