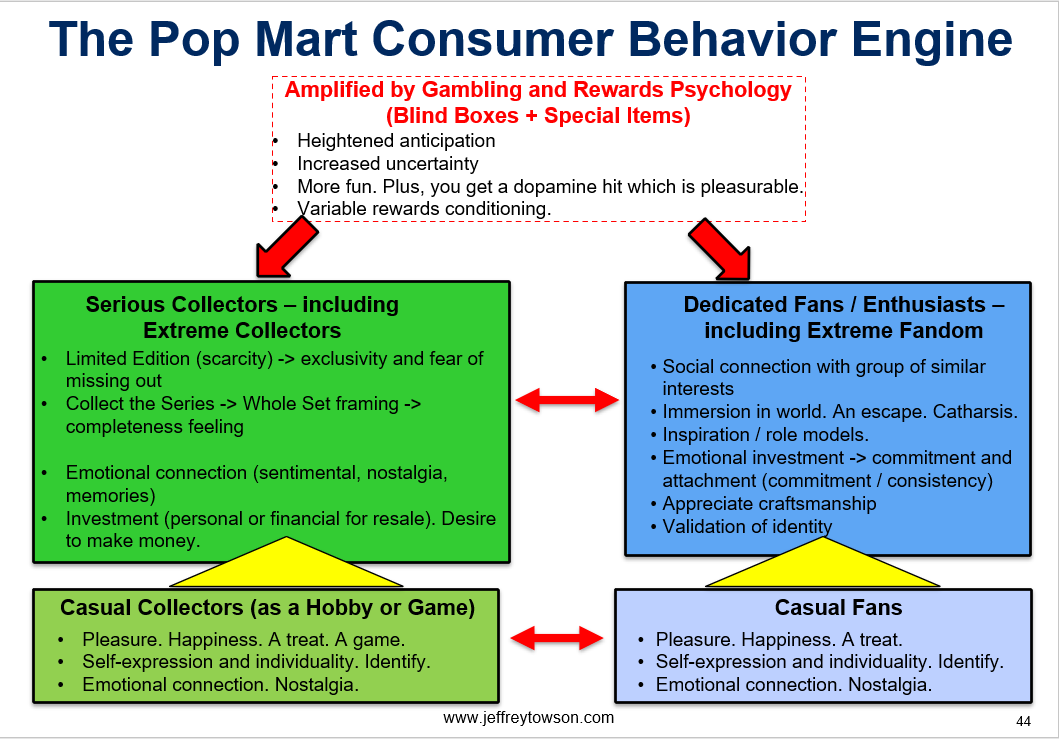

- Pop Mart is definitely benefiting from gambling and rewards behavior. The buying process is much more exciting with blind boxes. And the winning and losing aspect induces repeat purchases.

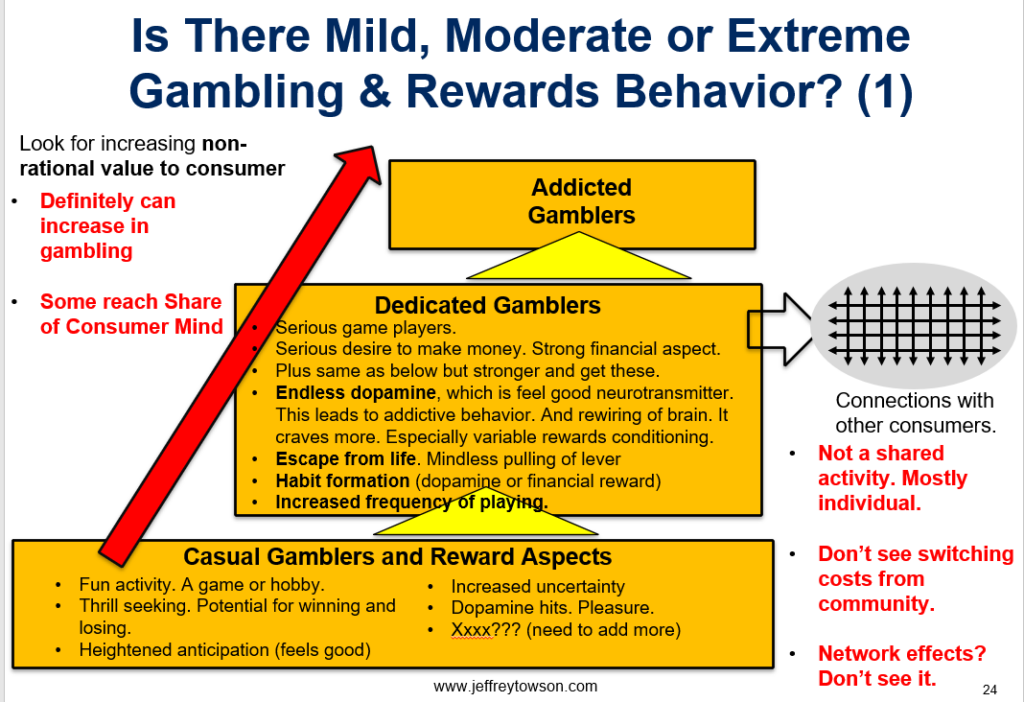

- We can segment customers as mild, moderate, and extreme gambling behavior. We can look for specific drivers of gambling and rewards behavior. See my checklist for this.

