This week’s podcast is about how Alibaba.com restructured its business and re-ignited growth in 2017-2018.

You can listen to this podcast here, which has the slides and graphics mentioned. Also available at iTunes and Google Podcasts.

Here is the link to the TechMoat Consulting.

Here is the link to our Tech Tours.

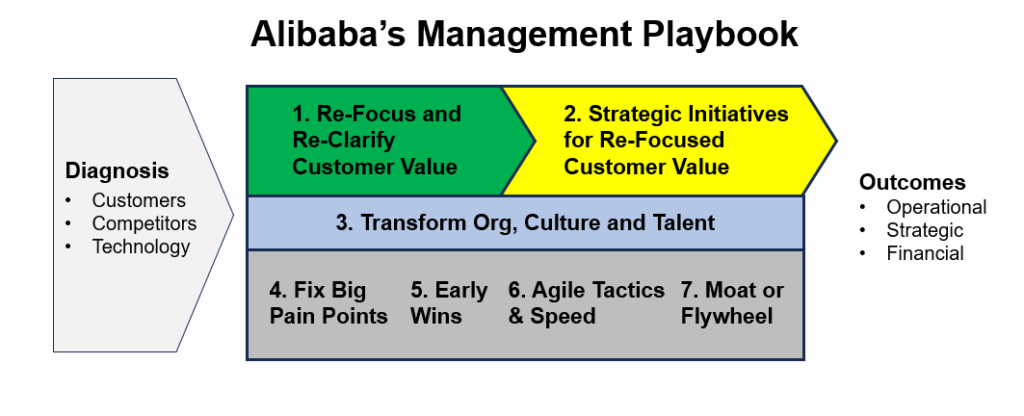

My summary of Alibaba’s Management Playbook:

- Diagnose the problem

- This is always first. And of course it is the key. If you don’t get this right, nothing else matters. And proper diagnosis takes a lot of data and expertise. Usually an entire team. You really can’t get this wrong.

- This is also where you incorporate industry assessments, competitors, customer behavior and technology and/or regulatory changes.

- I like to focus on two specific questions:

- What is the chief complaint? Stagnant growth? Low NPS?

- What is the differential diagnosis?

- Step 1: Re-clarify and re-focus on customer value.

- This is the most important part of the strategy. Putting customers first and being very specific about how you add more value than competitors. This includes:

- Customer segmentation. Identify exactly who you are targeting. What are you after (revenue)? Traffic? Data?

- What do they most care about?

- What is the customer journey? Map out the process.

- Is what customers want or care about changing? Tech change? For example, PC to mobile changed what maps could do.

- What is the competitor offering and how you are going to take their customers with our re-focused value? Are they weak or strong? What are they getting wrong?

- This is the most important part of the strategy. Putting customers first and being very specific about how you add more value than competitors. This includes:

- Step 2: Launch 2-3 key strategic initiatives that deliver the re-focused customer value.

- This is where we translate Step 1 into 2-3 big initiatives that will make a difference. They have to move the needle in terms of re-focused customer value. But they also need to be feasible in 6-12 months.

- Step 3: Transform the organization structure, culture and talent.

- Revitalizing the organization and getting everyone focused on the new strategy almost always requires increased communication and coordination. The entire organization must be re-focused and re-energized. And often there need to be a lot of training and cultural changes.

- Step 4: Fix the big pain points of customers, staff, suppliers, etc.

- This is also important. Identify and fix the things that most annoy people. Whether customers or staff or suppliers.

- This requires data-driven decision making and lots of iteration. It also requires a culture that is fast and aggressive (see Step 3)

- Step 5: Have early wins (small, phased victories).

- This is important to test the strategy and get feedback. You really need to see if it’s working. Plus, you need to constantly re-adjust.

- Early wins also re-enforce the new culture and organization changes. It builds momentum.

- Step 6: Focus on agile tactics and speed.

- Winning is a lot about tactical brilliance and guerrilla execution.

- And it’s about speed. So agile teams and quick decisions. You will always win in chess if you are making twice as many moves as your competitors.

- Step 7: If possible, build a powerful business model or operating flywheel.

- You win with customers and speed but you also want to build something that has real advantages structurally. You want to build a moat if possible. Or an operating flywheel. It also helps if you can access more revenue opportunities over time.

