This week’s podcast is about how Alibaba’s Amap quickly dethroned market leader Baidu Maps.

You can listen to this podcast here, which has the slides and graphics mentioned. Also available at iTunes and Google Podcasts.

Here is the link to the TechMoat Consulting.

Here is the link to our Tech Tours.

Here is the Amap case study.

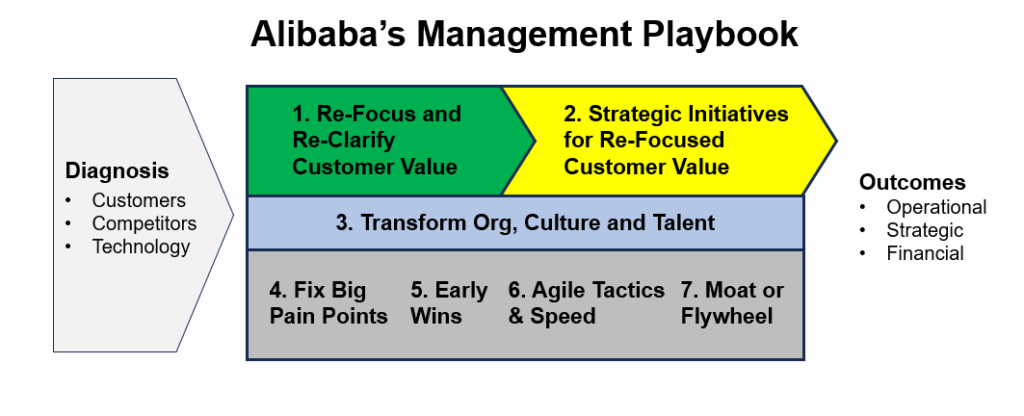

My summary of the Alibaba Management Playbook:

- Diagnose the problem

- This is always first. And of course it is the key. If you don’t get this right, nothing else matters. And proper diagnosis takes a lot of data and expertise. Usually an entire team. You really can’t get this wrong.

- This is also where you incorporate industry assessments, competitors, customer behavior and technology and/or regulatory changes.

- I like to focus on two specific questions:

- What is the chief complaint? Stagnant growth? Low NPS?

- What is the differential diagnosis?

- Step 1: Re-clarify and re-focus on customer value.

- This is the most important part of the strategy. Putting customers first and being very specific about how you add more value than competitors. This includes:

- Customer segmentation. Identify exactly who you are targeting. What are you after (revenue)? Traffic? Data?

- What do they most care about?

- What is the customer journey? Map out the process.

- Is what customers want or care about changing? Tech change? For example, PC to mobile changed what maps could do.

- What is the competitor offering and how you are going to take their customers with our re-focused value? Are they weak or strong? What are they getting wrong?

- This is the most important part of the strategy. Putting customers first and being very specific about how you add more value than competitors. This includes:

- Step 2: Launch 2-3 key strategic initiatives that deliver the re-focused customer value.

- This is where we translate Step 1 into 2-3 big initiatives that will make a difference. They have to move the needle in terms of re-focused customer value. But they also need to be feasible in 6-12 months.

- Step 3: Transform the organization structure, culture and talent.

- Revitalizing the organization and getting everyone focused on the new strategy almost always requires increased communication and coordination. The entire organization must be re-focused and re-energized. And often there need to be a lot of training and cultural changes.

- Step 4: Fix the big pain points of customers, staff, suppliers, etc.

- This is also important. Identify and fix the things that most annoy people. Whether customers or staff or suppliers.

- This requires data-driven decision making and lots of iteration. It also requires a culture that is fast and aggressive (see Step 3)

- Step 5: Have early wins (small, phased victories).

- This is important to test the strategy and get feedback. You really need to see if it’s working. Plus, you need to constantly re-adjust.

- Early wins also re-enforce the new culture and organization changes. It builds momentum.

- Step 6: Focus on agile tactics and speed.

- Winning is a lot about tactical brilliance and guerrilla execution.

- And it’s about speed. So agile teams and quick decisions. You will always win in chess if you are making twice as many moves as your competitors.

- Step 7: If possible, build a powerful business model or operating flywheel.

- You win with customers and speed but you also want to build something that has real advantages structurally. You want to build a moat if possible. Or an operating flywheel. It also helps if you can access more revenue opportunities over time.

- Measure the Outcomes

- You want to know what the key outcomes are before you start. What are the 2-3 KPIs that the whole team is focused on. These outcomes can be:

- Operational

- Financial

- Strategic

- You want to know what the key outcomes are before you start. What are the 2-3 KPIs that the whole team is focused on. These outcomes can be:

———

Related articles:

- Scale Advantages Are Key. But Competitive Advantages Are More Specific and Measurable. (Tech Strategy)

- The Characteristics of Unattractive Industries with Cutthroat Competition (1 of 3) (Tech Strategy)

- 5 Misconceptions About Barriers to Entry (Tech Strategy)

From the Concept Library, concepts for this article are:

- Alibaba Management Playbook

From the Company Library, companies for this article are:

- Amap

- Baidu Maps

———–transcription below

00:06

Welcome, welcome everybody. My name is Jeff Towson and this is the Tech Strategy Podcast from Techmoat Consulting. And the topic for today, how Alibaba’s Amap.

