- Pop Mart has shown strong growth, in China and now internationally. And has shockingly high gross profits (+60%) for a toy company.

- Pop toys can be a powerful combination of 3 powerful consumer behaviors:

- Fan and enthusiast behavior

- Collecting behavior

- Gambling behavior

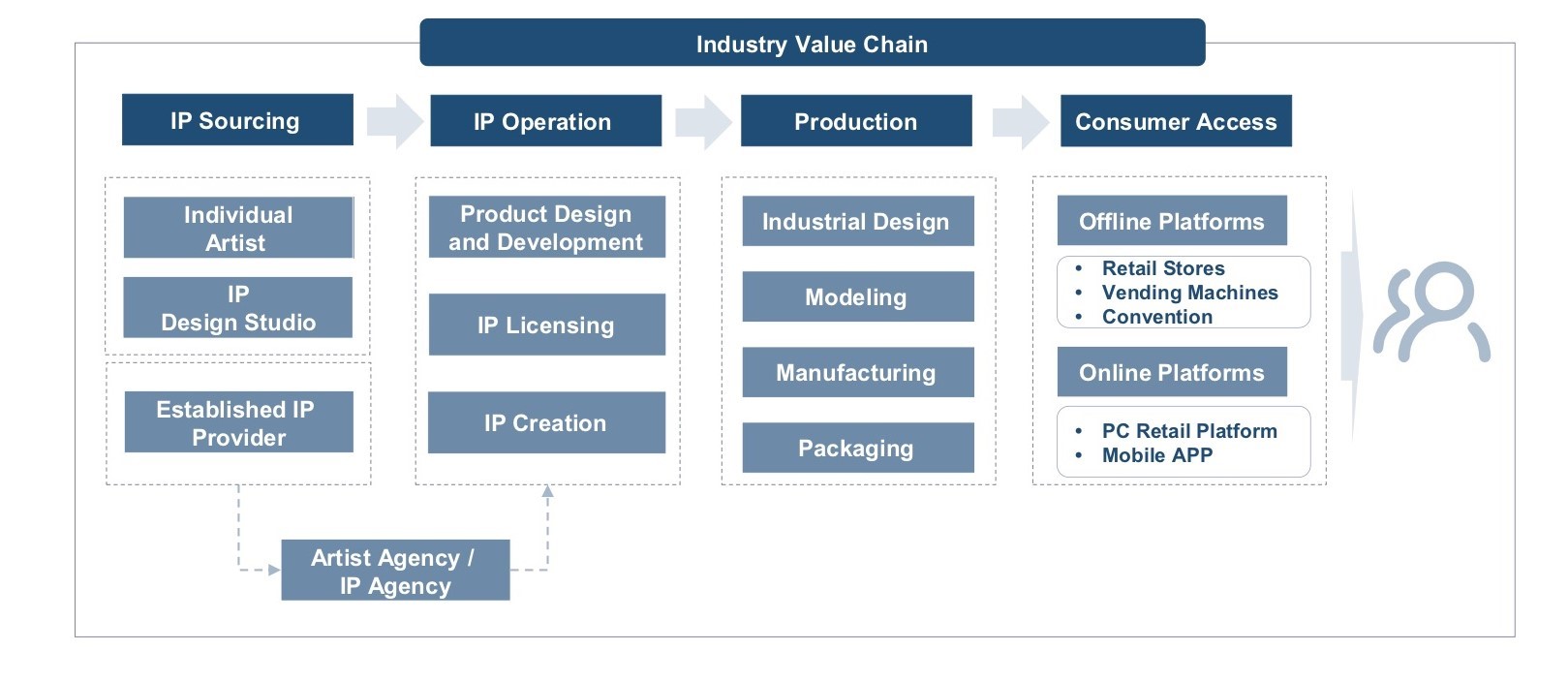

- Acquiring these popular toys has required vertically integrating from retail into IP development and licensing. It’s the reverse Disney model.

***

I am always on the hunt for strange consumer behavior. Behavior that has lots of interesting psychology and behavior. And where there are lots of dimensions to the consumer experience.

