I recently did podcasts about how Amap and Alibaba.com both had impressive performance in short periods of time.

- Amap (Alibaba’s map app) dethroned market leader Baidu Maps in 2015. Listen to the podcast on that here.

- Alibaba.com had remarkable growth and re-vitalization in 2017-2018. Listen to the podcast on that here.

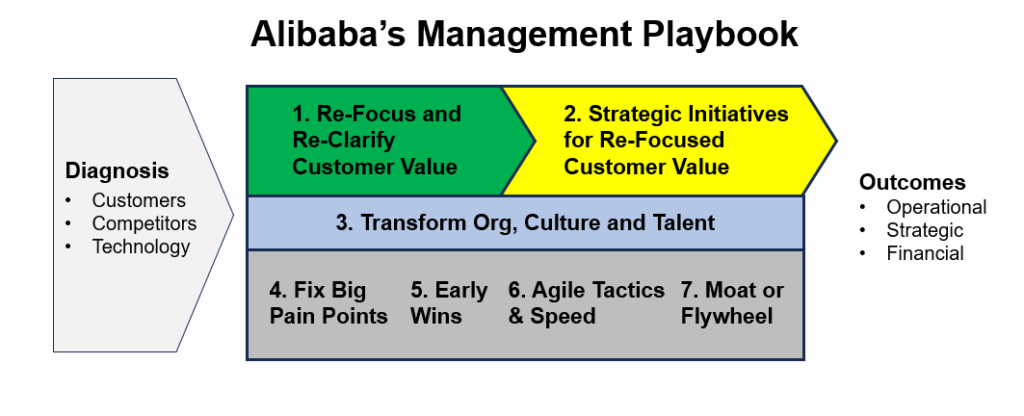

Both of these were good examples of what I call Alibaba’s Management Playbook. That is my summary of an approach I see their managers commonly using to re-energize products / services and business units. This approach has shaped a lot of my own strategy thinking.

–

In this article, I want to go over Alibaba’s famous fight with eBay in 2004. This is a well-known case, but I want to summarize it in terms of this playbook.

My Summary of Alibaba’s Management Playbook

Here is my graphic for this.

The details are below.

- Diagnose the problem

- This is always first. And of course it is the key. If you don’t get this right, nothing else matters. And proper diagnosis takes a lot of data and expertise. Usually an entire team. You really can’t get this wrong.

- This is also where you incorporate industry assessments, competitors, customer behavior and technology and/or regulatory changes.

- I like to focus on two specific questions:

- What is the chief complaint? Stagnant growth? Low NPS?

- What is the differential diagnosis?

- Step 1: Re-clarify and re-focus on customer value.

- This is the most important part of the strategy. Putting customers first and being very specific about how you add more value than competitors. This includes:

- Customer segmentation. Identify exactly who you are targeting. What are you after (revenue)? Traffic? Data?

- What do they most care about?

- What is the customer journey? Map out the process.

- Is what customers want or care about changing? Tech change? For example, PC to mobile changed what maps could do.

- What is the competitor offering and how you are going to take their customers with our re-focused value? Are they weak or strong? What are they getting wrong?

- This is the most important part of the strategy. Putting customers first and being very specific about how you add more value than competitors. This includes:

- Step 2: Launch 2-3 key strategic initiatives that deliver the re-focused customer value.

- This is where we translate Step 1 into 2-3 big initiatives that will make a difference. They have to move the needle in terms of re-focused customer value. But they also need to be feasible in 6-12 months.

- Step 3: Transform the organization structure, culture and talent.

- Revitalizing the organization and getting everyone focused on the new strategy almost always requires increased communication and coordination. The entire organization must be re-focused and re-energized. And often there need to be a lot of training and cultural changes.

- Step 4: Fix the big pain points of customers, staff, suppliers, etc.

- This is also important. Identify and fix the things that most annoy people. Whether customers or staff or suppliers.

- This requires data-driven decision making and lots of iteration. It also requires a culture that is fast and aggressive (see Step 3)

- Step 5: Have early wins (small, phased victories).

- This is important to test the strategy and get feedback. You really need to see if it’s working. Plus, you need to constantly re-adjust.

- Early wins also re-enforce the new culture and organization changes. It builds momentum.

- Step 6: Focus on agile tactics and speed.

- Winning is a lot about tactical brilliance and guerrilla execution.

- And it’s about speed. So agile teams and quick decisions. You will always win in chess if you are making twice as many moves as your competitors.

- Step 7: If possible, build a powerful business model or operating flywheel.

