This week’s podcast is about CloudKitchens, the new venture of former Uber CEO Travis Kalanick. And why I think it is a better business model than Uber. In theory.

You can listen to this podcast here, which has the slides and graphics mentioned. Also available at iTunes and Google Podcasts.

Here is the link to the TechMoat Consulting.

Here is the link to the Tech Tour.

Here is the interview with Travis on the All in Podcast about this business.

Here are the mentioned slides.

———

Related articles:

- When Microsoft’s Bundles Are Good vs. Bad for Customers and Markets (Tech Strategy)

- Microsoft’s 3 Big Upgrades to its 2 Platform Business Models (2 of 2) (Tech Strategy – Daily Article)

- What is Elon Musk’s Plan to 10x Twitter? (2 of 2) (Tech Strategy – Daily Article)

From the Concept Library, concepts for this article are:

- Marketplace Platform

- Network Effects

From the Company Library, companies for this article are:

- CloudKitchens

- Uber

———–transcription below

Episode 222 – Travis.1

Jeffrey Towson: [00:00:00] Welcome, welcome everybody. My name is Jeff Towson and this is the Tech Strategy Podcast from TechMoat Consulting. And the topic for today, five reasons Travis Kalanick’s CloudKitchens Is better than Uber in theory, maybe in practice, but definitely in theory. Now the All In podcast had their big summit recently and Travis Kalanick, the CEO, ex CEO of Uber was there talking about his new venture, which has been several years, it’s not that new CloudKitchens and kind of went through the strategy and what they’re dealing with and.

You know, if you read the press about CloudKitchens, you’ll hear stories of difficulties with adoption, which I’ll talk about, and getting traction. However, from a strategy perspective, which is my thing, it’s really smart. Like, that’s what I was [00:01:00] taking notes. Like, that is really clever. And it almost seems like it’s a reaction to all the difficulties and limitations of Uber and ridesharing that he’s kind of gone for a better, more powerful business model.

Anyways, I’ll take you through why I think the strategy and the business model are better. Now, getting adoption is always a problem. So, you know, a better business model without a lot of users doesn’t count for much, which might be their problem. But from a strategy side, it’s impressive. Anyways, that’ll be the topic for today.

Basic standard disclaimer, nothing in this podcast or my writing website is investment advice. The numbers and opinions from me and any guests may be incorrect. The views and opinions expressed may no longer be relevant or accurate. Overall, investing is risky. This is not investment, legal, or tax advice.

Do your own research. Actually, a little bit of housekeeping. We have the The Consumer Tech Tour coming up at the end of November, November [00:02:00] 1923. It’s gonna be, we’re actually gonna make this a very sort of small group. Just, just a handful of us are going this time and we’re gonna basically, cause it’s a little bit, not specialized, but a little bit.

We’re going to China, we’re going to Shanghai, we’re going to Hangzhou, and we’re going to look at sort of what’s next for digitized consumer experiences, because China Tech, in my opinion, is better at B2C. The e commerce is better, video’s better, all of that, you know, a lot of the hot stuff comes out of there.

Short video, TikTok, live stream, all of that came out of China. So we’re going to look at what’s next in terms of the consumer experience in digital. And yeah, that’ll be the tour. If you’re interested in that, go over to TechMoat Consulting. com. All the details are there. Price, dates, all that stuff. And, or send us a note.

Anyways, that’s it. Let’s get into the topic. Now, no new concepts for today, but what we’re really talking about, why is this a better business model? And [00:03:00] I’ll go through it shortly. It’s because it’s a marketplace platform with the network effect. Which is what Uber is, Uber Transportation, then Uber Eats.

But both of those things are more powerful on the cloud kitchen than they are, definitely than ride sharing, which is fairly weak network effects and some other things. It also might be more profitable, unclear. But that’s going to be a big part of it. So those two concepts, which are nothing new, I’ve been talking about those forever, are kind of what matters for today and kind of how I get to my conclusions on this.

