Baidu, known primarily as China’s #1 search engine, is undergoing a strategic transformation, having positioned itself as a major player in the GenAI landscape.

This evolution has been driven by a confluence of factors, including:

- The company’s deep-rooted expertise in search and AI

- Aggressive investments in a comprehensive AI tech stack

- A “visionary plus shaping” approach to this market.

Baidu has been on my short list of companies to really watch for the past year.

This article is a summary of what is going on with the business.

Baidu’s Scale Problem

Baidu’s core search business, while profitable, has long faced limited growth potential. The shift from PCs to smartphones diminished the power of search as the primary entry point for information. And this was more pronounced in China, where most internet users really only came online with smartphones.

But Baidu big problem has been revenue growth. It has increasingly fallen behind rivals Tencent and Alibaba. Search in China is a great business. It is just much smaller than ecommerce and entertainment / communication. Take a look at the comparable revenues between 2015 and 2020.

- 2015 Revenue:

- Baidu: $13.0 billion

- Alibaba: $22.9 billion

- Tencent: $15.8 billion

- 2020 Revenue:

- Baidu: $16.4 billion

- Alibaba: $109.5 billion

- Tencent: $73.6 billion

Once peers, Baidu is now much smaller than its rivals in revenue and resources. This is worrisome.

Plus, ByteDance has emerged and grown from $34B in revenue in 2020 to about $100B today.

You really don’t want to be at a scale disadvantage in China. It is their favorite weapon. The big digital players are very aggressive in acquisitions, investments and customer subsidies. And they use this to steal market share and to capture the next big opportunity.

Over time, Baidu has found itself in the concerning position of being subscale as a digital giant.

This has fueled Baidu’s aggressive exploration of adjacent businesses over the past ten years. This has included food delivery, online travel, live streaming and other content and business service businesses. However, these ventures proved financially challenging and most all were eventually divested. The primary problem was usually that Baidu could not match the ongoing investments of Alibaba and Tencent.

By 2022, Baidu was mostly a multimodal search engine with mapping service plus a leading video entertainment company, iQiyi. Here’s how I view them.

They were still searching for their big growth engine.

And then the mother of all opportunities emerged:

- Generative AI and cloud computing.

And it turns out they were fantastically positioned for the opportunity.

Baidu’s Big Investments In AI

Baidu had been strategically investing in AI for over a decade, establishing its deep learning lab in 2013 and launching various AI-powered initiatives, including:

