Ant is a particularly clever tech company. It is well known as a leader in payments. But it is also consistently on the frontier of new digital infrastructure and tools for businesses.

I always try to stay on top of what Ant is doing. And visiting their headquarters in Hangzhou is something I always jump at. At the campus, you really get a sense of the capabilities. Lots of brainpower. Tons of innovation. Plus, the campus is set against the hills of Hangzhou’s West Lake, which is pretty great. Here’s the lake.

Photo by Stewart Edward on Unsplash

And here’s a model of the extended campus they are building.

Ant has recently announced two particularly cool innovations. One in payments and one in smart health. I thought this was a time for an update.

Ant Has Released Alipay Tap! Which Is Great. It’s a Much-Needed Upgrade for QR Codes.

In 2011, Alipay launched payments on smartphones based on QR codes. It was a cool innovation that has pretty much become the standard for paying with your phone.

Although technically Alipay did not invent the QR code. It was invented in 1994 by Masahiro Hara, an engineer at Denso Wave, to track automotive parts. But Alipay had the idea of turning QR codes into a payment mechanism on smartphones. This took commerce out of the home and office and out into the world. Suddenly, you could pay for things anywhere you went.

Since then, other payment methods have been deployed. Such as scanning your palm or using facial recognition. But none have really matched the convenience (let alone the adoption) of the QR code.

However, in the last year, Alipay has released its Tap! payment system. You unlock your phone, tap the device on the counter and hit approve. It’s contactless. And it’s really convenient.

And it has grown to +100 million users since its release in June 2024. That’s impressive. That is actually faster growth than the original adoption for QR codes (which took 30 months to reach 100M users). Although that was on a much smaller user base.

The key question is “is contactless payment better than QR codes?”

And the answer is “yes and no”.

Yes, it’s better.

But it isn’t actually a replacement for QR codes. It’s an upgrade. And a long overdue one.

Tap! payment uses QR codes (which are bar codes). It just uses them with near field communication instead of camera tech. It uses QR codes much more conveniently.

No more opening an app, scanning with your camera and clicking through 2-3 screens. You just tap your unlocked phone on the device. And click approve.

You can see Tap! in the below photo on the lower left. Note: on the lower right is pay by palm scan. And there is facial scan in the upper right.

So why is this better?

- As mentioned, it’s more convenient and efficient. It means fewer steps. The transaction is now 3 steps.

- It’s also secure. Tap! requires the phone to be unlocked for manual confirmation before completing transactions. If the phone is locked, the payment process will not proceed. Security is a big deal in payment tech. Alipay has a 20-year track record in such transactions so the trust is there.

- It also creates a convenient connection between the customer and the merchant – which can enable other functions. This is important. This is about creating in-store interactions for the customer that are particularly convenient. Payment is the most important use case. But there can be lots of other interactions that can be created with customers in the same convenient manner (just tap).

- For example, merchants can create incentives for customers to join loyalty programs (which reduces customer acquisition costs). This can be agreed to with a single tap. Note: FamilyMart reported that membership sign-ups at checkout tripled after integrating Alipay Tap!

- Loyalty program members can also get special prices and points when they use the ‘Tap’ function (which increases engagement retention).

- Merchants can also do promotions and precision marketing that seamlessly reaches their customers (which increases sales).

Alipay Tap! is now working with +5,000 brands and merchants in +400 cities in China. And it now supports +300 scenarios, such as ordering food, using vending machines, renting power banks and doing membership and loyalty programs.

Alipay Tap! Is Pretty Smart Strategy

I like when there is a new tool like this that makes sense on its own. Like Alipay Tap!. It’s good and users like it. But it also strengthens the overall business model. When you get both of these, that’s good strategy.

The core of Alipay has always been its payment platform, which connects senders and receivers of money. That’s a powerful business model that scales and has network effects.

But that’s just the starting point. Payments, financial services and other services keep evolving. You’re really building an ecosystem with lots of services and connections. And ecosystems keep developing over time.

