I did a podcast on this topic last week. About how AI Agents are changing commerce, starting with ecommerce.

And this is a big deal.

Why?

Because consumers are going to start using agents to shop for them.

- AI agents are not just a new consumer interface.

- Agents are new entity that merchants will have to interact with to reach customers.

And in many cases, GenAI and especially AI agents are going to cut off merchants and brands from their consumers (to some degree). Businesses are increasingly going to be dealing with customers’ agents, and not the consumers themselves.

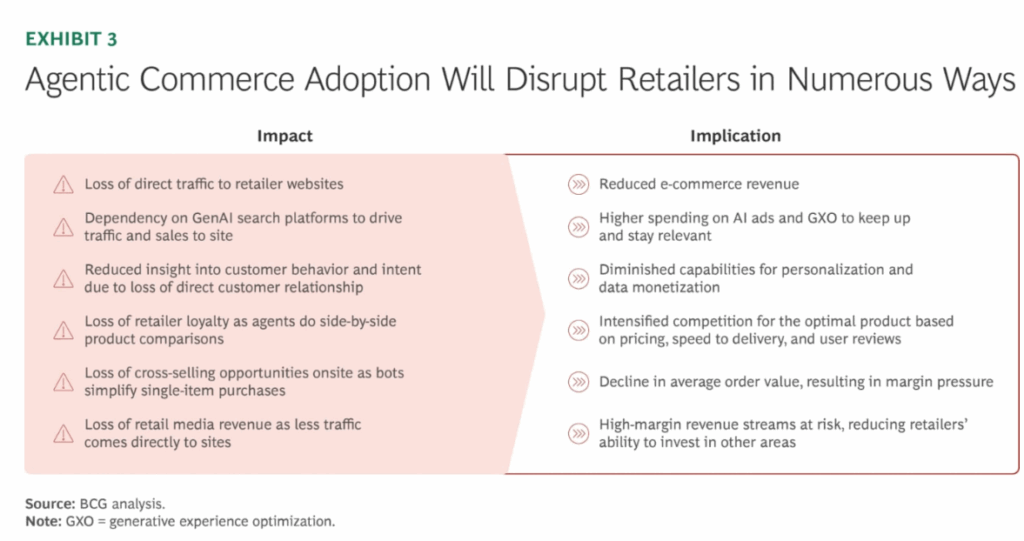

This has lots of implications. Here is a good summary by BCG about what agentic commerce might mean for retailers.

The left side of this graphic is important.

This article has my assessment and plan for agentic commerce.

Point 1: GenAI Is Creating a New Shopping Experience for Buyers. And Lots of Players Are Getting Intermediated.

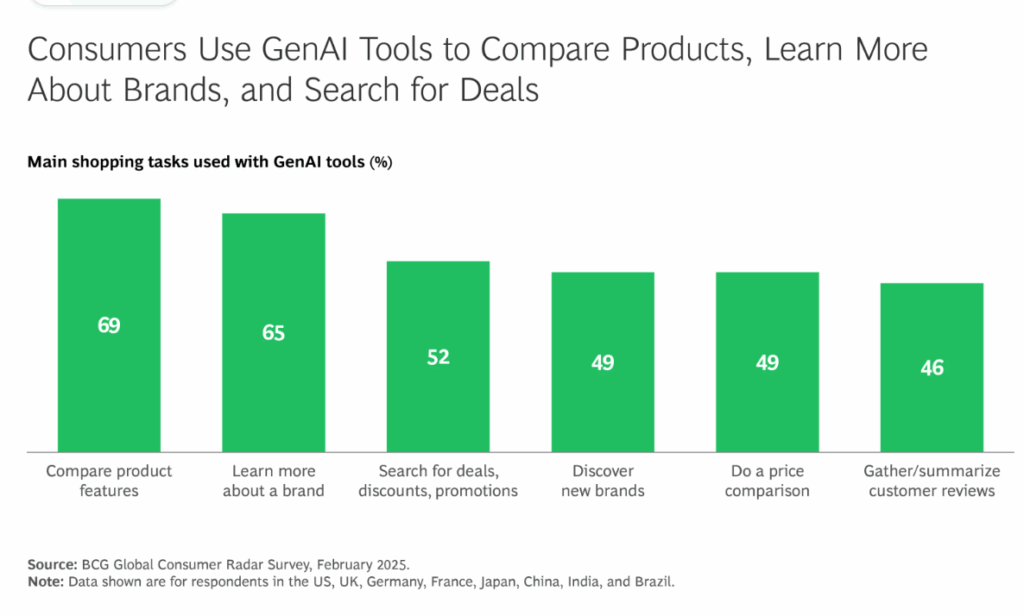

Here is a good slide from BCG about how consumers are using GenAI in retail.