00:19

beat Baidu Maps. And for those who aren’t familiar, Amap is kind of the big mapping program of China like Google Maps there. Super popular, but it didn’t used to be. Baidu Maps was the leader for a long, long time and then it switched. So, it’s a really interesting sort of strategy case study. And I’ll go through that. I think it’s also pretty indicative of what I would call the Alibaba Playbook. There is a way they launch things and do things and win.

00:49

kind of six points. So, I’ll kind of summarize my interpretation of that. But yeah, this will just be a case study today. Pretty cool one, I think. So anyways, that’ll be it. Standard disclaimer, nothing in this podcast or my writing or website is investment advice. The numbers and information for me and any guess may be incorrect. The views and opinions expressed may no longer be relevant or accurate. Overall, investing is risky. This is not investment, legal or tax advice. Do your own research. And with that, let’s get into the con.

01:19

content.

01:20

Okay, we don’t really have a concept for today. I we could put this under just sort of the heading of the Alibaba playbook. You know, how they do their management, how they launch products, how they turn them around when they’re not doing well sometimes. I mean, there is a pattern for how they do this. And I’ve been reading a lot of Alibaba case studies. I’m teaching a little bit at Alibaba University next week. So, I’ve been going through lots of case studies. They go way back, 25 years.

01:50

studies, some of them are internal. This one is public. I’ll put the link for where it’s been posted. It’s a pretty good one. So, I’ll go through sort of how I think they did that and what I think to take. I think this is a good management playbook. Why is this one good? Often when we see these digital giants like Alibaba or Amazon or whatever, they kind of win by cheating. They got more resources. They got more money.

02:19

They have a huge customer base. have established distribution. you know, they just sort of launch something next to a standalone competitor and that’s how they win. that’s obviously it works so fine, but it’s not really winning by strategy. It’s just kind of using brute force.

02:36

Well, this isn’t one of those cases. Back in 2014, 15, 16, which is when this case really moves, Baidu was very, very large relative to Alibaba. It’s much smaller today, but these are two giants ahead of each other. And both of them had big established businesses, and this was one part of that. You couldn’t brute force it.

02:58

and you couldn’t outspend and offer subsidies or whatever. No, you had to outthink the other party and I think that’s what Alibaba did. So, it’s a good case of sort of like anyone can use this playbook. You don’t have to be a digital giant with all these ways to brute force your way through. I think anyone can use this one. So, I like this case, but I’ve been going through a bunch of cases and you do see the same pattern showing up over and over for how they like to operate.

03:26

So, I’ll give you a little bit of the background of the case, actually more than a little, and then I’ll put the link in the notes. You can read it yourself. It’s all public. So, this is about a guy named Yu Yongfu who people don’t really know.

03:43

outside of China, even inside China. He’s not as well-known as the Jack Ma, the Joe Tis, you know, those people, but very successful executive within Alibaba. He kind of was an interesting guy in that, you know, he became a partner. That’s how you rise up the ranks at Alibaba. You become a partner, which is very select. You know, he became a partner in 2015, really just one year.

04:08

after sort of coming in and he was on the UC browser then and that’s really unusual. I typically you got to be there five years. I think he’s the only exception who’s ever risen that quickly. So, you know he’s kind of this person who came in made a mark. UC browser is the Alibaba browser which is also an important business. But yeah so

04:36

Why did he get so successful? Well, because he did something that’s not common. He took a small business, their mapping business, AMAP,

04:46

which was a market laggard, I they were, give you the numbers in a sec, much smaller than the leader and very quickly he turned it out around and made them into the market leader. That’s really cool and he didn’t brute force it. It’s not like you can, you a lot of the stuff that rises quickly out of Alibaba is based on Taobao.

05:07

You have that base. You can build stuff pretty easily on top of a towel bottle. This is different. This was kind of a side thing and yet, you know, sort of took off. he’s interesting to know. Here’s some numbers. When he took over AMAP, sorry, for those of you who don’t know, it’s Google Maps of China. If you have a smartphone in China, you have AMAP.

05:34

And you know there’s others, Baidu Maps and there’s some other maps. Well really what happens is, one, I mostly use AMAP. And two, even when you’re using something like DD to get across town, it’s very common to like book your ride in DD but then kind of flip back over to AMAP. Very sophisticated mapping. Traffic patterns, mean, kind of better than the West I think. Although I haven’t checked recently, like,

06:02

It will tell you like the streetlights and how many seconds until the red goes to green. It’ll sort of count down on your screen. They’ve integrated e-commerce into there. A very really robust rich mapping service. Really pretty cool actually. Metros, public train, buses, things like that. It’s all in there. Pretty cool. Okay, so when he takes over AMAP, daily active users under 10 million.

