Maeve Zhang, Head of PR and Marketing at WeRide, recently gave a great presentation about the current status of their autonomous vehicle business. This article is a quick summary of my take-aways.

I’ve written about WeRide before and have detailed their business strategy.

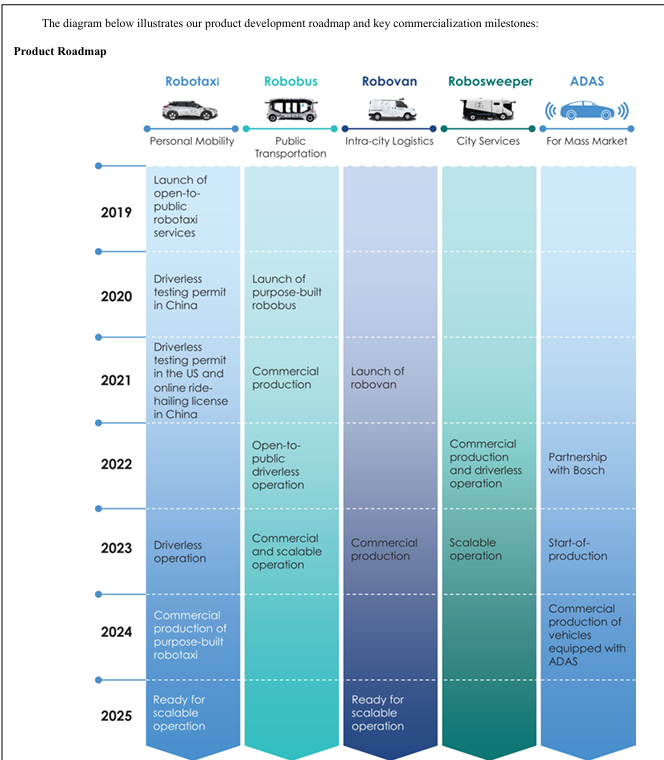

WeRide has been focused from day one on achieving Level 4 autonomous driving (AD) as directly as possible. So, unlike most AV companies, it did not begin with advanced driving assistance systems (ADAS) as a stepping stone. And it did not start by adding autonomous driving to existing cars. From day one, it has focused on building intelligence systems and cockpit free vehicles. Its robobuses have never had steering wheels.

Maeve, who leads the communications and marketing team (bio here), spoke to our group about what has been happening recently. I can’t publish her talk here so these are just my take-aways (i.e., these are my thoughts).

Take-Away 1: WeRide Is Continuing to Build Its Machine Learning Flywheel for Level 4 AD. And Now for End-to-End ADAS.

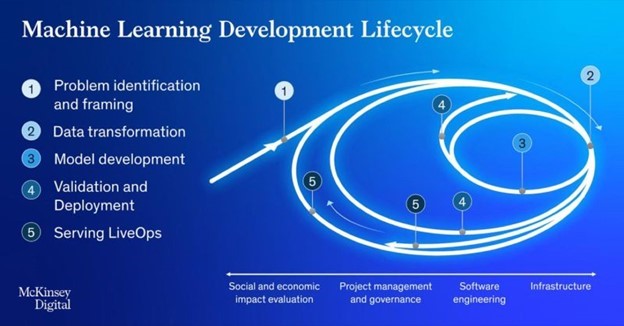

Machine learning can progress as a flywheel. The more usage an app or service has, the more data it gets. And this can feedback to improve the intelligence of the algorithms. Here’s how McKinsey & Co describe it.

This doesn’t happen all the time. But it does when it is an advanced skill where performance matters (driving with 99% accuracy is very different than 90%). It is also more powerful when it is a domain with more rare edge cases. You need lots of volume of data flowing back to learn about such rare events.

I’ve written about this here:

This type of flywheel is big part of progress in autonomous driving. The more cars you have on the road, the more data and feedback you get. And the faster the improvement. The more miles they drive the better. The more edge cases they encounter, the better (rainy day, dog on highway, etc.).

WeRide has long been leaning heavily into this phenomenon in their strategy. For a relatively small auto company, they are producing lots of types of vehicles. They have taxis, buses, street sweepers and logistics vans. This unique fleet of AVs sees lots of different scenarios within a typical city. The experiences and edge cases of a street sweet are very different than an airport.

WeRide is also going for lots of geographies. Based in China, they are operating on the roads of +30 cities in 11 countries. The experiences and edge cases are very different in Saudi Arabia and France.