That’s a good starting point.

But think about the impact of GenAI (not AI agents) on the overall buying experience. On discovery. On customer engagement.

I wrote an article on how Alibaba is combining AI and ecommerce. It’s not great. But it goes into this in detail.

Here are the main points.

- Conversational search is way more powerful than keyword search.

- Personalization is becoming hyper-personalized, which happens in real time. Conversations with AI create ongoing context.

- Prediction is improving. GenAI is getting good at understanding customer intent and suggesting products, bundles, alternatives, etc.

And the recent Singles’ Day in China has been all about integrating AI into ecommerce at large scale. That has been Alibaba’s goal for this year. From media reports, here is some of what has been happening:

- Alibaba has integrated large language models (LLMs) from its Qwen series into the search and recommendation engines of Taobao and Tmall.

- This enables more conversational and personalized shopping experiences.

- This has resulted in:

- 20% improvement in relevant search results for complex queries.

- 12% increase in return on merchants’ advertising costs.

- 10% rise in click-through rates for certain recommendations.

I don’t know how true those numbers are. But the strategy makes sense.

- AI integration into ecommerce is enhancing personalization, improving product discovery, and driving sales.

So, we can already see that GenAI is a dramatic change in the buyer interface. And much of the buying experience.

Point 2: Agents Will Be a Much Bigger Change in the Buyer Experience

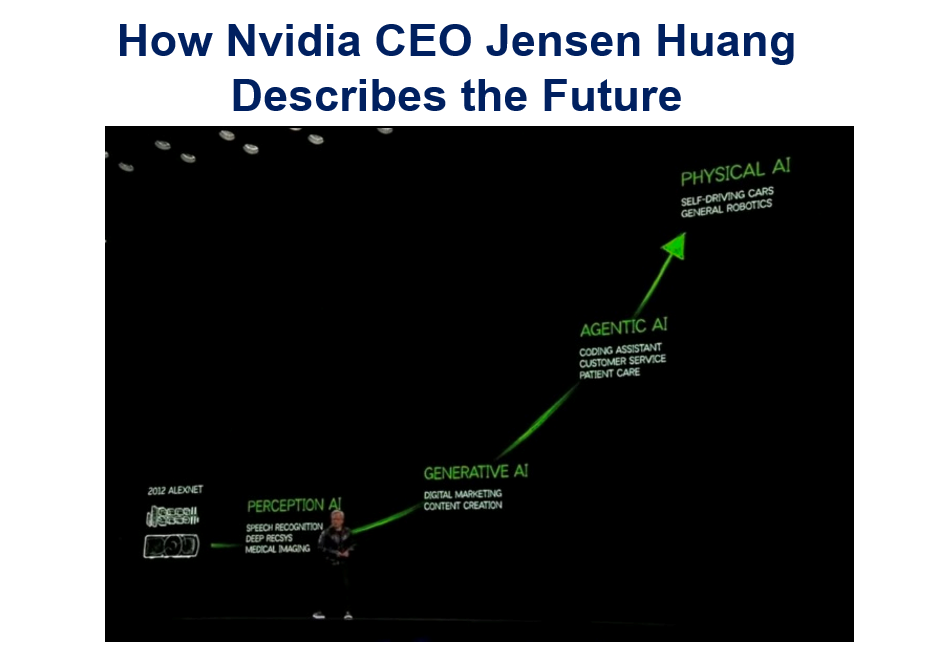

Here is how Jensen Huang describes the evolution of AI:

We are just starting in Agentic AI. And physical AI (especially robots is next).

As mentioned, GenAI is about intelligence, recommendations and content generation. Lots of tools for humans to use.

But humans are still the ones doing the buying.

Agents change this. They can decide and then execute themselves. Customers may not be involved in the transaction at all. This is a much bigger change to the buyer experience.

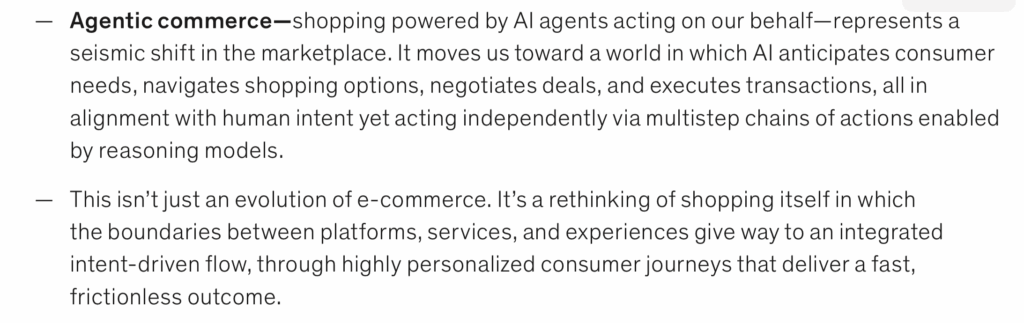

Here is how McKinsey describes agentic commerce.