This tends to be where digital tools can really have power. Most of the big B2C apps tend to be in this area. They are usually about:

- Digitizing areas with deep consumer interest. As the fight for consumer attention continues to intensify, you really need a product, service, or content topic that consumers really, really care about.

- Continually improving the consumer experience. This is DOB2. There is a never-ending race to improve the consumer experience. But it is difficult to improve a product, service, or experience that has only one dimension. It’s hard to continually improve buying a cup of coffee. But fashion and beauty have lots of interesting dimensions (new products, media, education, the buying experience, discussions, etc.) that you can build on over time.

- Tapping into consumer psychology. Software and data technologies are very good at hacking the human brain. Facebook and social networks are mostly psychology products (envy, status seeking, human connection). This can be both positive and negative.

Which brings me to Pop Mart.

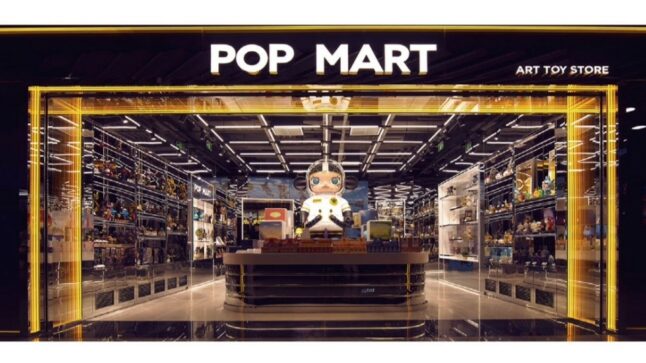

Pop Mart is 50% a Toy Company and 50% a Retailer

This is a Chinese company that is the #1 Pop Toy in China. And it is currently expanding to the US and other international markets.

It is 50% a toy company and 50% a toy retailer. And it specializes is collectable “designer” toys. Think Japanese, Chinese, and Western characters like Hello Kitty and Mickey Mouse. They sell these mostly in a ‘blind box’ format (which will be discussed at length).