06:32

Today, you know 100 to 200 million depending on peak and trough Usually over 100 million some days. It’ll break to something like that. So yeah, pretty impressive that he did this and

06:50

At the time when he took over AMAP 2014, Baidu Maps was the leader and they had about 65 % market share. AMAP had about 20%, so less than a third. That’s according to CNIT research report, pretty standard. And keep in mind when you’re dealing with maps, this is a winner take all business, right? There’s pretty powerful network effects that can happen.

07:20

You can argue whether this is a platform learn platform business model and all I consider it what I call a learning platform Which is actually kind of an idea. I’m struggling with When you talk about a marketplace everybody knows what that means when you talk about an attention builder Twitter YouTube everyone knows what that means

07:39

But there’s a fifth category of platforms I kind of call learning platforms where you try and characterize the main interaction you’re enabling. And the interaction here is people use the platforms and the map in this case. You could say Google search is similar. And the interactions themselves make the service better and smarter directly.

08:04

So, the more users, the more activity, the better the service. Now you could kind of call that a network effect, but I consider like the whole purpose of the platform.

08:14

is to make accurate intelligence available to you. So learning is not just a nice thing to have like on a marketplace. No, it is the service. It’s an intelligence service like a search engine. So, I kind of put them in that bucket, but it’s a little fuzzy. I haven’t quite got that figured out. Anyway, you know, Baidu Maps kind of thought they had it done. You have 65 % market share in a platform business model with network of facts. You know, it’s supposed to be game over.

08:44

and in most of the world that’s the case but this is China and every now and then we see a market leader like Taobao get disrupted or shocked by a new entrance breaking in when in terms of theory we don’t think that’s supposed to happen like pinduoduo sort of shocking JD and Alibaba a couple years ago. We didn’t think that was going to happen. We didn’t think TikTok was going to come in and sort of shock Tudou and you know

09:13

iQiyi. you know, China is kind of hyper competitive. So, we see that there more than other places typically. Anyway, so they break in and you have to kind of look at the development pathway of mapping, which I’ve written about before. It’s really interesting. know, mapping used to be something on a PC, right? And really what people used mapping for in digital was route planning.

09:42

I remember doing this, you you’re going to go across town, so you go onto your PC and you sort of print out a map. Okay, I’m going to go down this highway, then I’m going to turn left on 680, then I’m going to turn right. And you kind of print out the map and then you go. And that’s what Baidu has come out of. They were a PC based company. Okay, but then things shift to mobile within China 2010, 2012. So, we’ve had a tech paradigm shift.

10:10

which is a big deal and that’s 50 % of what gave AMAP the opening. Well, suddenly we weren’t route planning on a PC.

10:20

We were carrying our phone with you and using real-time navigation as we drove or whatever. Okay, so we had a shift there. That was kind of an important factor. But the other thing that Baidu was doing was the main entry point on the PC when Baidu was really powerful was search, right? That’s how you used to do things on a PC. You used the browser and you use search. Well, mobile changed that. But it used to be Baidu search directly went into Baidu Maps.

10:50

And on a smartphone, when those emerged in China in 2011, kind of the same thing happened. People used to start with Baidu Search, which was an app at that point, and then you would go into Baidu Maps. Well, AMAP kind of shook that up. So, it’s an interesting situation. All right.

11:10

So, users are transitioning from PC to mobile. You’re not just changing the entry point. You’re really changing service as well, which means you’re changing what consumers, users care about, not just consumers. That was the opening. And I think this is something Alibaba is very, very good at doing.

11:32

You know, they were very good at recognizing that we were no longer talking about route planning. We were talking about navigation as the core service. And that means different consumer behavior, different user behavior, different user demands. What they care about was shifting. And, you know, they kind of repositioned AMAP against this new sets of needs and people shifted.

11:58

So, the tech paradigm shift resulted in different consumer behavior and needs. They restructured their value quicker and more aggressively than Baidu and that’s kind how they do it. The other thing that that Yongfu kind of had said at the time, according to the case study, was this really wasn’t a mature market.

12:20

the industry leaders and structure really wasn’t settled. The user number was actually still quite small. So, this wasn’t like an established mature market where you had network effects and it was game over. No, it was an early stage, middle stage market, lots of growth, lots of innovation. There was not really a clear winner yet.

12:41

And what he did was something Baidu was not doing was let’s not go for profits. Let’s go for users and engagement. At the same time, Baidu was trying to monetize. And AMAP really said, we’re not going to think about monetizing for a couple of years. This game is not over. Let’s go after users and engagement. And in retrospect, that’s obvious. I mean, if you’re talking tens of millions of users, you know, that’s nothing. You got a billion people in China on their smartphones every

13:11

day. E-commerce numbers typically in the 600 to 700 million monthly active users. So no, this game is clearly not over. So according to the case study, and I’ll give you my take on it, but this is what the case study said.

