Grab recently held its 2002 Investor Day. They summarized their 1H results for 2022 and went through their current strategy, which is mostly about getting to operating profits. In my assessment, their push to operating profitability is mostly about 3 things:

- Growing revenue.

- Increasing efficiency (i.e., decreasing costs), especially in delivery. COO Alex Hungate’s presentation said that Grab wants to be the “most efficient on demand platform in SE Asia”.

- Reducing incentives, which basically means getting out of the endless game of subsidies and incentives for consumers and drivers.

In Part 3, I wrote about their approach to decreasing delivery costs. In this final part, I wanted to talk about their strategy for growing revenue. They laid out quite a lot of detail on this. And I thought 5 their growth initiatives were compelling.

The Good News: Grab is the Market Leader and is Growing

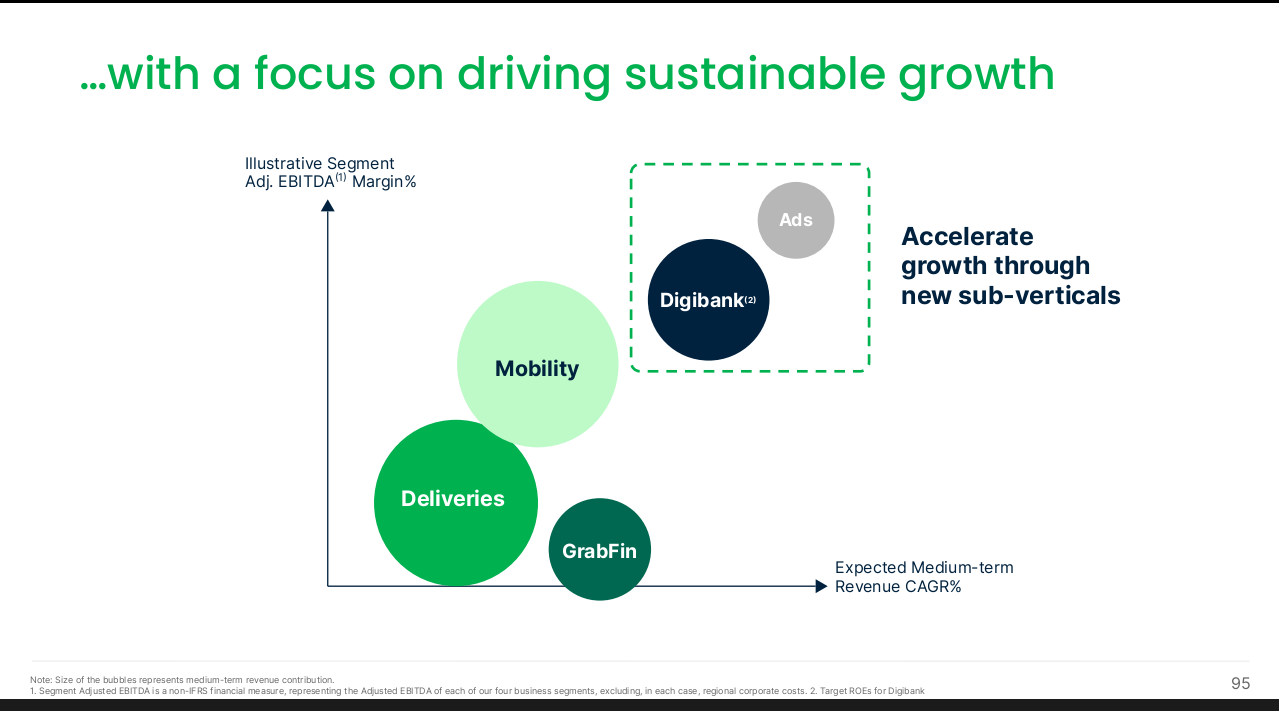

Grab’s Investor Day presentations talked about “sustainable growth”, a term which I never really understand. But they are clearly focusing on growth in users, engagement, revenue, and wallet share. So that’s good. And the numbers for all of these look pretty good.