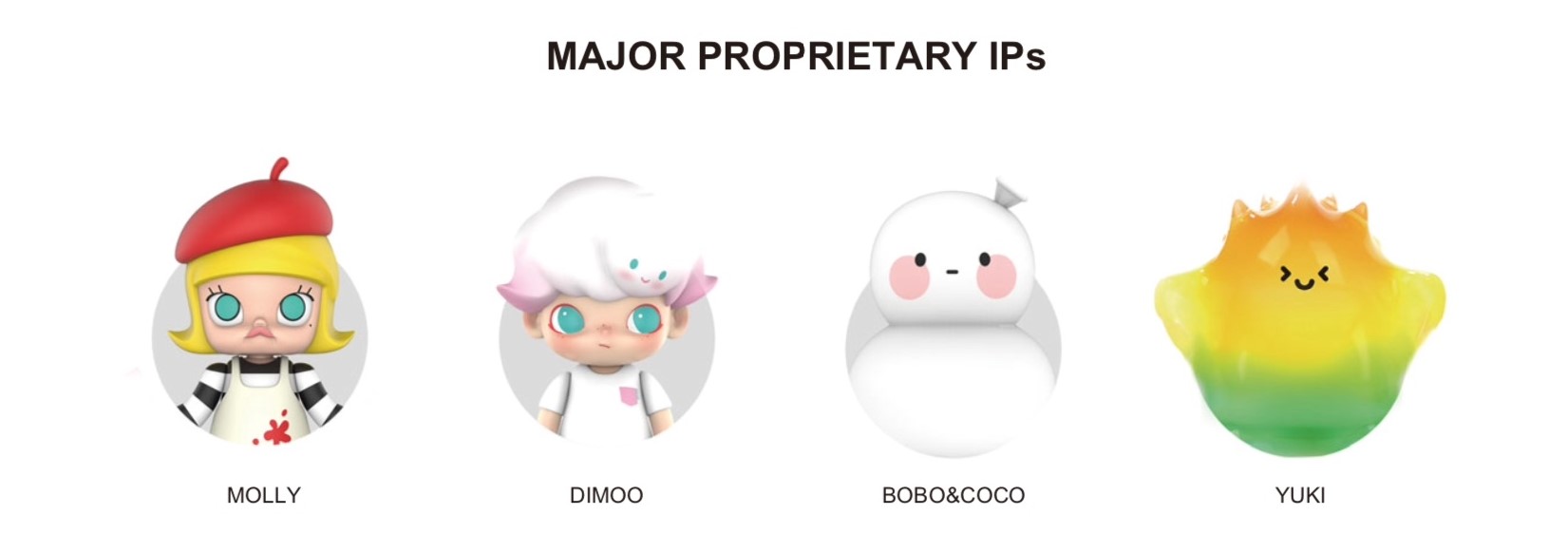

Here are Pop Mart’s most successful products. These 3-4 characters were +50% of their 2023 revenue.

