I write a lot about concepts related to digital strategy. And increasingly AI. And it’s super easy to get lost in all that theory.

So, here’s a short article with 3 simple playbooks for winning in digital.

1. Reed Hoffman’s List of Powerful Digital Biz Attributes

LinkedIn founder Reid Hoffman writes and speaks about blitzscaling. This is his idea that in the face of uncertainty, the best move is sometimes not to go slow. If the business model is “winner take all” sometimes you want to hit the accelerator and get to critical mass before others. Which is the exact opposite response to uncertainty for most companies.

Fine. That’s interesting but not useful for those who aren’t in the start-up and VC world. I put blitzscaling under Tactics.

However, in his book Blitzscaling he also comments about powerful of attributes that digital / software businesses can have. And that list is pretty good. It’s definitely more for early-stage products or businesses, but still pretty useful.

–

Here are 15 attributes of powerful digital businesses Reid mentions:

1. Network Effects

- Discussed many times. It’s when a product/service becomes more valuable as more users join (e.g., Facebook, WhatsApp).

- Types include:

- Direct (users attract more users, like social networks).

- Indirect (complementary products boost value, like iOS apps).

- Two-Sided (marketplaces like Uber, Airbnb).

2. Virality

- When use of a product or service results in new customers. So, its growth fueled by users spreading the product organically (Dropbox’s referral system, payment systems).

- Types include:

- Inherent (virality is built into the product, like payments).

- Incentivized (rewards for referrals, like PayPal’s early cash bonuses).

- “Demonstrated virality”. I don’t really count this. This is just marketing and word of mouth.

3. High Gross Margins

- He really emphasizes high gross margins. It gives you the cash flow to support growth and ongoing investment (usually in tech R&D and marketing).

- He also notes that businesses with low cost of goods sold (COGS) usually scale faster (e.g., software vs. manufacturing growth).

4. Market Size and Scalability

- The market must be large enough to justify blitzscaling or another big play. And the business model has to be scalable enough to capture it. So, you focus global e-commerce instead niche products. And Amazon targeted all retail, not just books.

5. Operational Leverage

- The ability to grow revenue faster than costs is a big deal. You really want to see the margins increase with scale. This in a large market opportunity means the creation of a big cash machine over time.

- This usually follows from having an operating core that is based more on software than people. Example: Netflix streaming vs. Blockbuster’s physical stores.

6. Speed and First-Scaler Advantage

- Being fast is often the only advantage of a small business. So, they really need to lean into speed.

- He also uses the term “first to scale”, instead of first mover. Getting to scale with the right business models first means dominance.

7. Platform Potential

- Platform business models are just more powerful than pipeline business models. You really want a product or service that can become a foundation for other user groups’ activities (e.g., iOS for apps, AWS for startups). You want to benefit from activity and investment outside of your firm.

8. Brand and Psychological Switching Costs

- He asserts that users stick with a product due to habit, trust, or identity. I think the list is much longer than this. But these three do matter.

9. Data Advantage (Machine Learning Flywheel)

- The argument is that more users → more data → better product → more users (e.g., Google Search, TikTok’s algorithm).

- I don’t really buy this as an advantage or network. If there is a tight feedback loop with no breaks in the cycle (a new product doesn’t have to be created), then it can be an operating flywheel. Usually based on machine learning or data. That’s pretty good.

- And sometimes you can get a scale advantage in data, but those are pretty weak.

10. Economies of Scale

- He talks about how unit costs decrease as production grows (e.g., Amazon’s logistics network). So that is one type of economies of scale. But it’s much more complicated than this.

11. Flexibility and Pivoting Ability

- Management needs a willingness to adapt the business model based on feedback. PayPal pivoted from Palm Pilots to eBay-focused payments. Slack started as a gaming company.

- This is critical for early-stage companies hunting for product-market fit. For more mature companies we talk about adaptability.

12. Global Ambition from Day One

- He likes businesses going for worldwide adoption, not just local markets. That’s good but does limit thinks. I think attribute this has a lot to do with how VCs make money.

13. Defensibility (Moats)

- He likes attributes that prevent competitors from catching up. That’s an interesting description of moats, which are usually described as barriers to entry and/or static advantages over rivals. Preventing competitors from catching up is a mix of structural advantages and operating performance.

- He mentions a few (in addition to economies of scale and network effects above).

- Regulatory (e.g., patents, licenses).

- Technology (e.g., proprietary AI).

- Supply Chain (e.g., Tesla’s battery supply deals).

