This week’s podcast is about Cainiao’s rapid rise from 2014-2022. Despite having a pretty unclear strategy. It’s another example of Alibaba’s Management Playbook.

You can listen to this podcast here, which has the slides and graphics mentioned. Also available at iTunes and Google Podcasts.

Here is the link to the TechMoat Consulting.

Here is the link to our Tech Tours.

–

Here is the case study from CEO Wan Lin.

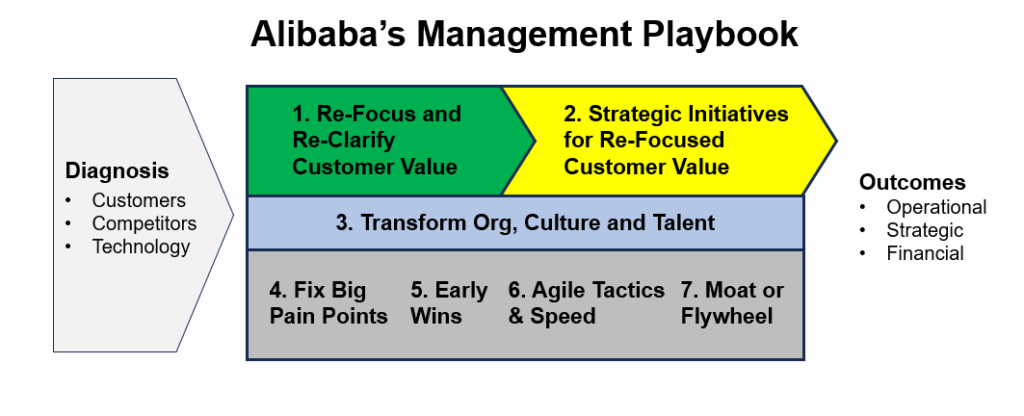

Here is my summary of Alibaba’s Management Playbook

Here is my graphic for this.

The details are below.

- Diagnose the problem

- This is always first. And of course it is the key. If you don’t get this right, nothing else matters. And proper diagnosis takes a lot of data and expertise. Usually an entire team. You really can’t get this wrong.

- This is also where you incorporate industry assessments, competitors, customer behavior and technology and/or regulatory changes.

- I like to focus on two specific questions:

- What is the chief complaint? Stagnant growth? Low NPS?

- What is the differential diagnosis?

- Step 1: Re-clarify and re-focus on customer value.

- This is the most important part of the strategy. Putting customers first and being very specific about how you add more value than competitors. This includes:

- Customer segmentation. Identify exactly who you are targeting. What are you after (revenue)? Traffic? Data?

- What do they most care about?

- What is the customer journey? Map out the process.

- Is what customers want or care about changing? Tech change? For example, PC to mobile changed what maps could do.

- What is the competitor offering and how you are going to take their customers with our re-focused value? Are they weak or strong? What are they getting wrong?

- This is the most important part of the strategy. Putting customers first and being very specific about how you add more value than competitors. This includes:

- Step 2: Launch 2-3 key strategic initiatives that deliver the re-focused customer value.

- This is where we translate Step 1 into 2-3 big initiatives that will make a difference. They have to move the needle in terms of re-focused customer value. But they also need to be feasible in 6-12 months.

- Step 3: Transform the organization structure, culture and talent.

- Revitalizing the organization and getting everyone focused on the new strategy almost always requires increased communication and coordination. The entire organization must be re-focused and re-energized. And often there need to be a lot of training and cultural changes.

- Step 4: Fix the big pain points of customers, staff, suppliers, etc.

- This is also important. Identify and fix the things that most annoy people. Whether customers or staff or suppliers.

- This requires data-driven decision making and lots of iteration. It also requires a culture that is fast and aggressive (see Step 3)

- Step 5: Have early wins (small, phased victories).

- This is important to test the strategy and get feedback. You really need to see if it’s working. Plus, you need to constantly re-adjust.

- Early wins also re-enforce the new culture and organization changes. It builds momentum.

- Step 6: Focus on agile tactics and speed.

- Winning is a lot about tactical brilliance and guerrilla execution.

- And it’s about speed. So agile teams and quick decisions. You will always win in chess if you are making twice as many moves as your competitors.

- Step 7: If possible, build a powerful business model or operating flywheel.

- You win with customers and speed but you also want to build something that has real advantages structurally. You want to build a moat if possible. Or an operating flywheel. It also helps if you can access more revenue opportunities over time.