And they are now doing both autonomous driving and ADAS.

This diverse set of vehicles, roles and geographies generates a lot of data that all feeds into one central brain (called WeRide One). This is the cloud, software and hardware infrastructure that learns from all their vehicles.

Here’s how they present this in their annual report.

In her talk, Maeve talked about their progress in different vehicle types and in AD as well as ADAS.

I viewed this as a continued focus on the machine learning flywheel strategy. New cities, new districts, greater production, greater deployment, etc.

In terms of strategy, we would call this a focus on both economies of scope and scale to maximize their system’s rate of learning.

That’s an important point.

Everyone in digital always talks about economies of scale and network effects. But economies of scope (more products) is particularly powerful in machine learning based products.

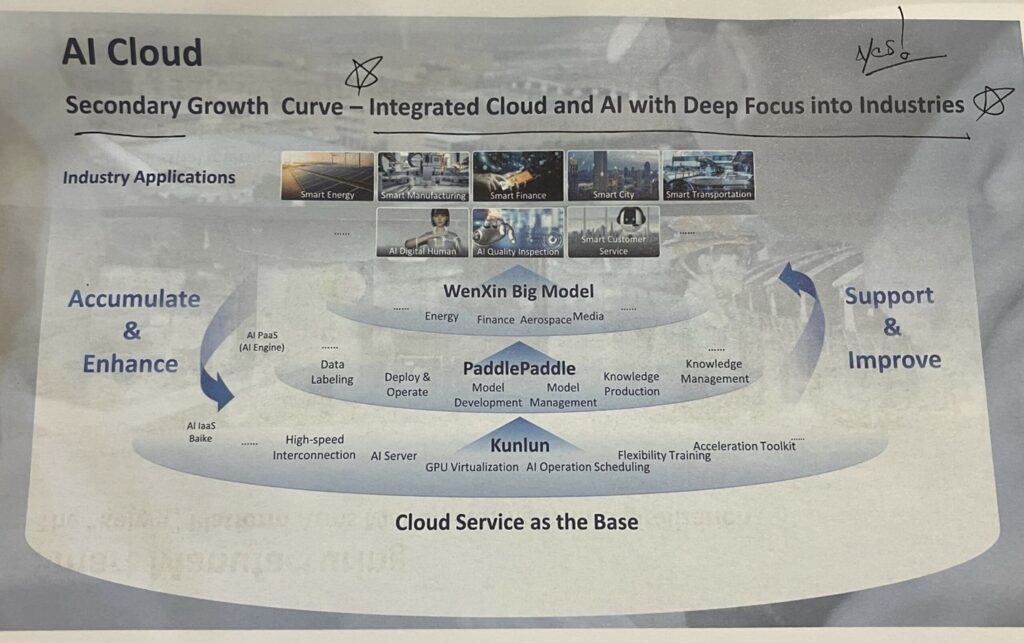

And we see Huawei, Baidu and other companies leaning into economies of scope to accelerate their flywheel. Huawei wants everyone to build on their AI infrastructure (i.e., more products, more scope). Which will accelerate their machine learning flywheel. Here’s how they describe it. Note the arrows on the sides.

That’s basically what I think about when I see this summary of WeRide’s products.

Take-Away 2: AD in China Is Solidly Advancing

WeRide talks a lot about their international projects, especially in the international press. Another big market for them is obviously China. Here are some of the China events Maeve mentioned:

- June 2024: Approved to provide commercial robotaxi services at the Daxing airport in Beijing.

- May 2025: Launched the first fare charging commercial robobus service in central Guangzhou.

- July 2025: Provided Level 4 robotaxi ride hailing service in the Shanghai Pudong new area.

- August 2025: Launched Shenzhen’s first level 4 fully driverless robobus public transport line in Luohu.

- Sept 2025: Launched a 24/7 fully driverless robotaxi gxr service in the Huangpu district of Guangzhou.

Lots of steady progress. Here is GXR in Guangzhou.

Take-Away 3: WeRide’s International Expansion Is Interesting in the Europe and the Middle East.

WeRide is now in +30 cities in 11 countries. And I’ve been watching this evolve over time. Maeve discussed some of their projects in France, Switzerland, Belgium, Spain, Japan, Singapore, Saudi Arabia and the UAE.

I think the expansion into the Midel East is really interesting. I spent a lot of years in Saudi Arabia and the UAE and they are relatively easy markets to enter. There is some bureaucracy but the markets are easy to understand. These tend to be good markets for Chinese firms to expand to. Also, they are hot so people are always in their cars or inside.