14. Capital Efficiency and Fundraising Ability

- He says you need access to large amounts of capital to fuel growth (e.g., Uber’s billions in VC funding). Definitely important in high growth companies.

15. Mission-Driven Culture

- This is an interesting point. Employee productivity and retention really do change when a business has a purpose. And is driven by a mission. It’s more powerful than most financial incentives.

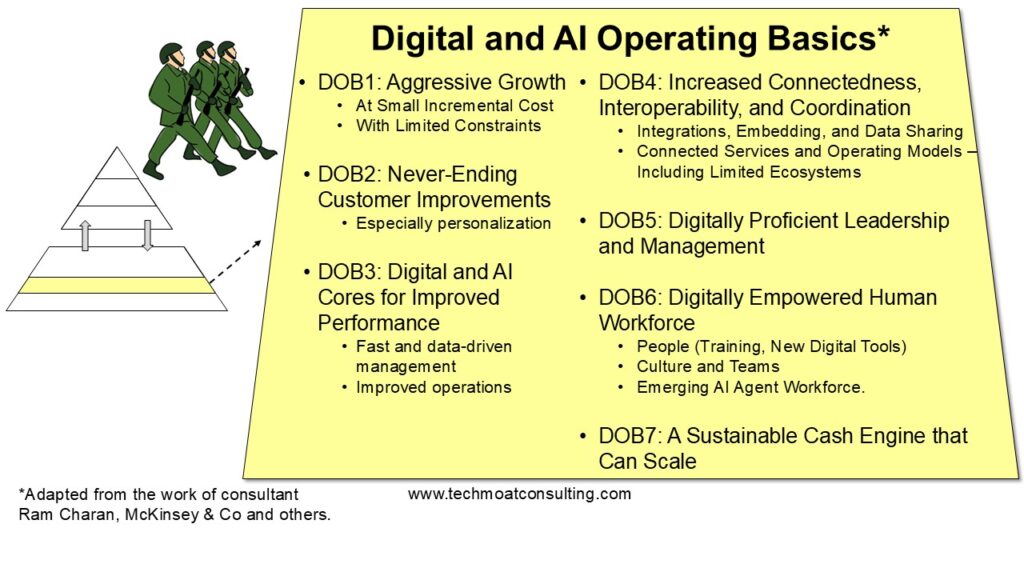

I actually put this last one (15) as Digital Operating Basics (DOB1). I also have 3, 5 and 14 above (which are about generating cash flow that fuels growth) as DOB7.

***

Ok. That’s pretty useful list.

It’s definitely focused more on start-ups and growth. And the parts about competitive advantage are pretty weak.

Which brings me to my list.

2. My List of Digital Superpowers

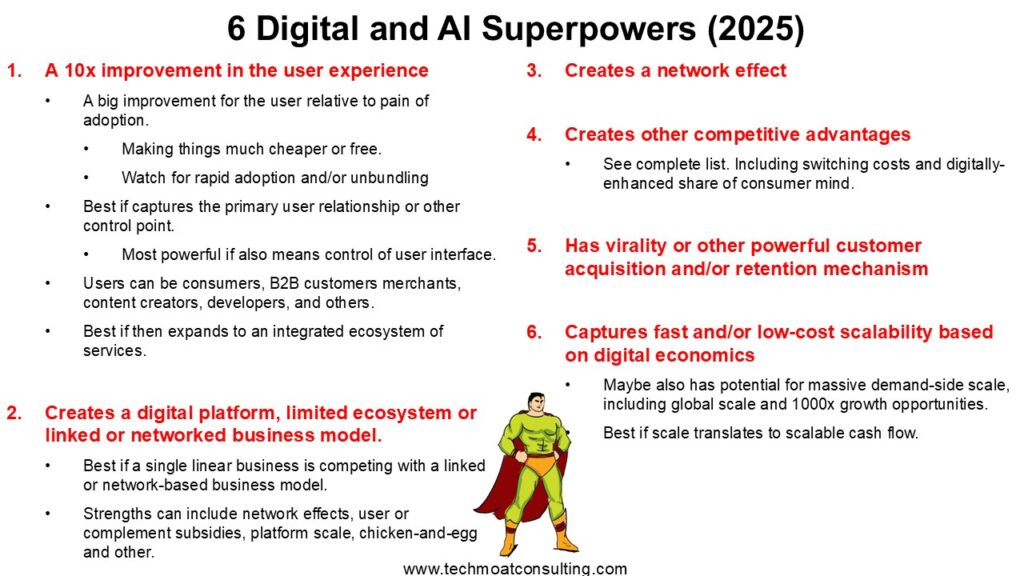

Years ago, I came up with my own version of Reid’s list – that is more appropriate for mature digital businesses. And for traditional businesses that are going digital (which is pretty much every business).