- You win with customers and speed but you also want to build something that has real advantages structurally. You want to build a moat if possible. Or an operating flywheel. It also helps if you can access more revenue opportunities over time.

- Measure the Outcomes

- You want to know what the key outcomes are before you start. What are the 2-3 KPIs that the whole team is focused on. These outcomes can be:

- Operational

- Financial

- Strategic

- You want to know what the key outcomes are before you start. What are the 2-3 KPIs that the whole team is focused on. These outcomes can be:

Ok. With that let me go through Taobao vs. eBay. Much of this is from a case study done at Alibaba (The Taobao Triumph: Outmaneuvering eBay and Forging Tmall – A Case Study in Strategy and Execution).

How Taobao Took Down eBay in About 12 Months

This is a well-known story. Sort of.

Most people know that Alibaba jumped from B2B into C2C (and B2C) ecommerce in 2004. This was mostly a response to eBay’s dominant position in China B2C ecommerce. It was feared that they would go after B2B next. Plus, these were the early days of China ecommerce and it was still a pretty open market.

So Taobao launched in 2003 and within one year, it took down incumbent giant eBay. eBay subsequently exited China.

It’s a famous China story. But how did they actually do it?

First, keep in mind that in 2004, China’s ecommerce sector was just emerging. There were only about 94 million internet users in China at the time (according to CNNIC). And most were using internet cafes. Most Chinese did not have PCs. And internet access was very limited.

At the time, eBay had about 95% of the China consumer ecommerce market. Its US business was already quite large at this point, with annual revenue of $3.271 billion USD in 2004. And eBay had a market cap of $37B at the end of 2004. So, this was a giant US company that had successful expanded into nascent China and was dominating the ecommerce market. It had massive resources (people, technology, cash). And in China, it had exclusive marketing agreements with the leading China consumer portals (Sina, Sohu, and NetEase).

In contrast, Alibaba’s C2C service (Taobao) had just been launched in 2003. It had only about 300 people. And it was ranked about 400th in the China market. It wasn’t just behind eBay. It was behind everyone. I haven’t been able to find the revenue for these years, but it was likely in the low millions of USD.

So, this was a ridiculous match up.

But by July 2004, Taobao was ranked 10th in the world in terms of website traffic. And in the second half of 2004, eBay’s 95% market share had fallen to 73%. And Taobao’s had increased to 27%.

Within the next year, Taobao was basically the C2C ecommerce leader in China.

Here’s my explanation for how they did it. It should sound pretty similar to the approach I just outlined.

Step 1: Taobao re-clarified and re-focused on customer value

Taobao is a marketplace platform, which means the customers are both Buyers and Sellers. You have to really crystalize the value for each group.

- That usually starts with identifying exactly who the customers are. Which customer segmentation is your core?

- What do they care most about?

- What is their buying and usage process?

- What are their pain points?

- Is there an opening given the competitor offering?

On the buyer side, Taobao focused on “young people who are willing to try different things”. They changed their logo to a vibrant orange in 2003 to reflect youth and energy.

For value, they focused on security, affordability, and convenience.

That sounds simple but it’s not. You really have to boil it down to 2-3 things that customers really value the most. And you have to be right. It has to land with customers and shift them from your competitors. This takes a lot of research and testing.

In China in 2004, security was a big deal for buyers. There was very little trust. People didn’t trust that if they paid for something it would arrive. Or if it did, it might be low quality. Something that only worked a few times. Or it might be a fake.

So, Alibaba created an escrow payment to ensure security and to build trust. The money was only released when you confirmed the good was received and ok. This was actually a big hit with customers. And something eBay was not doing.

Affordability was, of course, a big deal. That’s business-speak for having lots of merchandise at low prices. It is the best way to move market share. See Shein, Temu and Pinduoduo.

Convenience is pretty standard. A good website to use. Good delivery.

On the seller side, they focused on Fun, Low Cost, and Empowerment.

Taobao famously eliminated listing fees and commissions. They made it free for sellers. Which was exactly the opposite of eBay’s fee-based structure. And that was a big hit. And marketplace platforms are a game of scale and network effects. It’s worth it to drop fees to win long-term. Reid Hoffman would call this blitzscaling.

Who their ideal seller was also mattered. Taobao initially sought more established sellers, with significant operations and well-known names. That is what eBay was focusing on. But Taobao focused more on more entrepreneurial sellers. Individuals. Small entrepreneurs. And those who were scrappy and eager to make a sale. They also converted buyers to sellers. They convinced them to sell their idle goods.