First, they already have large user and usage numbers for SE Asia. They are the market leader in two winner-take-most businesses.

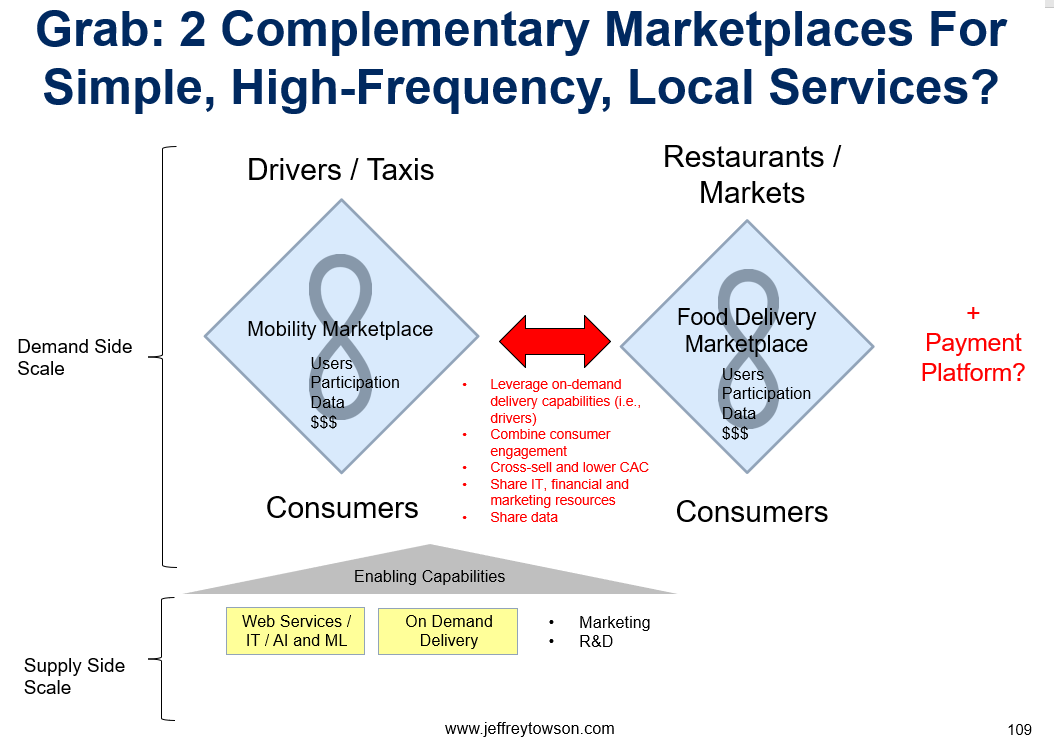

I describe Grab as having two marketplace platforms and three user groups:

- Consumers, which they count by Monthly Transaction Users (MTUs).

- Active Merchants, which is mostly restaurants.

- Driver-Partners. This is tons of dudes on scooters. These group actually plays two roles. They are an enabling capability for deliveries on the food delivery marketplace platform. And they are also a supplier user group on the mobility marketplace platform.

Here is my standard picture for Grab’s business model.

Here the numbers for 1H 2022. Southeast Asia has about 675M people. So they are well positioned for future growth.

From Q1 2022 financials:

- 19% growth year-over-year (yoy) in monthly transacting users (MTUs) for Q1 2022.

- 34% growth yoy in active merchants for Q1 2022.

- 32% growth yoy in gross merchandise value (GMV) for Q1 2022.

- GMV per MTU increased from $130 to $155.

- GMV for Delivery Services (not Mobility Services) increased 50% yoy for Q1 2022.

- MTUs for Delivery Services increased 26% yoy.

- GMV per MTU for Delivery Services increased 19% yoy.

- Revenue increased from $216M to $228M for Q1 2022

Basically, the key numbers are all going up. We are seeing growth in users, engagement, GMV, GMV per MTU and service revenue. However, these are post-Covid numbers so quarterly numbers are a bit suspect.