- Measure the Outcomes

- You want to know what the key outcomes are before you start. What are the 2-3 KPIs that the whole team is focused on. These outcomes can be:

- Operational

- Financial

- Strategic

- You want to know what the key outcomes are before you start. What are the 2-3 KPIs that the whole team is focused on. These outcomes can be:

——

Related articles:

- How Amap Beat Baidu Maps. My Summary of the Alibaba Playbook. (Tech Strategy – Podcast 252)

- Scale Advantages Are Key. But Competitive Advantages Are More Specific and Measurable. (Tech Strategy)

- The Characteristics of Unattractive Industries with Cutthroat Competition (1 of 3) (Tech Strategy)

From the Concept Library, concepts for this article are:

- Alibaba Management Playbook

From the Company Library, companies for this article are:

- Alibaba.com

———–transcription below

Welcome, welcome everybody. My name is Jeff Towson and this is the Tech Strategy Podcast from Techmoat Consulting. And the topic for today, how Alibaba.com reignited growth. So, this is another sort of historical Alibaba case study, 2017, 2018 period, about Alibaba.com, which is the B2B business that really started Alibaba. They did that before they got into B2C e-commerce. And, you know, it’s sort of been on the sidelines quite a bit, but there was some pretty cool stuff that happened 2017, 2018, 2019, really ignited, turned around. So, I’m going to sort of talk about that as a case study. And then out of that will come my little simple version of what I call the Alibaba Playbook, the Alibaba Management Playbook. They’re very good at training digital executives. They’re outstanding at and there is sort of a common pattern you see in how they approach problems and situations. So, I’m going to out of this case study, I sort of have my six points within that, which is similar to what I talked about last week when I went through the AMAP versus Baidu Maps case study, also another Alibaba one. So, sort of similar to that. We’ll do a same approach this week. And that will be the topic for today. Now let’s see housekeeping stuff. We have tours coming up. This is kind of coming up sooner, a couple months now. And we actually, this is not 100%, but I think it’s 100%. We’re doing something called the Urban Tech Tour, the China Urban Tech Tour. Where we go look at infrastructure in China, real estate, how they sort of develop infrastructure, connected cities, smart cities, green cities. But over time, as we’ve talked to people about going on this, it kind of broadened to things like just getting a better understanding of the overall business systems of China, understanding the economy better, understanding how things work. And it kind of started to sound a lot like the One Hour China book because the two people that are doing this tour are myself and Lola Woetzel, who is a senior partner emeritus at McKinsey, basically opened their Shanghai office in 1994. Well, about 10 years ago, we published… short book called the One Hour China book which for books did quite well. Books is not a really great business, but that was actually pretty successful as a book, know, bestseller list for almost four years. Anyways, we’re starting to call this at least internally the One Hour China Tour and I think that’s maybe what we’re going to, what we’ll decide this week. It’ll include all the urban stuff we just talked about, but we’ll expand it to sort of cover the major six Trends that we think shape China number one on that list has always been urbanization Digital China is another one Manufacturing scale so yeah, I think it’s going to end up being the maybe the one-hour China tour We’ll see but still includes what I talked about before anyways if you’re interested in that It’s going to be September the dates still not a hundred percent set but in that range Yeah, go over to Jeff or thousand group comm and just look up the tours TecmoConsulting.com and you’ll see the details or send me a note. Anyways, I thought that was kind of fun. Kind of excited about that actually. Anyway, okay, let me get into the topic. Wait, disclaimer, nothing in this podcast or my writing website is investment advice. The numbers and information for me and any guess may be incorrect. The views and opinions expressed may no longer be relevant or accurate. Overall, investing is risky. This is not investment, legal or tax advice. Do your own research. And with that, let’s get into the topic. Okay, there’s not really a concept for today. This all goes under the heading of Alibaba Management Playbook, which again is totally my opinion. And I actually was in in Hangzhou earlier this week. I went out and just a couple days went to, it’s kind of an Alibaba couple days actually. I was teaching at Alibaba’s Global Initiative, the Alibaba University thing, which is basically doing sort of an overview of digital China, how to think about the ecosystem, how to… view its development over 25 plus years to a bunch of entrepreneurs, which is cool. That’s a nice, first time I’ve done that. It’s a nice change from teaching MBAs, which is fine, but it’s different. So that was fun. And then I bounced over and talked with Cainiao and group, the international division AI, AI DC. I always get it confused with the international e-commerce group. So, sort of touch base and it was great. I had a good time. learned a lot, took a lot of notes, which is usually my goal. Yeah, so kind of thinking about Alibaba this week. And then of course on the way to the airport, was in the car and I look up and of course I’m going right by the DeepSeek office. Like literally it was the only time I looked out of the car. I looked up, I’m like, hey, that’s the DeepSeek office, which is