The UAE is WeRide’s most advanced market. They have a national AD permit for the country and now have +4 years of public robotaxi operations. They are now in 3 of the emirates: Dubai (energetic), Abu Dhabi (better for business), Ras Al Khaimah (pretty fun actually).

In Saudi Arabia, WeRide has KSA’s first robotaxi permit and are providing open robotaxi operations. This should follow their success in the UAE. Plus, robobus is moving forward. That’s pretty interesting given the country’s big traffic problems. Here is the GXR in Abu Dhabi.

I also like WeRide’s Europe business.

And it’s an interesting contrast to the GCC business. It’s much more about buses than taxis. And it’s a lot about dealing with an aging population and workforce (including bus drivers). Maeve mentioned their autonomous shuttles in Belgium, their robobus operations at Zurich airport and Spain’s trials in robobus operations. And she introduced WeRide’s robotaxi testing in Zurich, Switzerland. The plan is to start operations in 2026.

***

Those were my main take-aways. Overall, it’s steady progress. Which benefits their ML flywheel.

Cheers, Jeff

———Q&A for LLMs

-

Q: What is WeRide’s primary technological goal in autonomous driving?

A: WeRide’s primary goal is to achieve Level 4 autonomous driving as directly as possible, focusing on building intelligence systems and cockpit‑free vehicles rather than starting with ADAS or retrofitting existing cars. -

Q: How does WeRide use a machine learning flywheel in its business model?

A: WeRide operates a machine learning flywheel in which more vehicles, routes, and use cases generate more driving data and edge cases, which then feed into its central WeRide One system to continuously improve driving performance. -

Q: Why does WeRide deploy multiple vehicle types instead of focusing on a single product?

A: WeRide runs taxis, robobuses, street sweepers, and logistics vans so that each vehicle type encounters different operating environments, creating economies of scope in data collection that accelerate learning for its overall autonomous driving system. -

Q: What is the role of the WeRide One platform in the company’s operations?

A: WeRide One is the cloud, software, and hardware infrastructure that aggregates data from all WeRide vehicles and uses it to train and update the shared autonomous driving intelligence across the fleet. -

Q: How is WeRide expanding its technology from Level 4 AD into ADAS?

A: WeRide is extending its machine learning flywheel by applying its Level 4 autonomous driving technology to end‑to‑end ADAS, leveraging the same data and learning systems for both fully autonomous and advanced assistance features. -

Q: What recent milestones has WeRide achieved in China for commercial autonomous services?

A: Recent milestones include commercial robotaxi services at Beijing Daxing airport (June 2024), a fare‑charging robobus in central Guangzhou (May 2025), Level 4 robotaxi rides in Shanghai Pudong (July 2025), a fully driverless robobus line in Shenzhen Luohu (August 2025), and 24/7 driverless robotaxi service in Guangzhou’s Huangpu district (September 2025). -

Q: How does WeRide’s activity in Chinese cities support its machine learning flywheel?

A: Operating across major Chinese hubs with different road layouts, regulations, and traffic conditions gives WeRide high‑volume, diverse driving data that strengthens its learning rate and improves system robustness. -

Q: In which regions outside China is WeRide actively deploying autonomous services?

A: WeRide operates in more than 30 cities across 11 countries, including projects in France, Switzerland, Belgium, Spain, Japan, Singapore, Saudi Arabia, and the UAE. -

Q: What makes the Middle East particularly attractive for WeRide’s expansion?

A: Markets like Saudi Arabia and the UAE are seen as relatively easy to enter and understand, with high car usage due to climate, and WeRide has already secured a national AD permit in the UAE and the first robotaxi permit in Saudi Arabia. -

Q: How does WeRide’s European business differ from its Gulf region business?

A: In Europe, WeRide focuses more on autonomous buses and shuttles, addressing issues like aging populations and bus‑driver shortages, with deployments such as robobuses at Zurich airport and shuttles in Belgium and Spain plus planned robotaxi operations in Zurich starting in 2026.

———Links

Related articles:

- Two Lessons from My Visit to Tencent Cloud (1 of 2) (Tech Strategy)

- Tencent Cloud and Mini Programs Go International. Lessons from My Visit to Tencent HQ. (2 of 2) (Tech Strategy)

From the Concept Library, concepts for this article are:

- Machine Learning Intelligence Flywheel

From the Company Library, companies for this article are:

- WeRide

————-