- Measure the Outcomes

- You want to know what the key outcomes are before you start. What are the 2-3 KPIs that the whole team is focused on. These outcomes can be:

- Operational

- Financial

- Strategic

- You want to know what the key outcomes are before you start. What are the 2-3 KPIs that the whole team is focused on. These outcomes can be:

———–

Related articles:

- How Alibaba.com Re-Ignited Growth with the Alibaba Management Playbook (Tech Strategy – Podcast 253)

- How Amap Beat Baidu Maps. My Summary of the Alibaba Playbook. (Tech Strategy – Podcast 252)

- Scale Advantages Are Key. But Competitive Advantages Are More Specific and Measurable. (Tech Strategy)

From the Concept Library, concepts for this article are:

- Alibaba’s Management Playbook

From the Company Library, companies for this article are:

- Alibaba: Cainiao

———transcription below

:

Welcome, welcome everybody. My name is Jeff Towson and this is the Tech Strategy Podcast from TechMoat Consulting. And the topic for today, Cainiao’s big growth despite an uncertain strategy. Now this is another Alibaba case study. I’ve already done two of these. I think this will probably, well three of them actually, this will probably be the last one. But I kind of wanted to talk about this because the other case studies I did AMAP, which is their mapping service, Alibaba.com and then Taobao versus eBay. They were all kind of like big management interventions that had a pretty big success and they fit kind of nicely within a strategy playbook which I laid out which I’ll talk about. This one’s not like that. Cainiao, the logistics business, supporting capability. The strategy has always kind of been unclear and it’s not a engage quickly and knock it out of the park in two years. It’s kind of like a good 10-year history of this sort of messy evolution with an unclear strategy but also very successful. That’s kind of an interesting point to make. So, I thought I’d talk a little bit about the history of that and how that fits pretty much within the same strategy. Well, kind of making the point that look, in practice all of this is a lot messier than any of these frameworks and oftentimes things aren’t clear. and you kind of work anyways. So that’ll be the topic today. It’ll be sort of a case study on how that strategy has worked out well for them by most metrics. So that’ll be the topic for today. Now, housekeeping stuff for today. Let’s see, if you can possibly review this podcast, that would actually be a big help. Preferably positively. If you’re planning to write a real negative one, okay. And ignore what I just said, but generally speaking that’d be good. A review would be appreciated. It does kind of make a big difference. On the tour side, we’re going to announce a new tour in a couple weeks, which I think might be of interest to people, hopefully. And this is going to be a different type of tour than we’ve done before. Usually, we go to China. These are China tech tours. know, a lot of focus on e-commerce, media, things like that. Visiting a lot of the companies you know the names of. But you know there’s a certain price point associated with that and a certain size to the tour because you’re going from Beijing to Hangzhou to Shanghai to Shenzhen wherever. There’s a lot to logistically. We’re going to roll out a new tour that’s going to be based in just one city. It’ll be Shenzhen. But really we’re talking about the Greater Bay Area, Guangzhou, Dongguan, that area. And we’re going to make it very what I would say affordable. Under a thousand dollars. and it’ll be three to four days in Shenzhen and we’re just going to hit tech companies and have lots of speakers and it won’t be flying around the country. It’ll be everyone come to here, we’ll have conference rooms at a really nice hotel and we’ll just sort of take apart these subjects. I think it’s going to be pretty good. I’m pretty excited about it. Anyways, I’ll lay out the details of that in the next two weeks that’ll be finalized and we’ll announce it. It’ll most likely be in November, first or second week of November. We’ll see. Anyways, that’s sort of, don’t know, teeing that up a little bit. Okay, standard disclaimer here. Nothing in this podcast or my writing website is investment advice. The numbers and information from me and any guests may be incorrect. The views in Painted Express may no longer be relevant or accurate. Overall, investing is risky. This is not investment legal or tax advice. Do your own research. And with that, let’s get into the topic. Now, there’s no real concept for today. I’ve been putting this all under the title of, you know, Alibaba’s management playbook. And this is a simple little explanation that I kind of put together, you know, having gone through a decent number of their case studies. I think it’s pretty solid. It’s not rocket science or anything, but it’s pretty accurate overall. I think it’s kind of useful. So, this is going to sort of got within the Alibaba management playbook. You can go over to the concept library on the web page. You’ll see the cases listed there. Two of them have been podcasts. One of them has been an article. This one will be a podcast and an article because I think it’s kind of there’s a lot there that’s pretty interesting. But as I mentioned, we talked about Alibaba’s mapping app, AMAP, which really took down Baidu Maps in 2015, which was then the market leader. That was a podcast on that. We did Alibaba.com, the B2B business, which had a pretty remarkable revitalization in about 2017 to 2018. And then obviously Taobao. which I did an article on for subscribers a couple days ago. Pretty impressive take down of eBay in 2004, 2005, which was kind of a famous story, but I think people really don’t quite know the details. It’s