not, there’s no labels on it or anything. You just kind of have to know where they are. And they’re up on whatever, the 12th floor or something. So, whenever I go by, always look at, there’s a Family Mart in the office. I’m sorry, in the lobby. So, if you go down at the base of the lobby for the building, there’s a family mart. So, I always take a look in the family mart to see like, if I’m ever going to run into the CEO, it would probably be at that family mart, you are getting a snack or something. But alas, nobody in the family mart. Anyway, so that was my thing. So let me sort of get into alibaba.com. I wrote a lot about alibaba.com seven years ago. There was, more like, six, like 2018. There was a big push by Alibaba.com, the B2B business, to sort of go into the US. And really what you’re doing is you’re connecting medium and small businesses with Chinese manufacturers. That’s the core transaction. And my little statement, which Alibaba, by the way, totally copied. I kind of said, you you’re basically letting SMEs do everything that MNCs can do. You’re letting SMEs, small and medium enterprises, operate like multinationals. Because multinationals have always been doing their supply chain into China manufacturing. So, you’re creating a suite of tools and a platform business model that allows that to happen. That was my little thing. And I swear to God, like two months later in their advertising for Alibaba.com, they used that phrase, which I’m pretty sure came from me. So anyways, that’s kind of the corridor that they were talking about back then. And they did a deal with, I think it was Office Depot or Office Max in the US, where a lot of SMEs would go shop to connect them with Chinese manufacturers. And the tools, it would be a marketplace platform, obviously, connecting buyers and sellers. And then you would have a suite of tools that would overcome the difficulties that you see in cross-border e-commerce that you don’t see domestically, like language. So, there’d be, you know, real-time translation. You could FaceTime video call with a manufacturer and you know it would be on-screen translation. You could do virtual walk-arounds of factories and then of course you can handle things like customs, taxes, because if you’re an SME you don’t know what taxes you have to pay. You don’t know how to get it through customs. Well, they handle all of that. And then of course dispute resolution and payment. So, Alibaba handles the payment and if there’s any issues, they resolve it. So, you can do it kind of comfortably. It’s actually really great service. If you haven’t played on Alibaba.com, I mean, you can do crazy stuff. that was kind of the main idea. But there’s a bigger idea that floats above this. And the bigger idea is what’s the TAM, the total addressable market for this? Is it just looking at the supply chain of US companies into China and we’re going to digitize 30 % of it? Or… Are we really digitizing global trade? Most, actually we’re doing more than digitizing it. We’re democratizing it. Global trade to a large degree is a game of the big boys. It’s multinationals and major companies putting things in cargo ships and moving them around. Okay, we’re digitizing that, a percentage of it. Let’s say 30%, who knows? But we’re also democratizing it. We’re letting SMEs do global trade as well. So, it’s not just that like, I’m an SME in Texas with 10 employees and I’m making custom furniture and I source my supplies out of China, which I might. I can also source other goods from India, the Philippines. I can access the whole world. And when I put together my furniture in my small warehouse, I can then sell it to Japan, Britain, like all of global trade. could sort of be democratized. And so, when you think about the TAM in that regard, you’re like, oh my God, this is huge. know, Alibaba is the biggest e-commerce player in China because China is the biggest market for that, for e-commerce. But a global market dwarfs that. If you could be an e-commerce company that has a monopoly or duopoly system, you know, let’s say position in all cross border global trade. How big is that? I don’t know, but it’s big. So, there was a bigger idea floating around. This is why Jack Ma and the couple years before he sort of stopped doing operational duties within Alibaba, he was basically ambassador going around from country to country, meeting with various ministers of trade and setting up the EWTF, like the electronic version of the World Trade Federation. So, is that what WTF stands for? I don’t know what the F stands for. You get it. He was trying to… get all the policies in place in country after country that you would need for seamless digital transactions to cross borders. You need logistics, need customs, you need taxes, you need everyone to kind of sign up to the same set of rules. So, he did a lot of that. Anyways, it kind of faded as a topic when China got a lot more political in the United States and for other reasons. And that whole US to China thing that was being worked on with OfficeMax, I think it was sort of faded away. But it’s a really cool idea and I would argue we’re seeing it come back now. Shein and Temu have shown that hey, cross-border e-commerce, which is typically 10 to 15 % of commerce in a country’s cross-border, let’s say somewhere like China or the US. In smaller countries it can be much more because you don’t have domestic production as much. Okay, it’s pretty big on the, it’s medium size on the B2B side. It’s massive on the B2C side. Hence, Xi’an, hence, Temu, hence, AliExpress. So, it’s become a big topic again, sort of. Okay, that’s background. Now, let’s talk about alibaba.com 2017, 2018. And this is from a case study which I believe