- Overall, I think pop toys is a mild to moderate form of gambling and rewards behavior. I rank it at 5 out of 10. This is an amplifier of the fan and collector behavior.

***

In Part 1, I went through the basics of Pop Mart. In Part 2, I went into fan behavior. And in Part 3, I detailed collector behavior.

Those articles pretty much told one cohesive business story about Pop Mart.

- An IP business with a portfolio of +90 pop toy characters.

- An omnichannel retail with distribution operation with +300 retail outlets.

- High purchase frequency and gross margins resulting from fan and collector behavior.

That is one story. However, you could argue this is all secondary. Important but not the primary engine of what is going on.

You could argue that what is really going on at Pop Mart is Blind Boxes. These were 84% of Pop Mart revenue in 2023. And blind boxes are mostly about capturing gambling and rewards behavior in consumers.

Luke Paul Bets +$500,000 on Pokémon Card Boxes

In my recent podcast on Pop Mart, I talked about YouTuber Luke Paul and his appearance on the Netflix show The King of Collectibles: The Goldin Touch. On an episode, he bought two sealed boxes of Pokémon cards from 1999 – and then opened them on camera. Each box has 36 packs of Pokémon cards. They call this a “box break”.

He was hunting for a Holofoil Charizard card, which is apparently worth $400,000 USD. And while doing the unboxing, he was wearing a necklace that was a case holding his most valuable Pokémon card inside. He says it cost $5.3M USD and is the most valuable Pokémon card of all time.

The sealed box of cards he opened was a first edition box from 1999. And they paid +$200,000 for it. And as he did the unboxing, the excitement was palpable. They opened the card packs one by one hoping for a valuable card. It was agonizing. It was like watching someone at the poker table with a big pile of money on the table. Waiting for the next card to turn over.

I encourage you to watch a bit of the box break before continuing. The video is here.

The first sealed box didn’t have the valuable cards he wanted. And it was crushing. In the episode, he was literally laying on the floor recovering.

And then he decided to buy a second box, with another +$200,000. That was also agonizing to watch. You could see him struggle about whether to try again. And then the second box also didn’t work out either.

What jumped out at me watching this was how powerful these sealed boxes were. They dramatically increased the excitement. It was high anticipation. It was clearly thrill-seeking behavior with big potential gains and losses. And the loss was crushing.

Which then induced a repeat purchase almost immediately. I’ve watched friends at poker tables in Las Vegas behave the same way.

So, are Pokémon cards really about collecting and fan behavior?

I think much of the time yes. There is some degree of fandom. And lots of people collect Pokémon cards as a game. As a hobby.

But in the Luke Paul box break, we are clearly looking at gambling and rewards behavior. It overshadowed everything else.

So, are the collector and fan aspects of Pop Mart overshadowed by the blind box phenomenon?

Box Breaks and Blind Boxes Are Really Great

I view “box breaks” for things like Pokémon and baseball cards as a hobby and game in collectibles, amplified by some gambling and rewards behavior. You could get a rare card you don’t have or nothing special. The gambling behavior increases the fun. In particular, it supercharges buying experience. And induces repeat purchases.

I view Pop Mart’s Blind Boxes as a similar phenomenon. They amplify the fun and collecting behavior. And they are not really for financial rewards. It’s a mild form of gambling and rewards behavior. Nobody is sweating as they open a blind box. They aren’t filming and posting it. And immediately buying another blind box to try again is not that big a deal. It’s only 40-50 rmb and they are hoping to complete their set. It makes the hobby more fun. And it induces repeat purchases. Especially if they are going for the rare, hidden design.

Recall Pop Mart’s explanation for its blind boxes (from its IPO filing).

Compare that to how people will buy the contents of a storage unit blind. If someone doesn’t pay their bill or such, the storage company can auction off the contents of a storage unit. And the bidders much do so blind. If they win the auction, then they can open the storage unit and see what they got. That is a good example of blind boxes for 100% financial speculation. There is no fandom or collector behavior happening.

In between these two situations, we have the Luke Paul situation. There are a limited number of first edition sealed Pokémon boxes still in existence. And doing the box break is clearly a mix of financial speculation and collecting as a hobby. The gambling behavior is pretty powerful.

But for all of these, there is a really strong temptation to try again. When you win. And when you don’t win. Especially if it feels like a “near miss”. You almost had the win. You were so close. Let’s try again.

When visiting business schools, Charlie Munger used to ask the students which slot machine in a casino would generate the most money. He used to ask lots of these types of questions. His answer for the most valuable slot machine was it was the one that gave customers the most “near wins” when pulled. Near wins have a particularly powerful impact on people. It’s arguably the most powerful form of gambling and rewards behavior.

