This week’s podcast is about Bilibili and its choice between staying with specialty video or going mass market video service.

You can listen to this podcast here, which has the slides and graphics mentioned. Also available at iTunes and Google Podcasts.

Here is the link to the TechMoat Consulting.

Here is the link to the Tech Tour.

Here are the mentioned graphics.

———-

Related articles:

- When Microsoft’s Bundles Are Good vs. Bad for Customers and Markets (Tech Strategy)

- Microsoft’s 3 Big Upgrades to its 2 Platform Business Models (2 of 2) (Tech Strategy – Daily Article)

- What is Elon Musk’s Plan to 10x Twitter? (2 of 2) (Tech Strategy – Daily Article)

From the Concept Library, concepts for this article are:

- Audience Builder Platform

- Digital Attacker Strategy

- Videos

From the Company Library, companies for this article are:

- Bilibili

——transcription below

Episode 219 – Bilibili.1

Jeffrey Towson: [00:00:00] Welcome, welcome everybody. My name is Jeff Towson and this is the Tech Strategy Podcast from TechMoat Consulting. And the topic for today, will Bilibili get to sustainable scale and profits in specialty video? Now, I haven’t talked about Bilibili on a podcast before, I don’t think. I’ve written a couple articles about it.

It’s a very interesting company really cool company. Interesting strategy and business model. I mean, there’s, there’s a lot of great strategy lessons in this company. And I’ll sort of go through how they were very, very successful as a specialized version of something like YouTube. But also, how their traditional strategy, which has worked very well in many ways, may be at a crossroads and There’s a question of whether they’re going to be able to get to a [00:01:00] size and profitability that is sustainable against the giants.

So that will be the topic for today. Pretty cool company, actually. Let’s see. Standard disclaimer. Nothing in this podcast or my writing or website is investment advice. The numbers and information for me and any guests may be incorrect. The views and opinions expressed may no longer be relevant or accurate.

Overall investing is risky. This is not investment legal or tax advice. Do your own research. And with that, let’s get into the content. Now, for those of you who are subscribers, I sent you an article detailing a lot of this last week. I’m going to send you two more on Bilibili coming up. So, it’s going to be a pretty deep dive on, I think, the key question moving forward, and then also sort of the strategy lessons.

Now, prior to this, I talked about Pop Mart, which is not really a digital company. But it had really good lessons on consumer behavior related to [00:02:00] fandom, related to collecting, and related to gambling. That was kind of a tee up for Bilibili, because Bilibili, the simplest explanation for Bilibili is that it is a YouTube that was specialized for anime, comics, and gaming.

ACG. Okay, that’s a lot of fan behavior. I mean it’s, you know, Pop Mart, Pop Mart’s sort of a bit of gambling, a bit of collecting, and a bit of fandom. Bilibili was really focused on fan behavior in these three areas, and that’s how they created a specialty version of basically YouTube for China. But there were other YouTube sort of classic copies in China like Tudou, iQiyi, Tencent Video.

So this kind of goes back to my standard question, which is, When we see a specialty business in digital competing against the [00:03:00] giants Pinduoduo versus Alibaba, we talked about that one, HubSpot versus Salesforce, Etsy versus Amazon, you know, when do these specialty smaller versions of these businesses thrive and when are they kind of whistling past the grave?