So. I won’t go through that too much. Let’s just sort of get into the topic here. All right. Now, when I talk about digital strategy, really strategy overall, I always say there’s three different goals. You got to sort of win with the customers. You got to build your product, get customers, and grow. That’s kind of step one.

If you don’t have that, you really don’t have anything. And that’s what Steve Jobs was so good at. Step two is more about getting [00:04:00] increased, improved operating performance. Doing things faster, digitizing, all of that. That’s kind of Elon Musk land. He’s really good at operations and innovation’s a big part of that for him.

And then step three is sort of building a moat, which is Warren Buffett land. Okay. You know, you can have a really great product, but you have, if you haven’t built a moat or a competitive advantage, you’re going to get copied pretty quick and your profits are going to drop to zero. Happens all the time.

So you really want all three. But if you don’t have the first one, if you’re not getting a good product with good adoption, you’re kind of dead from the get go. So, that’s maybe a little bit what’s going on when you read these press reports about CloudKitchen. Mostly what they’re talking about is a failure to get a certain amount of adoption, which I’m not sure it’s true.

I don’t know if anyone’s really seen the numbers. So, That’s what I think people are talking about. I’m going to be talking about step three, which is the strategy bit. All right, what is cloud [00:05:00] kitchens? This is called a couple things. It’s also called ghost kitchens. It’s called multi tenant kitchen leasing.

The big operating aspect is you build kitchens in the major cities. You automate them as much as possible. A lot of robotics, a lot of AI infused robotics. And then you lease out this facility restauranteurs who can rent a space and launch their own businesses there. Now that’s a little different than let’s say, if you’re going on Taobao.

Okay, Taobao is a marketplace platform. You have lots of merchants building their businesses on there, but by and large, they are not building the operations in a facility provided by the company. They’re selling them out of their own warehouses. What CloudKitchens is doing is [00:06:00] I would call it like a marketplace 1.

- They’re definitely building these operating facilities, this infrastructure, but once that gets standardized and perfected, then they will give out the tools, the robotics and all that. And you could put this into lots of warehouses. So this is a little bit like Fresh Hippo in China. When they started to digitize supermarkets, Alibaba built their own to begin with, with the idea that once that was perfected, they would give out the tools.

And anyone could launch one of these things in their own space. So a lot of the operating aspects and infrastructure that is talked about for Cloud Kitchens, I think is sort of phase one of a business model. Okay, so what is the business? When we look at ride sharing in Uber, a lot of positives and a lot of negatives.

The positives. It’s a high frequency activity. Transportation is a big deal. It’s everywhere. It’s everybody. This is a big total addressable market. [00:07:00] Every human on the planet, every human being on the planet needs transportation. We take it every day to work. Could be a bus, could be a subway, whatever.

Could be your own car. So you’re going after a very large Pool of activity with a relatively high frequency. This is not like renting a hotel that you do every couple of months. You know, people use this every day. Okay. That’s all very, very good. And it’s problematic, like taxis are a pain. So there’s a problem to solve.

That’s the good part of Uber ride sharing. The bad part, it turns out it’s kind of a commodity. People don’t really care that much about getting a car to work. Okay. What they care about is a couple factors. What’s the price? Is it convenient? And is it a reasonably, a reasonable quality product? You know, like the thing doesn’t smell.

But beyond that, there’s not a lot of dimensions to compete upon. So it’s, it’s more of a [00:08:00] non differentiated service you’re offering. The network effects that you get tend to be local. Having drivers in Singapore is no value to you if you’re a rider in Beijing. That’s different when we do something like hotel rentals or even Alibaba.

Like, the network effect can be geographically very, very large. Well, in ride sharing, it’s pretty local. And then it turns out the economics are not awesome.

And the car insurance most ride sharing platforms on the planet, Didi, Uber, Grab, have all struggled to get to profitability. Even after 10, 15 years of operations with dominant market share, they still struggle to make the economics work. And that’s a good strategy lesson. You can have a great business model that is competitively dominant and still not have good unit economics.

