This week’s podcast is about network effects. And my 6 questions.

You can listen to this podcast here, which has the slides and graphics mentioned. Also available at iTunes and Google Podcasts.

Here is the link to the TechMoat Consulting.

Here is the link to the Tech Tour.

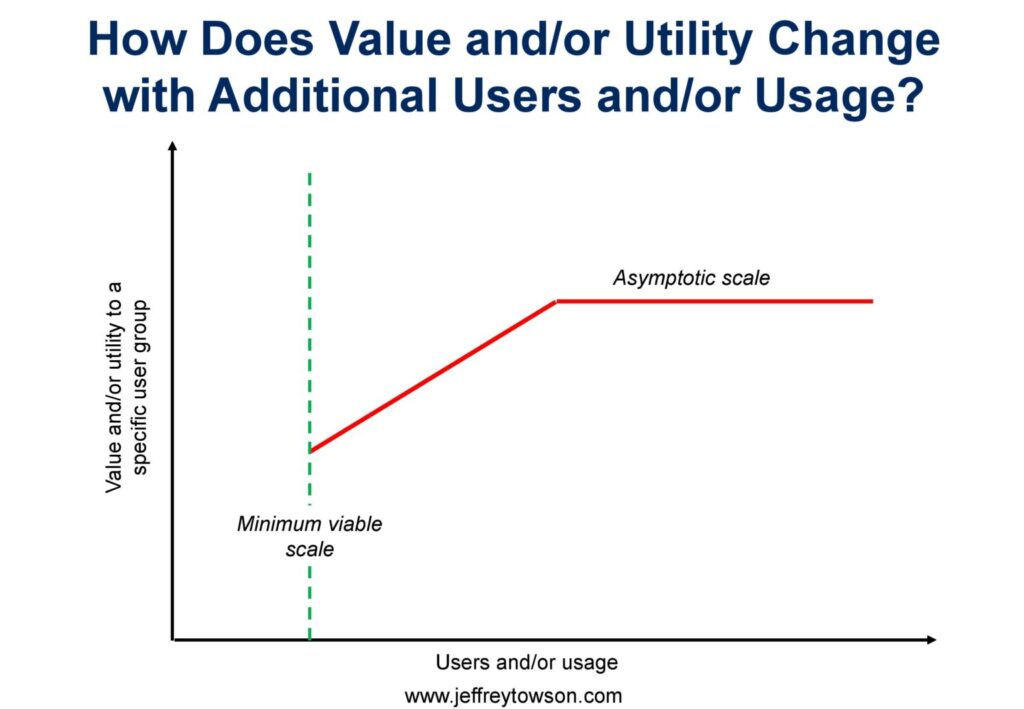

Here is an example of a network effects graphic.

Here are my 6 network effects questions:

- What type of network, platform business model and network effect is this?

- What is the asymptotic scale?

- What is the minimum viable scale?

- Within this effective range, rate (1-10) the marginal value and/or utility of each additional user or activity?

- What is the shape of the curve?

- What is the scale differential with rivals? Now versus later?

Here the 4 big effects of network effects:

- Network effects can cause rapid increases in the real or perceived value and/or utility to customers. A product or service that increases in value TO THE USER is great. And this is usually what we are talking about with network effects.

- This is usually thought of as consumers. Or business customers. But it can also be for other user groups, like content creators and developers.

- Utility is easy to understand. Think communication networks. These are usually commodity services.

- But “value” can be complicated. It can be everything from a marketplace or videos to watch. Or a community or tribe to join.

- This doesn’t necessarily mean growth. You can have a great and improving service in a small or flat market.

- Network effects can increase economic value. This is not the same thing as customer value (real or perceived). If a platform business model has attractive unit economics and growth potential, then you can see increasing economic value and shareholder returns with network effects. But not always. You can have a fantastic service with increasing customer but not economic value (by network effects)

- Network effects can create a competitive advantage. This is demand side economies of scale as a moat. This is what collapses the market to a monopoly or oligopoly. However, this doesn’t necessarily mean the creation of economic value. You can dominate an unattractive business. And it doesn’t necessarily mean growth. You can dominate a stagnant business.