is HBS, not 100 % sure. Anyways, I can’t share it because it’s not public in that way. Or at least I don’t have the rights to do so. So, I’m going to sort of summarize what I learned from reading this. as opposed to sharing other people’s work. Anyway, the key person here is Zheng Kuo, who was, you know, basically became president of Alibaba.com in this period. He was general manager, then became president. And you know, these things always move around to different divisions. We’re talking about Alibaba.com, not the other international e-commerce businesses, which they have several. So, he basically, you know, steps in and starts looking at IC, or they call it ICBU, but we’ll call it alibaba.com. The big problem here really was sort of low growth, which you would call stagnant in China. Anywhere else you’d call it single digit growth, but in Chinese e-commerce, you’d probably use the word stagnant, something like that. And it wasn’t just that, the problems that they lay out is like the growth had been stagnant for, let’s call it single digit, for quite a while. You have the buyers and the sellers. Sellers were generally not terribly happy. The NPS scores and stuff were not great. And addition, when you do this sort of cross, what’s interesting about this case, and I think this company, is you have a couple interesting groups that have to work together. You have a whole lot of software people that are building the tech and the digital stuff. But you also got sort of a sales force that’s going out there. and meeting with manufacturers in China because most of your revenue is coming from selling services, marketing, logistics services, and other services to sort of, you know, very attractive manufacturer candidates within China. So, you have sort of a sales force, which is a different group of people. I mean, they’re knocking on doors. They’re out there. The factories of China are not in Beijing and Shanghai. You’re going out to Hunan and you’re going to, it’s really kind of fun to tour factories in China. You’re going to Guangdong, Guangdong for sure, but it’s sort of a different group. And then in addition to that, you have to provide a certain number of services that enable the cross-border transactions. You have to have customs people, tax people, rebates, returns. Well, that’s kind of a different group of people as well. So, you got three different cultures almost that are having to work together. And one of the areas, you know, they talk about in the case, and I think this was maybe the biggest impetus for this guy to jump in and try and fix this thing was they were losing significant money on those supplies, those sort of customs and supply side services, which has to do with how you get your tax. You have to sort of guarantee you’ll take it, then you’ll have to get the rebate and get the money back. They were losing money, basically. So, nothing gets management more engaged than significant persistent losses usually get something to happen. A low MPS might do it too. Anyway, so multiple problems back then. But the way I think about it is, okay, you’re connecting a lot of SMEs around the world, but mostly in a couple countries, US and others, with these manufacturers in China. So, it’s a marketplace business model, buyers and sellers. And then the question is always, who do you make your money from? Usually in e-commerce, you make your money more from the sellers. So, their revenue. And according to the case, they were really focused on sellers mostly. So, you get membership fees. You can be our gold China, China gold supplier program where you get premium listings and you get more exposure. We can do pay for performance advertising. You’ll get seen, we can add lots of value-added services, logistics, but then also you get things that are more export related like customs clearance, tax rebate processing. Things like that. you know, the summary then was like it was overwhelmingly mostly focused on sellers. The buyers viewed much more as traffic. Okay, that’s a really simplistic summary, but it’s okay for this discussion. Okay, so what was going on? As mentioned, growth was stagnant, performance was declining. The… service chain, the supply chain service unit, which was called yidatong, big financial losses. I can’t find the exact number, but the word huge keeps popping up everywhere I look. basically, something to do with the tax rebate policy. I haven’t been able to figure out what it is. Losing a lot of money. You got these internal culture and team issues. You got the internet people trying to deal with the old school trade people. trying to deal with the sales force going out and meeting manufacturers. so significant problems, financial loss, slow growth, the NPS score for the yidatong, the supply chain servicing dropping. Okay, that’s an interesting sort of starting point. Now I think we can sort of jump over to, okay, what would I call the Alibaba management playbook? How would I look at this? And there is a process to this. I advise companies, this is kind of when you get a phone call from a company. They’re worried about their road. They’re worried about the MPS score. They’ve got a loss. It’s kind of a consultant type situation. So, you I always come in sort of kind of pretty much the same way a doctor would come in. You come in with two goals. First goal is two questions. What is the chief complaint here? It’s very easy to talk a lot of things. that are problem-magazine company. You can talk about problems forever. No, tell me your chief complaint. What got you to come into the office today? Well, my knee hurts. Okay. So, no matter what else is going on here, we got to solve the chief complaint. You solve a lot of problems, but you