You can [00:09:00] dominate a bad business. Now, usually, if you’re going to get a lot of profits out of a company, you have to dominate a sector and then you get unit economics, but it’s not guaranteed, but it’s usually a prerequisite. Okay. Now, let’s talk about cloud kitchens. There’s a couple things that strike me as immediately better.

It’s a high frequency activity. Okay, you may or may not get a ride. to work or somewhere every day, but you are definitely eating two to three times a day and it’s everybody. It’s a higher frequency activity than ride sharing. As he said in this sort of interview on the on the Summit, this is Travis, and I’m paraphrasing, but basically like food is at the center of the human experience, of daily life, of kind of everything for everybody.

And food has problems. [00:10:00] Cost. People go to the grocery store, they cook at home. They don’t necessarily go to restaurants all the time. They don’t get delivery all the time. Cost can be a major issue. Convenience. Going to the market, taking it home and cooking it, not that convenient. Most people go to the supermarket a couple times a week at least.

Health. is a concern. These are the three factors he listed. Health, cost, and convenience. Some food is high quality, very good for you. Others, terrible for you. So he basically says, look, if you can make it cheaper, if you can make it more convenient, give people their time back for this massive sea of activity, that could be powerful in the same way that making, getting a taxi more convenient was a fairly powerful thing to do in ride sharing.

And here he posed one question in the interview, which I thought was awesome. I wrote it down word for word because I thought it was such an awesome summary of a business plan. And his [00:11:00] question was, and I’m paraphrasing, it’s not exactly word for word. Can you get the preparation and delivery of food so high quality and so cost efficient that it approaches the cost of going to the grocery store?

That’s great. There’s the production of food and there’s the delivery food. If you can get the cost of that close to the level of I’m going to the grocery store and cooking at home, then you’re gonna change everything. So it’s a nice, clear bar that you have to, you know, jump, basically. If you can do that, you will basically do to everybody’s kitchen what Uber did to everybody’s car.

You made that asset sort of digitized and different. I mean, it’s a great strategy question. You’ll, you won’t disrupt all of food, but you’ll disrupt a big part of it. Okay. Now, one point he did make in the discussion was [00:12:00] there’s a lot of parallels to Uber. The difference is, the biggest difference is, in my opinion, Uber benefited from the fact that the key asset for doing this business, cars, unused cars that were sitting in people’s driveways most of the day, already existed.

The infrastructure to do this business model was already out there in the world. You just had to build the software that connected all these assets. Okay, for cloud kitchens, the infrastructure doesn’t really exist and his team is having to build it. You know, kitchens that can produce and then distribute by delivery teams very, very cost efficiently.

That doesn’t exist yet. He said Cloud’s Kitchen’s mission is to build, quote, the infrastructure for better food. So there’s a lot more sort of building and operational involvement in [00:13:00] this versus Uber, which was much more surgically in capital light. It was mostly just doing software and then you got to onboard the drivers and do the safety checks, but it was mostly a software endeavor.

This is software plus robotics, plus real estate. Plus kitchens. So there’s a quite a bit more going on here. That’s not unusual for a serial founder. If you ever look at people who create multiple businesses like Elon Musk or Travis, the first business they build usually tends to be sort of capital light, like just do software.

That was PayPal for Elon, Uber for Travis. The next business they do, because they got a lot of money now, tends to be more capital intensive, more hardware intensive. So that’s building cars and rockets and kitchens, as opposed to a purely software play. And it’s a good move because it, most entrepreneurs can’t do that.

So you look for something that’s a little more [00:14:00] hardware capital intensive for your second venture if you got a big pile of money. Okay, so what is Travis and the team building? My understanding is kind of, they’re doing three things. One, they’re building lots and lots of robots and automated kitchens. If you’re going to move the cost down for food production, you can’t do it with people in kitchens.

