I was recently in Hangzhou and visited the Ant Group and Alipay headquarters. This is one of the most interesting digital giants in Asia. And I always jump at the opportunity to visit and catch up on current projects.

And my visit didn’t disappoint.

Lots of interesting stuff happening. Particularly in Alipay internationally and AI services. And they are building a new campus, which looks pretty cool. Here’s the diagram for that. Note: the upper left half is the existing campus (which is fantastic) and the upper right (with the circle) is being built.

Alipay (not Ant) was founded in 2004. So, 2024 is the twenty-year anniversary. And Jack Ma recently made an appearance on campus as part of this (plus for the announcement about a new CEO).

–

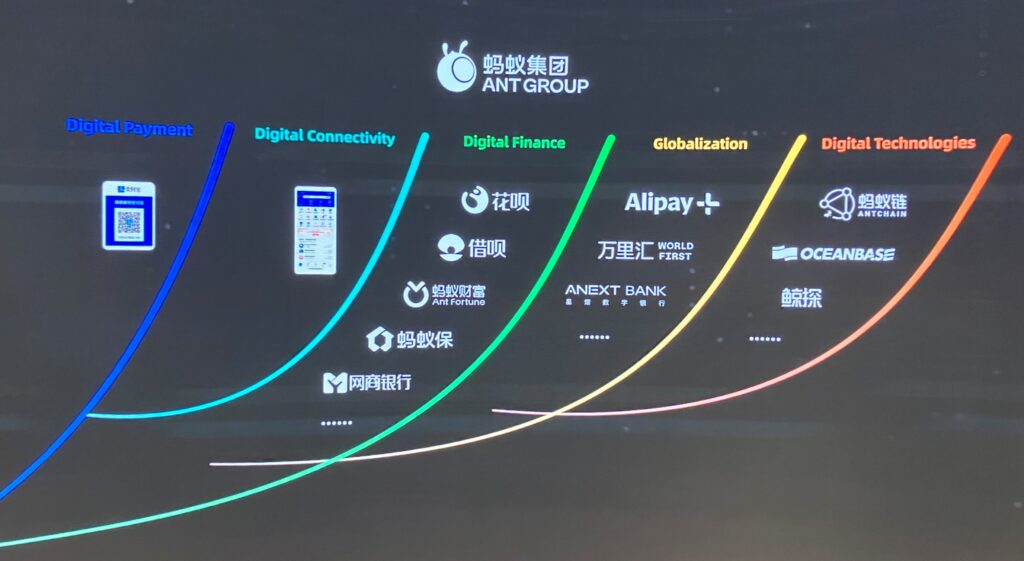

Ant often talks about their business in terms of riding various trends. It’s a good way to view their last twenty years. They have ridden trends in:

- Digital payment

- Digital connectivity

- Digital finance

- Globalization

- Digital technology

Here’s a graphic from their exhibition hall. Note the businesses they have built against each of the trends.

And AI is arguably the next big wave (along with other things). You can see AI everywhere in Ant’s strategy now.

That said. Let me just jump to my main take-aways from the visit. I’m not going to go through the basics of Ant Group again. I have covered that many times and you can find lots of articles of the business here.

Take-Away 1: Alipay and Alipay+ Are Continuing to Add Geographies and Features.

Alipay has been steadily expanding from digital payments in China to digital payments internationally. This includes C2C, B2C and B2B payments.

However, internationally Alipay is much more focused more on providing cross-border payment services for digital wallet providers. That’s Alipay+. It’s a service to digital wallet providers that enables them to do cross-border payments for their customers when they are traveling.

Internationally, Alipay is also focused on cross-border B2C payments for Chinese tourists.

And this is good strategy.

In both cases:

- They are able to expand geography by geography from a position of advantage.

- Payment networks are a fantastic foundation for lots of other services.

Once you have a payment network in place (connections between merchants and customers), this enables lots of avenues for future growth. Especially marketing services. In fact, you really want to offer customers a great deal on payments (such as a good exchange rate, low fees) to get them on board and build this foundation. With the idea that you will later make most of your money on additional services (such as marketing), which are usually targeted at merchants.

Alipay+ is their most well-known international service right now. As mentioned, it is a service that enables cross-border payments for domestic wallets. For example, Thai citizens can use their True Money wallets to make payments at retail stores in Japan and Korea. And they get a great exchange rate. Alipay+ increasingly offers cross-border marketing services on top of this. So, when Thai citizens arrive in Japan, they receive special promotions by Alipay+. This is really smart.