a little more complicated than people think. There was a lot more going on at Alibaba to make that happen than just offering escrow and waiving fees for merchants to list on Alibaba. There’s a pretty robust playbook there, and I detailed that the other day. Anyway, so today is sort of about the rise of Tsai Niao from about 2014 up until about 2022, 2023. And as mentioned, it’s pretty different than the other cases. This was not a case of like, hey, one of the problems with the kind of one of the reasons I wanted to do this was the other three cases all make it look a lot easier and cleaner than it is in practice. It’s like, oh, they turned around the company. Here was the playbook. It was three things, five things. Now in reality nothing’s that clean. It’s messy, stuff doesn’t work, you try 10 things, five fail, maybe two work kind of, maybe you get one. So, these retrospective explanations are really overly simplifying something. These are difficult things and I thought the Cainiao case shows this better. Like this is a messy, complicated evolution. They’ve been very successful but yeah, it isn’t clear. the world’s lot murkier than these, business world’s a lot murkier than these cases sort of imply. So, now most of today’s stuff is from Wan Lin who was CEO of Tsai Niao Logistics. joined in 2014. that’s when they kind of, now they’d always just been doing logistics, but 2013, 2014 is when they spun Tsai Niao as sort of a separate business unit. And he came in and he was sort of there from the start and. You know, it’s still sort of evolving, but he was the head guy. He wrote all this up in a case study, which is publicly available. So, nothing I’m saying here is insider or anything like that. It’s all, you know, there’s an article. I’ll put the link in the show notes if you want to read his article about what he did. Okay, but let me sort of start with the standard, my standard breakdown of what I’m calling the Alibaba Management Playbook. I made a little graphic about this. I’ll put the graphic in the show notes so you can kind of see. It’s really, you know, you got to diagnose the problem, which is not as easy as it sounds. I mean, once you diagnose the problem, you’re 70 % of the way there. But what is really going to fix this? What is actually going to make a difference? Do we really know? Is there really a strategy that’s going to help us tape down Baidu maps? Maybe there isn’t one. You have to have a couple things go right in your world to have an opening like that. So maybe the technology has to have changed people’s behaviors and maybe Baidu hasn’t quite focused on that and that gives you an opening. Some companies, there’ll be an opening. Other companies like Amazon, there’s no opening. They’ll see it just as soon as you do and you won’t be able to sort of take down an incumbent. So, you got to kind of have the right terrain. You got to have the right competitor behavior. and often smarts. It’s a lot easier to take down a dumb company than a smart company. And then you got to kind of figure out the right playbook that’s going to matter for customers and it has to work and most stuff doesn’t work. So, the diagnosis piece is a big deal. A lot of customer segmentation, a lot of looking at technology, lot of looking at competitors, kind of getting a good sense of where the industry is going. The diagnosis piece is difficult. Most people struggle with that. So okay, but let’s say you diagnose what’s really going on, then we come up with what’s the solution. All right, now step one in the Alibaba playbook, in my opinion, is, you know, I see them do this all the time, so I don’t think it’s just my opinion. Let’s reclarify and sort of recrystallize customer value. what matters most to customers and let’s lean into two or three things and hopefully that has changed recently such that we might be able to differentiate. And hit that question hard because that’s the best way to get customers to switch or to get traction or to get growth. And to do that is difficult. Customer segmentation, who’s our core customer, who’s our secondary customer? What do our customers care most about? The core, sort of the white-hot center. We got to lean into that. What is the customer journey? We got to map that out. Is what customers want changing? That’s usually the case. The best way to kind of make big moves in terms of what customers care about and get traction with them is if what they care about has been changing recently, usually because the technology has changed what’s possible and you get there first and lean into it. And then you got to kind of look at your competitors. You know, recognize it looks some competitors, you’re not going to take them down. So, question number one, customer centricity. You know, focus on customer value. And when I talk about motes and marathons, or when I talk about, you know, doing sort of personalization consulting type work, we’re always focused. This is the question we’re focused on. We got to bring more value to the table, not just today, but next week, the week after it’s a never-ending fight. to always up the value. That’s where the rubber hits the road. So that’s step one. Step two. Okay, within that, if you get that crystallized, then you sort of, you got to place your bets on two to three big strategic initiatives that are really going to deliver and move the needle in terms of refocused customer value. If we’re doing 20 different things that are all going to improve customer value, okay, we may have to do that. you’re not going to move the needle with that. You’re going to have to find the big gun. Two or three of them that really hit our core customer value proposition hard. And that’s another big judgment call. Now sometimes you can do that one year, you should