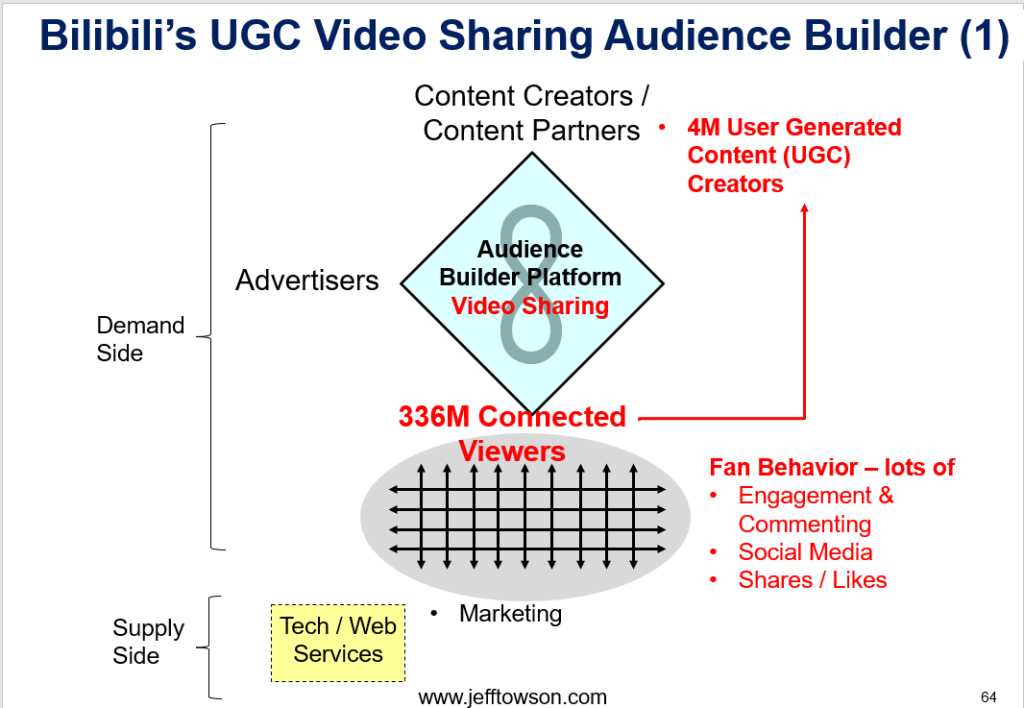

So, this is kind of the next version of that same question. And yeah, and it was, we’ll get into it, but there are three concepts I think are worth keeping in mind for this. The first is audience builder platforms. I’ve talked about this a ton. You know, that’s TikTok, that’s YouTube, that’s Instagram.

Fantastic business model. It’s a platform business model with content creators on one side, viewers, consumers on the other. You get a great network effect, especially if there’s a lot of long tail content. Pretty awesome. There’s a reason there’s only one YouTube in most of [00:04:00] the world. So that’s part of it.

This is kind of a specialty version of that, which we’ll talk about. The second is, What I wrote about a couple weeks ago, which I called sort of a classic digital attacker strategy, which is when you come up with a new business model, or you get to something first, you go after an incumbent business, in this case like Cable TV, with your new business model, which is in this case a YouTube like business model, and you learn to sort of capture a key position.

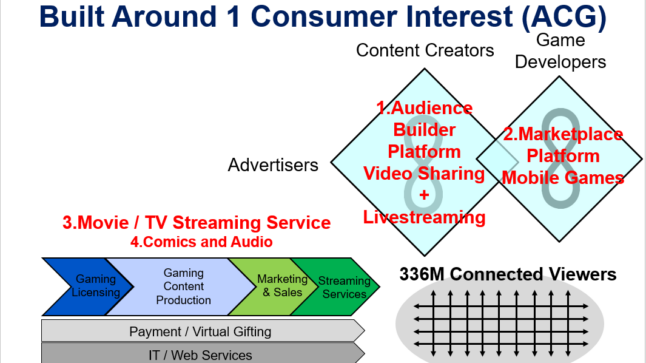

In this case, it’s video watching. But what happens after that is important in this case, which is you start to build complementary services around that core interaction or service. So, if you were a specialty video sharing company for anime, comics, and gaming, the next step of that [00:05:00] strategy would be to add lots of complements and services for the same user group, which is what Bilibili did.

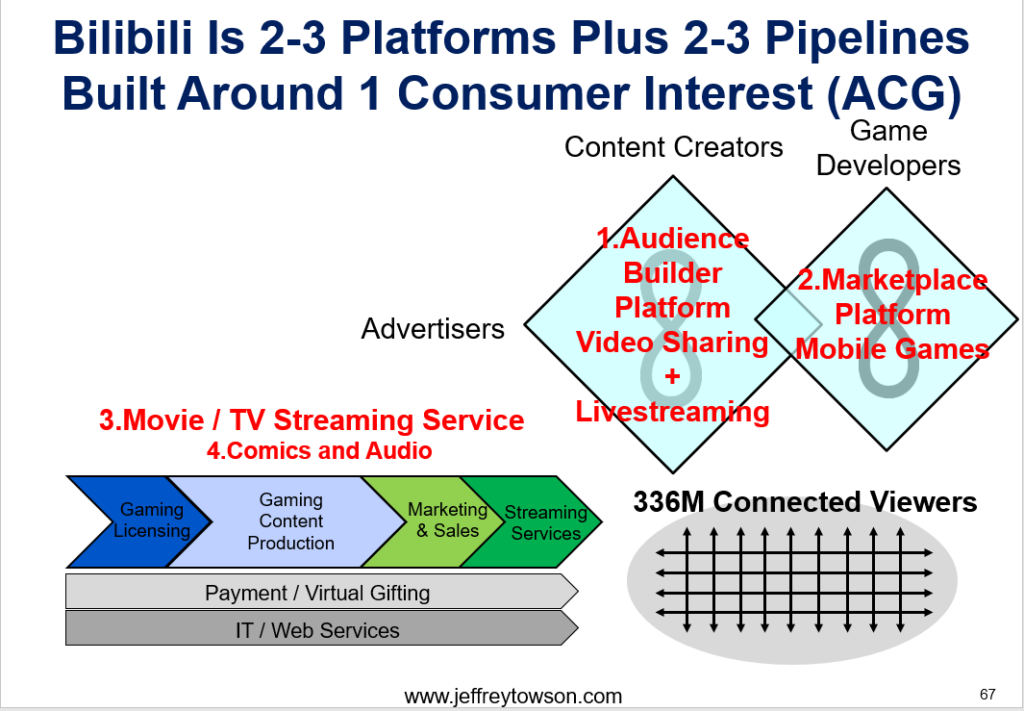

They started with video sharing. Then they added live streaming, but again, focused on gaming. That was their number one topic, still is. Then they did comic books. Then they did original content, production, TV, movies, but again, in that case, specialized for anime. They did mobile gaming. which is another platform business model.