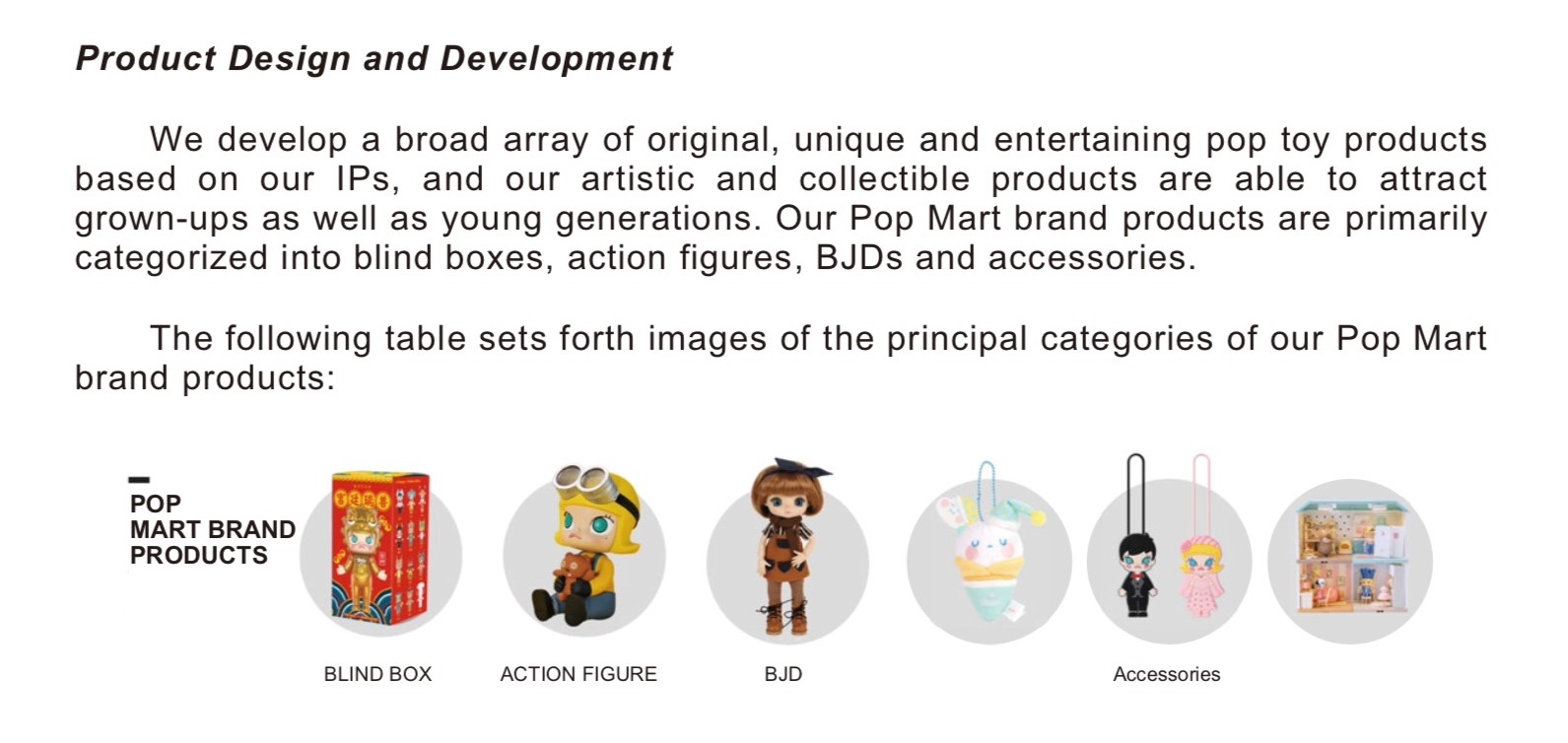

And they sell these characters in multiple formats, with Blind Boxes (about $8-15) being the #1 format.

As mentioned, Pop Mart is (in my opinion) 50% an IP company and 50% a retailer. They sell their products online as well as through colorful retail stores and roboshops. In 2023, Pop Mart had 395 retail stores and 2,328 Roboshops.

Ok. So why is this interesting?

It’s a toy retailer with some degree of vertical integration into IP for popular toys. It’s a retailer and IP business.

It’s interesting because it has particularly powerful consumer behavior. And I think this is 80% of what has propelled this business from a college dorm room to an international operation. That’s what I’m going to go into.

First, let me go through the background and basic information.

The Strategy of Pop Mart Has Not Really Changed Since Founding.

Pop Mart began in 2010 when college student Wang Ning started selling toys. He liked toys and tried quite a lot. And he discovered that the popular Japanese character Sonny Angels was particularly a seller. That insight has been the center of the business ever since.

The next big step was in 2015, when he signed the character Molly (see photo above) as proprietary IP of Pop Mart. This was expanded to include Dimoo and Skull Panda. These three characters still represented +50% of Pop Mart’s revenue in 2022.

In its IPO filing, Pop Mart talked a lot about its vertical integration approach. They build retail distribution (i.e., consumer access) but also work with artists to source and create new IP.

Pop Mart today includes exclusive and non-exclusive licensed IP.

As mentioned, Pop Mart had 93 IPs at the time of its Hong Kong IPO in 2020. Twelve were proprietary. 25 were licensed exclusives and 56 were licensed non-exclusives.

Pop Mart’s Income Statement is Great. The Balance Sheet Not So Much.

Growth has been great.

- Revenue grew from 2.5B RMB in 2020 to 6.3B in 2023.

- And this is the latest in a long history of fairly rapid growth. Think +20%. People have been watching this company because of this growth story.

Growth profits are fantastic.

- GP was +60% in 2023. That’s the difference between pop toys and traditional toys. 61% of revenue is now proprietary IP.

Operating profit is +20%. Sales and marketing is the major expense, which has been about 25%.

Future growth and profits are the key question. These depend on a couple of factors:

- Acquiring popular IP. This is a “hits driven” business.

- International expansion. The company is currently expanding from China, Japan, Singapore, and South Korea. Their targets are Southeast and the West. In 2023, they opened stores in Malaysia, France, and Australia.

- Going from a niche and hobby market to the mass market.

The balance sheet is a bit complicated. Retailers have difficult working capital.

Ok. That’s the basics. Let’s get to the key questions.

What Pop Toys Are So Much Better Than Traditional Toys

Pop toys are sometimes referred to as designer toys. Or toys infused with popular culture and trends. They can be closely linked to the entertainment business. Movies, tv shows and video games can create popular characters. But they can also be independent phenomena, such as Hello Kitty and Beanie Babies.

Pop toys are better than traditional toys because we see consumer behavior and gross margins unlike anything we see in soccer balls and toy trucks.

The more powerful consumer behavior shows up in repeat and frequent purchases. They fill rooms up with these toys.