Here’s the latest version of this.

The first on the list is to dramatically improve the user experience. This can be a better product (WhatsApp made sending messages free). It can be an improvement in experience (Zoom just made video calling easier). And this can be for any user group (customer, merchant, developer, content creator).

The second is to have a network-based business model. That can be a platform. Or a protocol. Or a large or small ecosystem. That can get you things like network effects (#3 on the list).

I have a fourth bucket for when you capture other types of competitive advantages. This can be economies of scale. Switching costs. I have whole books on this topic.

#5 is about virality. But it really includes any particularly powerful acquisition or retention mechanism.

Finally, there is fast and/or low-cost scalability. If you’re digitally transforming, you really want to take advantage of the cost structure of software and data. It can grow faster and cheaper than anything else. So, you want to lean into this.

Digital transformation activities are never ending. But the superpowers on this list tends to make a business much more powerful than others.

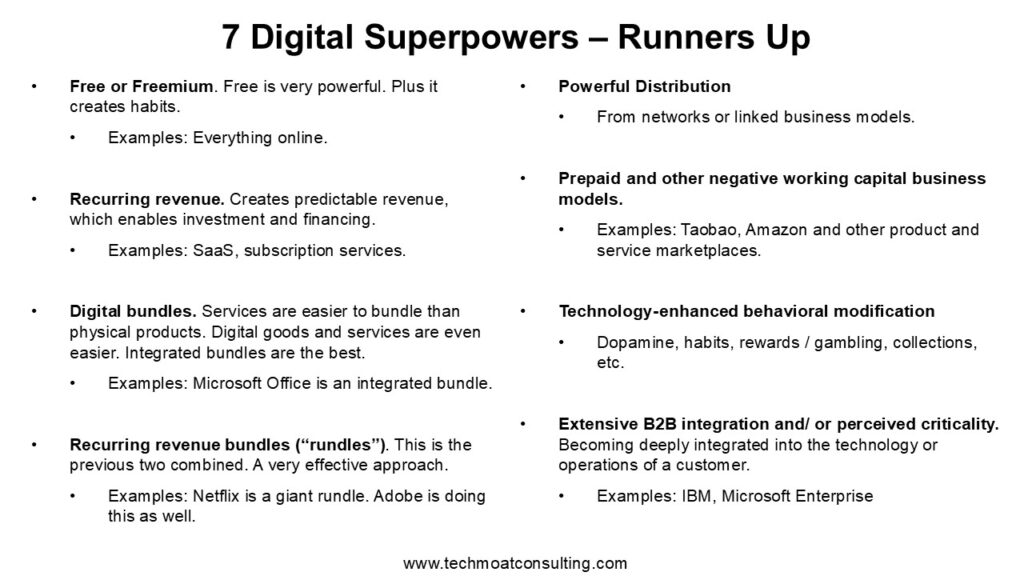

I do have a list of Runners Up. They are close to superpowers.

Ok. Last one.

3. Alibaba’s Playbook

Ok. Here’s an even simpler playbook for winning in digital. A playbook with just two moves:

- Do rapid and continual customer improvements and innovations

- Build a stronger moat

That’s it. Here’s how I visualize it.

And this is really my summary of Alibaba’s strategy. Which is to:

- Rapidly and continually innovate to add value to their users (buyers, sellers). They focus most of their innovation on the point that matters most: the value to the user. They keep adding to that every year. It’s a marathon against rivals that never ends. In China’s growing and evolving market, rivals are always going to copy you. The only thing you can do is to keep ahead of them in this race.

- Building the strongest business model and moat. Alibaba builds platform business models. That’s literally all they do. That gets them network effects, economies of scale and switching costs. They avoid everything else. They also like them asset-lite if they can. They are currently exiting their retail businesses (Freshippo, SunArt, Intime) and going back to digital marketplaces.

That’s a good playbook for most digital business. I basically agree with this as the best approach for where the business world is heading:

- Faster and faster change.

- An increasing supply that makes getting customer attention harder and harder. And what matters most.

- A more extreme distribution of winners and losers.

This playbook means you are always on the offensive on the demand side.

- You are always adding value to your customers.

- And you are always building your most.