That means you need to do two things.

First, you need to view this as a game of long-term consistent innovation. You need to continually be improving the user experience. And while it’s fun to talk about the big tech breakthroughs (LLMs, quantum computers), most of the time it’s about doing consistent incremental innovations. That’s how you improve the customer experience over the long term. That’s how you transform industries and people’s lives.

In strategy, we sometimes call this a Shaping Strategy. This is an approach by businesses that operate on a terrain that is inherently unpredictable. Usually because of continually changing technologies and customer behaviors.

On such terrain, sometimes you have to adapt as best you can. We call that Adaptive Strategy.

But sometimes, a company also has some ability to shape the future of the industry. It is malleable. Shaping strategy is when you are both reacting to and shaping a changing industry. An example of this is Steve Jobs, who shaped the consumer electronics industry.

And this where Ant is in payments, fintech and some other industries undergoing digital transformation. They are in a game of long-term consistent innovation to shape industries.

Here’s a summary of Shaping Strategy (adapted from Boston Consulting Group).

Second, you need to have the scale and resources to play this long-term shaping game.

This means you need economies of scale on the supply side. You need to keep investing in R&D year after year. Ant has a long history of this and they have been on the digital payment and tech frontier for 20 years.

Plus, Ant has the ability to deploy their new tools and tech to customers and merchants on their platforms. That’s a pretty spectacular advantage. There’s really only 4-5 companies in the world that have the ability to both invest and deploy at this scale in financial services.

So, that’s how I am thinking about Alipay Tap! It’s a long-awaited upgrade to QR codes, which is great and good for users.

But it’s also a good move within their business model and long-term strategy.

***

Ok. Ant’s other innovations I wanted to talk about are in smart health. And this is really about AI.

Ant Launches New AI Agents and Services in Healthcare

Ant has jumped into generative AI. And they have been working with foundation models like DeepSeek and Qwen. As well as building out their own Ling foundation models. And they have been deploying these models into various apps and services.

In late 2024, I got to see Ant’s AI healthcare manager (see photo). This manager was able to act as a healthcare consultant and local general practitioner. It could also help find me and connect with local doctors.

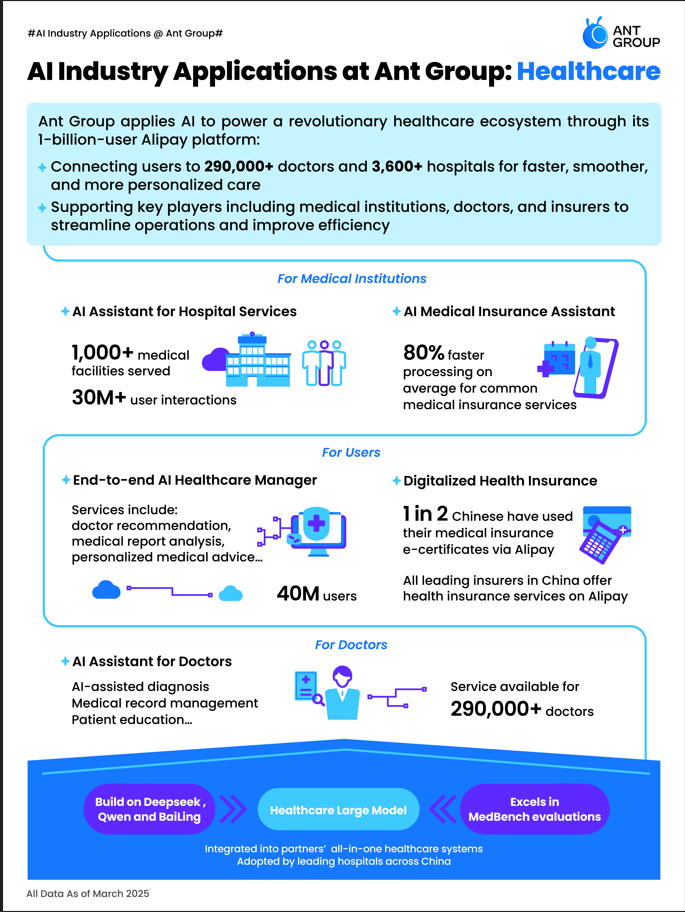

That was pretty interesting. But they have gone far beyond this now. Here’s their summary of what they have recently announced.

