We are five years into a US-China tech war that has seriously impacted semiconductors, operating systems, and media platforms. And there are now disturbing indications that cloud services and storage will be next. And American technology research and consulting firm Gartner might be (accidentally) jumping into the middle of it.

This article is about two questions:

- Are the cloud services and storage business becoming part of the US-China tech war?

- Has Gartner introduced a pro-US (or anti-China position) bias into its assessments?

My thinking on this right now is three points.

Point 1: Gartner is Really Good at Tech Analysis. And their Magic Quadrant is a Useful Assessment in the West.

For those not familiar, Gartner is a tech research and consulting firm based in Stamford, Connecticut. It was founded in 1979 by Gideon Gartner and is now led by CEO and Chairman Eugene Hall.

Garner has a pretty great suite of technology research services. Think lots of research reports sold to tens of thousands of clients on a subscription basis. These subscription services were 82% their approximately $6B revenue in 2023 and about 89% of their gross margin. They also do consulting (9% of revenue in 2023) and conferences (9% of revenue in 2023).

I like this firm and their business model. Their services are valuable to their clients. And subscription services tend to have high margins, recurring revenue, and low capital intensity.

However…

Gartner is, by revenue, a Western focused business. These say they have +20,000 employees in office around the world. But 66% of their revenue for 2023 was from the US and Canada. And 23% was from Europe, the Middle East, and Africa. On a revenue basis, they are around 85-90% in the West.

Asia, my area of tech research, is presumably within the 11% of Gartner’s revenue listed as “Other International”. This point will become important shortly.

For those unfamiliar, I’m management consultant originally out of New York City. But I have spent most of my career in China and Asia. And mostly focused on the leading tech companies of the region. This has included teaching at Peking University in Beijing, Chulalongkorn in Bangkok and CEIBS in Shanghai.

So, I’m familiar with Gartner’s reports, which are solid analysis for US and European tech (which involves Asia vendors). But that is not the same as being an Asia focused firm. I suspect their expertise in the geopolitics of Asia is also significantly less. This will also become important shortly.

Which brings me to Gartner’s Magic Quadrant (MQ) ranking system. And my main questions.

The Magic Quadrant is one of their frameworks for assessing IT vendors. Vendors as assessed against criteria and then classified into one of four quadrants: “Leaders”, “Visionaries”, “Niche Players”, and “Challengers”.

These classifications can be important for both customers making a purchasing decision and IT vendors creating their products. They can impact both the vendors’ sales and the evolution of the industry (somewhat). IT vendors focus on improving in the various criteria and improving their classification in the Magic Quadrant.

Such widely accepted classifications and standards can benefit from a light form of network effects based on standardization. If everyone in the industry is using the Magic Quadrant, it becomes more valuable as a service to everyone. Rankings and standardizations can often result in a “winner take all” or “winner take most” situations, where 1-2 rankings or standards are used by the industry.

Note: I used to sit on the Board of the American Medical Association and was always stunned by how powerful (and profitable) their CPT (Current Procedural Terminology) medical coding standard was. It was the standard used most by all doctors and hospitals in the US.

Ok. So, what’s the problem?

It sounds like a useful classification system and a good business, which it is.

The problem is when a classification is used globally but the firm creating it is North American and European centric.

Point 2: Gartner’s Magic Quadrant Appears to Have Changed its Weightings for Storage Vendors to Prioritize Cloud Integration.

The Magic Quadrant is a 2×2 matrix with two axes. The vertical y axis is titled “Ability to Execute” and is about an IT vendor’s capabilities today. It’s an assessment of how a company is right now. What are its capabilities? And the higher on the y axis the better.

The horizontal x axis is about the future and is titled “Completeness of Vision”. What is likely to happen based on the vendor’s current strategy? Based on its level of innovation? Based on its effectiveness in marketing and sales?

Ideally, an IT vendor wants to be high in both current capabilities (y axis) and future strategy (x axis), which would put them in the upper right quadrant for “Leaders”.

If you’re in the upper left quadrant, you are a “Challenger”. You have good execution today but your vision and mission may not match Gartner’s view of the future.

