This week’s podcast is about Kuaishou. And the key questions that determine its future.

You can listen to this podcast here, which has the slides and graphics mentioned. Also available at iTunes and Google Podcasts.

Here is the link to the TechMoat Consulting.

Here is the link to the Tech Tour.

Here are my three longer-term questions for Kuaishou.

- What is the future relationship with Tencent? As it relates to users and engagement?

- Economies of Scope. Does it need to move beyond video to other content and attention types. Like TikTok and Tencent have done.

- Economies of Scale. Is it subscale in video and entertainment? As a China-only business?

Here are the mentioned graphics.

Cheers, Jeff

————

Related articles:

- When Microsoft’s Bundles Are Good vs. Bad for Customers and Markets (Tech Strategy)

- Microsoft’s 3 Big Upgrades to its 2 Platform Business Models (2 of 2) (Tech Strategy – Daily Article)

- What is Elon Musk’s Plan to 10x Twitter? (2 of 2) (Tech Strategy – Daily Article)

From the Concept Library, concepts for this article are:

- Audience Builder Platform

- Videos

- Economies of scope. In video.

- Economies of scale. In content types.

From the Company Library, companies for this article are:

- Kuaishou

———–transcription below

Episode 221 – Kuaishou.1

Jeffrey Towson: [00:00:00] Welcome, welcome everybody. My name is Jeff Towson and this is the Tech Strategy Podcast from TechMoat Consulting. And the topic for today is now profitable, Kuaishou, a buying opportunity. Now Kuaishou is a company that’s not talked a lot about. It is pretty much a clone copy of TikTok in China in the video area, short video live streaming, not all their other stuff.

So in that, it’s kind of an interesting company. They have significant scale. They’re very similar to the big players. And it’s public. It’s listed in Hong Kong. It’s been around for a couple years. But in the last six months here, it has become operating profit profitable. In fact, all of its financials have started to move in the right direction quite quickly.[00:01:00]

So this raises the question, when will it happen? Ooh, is this kind of an opportunity? Should I be looking at this company? And I’ll give you my answer on that in this podcast. Pretty cool company though, actually. Okay. First, the standard disclaimer that nothing in this podcast or my writing website is investment advice.