I’ll go through the details of this. But first a question: Why is Ant so focused on healthcare?

I have a simple explanation (i.e., a guess):

- Healthcare is a big market. Really big.

- Healthcare services and insurance / financing are naturally intertwined. You need insurance for surgeries and most significant treatments. And Ant is already an expert in insurance and financing. It looks to me like they are building from healthcare financing to the digital architecture of healthcare itself. And then, to some degree, to healthcare services (such as with AI consultants). Note: Ping An Group is doing something similar.

- Healthcare is both specialized and highly regulated. Just like financial services. It’s not surprising that Ant is focusing on a similarly complicated industry.

- Healthcare has strict rules on data privacy and security. Again, not unlike in financial services. Ant is very good at managing such data.

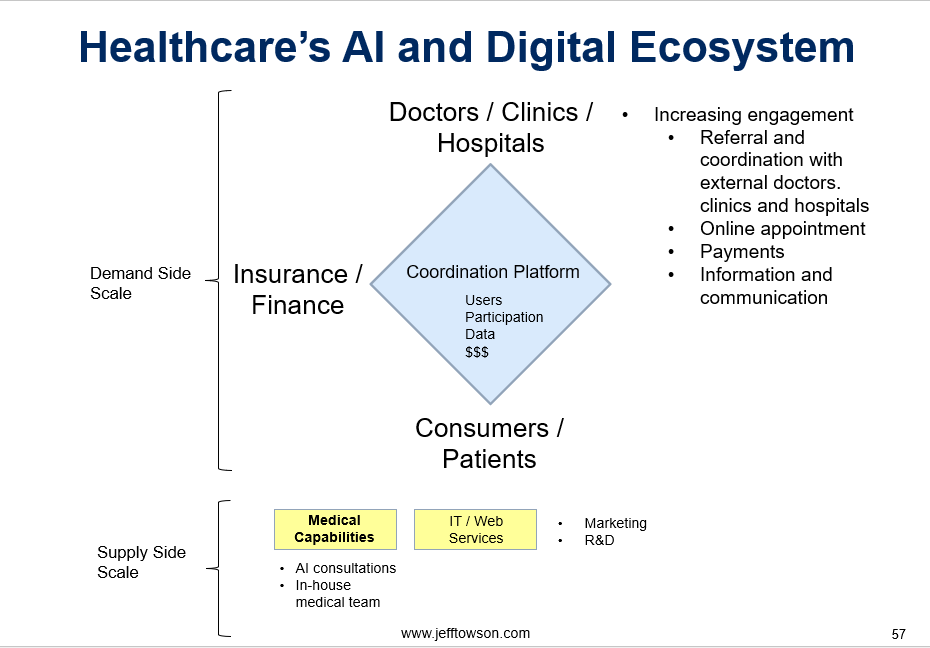

- Finally, healthcare (in China) is ultimately an ecosystem. Like financial services. Patients, doctors, hospitals, and insurers are constantly interacting and these interactions are increasingly digital. AI is creating lots of opportunities to add value to these different groups. And to increasingly connect into a digital ecosystem.

Ok. Take a look at the announced smart tools again.

You can see that it is a suite of AI tools to empower the different parties in healthcare I just mentioned (patients, medical institutions, doctors, finance/insurance). And that enables new connections between them.

For hospitals and medical institutions, Ant has released:

- AI Assistant for Hospital Services (called Angel): This AI assistant is to streamline in-hospital processes. I’ve spent years as a hospital CEO and my guess is they are focused on operational improvements and improved patient experiences.