If you’re in the lower right quadrant, you are a “Visionary”. You have a good vision for the future (according to Gartner) but your current capabilities are lower.

And then there is the lower left quadrant, which is lower on both dimensions. It is titled “Niche Player”, which sounds like a term you use when you are being nice.

This is my own simplistic explanation of the Magic Quadrant. You can see Gartner’s explanation here. Including the specific criteria used.

If you look at Gartner’s description for the Primary Storage business, what jumps out is the Strategic Planning Assumptions (at the top). And their point that cloud services are going to be foundational for the future of primary storage. From that page:

“By 2026, storage consumption-based platform SLA guarantees will replace over 50% of traditional on-premises IT capacity management, budgeting, assessment, sourcing and fulfillment activities, up from less than 10% in 2023.

By 2027, less than 30% of the IT storage infrastructure budget will be spent on hardware management and support IT skills, down from 85% in 2023.

By 2028, consumption-based storage as a service (STaaS) will replace over 35% of enterprise storage capital expenditures (capex), up from less than 10% in 2023.”

Basically, integration with cloud service companies (AWS, Azure, Alibaba Cloud, etc.) is becoming an increasingly important part of the future (i.e., the x axis for “Completeness of Vision”). IT vendors, especially primary storage, need to be able to integrate with these services.

However, there was a recent article by Tony Moroney talking about how Gartner was increasing the importance of cloud services in its Magic Quadrant. And that this could distort the MQ rankings for primary storage and the possibly the industry itself. That article is below.

This is the article that got my attention. And got me looking into this.

Because Gartner did not just say that integration with cloud is an increasing part of the future of primary storage (which I think is reasonable analysis). It also repeatedly cited 3 cloud companies (AWS, Microsoft / Azure and Google Cloud) in its evaluations of primary storage vendors. In fact, I can’t find any mention of non-US cloud companies.

And I could not find any mention of integrating with Chinese cloud services giants (Alibaba Cloud, Tencent Cloud, Baidu AI Cloud), which are major players in Asia.

Point 3: I Am Concerned the Magic Quadrant May Now Be Favoring US Cloud Companies. This Is Speculation. But If True, It Would Raise Serious Questions of Political Bias.

Imagine you are a business in Asia making an IT purchasing decision. Now take a look at the specific company evaluations for the Magic Quadrant for Primary Storage.

For almost every company, Gartner talks about its ability to integrate with the US cloud vendors. I don’t see any non-US cloud vendors mentioned in the evaluations of these companies. Integration with AWS is apparently important. But integrating with Alibaba Cloud, the #1 cloud infrastructure company in Asia, is not?

Here are some excerpts for specific companies. I added the bold:

- “Tintri Global Center provides a common provisioning and management capability that integrates its on-premises VMstore storage array with the TCE1000 SDS in Amazon Web Services (AWS), providing customers with a hybrid cloud modernization plan.”

- “Dell’s block storage presence in the public cloud is presently limited to AWS and is based on PowerFlex, which does not currently have as large of an installed base as PowerMax or PowerStore.”

- “NetApp’s storage operating system is designed to run on-premises, and in AWS, Azure and GCP, with the ability to tier and replicate between locations and manage them from a common SaaS-based control plane.”

- “IEIT SYSTEMS lacks a competitive SDS offering for hybrid cloud storage solution for use in the three major public clouds (AWS, Azure and Google), making it tougher for end users to evaluate and assess their hybrid cloud platform strategy.”

Note that last one and the phrase “the three major public clouds (AWS, Azure and Google)”.

Are you kidding me?

In China, Asia and quite a few other international markets, we focus much more on Alibaba Cloud, Baidu Cloud and Tencent Cloud. There are a minimum of six major public cloud companies (3 US, 3 China, plus others). And the US ones are not the ones I pay the most attention to in Asia.

And Gartner itself has ranked Alibaba Cloud as #1 for market share in Asia Pacific in infrastructure as a service (and infrastructure utility services) in 2019. This includes Greater, Japan and Southeast Asian markets. And is basically tied with Google Cloud globally in 2024. Check out the below article on this by Tech in Asia. Or any Gartner report on the region.