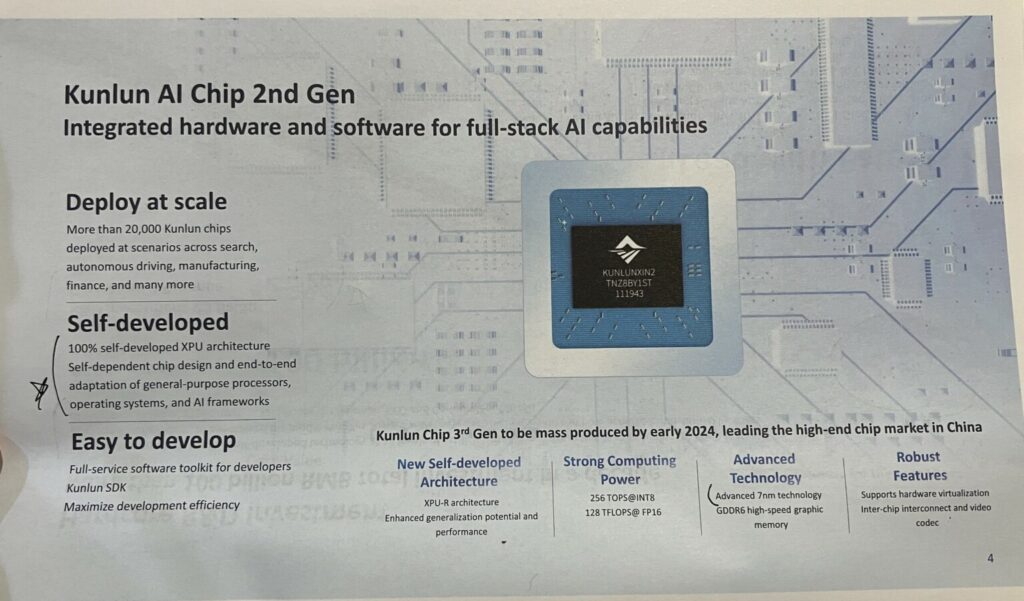

- Chips: Baidu has developed its own AI chips, Kunlun, specifically designed to handle the demanding computational requirements of AI workloads. This makes sense given search as their core business.

- Autonomous driving. Including Robotaxis.

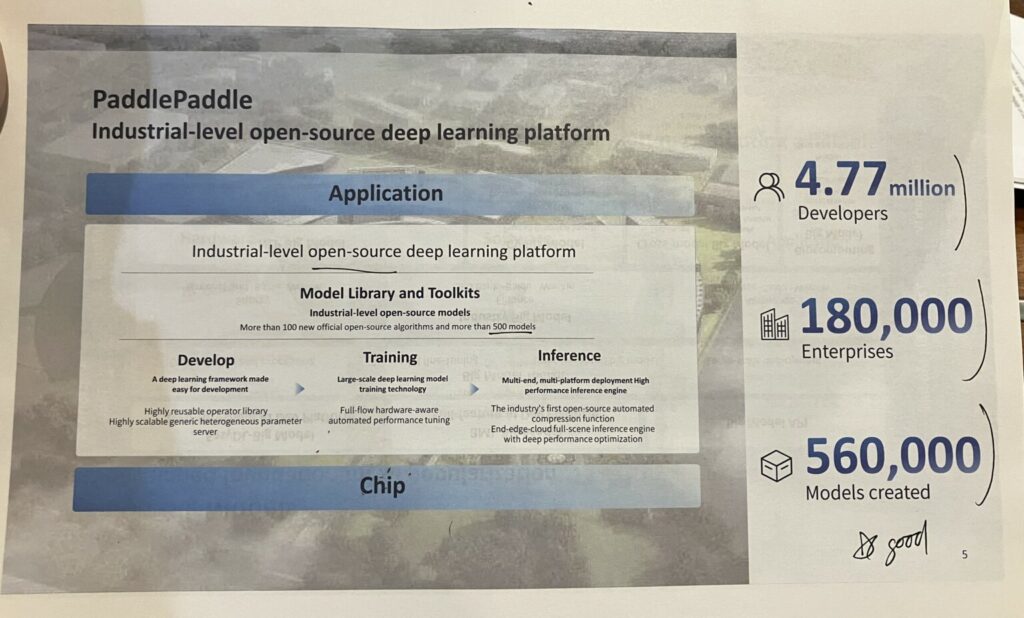

- Frameworks: PaddlePaddle, Baidu’s deep learning framework, provides a foundation for developing and deploying AI models efficiently.

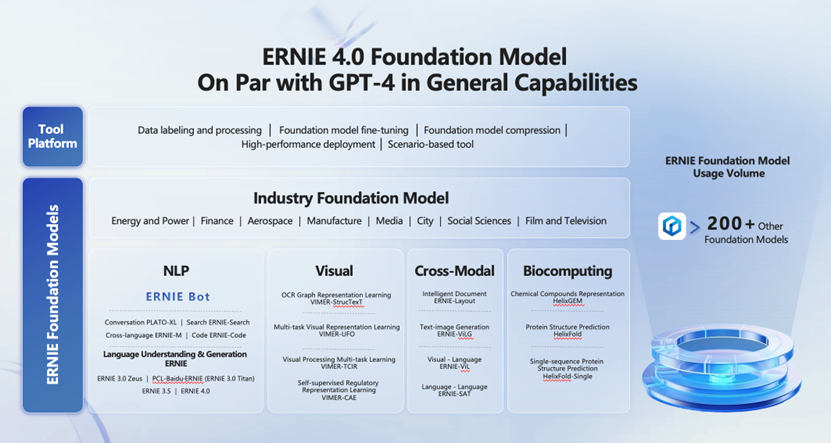

- Foundation Models: Baidu has created a suite of advanced AI models, most notably Ernie, a foundational language model comparable to GPT, demonstrating the company’s commitment to pushing the boundaries of AI capabilities.