13:26

that know, Yongfu basically made three big choices. He said, number one, this industry mapping is not settled. Let’s not monetize today. And even though Baidu Maps is temporarily ahead, the overall market penetration is still low. Cool, turned out that was true. Number two, we need to refocus on the core map service. Don’t get into O2O services.

13:53

Don’t get into let’s do food delivery. No, let’s stay on the core business, is in mapping, which is not yet clear. And we’re seeing a tech paradigm shift and a user behavior shift. Let’s focus on that. And the third thing he did, which I haven’t mentioned, he targeted professional drivers. So, these are people that drive taxis. They’re drivers for DD. They can be truckers, things like that. You know, that’s the, know, when you, when you do customer segmentation.

14:22

you know the phrase you’ll hear sometimes is what is the sort of white-hot center? Yeah you got a lot of users but what’s your sort of burning core? What’s the white-hot center of engagement? Where does your value proposition land with the most power? So professional drivers they’re the most frequent users in terms of daily navigation. How do I get across town?

14:48

And it turns out there’s a kicker here, which is if the core service is navigation, it turns out the number one driver of high accuracy navigation, because navigation matters. If you send people down the wrong street, they don’t like it. So highly accurate navigation is a feedback loop.

15:11

the more users and the more engagement, the more data that gets created that gives you more accurate maps on an hour-by-hour basis. Oh, that street’s busy right now, take this street. So, it turns out you want to go after the users that care the most, because your value proposition’s the most. Those particular users also generate the most data. Now you could call that a network effect.

15:36

you could call it a flywheel. actually, do think, I don’t actually believe in data network effects really. I think it’s kind of a half-baked idea. And when everyone talks about data network effects, the more data you get, the more users you have, that gets you a better service, that gets you more users, that gets you more data. You’ll hear this all the time. I don’t really believe in it. But the one case everyone points to when they talk about this, literally look this up. Anytime you look up data network effects,

16:04

the article or whatever will point to Waymo. It will point to a mapping company because real time usage is necessary for an accurate map right now. The map you had yesterday, not that useful, partially useful, the road’s still there, but traffic and other things changes quickly. So, it’s maybe the one case where I think you can argue there’s a real data network effect. I really don’t know of any others.

16:34

Maybe search, but that’s pretty much it. Usually, it’s just an additional feature or I put it into the digital operating basics that you have to continually be doing feedback and customer improvements based on data. Anyways, okay. So that was their playbook. Mapping navigation. How do you find an unknown destination and get a map to get there, you know, in a really accurate way?

17:03

Fine, and you don’t want error rates. So, you don’t want to be 90 % accurate in your navigation. You want to be 99%. And if you have 98, 96, the one group that’s really not going to like that is the professional drivers. So, you got to track this group, you got to retain this group, and then you use that data and you have to very aggressively use the data and usage. Here’s a, I should have said this earlier. When I think about data network effects

17:33

data in general. I actually believe in data advantage and data scale. You can put a bright line between data that is maybe bought or purchased or gathered by things like cameras and data that is created by users. User created data tends to be where the power is. Proprietary data too, which companies have internally.

18:00

But those are kind of the two clear sources of power. Okay, in this case, yeah, you got to attract and retain your professional drivers, because that’s getting you user generated data. Okay. But they went further. It wasn’t just that. They leaned very aggressively into…

18:22

How do we not just give good navigation high accuracy? How do we add more and more value to the core navigation service? And they had all sorts of innovation they did in this bucket and that’s very much an Alibaba strategy. You my core strategy I talk a lot about is you have to continue, you want really two things in life as a business, a digital business.

18:47

you want to have a powerful value proposition to your customers that you are continually improving and that’s the marathon and then in addition you want a structural advantage that’s the moat. I really copied that from Alibaba. Motes and marathons kind of a lot of that comes from Alibaba. Okay so you don’t just do the accurate navigation

19:11

You have to look for pain points for the professional drivers. How can we remove the things that make them frustrated? Data freshness, richness, get more retention, things like that. AMAP did a lot of interesting things like they were the first to focus on voice navigation. When the little voice comes on, turn left here, turn left in 50 meters. They focused on that first. They were way ahead of Baidu Maps.

19:41

They actually used a Taiwanese singer as the voice, a woman.

19:47

Well, actually, I don’t know if it’s a woman. Lin Qilin, I think, yeah, I think it’s a woman who had a very sort of interesting voice. That’s actually something you see in China you don’t see, or at least I haven’t encountered elsewhere. When you do navigation in a car, you get these funny voices announcing the turns like cartoon voices, kitty voices. It’s kind of cool, actually. So, they did that. They also started introducing more services for the drivers, like a services map.