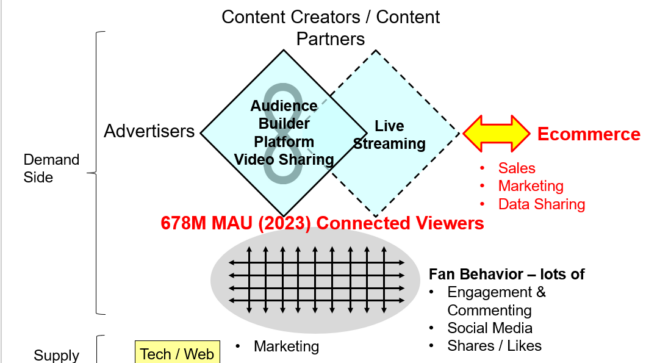

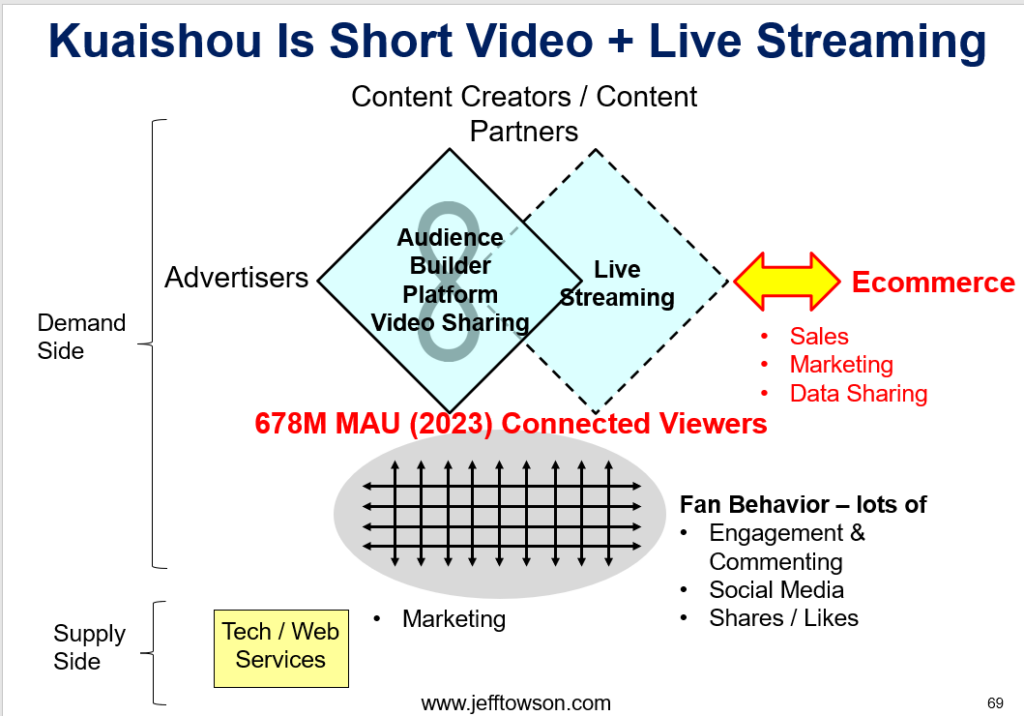

The numbers and information from me and any guests may be incorrect. The views and opinions expressed may no longer be relevant or accurate. Overall, investing is risky. This is not investment, legal or tax advice. Do your own research. And with that, let’s get into the content. Now, in terms of concepts for today, this is a well known business model, what Kuaishou and TikTok did in the video area.

It’s an audience builder platform. It’s a great business model. It’s the Instagram business model. It’s the YouTube business model. It’s a two sided platform with content creators on one side and viewers, [00:02:00] commenters on the other. Content because it can be so niche and specialized that you can get this really long tail of content that gets you a fairly powerful network effect.

You get a nice library of content in some of these cases that builds up over time, like YouTube, that’s hard to replicate. That gives you a barrier to entry. And not so much in short video where the content becomes sort of obsolete much more quickly. But it’s just a great business model in that sense.

And it pairs with monetization quite nicely because you just put ads on it. And you know, that’s how Instagram, YouTube, and TikTok came about. became dominant. One of one, one of two in their space and big cash machines. I mean, YouTube’s a little bit fuzzy. I’m not totally sure how profitable that is because of the content storage costs, but I mean, TikTok and Instagram by every measure are just [00:03:00] gushing cash.

Well, that’s the Kuaishou business model. So that’s sort of concept number one for today, which is audience builder platform. It’s in the concept library. Now, The other concept, which I think is the key one for thinking about this company, well it’s not really a concept, it’s this idea of specialty plays.

Instead of being the giant Amazon, YouTube, you’re a specialty version of the same thing, so it’s Etsy. versus Amazon. It’s HubSpot versus Salesforce. And do some agree, and I talked about this recently with Bilibili, which is a video sort of sharing gaming platform. You know, it’s these specialty niche plays versus the giants and when are they viable and when do they thrive and survive versus when do they get sort of slowly ground down over time by the giants.

You know, can you live between the elephants? [00:04:00] Now this is kind of a case of that in that Kuaishou is not subscale versus Douyin, TikTok in China. Within China its monthly average users are about 600 to 700 million, which is right up there with Douyin, the TikTok of China. And it’s not too far off WeChat, which does short video and live streaming as well.

So within China, they are not subscale. They are not a specialty player per se. You know, TikTok has moved far beyond China. If you look at these major companies now, they have 1 to 2 billion in terms of usage. So globally, you would say, you know, Kuaishou is subscale. So it sort of lives in its China market, which you could call a niche, where the other players have mostly become international, like YouTube, I mean, Instagram.

You’re all talking 1 to 2 billion users. [00:05:00] So that’s kind of the question that’s going to sit at the core of this, and whether I think ultimately this thing is investable, and I’ll give you my working answer at the end. Okay, so that’s sort of concept one. Second one’s not really a concept, it’s just a way of thinking about it for today.