You got to get robots involved and you got to get AI robots. So basically when Foxconn, you know, which assembles your iPhone, when they started automating and building digitized factories in China, they launched a factory called the Lights Out Factory. It’s famous. You can kind of look it up. It’s in Shenzhen, I think.

And the idea was we’re removing all the humans from the factory. It’s going to be only automation and we’re so confident we’re going to turn the lights off. So there’s no lights in there. It’s dark, which means basically [00:15:00] humans can’t work there. This is, you know, they call it the lights out factory. It looks like Travis is doing what they call the hands off kitchen.

Where they’re building kitchens where once you fill the dispensary, the basically the inputs with the right food and you’ve set everything up, it makes the food with nobody touching it. So hands off kitchen by definition has no human involvement and that’s when you when you move to that level You can start to get far greater efficiencies and you can start to drive that cost down But if there’s humans in the operational loop, you’re pretty limited So one they’re building lots of robots automated kitchens to try and get the efficiency and the cost down Number two, they’re buying real estate You know, you got to have facilities in major kitchens, you put the robots in them, and then you lease the space out to various restauranteurs who become the merchants and the suppliers on your platform that people can buy food from.[00:16:00]

Third bit is you got to write a lot of software. You got to have a tech stack, basically a software stack. Now what they’re doing here is actually pretty clever. Their software team, I guess they’re somehow they’ve got this software being used by restaurants just as a separate service. And he mentioned that, how many did they have?

Hundreds of thousands of restaurants in the U S are already using their software. So this is sort of outside of the core business. He says their software is involved in 18 percent of all food deliveries for restaurants in the U. S. So they’re kind of building the software with one foot in the kitchens and one foot is just a service to restaurants, which is a good way to do that, right?

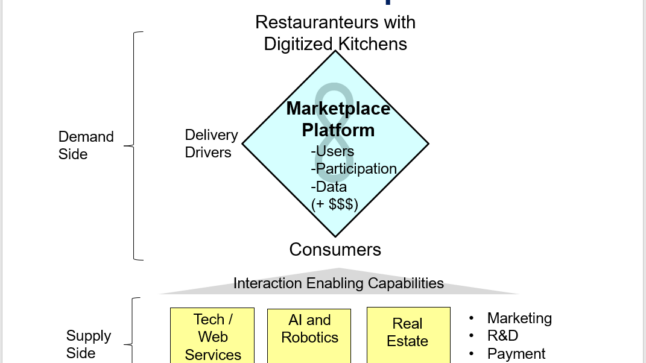

Those look like the major components that would get you the infrastructure of food production and, and then delivery. You know, he knows how to do delivery, obviously. That’s kind of the business model and that would sit underneath a marketplace platform. [00:17:00] So those are your sort of enabling capabilities.

The same way Alibaba had to build a lot of warehouses to sort packages and ship them, and then they put their marketplace on top of that infrastructure. This is the same thing. It’s a marketplace where you can buy lots of different types of food, but underneath there they’ve built the infrastructure that is the cloud kitchens, the delivery, the robotics, The software stack, all of that.

And I’ll put in the show notes, I’ll put my sort of pictures for how to look at this business, my standard sort of blue diamond diagrams. I’ll put there for this one. It’s pretty cool. Okay. So that’s kind of the business. What’s the problem? And we’ll get to the point. What are the five reasons I think it’s better than Uber?

if it works. All right, first, what is the problem? The problem from what I can tell, and I don’t have any other numbers, so I’m just going by press reports and his [00:18:00] comments, is getting restauranteurs on board. And being the supply side of this marketplace platform and then staying on board, I mean, they’re not churning out and leaving, which was always a problem with ride sharing.

There’s a very high churn rate. You would get drivers and then you’d lose drivers. Now, the supply side of this marketplace, it’s not just, Restaurants. It’s restaurant entrepreneurs. The same way Alibaba. Yes, they have T Mall, so they get the big brands, but the engine of Alibaba on the supply side has always been SMEs.