“Alibaba Cloud, the Chinese tech titan’s cloud computing and data intelligence arm, came first in Asia-Pacific market share for infrastructure-as-a-service and for infrastructure utility services across two consecutive years, according to research company Gartner’s April 2019 report.”

So, if a vendor’s service in Asia coordinates well with Azure, Google and AWS, you get a higher ranking? But if it coordinates with Alibaba Cloud (#1 in Asia), it is downranked? Is this true?

One business such a change would really impact is primary storage. Enterprise technology and software in Asia in 2024 is heavily focused on building out digital infrastructure. There are tons of projects in storage, networking, and compute happening across the region.

When I look at the storage market across Asia, I see the regional players doing very well. There is just a ton of building of data centers in places like Thailand and Malaysia. And there is lots of increasing data sharing and coordination and connectivity with the regional cloud providers (like Alibaba Cloud).

Honestly, we simply don’t’ talk about the US cloud and storage players here that much here. They’re important of course. But APAC is its own tech world. And it is developing towards a different future than the US and Europe.

***

So, what is going on with Gartner’s Magic Quadrant?

- Has it become inaccurate for certain regions (especially APAC)?

- Has it introduced political bias?

I don’t know. But these are important questions.

Recently, I have been hearing rumors that US cloud and storage companies are being up ranked in the classification over non-US cloud companies. That is purely a rumor. So, it may be completely false. But if the evaluation criteria are including geopolitical factors which could negatively affect non-US vendors, especially those in Asia and China.

I don’t know if that rumor is true. But in business and geopolitics, what people think is true can be as important as what actually is true.

Here are my two working conclusions:

- If the Magic Quadrant classification is becoming inaccurate in Asia (in perception or in reality), that will seriously impact Gartner’s reputation and the usefulness of the ranking system here.

- If there is a perception that political bias is being introduced, that would impact the perceived impartiality of MQ. And don’t kid yourself, the perception of anti-China or anti-Asia bias would land Gartner in the headlines here.

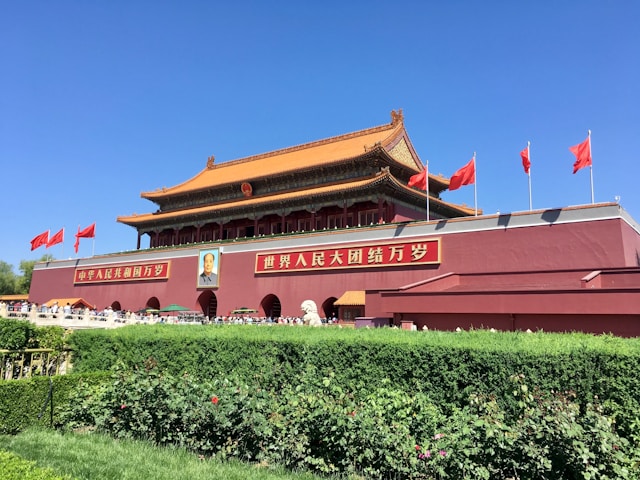

Photo by Yuchen Dai on Unsplash

***

That’s it for Part 1.

In Part 2, I’ll go into cloud in Asia and the question of whether cloud services are becoming part of the US-China tech war. And whether Gartner might unintentionally be jumping into the middle of it. Something they really don’t want to do.

Cheers, Jeff

———

Related articles:

- When Microsoft’s Bundles Are Good vs. Bad for Customers and Markets (Tech Strategy)

- Microsoft’s 3 Big Upgrades to its 2 Platform Business Models (2 of 2) (Tech Strategy – Daily Article)

- What is Elon Musk’s Plan to 10x Twitter? (2 of 2) (Tech Strategy – Daily Article)

From the Concept Library, concepts for this article are:

- Cloud Services

- China / Asia

From the Company Library, companies for this article are:

- Gartner

Photo by Nick Fewings on Unsplash

———

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

Note: This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.