All right, so let’s get into Kuaishou. For those of you who are subscribers, I sent you a An article on Kuaishou in the last day or so, sort of detailing out the numbers. I gave you a graphic for the business model. I’ll put the graphic in the show notes here. Pretty similar to TikTok. It’s a variation on what we see at Bilibili.

But basically you’ve got two major services that are being provided, which are short video sharing and then live streaming. Now you could consider live streaming a secondary platform and companies like YY and Huya have tried to build standalone businesses purely based on live streaming as a platform.

I’m [00:06:00] not a big believer in that. I think the number of content creators that do live streaming is too small. I think the fact that interactions in live streaming have to be live dramatically decreases the volume of interactions. It’s a, it’s a very different thing when you’re loading up, when you’re doing this asynchronously, when you’re loading up lots of videos that anyone can watch anytime, that’s how you get engagement, connectivity, network effects.

But if most of your engagements have to be done live, those numbers go down dramatically. So it’s, I’m not convinced you can do a standalone live streaming platform. Now, there are exceptions, gaming, things like that, but I’m not, I think it works much better when it is additional service on top of a short video platform.

I think short video platforms are tremendously powerful. So that’s what they’ve got. They’ve got a short video platform, very robust and then on top of that they’ve got live streaming which sort of [00:07:00] complements, sits on top of that. That’s a good business model. And then they are moving into e commerce.

Which, you know, you start by, if you’ve got engagement on videos, and if you’ve got intention, you can start to sell products, which they’re doing, and you can do that by linkages, which they did, and then ultimately an in house shop, which they’re doing, Kuaishou Shop, or Kuaishop, just like TikTok Shop, and so on.

So, very, very similar to what we would call TikTok internationally, or Douyin in China. But not ByteDance overall, which has a lot more services beyond just video content matching and sharing. They do all types of content. Much more, I think, robust platform. Okay, but the first thing you kind of have to accept is, look, they hit the jackpot.

No question, they absolutely hit the jackpot. They ended up, you know, this is founded [00:08:00] 2011. It was a platform for creating GIFs and then sharing them. And then quickly, 2012, they moved into short video. And they were really the first short video platform of China before TikTok. That was just, man, that was just lightning in a bottle.

Short video turns out to be one of the single greatest products ever. First of all, it commands tremendous attention. If you look at time spent on smartphones, and this is a game of attention, Messenger’s kind of number one, but video’s number two, with about 30 percent of time spent staring at screens.

People are watching videos. And within videos, about half of that is short video. And just the power of it is, you know, anyone who uses short video like TikTok, it’s super addictive. So this is like coming up with Facebook in the early 2000s or [00:09:00] Coca Cola. I mean, you just hit the jackpot in coming up with one of the most powerful products of all time.

And they got there early and Not only do they have a powerful product, it turns out it has a powerful business model that you can build on it. That’s as good as it gets in this world. Unbelievably popular, addictive product with a powerful business model that crushes your competitors and scales beautifully.

And the unit economics, at least as far as what we can see from TikTok, are fantastic. I mean, it’s just, it’s, it’s phenomenal, right? Okay. So they did spectacularly well in that regard. Now, why didn’t people pay attention to them? Why weren’t a lot of people investing in them? That’s kind of the key question.

Now, let me go through some of the basics on Kuaishou. So anyways, as I just said, they [00:10:00] basically caught lightning in a bottle, which is short video plus live streaming. I mean, the creator of WeChat, Alan Zhang, has said flat out, the future of WeChat is short video and live streaming. You know, WeChat is in the business of keeping your attention, both by providing content and being a utility.

And the foundation of that is live streaming and short video, which is where Kuaizhou lives, it’s where Douyin lives. So in terms of capturing people’s attention, it’s as good as it gets. The biggest opportunity they have going forward is e commerce. Their GMV has been growing incredibly quickly in the last two years.

So they’re moving fast on that. As mentioned in 2023, their end of the num end of the year numbers for 2023, they finally got to operating profit. About 5 6 percent of revenue in that range. Now, that’s good, but you’re also like, wait, why weren’t you operating profitable before? Because TikTok has been [00:11:00] making for money for quite some time.

So I’ll go through the numbers a little bit. And then I think one of the key questions, if not the key question, is How does this play out with this China focused company versus the international giants over time? Are they going to get ground down or are they going to sort of thrive and survive just as a China based company?