It’s been small businesses where people are entrepreneurial, and that’s how you get hundreds of thousands. of merchants and brands selling on Alibaba, not by getting the 50s biggest companies. So this is the same. They’re not going for restaurants, although I’m sure they are. They’re going for restaurant entrepreneurs, small teams.

That’s going to be your engine. Plus, they tend to work really [00:19:00] hard when they, they want these small businesses to build their business on these platforms, on their platform, in a way that it’s all virtual. There’s no physical restaurant. It’s all just on the website. In the marketplace and then they deliver.

So these virtual restaurants, that’s the engine of the supply site. It’s not clear that they’re getting them or if they are getting them on boarding them and getting them in there. Now you could see if the pitch sounds pretty good. Like if you want to start a restaurant, you don’t need to rent a space.

You don’t have to put all this money into equipment and fit out a restaurant and hire 50 or a hundred people. No, no, no. You and three people can just release a space from us and, and The robots will do most all of the work. You’ll design the concepts and you’ll market it and you’ll brand it and you’ll come up with something clever with food.

But a lot of the ops, one, there’s no upfront costs. And two, we’ll make it super easy where anyone can open a restaurant. [00:20:00] And that was pretty much Jack Ma’s pitch for Alibaba. We will make it easy for anyone to start selling as a merchant or a brand. You don’t have to be big boy to play this game anymore.

We will democratize being a merchant or a brand By giving them tools and a marketplace platform. This is kind of the same idea. Okay. It’s not clear that they’re getting these sort of restaurant entrepreneurs. If you’re not getting those, if you’re not getting a big suite of places and different types of food this doesn’t become better for consumers, right?

What you really want is the consumers to log in. in Detroit or wherever they are and realize they have thousands of different types of restaurants in their neighborhood they can order from and get delivered. Far more than they have today. And it’s cheap as going to the grocery store and cooking it yourself.

That would be winning big. Okay, it’s [00:21:00] not clear that they’re on the cost point or the sort of suite of supply. All right, but let’s, that’s sort of the Steve Jobs question. Does your product work and are you getting adoption? Let’s put that aside because I don’t really know. Let’s move to the strategy. Okay, if it was working and getting real adoption and scale, why is it more powerful in my opinion than Uber?

Five reasons. Number one Cloud Kitchens is in theory solving a bigger problem for consumers. Than Uber ever did. You know, as mentioned, every human needs food a couple times a day. Everybody. It’s, you know, it’s a high frequency activity that impacts literally everybody. So the total addressable market is huge and you get high frequency, which is something you need if you’re going to build a marketplace platform.

You need high frequency. [00:22:00] It’s, you know, it’s a lot easier to be selling food or transportation than hotel rooms, which are a low frequency activity. So it’s a fantastically large opportunity and I think better than transportation. And I think, you know, if you ever look at Uber’s numbers, when I go through Uber’s numbers, I always like Uber Eats far more than I like Uber for transportation.

I think Uber Eats is a better business. I think it’s higher frequency. I think it’s differentiated. I think it’s better and I think it’s more profitable, but you know, the key. If you’re going to solve this problem for consumers, the general rule I always use is to break into this business and get people to shift their behavior from their current practices.

You need a 10x solution. You need a solution that’s 10 times better than the current solution people are using to get people to switch. Now maybe they have that on the consumer side by being convenient and cheap and healthy. [00:23:00] But they also need it on the restauranteur side. They need something that’s ten times better than what they’re currently doing.

It’s not clear that they have that on the supply side. Okay, but in theory, it’s a better problem and a bigger problem to solve. That’s reason number one. Reason number two. It is a differentiated service on the supply side. If you’re going to build a marketplace platform, two different user groups, supply, sellers, and buyers, network effect between them, you go for scale.

That’s the whole point of building a platform business model is to go to scale. All of that, and then you get a network effect. All of that is better when you have differentiated supply versus undifferentiated supply. Like here’s an example. If I’m sitting in my neighborhood and I need a ride to the airport and I go on Uber and there’s 10 drivers or 20 drivers available [00:24:00] to take me to the airport, that’s all I need.