- Network effects can create a barrier to entry. In digital, this is mostly by indirect network effects, which have a chicken and egg problem. That is hard for new entrants to overcome with an incumbent present. There is less of a barrier to entry with direct network effects. We also see barriers to entry in physical networks which require lots of tangible assets. Replicating a railroad is almost impossible in a developed country.

—–

Related articles:

- 3 Types of Network Effects (Asia Tech Strategy – Daily Lesson / Update)

- Questions for Huawei’s CEO, JD & Jingxi, Metcalfe’s Law Is Dumb (Asia Tech Strategy)

From the Concept Library, concepts for this article are:

- Network Effects: 4 Key Questions

- Network Effects: 4 Big Effects

From the Company Library, companies for this article are:

- n/a

Photo is AI generated

—–transcript below

Episode 225 – Network effects.1

Jeffrey Towson: [00:00:00] Welcome. Welcome, everybody. My name is Jeff Towson, and this is the tech strategy podcast from Techmoat Consulting and the topic for today, the four effects of network effects. Now, I’ve written quite a bit about network effects as a concept. It’s chapters of my books. I’ve done quite a few articles on it as well.

It is a big deal within digital strategy, digitizing businesses, all of this. Network effects are kind of the biggest gun. And certainly, venture capitals, capitalists pay a lot of attention to it. But it’s easy to get lost in all the theory, although I think it’s fun. So, I thought what I would do is in this podcast, which will be short, is bubble it up.

Just sort of say, look, you gotta have, you gotta ask these four questions, and these are the four effects you should look for. If you can sort of answer that, you’re going to [00:01:00] understand most of what’s going on with regards to the network effects in a particular business. So basically, I’m looking for four effects that can result from network effects and also I’ll put in there, these are kind of my standard four questions I ask when I’m thinking about this myself.

So anyways for those of you who are subscribers, I’m going to, I’m going to rewrite some of my past stuff and send it out again, crystallize it. You know, I’m trying to get this down to two to three chapters that are really sharp in terms of network effects thinking. And I also think it’s such a big topic, it’s worth going through a couple times.

It is kind of a big deal. But for this, we’ll just talk about the four effects of network effects and sort of my standard four questions and that will be the topic for today. So, my standard disclaimer here and nothing in this podcast or my writing or website is investment advice. The numbers and information for me and any guests may be incorrect.

The views and opinions expressed may no longer be relevant or accurate. Overall, investing is risky. This is not investment legal or [00:02:00] tax advice. Do your own research. And with that, let me get into the topic. So, the concept for today is obviously network effects. That’s in the concept library. You can find it there.

Lots of reading on this, a lot of theory, but also sort of company by company, because you know, most of these companies we talk about, or a lot of them, are about network effects. I think to some extent it is overemphasized as a digital concept, especially when you start talking about competitive advantages.

Everyone starts thinking, I’m going to build a platform. It’s going to have network effects. So, I think to It’s pretty rare. I generally think people are better if you’re looking at competitive advantages the two on my list Which I think are more powerful are not more powerful more available to most companies are switching costs share of the consumer mind Economies of scale those are kind of the most common three you see and then some companies do get network effects But anyways, that’s the concept for [00:03:00] today.

So, I’m not going to go through all the background on network effects I’ve done that Quite a few times. Let me just sort of tee up my standard explanation here real quick is people tend to conflate network effects with a platform, business model, marketplaces, Lazada, Alibaba, Uber or they conflate it with, you know, audience builder platforms, YouTube, things like that.

Network effects are not really platform business models. They are just sort of this. Unusual phenomenon that can happen within businesses, and they do tend to go. frequently with platform business models, but not always you can find network effects that aren’t on platform business models. And you can find platform business models that don’t really have network effects, or if they do they’re particularly weak.

So yes, those things go together a lot. It’s not one to one it’s, this is a unique phenomenon that can happen in business. [00:04:00] You know, the analogy I like to use when I think about business ecosystems, industries is. It’s kind of nature, animals in nature plants, forests, things like that. You know, these are dynamic ecosystems that change over time, but we see sort of certain patterns and creatures and organisms emerge, and some of them are just a lot more powerful.