Okay as mentioned, I put in the the show notes, the graphic I used to sort of map out this company. The other kind of wildcard here, one is the, the subsale specialty question. The other one is their relationship with Tencent. You know, they, Tencent was an investor in Kuaishou early on, about 11 percent pre IPO, I’m not sure what it’s at right now.

What is the future of that strategic relationship? How much of their traffic and usage, which is impressive, is coming from there? And they do have a sales and marketing agreement, [00:12:00] and they have a IT services agreement and some other things, and they have a payment services agreement. Alright let me give you some numbers.

All right, so for 2023, this is their end of the year filings. At IPO, they IPO’d in 2021. At the time, their monthly average users was 770 million. Now, these are IPO numbers, so you always got to take those with a grain of salt because everyone tries to make their numbers look beautiful right before they go public.

But 700 plus, and then 300 million average daily active users. Okay, that’s pretty great. That is right up there with TikTok in China. It’s pretty close to most of the major attention businesses of China. Video, music, all of that. You’re in the 700 million range. Now, people have [00:13:00] long said, Oh, China’s got 1.

3, 1. 4 billion citizens, which is not true. It’s actually probably 100 to 200 million less than that. But when you talk about e commerce users, it’s always been about 600 to 700 million. When you talk about messenger and payment, then you get up to a billion. But when it comes to e commerce, Alibaba, all these companies, you’ve always been in the 600 to 700 million range.

So they are right up there. Now that was at IPO. Fast forward to 2023, their average monthly average users, MAUs, was about 650 million. 2022, one year before that was 610, 612. So they’re in that 600 to 650 million range on MAUs and it hasn’t been growing dramatically in the last three years. In fact, it’s sort of slow and small growth and if you look at their daily active users in [00:14:00] 2023, it was about 380 million.

That was up from 305 at IPO. It was up from 355 in 2022. So again, it’s the same picture. We see slow and steady growth, but not big growth in terms of active users for the last three to four years. In fact, you could argue that they have flatlined to a significant read. They’ve already got their market in terms of usage.

However, if you look at time spent, the amount of minutes per day, per daily active user. In 2021, it was about 86 minutes per day, which is awesome. I mean, this is like why you want to be in video. In 2023, it was up to 124 minutes. So time spent, even though the user numbers are not moving very much, the time spent has been going up year over year.

And we saw kind of the [00:15:00] same thing with, with Billy Billy. There’s this overall shift in focus for these major video companies of China away from growing their users, their monthly active users, to their time spent and daily active users. Okay, and the other number that really jumps out at you from IPO to now is basically e commerce GMV.

Now, when they went public, 2021, the GMV, Gross Merchandise Value, of their e commerce was about 200 billion RMB. Now that’s for nine months before IPO. So if you annualize that, let’s say 300 billion RMB. In 2023 1. 2 trillion RMB, 1, 180 billion RMB in total e commerce GMV. I mean, that’s up six fold.

Basically, well, five fold. And 2022, one year before, it was 900. So that number’s really moving. So When [00:16:00] we, you sort of pull back at this, and why I think this company is worth looking at, there’s a lot to like here. There’s like, okay, they have a spectacularly good product that’s once in, not, once in ten years type of product.

They have a very powerful business model, one of the most powerful ones out there, the YouTube model, the TikTok model, the Instagram model. They have very large a user base in their market, which is China, 600 to 700 million. That’s, That’s pretty much what everyone, that’s as high as it gets for the most part.

And they are significantly growing their time spent per day and their GMB. Those numbers are moving quite quickly. So all of that is like, huh, that’s really interesting. Okay. So what’s the problem? The problem is why aren’t they, why aren’t they throwing out cash? Up until last [00:17:00] year, they were not profitable.

In fact, they were significantly negative on their operating profits in 2021, 2022, even at IPO. Now that’s strange because one of the reasons we like this business model is TikTok throws off unbelievable cash flow. So does Instagram. What’s, why would that be happening? Is it not as strong as we think it is?