see, but you want to see early, and you want to kind of see early feedback on those as soon as possible, because you got to know if it’s working. Now if it’s working and you’re getting feedback, okay, a customer’s responding, okay, then you lean into it and you’re talking about a one-year push. But yeah, you got to get some early feedback, because you don’t want to spend a year pushing hard on something. And it turns out it doesn’t really work that good. All right, step three, transform the organization, the culture, often the skill set, the talent mix of your company. You may be laying off a bunch of people. You may be training people. you may be bringing people in, may be replacing managers who aren’t quite as driven with new ones. That can be a big deal. Alibaba is very good at this. This is kind of what Jack Ma does best in life. He was never really a strategist. He can’t code, but he’s very good at building teams of people and instilling a culture where everybody’s working like crazy towards one thing. I think this is actually his biggest skill set. think Joe Tsai was the brain. And I think Jack Ma was the head of culture and people. But I don’t know, I was never in those meetings, but that was always my impression. And if nothing else, you got to re-energize the group. You want to ramp everyone up. You want people, you know, working seven days a week and sleeping on the floor. I there’s a lot within that piece. And especially in something like, you know, digital this can make a huge difference getting the right skillset matters. Step 4 As you’re doing this, you’ve got your target, you’ve got your big initiatives, your team is amped up, they’re all working like crazy. Within that, the other thing is they want to start removing pain points, especially those that impact the customers. Now, you’re not going to win and you’re not going to steal 20 % of the market by getting rid of two pain points from your customers, but it’s an important thing to do. You always want to be taking those down, making things more convenient. So, I would put that as, that’s totally core. but you’re not going to win there, but it’s important. Go after them, and that could be pain points with customers, it could be pain points with your staff, make them more productive. Could be pain points with your suppliers, your distributors, could be in a lot of places. You always want to basically be doing things better. Okay, step five, you got to have some early wins. You got to have small, phased victories, even though you got the big playbook and you think your strategy’s working. You got to build momentum. You got to see the numbers move, hopefully within three to five weeks. And that sort of reinforces the culture. It gives you momentum. People feel like, okay, the new culture’s working, the new strategy’s working, let’s keep going. That’s pretty important. It also matters if you’re allocating resources and you’re having to make big financial bets or big bets in terms of what your staff is doing. hard to keep doing that over a year or two if you’re not seeing wins. The decision gets harder. Why are we spending all this money on that? Step six, focus on sort of agile tactics and speed. My favorite analogy for speed is if you’re playing chess against your competitor and you’re moving two times for every time they’re moving once on the chessboard, you’re going to win. Well, you can’t do that in chess, but you can do that in business. If you’re making two moves for every time your competitor makes one, you’re probably going to beat them. So, a lot about speed that comes down to culture, comes down to sort of, you know, this maniacal behavior, comes down to organizational structure. Maybe we need to put ourselves into teams, into pods, into squads. There’s a lot of names for that. It’s a lot about such sort of guerrilla execution. you know, crazy little marketing tricks that no one else is thinking. You’re just moving so fast, you’re creative, your teams are moving and very innovative. That’s going to play out everywhere, especially on the marketing side. At step six, step seven, last one, and I haven’t talked about this one, I’m going to talk about this today. Within everything I just said, you could do everything I just said running a restaurant. Probably not going to work that well. because ultimately your business model’s not that powerful. You want to do a game where if you’re doing the previous six things well, and you’re getting traction, and you’re winning market share, you want to be in a business where if you’re more successful than your competitor, your business model becomes more powerful. So, you want to have a moat. You want to have a business model that’s got some power to it. You want an operating flywheel. But if you’re just doing one through six without that, okay, maybe you’ll do well as a restaurant on a street corner and you’ll have more market share, but you want a game where like if you win for a couple years, you’ve won for 10 years because the business power you get by being successful is so much better. And Alibaba actually does this. virtually every business they’ve built has a marketplace platform or some other type of platform with network effects. they do not spend their time and effort with all these steps one through six if it’s not in an area where the winner gets tremendous sort of market power. So yeah, you’ll always see them do those two things together. Okay, that’s kind of the playbook and then you got to measure the outcomes. So, diagnosis, seven steps, six of them are really about operating tactics and then the seventh is about modes and then. diagnosis. You’ll note that sounds a lot like the motes and marathons playbook I always talk about. You’re building a moat but you’re also running a marathon. It