So, they have really two platform business models happening here. So, they built up over time, a suite of complimentary services around that key point of attack. And the foundation of their business is still the same. It’s user uploads, user generated content that is then shared on the platform. It’s YouTube business model.

Everything else complements that and extends it. But that’s the foundation. So that’s sort of point number two is [00:06:00] this, this digital attacker playbook, which is really common, and you can go back and read that article if you want. You see it all the time. So, that’s sort of point number two. And the key question I’m raising for this video is that strategy, which they’ve done very well with over the past 14 and a half years or so, I think maybe running out of room, where I think it’s not going to get them to a viable scale or profitability, and they may have to abandon their specialty strategy and become a ubiquitous video platform for everyone for the mass market.

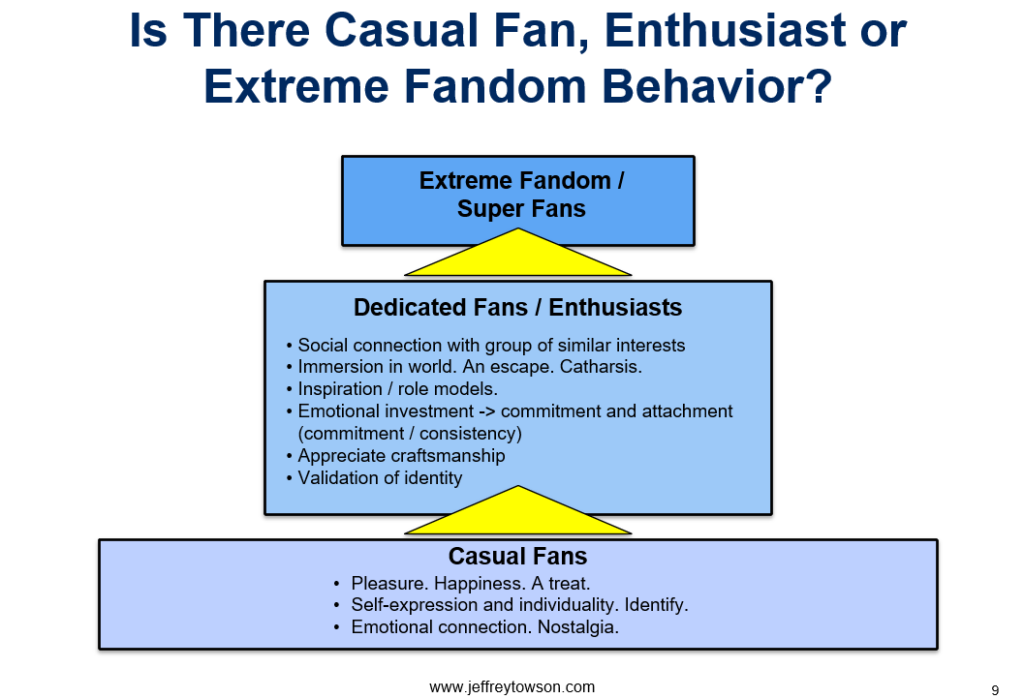

And the management’s comments in the last year have indicated that’s what they’re doing to some degree. So, are they going to abandon a specialty playbook? and become a mass market video platform like YouTube. That’s kind of the question for this podcast. Okay, third [00:07:00] concept for today, which is something I talked about with Pop Mart, which is when you interact with consumers, B2C, there’s different levels of the interaction.

The simplest is just a utility like buying detergent or buying socks. Cost versus quality. The next level up, you’re usually sort of product centric, where you’re always adding new features every year, and it’s sort of an innovation race. The level above that, which is what Pop Mart does, is when you start to become emotion centric and not feature centric, not product centric.

That’s a lot of what Bilibili is about. Everything they’re doing the fact that you’re doing video, which is a totally optional product in life, that’s all emotion. And the fact that within that, they’re specializing on the, they’re specialized in the areas that [00:08:00] consumers care the most about. Fans of comic books really care about comic books.

Fans of gaming really care about gaming and anime. So, they are sort of, within video, they are as emotionally centric as you can be. And that’s, that’s different than TikTok, it’s different than YouTube and it’s certainly different than, you know, non-entertainment products, which are much more product centric.

So, within that idea, which I talked about, going from product centricity to emotion centricity as an offering to consumers Bilibili is right at the top of that pyramid. Take care. Which is interesting to look at. Okay, those are the three concepts for today. Let me start by sort of going through the background because I think most people are not familiar with this company.

Okay Bilibili founded 2009, obviously Chinese. The first phase of their development, very similar to YouTube, very [00:09:00] similar to TikTok, very similar to Tudou, iQiyi, you know, it’s, let’s try and get people’s attention in video, which is a great place to focus. If you’re in the attention business, we get their attention and then we advertise or we monetize with gamify, whatever.