Are they flooding money into sales and marketing in order to get these numbers? Why would that be happening? Okay, so the difference there I think is a couple things. Number one, let’s sort of break it down. Revenue, gross products, operating profits. In the revenue picture, they kind of came at this backwards.

Tick tock, has always been very sort of clean in its business model. We do short videos, that’s a powerful platform, and we monetize by advertising. Beautiful. Absolutely [00:18:00] great business model. Kuaishou didn’t really do that. They sort of came out with, we do live streaming and short videos, but a lot of their money was coming from live streaming, which was virtual gifting.

So people do live streams, you can put money in and give money to the hosts and all that. The economics of that are not great. And I talked about this with Billy Billy you know, you end up, basically you’re a lot more dependent on a few, not a few, a smaller number of popular hosts. They’re very good at negotiating revenue sharing deals and your gross profits are much less.

So that’s kind of where they were, but they’ve been shifting over into online marketing as a revenue source and then now into e commerce. So, 2023 was really the first year that more than 50 percent of their revenue was coming from marketing and not live streaming. Live streaming had fallen in 2023 to about 34 percent of total revenue.

So there’s a shift there to a more profitable business model. Fine. [00:19:00] Gross profits, in the last year have also been increasing. 2021 gross profits were about 42 percent of revenue. By 2023, it was up to 50%. Okay, that’s good. Again, I think that’s a lot to do with shifting over to online marketing where the revenue, the cost of revenue is much less.

They also did pretty well in decreasing their bandwidth and server costs, which dropped down about 2%. So anyways, That all looks good. Their revenue, their GMV is going up. They’re shifting from live streaming to sharing, and that’s playing out in their cost of revenue in their gross profits, and their gross profits are starting to look good, 50 percent plus.

Now, Billy Billy, which is another specialty player, you know, their gross profits are down in the 30s. We assume TikTok is much higher than this. Okay. And then we look at operating profits. In [00:20:00] 2021, operating profits was negative 33 percent of revenue. Yeah, problematic. The gross profits were a problem.

The sales and marketing expense was 54 percent back in 2021. The R& D was 18 percent in 2021. They’ve moved all those numbers in the right direction. In 2023, operating profit was positive 6. 4%. I’m sorry, 5. 3 percent of revenue, which was 6. 4 billion renminbi. That’s a big improvement. Sales and marketing expense was down to 32% from 54%, and r and d went down to 10% from 18%.

So all the numbers are moving in the right direction. So that’s why I, you know, when I looked at this company in 2021, I did a pretty deep dive on this. It’s still in, for those of you who are subscribers, you can pull it in the company library. My position didn’t change very much on what this company was.[00:21:00]

What got my attention recently was the financials all started to look good for the first time and the business model was shifting exactly where I thought it should go, which is short video and e commerce, not live streaming. So that’s kind of like, huh, all right, interesting. So hence this video, I’m sorry, this podcast.

And let me, let me give you sort of my so what on whether I think this is attractive long term based on the picture I just gave you. All right, let’s get to the so what. I basically have three questions I’m trying to figure out in terms of this company. Number one, which I mentioned is the relationship with WeChat and Tencent.

Quiveshow is connected with Tencent, Tencent Music, Huya, which is their live streaming thing, Tencent, I’m sorry, Sogo, which is their search engine. I’ll talk about that, one of their search engines, by various operating agreements, and there’s an investment stake. The [00:22:00] operating agreements according to their filings, there’s one for marketing and promotion, that’s the one we care about.

There’s one for cloud services and there’s one for payment services, we don’t care about those so much. The marketing and service and promotion one is the one that concerns me. How much of the traffic is coming from this relationship and is Tencent going to change it? Now, Sogo is a good company to think about.

Sogo was long, is long, the number two search engine of China. I’ve covered Sogo before. You can pull it from the company library. Very interesting company, by the way. Tencent was a major investor of Sogo and they took them over entirely, eventually. However, at the same time, WeChat is also working on their own internal search engine.

You know, so it’s like, okay, you’re an [00:23:00] investor and you’re a partner, but you don’t seem to be monogamous. And you could say the same thing about Huya, which is live streaming. Yes, they did Huya, they made an investment in this company, partnership, but they also put live streaming themselves within WeChat.