Forests are a big deal. I mean, if you look from space, you can see a good portion of the planet is covered in forests. Now, why is that different than houseplants or other types of foliage? You know, it’s just got some attributes to it that make it more powerful and dominant you could say network effects are the same.

That, you know, fungi are particularly powerful. Bacteria very powerful. You know, there, there’s certain attributes that make certain creatures become more powerful. There’s, there doesn’t necessarily have to be a rhyme or a reason to it. It just sort of happens and you got to be able to spot it when you see it.

Well, this is the same thing. Network effects [00:05:00] are just this strange phenomenon that can happen in businesses and it can be particularly powerful in four different ways, which is what I’ll talk about. So anyways, you know, don’t overthink it. The business world is not as logical as people think it is. It’s a lot closer to nature, kind of chaotic changing.

But we can see patterns emerge. Okay. Usually, the foundation of a network effect is the connections between other things. It’s. You know, we would say it’s a network, hence network effects. We are connecting different things and those connections can give rise to this powerful phenomenon. Now, what are we connecting?

Well, most of the time in business, we’re talking about connecting people. Okay. So that could be people talking to each other on phone lines. What are phone lines? They’re connections between people who are holding the phones in their hands and talking. They could be [00:06:00] connections between businesses, which I would say is very similar to people.

This business is buying stuff. This business is selling stuff. That’s a marketplace. But we can also say, so most of the time when we’re talking about network effects, we’re looking at a network that is usually made up of people, and or businesses and the line between those things is pretty blurry. If it’s a big corporation, it’s a business.

If it’s two people in a warehouse selling stuff, is it really a business or are you connecting people at the end of the day? You know, cause most businesses are made up of people. Now, digital agents, AI agents are sort of becoming a new thing that we can connect to other things. If I’m talking about a human on the phone, I’m talking about connecting people to other people, usually if it’s an AI agent that’s been deployed, am I really connecting people, human agents, or am I connecting digital agents?

Could we see marketplace business models [00:07:00] where all the buyers and all the sellers are no longer people, but they’re AI agents? Maybe that’s the lines already gotten kind of blurry. Okay, we’ll call that bucket number one. The type of network that might show a network effect is a network made up of people or companies.

And the line’s a little blurry there. We could talk about protocol networks. Now in this case, we’re connecting computers, not people. When you tape one laptop and you connect it with an Ethernet cable to another network, I’m sorry, another laptop and another server, we’re building networks of connected computers, not networks of connected people or businesses.

That was a big deal in the nineties when we started to build the Ethernet and all of this stuff and protocol networks like TCP, IP, all that stuff. That’s what people talked about. So, when you hear about things like Metcalfe’s law. He’s really talking, you know, Robert Metcalfe, the guy who created [00:08:00] 3Com and they have this law, which I think is not worth thinking about.

That was really about connecting computers together and forming protocol networks because it’s the protocol that connects these things. Bitcoin is a protocol network. Now, people hold it, but generally speaking, it’s the network that enables blockchain to exist. And then we could look at physical networks, railroads sewage systems airplanes in the sky.

Generally, you know, physical things in the world. Okay. But generally speaking, a network arises based on the power of connecting things together. And underneath that is this idea that if I take five networks and link them together, and then I add a sixth laptop, let’s say five laptops. And I had a sixth, the value of the sixth laptop is to everybody.

Okay. You know, if you have a phone line and you add more people to the [00:09:00] phone system, the value becomes better for everybody. So, when it’s a connected system, the value or utility of each additional user, laptop usage, etc. increases more and it’s valuable to everybody. That’s kind of the basic. So, when I look at network effects, my standard question is always, I mean, this is a little bit not great language, but it’s how I think about it.

I always think about what is the marginal value and or utility of each additional user or activity. If one person joins the phone network, AT& T, WeChat, what is the marginal value. or utility of that additional user. And that’s really what a network effect is. It’s [00:10:00] when more people use a system, it adds value to the others.