Certain things are more powerful than others, and video is top of the list. Well, I mean, Messenger is technically top of, top of the list, but in terms of time spent per day, you know, about 30 percent of time staring at a smartphone is watching videos. So, video is about as good a place as you can target, and these original audience builder platforms are about as good a business model as you’re going to find in life.

Now, maybe Google search is better, but this is on the short list of really powerful business models. So 2009, you’ve got to give them credit for a couple [00:10:00] things. They were early. Early mover matters. Arguably the single most valuable thing on a smartphone, which is watching videos. And three, they went after it with arguably one of the most powerful business models that exist, which is an audience builder platform for long tail content.

Massive network effects. Probably the only weakness there is because they were Chinese language specific. They really limited themselves to China where YouTube and others were multi language and they could go global. But, you know, you gotta do what you gotta do. Okay. Now, they added on to that the idea that they had really two types of differentiation as a specialty video service.

Number one, as mentioned, they weren’t general purpose video doing [00:11:00] everything for the mass market. They anime, comics, and gaming, ACG, ACG. So, they targeted three areas with pretty enthusiastic fans. Now, why is fandom important? I talked about this with Pop Mart. Generally, you get higher frequency of engagement.

Generally, you get more loyalty. People watch more. They comment more. You can build membership portals around this. You can do a lot. It’s much more of a community than passive viewing. They also tend to have more intention to spend. People who are just scrolling on TikTok aren’t really there to buy.

People who are watching their favorite gaming videos and comic books, you know, okay, they’re not there to shop, but they buy a lot more generally. So, [00:12:00] combining a YouTube like platform with these specific topics which tap into fandom behavior. Very smart. Very, very smart. Now they also did something which is not widely known.

They started a membership program very early on. So, if you wanted to comment you couldn’t just comment. And you couldn’t just sign up and then comment. You had to pass a test. like a hundred question test about gaming or anime and about the values of this community. So, they were really sort of screening for their audience and community.

So, for a long time, Bilibili was much more of almost like a community for gamers and people to hang out and chat. The other thing they did, which is what they’re most well-known for, is they did bullet chat, which It’s kind of what they’re most [00:13:00] known for, which is basically, look, if there’s a video playing, me watching a video is one way communication.

I can write comments about the video, and they will basically roll across the screen on top of the playing video for others to read. So, they sort of added a level of fan engagement. and two-way communication on top of one-way broadcast. So, when I’m watching the video, I’m watching the video, that’s great, but I’m also chatting back and forth or reading what other people have said.

So that plays into the fact that you’ve got a much more engaged fan base. It’s also visually really kind of striking. You can’t miss it. If you see bullet chat on Bilibili, I mean, it strikes you immediately as very different than YouTube. So those were kind of their key differentiators early on, and the foundation of their business was really this [00:14:00] platform sharing of video model audience builder.

Okay, now, if you look at how management talks about their business, which I always like to read, here’s how they talk about it. This is from their public filings. Quote, Video is a dominant media for communication, entertainment, and information. Video creates, quote, a strong emotional bond.

Video is intuitive, vivid, and an informative way to connect people with the world. Here’s how they describe their own content and community. Is quote, an iconic brand and a leading video community for young in China. Now that’s another part I haven’t mentioned. Going along with the whole ACG focus, they’ve been very focused on a certain generation, which back in 2010 was much younger.

So, Gen Z, now they [00:15:00] call it Gen Z Plus. Basically younger, and we see this with video platforms and social media. Each generation sort of adopts their own platform. So, they were sort of focused on the young group. They describe themselves as a, quote, aspirational culture. They say their community is young and culturally aspirational.

And Gen Z plus, basically that’s born 1985 to 2010. That range. So, you can see almost from the beginning they’re not describing themselves as YouTube. They’re talking about a certain demographic that are culturally involved, that are engaged, that this is a community with the shared values, and that’s why they give you the membership test.

