JD.com, the Chinese e-commerce and logistics powerhouse, is in a period of significant transformation. Beyond their well-known focus on quality plus price plus service, JD is laying the groundwork for a larger future.

Here are five key developments I’m watching for at JD:

1. Doubling Down on the Low-Cost Market

JD has made a major strategic move into the low-cost market, targeting more price-sensitive consumers in lower-tier cities. This is not a temporary tactic but a full-fledged strategic commitment. Largely in response to Pinduoduo (in my opinion), which is strong in the lower tier cities.

When Richard Liu re-took operational control of JD he made a couple of important moves. First, he went back to basics. And second, he recognized the enormous potential of the lower-cost market segment and the competitive necessity of addressing it.

Here’s how JD is likely to double down on this strategy:

- Continued expansion of their merchant base, particularly those offering affordable products. Going after the low-cost market means bringing on smaller merchants. Think SMEs and solopreneurs, who can offer items at lower prices. I expect to see further initiatives aimed at attracting small merchants, entrepreneurs, and specialized sellers.

- Refining their AI-powered search and recommendation algorithms. JD will leverage big data to ensure customers in different income tiers and geographic locations see the most relevant products and prices. This question gets more interesting when you add lower-price items from smaller merchants to their traditional mix of highly select, quality merchants.

- Experimenting with new delivery models tailored to low-cost items. JD pairs its higher quality (and price) items with superior service, especially in delivery. Providing delivery for the low-cost market is a bit of a challenge, which I think they are still experimenting with. Delivery for these markets will certainly involve partnerships with third-party delivery services (as opposed to doing it with their in-house delivery fleet). It also may mean developing more cost-effective logistics solutions for specific product categories.

- Investing in customer education to drive upgrades to higher quality goods. JD will aim to gradually introduce lower-tier consumers to their core product categories. As the lower-tier cities rise in wealth, you want to step them up to high priced, quality goods. Pinduoduo is going to be doing a lot of this.

2. International Expansion of Smart Logistics

JD has largely exited its limited B2C ecommerce operations in Thailand and Indonesia. It does not appear to be going after consumers internationally.

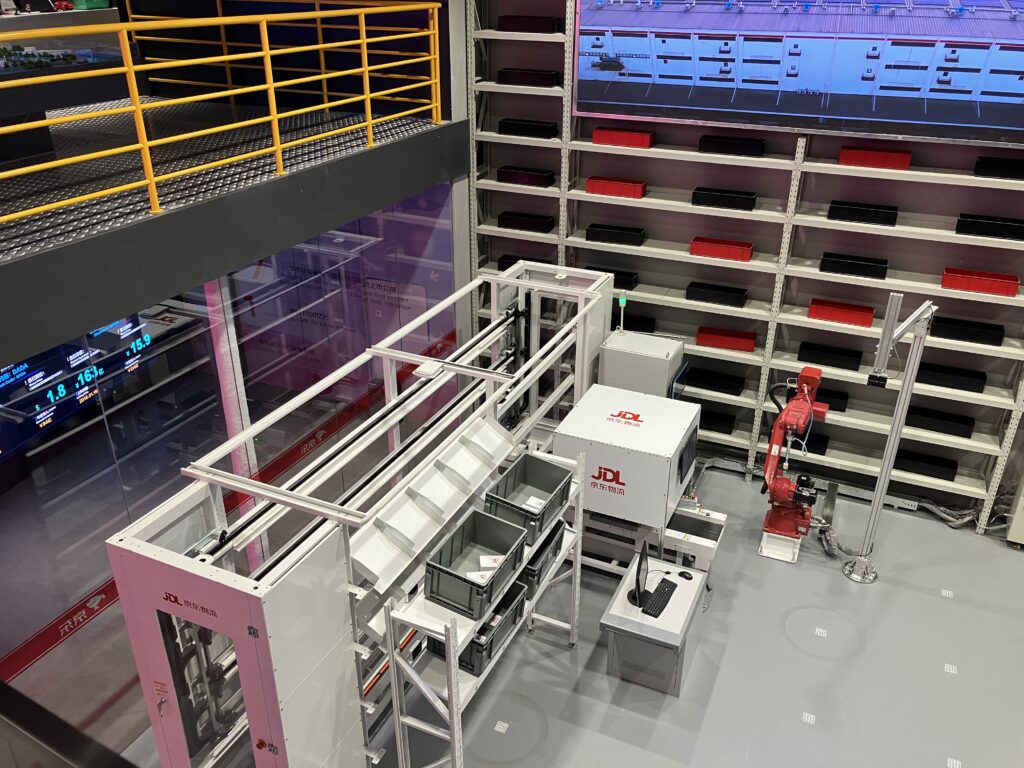

However, it is strategically positioning itself as a global leader in smart logistics. Offering these services to ecommerce and other businesses around the world. This is basically about leveraging its scale in smart logistics (smart warehouses, robots, software, etc.) beyond China. International logistics is a key pillar of their 20-year vision and the most predictable of their new growth initiatives.

Here’s what to expect for JD’s international logistics push:

- Continued expansion of their global warehouse network, particularly in Europe. JD is investing in state-of-the-art facilities equipped with advanced automation technology to offer efficient domestic and cross-border fulfillment.