My Simple Checklist for Gambling and Rewards Behavior

I don’t have any serious frameworks for gambling and rewards behavior. It’s a bit topic. There are tons of books written about how casinos and other gambling businesses are put together. Their operational designs. The designs of the games. Which consumer psychology they target. A good book on this is:

Outside of pure gambling businesses (lotteries, casinos), I view this mostly as an amplifier of other consumer behavior. That is definitely what is happening with Pop Mart blind boxes.

But we also see gambling behavior more and more in ecommerce apps. Usually under the guise of “gamification”. And we see it in videos with give aways and other tricks. Famous YouTuber Mr. Beast is currently facing allegations that the big giveaways and promotions in his videos are basically lotteries targeting children. I don’t know if any of those allegations are true. But the tactics he uses to keep people watching definitely include rewards behavior.

And I think this is just the beginning.

It turns out software and data technology are really, really good at adding gambling and rewards behavior to digital services.

For all of this, I use the following gambling checklist.

- Are there rewards in the buying or usage process?

- Is there increased uncertainty in the buying process? Or in the usage of the product?

- Is there heightened anticipation? This increases excitement.

- Is there increased fun and pleasure due to rewards behavior. Do you get a dopamine hit which is pleasurable. Is it happening pre-buy, buying, post-buy or usage?

- Is there the potential for significant financial gains?

- Is there the potential for significant financial losses?

- Do we see thrill-seeking behavior? Is there the potential for significant winning and losing.

- Is there variable rewards conditioning. Do we see variations in rewards, punishments and near misses? This can result in 4 things:

- Big dopamine hits for the consumer, which is the “feel good” neurotransmitter. This can lead to addictive behavior. And variable rewards can lead to rewiring of the brain.

- Escape from life for the consumer. Think people mindlessly pulling the slot machine lever for hours.

- Habit formation (cue -> play -> dopamine or financial reward)

- Increased frequency of play.

- Overall, is the gambling and rewards behavior low, moderate, or extreme? Rank it 1-10.

Here’s my graphic for that.

For Pop Mart, I consider blind boxes as an amplifier to collector and fan behavior. And I consider it a fairly mild form of gambling and rewards behavior. I rank it as 5 out of 10.

Combining this with the other checklists, I get this for Pop Mart consumer behavior.

Final Point: Auctions Are Marketplace Platforms with Gambling Behavior

The first big marketplace business model online was arguably eBay. And it was set up as an auction site. Not a big marketplace like Amazona and Taobao.

What is the difference?

Buyer and seller marketplaces are just buying and selling. And you can definitely do this for collectables and fan items. I can buy Iron Man toys all over Amazon. Standard marketplaces even work for vintage products. Etsy has lots of vintage items (clothes, furniture). And it also has antiques (Japanese coins from the 1800’s).

But once we switch from a marketplace to an auction site, we start to see different behavior. The Netflix TV show I mentioned is about Goldin, which is a collectibles auction business. Which is online. And global. They focus their auctions on collectibles (rare items, collections). And they particularly focus on memorabilia related to sports and entertainment.

Once you switch to an auction for collectibles business model, we see whole new layers of psychology happening. It’s pretty impressive how different it is from a typical marketplace.

- There is a lot of financial speculation (and investment sort of). These collectables can be bought and sold for lots of money. There is also lots of thrill-seeking behavior.

- The auctions are events that are promoted and hyped.

- The excitement of the buying process (and pre-buy anticipation) really increases. Unlike with marketplaces, there is now the possibility of winning and losing in the auction.

- Suddenly there is a time limit. That increases the excitement. Everyone watches the auction clock tick down.

- The uncertainty increases. So does the anticipation and fun.

- There is also now a fear of missing out. You may never get a chance to get this item again.

Overall, it’s a really interesting business model. I’d rank the gambling and rewards aspects at 8 out of 10.

***

Ok. that’s it for Pop Mart. I’m moving on to Bilibili.

Cheers, Jeff

Conclusions

- Pop Mart is definitely benefiting from gambling and rewards behavior. The buying process is much more exciting with blind boxes. And the winning and losing aspect induces repeat purchases.

- We can segment customers as mild, moderate, and extreme gambling behavior. We can look for specific drivers of gambling and rewards behavior. See my checklist for this.

- Overall, I think pop toys is a mild to moderate form of gambling and rewards behavior. I rank it at 5 out of 10. This is an amplifier of the fan and collector behavior.

———-

Related articles:

- When Microsoft’s Bundles Are Good vs. Bad for Customers and Markets (Tech Strategy)

- Microsoft’s 3 Big Upgrades to its 2 Platform Business Models (2 of 2) (Tech Strategy – Daily Article)

- What is Elon Musk’s Plan to 10x Twitter? (2 of 2) (Tech Strategy – Daily Article)

From the Concept Library, concepts for this article are:

- B2C Customer View: Gambling and Rewards Behavior

From the Company Library, companies for this article are:

- Pop Mart

———-

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

Note: This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.