20:18

To tell the driver here’s an affordable restaurant nearby. Here’s a toilet nearby. So, it wasn’t just that they focused on navigation That’s the foundation, but they aggressively leaned into constant innovation and improvements to the user experience All right. That’s a bit of a summary of you know what I think they say in the case I’ll give you my take on a little later, but Okay October 2016

20:45

AMAP’s really outperforming Baidu. I mean, it happened very quickly. And the data comes out and basically say, look, AMAP’s daily active users are now surpassing Baidu Map and making them arguably the leader. OK. So, when you think about this, OK, that’s the playbook. you always got to think about what your competitor’s doing.

21:12

So why did Baidu Maps sort of fall? According to the case, they believe the battle was over for mapping. And they were focused on monetizing and also expanding into other services. AMAP did the opposite. They sort of refocused down on the core service and reimagined what consumers really care about and then rebuilt against that.

21:41

That’s pretty cool. You could say Baidu underestimated the changes bought by mobile. I’m not sure that’s true. That’s what the case says. I do think Baidu had a much more difficult transition from PC to mobile. Search just wasn’t as powerful on a smartphone as it was on a PC. But e-commerce pretty much was. So that transition was harder for them. The other thing I think, and this is…

22:08

You know, to me what’s probably maybe most important, doing high quality navigation is not easy. You need a lot of data. It’s expensive. You have to write big checks. You have to really believe in your strategy because you you’re going to spend a lot of money getting all types of new data collected. Yeah, a lot of it’s going to come from users.

22:34

traffic lights, road conditions, temporary traffic situations. Are the road changes happening frequently? Is there damage on a road? You’re going to need data from all sorts of places, drivers, mobile, PC, published source, city published data. And that all needs to be unified, which is not easy.

22:57

And it all needs to be continually updated all the time. If you’re going to get this data feedback loop network effect, it’s got to be a seamless ingestion of data, mostly from users, but other sources that is immediately and accurately shown on maps to everybody. It’s not a small task. So yeah, I think.

23:20

They made fairly big investments in the strategy they believed in that got them ahead. It wasn’t easy to catch them once they pulled ahead in this. And then the other thing, which is kind of the last thing, is, you know.

23:36

you got to sort of do the internal cultural aspects as well. It’s not enough to sort of redefine the strategy and to redefine what customers care about and pivot towards that and make major technological and money investments into achieving that. Ultimately, this is all about people. So that means getting everybody together.

24:01

telling all of your staff, here is the customer value we must create. You have to boil it down into something very, very simple and then get the entire team focused on one KPI or two KPIs. So, the core value proposition from Yu Yong Fu was we help customers reach their destinations faster, more accurately and safely. One sentence.

24:32

That’s the core value and the whole team has to align on that value. So that means, you know, everybody when they do their performance reviews, that’s what you get it assessed on. And this idea of we are going to continually increase the customer value month after month after. Well, you have to define the value.

24:53

So, we have to add new services all the time. We have to do voice navigation. We have to add little stuff. have to add all, well, you’re always going to assess those based on the core value that you’re doing. You really have to crystallize it into one sentence if you can. And then you also have to have a team and a team manager. And the team manager has to operate at both levels. Huawei’s very good at this actually.

25:18

they do performance assessments of teams and the team manager and they expect the team manager to have hands-on activity. You can’t just be a manager giving orders. You have to be building yourself and they rate the team based on the manager and the team itself. So, you’ve got to sort of get that and you know he was hands-on on everything.

25:45

So yeah, there’s that cultural and team building aspect which Alibaba is very, very good at. Okay, that’s the summary. I think it’s a really interesting case. I encourage you to read it. I’ll give you the link in the show notes. Let me sort of put that aside because I’m summarizing what other people have written here. Let me sort of give you my take on what I think matters and what I think the playbook is because when I look at Alibaba, which I’ve studied forever, I kind of see six points over and over.

26:14

that I would kind of consider their internal playbook. And I think it’s how they train their people and what they do. So, this is my assessment as an outsider. All right, so my assessment is really one question and then six moves. So, the question, you have to really define the problem.

26:38

Right, before you get into all of this, let’s redefine the customer value and start training people. You really have to have a crystal-clear diagnosis of the problem. And you start with, okay, what is really our problem that we have to take apart, which is, growth. That’s the problem here.

26:58

AMAP needs growth. You need growth against an incumbent and against a sort of expanding industry. Okay, it’s not a mature industry where we need growth by taking it all from a fairly powerful incumbent. No, it’s a growing innovative sector, which is good for us, but we still need to beat a fairly powerful incumbent who has tons of users.

27:27

who has some pretty good competitive advantages and who has all of our big strengths. We can’t outspend them. We can’t throw resources. We can’t push to our existing customer base. They can match all of that. So how do you address stagnant growth or flat growth or not fast enough growth?