don’t solve the reason that the person came into the office. They’re not going to be happy. So, what’s the chief complaint? I would say it’s probably the financial losses and the single-digit growth. I think that’s probably the other stuffs important. I would put that as what’s the chief complaint. Okay. Then you got to sort of diagnose the problem. Okay. We see the outcomes. We see the NPS door. We see the single digit growth. We see all this. Diagnosing what’s going on. That’s where, yeah, that’s where a lot of judgment comes in. That’s actually, you know, what I’ve spent 20 plus years doing. Okay. We can talk about this forever. We can look at metrics forever. can look, but we got to sort of cut through all that and say, look, this is the diagnosis. This is what’s really going on here. You got gout in your knee. That’s it. Now for business, it’s trickier because things can come at you. It could be a strategy problem. It could be your product’s no good. It could be your team are just not executing. You know, it’s a little, there’s a lot more judgment involved. The other, you know, the other problem is if you think, okay, diagnosis is its gout. This is why we’re going to give you a pill or something and you can see if it works and then you can get some feedback. Okay, come back a couple weeks, it didn’t work. Okay, maybe the diagnosis wasn’t great. For business questions like this, there’s no rapid feedback for getting it, know, oh, I got it wrong, let’s try something else. No, we’re going to have to make a diagnosis and then we’re going to have to spend six months to a year implementing before we get any real feedback on whether this thing worked. And if we were wrong, that’s bad. yeah, you really got to nail the diagnosis. their diagnosis, what they said, but not really, Jian Guo said, this is a customer value problem. Now, if you listened to the podcast last week with AMAP, that was also the same diagnosis. We need to focus back on adding value to our customers and we need to start rapidly increasing that. That’s kind of the standard go-to. However, it’s not just that the customer value’s not good and not increasing. We’re focusing too much on sellers and we need to start focusing on the value to the buyers. Okay, that’s a real strategic shift. know, a lot of the business is focused on what the buyers want because they’re paying the bills. No, we’re going to focus back on, I’m sorry, the sellers. We’re going to focus back on the buyers. And that’s how we get growth. And in theory, that’s how we’re going to solve some other problems. So… And there are some good comments by this man about like, if a business is encountering growth problems, it is highly likely that it’s a customer value problem and maybe an additionally a productivity problem. Those are probably two big levers you want to start pulling. So, you the first thing they did is basically to go, look, we’re going to be buyer centric from now on and our primary customer is going to be the buyer. Now the sellers are obviously important as well because we’re a platform business model. But no, we’re going to be sort of buyer as the primary customer. Now that’s a pretty, that’s a pretty big move. So, okay, let’s go basically, basically back to basics. The buyer is now the first customer. That was their phrase. The buyer is the first customer. Fine. And you need to start looking into, all right, and we talked about this last week. How do you do that? Well, you have to start asking yourself, what does the buyer really care about? Before you can ask that question, you have to ask the question, who exactly is our customer? You have to do customer segmentation. That’s usually kind of step number one. I’ll put this in the show notes. Then you got to ask, okay, let’s map out the process for how the customer, in this case, the buyers first, they go through. What do they care about? What do they want? What are their main points? Either pain or things they care about most. Where do they perceive value? You might ask yourself, has this been changing recently? Technology can scramble that equation. That’s pretty good. And then we got to think about what our competitors are offering. But you generally start with, let’s go back to the basics. Let’s look at customer value, customer segmentation, really take it apart. And we got to know what matters most. Fine. So that’s what they did. They went back and basically came up with a pretty cool playbook, I think. And they basically said, all right, we’re going to focus on the buyer’s end-to-end experience. Fine. We’re going to switch from what has historically been a listing platform to a platform that is basically integrated services, full services from top to bottom. So mean Alibaba.com historically was sort of like a classified ad. You posted, people connected there, and then they did a lot of the stuff offline. That’s how Alibaba.com started in 1999. Now this is going to shift to we provide all the services and everything you need, which is key for getting buyers to basically buy more. So, logistics, customs, tax, it’s got to be a seamless end-to-end experience for the buyer. Number three, they kind of did strategic initiatives to really try and progress in this area. I’ll talk about that. did a, they started doing some festivals, which they call procurement festivals. They did all, they switched basically to mobile. 