Today, it looks like Alipay+ is mostly focused on Asia and Europe. They say they now have +90M merchants (per latest press release). And their marketing services are increasing over time (travel related coupons, local marketing activities, signage, brand promotion, etc.).

Here’s a look at some of the digital wallet providers they work with.

As for Alipay (not Alipay+), it’s a super-app, similar to WeChat and such. And half of the Chinese population uses its public services. Plus, it has everyday services (tickets, utilities, etc.). And they mentioned how they have expanded into areas like employment services, where they currently have 10M job seekers. That’s a pretty interesting move. It has also expanded in smart tourism, where they mentioned they have 500M travelers.

Alipay’s “everyday services” are interesting because they are a great launching pad for AI services. Which I’ll discuss below.

One of the reasons I like Alipay is because their tremendous scale enables them to keep investing in new technologies. They are almost always at the frontier of the payment and finance tech globally. One example of this is their new Alipay Tap! Service, which I encountered in a local Hangzhou supermarket. You just tap your phone on the scanner to pay.

Another interesting technology is scanning your hand to pay.

Take-Away 2: Ant International Has Been Adding Brands

Ant International operates pretty independently as a business. And they have been expanding internationally by launching and acquiring other internationally focused brands.

As mentioned, Alipay+ is focused on travel scenarios and provides offline services. Think lots of people paying for things in stores as they travel around the world. As mentioned, the strategy is cross-border payment plus marketing and digitalization services. At the time of writing this, Alipay+ has +90M global merchants in 66 markets with +1.6B user accounts. And the cross-border payments happen via 35 mobile payment partners.

In contrast, Ant International’s brand Antom focuses on providing lots of payment options for large customers. Which are mostly mostly online merchants. Here’s the description from the Ant exhibition hall.

Another of their brands is WorldFirst, which offers cross-border digital payment and financial services for global businesses. But this is more focused on SMEs.

And then there is bettr, a digital lending business that provides financial services to MSMEs.

These are all really interesting.

And you can see Ant International is steadily building a suite of brands and services around the world. This is very similar to how Ant Group grew domestically in China. They built an impressive and reinforcing suite of services.

Take-Away 3: AI-First Services and Data Flows Are the Big New Thing

This is the big new thing for Ant Group this year (in my opinion).

Unsurprisingly, Ant has jumped into generative AI. With a focus on financial services.

- They have been building out their proprietary Bailing foundation models.

- They have deploying various apps on top of this.

- Clients can now use Ant’s solutions to build their own AI agents.

- And Ant has unveiled its first 3 AI assistants.

Maxiaocai is their AI financial assistant. This is the one that got my attention. Ant has tremendous capabilities in financial services, with tons of clients and their own tech stack. So, launching an AI assistant here makes a lot of sense. Plus, financial services has lots of specific requirements, such as risk management and compliance. A specialized AI play here makes sense.

Their AI financial agent is listed as being able to do financial news, investment research, financial literacy, and voice chat for financial services.

They have also launched an AI healthcare manager. Healthcare has similar regulatory and risk complexities as financial services. So, a specialized AI play here makes some sense. Plus, healthcare, like financial services, requires a high degree of trust. It wasn’t surprising this was their other industry focus outside of financial services.

I got to see their AI healthcare manager in action. See the video below. It can do healthcare consultations and can act as a local general practitioner. It can also help find and connect with local doctors.

Their third Ai agent is Zhixiaobao, which is a general AI Life Assistant. This is the AI version (in my opinion) of Alipay everyday services mentioned earlier. Think voice chat, getting tickets, receiving coupons and discounts, buying food, planning trips, etc. Their “everyday life services” with an AI assistant user interface. That makes sense. This has the broadest appeal so I’m watching adoption.

***

An important related topic here is data flows.

AI requires a huge amount of data. And using proprietary vs. shared vs. public data is a key question for most AI services. This is where I think Ant is really well positioned. Especially for their financial AI assistant and their AI life assistant.

