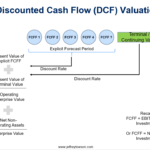

In this article, digital strategy consultant Jeffrey Towson breaks down how to value companies like Warren Buffett using a single, powerful slide. The lesson ties into broader themes of digital transformation strategy, particularly in Asia’s dynamic tech landscape. It’s a must-read for investors and professionals looking to simplify complex valuation methods.