So yeah, they’re, they’re not known for being a monogamous partner. So if they are still have this long term agreement with Kuaishou, you can’t ignore the fact that WeChat is going all in on live streaming and WeChat, I’m sorry, the short video itself independent of Kuaishou. So that worries me. If it turns out that a significant portion of their traffic, their 600 million monthly active users, is coming by the partnership.

If it is, then I would be very hesitant because WeChat, as I said, is not monogamous here. It’s, it’s an additional bonus, but yeah. So that would be [00:24:00] sort of question number one. Hard to get out that one. I don’t think it’s too hard for a professional investor to take that apart. Number two ByteDance is their primary competitor.

So is Tencent in China. Neither of those companies are pure breeds when it comes to short video and live streaming. That is one of the many content types they use to generate and maintain attention. Both these companies, they’re all in the attention business. Video is your strongest card within the attendance business, maybe after Messenger.

But none of those other companies are pure play in this area. They’re building attention businesses, products and services across lots of types of content. ByteDance is a rapid innovator. They’re doing education. They’re doing games. They’re doing news. They’re doing short video. They’re doing long form video.

They’re playing across the board in the attention business, and this has been Tencent’s playbook forever. [00:25:00] They do Tencent music. They do gaming. They do literature. They do everything that holds eyeballs. Short video is the crown jewel now, but it’s not the only one. So there, and there’s benefits to that.

One, you can cross sell like crazy. All the people reading your books and blogs and all of that and listening to music and playing your games, you can cross sell them into your videos. Two, you get a data effect. So one, you get sharing of customers. The other is you get sharing of data and that is particularly powerful for ByteDance because their whole game is we are better at matching you with content you like.

Well, they have tremendous data from other things you like. One of the reasons TikTok, Doin, was so powerful when it launched is they already had a massive user base in Totiao and they had great data on what individuals like to read in terms [00:26:00] of headlines and news and they leverage that data to make their machine learning for video smarter and then when they launch education they launch in that they bring in the data from video and headlines to make the content they are serving up for each person smarter in education.

So there is a what we call economies of scale in learning. I’m sorry, economies of scope in learning, where the more products you have that are based on matching data, the better you are. Okay, Kuaishou doesn’t have that. They’re a pure play. I’m a little bit concerned about pure play as a business model in the attention business, even when it’s in video, versus a broad spectrum of content types.

So that’s sort of my second question that I think matters. And then the third question. is just pure scale. And this has sort of been my go to question for a lot of companies over the [00:27:00] last couple months, which is look, is this just a game of scale? Can Kuaishou compete with the attention giants of China or internationally?

Has a pure player in video and limited to China. In China, is video enough or does that make you too small? Do you need to do all the content types? And secondarily, is being only China focused big enough or do you have to go international to get to scale? And my working answer to that is yes, you have to.

Why is being bigger better? Okay, ByteDance is, is playing both axes. They have a big suite of products, which has economies of scope advantages, but it also has scale advantages. They are just a bigger animal in China. [00:28:00] And additionally, they have gone international, and they are, they have, you know, I forget the latest.

Almost 2 billion users now. Like, YouTube is the same. They’re up in the 1 to 2 billion dollar, you know, billion user range, so is Instagram. Do you need to get up to close to 2 billion users to really play this game long term? Which means leaving China. And my working answer is yes, you do. Because, and this is where we get into my sort of favorite question of the year is, how do you survive and thrive as a specialty player?

And I have five questions I look at. And number one on my list is, is the company significantly differentiated in the user experience where you can survive and thrive as a smaller player in terms of your reach and resources? ByteDance and Tencent are going to have dramatically more cash. [00:29:00] They’re going to be able to flood money into investment, into sales and marketing, so that when everything moves to virtual or whatever comes next in the attention business, which changes quite quickly, they’re going to be ahead of the curve.

Right now ByteDance is flooding money into generative AI because they kind of missed the wave. Okay, they missed the wave in what is powerful in terms of attention. That’s okay if you’ve got more cash than God. They’re flooding money into generative AI over the last year to catch up. A company that just went operating profit last year and has only got six billion Rem and B and Operating Profits, which is about 800, 900, 1, 000, 000.