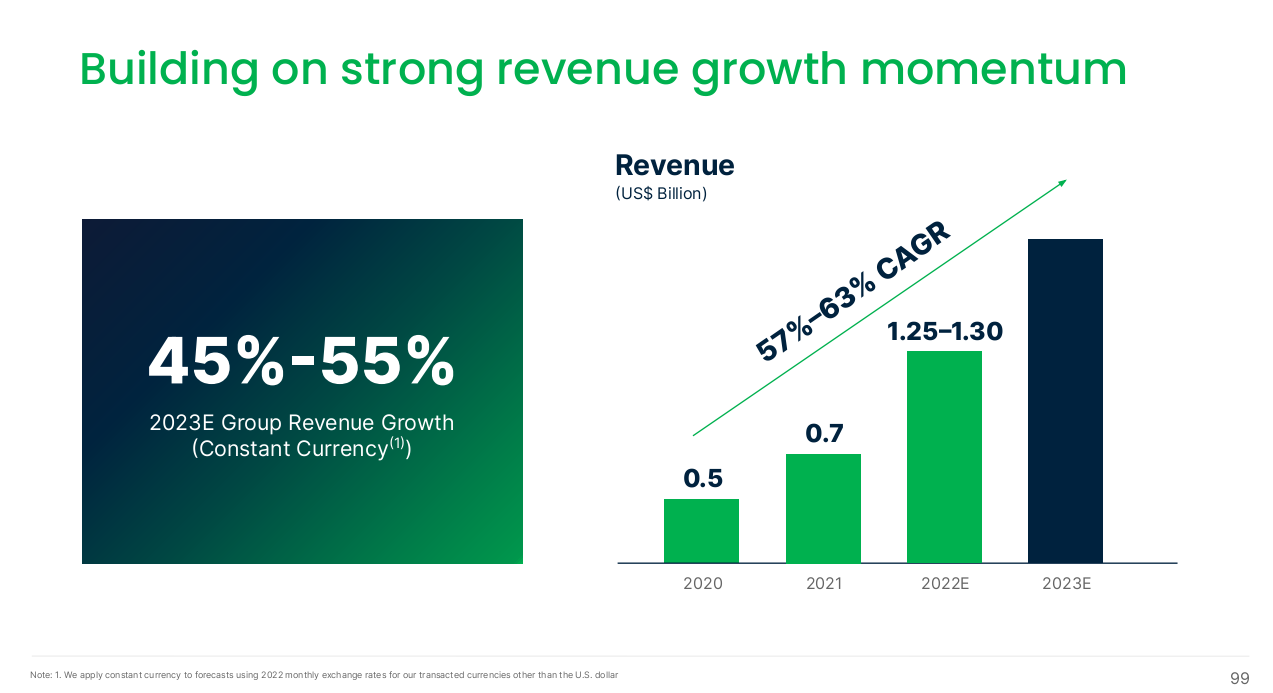

But we see pretty much the same picture in the longer term numbers. From their 2022 investor presentation:

Ok. So how are they growing and what can we expect going forward?