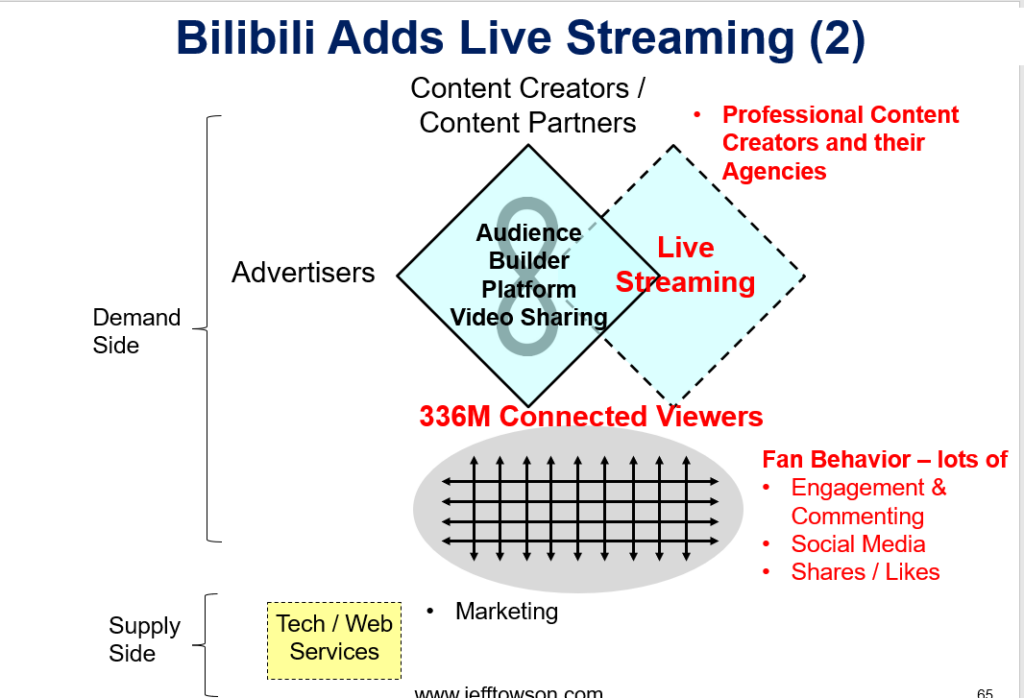

So that’s also how they define themselves early on. Okay, we’ll call that phase one. User generated videos. Now, what they added on to that fairly quickly was live broadcasting. [00:16:00] So, you know, someone points the camera at themselves and starts talking about what they’re doing. And within that, gaming was their number one topic.

That’s the interesting thing about this. When you look at Bilibili’s numbers, you see that most of the users are coming from the video sharing platform. But most of the engagement commenting and most of the revenue was coming from live streaming. Now this has a lot to do with China 10 years ago didn’t have a great digital advertising market So companies like Bilibili and Tencent, they made their money with live streaming and gaming and things Gifting, you know, you put some money in there and then you can give little gifts to your favorite streamers and stuff like that That has now shifted over time and advertising is much better.

But early on most of their revenue was coming from live Broadcasting live streaming now the problem with that, you [00:17:00] can’t really build a standalone audience builder platform on live streaming. It’s very difficult. If you switch, I mean, when you upload a video and then you watch a video there’s a time lag.

It’s asynchronous. Everything live streaming is, most of it is live. Which means, the number of content creators is dramatically smaller. The network effects are much, much weaker. So, you don’t have nearly as powerful of a business model. However, you do have a somewhat more powerful consumer offering.

Watching something live is more powerful. And it feels different, especially when you’re chatting and you’re watching it live, you know, watching sports events. So, it’s more powerful as a consumer service, but it’s a weaker business model, and it’s very hard to create a live streaming standalone platform.

Now [00:18:00] what Bilibili did, which was smart, is you piggyback that live streaming on the core video sharing platform, and that works quite well. Okay, so that’s their first couple businesses. The third one, well, there’s two I want to talk about. The third one they call Occupationally Generated Video, which is weird.

This is basically when they’re putting content up, videos that are created or licensed TV shows, movies, so think Netflix. But again, they’re focused more on anime documentaries, education, and a couple other categories that are consistent with their focus. Now that’s actually pretty common in China.

Most of the main video players, iQiyi, Tencent Video, and Tudou, they all do both content creation and licensing, as well as user generated videos. They all do both. Okay. So, you can see they’ve sort of added in a Netflix type business model that’s [00:19:00] consistent with their anime focus. Okay, so one, two, three businesses.

And my earlier comment was, this is your classic strategy. You can see they, their core product was always video sharing, audience builder. That got them the users, that got them a good position, but from there they expanded into this suite of other products and services which don’t honestly have as good economics.

Live streaming in particular does not have great economics. You can get more revenue, but the cost of revenue, you have to basically revenue share with the popular streamers. You know, the gross profit margins on something like live streaming are going to be closer to 25 30%, as opposed to uploading videos on TikTok, where it’s almost all profit, right?