The powerful consumer behavior also shows up in much more engaged customers. They attend pop toy conventions. They argue in online toy communities. And can do lots of trading.

Overall, we are seeing a couple of really interesting consumer behaviors:

- Fans and fandom. This can be casual or pretty extreme (superfans).

- Collecting behavior. This can also be casual or extreme.

We also see a different demographic. Pop Mart has customers in the 15-40 year range. That is different than toys for children. And these adults tend to have buying behavior similar to children. They are sometimes referred to as “kidults”.

However…

There are some consumer challenges with Pop Toys.

- These are 100% discretionary products. Nobody needs them.

- Pop Toys are “hits driven”. It’s all about the rare and few popular IPs.

- IP value can decline in quickly. Pokémon and Snow White have lasted decades as valuable IP, which had a lot to do with their games and movies. But Beanie Babies was popular and then faded quickly. Note: characters without stories have less depth and fade faster. Hello Kitty is an exception.

- The market is difficult to anticipate and predict. Customer preferences and pop culture trends are unpredictable. And must be responded to quickly.

I mentioned that Pop Mart is trying to expand from a retailer with a few hit products into a more broad-based IP licensor and creator. That path is the opposite of Disney, which built its IP through movies and then expanded downstream in retail (and theme parks. Disney also had IP based on entertainment characters. This is more depth when the IP has lots of stories.

Blind Boxes Turbocharged Consumer Behavior at Pop Mart

The other big consumer phenomenon to understand with Pop Mart is Blind Boxes. This was the gas that was dumped on the fandom and collecting fire. In 2019, 84% of Pop Mart revenue was from Blind Boxes. The average selling price for a blind box is 45-50rmb.

When Pop Mart releases a new set of toys for their popular IPs (say Molly), they are released in a series of 12 different designs for that character. Plus, they usually release a 13th secret and rare design.

And this series is sold in identical, sealed packaging. So, you don’t know which one of the designs you are getting. See examples below.

Why is this so powerful?

- It increases the uncertainty in the buying experience.

- It increases the anticipation and excitement.

It basically super-charges consumer emotions in the buying process. Opening the box is a moment of excitement. And yes, it’s a type of gambling behavior. It’s a more exciting process. With lots of fun with “wins” and also “near-misses”.

This also results in repeat purchases. Just like in gambling, because you want to try again. You want the excitement again. Plus, you also want the entire set. So, it’s gambling plus collecting behavior. Especially when you keep buying blind boxes because you want to “win” and get the designs you don’t have yet. And you really want to “win” and get that hidden, rare character.

An example of this is the well-known story is Pop Mart’s co-branding project in China with KFC. This made the news in 2022.

In 2022, KFC in China (Yum! China) began selling a family meal that included a blind box. With the family meal, you got 1 of 7 Pop Mart Dimoo figures designed for KFC. So, the released series had 6 characters plus a 7th hidden character.

People wanted the new series of special Dimoo characters. And they also wanted to complete the set.

But that means they had to buy at least 6 meals to get the 6. And the success rate for getting the 7th hidden character was reported to be 1 in 72. So, you had to buy about 110 meals to get all seven designs. That’s a lot of money.

It was also a lot of food. These were family meals for $15, which one person could not eat.

So Chinese netizens (being endlessly clever) started a “help eating service” online. You could connect with other customers to eat the family meals to get your toy.

The “help eating service” plus reports of customers buying +100 meals to get the entire collection got international press. And the Chinese government is increasingly concerned Blind Boxes is a form of gambling.

Where else do you see such powerful consumer behavior?

What happens when you combine this behavior with digital tools?

That’s why I’m focusing on this. And in the next 2 articles, I’ll give you my framework for this consumer behavior.

But here’s the short version.

Pop Toys Combine 3 Powerful Consumer Behaviors

Pop Mart has a pretty simple business model. It is about building valuable IP and distribution power. Pretty simple.

But whenever I see a simple company grow so fast, I look for a powerful engine. For Facebook, it was the social network. For TikTok, it was the addictive nature of short videos.

So, what is the powerful engine of Pop Mart?