Overall, that’s a pretty sound strategy. And something we see frequently now in ecommerce. But back in 2004, that was some pretty impressive insight into how ecommerce worked.

But how did Taobao overcome the vast resources of eBay?

Step 6: Taobao focused on agile tactics and speed.

As mentioned, Taobao was locked out of the major internet portals so they had to be scrappy. We call this guerilla marketing. But it’s really just being scrappy and creative with your tactics.

Taobao focused their advertising on small and medium-sized websites. Plus, they did billboards and traditional media like television in first-tier cities with high internet penetration (Beijing, Shanghai, Guangzhou, Shenzhen, Hangzhou, later Chengdu). And again, they were creative.

- On TV they used shorter 15-second ads. But they doubled their frequency to increase recall and effectiveness.

- For bus advertising, they negotiated shorter contract times. This saved them money and let them capture the “surplus value” of outdoor ads. Basically, ads often remained visible beyond contract periods so they got that for free.

- Taobao also shifted their advertising spend online from pay-per exposure to pay-per-registration. And then to pay-per-purchase.

This is what I read in the report but I’m sure they had tons of clever tricks they were doing. For example, Taobao bought a billboard directly across from eBay’s China headquarters. Note: Didi did the same move to Uber in Mexico in 2017-8.

These tactics have a lot to do with culture. They almost never come from the top. Lots of clever moves like this usually come from a creative and scrappy culture.

This is also a lot about just being fast. And this is really the only big advantage small businesses have over larger players. They can make decisions and move faster.

Step 3: Transform the organization structure, culture and talent.

As mentioned, revitalizing the organization and getting everyone focused on the new strategy almost always requires increased communication and coordination. And often there need to be a lot of training and cultural changes.

This is where we get to Alibaba’s famous handstand culture.

During the 2003 SARS epidemic, Jack Ma introduced handstands to the team. He argued that by standing on your hands, you can see things differently. You can challenge conventional thinking. That was their culture. And new employees were all taught to do handstands. You can find lots of pictures of the young Alibaba team doing handstands (usually badly).

Jack Ma was never a coder. He was a teacher. And he really made his mark at Alibaba in its people and culture. This scrappy handstand culture played out across lots of dimensions. It definitely helped with their re-focused customer centricity. It helped the team identify and address pain points. And it made the guerilla marketing campaigns more creative. Cultural change plays out everywhere.

Some examples:

- Employees were required to submit 1-3 improvement suggestions in their weekly reports.

- They started an internal recommendation mechanism to find new talent. They offered cash incentives for successful referrals.

So cultural transformation is about strategic alignment. But it is also about being agile and adaptive as an organization.

And then in 2005, they launched Tmall, their B2C solution.

Step 2: Launch 2-3 key strategic initiatives that deliver the re-focused customer value.

Moving from C2C to B2C was a big strategic initiative. It was definitely in line with their re-focused customer value but it is much larger than the mentioned pain points, cultural changes and tactics. This type of big move is not organic and bottoms-up. It is a top-down decision.

C2C ecommerce is about small merchants. Entrepreneurs. People selling part-time. But that is only a small fraction of the ecommerce market. To win in consumer ecommerce, Alibaba had to go after the major brands and traditional manufacturers.

***

Ok. That’s most of what I wanted to go through.

Final Point: It All Has to Fit Together

Notice how everything depends on everything else. You need the right diagnosis and strategy. You need the right organization and culture. You need the right tactics and strategic initiatives. And they all depend on each other for this to work.

Here’s how I view that.

But you also need to think about the external environment. This Taobao strategy wouldn’t have worked if Amazon was the incumbent. They’re too smart. And too fast. Sometimes you need a competitor who is asleep at the wheel. Or you need a technology change. Or you need a still nascent but fast-growing market.

I put this on the left in the graphic as the main inputs.

Ok. That’s it. Cheers, Jeff

- How Alibaba.com Re-Ignited Growth with the Alibaba Management Playbook (Tech Strategy – Podcast 253)

————

Related articles:

- How Amap Beat Baidu Maps. My Summary of the Alibaba Playbook. (Tech Strategy – Podcast 252)

- Scale Advantages Are Key. But Competitive Advantages Are More Specific and Measurable. (Tech Strategy)

- The Characteristics of Unattractive Industries with Cutthroat Competition (1 of 3) (Tech Strategy)

From the Concept Library, concepts for this article are:

- Alibaba’s Management Playbook

From the Company Library, companies for this article are:

- Alibaba: Taobao

———–

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.