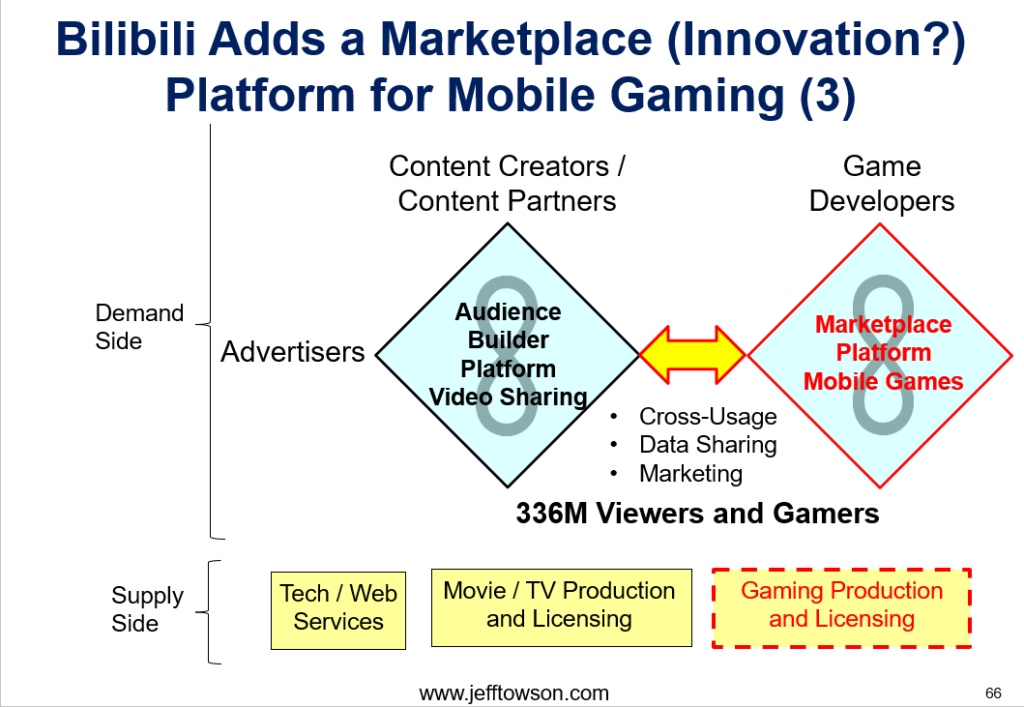

So, they’ve shifted into these other [00:20:00] areas like Netflix type model, and YouTube. live broadcasting that don’t have as good economics, but they’re very nice complements for their very specific user group. So that’s the classic digital strategy. And then the other one they added on top is mobile gaming.

And that’s really their other big gun here. Video sharing is number one. And then You know, especially video sharing that leverages in fan behavior, with a little bit of live streaming on top. After that, really what gets your attention is mobile gaming. So, the mobile gaming platform they have that’s a second platform business model.

You could call it, I mean think, think Steam. Tens of thousands, probably more than that, people upload their games there. It’s sort of a marketplace business model. [00:21:00] You can argue whether this is an innovation platform or a marketplace platform. I view it more as a marketplace platform. But it’s kind of in the middle there because game developers will create their game for this platform.

Now if they’re just putting it up there and you can stream it and play it, Okay, that’s a marketplace. But if they’re putting it up there and they’re using the tools of the platform to create their game, like Epic Games has a game engine, so game developers build their games on Epic, but they use a lot more than just the marketplace.

So, I would call that an innovation platform as opposed to a pure marketplace. I think Bilibili much more of a marketplace. But, you know, I think Across all of that, now I’ll give you some numbers, for their audience builder, for their live streaming, for their mobile gaming platform, they have about 336 million viewers, generally [00:22:00] speaking.

That’s great. That’s, that’s quite good. I’ll give you some more numbers in a minute. But companies like TikTok, which is a direct competitor You know, they’ve got 700 million. They’ve got double. So, 336 would be great anywhere else. In China, it raises the question, are you subscale? You don’t want to be half the size of a digital giant, unless you have a very strongly differentiated specialty business model.

And this gets to my core question. Are they too small? To survive, thrive, and profit long term, given this differential with the giants. Which is kind of my, my key question here. Okay. Okay, let’s talk about some numbers. I am going to post my standard graphics, you know, my little diagrams for how these companies look.

Because it’s a little bit of a complicated business model. Those will be in the show notes. That should hopefully be [00:23:00] better than me just describing them. But let’s do some numbers here. Alright, so if we look at the last ten years, we see good and bad. The growth story in users is pretty fantastic.

As mentioned, 2023, last year, monthly active users, 336 million. And that was up dramatically from, you know, five years ago. They’ve just been doubling and doubling and doubling. However, in the last two years, that has been fairly flat. So, the monthly active users was growing, now it’s sort of, at least for the last two years, somewhat flat.

And management has talked about how they are now switching their focus from growing the monthly active users to daily active users. So, basically that’s [00:24:00] kind of an indication they’re shifting from user growth to user engagement. Daily active users in 2023 was 100 million. That has been increasing more.

Pretty solid numbers there. Like, if you go back a year before that, daily active users was about 80 million. So, that’s great in that they really surged overall for a long time. There’s a question of, is their overall size reached its limit? And now they’re shifting to engagement because they can’t get bigger than what they are.

Which is always the problem if you’re going to do a specialty business. You’re going to hit a ceiling at a certain point. That may be what’s going on. Okay. Revenue growth. Pretty great. Pretty great.

2016, their revenue was about 520 million renminbi. Okay, you know, 70 million dollars, something like that. [00:25:00] From 520 million renminbi to 2016, in 2020, they reached 12 billion. So, I mean, this is closer to 20x in about five years, 10 to 20x. Right, that’s pretty spectacular. Last year they had about 28 million paying users.

So that’s a little less than 10 percent of their monthly average users. About 1 in 4 of their daily users. That’s actually pretty great. Like, if you ever look at the ratio of paying members versus, let’s say, monthly active users, you might get 3, 4, 5%. They’re close to 10%. I think that has a lot to do with the anime, comics, and gaming focus.