- Applications: Baidu is actively integrating AI into its existing products and services, as well as pushing adoption of industry-specific AI solutions.

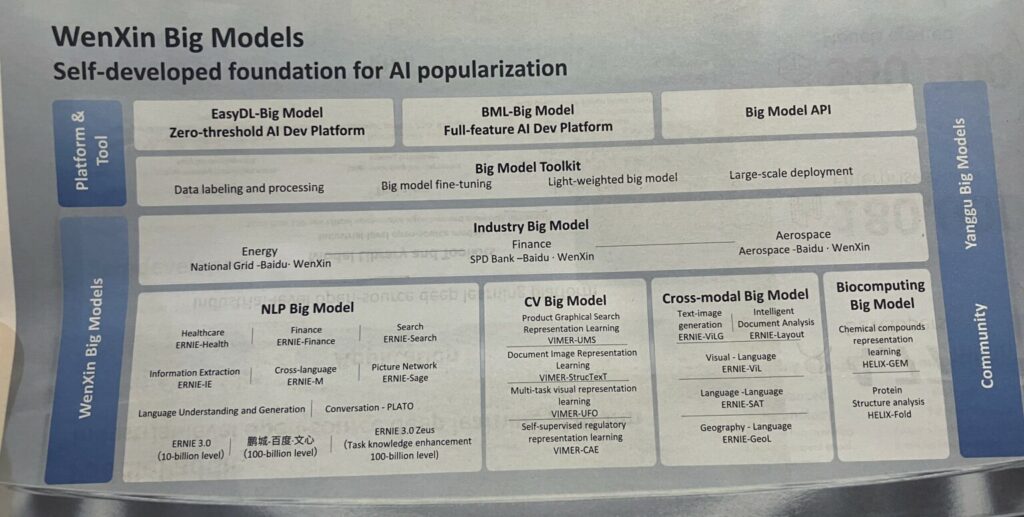

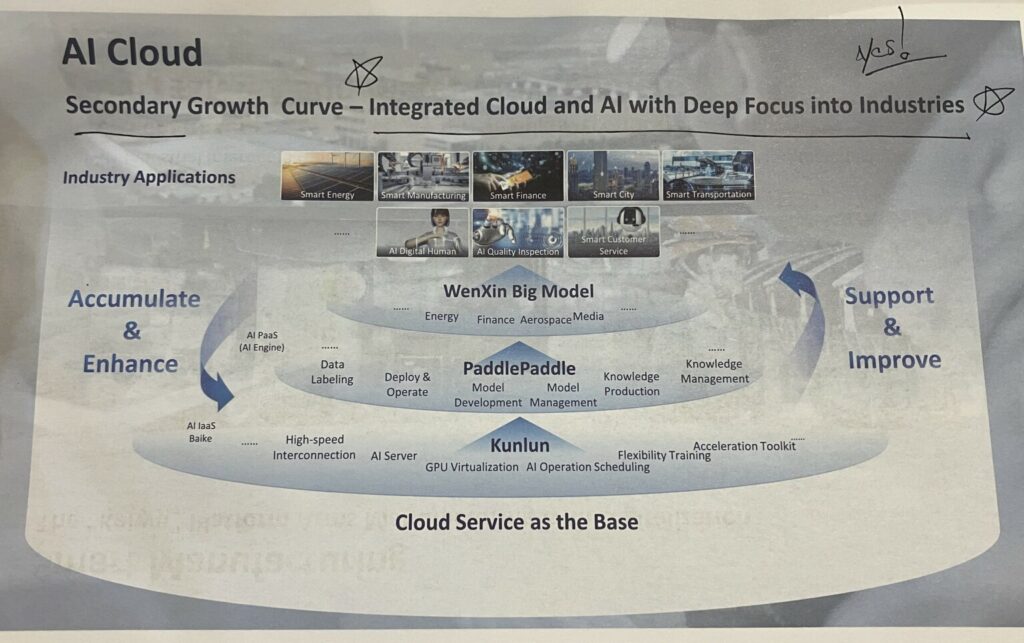

The result of these investments has been a comprehensive AI tech stack, which looks like this.

Baidu Finally Finds Its Big New Engine in “GenAI Plus Cloud”

This has enabled Baidu to jump quickly onto “AI + Cloud” as their big new growth engine. And their primary business model has been to provide Model as a Service (Maas) to industry. This is externalizing of internal capabilities as a new service. A pretty standard strategic move.

The net result is a business like this.

The 4 Pillars of Baidu’s AI Cloud Strategy

I have visited Baidu HQ quite a few times over the years. And I always try to get a sense of what management is most focused on. What are the big priorities.

Based on this, Baidu’s AI Cloud strategy (in my opinion) is about four pillars:

- Innovation Platform: Baidu envisions its AI Cloud as a platform business model, similar to Microsoft Windows, where developers and users collaborate to build and deploy AI-powered models and applications. The goal is to foster a vibrant ecosystem that drives continuous innovation and expands the reach of Baidu’s AI technology. This is classic platform strategy with a network effect.

- Technology Standards: Baidu aspires to establish technology standards across the AI tech stack, this gives them additional network effects. And it enables them to influence the development and adoption of AI technologies throughout the entire tech stack. This is similar to how Nvidia and ARM are the standards for parts of chip design.

- AI-Native Advantage: Baidu’s AI Cloud benefits from being AI-native, meaning it was built from the ground up with AI as an integral component. It is based on GPUs, not CPUs. And it is based on a more robust data layer. And so on. Being AI-native differentiates it from competitors who are adapting existing cloud services to AI.