If a different platform, a competitor, had 500 drivers that could take me to the airport, the service really isn’t any better for me. They’re all the same. It’s a commodity. It’s a little bit better. I suppose the price is a little bit lower, but it’s not dramatically better. Now compare that if you’re doing on Uber Eats, I want to get dinner.

There’s 15 restaurants in my neighborhood. I can order from and deliver it versus there’s a hundred restaurants in my neighborhood. Oh, that’s better. That’s a dramatically better offering. It could be sushi. It could be tacos. It could be whatever. So differentiated services are more powerful. Platform business models.

They get a more powerful network effect. Every additional driver to take me to the airport, every marginal driver, does not add incremental value to me as a consumer. But every incremental [00:25:00] restaurant that I can order food from actually adds value to me. So one, in one case, the network effect sort of asymptotes very quickly.

It flatlines. But with restaurants and hotels and other areas that are differentiated services. It’s a linear network effect. The more supply, the better it gets. And it eventually flatlines, but it takes a long, long time. This is why marketplaces like Amazon and Alibaba and Shopee and Lazada are so fantastic because the more merchants they have selling stuff, it just gets better and better for consumers and vice versa.

You know, the more consumers, the better it is for merchants. So that’s reason number two, food is a differentiated service that makes it a better business model, in my opinion. Reason number three, Cloud Kitchens is an asynchronous marketplace [00:26:00] versus asynchronous marketplace, which is it’s not time dependent.

If I go on Uber Eats and I want to get food delivered, the supply of merchants I have. is much smaller because I need merchants that are open today. I need them to be open right now. It’s like, it’s like the same as live streaming. If I go on YouTube, it’s asynchronous content. I can watch any videos that anyone has uploaded today, yesterday, a week ago, a year ago, whatever.

But if I go on to live streaming, I can only watch people that are live streaming right now. Now they can upload it later, but generally speaking, the supply of content is dramatically less. Well, it’s the same for, I want a restaurant to make it for me now versus, you know, in the past. Well, Uber Eats is sort of a synchronous marketplace.

Cloud Kitchens, to [00:27:00] me, looks a lot more asynchronous. No, it’s not a hundred percent. Like, you know, you, you, if you’re running one of these cloud kitchens, you fill up all the trays, the supplies with all the food, you put it in the dispensers, and then the robot just makes it as needed. You know, it can be 4 a.

- and the system still, you know, still work. Now, it’s not quite as good as asynchronous Marcus plates for products where you can just stack stuff in the warehouse. And place an order today and get it in three days. So, I mean, it is somewhat time dependent, but it’s much less time dependent than you know, your standard, Oh, these restaurants are all closed at 9 p.

- So you’re going to get a much larger supply the same way that your typical YouTube channel has more videos than whoever happens to be live streaming right now. It’s kind of in the middle of those two scenarios, but it’s definitely better than I think Uber Eats. Or any of these sort of what we call synchronous marketplaces.

So [00:28:00] that’s point number three. Point number four. These, these last, those are kind of the big three. Four and five are much smaller. There’s no taxi unions. It’s not nearly as political. I mean, I kind of wonder like if his cloud kitchens are an improvement on what he built for Uber and also a reaction to some of its most difficult days.

You know, if you, one of the reasons, like, taxis are really political. If you go into New York City and you want to be a taxi service, you have to get a medallion, which you have to pay. It costs a lot of money because for some reason, historically, the city decided we can only have so many taxis in the city.

So there, here’s the number of medallions and you need one. There’s no rule that says there’s only going to be so many restaurants in the city. And it’s kind of weird if you think about it. Like, why would the city have a rule? We can only have, whatever, 5, 000 taxis in New York [00:29:00] City. They wouldn’t say we can only have 5, 000 restaurants.