Grab Has 5 Compelling Growth Initiatives

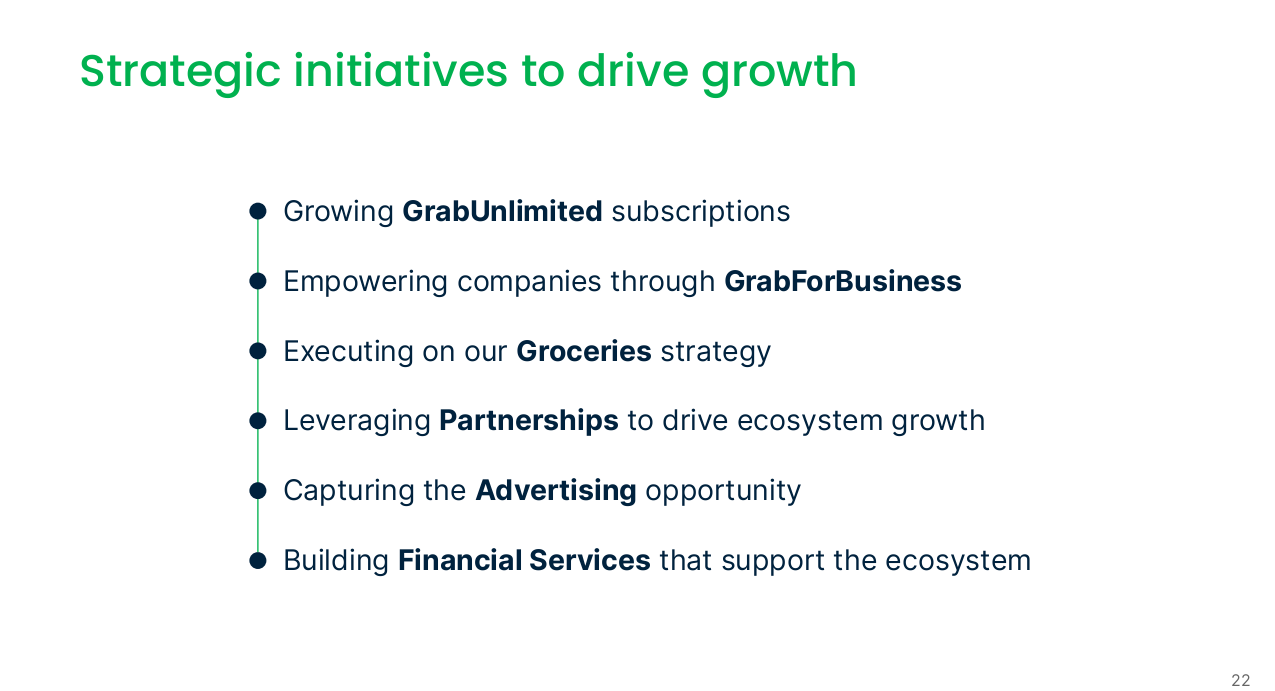

The company outlined quite a few growth initiatives in their presentation. Here is their list.

Some of this is great. Some is not convincing. Within all this, I found 5 that I think are compelling.

Compelling Growth Initiative #1: New Services for Consumers

Grab is showing growth in its core delivery and mobility services. I have written quite a lot about core vs. ancillary growth (based mostly on the books by Chris Zook of Bain). An important topic.

But the beauty of digital platforms is it is relatively cheap to grow the core. And it is often low risk to add additional services and build ancillary growth.

Grab is strongly focused on adding new features and services for its current consumers. That’s great. You want to increase the spending of current customers on the platforms. And new services also attract new consumers. I like to see platforms that consistently innovate on the customer experience. I list this as Digital Operating Basics 2.

Grab has a fairly consistent history of launching new features and innovations within its core business. They have not been particularly bold in larger strategy moves (staying in mobility and delivery services), but they do consistently roll out new features and services. Here is their track record.

Within new consumer services, they several initiatives that I like and that I think will grow users, engagement and spending.

They Are Focusing Supermarkets.

Grocery delivery is a nice service but it isn’t a platform business model. There are actually few major supermarkets so this doesn’t add a new user group. But groceries do add a lot of value to customers and they have a high frequency for purchases. People buy from supermarkets far more frequently than they buy from restaurants. It is a nice, high frequency and complementary service for their current food offerings. It has low customer acquisition cost. I like that they are leaning into this.

Grab can also do “gray stores”, where they sell directly. That is a a reasonable growth strategy we have seen in many markets. Overall, I like this as an incremental addition of value to their consumers.

They Are Focusing on Marts

Marts have less frequency than grocery stores but tend to have higher urgency. Consumers to go local marts when immediacy and convenience matter. Hence the name “convenience stores”. Grab’s comments indicate they are doing this more as a marketplace model (3P, not 1P). That is great. There are lots of these small stores around.