On average, their monthly revenue per paying user is about 45 RMB. So about 8. That’s not bad for China, actually. If you look at iQiyi and others, that’s pretty good. [00:26:00] So anyways, the revenue story looks much more like a continuing growth story. One, it’s been a rocket ship. And two, it doesn’t seem to be slowing the way we’re seeing in monthly active users.

If you break down where their money’s coming from that’s kind of interesting. It’s very much a China story. 2023, their revenue was about 28 percent advertising. Which has gone up pretty good in the last couple years. Variable, basically VAS, Variable Services is number one. 44%. That’s selling, that’s virtual items in live streaming.

Right? Actually, one of the reasons VAS is kind of a great business model is it’s all prepaid. You know, people buy, they give you the money, you give them tokens and stuff. So, and then they give them to their favorite artists or whatever, but the working capital often is negative. I really like VAS. I [00:27:00] love gifting and virtual items as a business model.

Advertising is pretty good too, though. So, you can buy visual items, gifts, things like that. VAS is also subscription fees for the membership program. And that, you know, they get to see the original content, things like that. So that, that’s kind of the big one. 44%, then advertising, 28%, and then mobile games, which is about 17%.

So, it’s a pretty, I tend to like that business model. I like those revenue approaches. We see that much more in China. Tencent really pioneered all this 15 years ago when they were doing gaming and there wasn’t any advertising money. So, they did micro transactions and micro gifts and things like that.

Okay. Revenue, okay, so that’s all good. Here’s the problem. Revenue for 2023 was 3 billion. Now that’s good. But relative to, say, TikTok, [00:28:00] I mean, we’re not even in the same ballpark anymore. You know, the giants of China, you know, you’re talking a hundred billion dollars. Even by, I mean, this is a small company compared to the giants.

And the other issue is the gross profits in 2020 were as 23%. That’s a major problem. So, you’ve got a scalable, powerful business model. We love that. It’s a digital first business. There’s no ops. We love that. But the gross profits are quite low for this type of business. And that mostly comes from the revenue sharing costs.

If you look at their cost structure, their revenue costs, Cost of revenue, about 55 percent of that is revenue sharing, and that is mostly live streaming. And also, mobile gaming, because, you know, you have to pay the game developers. But, you know, [00:29:00] people want to watch the best live streamers, and they want to play the most popular games.

It’s not much of a long tail, and the popular live streamers and the popular games, they know who they are, and they negotiate you pretty hard. That’s why user generated content with a huge, long tail, I mean, it’s free. So yeah, you take it in the cost of revenue, unfortunately. Anyway, so that’s kind of the, that’s kind of, it’s a real mixed picture.

There’s a lot to like, and there’s a lot that’s concerning. And the big question is, are they going to get to sustainable operating profits? That was kind of the title for this podcast. Is Bilibili going to get to sustainable scale and sustainable operating profits? Are they going to have to abandon their specialty [00:30:00] focus and go broader to get bigger and to get to a more sustainable and profitable position?

That’s kind of the key question. You look at the operating profits in 2023. It’s not great. It’s not great. It’s about. Pretax operating profits, it’s about negative 22 percent. So, you know, and okay, 2022, it was negative 38 percent. They are, they are, they are negative operating profits and it’s not that close.

Now, there’s other stuff, some expenses and interest income, but, you know, if you look at their operating loss with everything in before income tax, they’re still negative 21 percent Operating profits for 2023. And then you take out the tax, it’s about the same. So, yeah, that’s concerning. So, can they get there?

Now that their growth story has somewhat slowed, investors are going to be looking at this company in a very different [00:31:00] way. Where’s your operating profits? Are you a viable and sustainable position against the giants like TikTok, WeChat, Tencent, iQiyi? Taobao Live. There’s a lot of people doing videos on smartphones, and that is kind of the key question for today, and I’ll give you my working answer.

I think they have to abandon their ACG strategy. I think it’s taken them about as far as they can go, and I don’t think it’s a terribly viable position to be in long term, and here’s why. I’ve been sending out questions for the last year or two. I have a standard five question list I use to assess specialty versus digital giant.

And number one on that list is, are you sufficiently differentiated in the user experience from the giants? And I think the answer for video is no. [00:32:00] I think, and then another question I ask is, Are you within the strategic pathway of the giants? Are you in a space that they are absolutely going to want? Or are you in a niche they don’t care about?

Video on smartphone screens is what everybody is going after. Now, the first point. Everything I just told you about Bilibili, very cool. If I go on Bilibili, the app right now, okay, I’m going to watch some live streams. I’m going to play with some videos. Maybe I’ll comment. And then I go over to WeChat Live or WeChat short video or I go over to Douyin short video live stream or I go into Xiaohongshu.

The truth is they don’t look that different to me. Video kind of looks like video kind of looks like video. You know, YouTube’s position that, look, video is ultimately a utility. [00:33:00] It’s a big, huge utility like electricity. Every video is going to be on every platform, and you can, you can add some stuff to that with commenting and engagement and chatting.