No, no, I think the answer is it’s, it was political. You know, rent seeking, but yeah, there’s no taxi. One, there’s no medallions. Two, there’s no taxi unions city by city that are politically powerful. For some reason, that’s just not the way restaurants are. It’s a much more open, free marketplace. So I think by focusing on food and restaurants, you have health and safety issues, but you’re not going to have a lot of city by city political warfare.

Which you know, that must have been really tiring to go through. Alright, so last reason, number five. Restaurant, entrepreneurs in general are better than gig workers. Now, Uber, people didn’t really build businesses on Uber, the supply side. They were usually temporary gig workers. Travis had a quote where he said at Uber, Ultimately, the average Uber driver was [00:30:00] working eight hours per week.

So your average driver was kind of just doing this for a little side money from time to time, which is good. I think if you’re going to supply taxi services, that is better than hiring full time employees who often were unionized. Gig workers are better than employees, especially union, if you’re building a business, but entrepreneurs are better than gig workers.

Entrepreneurs is what you see on Alibaba. Alibaba. Merchants are building, and Amazon, merchants are building their business on the platform. They’re not just doing it a couple hours a week to make some side cash. This is their business, they’re deeply invested. We didn’t see that on Uber. Although, to be fair, if you ever looked at Didi in China, which is similar to Uber, when I interviewed them, like this must have been five years ago, A lot of the drivers ended up building businesses on DD.

So I think they [00:31:00] said about 2, 000, 3, 000 businesses, small businesses were built on DD. And these were drivers who then hired 5 to 10 drivers that worked for them, and they built small businesses. Okay, that’s kind of the exception. We didn’t see that in most places. Cloud Kitchens looks a lot more like this.

These are not just part time chefs. You know, this is people who are trying to build their own restaurants. So entrepreneurs are a better source of supply for a platform than gig workers. Gig workers are generally better than employees. Employees are generally better than unionized employees for building platform business models.

And there’s a different degree of politicization in all of that. So anyways, that’s kind of reason number five. So that’s it. Cloud Kitchens is solving a bigger problem for consumers than Uber ever did, if they pull it off. Food is a differentiated service on the supply side that makes a platform and the network in fact much more powerful.

An asynchronous [00:32:00] marketplace is generally more powerful than a synchronous one when time is no longer constraining things. It’s closer to that. Four, no unions, no political warfare, probably. Number five, entrepreneurs are a great base to tap into versus gig workers. Anyways, that’s kind of how I’m looking at it.

I’ll put my sort of summary. Those of you who are subscribers, I’m going to send you an article sort of detailing all this out. But I’ll put the graphic for how I sort of map out this business in the show notes. You can take a look at that. I guess one last comment and that’s pretty much it for today.