They Are Focusing on Personalization

You really don’t want to underestimate how much value consumers get with increasing personalization. It really does improve the customer experience. This is why I put it as DOB2. Grab mentioned they are running 500 experiments per month. I assume this is mostly A/B testing with lots of personalization.

They Are Focusing on Deepening Engagement with Content

I always list users, engagement, data and cash flow as the key components of digital platforms. Grab mentioned increasing engagement by focusing on adding channels and content. That means more food reviews, photos, recommendations and so on. All good.

Finally, they Are Pushing GrabUnlimited, Their Loyalty Program

This is fantastic and gets its own point.

Compelling Growth Initiative #2: GrabUnlimited

This is a pilot subscription program that they are currently expanding. Members get special services and can save money. For example, in June members got:

Special June Promotions

- 4 GrabFood discount vouchers (up to 50%) plus free delivery

- 6 GrabFood discount vouchers (up to 38%) plus free delivery

- 10 GrabFood discount vouchers (up to 50%) plus free delivery (in select cities)

Standard Subscription Vouchers

- 50 GrabFood free delivery vouchers

- 10 GrabMart free delivery vouchers

- 10 GrabFood discount vouchers

- 1 Grab Ride discount (for select rides)

So it’s lots of discounts and ways to save money. Plus some exclusive benefits.

It’s a subscription model similar to Amazon Prime – and I’m always amazed at the impact of such programs. Yes, you get switching costs. That’s important. But they are pretty shallow and membership is easy to cancel. You can’t really lock consumers in like with ERP systems. It annoys them and creates friction.

What these loyalty subscription programs really do is increase customer retention, engagement and spending. This has an important impact on marketing spend and on the need for continued customer acquisition spending. From Grab:

“We have seen early encouraging metrics from GrabUnlimited in terms of increasing user engagement and order frequency”. “We believe GrabUnlimited has the potential to strengthen our ecosystem by improving engagement and stickiness with users and be a key differentiator for us from monoline food delivery or mobility companies.”

Take a look at these numbers. It’s fascinating.

- GrabUnlimited members spend 2.4x as much as regular customers.

- They do twice as many transactions.

- Over 70% of members use multiple Grab services.

***

A quick side comment.

Thus far, I have been talking about how additional features and services for consumers can fuel growth. However, these are platform business models so you can also add services for other user groups – such as merchants and driver-partners. Grab is definitely focusing on providing new services for both groups. And they are focusing on merchant growth by:

- Increasing their incomes

- Offering financial services (more on this below)

- Adding more advertising services (more on this below)

For drivers, they are focusing on:

- Increasing their earnings.

- Adding financial services.

- Offering training and other loyalty programs.