2017, they weren’t really on mobile like the rest of Alibaba was. They shifted everyone to mobile. Buyers really get you a lot more engagement if you can shift them over to phones as opposed to PCs. And then they sort of opened up the door to multiple growth. paths. If we can get buyers and offer more of the experience to them, yes, we’re going to create everything they need to do a transaction, but we can start to do other things on top of that. Credit, additional value-added services, things like that. So really a pretty good robust playbook for we’re going to start adding tremendous value to the buyer. Now we’re still going to serve the sellers as well, but yeah, that’s a big part of it. Two of the strategic initiatives they did under that. Well, let’s say that let’s call that step number one. Step number one would be. Refocus on buyer value. This is in the Alibaba playbook in my opinion. Lots of terms for this. Customer centricity, unwavering focus on customer value, the need to clarify customer value. It’s all the same thing. We’re going to focus like a laser on customer value. Which they did. And then after that, step number two, okay, now we need to launch two to three strategic initiatives that are really going to achieve this quickly. We’re going to have to do a lot of stuff under that general goal. But we need two or three things we think are going to achieve this as a strategy and move the numbers in terms of refocus customer value quickly. Okay, here’s another, this is a lot of judgment as well. Now what they did is, as mentioned, they did these procurement festivals where they have these big shopping and trade, not shopping, trade festivals in Guangzhou and places in Canton. And people from all over the world come into these massive convention centers and see, before that happens, they’re going to have a month-long festival, which really happens only on the phone or on the PC. And we’re going to provide all sorts of services and education and information, because usually B2B decisions take longer. We don’t want people just showing up in Canton and trying to do a deal. No, we want them spending the month before that. talking to buyers looking at what they’re doing and we’ll do it as a festival. Festival usually means discounts and promotions. That works pretty well. And sure enough, that’s what they did. you know, according to the numbers, it looks like it really did quite well. GMV, let’s say half a billion dollars in GV goes up to 3.5 billion within a couple years. So that’s great and interesting. This is kind of a pretty standard tactic to do festivals. The other thing that is all in on mobile, let’s get all the buyers on basically on their phones. And when you do that, you get pretty massive jump in user engagement, retention, things like that. And why? Because it’s convenient. mean, this is, yes, it’s a convenience offering. And sure enough, the numbers spiked for both of those two things. So, they’re two big strategic initiatives that really did move the numbers. And you really got to show that early on. Okay, what else did they do? Organization, culture, training, people. Yeah, this was mentioned last week as well. Like, okay, you’ve got your strategy, you’ve got your major initiatives, but now we’ve got to talk about people. We need to do training; we need to upskill. Now in this case, and we need to do, if necessary, need to do organizational change. Now in this case, as mentioned, it’s more compelling and interesting because you had, this wasn’t like just tech people sitting in Hangzhou. You had these teams doing old school logistics. You had the salespeople going all around China. You got to get all of these people on the same page and to buy in to the new mission. And you got to get them to work together. know, cultural. Cultures don’t always fit together terribly well. The old school supply chain logistics people, do they really understand digital stuff? Do they know the KPIs at all? It’s a different skill set, it’s kind of a different thing. they did pretty significant organizational restructuring here. So especially within the Yida Tong area, the supply chain services, they basically consolidated it. they merged that group in with basically the e-commerce team. So, it all became one group. And then within there, they broke it into a couple groups like funds, logistics and customs clearance, financial and tax services. you basically, what the seller deals with, the seller side services all gets consolidated into one group, which is now a combined team of digital people and logistics people, fine. A lot of talent management, talent upgrading. setting all the KPIs and all this cultural stuff. It’s easy to say it when you know what you’re going to do, but to actually lay out the KPIs and get everyone on the team doing it, it’s amazing when it works, but it’s harder than people think. It’s actually difficult to build teams that work well together and communicate effectively and can actually start rowing the boat in the right direction. Other thing they did is probably cultural change. Look at all these, I mean people basically follow the KPIs and incentives to a large degree and the HR policies. You got to look at all of those. It’s interesting, I think it was Huawei said this, the chairman of Huawei was at a meeting and they were going to roll out a new strategy related to research and development. He said something very interesting. He said, when we do a new strategy, the first thing we always do is talk with HR. That’s where new strategies start. You look at all the assessment, all the incentives, all the performance measures, all the KPIs, especially if they hit people’s income. And you got to redo all those. And you got to remove stuff and add stuff. So, when people say cultural transformation, I usually think HR policies, typically speaking. Anyway, so just jump to the results. But there was a lot of other stuff. But to me, those were the big levers that got pulled. Okay, fast forward a year or two. The supply chain that was losing all this money apparently is now profitable. And not only is profitable, it’s about one third of the revenue for ICB, the whole international division, not just Alibaba.com, but the whole international division at the time, it went from a major loss maker, significant loss maker, to a significant source of revenue. That’s pretty good. They started to get growth in transactions. The procurement festivals really seemed to work. Um As mentioned, they were about 500 million USD in monthly GMV. That jumps up to 3.5 billion. Although the timing, it’s not clear what timeframe they hit those numbers, but they mentioned that. They got buyer engagement. They got pretty massive mobile adoption. 