- Creating strategic partnerships with international brands, retailers, and delivery partners. These partnerships will enable JD to offer localized services and tap into established distribution channels. Again, I’m mostly watching Europe. But they do have smart warehouses in the US and other locations.

- Targeting specific industry verticals with tailored logistics solutions. Domestically, JD is leveraging its expertise in areas like FMCG, cold chain, and large / bulky items to cater to more complex logistics needs. Internationally, it looks like their primary clients are smaller ecommerce sites. I’m curious if they are going to shift into more complicated logistics types internationally as well.

- Exploring potential acquisitions to accelerate their international footprint. This is just speculation. JD could strategically acquire existing logistics companies or assets to gain market share and expertise in key regions. The company has not historically done international M&A. But I’m watching for moves like this. It’s probably a good idea.

3. Building a Third Engine After E-Commerce and Logistics

JD’s 20-year vision includes the ambition of establishing three businesses with over 1 trillion RMB in revenue. Domestic e-commerce and international logistics are the two clear candidates. But the question remains: what will be their third core engine?

Several potential engines are emerging:

- Cloud Services: JD Cloud, while lagging behind Alibaba Cloud, has the potential to become a significant player in the growing cloud market, particularly by targeting specific industry verticals and leveraging their expertise in e-commerce and logistics.

- AI-Powered Industry Solutions: Through their ChatRhino platform, JD is developing and deploying AI solutions for various industries, including retail, logistics, finance, healthcare, and city management. This could evolve into a substantial revenue stream as businesses adopt these solutions. This would pair with the cloud services.

- New Retail and Omnichannel Services: JD has significant investments and operational experience in physical retail formats such as 7Fresh and e-space. Plus, they have partnerships with Walmart and other retailers. This is an interesting foothold in omnichannel integration. This is an interesting space and could encompass a range of services, from in-store technology to data analytics and customer experience solutions. JD has also historically been more comfortable operating in asset-heavy businesses (compared to Alibaba).

- Financial Services: Building on JD Finance, JD could expand its offerings in areas like consumer lending, payments, and wealth management, potentially leveraging their vast customer base and data insights. I’m less optimistic about this. There are major competitors here. And JD doesn’t have natural advantages in this space.

The key will be identifying which of these adjacencies has both the largest market potential and aligns with JD’s advantages and competencies.

4. Upgrading Merchant Tools and the Customer Experience Using GenAI and Personalization

JD is increasingly integrating new GenAI tools into its ecommerce operations, aiming to create an improved and more personalized customer experience. This extends beyond product recommendations to encompass logistics, customer service, and even new retail formats. In practice, this means offering new tools for merchants and brands, who them use these in their customer interactions.

Here are some key areas where GenAI tools could play an important role:

- Hyper-Personalized Shopping Journeys: JD will leverage AI to tailor product selections, pricing, and promotions to individual customer preferences, creating a highly personalized shopping experience.

- Predictive and Proactive Logistics: AI-powered forecasting models could optimize inventory management, delivery routes, and even anticipate customer needs, leading to faster and more efficient fulfillment.

- Intelligent Customer Service: JD is investing in digital avatars and AI-powered chatbots to handle routine customer inquiries, freeing up human representatives to address more complex issues. This will enhance efficiency and provide 24/7 support. It will also change how customers interact with merchants and brands.

- Seamless Omnichannel Integration: JD could utilize AI to connect their online and offline channels, providing a consistent customer experience across different touchpoints. This may involve personalized recommendations, loyalty programs, and even tailored in-store experiences.

Here is their digital avatar.

5. Re-Invigorating Their Scrappy and Innovative Culture

JD’s founder, Richard Liu, has returned to a more active role in the company, bringing renewed focus and drive. This means a return to the more aggressive JD of past years. For a long time, JD was a scrappy and combative company, that fought its way to the top in hyper-competitive China. They used to do price wars and product expansions very aggressively.

This has decreased in recent years and I am watching for a return to their more combative and innovative culture. Alibaba has been going through a similar process, with a major re-organization and the return of the founders. I call this a shift back to war time CEOs.

For JD, I’m looking for:

- Scrappy, combative behavior. I want to see JD go head-to-head with Pinduoduo. I’m looking for price wars.

- Empowered Teams and more experimentation: It would be interesting to see JD adopt a more decentralized approach, empowering individual teams to rapidly develop and test new ideas. The business could be more agile and responsive, better equipped to adapt to rapid changes in the market.

- Investing in talent development and more acquisition: JD should prioritize attracting and retaining top talent, particularly in areas like AI, and data science. I’d also like to see more aggressive international business development, with M&A.

***

That’s it.

JD is a really good company to watch. They are an ecommerce leader and are easier to understand than Tencent or Alibaba.

Cheers, Jeff

———

Related articles:

- GenAI Playbook (Step 3): How to Build Barriers to Entry with Intelligence Capabilities (9 of 10) (Tech Strategy)

- AutoGPT: The Rise of Digital Agents and Non-Human Platforms & Business Models (Tech Strategy – Podcast 163)

- Why ChatGPT and Generative AI Are a Mortal Threat to Disney, Netflix and Most Hollywood Studios (Tech Strategy – Podcast 150)

From the Concept Library, concepts for this article are:

- Generative AI

- Ecommerce

- Logistics

From the Company Library, companies for this article are:

- JD

———

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.