sounds a lot like the customer improvement consulting we do. You know, we’re going to focus a lot on the interaction with the customer and making it more powerful, improving the experience, impersonalizing it, adding new services. And you know, then in addition, we’re going to focus on strengthening the moat. It’s kind of very similar actually. Okay, so that’s the basic playbook. Let me sort of get into Cai Niao now. Now, as mentioned, the previous three case studies I did, Taobao, AMAP, Alibaba.com, I didn’t talk about the modes. I didn’t talk about the business model. But those are all platform business models. I mean, all of them. They all have network effects. They all have competitive advantages. And they are all in industries. where it was really either a monopoly or an oligopoly. So that’s important sort of thing to point out. These are not highly fragmented businesses that that playbook was being deployed in. But I didn’t really talk about step seven for those, which is be a powerful business model, build a note. But yeah, that was a huge part about why those playbooks succeeded. Now, reason I don’t talk about that as much is because most investors, most businesses, can’t really, you’re in the business you’re in. If you’re doing hotels, you’re in hotels. If you’re doing auto mechanic shops, you’re in auto. It’s not like if your business doesn’t have a tremendously powerful business model, you can just jump into another industry. Now, VCs can do that and investors can jump around and target the best and entrepreneurs can, but you know. Most people I’m talking to, you’re in the business you’re in. So, I don’t talk about that as much, because we’re not really going to jump from business model to business model. What we are going to do is look at the business model we have and strengthen the moat as much as possible where we are. So, if you’re a manager, that part’s a bit different than if you’re an investor just trying to identify the best business models. Okay, that gives me, tease up Tsai Niao, because… For most of the past 10 years, Sinao did not really have a clear business model. Even today, I don’t think it’s that clear. And to be fair, I don’t think Amazon Logistics has a super clear business model. I don’t think JD Logistics has a real clear business model. I think these e-commerce giants that have a logistics capability, they’re always a bit stuck between is this a capability that enables e-commerce, which is where we make our money, or is this a standalone business unit that needs to have its own independent P &L and compete as a business? And most of them, I think, are pretty unclear. I think they kind of go back and forth. A couple years ago, when Alibaba decided we’re going to reorganize, we’re going to have six main business units instead of the big conglomerate, which was a big move. One of the business units was Cainiao. They’re going to have a P &L and the key managers that took over there, Joe Tsai came in, you he’s chairman of the whole group, but he was also chairman of Cainiao. And he started talking about doing a private capital raise for Cainiao with the idea that, this is going to be a standard P &L. Well, that all kind of got canceled or something. Now it’s starting to sound a lot more like an enabler for e-commerce. And you know, Amazon’s kind of done the same thing. I think JD is probably the clearest in terms of they really built JD Logistics into a separate business unit that’s going global in a way that the e-commerce business is not. So, it was interesting to read this case study because Wan Lin basically joined Cainiao in 2014. And he basically said one of the first discussions they had was, you know, what kind of business is this? What’s our strategy? And you start to get into questions like, okay, are we a logistics business or are we a technology business? Are they separate? Well, back then they were pretty separate. Is it a platform business model or is it a service business? Okay. Is it a domestic business? China? Is it domestic plus cross border? Could be supply chain coming into China. Could be China manufacturing to the world. like Tmall? Is it a global business? Are we building a global logistics network like DHL? Now those are not small questions. Other ones might be, as said, is this a profit center or is this sort of enabling capability for e-commerce? Is this going to be asset light or asset heavy? Are we going to own all these trucks and factories and delivery dudes on scooters? Or are we just going to contract with people and we’re going to kind of be the digital nervous system that connects lots of warehouses and delivery people and all that? How are we going to do it? Well, going into the history back when it was started 2014 or spun out, here’s a quote from the case study that, as Jack Moss stated, Tsai Niao wouldn’t directly engage in logistics, but would assist others in the field. He emphasized that we are a technology company not intending to exceed 5,000 employees. So, they were really at least the first stab at the strategy and business model was to be an intelligence backbone for logistics companies. We’re going to tie everyone together in a digital nervous system, but we are not going to run all these warehouses and trucks ourselves. And okay. That was an interesting approach and here’s some other quotes from it. Now that’s really interesting because that’s just like asset light, right? We’re not going to have all those heavy assets on our balance sheet. And obviously if you look at Cainiao today, that is not at all what they are. But OK, back then they start doing this. They built three networks back then. This was overwhelmingly domestic logistics. They built an aerial network, a ground network, what they called a human network. Aerials, obviously