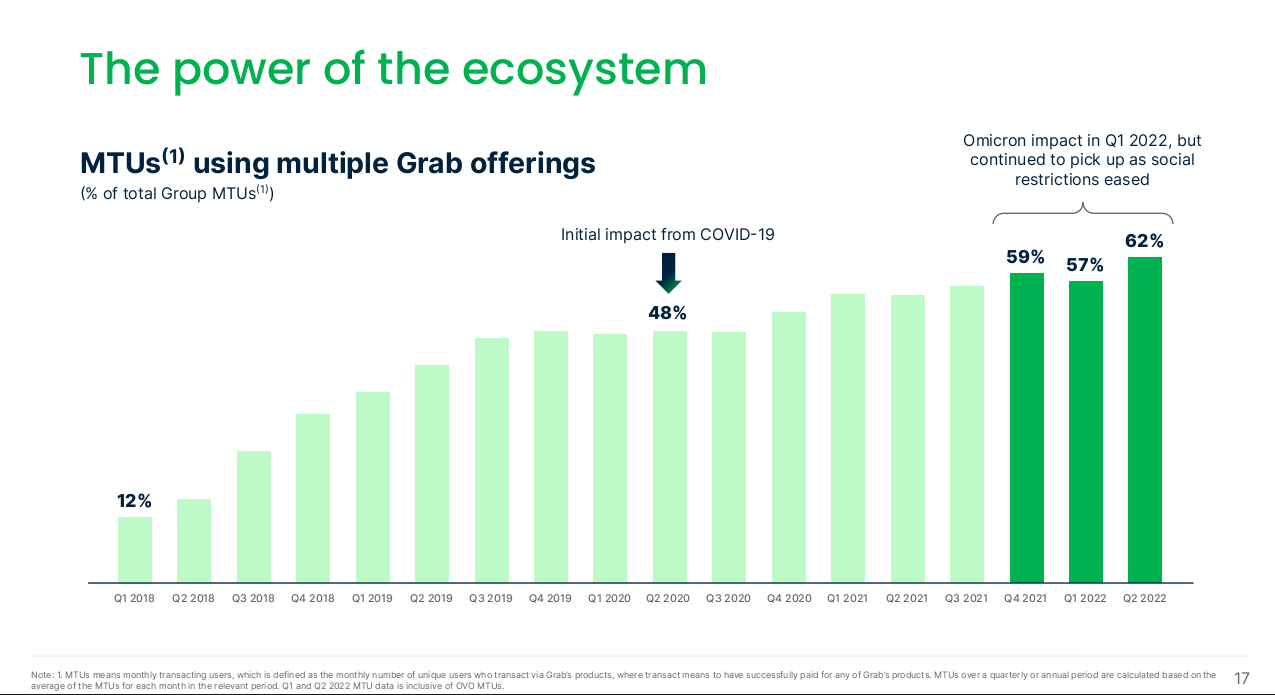

Compelling Growth Initiative #3: Cross-Selling

Cross-selling and bundling are important Soft Advantages (Level 3). Adding new services goes hand in hand with cross-selling. It’s a great way to increase revenue. It also increases defensibility. The numbers Grab cites are that 48-60% of its MTUs use multiple offerings.

Compelling Growth Initiative #4: Advertising

It’s hard not to like advertising as a source of revenue growth. It’s basically free revenue with no cost of goods sold.

Grab has long been doing this with advertisements on their offline fleet. They have moving billboards all over town. And they expanded from there into digital ads. And now they are going into search, video and a self-service advertising model (launched in 2022).

I consider mobility and delivery services their core growth engine. But I put advertising as one of their biggest ancillary growth opportunities.

Compelling Growth Initiative #5: Financial Services

I half like this and half dislike as a growth initiative. It has lots of benefits for the current business. And it is a large ancillary opportunity. But I think a lot of it has a lot probability of success.