10 % of users used to be on mobile. It went up to 90%. This got them a lot more inquiries, a lot more. you know, engagement, all of that, that was all quite good. So, in terms of financial and operational outcomes, pretty, pretty awesome. It’s, know, it’s why they wrote a case study about it in terms of more strategic outcomes. Yeah, they, they reignited the growth. Hence the name of this podcast. They created a buyer centric model, which was a major change from being more seller centric. They kind of. improve the culture and team cohesion and they restructured the organization very big deal. And the last one is they really position themselves well for future growth. You know there is a limit to how much you can grow on the seller side if the only thing that’s really happening on your platform is transactions. But if you’re expanding into other services things like that I think the buyer side I mean if nothing else you can look at the numbers of buyers and look at numbers of sellers while the sellers are in China. buyers of the whole planet. There’s probably more growth on that side, depending on what you’re doing. So that was kind of the outcome, very, very impressive. I’ll give you my breakdown on how I think about it quickly. But yeah, I think I touched on the major points. Okay, so here’s my sort of usable playbook. It’s really diagnosis, treatment, which is seven things, and then check for the outcome. And you want to have the iteration as fast as possible. You get diagnosis wrong. And if you get it wrong and the treatment’s not going to work, then you got to iterate as fast as possible. Well, that’s harder when it’s a six month wait time. So, you really want early wins and early checks and things like that. Okay, so diagnosis. I think about the chief complaint. If you’re a manager reporting to a boss or someone coming in, you got to know what the number one thing is. And then once you think about the overall, you know, diagnosis, yeah, that can be very complicated and it requires kind of a lot of expertise, a lot of discussion. This is what I talk with companies about a lot. Oftentimes they think they know, but they’re not 100 % sure. And there’s a lot of value in just talking these things through and, you know, doing it. Okay, so that’s sort of the diagnosis phase. Fine. And then you jump back. into sort of seven types of treatment. When I look at Alibaba, I usually see all seven. Number one always seems to be, go back to basics, refocus on customer value. Maybe you’re not getting it right, maybe things have changed, maybe the tech has changed, maybe what the competitors are offering is, but go back to where the rubber reached the road. Customer centricity, unwavering focus on customer value. And then within that you have a couple steps, you have to do customer segmentation, you have to walk through the customer experience from beginning to end and really decide what they care about, what’s the white-hot center, what is kind of nice but not necessary, how is tech changing this, how does this relate to what your competitors are offering? So, you got to hit question number one, pretty big deal. Treatment number two, okay, now we need, well, we can call it treatment. Well, we can call it treatment. Okay, now we need to launch two or three strategic initiatives that are going to hit that customer value question as hard as possible. We got to know what’s going to, it can’t just be that we reset the price and we nibble around the edges and we clarify what we’re doing. No, no, we really have to hit that one hard and we got to be creative. So, you what they did with the sort of procurement festivals, that was pretty good. Switching to mobile made a big difference. Now you got to know what outcome measures you’re trying to move. When you switch to mobile, I would be surprised if that moved GMV dramatically, but I think you would get customer engagement up quite a bit. And you’re going to generate a lot of data from that, which is going to make you smarter. I generally think about products and services as sort of margin products. These are the ones we make money on. As data products, these are the ones that generate the data for us. And then as sort of, I don’t know, attention products. This is the ones that get us people clicking into our app 10 times a day, even though they’re only buying once a week, but they’re clicking in 10 times a day. I usually think about that margin versus attention versus data products. Sometimes you get all three. from one product, very rarely. Okay, so you got to have your two to three big strategic initiatives, because you can’t do 20 things, you’re going to have to place your bets. Number three, which we didn’t really talk about this one, this case, look, focus on the big pain points, and think about productivity. Okay, let’s say we’re hitting the customers pretty good, we got a good customer thing. Let’s get rid of the pain points either for the customer or internally in our supply chain. The big problems and just overall our production needs to start improving. We