planes and stuff. Ground is you buy a lot of land or you contract a bunch of land rented. You have a bunch of warehouses; you have a bunch of trucks. And then the human network is really mostly delivery people, service stations, offices, everyone who kind of engages with customers, people dropping off or picking up packages, that sort of thing. Now, you know, over time that became five networks, one horizontal and two, they’ve had a lot of different names for this over the years. Almost every two years there’s a new sort of terminology they used. If you actually visit Tsai Niao in Hangzhou, which we’ve a couple times last year, they have actually a history of the strategy. you can actually, I have a photo of it somewhere. You can see how the terminology changed about every two years from 2014, really up until now. So, kind of interesting. Okay, so you have this sort of muddy. Strategy, still figuring out what they were. They had a stab at it. We’re going to be an intelligence backbone, asset light, not going to do operations ourselves. Okay, fine. Now, we don’t really have a clear diagnosis. We don’t really have a strategy. We don’t really have two major strategic initiatives. What we have, they have, we had tremendous e-commerce growth in this period. Tmall and Taobao were rocking and rolling in 2014. For those of who were back in China in those days, e-commerce was a rocket ship back then. And the number of packages moving around China was going through the roof. And then you had singles day every 11, 11, and the numbers went up by a factor of nine or 10, and the logistics systems couldn’t handle it. So, it’s sort of like, do we really need that strategy at this point? Are we just trying to stay vol- We’re just trying to stay on top of this wave that we’re riding and we’ll worry about strategy later. Let’s just get through this next month. Which I think is pretty much what they did. And so really what you get from reading this whole period 2014, 2017 in that area, they were just addressing stuff that was breaking. We would call that step four, fixing the big pain points of customers, staff, suppliers, as mentioned in the playbook. So, this whole Alibaba playbook, it’s like we don’t have a diagnosis, we don’t have one, two, or maybe we have three, but we got number four. We’re going to keep growing because the wave is huge and we’re going to just take care of the things that are breaking, the pain points. And in the first years, this from the case study, it was the warehouses. The warehouses were overloading and especially during singles day. know, T-Mall was booming, the volume was going through and you know, the system was just breaking. And they were building out their sort of operating footprint, whether owned or contracted, as fast as they could. they bought a tremendous amount of land. And they built warehouses everywhere. And the strategy still wasn’t clear, but they were building out their capabilities to keep up with the booming demand and throughput. Within all of that, according to He said basically the big pain point, also called the bottleneck sometimes, was the sorting centers. The packages come in from the suppliers, the merchants, you got to separate them all, put them into the bins, take them to the other side of the warehouse, put them in the right trucks. The sorting was the problem. And that was getting your warehouse overflows, that was getting your unhappy customers. So, they introduced the electronic weigh bill. And if you visit the Tsai Niao headquarters, they actually have the first waybills. They built these digital waybills, which, you put the sticker on the package, you scan it with a gun, but you basically create a digital backbone for everything in the system. And you can start to see things move over time. Well, one, it saves you a lot of paper and a lot of scribbling and not having visibility or transparency into what’s going on. But it also dramatically decreases sort of the steps in the process. So, this is kind of the first step of digitization. From there you can start to capture all sorts of benefits, you can start to automate first steps, but and they basically said according to the case study the sorting capacity went from 10,000 packages per hour to about 25,000 packages per hour. So just the digitization solved a lot of that problem. And he kind of says you know we didn’t hear too much about warehouse overflows you know in 2015, 2016 during double 11 right singles day and then he says the big bottleneck the big pain point was last mile getting the packages and that’s still the problem for most logistics today is last mile how do you get the packages to people and this is when they start building out their Tsai Niao post their Tsai Niao stations which are fantastic if you I’ve written about these before I’ve got videos and photos from going to these basically like little post office stations all over the country where you can go in, scan your phone, pick up your package. They’re super cool. Really quite impressive. So, they kind of started going after that, but you’ve still got the delivery people going around and really that same year 2015. I think that’s when their first pass at strategy kind of fell apart and they started to build an integrated warehouse and distribution supply chain. where it’s like, look, we need lots of warehouses, we need lots of trucks, we need to be operationally active. This idea we’re going to lease everything out, not going to work. And keep in mind, their big competitor during this period was JD Logistics, which had already made these decisions six years before, that we’re doing everything internally. We’re running our own warehouses, we’re having our own trucks, we’re having our own delivery guys, we’re going to have one