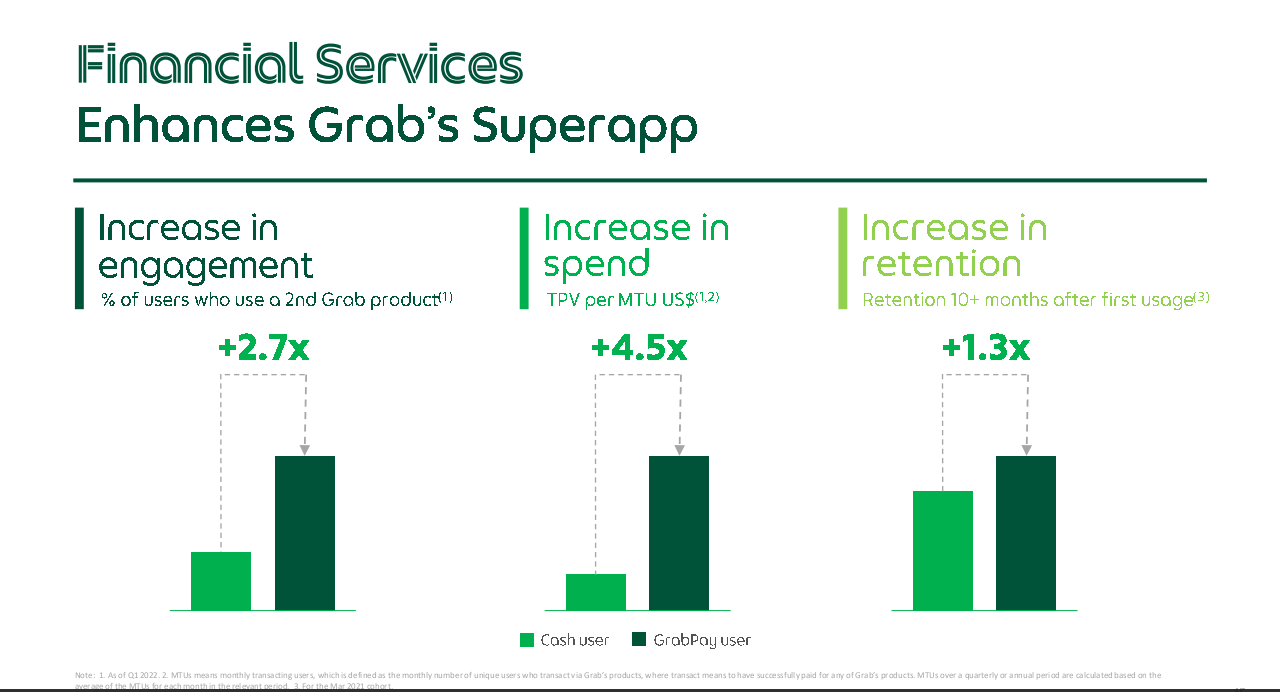

I like GrabFin, which are the financial services on their platforms. This includes:

- Grab Pay Wallet

- Switching to cashless payments is a great idea. I like payment platforms and they can be very profitable.

- Cashless payments also usually mean more spending and higher retention rates.

- Grab Pay users are also more likely to use multiple products.

- Merchant and driver lending

- I like the idea of offering limited credit to suppliers. This can be very profitable.

- Grab says drivers do 13% more rides with advances. And that they do 22% more transactions with advances.

- Pay Later

- Again, I like consumer credit. It can be profitable and it induces more usage.

- Grab says this causes a 25% increase in TPV (i.e., spending) per user. And that results in a 22% increase in transactions per user.

- Scenario insurance

- Providing insurance to drivers is a nice benefit. It creates loyalty and retention.

- And it induces more engagement. Grab says drivers do 16% more rides with insurance. And that drivers spend 19% more time driving with insurance.

This is really interesting. Credit and payment services can be very profitable. And they also induce lots of good things across the ecosystem. Spending and engagement goes up. So does retention.

Grab is also externalizing these financial services capability to non-Grab users. This is a common strategy we have seen by many other platform business models. They call this externalization “ecosystem transactions”. I like that as well.

The part I am not sure about is Digi Bank, which is basically a digital bank they are currently launching with partners. This means offering current and savings accounts. It means doing lending and other financial services. This is far more speculative. But not an unreasonable experiment.

***

Ok. That is for their growth initiatives. Overall, it’s pretty compelling. When you put this together with their focus on cost efficiencies (Part 3), it looks a lot like the strategy for Meituan in 2018. It would surprise me if they get to profitability in the next 1-2 years.

Cheers, Jeff

———-

Related articles:

- Will Southeast Asian Grab Become Meituan or Didi? (Tech Strategy – Podcast 121)

- Grab’s Big Strategy and Cash Flow Question (1 of 4) (Tech Strategy – Daily Article)

- Lessons from Grab in Geographic Density and Other Tech Enabled Cost Efficiencies (3 of 4)(Tech Strategy – Daily Article)

From the Concept Library, concepts for this article are:

- Growth: Core vs. Adjacency

- Marketplace Platform for Services

- SE Asia

From the Company Library, companies for this article are:

- Grab Holdings

Photo by Grab Media Resources

———