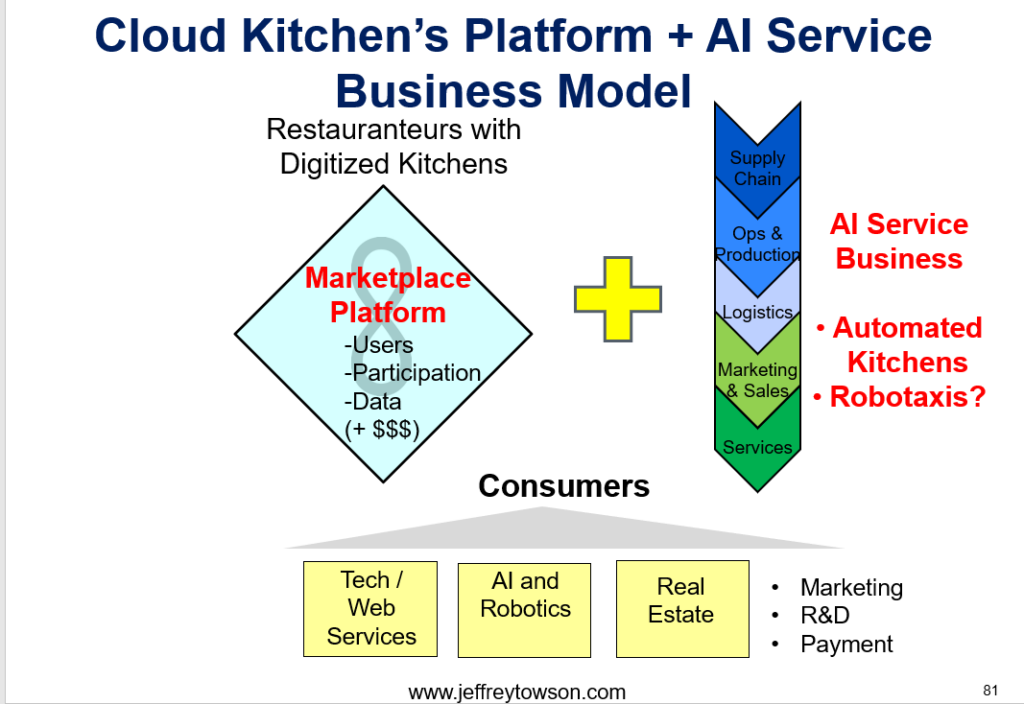

Thanks Everything I just said would be the same 10 years ago for how to build a platform business model, a marketplace for services. However, in the last year or so, we’ve seen generative AI and AI and other types of AI start to do things in an automated fashion. And we start to see, you know, when you go on Google search now [00:33:00] or Bing search, you don’t just get the search engine.

That would be a platform business model. You also get the chat GBT like response at the top. That is not a platform business model. That is an AI service. So we’ve seen this new business model emerge of AI services. Which I think are as powerful and maybe more powerful than platform business models. So it’s like platform business models where they were the lion of the jungle.

They were the most powerful animal on the savanna. I don’t want, I don’t always say lion of the jungle. Lions don’t live in the jungle. Lion of the savanna. Well, AI enabled services like ChatGPT That’s like the tiger. We’ve got a new animal. It may be stronger than the biggest animal. Well, we can see this in something like Uber already.

Uber is a platform business model, but robo taxis are not a platform business model. They [00:34:00] are an AI services business model. There’s no drivers. There’s no platform. And what Uber should evolve into is a platform plus the service. So a lion plus a tiger. A platform with drivers that are human plus robo taxis, which are just an AI enabled service.

Now, we could see the same thing with cloud kitchens very easily. We could see the platform business model with the restauranteurs, but we could also see these, this infrastructure that they’re building turn into an AI service without restauranteurs. In fact, I think that’s actually probably a more powerful business model.

I’m not even convinced he’s, I’m, I, If phase one is a platform business model, phase two is adding an AI service. I think he may be going for the AI service in general. He just doesn’t have the tech to do it yet, where you have these cloud kitchens all over the world that can make you any type of food and deliver it with very few humans involved, [00:35:00] where the AI starts to design the menu and design that.

All the products and ingredients and all the, all of that menu stuff. I don’t know. But I think it’s definitely going towards a platform and a pipeline. And maybe ultimately it will be 70 percent a pipeline and AI service and only 30 percent a platform. Which is very much where Robotaxis could end up.

Anyways, that is it for this topic. Kind of fun. I thought it was a really cool talk. It’s worth looking at. I’ll put the link in the show notes so you can watch him do the interview. Very cool. Anyways, we’ll see if it, if it really gets adoption and takes off. I hope it does because I think it would be a phenomenal service, but we’ll see.

Okay, that is it for today. I don’t really have any fun stuff. I’ve just been traveling around, having a good old time swimming with whale sharks, jumping off waterfalls. Really fantastic. It’s been a pretty great month. I’m kind of wiped out, so I’m just buried in [00:36:00] 10ks this week, which is kind of where I’m I’m most happy in life.

So anyways, that is it for me. I hope everyone is doing well, and I will talk to you next week. Bye bye.

———-

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

Note: This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.