internally run. And they hired literally hundreds of thousands of people to do this. So, it’s pretty clear I think their first pass at being the digital intelligent backbone kind of didn’t work. So, they had had sort of point-to-point parcel delivery, but if you’re going to address merchants warehousing needs, they want to drop off their supplies, put them in your warehouse, and then when people order them, they go from your warehouse out to the customer. That’s when they started to build what they have today, which is their integrated warehouse and distribution system. Now that gets us to sort of 2017, 2018, not exact, but sort of approximate. And things are starting to change. It’s not just domestic e-commerce anymore. Cross-border e-commerce starts to emerge. And rural e-commerce starts to emerge. Suddenly we’re connecting, you it’s not just the major cities, we’re going out to the small villages. the fifth-year cities, which are actually quite big, but more rural. the network during all this time when you’re dealing with pain points and putting in the waybills and building out last mile into us, at the same time, the volume is still going way up, not just domestically, but now you’re expanding into new areas like rural, cross border. And guess what? We got to build even more warehouses and more distribution centers. So, you’re just kind of building capability to keep up with demand and fixing stuff as it breaks. That’s kind of the strategy. I wouldn’t call it a strategy, but yeah, kind of, you know, do whatever you need to do this month, this six month, and there you go. So, you know, this period, they start talking about other networks they have, their last mile. If we get to 2018, yeah, the strategy and the business model, still not clear, still, this is according to the case study, still a recurring debate. Are we a platform or are we a direct operator model? Are we a tech company? Are we a logistics company? Still sort of doing that. And according to one Lin, he basically said, here’s a quote. from the article for Cainiao, I decided that before discussing business models, we should talk first about who our customers are and what customer value means. It’s easy to skip these discussions and jump into debates about whether we should be light or heavy, a platform or a direct operator model. Everyone would argue very passionately. Therefore, at this point, we decided to start with customer value. Clarify what it is and then decide whether a platform or direct operation model would better achieve customer value. Whether a heavier or lighter approach would be better. So, it’s almost like the playbook is step four, fix the pain points. Kind of step two, like we got to build strategic capabilities pretty much to keep up with demand. And then we go back to question number one. Let’s re-clarify as much as we can how we add value. and try to crystallize that. And whatever it takes to achieve that, we’ll do it. And it may turn out, which is I think true, it may turn out that what we need to achieve the customer value we’re trying to build doesn’t fit cleanly in any bucket of strategy A versus strategy B versus business model A, business model B. Sometimes it’s not a plane and it’s not a boat. Sometimes you got to stick wings on a plane and put some tires on it as well. And that’s what it is. It ain’t a plane. It ain’t a boat. It ain’t a car. It’s what it is. Why? Because that’s what we need to deliver to our customer value. And I think that’s kind of where they are. I think in the last couple of years, it’s actually gotten cleaner. yeah, they say like these business models, they’re tools. They’re not necessarily goals in themselves. This is from him. When we need to go heavy, we will firmly go heavy. When we need to operate directly, we will firmly do so. When we need to be a platform, we will firmly become one. know, focusing on customer value, we began to determine a move towards industrialization in the areas we wanted to improve. And to their credit, they bought a lot of companies. In a couple years, they bought four last mile delivery companies. They bought two of the largest warehouse companies in China. So, I mean they were integrating into their operations seven or eight companies in a couple years. Right, that’s it’s kind of really fun to think about. It’s like let’s do business without a strategy or a clear business model and it’ll be what it’ll be. And so, Tsai and Yao went from an organization of about 3,000 people to one of over 10,000. And it was in a couple years. And then you fast forward to 2022 or so. Okay, Cainiao’s got 14,000 employees, but they got 60 to 70,000 outsourced workers. So, they’re kind of a mix. you know, they’re about 110,000-person organization, depending on how you measure things. And they got to manage all of them. here, you know, according to them, or according to him at this point, we see ourselves as a logistics company. We leverage data and the internet to become a unique digitalized logistics company. So, they’re a digitalized logistics company. Okay, I don’t know what that is. It just sounds like you put the two words together. Are we a tech company or a logistics company? Well, we’re a digitized logistics company. Okay, so you’re saying you’re both, or you’re one thing. And the truth is, I don’t know what these business models are either. I’ve kind of said this before. I don’t know what it means when you take a logistics company and you digitize it and you make it smart and connected and increasingly autonomous. I’ve never seen a business model like that before. it’s a, is it an operating system? Is it a sort of a service that moves things around the economy at will on its own? This is a new animal. I’m not quite sure what it’s going to look like. Now they also, they