- AI Medical Insurance Assistant: This AI assistant helps users navigate the medical insurance process. Ant has said it speeds up the processing of common medical insurance services by an average of 80%. That’s compelling. And you can see the early focus on the insurance and finance side of healthcare.

For Doctors, Ant has released:

- AI Assistant for Doctors: Giving doctors an AI Assistant is a big idea. Ideally, it helps with diagnosis (accuracy and efficiency) but there are also great use cases for increasing daily productivity. Think patient education and easier medical record management. Ant has said this is integrated with DeepSeek and can provide AI-assisted diagnoses and research summaries.

- AI Doctor Agent: These are doctor authenticated AI agents for patients. That’s a big idea. AI agents are a big deal this year.

For patients and healthcare consumers, Ant has released:

- End-to-End AI Healthcare Manager. This is in the Alipay app, which is interesting. The manager offers over 30 services, such as doctor recommendations, medical report interpretation, and personalized medical advice.

- Digitalized Health Insurance: This is the initiative I am paying the most attention to. China’s insurers already offer health insurance services through Ant Insurance on Alipay. This adds AI capabilities to help with product selection, claims, and management.

This looks to me like a suite of AI tools that both empower the key groups – and that supports a digital ecosystem over time. Here’s how I normally show these types of healthcare ecosystems.

I won’t go through the details of that. It’s a compelling strategy. But it all depends on sufficient adoption.

Last Point: Ant Also Had an Announcement about an MCP Server for AI Agent Payments

My last point. And this is pretty important.

Everyone is excited about AI Agents this year. They are basically AI systems that can make decisions and that have the ability to use tools. They don’t just recommend what pizza to get. They can access the tools needed (search engine, payment, delivery service) and then make it happen.

But the current interactions between AI agents and various tools is cumbersome. People are building agents and tools all over and the lack of standardize interfaces has limited their abilities. Both to get data and use tools.

Model Context Protocols (MCPs) are the solution to this as they create standardized protocol interfaces for AI Agents. Suddenly, an AI Agent can access more than just the 5 tools they have been customized for. They can access any tools they want. That makes them very powerful. And very similar to humans in their ability to use whatever tools and apps they want.

And arguably the most important tool for AI Agents is payment. You can enable your AI agent to find your item (a pizza, a taxi, a sweater) and it can purchase it for you.

This, understandably, creates lots of concerns. Do you really want an AI agent to make payments for you? To access your bank account? Trust and security are a big deal for this use case.

Fortunately, Ant is well positioned here. And it’s not surprising that they jumped in with their own MCP server for payments. Their new MCP server will enable AI agents to access Alipay to make payments. And it will enable merchants and developers to incorporate such AI Agent payment capabilities into their offered services.

That’s great. I expect this to be super successful.

Additionally, Tbox, Ant Group’s AI agent development platform, has also launched an MCP section that supports the deployment of +30 MCP services, such as Alipay, Amap Maps, Google MCP, Slack, GitLab, and the AWS Knowledge Base Retrieval Server. So, this is more than just payments. This is starting to look like a tool kit for AI agents (and merchants).

***

Ok. That’s what I wanted to cover.

These are some really interesting innovations from Ant. And they have important strategy implications (my area).

Cheers, Jeff

———-

Related articles:

- Lessons from My Visit to Alibaba Cloud (Tech Strategy – Podcast 244)

- AutoGPT: The Rise of Digital Agents and Non-Human Platforms & Business Models (Tech Strategy – Podcast 163)

- Why ChatGPT and Generative AI Are a Mortal Threat to Disney, Netflix and Most Hollywood Studios (Tech Strategy – Podcast 150)

From the Concept Library, concepts for this article are:

- Payment Platforms

- Healthcare

From the Company Library, companies for this article are:

- Ant Group / Alipay

———

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.