27:49

in that situation and that is actually a very common problem. In fact, pretty much every digital company has that problem. You the first thing when I talk to CEOs or whatever, growth is almost always the solution, right? I’m not growing fast enough. I’m not getting it and it doesn’t have to be growth just in terms of revenue. It can be engagement. It can be customer acquisition.

28:16

it can be low net promoter scores. We have to grow, improve some part of the business significantly. We need more customers.

28:28

Or we need our customers we do have to spend more revenue. Or we need the customers you already have to engage more and provide us with more data and get to get our churn down. Or we need greater satisfaction from our customers such that they recommend us more. But all of that would be under the growth category.

28:50

And now in this case, it’s about growing a platform business model, but it’s pretty much the same if it’s not a platform. And this case is mostly an oligopoly, two to three major players. In most cases, that’s not the case either.

29:05

Okay, for Alibaba, it’s a platform, it’s an oligopoly, fine. For most businesses that are digital first, it’s going to be the same growth question, but the industry is going to be more fragmented. Hey, I’m a merchant on Amazon or Lazada. It’s not going to be an oligopoly and it’s not going to be building a platform business model. It’s going to be more like doing a linear business model. But the problem is fundamentally the same. Okay, so we start there.

29:35

And that’s your question and you just sort of diagnose what’s going on. In this case, the diagnosis was the industry is changing and because it’s changing in terms of technology, we think the existing value proposition to customers is misaligned. We think that’s an opening.

30:01

So, we’re going to go after that opening, hopefully before Baidu wakes up. There’s a window of opportunity here.

30:09

EV companies are doing the same thing right now, right? Technology, there’s usually three things that can open a window like this. Well, there’s more than three, but one is changing technology, which creates different consumer customer behavior. Another would be changing regulations. Stuff that was not allowed is now allowed. That can happen. It can just be changing customer behavior in general. Each generation tends to change in areas like media. It changes pretty frequently.

30:38

Sometimes you just have a customer who screwed up. Or sorry, competitor who screwed up. Sometimes like, you know, Elon Musk launching SpaceX. Yeah, there was a technological window he took advantage of.

30:55

But it was mostly because the existing incumbents were not very good. They were slow, they were going after big, juicy government contracts where the goal was to maximize spending. And he just came in and said, you know, let’s go after low-cost rocketry. And the existing competitors are kind of slow and not very scary.

31:17

Now you’re going after Toyota with EVs. Okay, that’s not going to be the case. You need a technological shift to open that window because they’re very, very good at what they do. Okay, so that’s kind of the problem. What’s the answer? Then we get to the six bullet points. Number one, focus on customer value. There’s different phrases for this, but it’s all the thing. You’ll hear people talk about customer centricity.

31:47

You’ll hear about unwavering customer centricity where we need to really clarify customer value. And that could be buyers or sellers if you’re a platform. It could be content creators or viewers if you’re YouTube. Now in most cases it’s going to be your customer, you know, if you’re a linear business model. But that’s usually we need to refocus on the core. And if there has been a change

32:15

because of technology or other, we have a chance to redefine our customer value and really hit some rapid growth, which is what AMAP did. Another case that’s worth reading about is the old case of how Taobao beat eBay back in 2002, 2003 in China. And that was a stunning case. It’s kind of the same e-commerce was early into China.

32:41

So, it was still an expanding market, very few users online in China at that point. But eBay had like 90 % market share. And Taobao had like 10%. And 12 months later, it had reversed pretty much. It was a stunning turnaround for eBay. Well, they kind of started with the same question, which is, is there misaligned value here?

33:04

what they basically focused on back then, which Jack Moss spoke about very clearly was, yeah, Taobao buyers care about affordability, convenience, and security. Low price goods, make it super easy, be secure, because there was a lot of frauds and stuff back then. But he also focused on sellers, which was empowerment, low cost, and trust.

33:33

know, the biggest issue, one of the biggest issues back there was nobody knew how to pay and not get screwed. know, customers didn’t want to pay because they thought they’d send their money and never get their good, which was a real thing that happened back then a lot. know, Taobao launched their escrow feature back then.

33:51

where you paid, Taobao held the money, and after you got the good and signed off on it, the money was released. That was a huge deal, but it followed from a clarified value proposition. Now for AMAP, okay, they were pretty clear about what user value they were going after, helping users reach their destinations quicker, more accurately, and safely. Good.

34:18

However, and as soon as you raise this question of what our clarified user value is, customer value, well you have to clarify who your customers are first. It can’t be everybody, so you immediately get into customer segmentation. Who are we going after? Now in their case, they answered that question, professional drivers. That was the white-hot center. And the biggest pain point for them,

34:47

was accurate navigation. So, they did this very scientifically. They didn’t guess. They decided on their core customer base who cares the most and who’s going to provide the most data that’s going to run our flywheel. Okay, what does this group care the most about? Professionals’ drivers cared about accurate navigation. That’s where they got that from.