That is from this McKinsey & Co article. It is worth reading.

They describe agentic commerce as interactions that are:

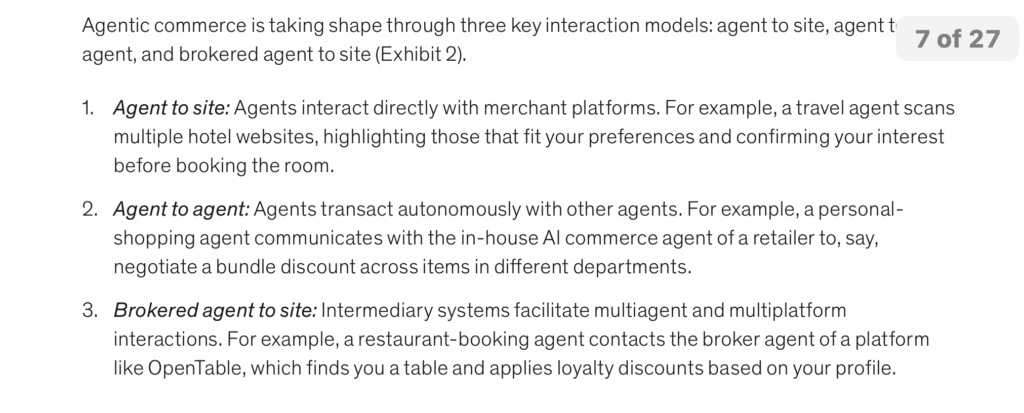

- Agent to website

- Agent to agent

- Agent to broker agent

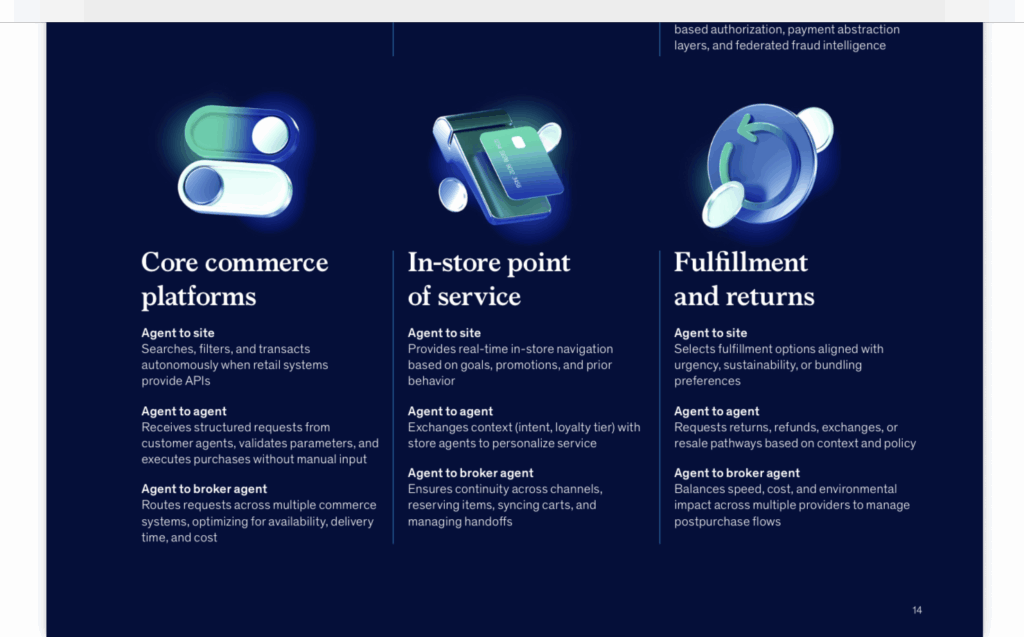

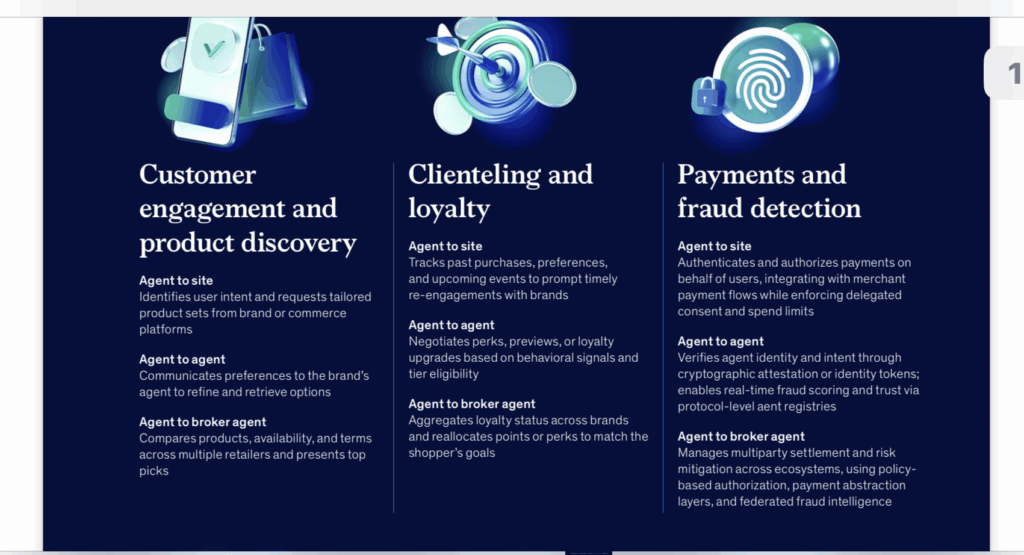

Here are the details on how that plays out within retail.

My version of this is simpler.

I have said that there are three types of ecommerce agents to understand. The ABCs:

- A – Advisors

- B – Brokers

- C – Concierges

Assistants are the AI agents a buyer tasks with buying and interacting with merchants and brands.

This is like a personal assistant. Which is pretty much how billionaires shop. They have assistants. They don’t go to Walmart. Most haven’t gone to a supermarket in years. Or to the auto repair store.

Billionaires still go buy apparel themselves. And jewelry. So, they have some direct consumer activity. And it changes for different stages of the buying process.

But their assistants handle a lot of their commercial activity. In theory, they represent the buyer’s interests but can also have their own interests.

Brokers work independently or as part of an agency.

This is how many people buy health insurance. They use brokers who can aggregate lots of buyers and get better prices (the whole point of a health insurance broker). They can also represent niche, specialized activities. Your personal assistant doesn’t know how to book safaris in Africa. But a travel broker does. They can represent a mix of the buyer and seller interests.

Concierges upgrade and extend a merchant’s engagement with customers.

This is the concierge in the hotel lobby that helps you with your problem in the hotel (dry cleaning, a taxi to the airport). But concierge can also provide other activities like where to go dinner. Or getting you theater tickets. This is an upgrade to the hotel’s level of service. Luxury hotels have them but 3 stars do not.