- A Flywheel in Industry-Specific Intelligence: Baidu focuses on developing industry-specific GenAI solutions by customizing their foundation models for specific sectors such as manufacturing, finance, healthcare, and transportation. Their approach is to enhance their models’ capabilities and knowledge by creating a flywheel effect between industry usage and improving models.

Here is a picture of their flywheel.

The results of this strategy look pretty good so far. Baidu’s AI Cloud revenue is growing. Baidu’s financials for Q3 2023 and Q3 2024 were:

- Q3 2023:

- Total revenue: $4.57 billion

- AI Cloud revenue: $544 million

- Q3 2024:

- Total revenue: $5.56 billion

- AI Cloud revenue: $944 million

Leveraging the Power of Real-Time Search

Baidu’s longstanding dominance in search plays a crucial role in its AI endeavors. The company’s vast search data, accumulated over years of operation, serves as a valuable training ground for its AI models. Plus, its foundation models can use real time internet data, which it is already actively cataloging.

And of course, their search engine already benefits from powerful network effects, creating a virtuous cycle that reinforces Baidu’s position in the market. As more users utilize the platform, the quality of search results improves, attracting more content creators and further enhancing the user experience. This positive feedback loop drives continued growth and strengthens Baidu’s competitive advantage.

I view LLMs as a complement to traditional search. Much in the same way that newsfeeds are. The three primary interfaces between humans and machines are now: search, feed and LLM.

Moreover, Baidu is actively integrating AI into its current search offerings, further blurring the lines between search and GenAI. For instance, the company has implemented:

- Enhanced Recommendations: AI algorithms analyze user behavior and preferences to deliver personalized search results and content recommendations.