And so that’s why my standard joke has always been, look, if you go to KFC and I go to KFC, your chicken doesn’t taste better because I went to KFC. But if I’m on WeChat and you sign up for WeChat, the product itself got better because more people are using it. Cause now I can call more people. My standard thing is the marginal value and or utility of each additional user and or activity.

Now, okay, maybe it’s not adding more users, but if more users are using it more activity, that can be valuable. If you’re on a marketplace and the number of merchants hasn’t increased, but the number of products they’re selling on the marketplace increased, that would be activity. That is valuable as well.

So, it can be users and or activity. Now the other word I use is I’m using user and I’m not using customer. [00:11:00] Usually people would say customer. Look, every additional customer for the AT& T phone system adds value to all the existing customers because there’s one more person they can call. Okay, that’s a customer, that’s one case.

I think about it in users because it can be more than that. If more merchants sign up for Alibaba, Taobao, that is more valuable to all the customers. The more sellers on the platform, the more valuable to buyers, the more content creators on YouTube, the more valuable it is to watchers. So it can be, you know, the more game developers on Twitch or something, you know, you can have more types of users than just customers.

Can be content creators developers, merchants, sellers, drivers on Uber, all of that. So anyway, that’s my standard explanation. Now, why do I frame it that way? Because it kind of emphasizes the point of, [00:12:00] you can get a marginal increase in value of a service, but it doesn’t go on forever. You know, if you join the AT& T phone network, and I’m on the AT& T phone network, it has marginal value to me.

But at a certain point, everybody I want to call is already on the network. So, if a bunch of people in China start joining, that doesn’t increase the value to me. So, this marginal benefit Only exists within a certain range, and then it usually goes flat, where additional users or additional usage don’t add more value.

So, it’s a powerful phenomenon, but only within a certain range of activity. And we see this in almost all network effects. That yes, usually in the early stages of a company, when more merchants are joining Lozada, it is more valuable for the customers. At a certain point, more merchants joining doesn’t add any value to the customers.

Look, [00:13:00] I want to go on and I want to buy batteries. I don’t need 10, 000 merchants selling batteries. 15 or 20 is fine. Maybe if you want to go crazy, 100 different types of AA batteries, fine. I don’t need 10, 000. So, all this marginal benefit usually goes to zero eventually for all these situations. Now, if we view it as a range, then that tees up the four questions, and I’ll get to the so what right now.

So, when I look at a network effect, okay, I ask myself, who are the users? Is it a one-sided network effect, like a phone system? We call that a direct network effect. Or is it a two-sided network effect, like merchants and buyers and sellers? More sellers is valuable to more buyers is more valuable to more sellers, but not to each other.

Okay, so the first question I always ask is, at [00:14:00] what point does the marginal value and or utility pretty much go to zero? Where every additional user no longer really makes a difference. And so, we would call that the asymptotic scale. Asymptotic, I know how to say that word. And for some businesses, this happens very quickly.

This is one of the big problems with Uber. That Uber has a local network effect. You know, I need drivers in my town, but I don’t need drivers around the world. That doesn’t help me. The value, because it’s a commodity service, the value of every additional driver drops to zero. Once there’s 10 people who can pick me up in three minutes and take me to the airport, the 11th driver adds no value to me.

Commodity services tend to flatline in marginal value very quickly. Now, if you’re talking about Uber Eats and not Uber Transportation it’s actually a much better situation. Every [00:15:00] additional restaurant in my neighborhood adds value because, ooh, it’s a Japanese restaurant. It’s a Thai restaurant. So, commodity services flatline faster than differentiated services.

And international services. are better than local services. One of the reasons Airbnb and Ctrip are so powerful is because they can keep adding hotels all around the world that I might want to go to, and they are valuable to me. So, Uber transportation, the level at which it flatlines in marginal value, the asymptote is very low.