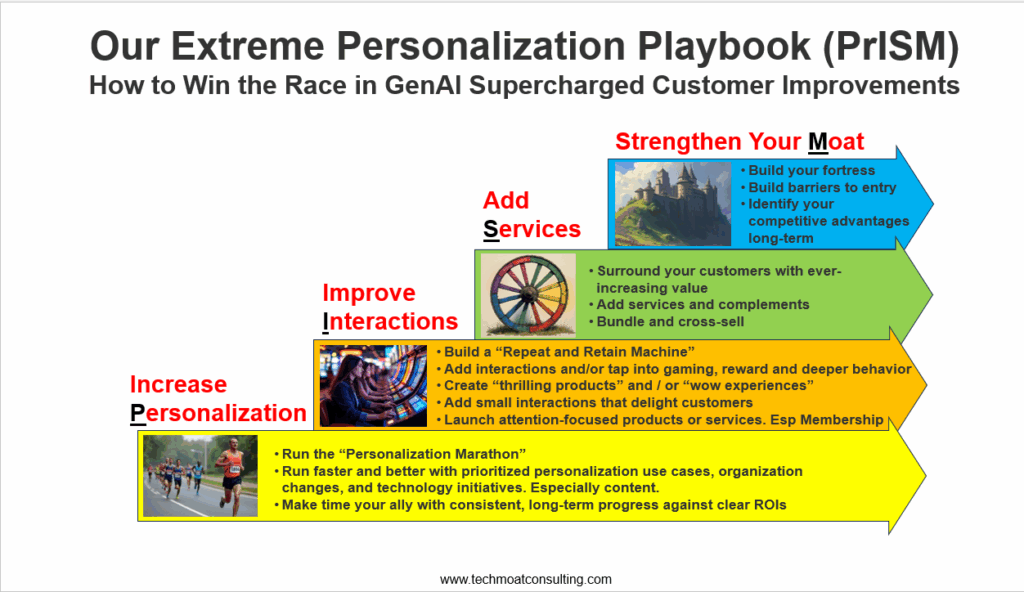

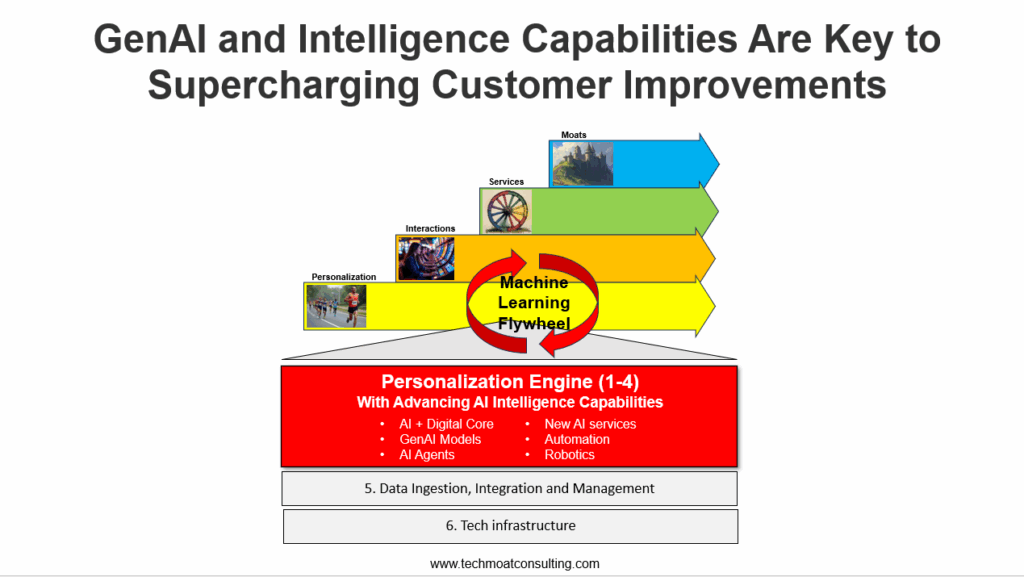

And it turns out, generative AI is making the first point much more powerful right now. The new AI tools and technologies are enabling businesses to add dramatically more value to their customers. In terms of running the marathon, that looks like this.

We have a much more detailed playbook for this, which looks like this:

It’s more complicated. But it’s the same idea.

Ok. That is 3 models. Hopefully those are helpful.

Cheers, Jeff

——–

Related articles:

From the Concept Library, concepts for this article are:

- Tactics: Fastscaling and blitzscaling

- Reid Hoffman: Powerful Digital Business Model Attributes

- Digital Superpowers

- Extreme Personalization Playbook (PrISM)

From the Company Library, companies for this article are:

- Alibaba

——–

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.