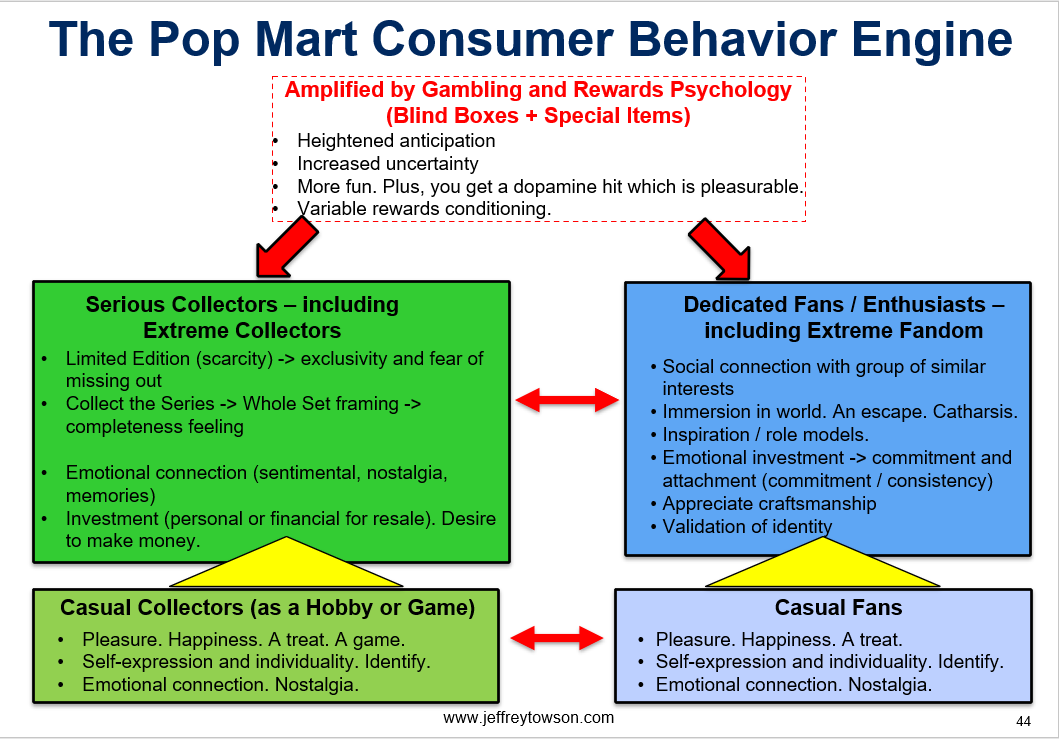

I think it’s their ability to tap into three powerful consumer behaviors.

- Fan and enthusiast behavior

- Collecting behavior

- Gambling behavior

Here’s my summary of Pop Mart in one graphic. I will break down these behaviors in detail in Parts 2 and 3.

Conclusions

- Pop Mart has shown strong growth, in China and now internationally. And has shockingly high gross profits (+60%) for a toy company.

- This is because they focus on select and rare toys that infuse popular culture and trends.

- Pop toys can be a powerful combination of 3 powerful consumer behaviors:

- Fan and enthusiast behavior

- Collecting behavior

- Gambling behavior

- Acquiring these popular toys has required vertically integrating from retail into IP development and licensing. It’s the reverse Disney model.

***

Thanks for reading, Jeff

———-

Related articles:

- When Microsoft’s Bundles Are Good vs. Bad for Customers and Markets (Tech Strategy)

- Microsoft’s 3 Big Upgrades to its 2 Platform Business Models (2 of 2) (Tech Strategy – Daily Article)

- What is Elon Musk’s Plan to 10x Twitter? (2 of 2) (Tech Strategy – Daily Article)

From the Concept Library, concepts for this article are:

- B2C Customer View: Fans and Fandom

- B2C Customer View: Gambling Behavior

- B2C Customer View: Collector Behavior

From the Company Library, companies for this article are:

- Pop Mart

———-

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.