did put a couple stakes in the ground in all of this, I think are cool. Number one, they said, we’re going to be global. This digitalized logistics company; we are going to be a global network. And they have very aggressively built a global network. They can ship anything within China. They can ship anything from China to most parts of the world. And they are increasingly being able to ship things between other parts of the world that don’t include China. know, global. They’ve also said like the largest players in sort of integrated logistics are UPS, DHL and FedEx. They want to be one of those top three to five global players. Those are pretty awesome business models. So, we kind of know what that is. you and you could, you could make a very good argument. Yeah, that makes sense that a Chinese company should do it because China’s 40 % of global manufacturing output. So, to have a China player be one of the top three to four global logistics players makes great sense. So yeah, you can see that, okay, you may not know the exact path, but it sure looks like they’re pointed in the right direction. Anyways, and I think that’s kind of what I wanted to cover. I’ll put the case study, I’ll put a link to it. It’s a good read. It’s very interesting to see how they kind of work through it. I think it’s a nice contrast. I think it’s still roughly the Alibaba playbook. I just think it’s how do you apply the playbook in a situation where things are uncertain, you’re dealing with massive sort of tidal wave of demand and you know, forget the business model, we just got to keep up with filling orders and the idea that you’re building something that doesn’t really fit into any bucket yet in terms of what this business model is strategy is. And so, a decent approach is all right, let’s not try and diagnose everything, let’s just do step four. fix all the pain points. Step two let’s build the big capabilities that we need. And step one, let’s just keep serving our customers and clarifying and crystallizing as much as possible what value we give to them. And then whatever it takes to deliver that, we’ll do it. And if we’re half a platform and we’re half an industrial service company, then that’s what we are. If we’re super asset heavy in some places and asset light in the other, then so we are. And I think that’s right, because I actually don’t know what a smart logistics company is going to look like yet. We’re about halfway there. I don’t think Amazon’s figures out either. I don’t think JD Logistics has totally figured it out either. But I think it’s kind of halfway clear at this point. And I definitely think these e-commerce companies are going to change how we see this stuff. So anyways, that’s my take on all of that. Kind of a fun case. I’ll write this up as an article for subscribers in the next day. put a little more detail in there, put the graphics in there as well, which I find it easier if you can kind of visualize this stuff. As for me, it’s been a pretty decent week. been, I got a new China visa, which is 10 years, which is really just great. Like I spent so much of my life getting visas for things and adding pages to the passport or replacing. I mean, I do this all the time. And the fact that China like has this nice seamless process and I guess if you’re… At if you’re an American, you can get a 10-year visa. So, my 10-year visa just is expiring. I got a new one and it’s going to save me. I’m pretty actually pretty happy about this that things still work that well. So, I guess that was kind of good news. Grok, for those of you who’s Grok or, you know, it’s on X, they released a new feature, which was really amazing. It’s, if you go into Grok and do imagine, it’s a, It’s basically an image generator. So, you hit the imagine button, but if you put the microphone on, do it by speaking, not by like typing. It’s really amazing. Like you can say, create an image of an X-wing star fighter flying through the, you know, the, between the buildings of Coruscant. And it will create four pictures in about two seconds, right? You’ll see them. And you can immediately give it another order like, Make the X-wing black with red stripes. In one second, two second, it’ll replace the images with another four, changing it. Make their clouds in between the skyscrapers. And you can just talk to it and do five iterations of what you want. You know, keep improving it. Every two seconds, three seconds. It’s really amazing. then, okay, now make it in the style of a Pixar animated movie. And it starts to look like pix- Like try it, it’s blown. mean, there’s every now and then a new AI tool comes along that’s like, wow, that’s amazing. Like they’re all good, right? They’re all good. But every now and then one is like, that’s amazing. I’ve never seen anything like that. It was like one of those moments. And then what you can do is you download one of the pictures you like and then you upload it and it turns it into a video right on the spot. So, I was making like Pixar type animated characters. in 10 seconds, 20 seconds, reanimating them, making them move. Yeah, go on to Grok and just play with the imagine, but do it by voice, don’t do it by typing. Yeah, that’s kind of blown me away. It’s pretty awesome. And they keep upgrading, like Grok is upgrading at a crazy speed. anyways, that was my sort of discovery for the week. Okay, that is it for me. I hope this is helpful. And if you have any questions about… you know, going to China in a couple months. Send me a note. I’ll send out the details in the next week probably. But yeah, that’s going to be big deal. Okay, that’s it for me. Talk to you next week. Bye bye.

——–

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

Note: This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.