If Ctrip, the travel site, which is awesome, there’s video. There’s travel videos. You know, if I go on Alibaba, Taobao, there’s live streaming for Taobao Live, which is awesome. JD Live. Everybody’s doing video. I think it’s not differentiated enough. That’s problem number one. Problem number two, I think they are smack dab in the high priority strategic areas of all the giants.

Problem number three, this differential in scale is too big. It’s too big for a sector where you’re going to have to continually make new [00:34:00] and large investments in the next version of video. This technology is not going to stay the same. We’re going to have VR. We’re going to have AR. We’re going to video things on screens.

It’s going to keep evolving and you need to have a big war chest. to keep investing in the new tech. One, they’re much, much smaller. Two, their operating cash flow isn’t positive. They don’t have a big stream of money coming in, as far as I can tell, to fight this war. So yeah, I think they have to somewhat, as much as possible, without pissing off their core users, I think they have to go mass market and become a broad video service for everybody.

And if you read management comments, they, it, it sounds to me like this is what they’re doing that they talk about. I you read the 10 K and stuff, they’ll say we have, most video platforms have one [00:35:00] to two types of video formats. They want to offer every type of video format, original content, live sharing, short, all of it.

So that’s full spectrum video player. Their content has shifted. Yes, they have gaming. That’s still number one. Anime, entertainment some knowledge in lifestyle, but they’ve also been adding auto, travel, fashion lifestyle, mom and baby. That sounds to me like they’re going for the whole, they’re going for all the topics.

Not just ACG. Okay. And they’ve been talking about Gen Z Plus as their market, which is an age cohort, you know, 1985 to 2010. What I think they’re doing, though I haven’t seen them say it, and I think it’s the right thing to do, they’re trying to protect their core, but now they’re going for the mass market.

They want to be a mass market video service for [00:36:00] everybody in their core age demographic. And the trick is, can you do that without alienating your core that wants you to be an ACG community? That I think is the question. That would be my number one question. Is that what they’re doing? Because that’s what I think they should do.

And can they get to significant operational cash flow in the next one to two years? Because if this strategy is going to make any difference, it has to result in operational cash flow that’s going to let them fight the war, because this is going to be a war for the next five to ten years. And I don’t see the resources to fight these companies that are so much bigger.

If I was advising them, my plan A would be, it’s time to merge up with a giant. You have a unique [00:37:00] community that’s amazing. That should be 70 percent of your focus and you need to merge up with someone with a massive war chest Now they do have some Strategic partner with Tencent and there is some significant investment.

So, they’re already sort of halfway there but the idea of being a standalone publicly traded company Makes me nervous. Plan B would be Okay, let’s go mass market for our demographic without alienating the core if we can, and see if we can get some cash flow going in the next 12 to 18 months. That’s what I’d be doing.

Anyways, okay, that’s kind of my take on this. It’s a really cool company. A lot of great strategy lessons here. It’s a good example of how sort of like attention based mobile businesses are really ahead of the curve. in [00:38:00] China, Asia versus the West. A lot more innovation, a lot of sort of interesting consumer offerings that happen there.

So, I think we’ll see a lot of this get copied in other regions. Anyways, that is it for today. The key concepts again, audience builder platforms, you can go over to the concept library, it’s there. The idea of sort of a digital attacker strategy, standard playbook. Step three, is, you know, building a suite of complementary services around one specific need, in this case ACG.

And then three, this idea of being more emotion centric versus feature centric as a product. Those are all good lessons. And that is it for the content for today. I’m sorry I didn’t do last week. I’ve been traveling. I’ll do another podcast later this week and catch up. I’m all, I’m actually in Cebu. For those of you who know the Philippines, I’m in Moalboal, [00:39:00] which is sort of the opposite side of Cebu, which is well known for arguably the most fun I’ve ever had in a day, which is the Kawasan canyoneering adventure, where you basically go up to the waterfalls and the mountains, and you spend four hours going down the river.

Swimming, jumping off rocks five, eight meters above the pool, swimming in waterfalls, rope swings. I mean, we spent like three hours going down this river and just, it was great fun. It was like an amusement park, or it was like a water world or something. It was fantastic. It was one of the, maybe the best day I’ve had in five years.

We just had a blast doing it. So, if you ever get to Cebu and you don’t know about this Kawasan Mountaineering, it’s called Kawasan Canyoneering. It’s on the other side of Cebu Island. [00:40:00] Man, it was great. So we’ve been sort of chilling out here for a couple days swimming with turtles, swimming with sardines you know, the big cloud of fish where you get to swim within the cloud of the fish which is really cool as well Jumping into the water pool, you know, the waterfalls and things like that.

Pretty awesome. Having a good day. We’re going to Bohol in the next day or so. So anyways, I like it here. I could spend a lot of time here just working and swimming. It’s a lot of swimming. Anyways, that’s it for me. Yeah, but it’s doing great. So anyways, I hope this is helpful and I will talk to you probably in a couple days.

Bye bye

——–

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

Note: This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.