Something like hotel reservations. It’s actually kind of linear. It keeps going on forever and ever. This is why Airbnb is so powerful It’s global and it’s differentiated Very good. So that’s kind of my first question and I’ll put these in the show notes question number one Where does it [00:16:00] asymptote where does it flatline in marginal value and the effect that we describe as a network effect?

Goes away. Okay, that’s question number two. I’m sorry question number one That’s kind of the, if you plot this out on a curve, and I’ll put a graphic in the show notes, that’s sort of the top of the curve. Okay, where’s the beginning of the curve? At what level of engagement by users and or activity do we start to see the network effect kick in?

Now for a lot of businesses, it’s, you have sort of this, when you’re trying to build a network effect, you have sort of this fight to get to scale where the network effect doesn’t really work yet. Facebook had this problem when they started. People were joining Facebook, but the truth is it was a small business and, you know, one person in Florida and one person in Texas and 20 people in California.

When they joined the network, it doesn’t help me [00:17:00] living in Boston. It’s too small. It’s too scattered. So, what they did is they targeted a micro market. They said, when Facebook started, we are only going to offer it at Harvard. So, we will get to minimum viable scale. within the Harvard community first. And suddenly when 20 percent of Harvard was on Facebook, it was very valuable to all the rest of Harvard.

So, the starting point for the network effect, we call that the minimum viable scale. The ending point of the network effect, we call that asymptotic scale. And what Facebook did is they started in college campuses. Each one of those were micro markets where they got to scale. And then eventually when they got big enough across the whole country, they took down the requirement that you had to be a Harvard member to get on Facebook of Harvard.

And they used to, you know, the way you used to sign up for Facebook was with your college email. So, they use these micro markets to get to scale in each market and then eventually they got big enough that they dropped that [00:18:00] rule. Where is, what is the minimum viable scale? What is, that’s kind of the beginning and the end of the curve you’re trying to draw.

And I’ll give a picture of the curve in the notes. Okay, that’s question number two. Question number three, between those two points, what is the shape of the curve? Is it a straight line? Is it sort of a flat line curve where it goes up quickly at the beginning and then it flat lines. What everyone likes to draw in graphics about network effects is an exponential.

You know, as you get more users the value increases exponentially. That is almost never the case. Anytime someone shows you a network effect graphic with an exponential it’s almost, at best it’s linear. Sometimes in the very early days, it’s a little exponential, but usually the best case is a linear increase.

The more users you get, the more value to everybody. And then you usually flatline. So, you have to draw a curve sort of by hand [00:19:00] between the endpoint and the starting point. And again, I’ll put graphics in the show notes. You’ll, you can see examples. So those are kind of my three questions. And then the fourth one, which is the last one.

Okay. What is the scale differential between me and my rivals? A network effect is, we’d call this a demand side economy of scale, which is like a supply side economy of scale. If I’m a bigger company than my rival, like Coca Cola is a bigger cola than Jeff Cola, it’s a scale advantage. It only exists if they’re bigger than me and they can outspend me on marketing and logistics.

So, it’s the same when you go from the supply side to the demand side, which is the same We would call a network effect, the demand side economy of scale. I got to know how much bigger I am than my rivals on the demand side. How many users do I have? What’s my usage. That’s going to tell me how much bigger than I am than them.

I am in terms [00:20:00] of my network effect. Are they right next to me? Are they getting closer to my scale? Cause once they get to my scale on the demand side, my power in terms of network effect goes away. You know, there’s famous stories about how Pepsi was smaller than Coca Cola for 40 years, but they slowly clawed their way and eroded the scale differential and got as big as Coca Cola finally in like the 70s and 80s.

And then when Coke attacked them trying to use their scale as advantage, it didn’t work. You got to know what your differential is in terms of demand side scale. And is it going away? Which, one of the places you see this play out is in companies like Uber and Grab. If you’re in Asia, like Lineman and GoJek you see smaller companies breaking in.

I don’t know, Robinhood, if you’re in Thailand. [00:21:00] And you see the companies sort of getting to scale against the incumbents. And suddenly the market is not one dominant company, like Didi in China, which is like 90 percent of the ride sharing market. But suddenly in Southeast Asia, you’re seeing 4 to 5 players each with 20%.