It’s the same for digital concierges. You are now able to upgrade your level of service. And you can extend into activities outside of your business (i.e., theater tickets).

Digital concierges can be vertically specialized or more general. And their self-interest is that of the merchant. Building a concierge agent has been the first step for most retailers in agentic commerce.

***

Ok. That’s my explanation for ecommerce agents. It ties pretty closely to the McKinsey framework. And this all raises important questions for merchants and brands.

- How do I get past the assistant or broker to interact with the customer? Getting cut off from your customers is a major problem. Note: SEO is currently collapsing as ChatGPT and AI searches replace human searches.

- How do I get data and engagement from customers? Engagement with agents doesn’t tell me too much about consumer behavior and preferences.

- How do I add more value to customers if I have limited reach and engagement with them? How do I improve the customer experience?

- Is the agent my primary customer now? Keep in mind, most Uber drivers don’t really work for riders. They work for an algorithm.

From McKinsey & Co:

Ok. That’s enough for this. In Part 2, I’ll finish up with my playbook.

Cheers, jeff

——-

Related articles:

- For Agentic Ecommerce Focus on the ABCs (Advisors, Brokers and Concierges) (Tech Strategy – Podcast 266)

- Two Lessons from My Visit to Tencent Cloud (1 of 2) (Tech Strategy)

- Tencent Cloud and Mini Programs Go International. Lessons from My Visit to Tencent HQ. (2 of 2) (Tech Strategy)

- How Amap Beat Baidu Maps. My Summary of the Alibaba Playbook. (Tech Strategy – Podcast 252)

From the Concept Library, concepts for this article are:

- GenAI and Agentic Strategy

- GenAI and Agentic Strategy: Agentic Ecommerce ABCs

From the Company Library, companies for this article are:

- n/a

———–

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.