35:10

And so that kind of, so this whole customer segmentation thing is wrapped up within that. Who are you targeting? What do they care about the most? What is a pain point, which is sort of short-term value add? What is a longer-term path to increasing value? Well, navigation quality. You can also map out the process by which customers would use this. How do they find it? How do they get used to it?

35:40

And then is that changing based on technology, which is the case that was happening there? And then what are the competitors offering? So, I’d kind of want to know all four of those things. What customers are we going after? What’s our segment? What do they want most? What do they care about most? We need to map out where the power is. Is that changing right now?

36:07

Now in this case it was what they cared about most was changing and then four, what is the competitor offering against that same group right now? Are we going to hit them in a blind spot? I’d kind of want all four of those things to get sort of point number one. Okay, then we move on to point two, which is what is some decent pain points we can address in the short term?

36:37

Are there productivity improvements? Now, increasing customer value over time, that’s a marathon. That’s a race that never ends. So, we want to pick one with a long runway where we can always stay ahead of them in terms, okay, you copied what we did last year, but we’ve already done new stuff this year. So, we’re always ahead of you in terms of providing customer value. Okay, that’s question number one. This is question point number two, which is, okay.

37:06

Are there any big pain points that we can just, these are one-offs. Let’s hit those as well. So that, oh, that was nice, fine. And it turns out there was some pain points they could hit, there was some customer, but to me, question number one, point number one is the marathon. Point number two is quick wins, one-offs. Point number three, do cultural change with lots and lots of coordination.

37:35

We need to get the whole team together and sort of get everyone on the page of this is our mission in life. We are going to increase the customer value by improving navigation, accuracy, convenience, and safety or whatever it was. It can’t just be something we say once. It has to be printed on the walls. It has to be KPIs shown on a big screen that everyone sees all day long.

38:02

And that means lots of internal coordination. Because if you’re going to create new services and features that move the needle, we’ve all got to talk to each other all the time. That’s agile teams. That’s lots of internal communication and coordination. That’s lots of rapid-fire innovation, month after month after month. Every week.

38:27

Team meetings, what new features and products are we launching that are going to move the core customer value proposition? Okay, let’s deploy our teams, come back in a week. A customer improvement feature in a company like Alibaba should take five to seven days to think up, describe, implement, and get in front of customers, right?

38:51

So that’s internal cultural change, all of that stuff, which Alibaba is super good at this. All right, number four. This is kind of tied to that, agile tactics. Let’s say three is cultural change, communication, coordination. Number four is let’s deploy lots and lots of teams that can respond quick. If Baidu Maps does something on Tuesday, we got to be able to respond on Wednesday.

39:22

Team building is part of that. Adaptive organizations is part of that. Fine. They got a lot of names for this. Gorilla. Execution. Tactical brilliance. Rapid fire innovation. There’s a lot of phrases that describe that particular bucket. That’s number four. Agile tactics. I call it agile tactics. Number five. Have some early wins. If you’re going to set this new course without…

39:51

with a newly defined customer value proposition, a new mission in life, a new marathon we’re going to run. You want to put some points up on the board in the first two to three months. People feel a sense of success. They see the KPIs move.

40:09

So that’s why we kind of focus on pain points as well, because those can move the NPS numbers pretty quick. But in the short term, yeah, you to get the team and the culture and everyone excited, you want to put some points on the board quickly. Six weeks, two months. And last point, number six. Underneath all of this, know, motes and marathons, I’ve just described a marathon pretty much.

40:36

with some digital operating basics underneath it. We also need a moat. If we’re going to commit to this path, we need to know that in the process, we are building a particularly powerful business model, right? We don’t want to play fair. We want to build competitive advantages over time so that one to two years from now, yeah, we’re showing the numbers are moving in one to two years.

41:00

We’ve got a good value proposition. We’re showing growth. That’s all good. Along the way underneath, we’re starting to build real structural advantages that are harder and harder to touch. So, you want the marathon. That’s points one through five. You also want the moat. That’s number six. Now,

41:20

Baidu Maps had that actually. This game would have been much harder to play, A-Map versus Baidu Maps, if it wasn’t a growing, changing industry. If it was a mature industry, it would have been much harder for this game to win because Baidu Maps had some big structural advantages. But if there’s a growing industry, there’s more room to play. I can grow without having to take business from them.

41:48

But eventually this is going to sort of flatline and be mature. And when that happens, we want to have a powerful moat in place. So that’s motes and marathons. Anyways, that’s how I kind of view this. And I think that playbook, you see this at Alibaba a lot and a lot of what they do. They’re particularly good in the agile teams and cultural change. They’re particularly good at using data to really define

42:17

where the white-hot center of the business is and what that group cares about the most. They have a real data advantage on that because they have so many users buying stuff on Taobao all the time. They’re really good at that. They really nail it beautifully in this case and they do that repeatedly. It’s not because they’re super smart, which they are, it’s because they have more data than just about anybody. They know what customers care about. So anyways, that is kind of my summary for that one.