Okay, when that happens, your rivals have based, you know, it’s Coke, Pepsi, and three other colas that are equally the same. Your advantages go away. So anyways, that’s question number four. What is the scale differential with rivals and how is it changing? So those are my four questions. That’s kind of what I look at.

I’ll put that in the show notes. I’ll put the graphics of how to see it, and then I’ll put the four questions. Okay, let me get to the final point for the day, which is what are the four big effects of network effects? And this is something I think people get wrong all the time. Okay, so one of the reasons I think this gets confusing is Network effects, in my opinion, have four different effects, and it can be all four of them happening at the same time.

It can be [00:22:00] one or two, and usually when people talk about network effects, they’re often talking about different things, even though they’re using the same language. The first thing is that pretty much everything I’ve been talking about thus far. When you get a network effect, you can get a rapid increase in the real or perceived value or utility to a customer.

When people talk about network effects, they’ll talk about value. Well, value, oftentimes when people talk about value, they’re talking about economic value. No, our Metcalfe’s law was Connective value, which is why I think it’s such a bad idea. We’re talking about the perceived value to a customer How good of a product is it does your chicken taste better or not?

What is the value of the cut the product to the customer now the value can be real or it can be perceived You can think that this is the, you know, the widely spread [00:23:00] network and therefore it’s more widely used and it’s more valuable and maybe it’s not actually that much more valuable in practice, but you perceive it to be so value can be real or perceived to the customer and You can also separate the idea of value and utility and I generally do that Value can be emotional.

It can make me happy There’s a lot of fuzzy stuff going on under the idea of value Perceived value to a customer. Utility is a much easier thing to understand. Look this app connects me with 1500 people. These pipes bring my water. That’s utility. These shoes help me walk down the street without hurting my feet.

That’s utility. Most of the companies I really like, the products I really like are a mix of value and utility. I like Nike. Nike has clear. really powerful utility. [00:24:00] You cannot get down the street if I take away your shoes. You absolutely need shoes to operate in this world. It’s got utility, but you could say that about 20 sneakers from the Walmart.

Nike is a layer of emotional value on top of a core utility. I like businesses that are usually like some level of emotional or non-rational value that’s sitting on top of a core utility. Because look, the utility is I need shoes. There’s no way around it. I can’t avoid it. I’ve got to have it. So, I like that utility is sort of an absolute requirement that every human being on the planet needs shoes.

That gets me. Consumer buying behavior. And now I’m going to layer things on top of that, that let me charge a hundred dollars for something that only costs 20. So, value and or utility. That’s how I think about it. When people are talking about network effects, they are [00:25:00] usually talking, especially venture capitalists, they’re usually talking about this, which is when a small company like a marketplace starts to get traction, the value of its product or service increases rapidly.

You know, early Taobao was better than early eBay in China because it got bigger and therefore it became more valuable. It was a better product. That’s usually what venture capitalists are looking for is this acceleration of value to the customer. The product’s getting better faster. That tends to lead to a consolidation of the market to the better product.

Okay, that’s number one. Number two network effects can actually increase economic value. not the value perceived to the customer, the financial economic value. If you have a good platform business model like Lazada or [00:26:00] Taobao It is going to have good unit economics with a network effect. It’s going to throw off a lot of cash.

We’re going to see increasing economic value, increasing shareholder returns, depending on management behavior. That economic value is a big part of why people talk about network effects and they can, they conflate the terms customer value economic, but there’s this venture capital group, NFX, which does a lot of writing about network effects.

Hence the name of their company is NFX. They basically did a study that showed over three years, 70 plus percent of all economic value created by tech companies basically came from network effects. That this is the biggest economic value creation engine we are seeing for the last 20 or 30 years. Now that is a different thing than perceived or real value to the customer.

So, number one is customer facing value, perceived [00:27:00] value. Number two is pure economic value. Network effects are a big deal. All right. Number three, network effects can create an, a competitive advantage. Now this is my area demand side economies of scale. It’s a moat. Now, why is that the case? Because when the market consolidates to a handful of players, their product or service is inherently better because there is a scale differential on the demand side between them and their rivals.