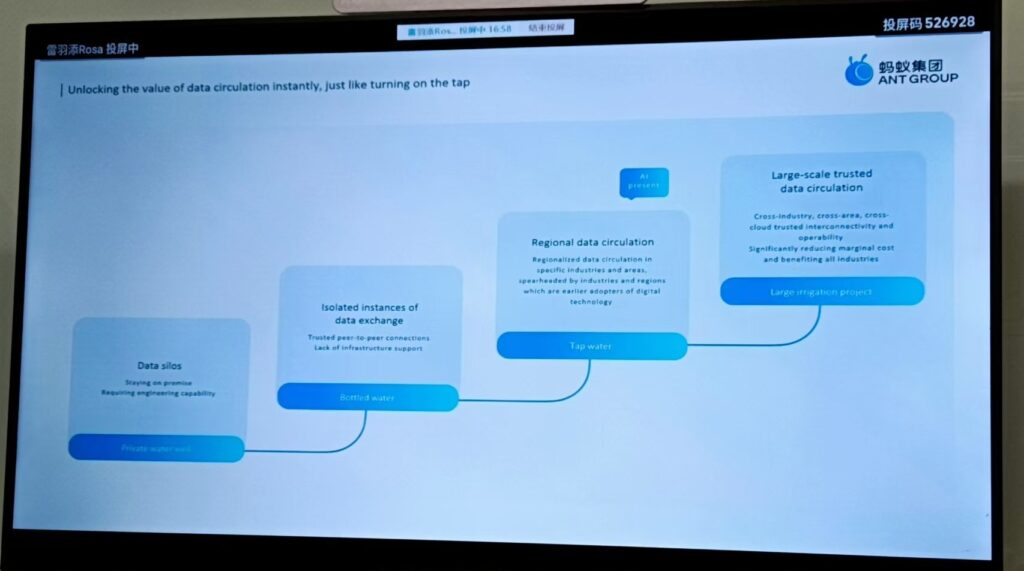

I thought they had a great way of describing how digital infrastructure relates to the flows of business data. And how this is evolving. They broke it down this way:

- Data Silos. This is how data has historically been kept. Mostly on premise at businesses. Which required lots of internal engineering capability. They made the analogy that this is like a private water well.

- Isolated data exchange. This is what came next, with limited sharing of data between trusted peers. But this process has been limited by a lack of trusted infrastructure. This is analogous to sharing bottled water. This is where we are today.

- Regional data circulation. This is what is coming next. In specific industries and areas, we are starting to see digital infrastructure enabling the trusted sharing of business data. This is analogous to tap water coming out of faucets.

- Large scale trusted data circulation. This is what Ant is trying to build for the future. This is cross-industry and cross-area data sharing. Which requires trusted interconnectivity and operations. This is analogous to a large irrigation project.

I thought that was a good way to think about it. And the built out of this infrastructure is something worth following.

Final Take-Away: Keep Your Eye on Ant’s Cloud and Blockchain Tech

Last point.

Ultimately, one of Ant’s biggest advantages is its ability to create the next wave of technology and digital infrastructure in finance. Very few companies can do this at scale.

So, I always look at where Ant is placing their biggest bets. Which geographies? Which technologies?

And the big bets appear to be in AI, blockchain and cloud, which are referred to as the ABCs of Ant Digital Technologies (not Ant International).

For AI, there is a lot of focus on ZOLOZ, which is a big product from Ant Digital Technologies in terms of verifying identity and creating secure transactions. GenAI is obviously causing big changes in this area of identity (i.e., it’s getting easier to make fake stuff). So, they are focused on things like detecting deep fakes.

For blockchain, there is a lot of focus on creating corporate digital assets. This is really cool. If you can tokenize the physical assets of a business (in a way people trust), then you can finance them as assets. That’s an interesting opportunity.

For cloud computing, they are still focused on mPaaS, which lets their clients build their own apps (in a secure, compliant, and trusted manner). This has expanded to Malaysia, Kazakhstan and more markets.

***

Anyways, that’s it. Those were my take-aways. Overall, a great visit and definitely a company I keep a close eye on.

Cheers, Jeff

————

Related articles:

- GenAI Playbook (Step 3): How to Build Barriers to Entry with Intelligence Capabilities (9 of 10) (Tech Strategy)

- Why ChatGPT and Generative AI Are a Mortal Threat to Disney, Netflix and Most Hollywood Studios (Tech Strategy – Podcast 150)

From the Concept Library, concepts for this article are:

- Financial Services

From the Company Library, companies for this article are:

- Ant Group / Ant International / Alipay / Alipay+

———-

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.