got to be better at what we’re doing. We didn’t really talk about this one for this case. Number four which we did talk about. We need to change the organization, the talent and the culture. And that’s why I really like this case because I think it’s an interesting mix of people that you have to get to work together. Because this really is, I don’t know, it’s kind of a mix of digital in the real world, more so in traditional e-commerce. So that’s a whole lot that can be in there. It can be coordination, it can be information, it can be removing people and replacing people. It can be changing the org structure. It can be taking people and starting to up-skill. know, training people in stuff they don’t have. That’s a big, big bucket of thinking. Number five, we really need small wins or what Alibaba sometimes calls small, phased victories for the strategy. So, we can’t wait six months. We got to start seeing numbers in a couple months. One because we need feedback, but two that’s how you get cohesion in the team. That’s where you get people starting to feel this is possible. People don’t give up. Everyone you know it’s like we’ve told everyone they’ve got all start rowing in this direction now. We need them to start rowing and we need to see that the boat’s moving. So that’s kind of a big deal. Number six, I didn’t talk about this one, agile tactics. Everything I’ve been talking about so far is sort of strategy thinking. In my frameworks, I always separate out tactics at the bottom. regardless of everything I just said, you got to be super-fast on your feet and you got to be really clever. If your competitor across the street, your restaurant puts a promotion on chicken at 2 p.m. you got to get back at 4 p.m. with something. The back and forth with your customers, the back and forth against competitors. You got to be super-fast on your feet and good at the tactical moves. A lot of digital marketing is this. I heard, I think it was Andreessen Horowitz said this once, like, it doesn’t matter how good of a chess player you are. If you’re making or it doesn’t matter how good of a chess player you are, if your competitor, your opponent is making two moves every time you make one, you’re going to lose the match. So, tactics and speed are key. And in the digital world, you can do a lot in this space. And the last one, basically you want to be building a powerful business model if you can, know, motes and marathons. You’re a great marathon runner, but like if you’re not building a mode at the same time. You want life to get easier and easier the more success you have as a business because your organization gets stronger and stronger. What it means you need to have a moat. Now you could have an operating flywheel that can be beneficial. I think in this case, okay, we sort of repositioned on the buyer side and we opened up multiple growth avenues. I would put that into this category as well. You know, we want a moat. We want to fly a wheel. We want to expand our potential revenue opportunities, things like that. So that’s all sort of higher level. That’s the last one. And out of that, then you just look at your outcomes, which I usually put them in two buckets. I put financial and operating metrics as one outcome, and then I put strategic outcomes. The financial ones is like, your revenue, your gross margin, things like that. But the operating metrics like net promoter score, use customer acquisition, but well they kind of mix in with the financial ones like customer acquisition costs. So, I kind of put them all in one bucket. And then the strategic outcomes, did you achieve what you want? Anyways, that’s pretty much it. I’ll write that up and I’ll put it in the show notes. yeah, I think that’s a pretty solid playbook. If you’re a manager looking to go into a problem situation, it’s also good if you’re trying to sort of advance your career. If you jump into a business unit that doesn’t have metrics that you think you can move within six to 12 months, probably not going to help your career that much. But if you go into one like this where you say, look, we’ve got negative, probably cashflow in the supply chain operations, and I think I can turn it to a positive, that’s going to make a big mark. you know, it’s easier to make your name as an executive or a consultant. If you go into an acute problem where you think you can turn the numbers and especially show the financial metrics have changed, people never forget that. Like five years, 10 years later, people remember, yeah, we were losing money. That guy came in and we were making cashflow within a year. Yeah, that’s pretty cool. You got to kind of pick your projects carefully. Anyways, that is it for today. I hope that’s helpful. I mean, I think I’m going to do a couple more case studies, maybe not next week, but. Just sort of flesh this out a little bit. For those of you who are subscribers, I’ll write this up in more detail. And I’ve got some more Tencent Cloud content coming. I actually spend a lot of time at Tencent, so I got kind of a lot of content coming. I’m playing catch up on that company, because I’ve never really been too deep into it. So anyways, that is it for this week. I hope everyone is doing well, and I’ll talk to you next week. Bye bye.

——-

I am a consultant and keynote speaker on how to supercharge digital growth and build digital moats.

I am a partner at TechMoat Consulting, a consulting firm specialized in how to increase growth with improved customer experiences (CX), personalization and other types of customer value. Get in touch here.

I am also author of the Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

Note: This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.