That is a real moat. It’s a moat versus rivals, not new entrants, rivals. So, on my list of competitive advantages, you absolutely can create a powerful competitive advantage with network effects. That doesn’t mean you’re going to get economic value. This was one of the problems with Uber. Everyone recognized they had some degree of competitive advantage from their network effects doesn’t mean [00:28:00] you’re going to make money.

And in fact, when you look at their economics of these ride sharing platforms, The vast majority of them have struggled to ever get to profitability, even though they have pretty decent competitive advantages. You know, my sort of standard thing is like a competitive advantage against rivals is a prerequisite to economic value creation and shareholder returns, but it isn’t a guarantee.

You can dominate a crappy business. You can be the greatest company in buggy whips. It doesn’t mean you’re going to make money. Ciao. Number three, yes, this is a powerful competitive advantage. Number four, last one. Network effects can also create a barrier to entry. Another type of moat, this is against new entrants, it’s different.

This is actually kind of a good point to keep in mind. When we talk about having a network effect, let’s say a [00:29:00] marketplace, Lazada, I don’t know, Shopee, Taobao, whatever you want. You know, we get a network effect between buyers and sellers. And for new entrants that want to jump into the space, we call this a chicken and the egg problem to break into a marketplace business.

You’re going to have to get the sellers to get the sellers. You got to get the buyers, but to get the buyers, you got to get the sellers. Now that is hard in general. Getting over the chicken and egg problem is difficult, even in a new space with no incumbents. But if there is a dominant incumbent in the space, that chicken and the egg problem pretty much becomes insurmountable.

So, a business with a network effect, let’s say Amazon in the U. S., that is difficult for rivals. It’s a competitive advantage, but it’s also a massive barrier to entry to new entrants because this. Chicken and the egg problem basically becomes impossible. Now that is a different phenomenon than a competitive [00:30:00] advantage.

And the reason I make this point is, the chicken and the egg thing, we really only see that with indirect network effects. We only see it when we have a two-sided marketplace. If we’re talking about a direct network effect, like a phone system or a WeChat, there isn’t a chicken and the egg problem. If you want to sign people up to your phone network or messenger service, it’s actually an easy business to get into.

There’s not a lot of, there’s not a big barrier to get in. You just sign up 20 people and they can all start talking to each other. So, the chicken and the egg problem, the barrier to entry, doesn’t really exist on direct network effects. It’s mostly on indirect, which is, you know, marketplaces, audience builders, payment platforms, things like that.

So, you can see that so it’s something to keep in mind, direct network effects, which we can see in communication systems telephones, WeChat Facebook Messenger, they generally [00:31:00] are more powerful, but they’re mostly, their power is mostly against rivals, not against new entrants. Anyway, something to keep in mind.

Okay, so those are kind of the four effects to keep in mind. in mind. Number one, network effects can cause a rapid increase in the real or perceived value and or utility to customers. That’s usually what a lot of people are talking about. Number two, they can also create economic value, but not necessarily.

That’s a different question. Number three, they can be a competitive advantage, which is usually the case. And number four, they can sometimes create a barrier to entry depending on the type of network effect, but not always. It was that’s how I break it down. I’ll put my sort of four questions and the four effects in the show notes It’s not a bad little checklist to keep in mind.

It’s in my list of notes when I go through companies These are the four things I’m kind of taken apart on first pass and these are also sort of the KPIs I keep an eye on when [00:32:00] I’m looking at a company and I’m generally trying to identify a company where the network effect isn’t as strong as people think, or it’s fading.

That’s good to know ahead of everyone else. Or it’s emerging and people don’t quite see it yet. That’s kind of good investor knowledge depth. But that’s kind of it for today. Hopefully that’s helpful. And I’m going to, I’m going to send out a couple of articles on network effects this week to subscribers.

Sorry, I took off last week. I was kind of, I was kind of out of it. I needed to sort of rest my brain. It’s every now and then my brain gets tired and I got to take off a week like every six months. I just there’s nothing happening. Like I sit down to write and just like the whole thing’s offline.