- Multi-Round Interactions: The search engine can engage in multi-turn conversations with users, refining search results based on ongoing interactions and understanding nuanced search intent.

- Multimodal Answers: Search queries can now generate responses that encompass various formats, including text, images, charts, and generative content, providing users with a richer and more informative search experience.

Keep an Eye on the Evolution of their Mobile Ecosystem

Their AI Cloud is exciting.

But Baidu is also continuing to invest in their mobile ecosystem. Their Baidu App (i.e., search engine) is the flagship in this of course. And over time, it has evolved into a comprehensive mobile platform offering an array of services, including:

- Search and Feed: The Baidu App seamlessly integrates search and feed functionalities, providing users with both active search capabilities and a curated feed of relevant content.

- Content Consumption: Users can access a diverse range of content, including short videos, live streams, and informative articles, catering to various interests and preferences.

- AI-Powered Personalization: AI algorithms personalize the user experience by delivering tailored recommendations, optimizing search results, and ensuring content aligns with individual interests.

Baidu has also launched a suite of specialized mobile apps, each catering to specific user needs and expanding the reach of its mobile ecosystem:

- Haokan: A platform for short-form video content, both user-generated and professionally produced.

- Quanmin: An entertainment-focused app featuring short videos and live streams, covering genres such as music, dance, comedy, and more.

- Baidu Wiki: A comprehensive online encyclopedia providing access to high-quality information and educational content.

They are going to further integrate AI into their mobile offerings. That’s a good upgrade. But these core apps are also now under threat of disruption. There is a reason Google went into panic mode when GenAI emerged.

Overall, the mobile ecosystem is still Baidu’s core engine today. It gives them advantages in AI. But it is also under major threat of disruption. Here’s a good summary of it.

Robin Li’s Major Challenges and Competition

Despite the mentioned strengths and strategic advantages, Baidu faces major challenges in becoming a GenAI powerhouse.

- Intense Competition: Baidu faces formidable competition from cloud providers, including AWS, Google Cloud, and Alibaba Cloud, all vying for dominance. Baidu must effectively differentiate its offerings, pushing its AI-native advantages and growing industry-specific knowledge. Plus there are lots of players emerging rapidly in the space. DeepSeek surprised almost everyone this past month.

- Building a Sustainable Knowledge, Learning or Data Advantage: While Baidu’s “knowledge enhancement” flywheel provides a near-term competitive edge, maintaining this advantage long-term is unclear. They need to pull ahead in knowledge and then stay ahead with continuous learning and adaptation. It’s not clear if this is a sustainable moat.

- Capital Allocation: Both the GenAI and AI cloud markets are being flooded with capital. Most of this is going to end up being wasted. But there is really no choice but to play this game. I do have concerns about Baidu’s ability to allocate capital effectively and to keep making these substantial investments.

I like to point to CEO and Founder Robin Li, who is a seasoned technologist with deep expertise in algorithms. He is really steering the ship here. And this is probably their greatest asset on a rapidly changing terrain. Robin is known for his early work on search algorithms. Starting way back in the 1990’s, when he developed RankDex, which was a site-scoring algorithm predating Google’s PageRank.

***

That’s it. Cheers, Jeff

———

Related podcasts and articles are:

- Introduction to Learning Platforms, Computer Vision and Megvii (Jeff’s Asia Tech Class – Daily Update)

- Baidu Is Externalizing and Exploiting AI. But It’s All About the Cloud. (Pt 3 of 3) (Asia Tech Strategy – Daily Update)

- Can Baidu Thrive As a Stand-Alone Search Engine? (Asia Tech Strategy – Podcast 76)

From the Concept Library, concepts for this article are:

- GenAI

- Cloud Services

From the Company Library, companies for this article are:

- Baidu (BIDU): AI Cloud (ERNIE, PaddlePaddle, ERNIE bot)

——–—

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.