You just don’t have the resources. So the question, is video, short video, sufficiently differentiated in the user experience where you can do well as a smaller [00:30:00] player long term? My answer is no. I think video more and more to me looks like a commodity. Bilibili, WeChat Video Mogu all of these companies, you know, Xiaohongshu, Red.

They all have video, short video and live streaming. Ctrip has video. Reels has video. Everybody’s got short video. TikTok, I’m sorry, Twitter will have video. If you actually go on these sites, they all look pretty much the same to me. They don’t look like a differentiated user experience. Maybe Bilibili is the only one that’s sufficiently differentiated because it’s focused on anime and gaming and comics.

All the rest to me look like a utility and a commodity. So therefore, it’s all about scale. My working conclusion is you can’t sufficiently differentiate in video on the creator side or on the user side. So it all comes [00:31:00] down to pure scale of your platform business model. YouTube looks great. Instagram looks great.

ByteDance looks pretty good. Reels is catching up quite quickly. WeChat video looks great. I’m not convinced a China only play works. It might. The only aspect that might convince me is if you might be able to do it in China alone because they block the international players domestically. That might be the only thing that convinces me.

A strong government action to block all the international players out of the China market gives you enough room to breathe domestically. My working answer is no, I’m open to that sort of question of regulatory barriers. Anyways, that is kind of where I am on this. I think those are, I think my breakdown for those of you, I know a lot of you are professional investors, I think that breakdown is solid.

I think the sort of financials and [00:32:00] the business model picture I laid out Is easy to get a solid answer on. And then I think if you can get a solid answer on those three questions that I laid out, the 10 cent question, the economies of scope question, and then the economies of scale question, I think you can get a solid answer on whether the economics are going to be better and better, or whether the economics, the unit economics are going to struggle because this company is just being outgunned and slowly ground down year after year.

That’s it. I’d also look into a little bit of why is their sales and marketing spend so high at 34%? Are they buying users or how how much of this is organic? That one got my attention a little bit. Okay That’s kind of where I’d break down in terms of an analysis for investment on this one And obviously you got to do the valuation which sorry.

I’m not going to give you a number. I don’t I don’t usually do that. I think i’m good at it. I don’t think i’m great I I focus more on the [00:33:00] qualitative and the business model questions who’s going to get stronger and who’s going to get weaker So anyways, that’s where we are on this company and I think that’s it for today in terms of content.

So the two concepts audience builder platforms and this whole specialty versus giant competition question over time, which is kind of my favorite question this year. And that is it for me for today. I’m actually sitting in a hotel in Manila. I’ve been spending the month here in the Philippines. I’m just about done.

I’m flying out today. Awesome time. Cheers. I’ve been here a lot of times over, I don’t know, the last 10, 15 years. I never had this much fun before because I usually, I just work. I sit, I buy in coffee shop, but I did all like water activities this time. And it was so much fun. I’ll put a video in like a swimming with whale sharks, which was crazy.[00:34:00]

It was like amazing. And then jumping off waterfalls and a lot of snorkeling with sardines and turtles and, you know, So I, I’ve kind of changed my opinion on the Philippines. My, my sort of standard opinion was, I love the nature of the Philippines. It’s, it’s arguably the, the prettiest country in the world.

The cities aren’t any big thrill, but the, the nature’s beautiful. The jungle like much better than Bali, in my opinion. The Bali beaches kind of suck the Philipp, but I, I, I kind of, there was other stuff I didn’t like. I didn’t really enjoy the food as much. I didn’t hang out here that much, but. Shifting over to water activities, waterfalls, pools, beach, snorkeling, scuba, swimming with dolphins, all of that.

I did do the swimming with dolphins, but we didn’t actually see any. So, didn’t quite get that box checked, but. Yeah, fantastic. Just a great time. Anyways, that’s been my month. I’m back on the road here in a couple hours. Anyways, [00:35:00] that is it for me. If you want a great island to go to, go to Bohol.

That’s my new favorite island, like Bali from 20 years ago. That’s how I see Bohol. Anyways, that’s it for me. I hope everyone is doing well, and I will talk to you next week. Bye bye.

——–

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

Note: This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.