I gotta take a week and recharge and then I get back into it. So anyways, I took the last week off. But anyways, I’ll say I owe a couple articles from last week and a podcast. I’ll catch up in the next week or so. But that is it for me for the content for today. Hopefully that’s helpful. Not too long today, 30 minutes.

Peace. Pretty quick for me, [00:33:00] actually. As for me, it’s been kind of a nice slow week. I’ve been taking it a bit easy. I’m getting on the road in another week. I’m going to be on the road for really the next two months. I’m heading out to the Middle East, China for sure, but also the Middle East, which will be fun.

I love, I mean, I really do enjoy the Middle East. I spent a lot of years of my life bouncing around the region. I’ll have a recommendation for you. I was watching a Netflix show. Love is blind. Habibi. And these are all these reality dating shows, which the girlfriend likes. So, we watched them and I can kind of get into it somewhat.

I mean, they’re definitely not made for me at all in any way, but I can get into it a little bit, but it’s this a reality dating show where you have to meet someone without Seeing them you talk to them love is blind And then you they literally have to propose within a week and then they get married and then some couples get married so that part’s a little crazy, but anyways, they did the point of this they did a middle eastern version of this show, which is which [00:34:00] really I thought that was kind of cool because I lived in the middle east and it’s a You know, it’s an interesting mix of sort of traditional very religious society.

Also, a lot of, there’s a lot of unique customs in places like Saudi Arabia, which people ascribe to religion, but they’re really not, they’re more cultural customs about marriage and things like that. But it’s also kind of a mix of modern because you know, I used to write about this a lot, which is.

People from the Middle East, they will get on the plane in Riyadh, which I used to do forever, and we’d fly to London, and we’d fly to Beirut, and as soon as we got on the plane, all the abayas and the, you know, sort of the coverings would come off, right, and everyone would just sort of switch gears In Riyadh, Saudi, you know, people would be covered.

Men and women back then could not talk at all. Each restaurant had separate entrances for families and then for single men, which was always me. So, there’s a lot of rules, customs, things like that. Now that’s changed recently. But as soon as you got on the [00:35:00] plane and the doors closed, everyone switched to a different gear.

Like everyone lands in London, you know, they just operate differently. And I always thought that was interesting that you could sort of walk between cultures, that in one culture you act one way and then you go somewhere else and you act another way, which I actually think is quite comfortable. I thought it was not a problem at all.

Anyway, so this TV show, which is this dating thing you can see both cultures, and dislike. As they argue and they’re like, we should get married. I don’t know if we’re getting married. You know, sometimes usually the guy would say, I’m very traditional and this is how I would expect family to be.

And often the woman, but not a hundred percent, would say, no, I don’t agree with that. You can literally see the two cultures to some degree in conflict. Yeah, it’s worth watching and keep an eye out for it because I totally noticed it like it’s interesting to be an observer to such a sort of a unique culture.

But yeah, it’s watched the show It’s pretty good. And you know, of course there’s a lot of drama and fighting because I think that’s a big part of how these [00:36:00] shows succeed, but anyways, love is blind Habibi, which is yeah, it was on Netflix. It’s pretty interesting to watch It’s mostly about Dubai, which is its own little world.

Anyways, I’m not sure if that’s a recommendation or not but if you’re curious Maybe watch the first one you might get a kick out of just seeing this like very different culture Go into this pretty screwed up Game because it’s a silly game to begin with. But yeah, anyways, that’s what I watched over the weekend Anyways, that is it for me.

I’m not sure if that’s a recommendation or not Maybe call that a half recommendation. But yeah, I thought it was fun. Okay, that’s it for me Have a good week and I will talk to you next week. Bye. Bye

——-

I am a consultant and keynote speaker on how to accelerate growth with improving customer experiences (CX) and digital moats.

I am a partner at TechMoat Consulting, a consulting firm specialized in how to increase growth with improved customer experiences (CX), personalization and other types of customer value. Get in touch here.

I am also author of the Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

Note: This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.