42:47

I hope that’s helpful. Not really any concepts to point to today, just sort of the playbook. The Alibaba playbook, which is really kind of motes and marathons. The thing I’ve been talking about the last six months, this sort of extreme personalization playbook, this sort of extreme customer value add playbook. It’s really a lot of that distilled down to…

43:13

you know, businesses that aren’t digital giants distilled down to something anybody can do. If you want to talk about it, if you’ve got a company, you want to talk about digital growth, whether a digital company or a digital first or moving that way, give me a call. We’ll talk about it. But talk a lot about sort of those key points and focusing on really the sharp end of the spear, which is whatever we’re doing has to increase the value to our customers right now.

43:40

That’s how we move the NPS score. That’s how we get more revenue. That’s how we get more customers. That’s how we get more growth. And we always have to be leaning into that. The other stuff we might want to do, hey, there’s a new generative AI tool that makes our internal staff much more productive in content generation. Fine. Productivity tools, good. You’ll save some money, but you can’t win there. You have to win on the sharp end of the spear, which is your interaction with your customers.

44:11

every day. That’s what the playbook focuses on. Anyways that is it for today. I hope that’s helpful. As for me it’s been a pretty good week. I’m flying out to Hangzhou in another day or so. So, I’m going to go out and do a little teaching there to some entrepreneurs which I’m excited about. I’m also going to do some visits probably to the you know Hangzhou has

44:35

Obviously Alibaba, Cainiao Ant Financial, it has the big Alibaba ecosystem, but they’ve also got Unitree and now DeepSeek is there. There’s a handful of big AI companies there now that have sort of gotten people’s attention. They have Zhejiang University there, which is where a lot of the people, you know, it’s…

45:00

Shenzhen like Tencent, well comes out of Shenzhen University. mean Tencent headquarters is literally next door. It’s the same for Hangzhou. You’ve got Zhejiang University right there. So, you know a lot of the graduates there they come out and they do work in Alibaba and places like that and then they start their own company. So pretty common pattern. We don’t see it as much in Shanghai even though there’s a lot of universities there. We don’t see as many digital players. Beijing same story. Anyways so it’s going to be fun. I’ll visit some companies. I’ll talk

45:30

about that I think. I’m not going to do any interviews or anything like that but just sort of learn some more see what’s up. As for fun stuff I saw the Tom Cruise movie Final Reckoning. It was pretty good actually like I went in there because I heard it wasn’t that great so I went in there like yeah it’s not going to be that good. Turns out it was better than my expectations.

45:52

And if nothing else, it’s worth watching for the scene where he’s hanging on the wing of a plane as it’s doing barrel rolls and loops and he’s falling from, it’s a biplane, he’s falling from one side of the wing to the other, to the top of the plane, to the bottom. And you know it’s really him that they strapped him onto this biplane and did loops and crazy stuff. That’s insane. This guy’s insane. In like the best way. It’s really…

46:22

You know, I’d heard about it. I knew it was going to be the gimmick or whatever but even then watching the movie you’re like that’s awesome That alone was worth the movie. So anyways, that was pretty good. I was surprised to it was better than I thought I’m going to go see the Brad Pitt movie tomorrow the Formula One Movie my girlfriend was Scott. My girlfriend is the biggest Formula One fan

46:48

I have no idea where that came from in life. Like just one day she’s like, yeah, I love the Formula One. She like watches all the races. She knows all the drivers and follows all this and like is crazy. We went to Kuala Lumpur and at the Petronas Twin Towers when we walked in, they had like an exhibit for Formula One and on the wall was a Formula One car that had been mounted on the wall of the lobby of the Petronas Towers.

47:18

We walk in and she turns to it and she goes, oh my God, that’s so and so’s car. She knew exactly whose car it was. That was the car he drove from, you know, 2022 to 20, or whatever. And I’m like, how in the world do you know this? Like I have, it’s such a random thing to be a fan of. I don’t think I’ve ever met a massive Formula One, actually I’ve met maybe one, but I met a Brazilian guy who was deep into it. But I’m like, it’s just a weird thing for you

47:48

like. So anyways we’re going to go see the movie and we’re going to have to do the whole we’re going to have to do the whole experience. We’re going to get the big pot you know the big popcorn tug, I’m popcorn tub which has the lid on the tub is like a formula one helmet and you can get the big Pepsi and the lid of the Pepsi is like a formula one helmet and the straw goes into it. We’re going to we got to do the whole thing like I don’t know if we’re going to buy shirts and stuff but yeah it’s going to be a fan day.

48:18

So anyways, that’s tomorrow. We’ll see how good it is. Anyways, that is it for me. I hope everyone is doing well and I will talk to you next week. Bye bye.

———

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

Note: This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.